PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN –POONAM BODRA

In the matter of Sri MOHAN I.P V/s HDFC ERGO GENERAL INSURANCE CO.LTD.,

Complaint No: BNG-H-018-2122-0093

Award No.: IO/(BNG)/A/HI/0075/2021-22

1) The complaint is for the rejection of reinstatement of policy on renewal.

2) The complaint had taken policy since 2017 with the R.I through Canara Bank which was due

for renewal on 15

th

May 2020. He recently came to know that the policy was not renewed for

the period May 2020 to 2021 despite premium was debited from the bank account. He

received SMS message from the bank for the renewal . Based on the same he communicated

to the bank to increase the sum insured and got quote to pay the premium . Accordingly he

agreed to pay and the premium was debited from bank account on 2

nd

May 2020. The Bank

confirmed the acceptance of policy. Later on he realised that policy was not issued instead

premium was refunded to the bank account on 14.05.2020. Neither the Bank nor the insurance

company informed about non issuance of policy. Since the premium was auto debit he was

under the impression that policy was issued. Hence requested the Forum for reinstating the

policy. Once the policy is reinstated he would like to claim the recently incurred medical

expenses.

3) The Forum noted from the documents that Smt.C.R.Nagavika is the Bank account holder

who has taken the policy covering her in-laws Sri.Mohan I.P and Smt.Shalini Mohan .

4) Mr.Vignesh Gowda the spouse Smt.C.R.Nagavika of the Bank account holder and son of

the Complainant I.P.Mohan raised grievance with the Respondent Insurer vide mail

06.03.2021 for reinstating the policy and the R.I replied stating since the tie up with Canara

Bank ended w.e.f 16

th

May 2020 they refunded the premium. Further they stated to approach

Canara Bank for alternate policy with them from other insurer.

5) The Forum asked the complainant vide mail dt. 20.09.2021 to provide correspondence made

by them with the Insurance Company in between the dates of 14.05.2020( date of premium

refund) to 06.03.2021, request for enhancement of sum insured with the Bank ,quote for

premium given by the Bank and his consent . The complainant replied mail dt. 21.09.2021

stating that he did not follow-up with the Insurance Company until he realised non existence

of policy which is on 06.03.2021. The quote was provided by the Bank representative and all

correspondence done orally with the Bank representative hence there is no documents. It has

been a practice in previous years where the policy was made available on App, he assumed

that the policy will be available on the App and did not follow up any further.

6) The R.I submitted that the Tie-up with Canara Bank has ended and intimation for migration

of policy was sent to the Insured Person. He did not opt for migration of policy . The premium

credit made by the Canara Bank was refunded to the account . Hence there is no reason for

raising the complaint.

Forum observed that there is complete lapses on the part of the complainant as admitted by him that

he did not open the App to view the policy in time and by not making immediate follow-up with

the insurance company though the policy was made through the Bank. He made mail correspondence

with the R.I only on 06.03.2021 for reinstatement of policy after the refund of premium on

14.05.2020. He did not act due diligently to protect his policy renewal being the Health Policy holder

since 2017. He did not produce any documentary proof to establish deficiency of services on the

part of the R.I. It is also noted that the tie-up between the Respondent Insurer and the Canara Bank

was ended as on the date of the renewal. The policy holder who has taken the policy on behalf of in-

laws could have approached Canara Bank for alternate policy being the account holder.

In view of above, the Forum did not find any deficiency of services with the R.I. Hence the

complaint does not fall under Rule No. 13 (1) (f)-(policy servicing related grievances against

insurers and their agents and intermediaries) of Insurance Ombudsman Rule,2017 and treated

as NON-ENTERTAINABLE .

Dated at Bangalore on the 24

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Sri.T.R.ARUNKUMAR V/s STAR HEALTH AND ALLIED INSURANCE

COMPANY LIMITED

Complaint No: BNG-H-044-2122-0215

Award No: IO/BNG/A/HI/0073/2021-22

• The Complaint emanated from partial settlement of Covid-19 claim under policy No.

P/141131/01/2021/00165 Claim No.CIR/2021/141131/0307911 on the ground of makeshift

package . Representation with the RI could not be resolved. Hence the Complainant

approached this Forum for the relief. The complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim . The R.I

reviewed the claim and agreed to settle balance claim amount of Rs. 98,934/- as per limits,

terms and conditions of the policy. The complainant agreed and confirmed the settlement

and gave his consent to close the complaint.

The complaint was resolved on compromise basis wherein both have agreed for the same and hence,

the Complaint is treated as Closed and Disposed off accordingly.

Dated at Bangalore on the 24

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Sri.SHARAD V/s STAR HEALTH AND ALLIED INSURANCE COMPANY

LIMITED

Complaint No: BNG-H-044-2122-0220

Award No: IO/BNG/A/HI/0074/2021-22

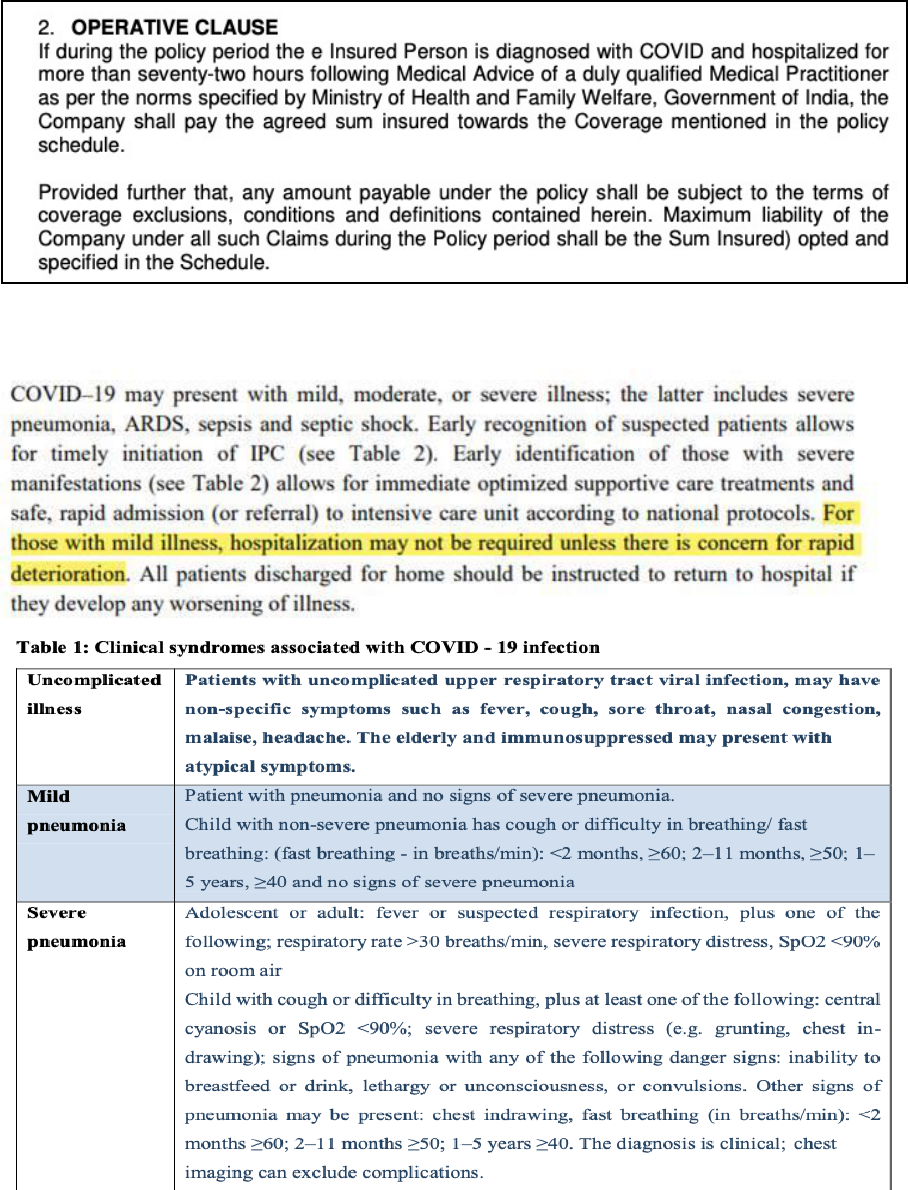

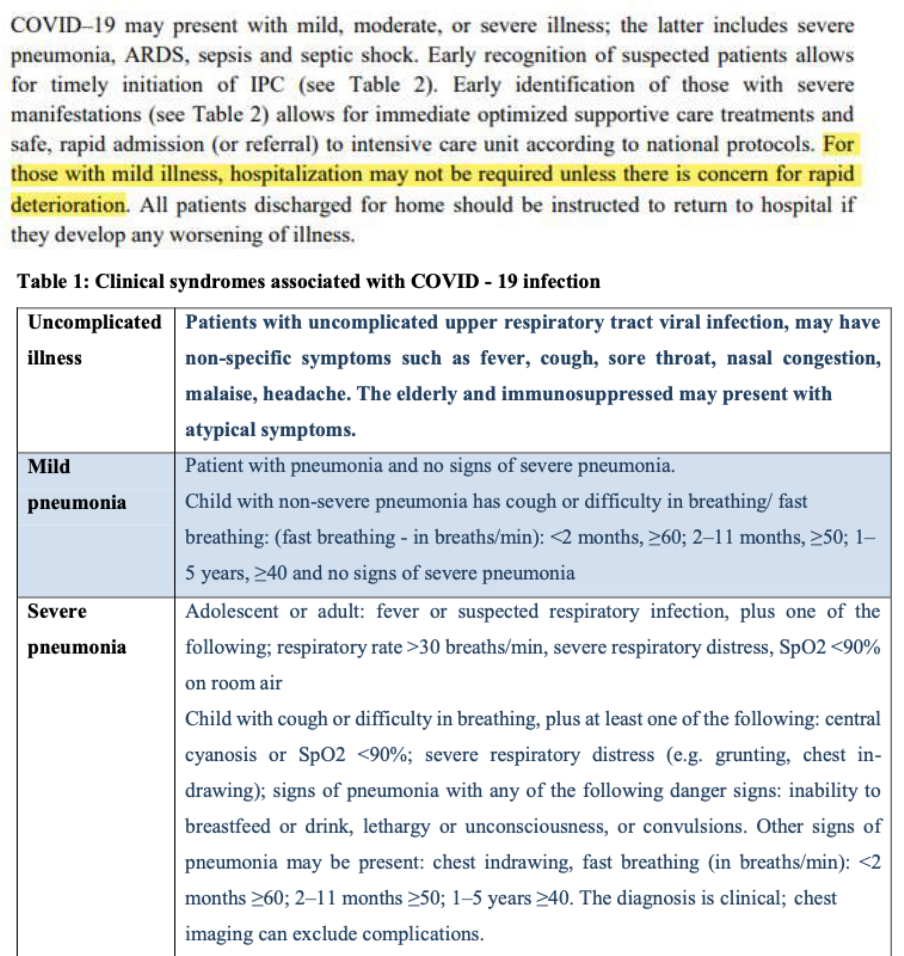

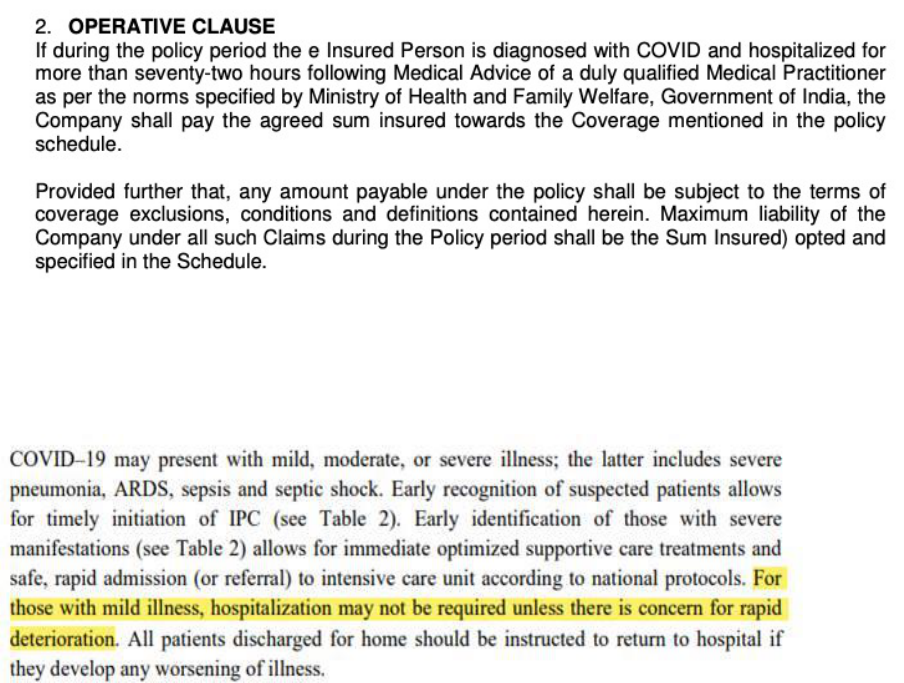

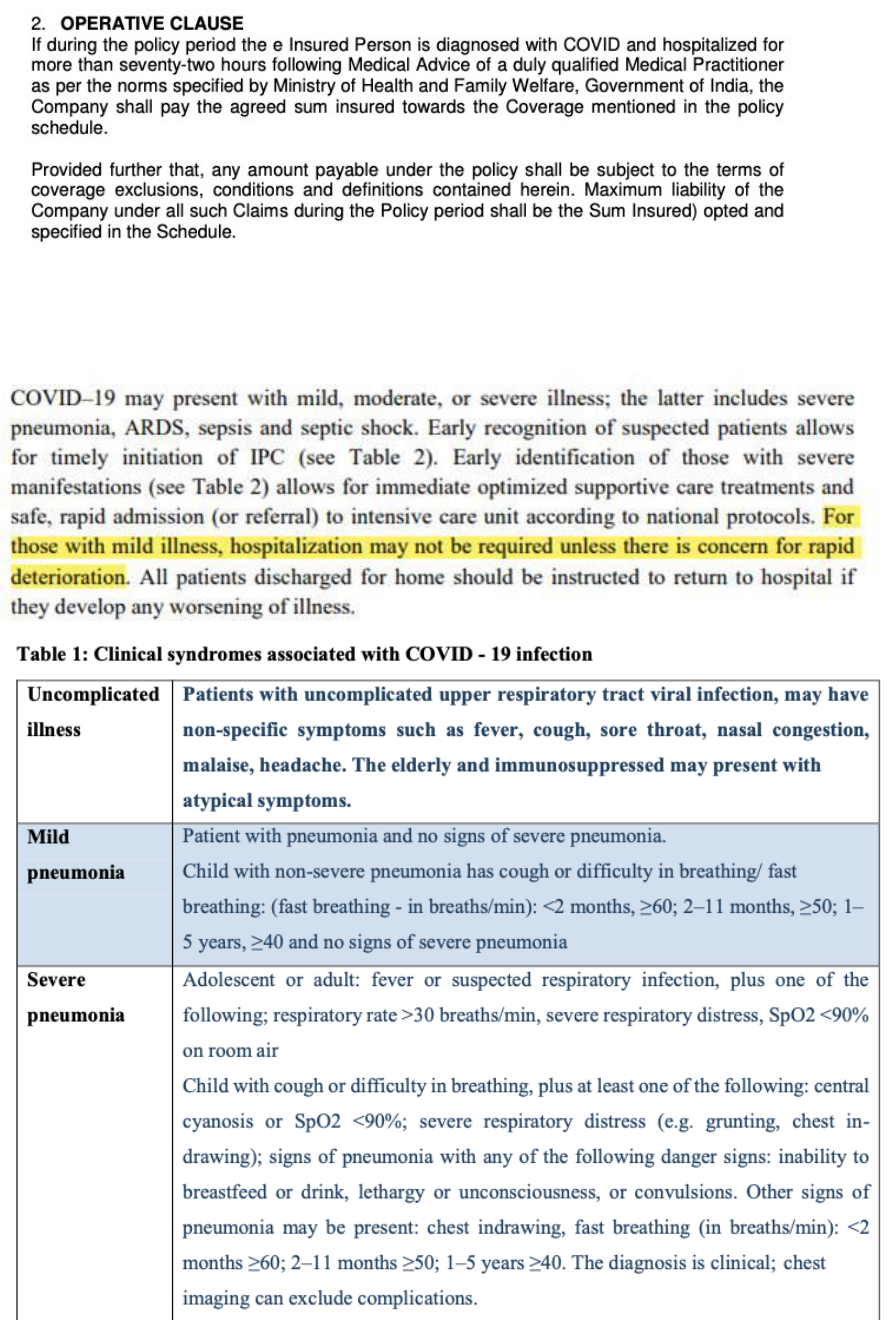

• The Complaint emanated from rejection of Covid-19 claim under policy No.

P/141111/01/2021/011756 Claim No.CIR/2021/141111/02529406 on the ground of

hospitalization was not required . Representation with the RI could not be resolved. Hence

the Complainant approached this Forum for the relief. The complaint was registered.

• After the registration the R.I reviewed the claim and agreed to settle claim amount of Rs.

2,26,258/- as per limits, terms and conditions of the policy. The complainant agreed and

confirmed the settlement and gave his consent to close the complaint.

The complaint was resolved on compromise basis wherein both have agreed for the same and hence,

the Complaint is treated as Closed and Disposed off accordingly.

Dated at Bangalore on the 24

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Sri.T.R.ARUNKUMAR V/s STAR HEALTH AND ALLIED INSURANCE

COMPANY LIMITED

Complaint No: BNG-H-044-2122-0215

Award No: IO/BNG/A/HI/0073/2021-22

• The Complaint emanated from partial settlement of Covid-19 claim under policy No.

P/141131/01/2021/00165 Claim No.CIR/2021/141131/0307911 on the ground of makeshift

package . Representation with the RI could not be resolved. Hence the Complainant

approached this Forum for the relief. The complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim . The R.I

reviewed the claim and agreed to settle balance claim amount of Rs. 98,934/- as per limits,

terms and conditions of the policy. The complainant agreed and confirmed the settlement

and gave his consent to close the complaint.

The complaint was resolved on compromise basis wherein both have agreed for the same and hence,

the Complaint is treated as Closed and Disposed off accordingly.

Dated at Bangalore on the 24

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

In the matter of MR. RAVI SHANKAR H Vs MAX BUPA HEALTH INSURANCE CO.

LTD.

Complaint No: BNG-H-031-2122-0318

Award No.: IO/(BNG)/A/HI/071/2021-22

• The Complaint emanated from short settlement of health claims of Rs.3,36,327/- vide claim

number 683134 under the policy no. 30413853202106 (for the policy period: 23.09.2020 to

22.09.2021) issued by the Respondent Insurer (RI).

• The Complainant (Insured Person -IP) was diagnosed with COVID-19 illness – bilateral

pneumonia and he was hospitalised at Brindhavan Areion Hospital, Bangalore from 13.05.2021

to 24.05.2021.

• RI settled the claim for Rs.1,76,169/- as per Covid package rate and disallowed Rs.1,60,158/-.

• The IP approached Grievance cell of RI on 15.07.2021 for the settlement of the balance amount,

but his plea was not considered favourably.

• Thereafter the IP approached this forum for settlement of his claim amount and the complaint is

not yet posted for personal hearing.

• After the intervention of this Forum, RI vide their mail dated 2.09.2021 agreed to settle the

balance claim for Rs.1,58,434/- as per terms and conditions of the policy.

• The IP vide his mail dated 21.09.2021 addressed to this Forum informed that he has agreed to the

settlement offered by the RI.

• Since the complaints were resolved on a compromise basis wherein both parties have agreed for

the same, the complaints are treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

a. The Complainant shall submit all requirements/Documents required for compliance of award

within 15 days of receipt of the award to the Respondent Insurer

b. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with the

award within thirty days of the receipt of the award and intimate compliance of the same to

the Ombudsman

Dated at Bangalore on the 22

nd

day of September, 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN –POONAM BODRA

In the matter of Sri AMIYA RAGHAV V/s CARE HEALTH INSURANCE CO.LTD.,

Complaint No: BNG-H-037-2122-0278

Award No.: IO/(BNG)/A/HI/0070 /2021-22

7) The complaint is for the rejection of cashless claim of Rs.1,27,735/- on 25.07.2018 for non

submission of required necessary documents. The complainant approached GRO on

25.07.2018 and the R.I rejected Grievance on 26.07.2018 and requested the complainant to

submit the claim for re-imbursement with all required necessary documents.

8) The complainant did not submit the claim for re-imbursement with the R.I instead he got

claim under corporate policy as per his mail dt. 4/6/2021 addressed to the R.I.

9) The complainant approached the Forum on 25.06.2021 for rejection of cashless claim,

submitted Annexure VIA claiming for Rs.1,27,735/-

10) The Forum noted that the complainant did not approach the Forum with in one year after the

receipt of the GRO reply rejection dt. 26.07.2018.

11) The Forum asked the complainant vide mail dt. 07.09.2021 the reason for his delay approach

and the reason for relief of Rs.1,27,735/- though the claim was reimbursed by the corporate

policy. He replied vide mail dt. 09.09.2021 stating that : ‘he never wanted the settlement from

Religare as it was already settled by corporate insurance but wanted to know why his

insurance claim was rejected even though he declared everything. The Complaint was never

about money. Further since he was not aware of escalation process to the Forum there was

delay’.

12) The R.I filed their objection to dismiss at the very outset as the complaint is not maintainable

under the provision of Insurance Ombudsman Rules,2017 as per Rule 14 Sub-rule 3(b)(ii) and

the claim is already settled by his Corporate Insurer.

Considering the above, the reason for delay approach to the Forum found to be not satisfactory since

under point No.7.19 of policy terms the RI has provided Grievance procedure along the address &

contact details of the Office of the Ombudsman. However the complaint is not for the relief.

The Forum notes that the complainant did not approach the Forum within one year after the receipt

of the GRO reply dt. 26.07.2018 as per Rule No. 14.3(b)(ii) of Insurance Ombudsman Rule,2017

thus found delay of 2 years 11 months .

Hence the complaint is treated as NON-ENTERTAINABLE under Rule No. 14.3(b)(ii) of

Insurance Ombudsman Rule,2017.

Dated at Bangalore on the 17

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Mr. NARASIMHA REDDY Vs RELIANCE GENERAL INSURANCE CO. LTD.

( MUMBAI )

Complaint No: BNG-H-035-2122-0156

Award No: IO/BNG/A/HI/0069/2021-22

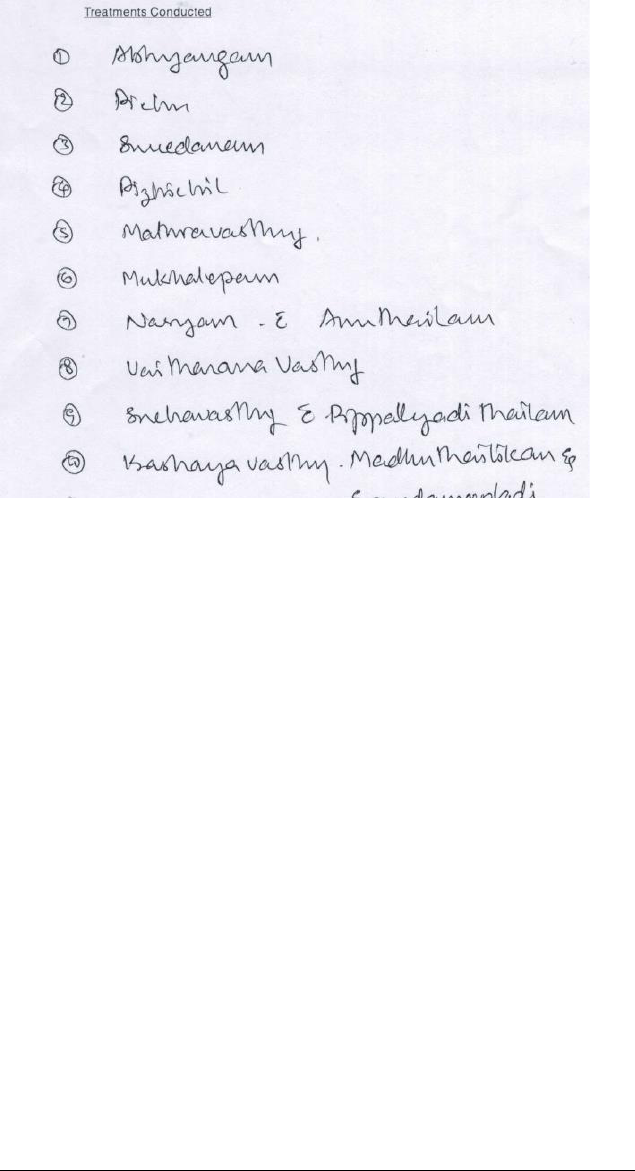

b. The Complaint emanated from repudiation of hospitalisation claim under policy

No.- 14152202820002695 and Claim No. 2012100013626 on the ground that non

allopathic treatment is not payable. Representation along with the RI could not be

resolved. Hence the Complainant approached this Forum for relief. The complaint

was registered on 26.06.2021.

c. After scrutiny of the documents, the Forum informed the R.I to relook the claim .

The R.I vide mail dt. 14.09.2021 informed the Forum that they reviewed the claim

and agreed to settle Rs. 10,790/- against claimed amount of Rs.20,200/-. The

Forum sent the mail to the complainant for his consent if agreeable. The

complainant agreed for the settlement and gave his consent to close the complaint.

d. The complaint was resolved on compromise basis wherein both have agreed for

the same and hence, the Complaint is treated as Closed and Disposed off

accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

(a) The Complainant shall submit all requirements/Documents required for settlement of

award within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 16

th

day of September 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF

KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Mr. NARASIMHA REDDY Vs RELIANCE GENERAL INSURANCE CO. LTD.

( MUMBAI )

Complaint No: BNG-H-035-2122-0156

Award No: IO/BNG/A/HI/0069/2021-22

e. The Complaint emanated from repudiation of hospitalisation claim under policy

No.- 14152202820002695 and Claim No. 2012100013626 on the ground that non

allopathic treatment is not payable. Representation along with the RI could not be

resolved. Hence the Complainant approached this Forum for relief. The complaint

was registered on 26.06.2021.

f. After scrutiny of the documents, the Forum informed the R.I to relook the claim .

The R.I vide mail dt. 14.09.2021 informed the Forum that they reviewed the claim

and agreed to settle Rs. 10,790/- against claimed amount of Rs.20,200/-. The

Forum sent the mail to the complainant for his consent if agreeable. The

complainant agreed for the settlement and gave his consent to close the complaint.

g. The complaint was resolved on compromise basis wherein both have agreed for

the same and hence, the Complaint is treated as Closed and Disposed off

accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

(b) The Complainant shall submit all requirements/Documents required for settlement of

award within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 16

th

day of September 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF

KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

In the matter of MR. KIRAN KUMAR Vs STAR HEALTH AND ALLIED

INSURANCE CO. LTD.

Complaint No: BNG-H-044-2122-0289

Award No.: IO/(BNG)/A/HI/0068/2021-22

• The Complaint emanated from denial of health claims of Rs.1,42,154/- vide claim number

CIR/2021/111113/2378594 under the policy no. P/111113/01/2021/020245 (for the policy

period: 25.11.2020 to 24.11.2021) issued by the Respondent Insurer (RI).

• The Complainant (Insured Person -IP) was diagnosed with COVID-19 and he was

hospitalised at Ramaiah Medical College Hospital, Bangalore from 20.03.2021 to

29.03.2021.

• The RI repudiated the claim vide letter dated 27.06.2021 stating that the hospitalisation was

not warranted as the IP’s SPO2 level was normal.

• The IP approached Grievance cell of RI on 13.07.2021 for the settlement of the balance

amount, but his plea was not considered favourably.

• Thereafter the IP approached this forum for settlement of his claim amount and the

complaint is not yet posted for personal hearing.

• After the intervention of this Forum, RI vide their mail dated 03.09.2021 agreed to settle the

claim for Rs1,38,216/- as per terms and conditions of the policy.

• The IP vide his mail dated 03.09.2021 addressed to RI informed to settle the offered

amount.

• The IP vide his mail dated 15.09.2021 addressed to this Forum informed that he has agreed

to the settlement offered by the RI.

• Since the complaints were resolved on a compromise basis wherein both parties have agreed

for the same, the complaints are treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

a. The Complainant shall submit all requirements/Documents required for compliance of

award within 15 days of receipt of the award to the Respondent Insurer

b. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with

the award within thirty days of the receipt of the award and intimate compliance of the

same to the Ombudsman

Dated at Bangalore on the 15

th

day of September, 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Mr. Loknath R Vs Oriental Insurance Co. Ltd.

Complaint No: BNG-H-050-2122-0282

Award No: IO/BNG/A/HI/0067/2021-22

h. The Complaint emanated from the partial settlement of Covid-19 claim for

Rs. 118337/- against claimed amount of Rs. 210557/- under policy No.-

423000/48/2021/830 and Claim No.-55662122105169. Representation along

with the RI could not be resolved. Hence the Complainant approached this

Forum for relief. The complaint was registered on 10.08.2021.

i. After scrutiny of the documents, the Forum informed the R.I to relook the

claim as the claim was settled in accordance with Covid-19 claim settlement

guidelines of Karnataka Govt. instead of the terms and conditions of the

policy. The R.I vide mail dt. 15.09.2021 informed the Forum that they

reviewed the claim and agreed to settle Rs. 63496/- after deduction of an

amount of Rs. 118337/- already paid to the insured . The Forum sent the mail

to the complainant for his consent if agreeable. The complainant agreed for

the settlement and gave his consent.

j. The complaint was resolved on compromise basis wherein both have agreed

for the same and hence, the Complaint is treated as Closed and Disposed off

accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

(c) The Complainant shall submit all requirements/Documents required for settlement

of award within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate

compliance of the same to the Ombudsman.

Dated at Bangalore on the 15

th

day of September 2021.

( POONAM BODRA )

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL. CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

In the matter of MR. KIRAN KUMAR Vs STAR HEALTH AND ALLIED INSURANCE

CO. LTD.

Complaint No: BNG-H-044-2122-0289

Award No.: IO/(BNG)/A/HI/0068/2021-22

• The Complaint emanated from denial of health claims of Rs.1,42,154/- vide claim number

CIR/2021/111113/2378594 under the policy no. P/111113/01/2021/020245 (for the policy period:

25.11.2020 to 24.11.2021) issued by the Respondent Insurer (RI).

• The Complainant (Insured Person -IP) was diagnosed with COVID-19 and he was hospitalised at

Ramaiah Medical College Hospital, Bangalore from 20.03.2021 to 29.03.2021.

• The RI repudiated the claim vide letter dated 27.06.2021 stating that the hospitalisation was not

warranted as the IP’s SPO2 level was normal.

• The IP approached Grievance cell of RI on 13.07.2021 for the settlement of the balance amount,

but his plea was not considered favourably.

• Thereafter the IP approached this forum for settlement of his claim amount and the complaint is

not yet posted for personal hearing.

• After the intervention of this Forum, RI vide their mail dated 03.09.2021 agreed to settle the

claim for Rs1,38,216/- as per terms and conditions of the policy.

• The IP vide his mail dated 03.09.2021 addressed to RI informed to settle the offered amount.

• The IP vide his mail dated 15.09.2021 addressed to this Forum informed that he has agreed to the

settlement offered by the RI.

• Since the complaints were resolved on a compromise basis wherein both parties have agreed for

the same, the complaints are treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

a. The Complainant shall submit all requirements/Documents required for compliance of award

within 15 days of receipt of the award to the Respondent Insurer

b. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with the

award within thirty days of the receipt of the award and intimate compliance of the same to

the Ombudsman

Dated at Bangalore on the 15

th

day of September, 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

In the matter of MR. KIRAN KUMAR Vs STAR HEALTH AND ALLIED INSURANCE

CO. LTD.

Complaint No: BNG-H-044-2122-0289

Award No.: IO/(BNG)/A/HI/0068/2021-22

• The Complaint emanated from denial of health claims of Rs.1,42,154/- vide claim number

CIR/2021/111113/2378594 under the policy no. P/111113/01/2021/020245 (for the policy period:

25.11.2020 to 24.11.2021) issued by the Respondent Insurer (RI).

• The Complainant (Insured Person -IP) was diagnosed with COVID-19 and he was hospitalised at

Ramaiah Medical College Hospital, Bangalore from 20.03.2021 to 29.03.2021.

• The RI repudiated the claim vide letter dated 27.06.2021 stating that the hospitalisation was not

warranted as the IP’s SPO2 level was normal.

• The IP approached Grievance cell of RI on 13.07.2021 for the settlement of the balance amount,

but his plea was not considered favourably.

• Thereafter the IP approached this forum for settlement of his claim amount and the complaint is

not yet posted for personal hearing.

• After the intervention of this Forum, RI vide their mail dated 03.09.2021 agreed to settle the

claim for Rs1,38,216/- as per terms and conditions of the policy.

• The IP vide his mail dated 03.09.2021 addressed to RI informed to settle the offered amount.

• The IP vide his mail dated 15.09.2021 addressed to this Forum informed that he has agreed to the

settlement offered by the RI.

• Since the complaints were resolved on a compromise basis wherein both parties have agreed for

the same, the complaints are treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

c. The Complainant shall submit all requirements/Documents required for compliance of award

within 15 days of receipt of the award to the Respondent Insurer

d. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with the

award within thirty days of the receipt of the award and intimate compliance of the same to

the Ombudsman

Dated at Bangalore on the 15

th

day of September, 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Mr. Sunil Ambore Vs United India Insurance Co. Ltd.

Complaint No: BNG-H-051-2122-0179

Award No: IO/BNG/A/HI/0066/2021-22

1. The Complaint emanated from partial settlement of Covid-19 claim under

policy No. 5001002819P111087388 and Claim No.HH872124975 on the

ground of non submission of original money receipt of Rs. 60000/-.

Representation along with the RI could not be resolved. Hence the

Complainant approached this Forum for relief. The complaint was registered

on 02.07.2021.

2. The Forum informed the R.I to relook the claim after the complainant informed

the Forum that he has already submitted the required documents . The R.I vide

mail dt. 15.09.2021 informed the Forum that they reviewed the claim and

settled Rs.60000/- against claimed amount of Rs.60000/- via NEFT( no.-

21223788941) on 24.08.2021. The Forum sent the mail to the complainant for

his consent if agreeable. The complainant has confirmed the receipt of amount

Rs. 60000/- vide his mail dt. 15.09.2021 and gave his consent for closing the

complaint .

3. The complaint was resolved on compromise basis wherein both have agreed

for the same and hence, the Complaint is treated as Closed and Disposed off

accordingly.

Dated at Bangalore on the 15

th

day of September 2021.

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Mr. Manish Bahety V/s HDFC Ergo General Insurance Co. Ltd.

Complaint No: BNG-H-018-2122-0092

Award No: IO/BNG/A/HI/0065/2021-22

4. The Complaint emanated from repudiation of hospitalisation claim under

policy No.-2805203520424501000 and Claim No. - RR-HS20-12335435 on

the ground that the submitted claim is for the illness which has a specific 2

years of waiting period as per the policy. Representation along with the RI

could not be resolved. Hence the Complainant approached this Forum for relief.

The complaint was registered on 22.04.2021.

5. After scrutiny of the documents, the Forum informed the R.I to relook the

claim .The R.I vide mail dt. 14.09.2021 informed the Forum that they reviewed

the claim and agreed to settle Rs. 97971/- against claimed amount of

Rs.98271/- . The Forum sent the mail to the complainant for his consent if

agreeable. The complainant agreed for the settlement and gave his consent.

6. The complaint was resolved on compromise basis wherein both have agreed

for the same and hence, the Complaint is treated as Closed and Disposed off

accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

I.The Complainant shall submit all requirements/Documents required for settlement of award

within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 14

th

day of September 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF

KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

In the matter of: Mrs. Kamal Deep Vs Care Health Insurance Limited

Complaint No: BNG-H-037-2122-0309

Award No.: IO/(BNG)/A/HI/0064/2021-22

• The Complaint emanated from the repudiation of health claim vide claim number

91575144-01 under the policy no. 17642769 issued by Respondent Insurer (RI).

• Complainant’s daughter Ms. Anisha Peter (Insured Person -IP) was admitted at Aster

CMI Hospital on 30.01.2021 wherein she was diagnosed with Postprandial

Hyperglycemia.

• Post the discharge of IP, the complainant filed a reimbursement claim and the RI

repudiated the claim on the ground of non-disclosure of pre-existing disease.

• Complainant approached Grievance cell of RI on 16.07.2021 requested to consider

the claim, but her plea was not considered favourably.

• Thereafter the complainant approached this forum for settlement of her claim and the

complaint is yet to be posted for personal hearing.

• After the intervention of this Forum, RI vide their mail dated 08.09.2021 agreed to

settle the claim for Rs.75,749/- as per term and conditions of the policy.

• Complainant vide her mail dated 13.09.2021 addressed to this Forum informed that

she has agreed to the settlement offer by the RI.

• Since the complaint was resolved on compromise basis wherein both parties have

agreed for the same, the complaint is treated as Closed and Disposed off

accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

c. The Complainant shall submit all requirements/Documents required for compliance of

award within 15 days of receipt of the award to the Respondent Insurer

d. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with

the award within thirty days of the receipt of the award and intimate compliance of the

same to the Ombudsman

Dated at Bangalore on the 14

th

day of September, 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Sri. M.VIJAYA V/s Care Health Insurance Ltd.(Gurugram)

Complaint No: BNG-H-037-2122-0311

Award No: IO/BNG/A/HI/0063/2021-22

• The Complaint emanated from rejection of claim under policy No. 11515505 for the

hospitalization of Insured Person Smt.Pushpa Vijay for the period 09.01.2021 to 15.01.2021

on the ground of PED which falls under waiting period. Representation along with the RI

could not be resolved. Hence the Complainant approached this Forum for relief. The

complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I vide

mail dt. 09.09.2021 informed the Forum that they reviewed the claim and agreed to settle

Rs.3,02,190/- against claimed amount of Rs.3,16,810/- by deducting non-medical expenses

as per terms and conditions of policy. The Forum sent the mail to the complainant for his

consent if agreeable. The complainant agreed for the settlement and gave his consent and

requested the Forum to close the complaint vide mail dt. 13.09.2021.

• The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

• The Complainant shall submit all requirements/Documents required for settlement of award

within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 13

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KETALA &

ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Smt. Vidya V.Kathote V/s STAR HEALTH AND ALLIED INSURANCE

COMPANY LIMITED

Complaint No: BNG-H-044-2122-0205

Award No: IO/BNG/A/HI/0062/2021-22

• The Complaint emanated from partial settlement of Covid-19 claim under policy No.

P/141212/01/2021/000279 Claim No.CIR/2021/141212/02013248 on the ground of

settlement as per GIC circular. Representation with the RI could not be resolved. Hence the

Complainant approached this Forum for the relief. The complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I

reviewed the claim and agreed to settle Rs.85,671/- as per limits, terms and conditions of

the policy. The complainant agreed for the settlement and gave her consent to close the

complaint.

• The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed of accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

• The Complainant shall submit all requirements/Documents required for settlement of award

within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 13

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Ms Mumtaz Habib Lala Vs Star Health And Allied Insurance Co. Ltd.

Complaint No: BNG-H-044-2122-0262

Award No: IO/BNG/A/HI/0060/2021-22

• The Complaint emanated from the partial settlement of Covid-19 claim for Rs. 31069/- against

claimed amount of Rs. 73,322/- under policy No.-P/181314/01/2021/008201 and Claim No.-

CIR/2022/181314/2603394 . Representation along with the RI could not be resolved. Hence the

Complainant approached this Forum for relief. The complaint was registered on 04.08.2021.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I vide mail

dt. 08.09.2021 informed the Forum that they reviewed the claim and agreed to settle Rs. 14,805/-

after deduction of an amount of Rs. 10,886/- already paid via NEFT ( UTR No.-

N222211596891848 ) dated 10.08.2021 . The Forum sent the mail to the complainant for his

consent if agreeable. The complainant agreed for the settlement and gave his consent.

• The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed off accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

a) The Complainant shall submit all requirements/Documents required for settlement of award

within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 13

th

day of September 2021.

( POONAM BODRA )

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL. CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- Smt. POONAM BODRA

In the matter of: MR. RASHMI KUMAR RANADIVE V/s MANIPAL CIGNA HEALTH

INSURANCE CO. LTD.

Complaint No: BNG-H-053-2122-0176

Award No: IO/BNG/A/HI/0059/2021-22

• The Complaint emanated from partial settlement of hospitalisation claim under policy

No.PROHLR111229000 and Claim No.24182169 on the ground of consideration of OT

consumables as non-medical expenses by RI. Representation along with the RI could not be

resolved. Hence the Complainant approached this Forum for relief. The complaint was registered

on 01.07.2021.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I vide mail

dt. 06.09.2021 informed the Forum that they reviewed the claim and agreed to settle Rs.73060/-

against claimed amount of Rs.73060/-. The Forum sent the mail to the complainant for his consent

if agreeable. The complainant agreed for the settlement and gave his consent.

• The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed off accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

b) The Complainant shall submit all requirements/Documents required for settlement of award

within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate compliance

of the same to the Ombudsman.

Dated at Bangalore on the 9

th

day of September 2021.

(Smt. POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- Smt. POONAM BODRA

In the matter of: Sri.SIDDAPPA GOUDA PATIL. V/s STAR HEALTH AND ALLIED

INSURANCE COMPANY LIMITED

Complaint No: BNG-H-044-2122-0151

Award No: IO/BNG/A/HI/0058/2021-22

• The Complaint emanated from rejection of Covid-19 claim under policy No.

P/141141/01/2021/002453 Claim No.CIR/2021/141141/0369817 on the ground of that based on

the hospital records the Insured Person need only home isolation and hospitalization does not

warrant . Representation with the RI could not be resolved. Hence the Complainant approached

this Forum for the relief. The complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim . The R.I vide

mail 06.09.2021 informed the Forum that they reviewed the claim and out of claimed amount of

Rs. 1,61,025/- (including Pre & Post Hospitalization charges) an amount of Rs. 1,06,648/- was

settled to the Insured as per policy terms and conditions vide NEFT transaction

no. N222211597540197 dated 10/08/2021 which was agreed by the complainant. The

complainant agreed for the settlement and informed the Forum vide mail dt.06.09.2021 his

consent to close the complaint.

• The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed of accordingly.

Dated at Bangalore on the 6th day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN FOR THE

STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 17 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – POONAM BODRA

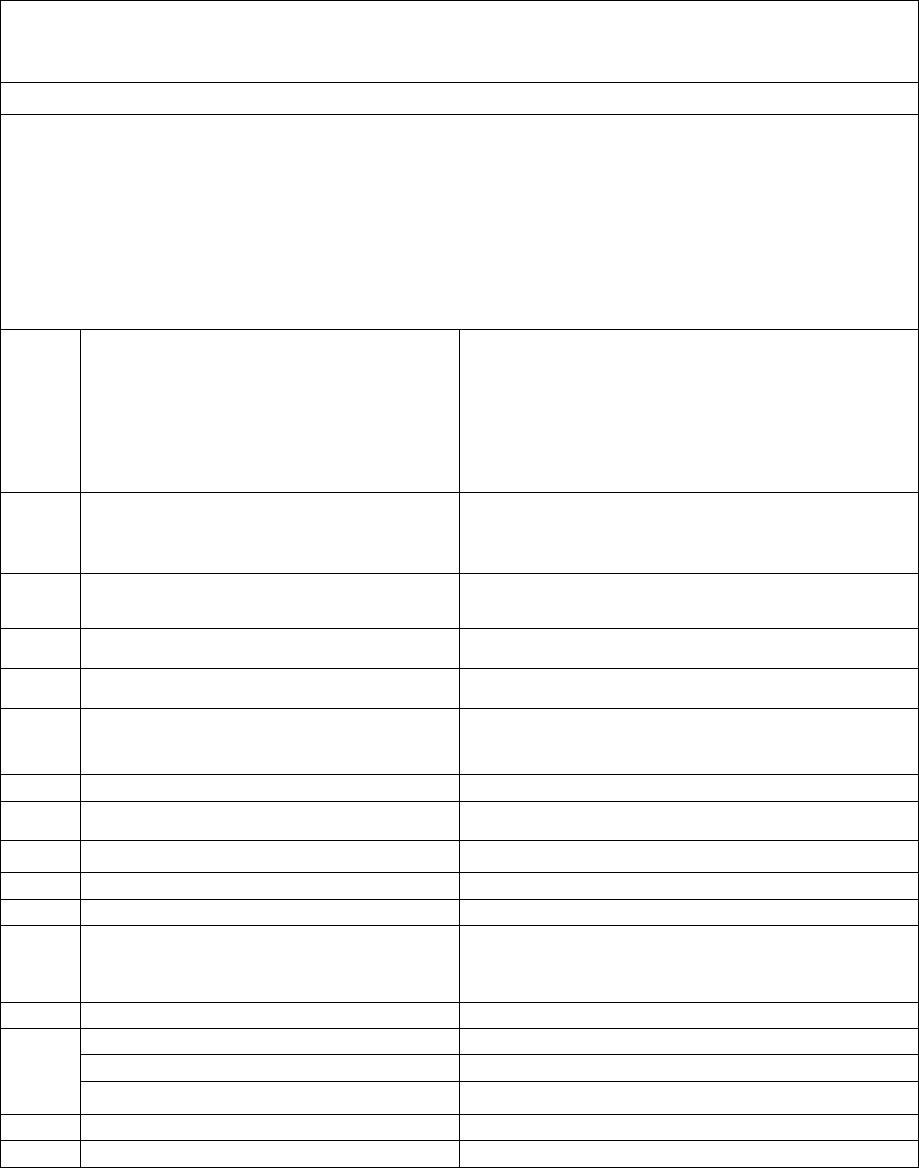

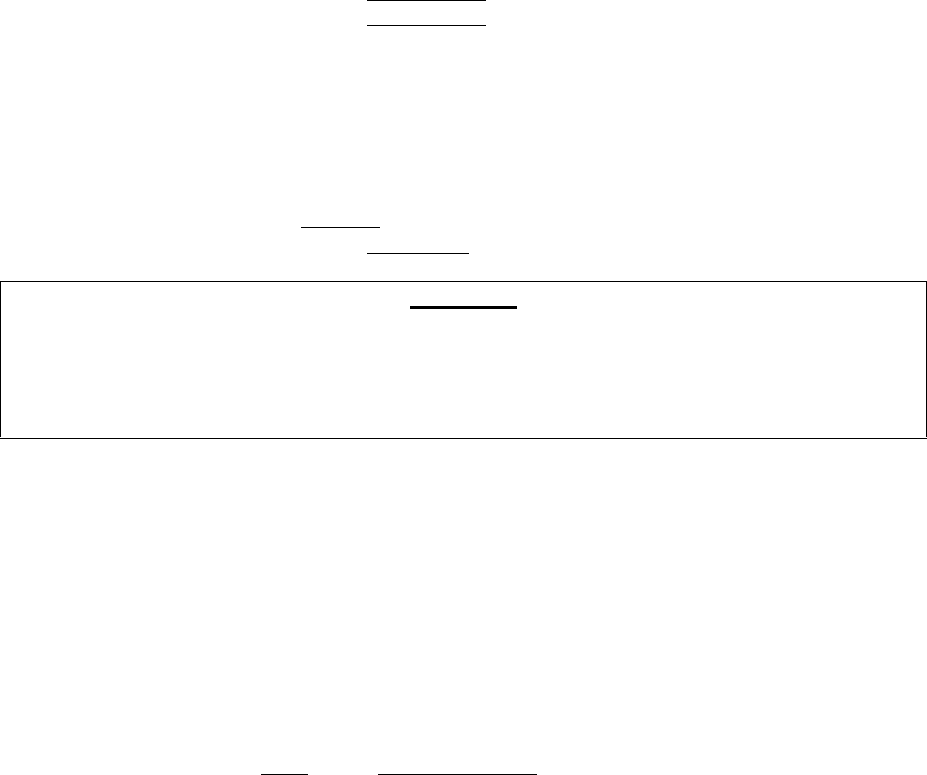

In the matter of MR. SUNIL ANANT JINRALKAR Vs STAR HEALTH AND ALLIED

INSURANCE CO. LTD.

Complaint No: BNG-H-044-2021-0804

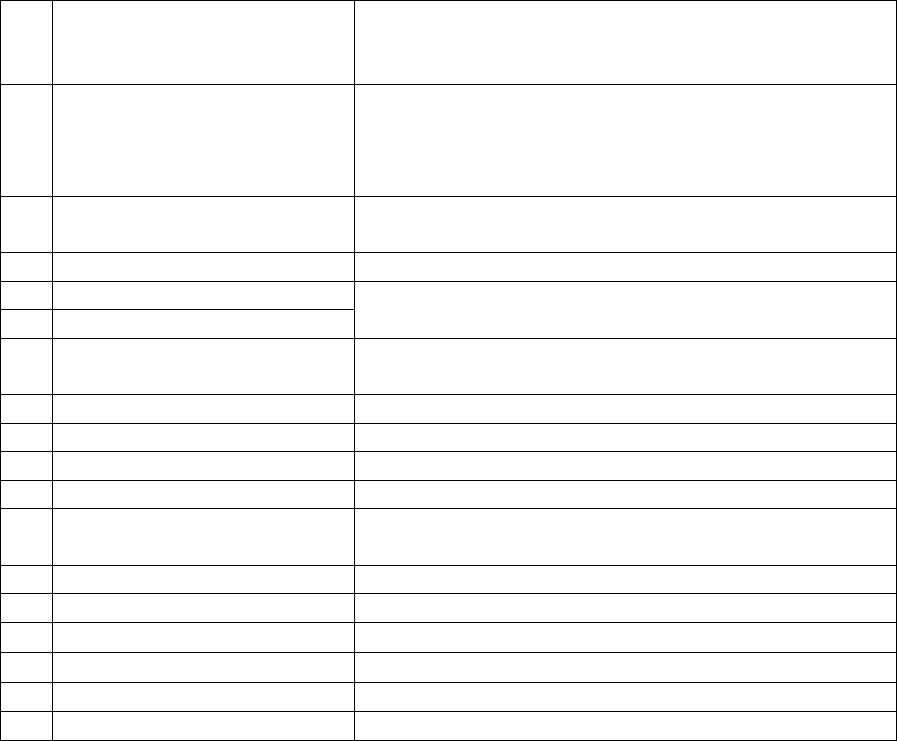

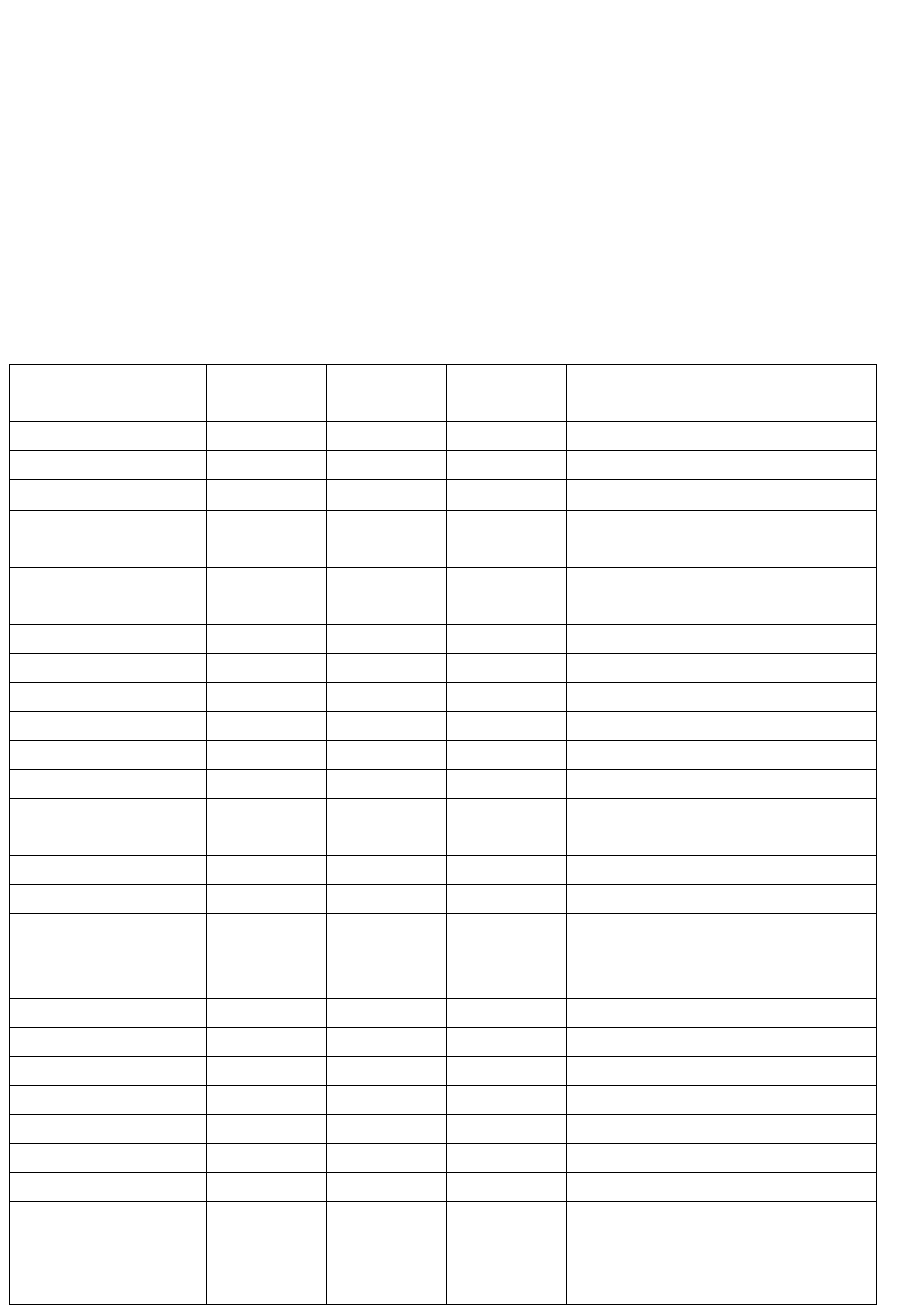

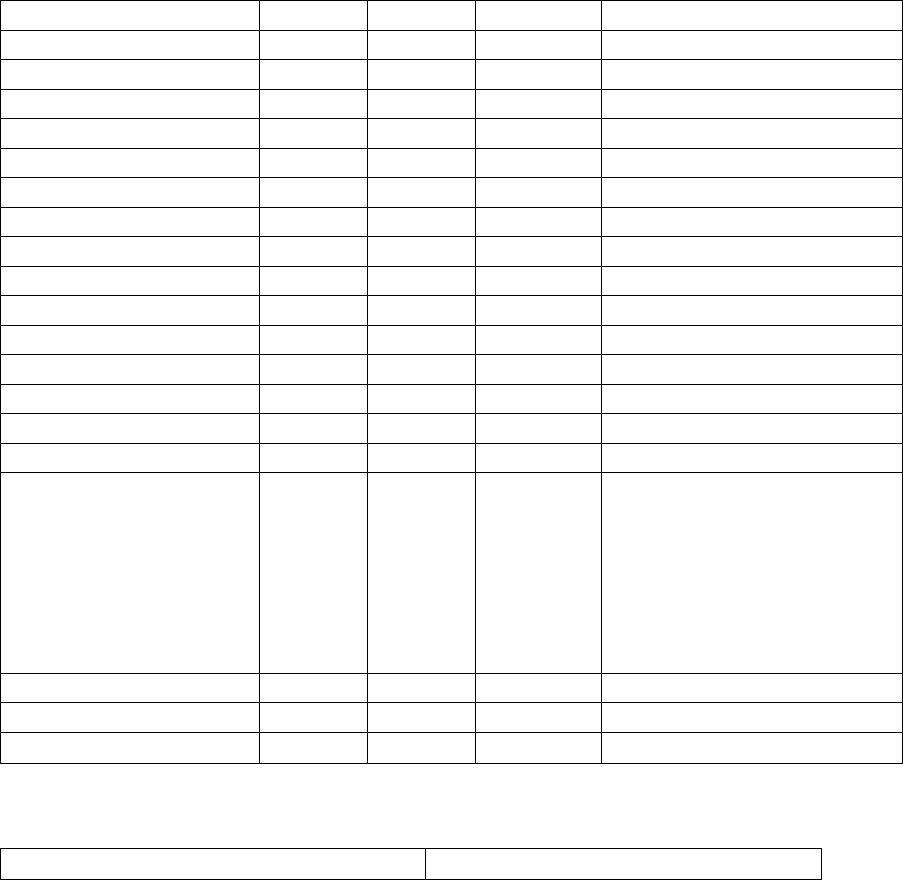

Award No.: IO/(BNG)/A/HI/0057/2021-22

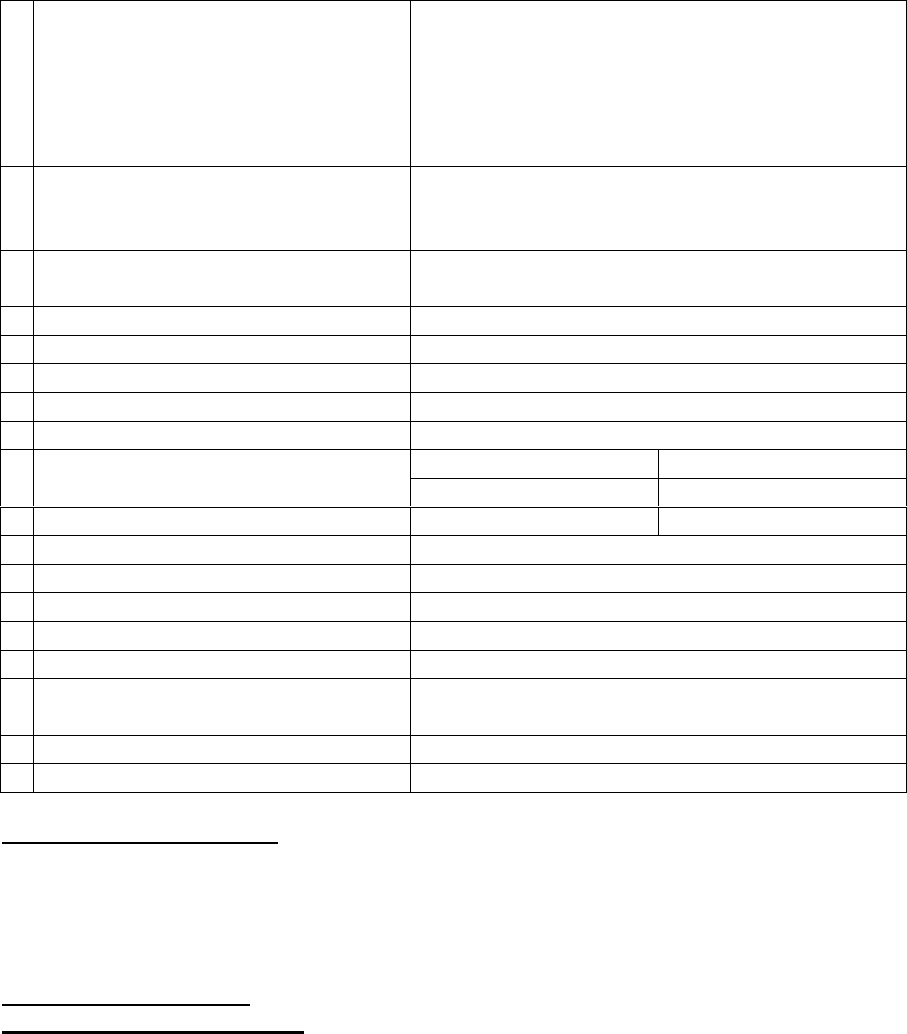

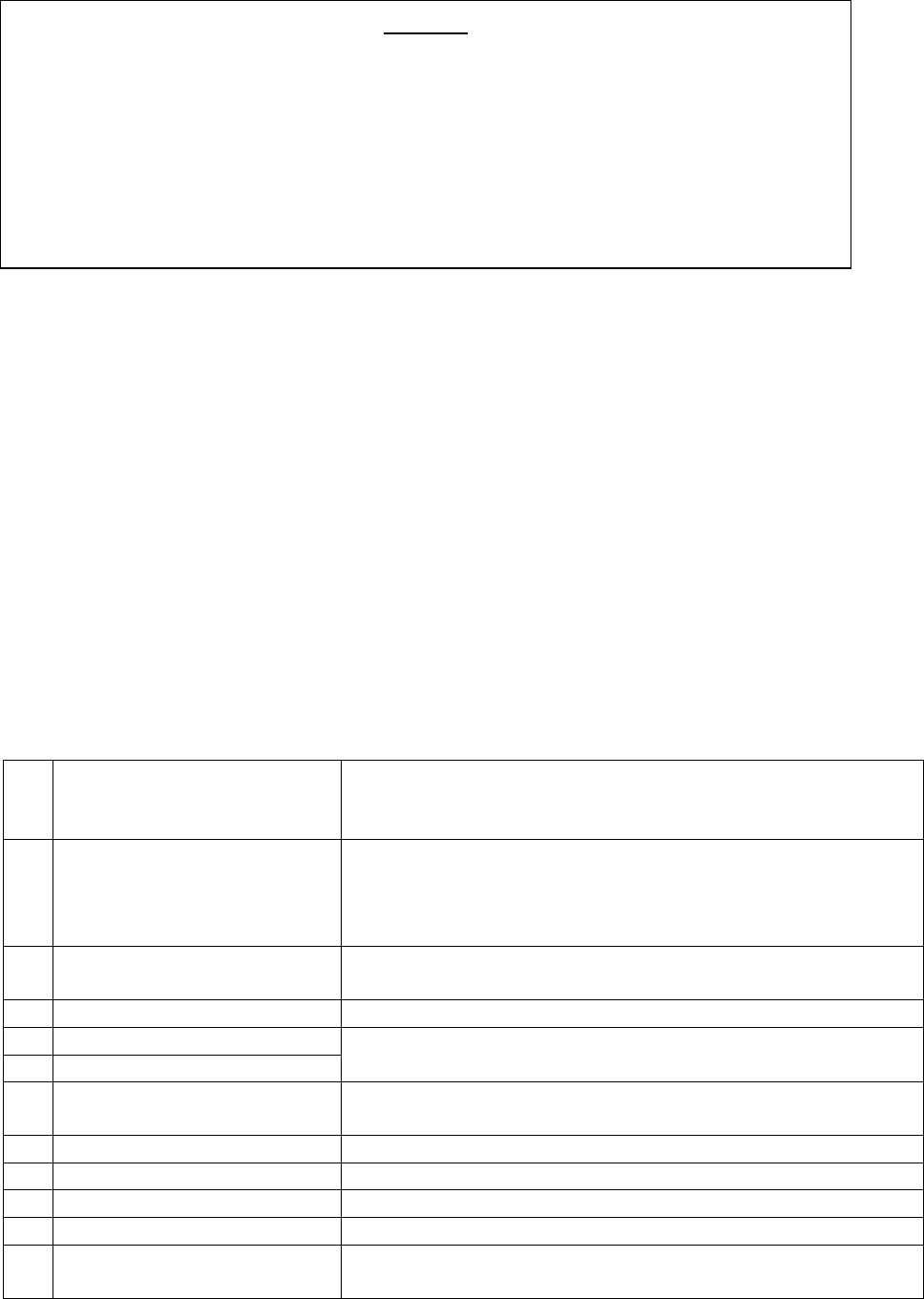

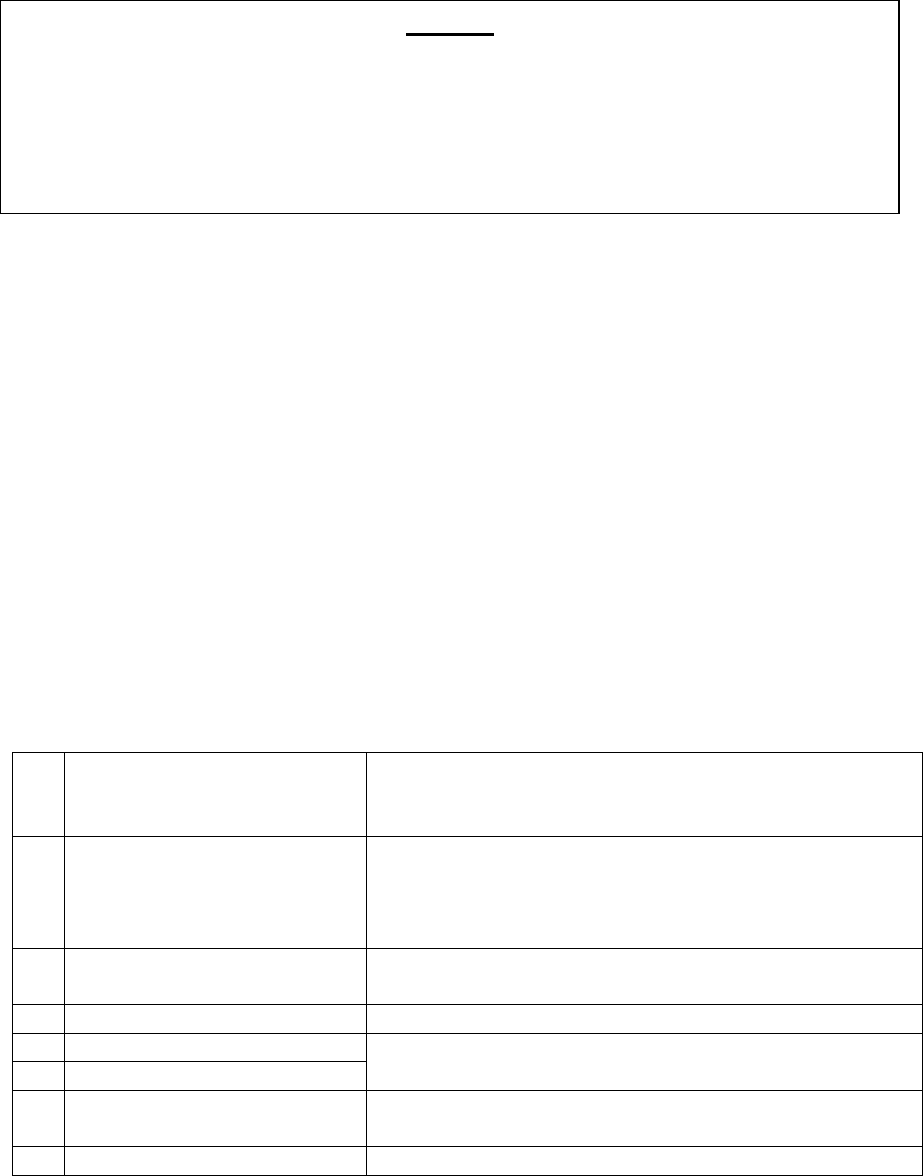

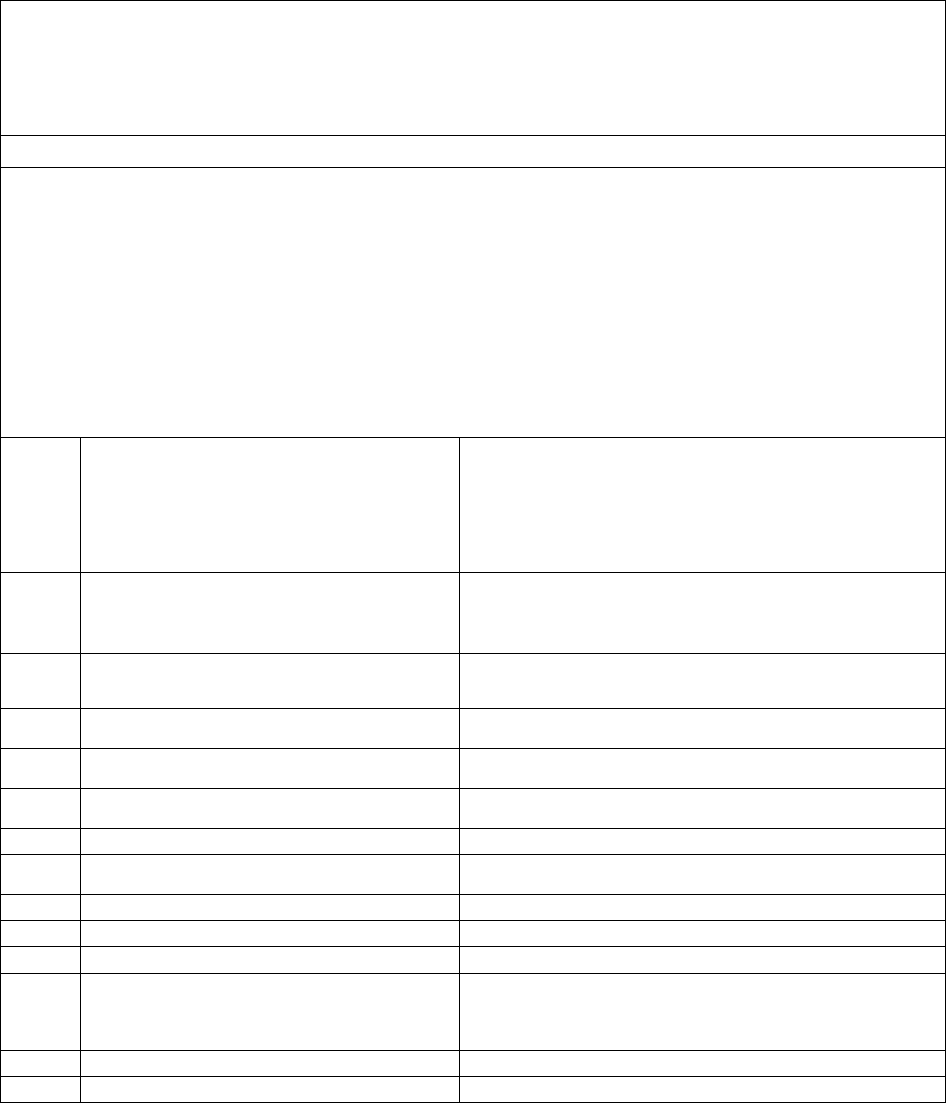

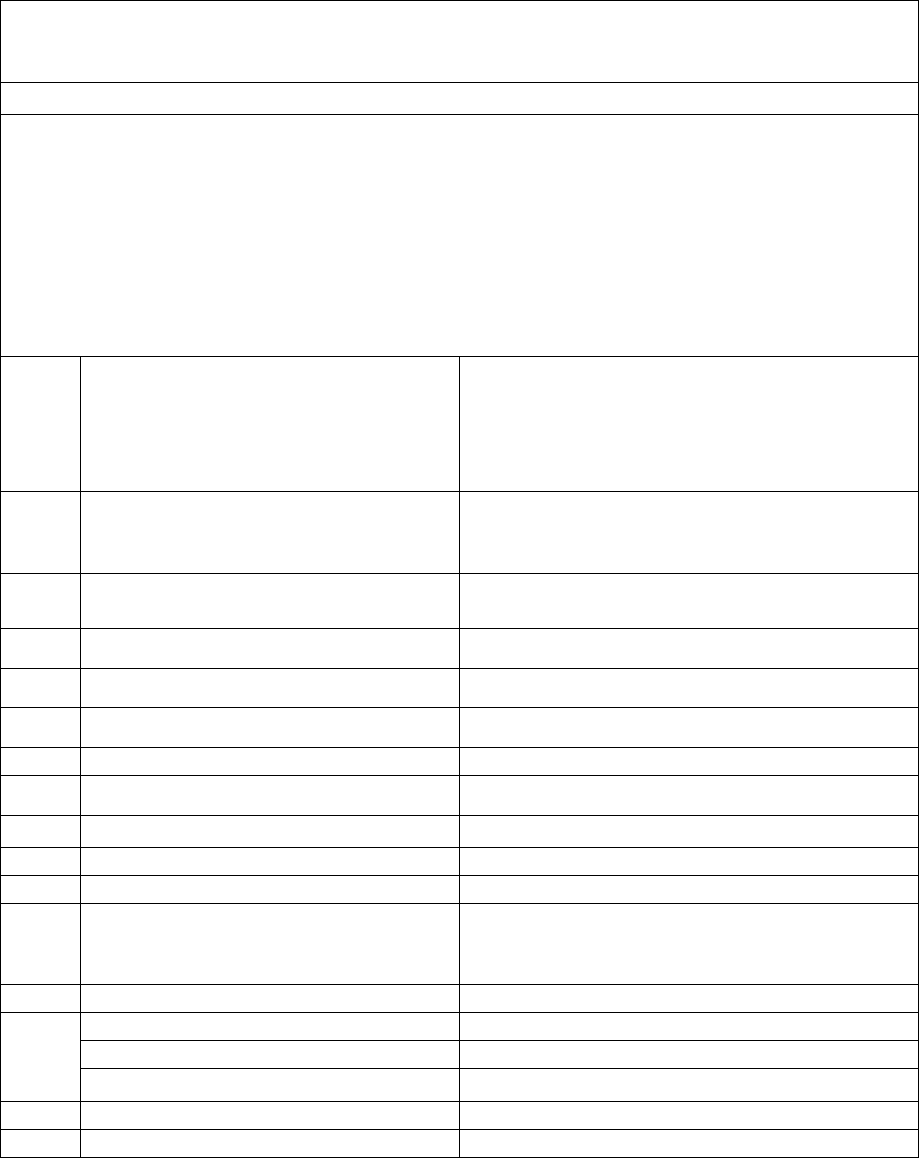

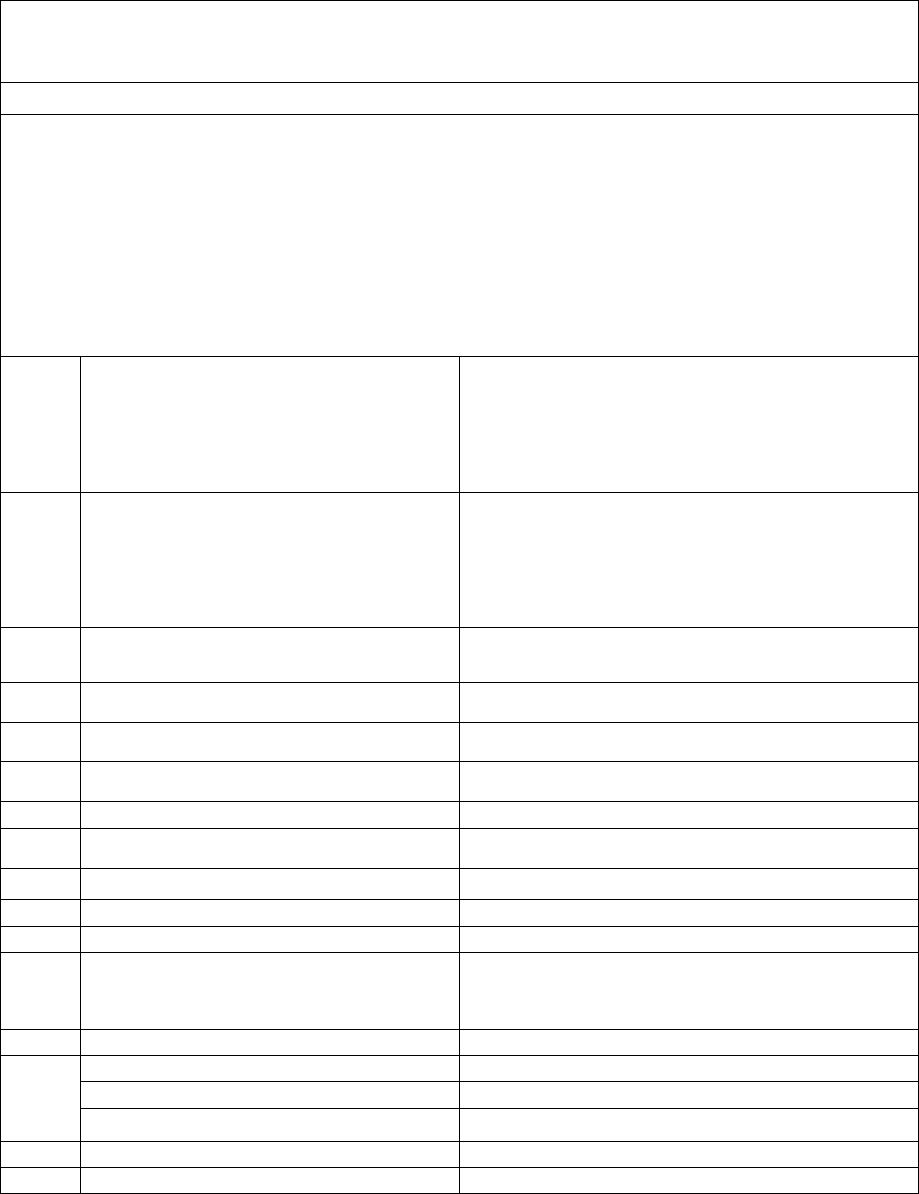

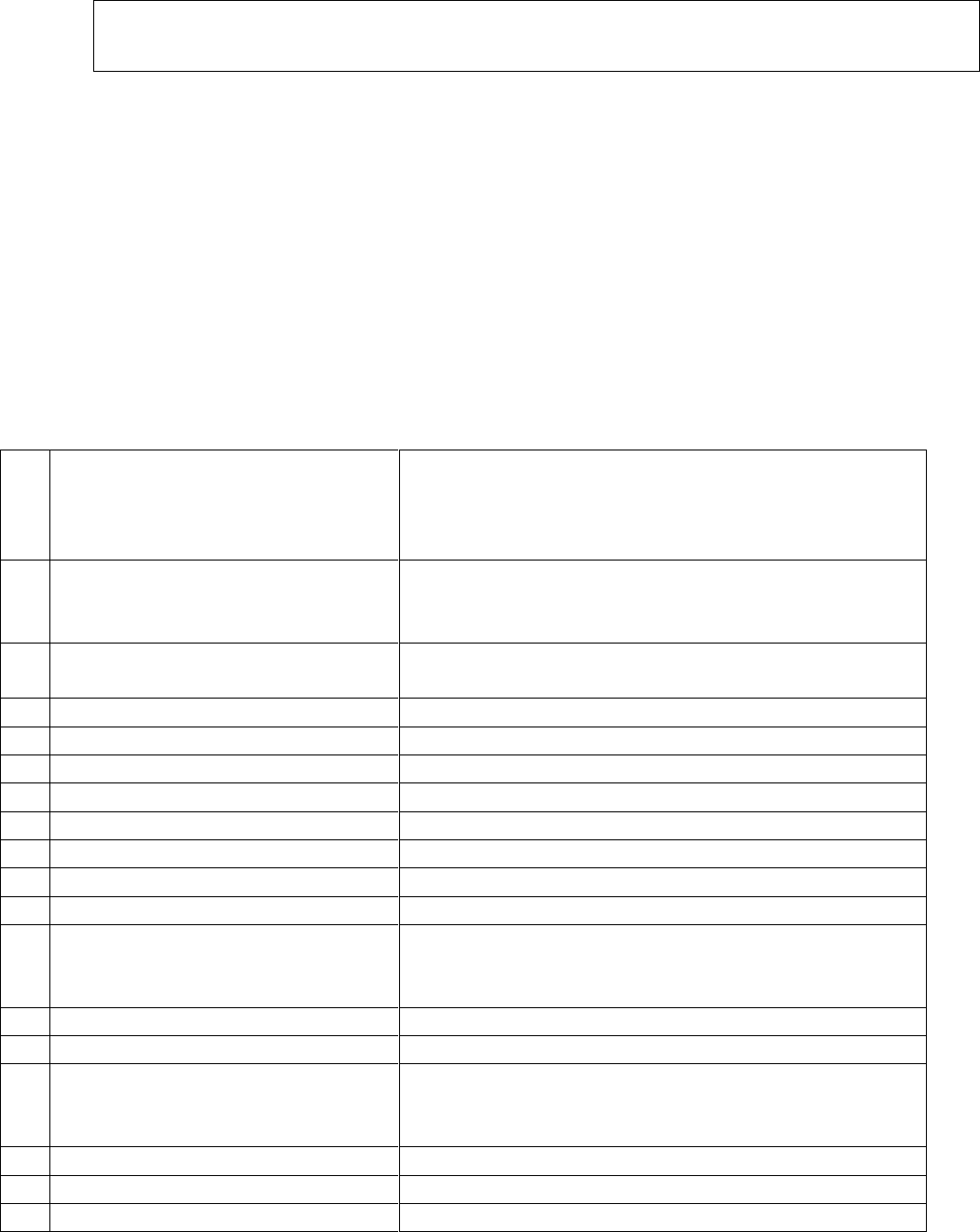

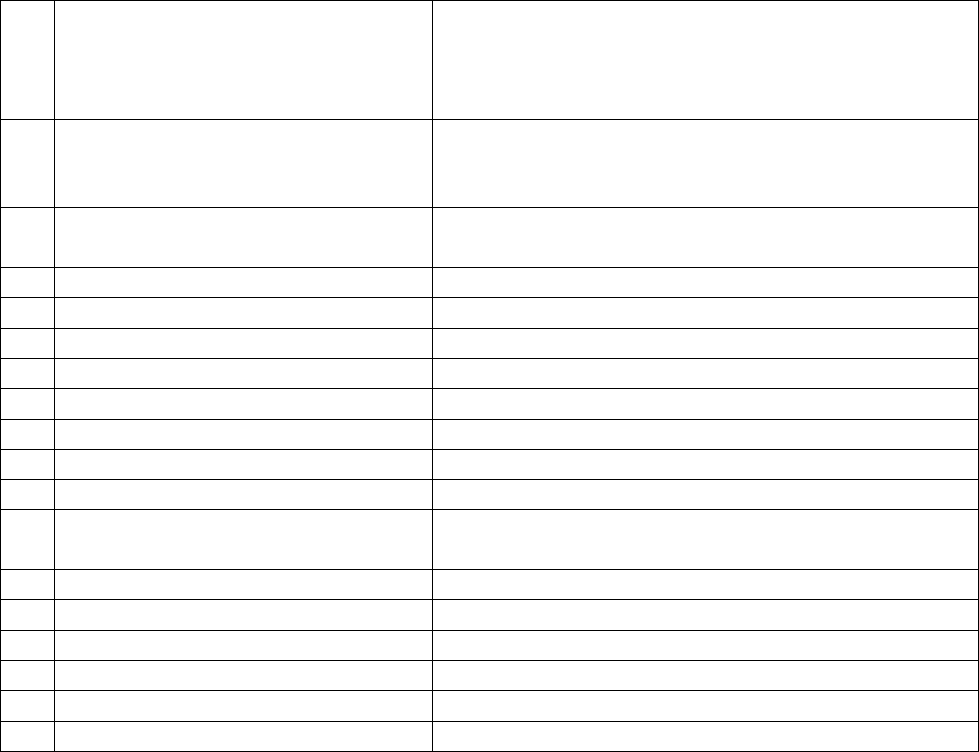

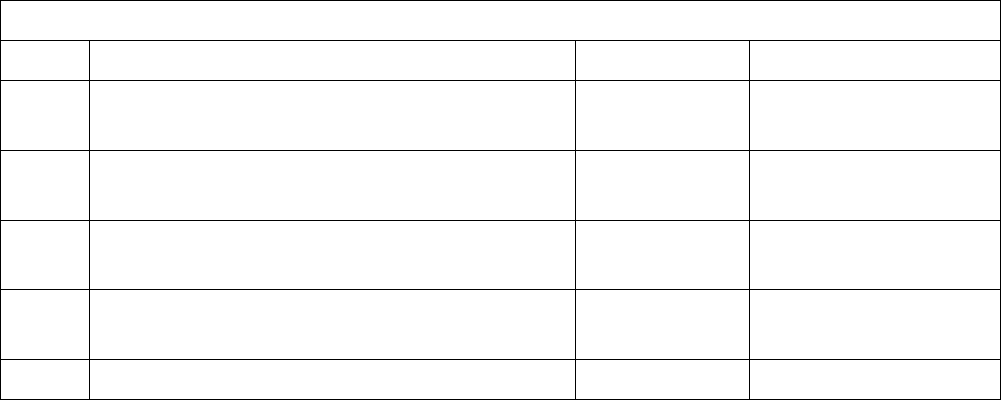

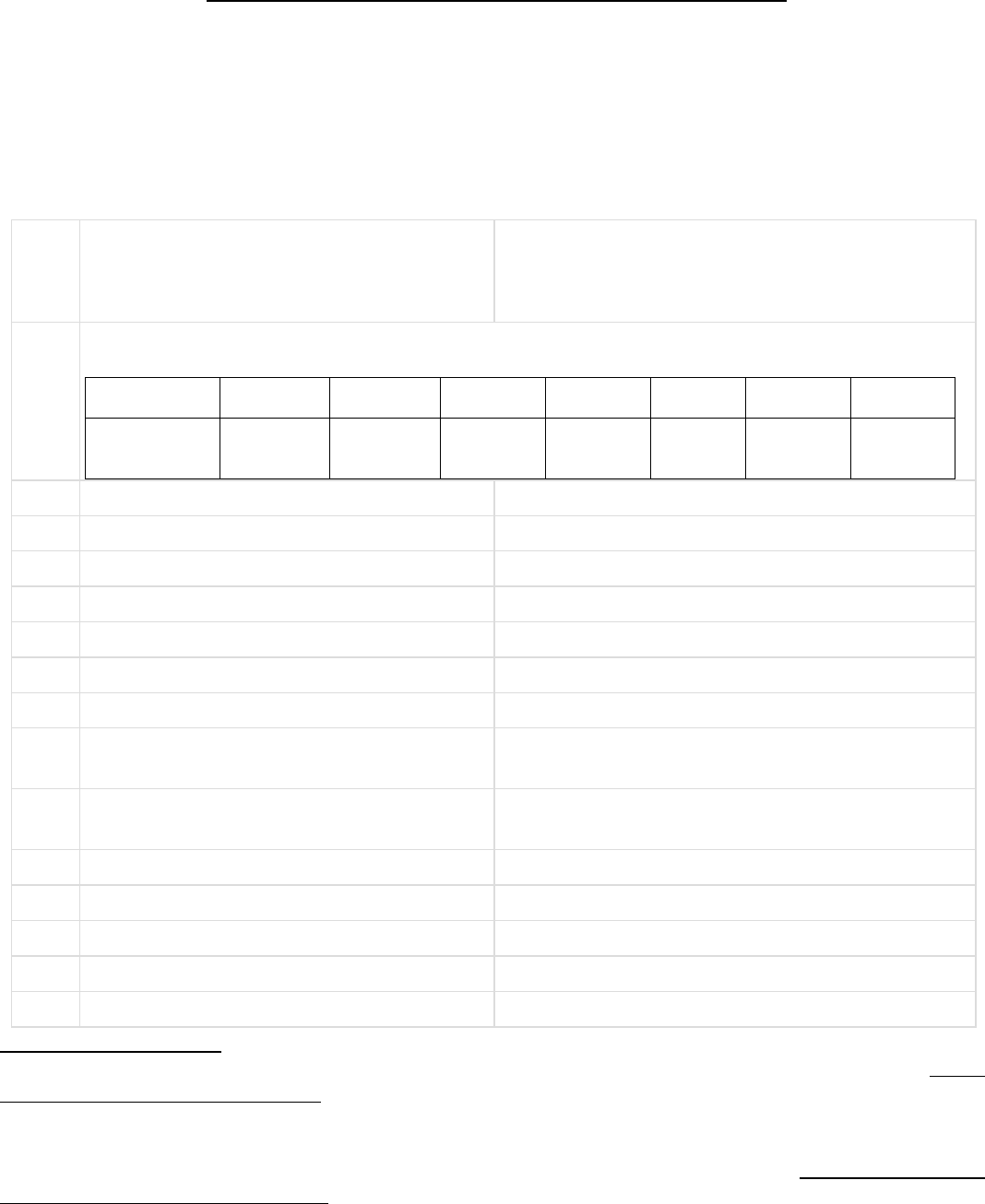

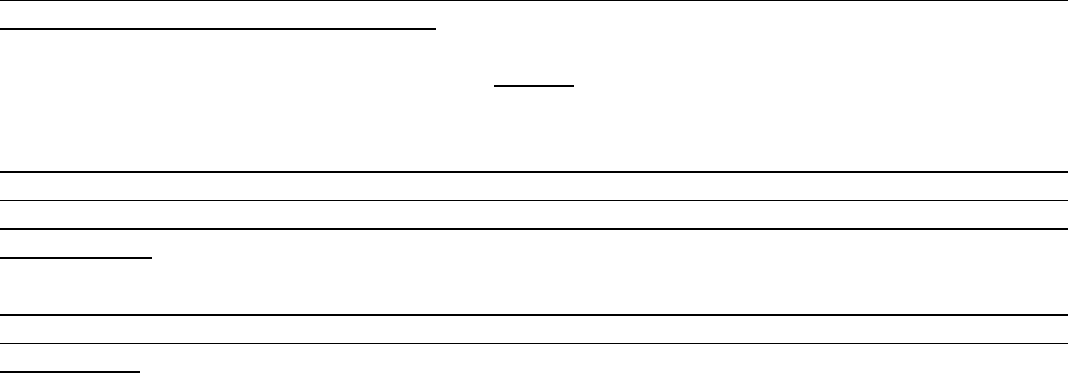

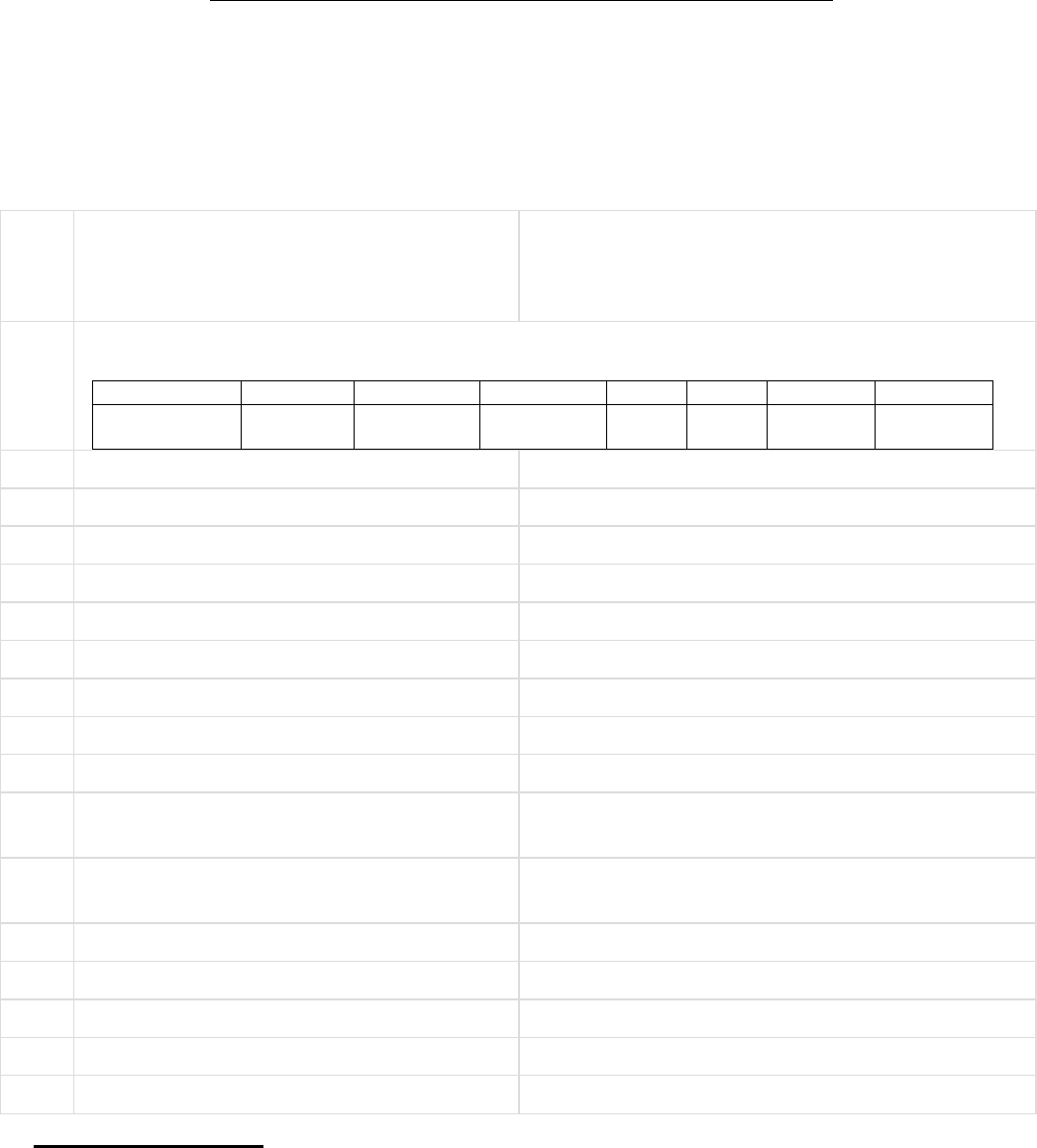

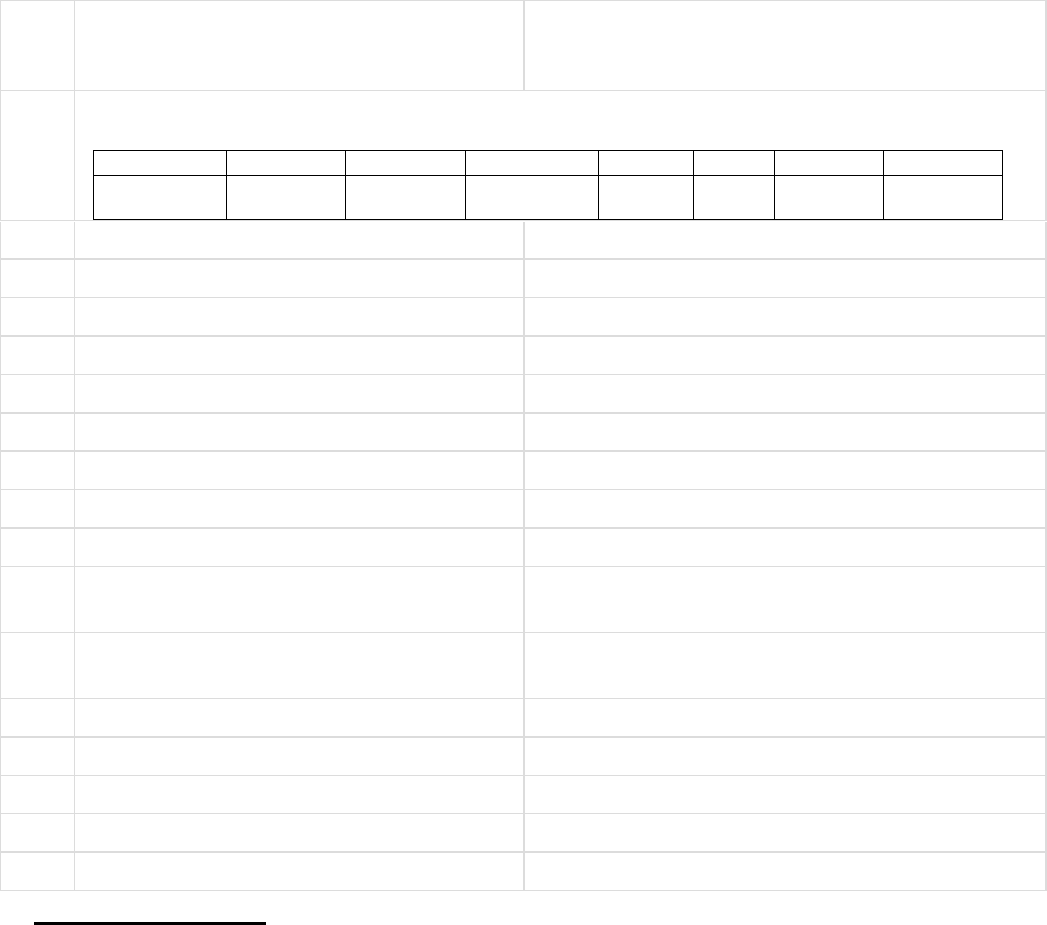

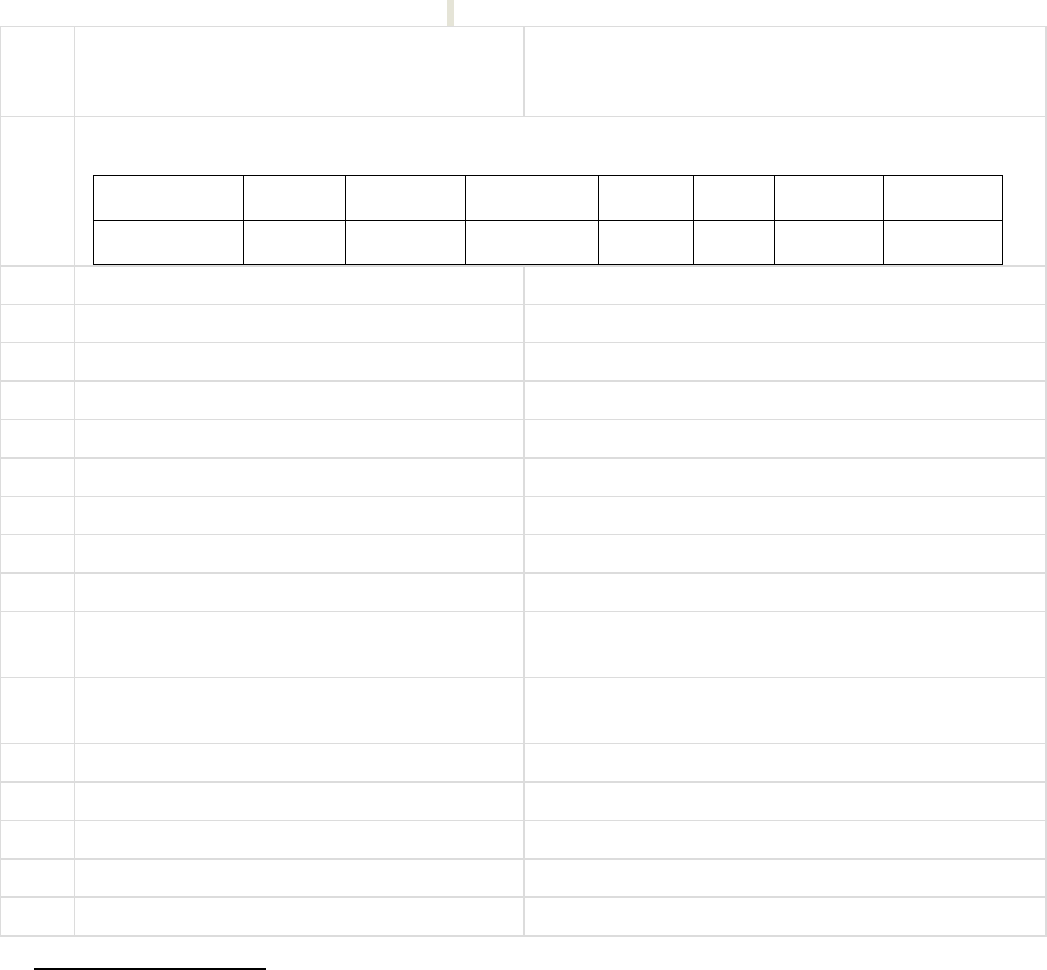

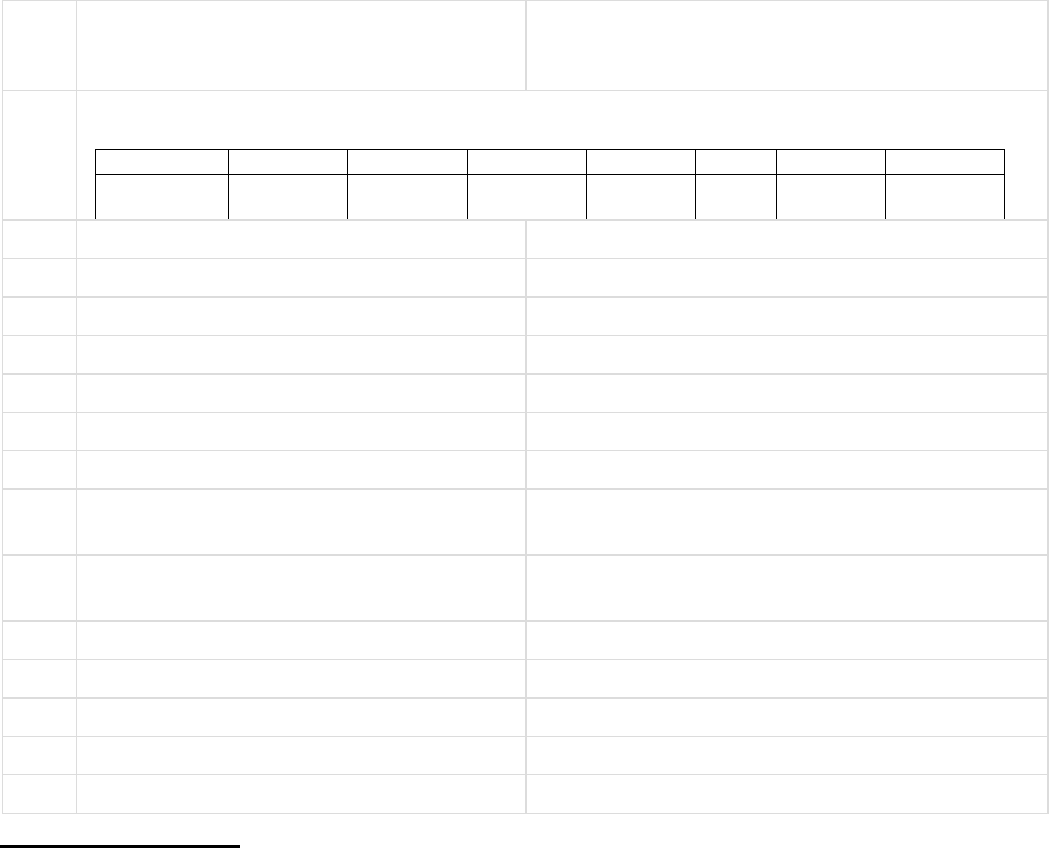

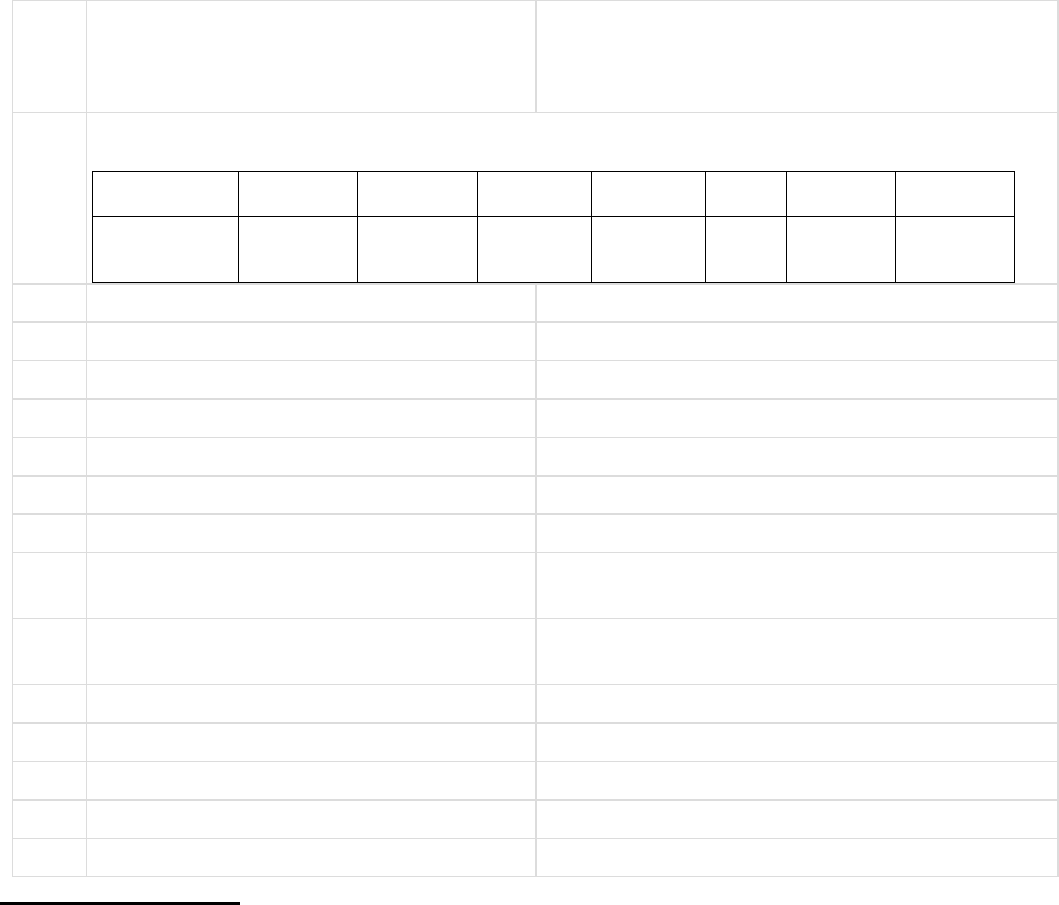

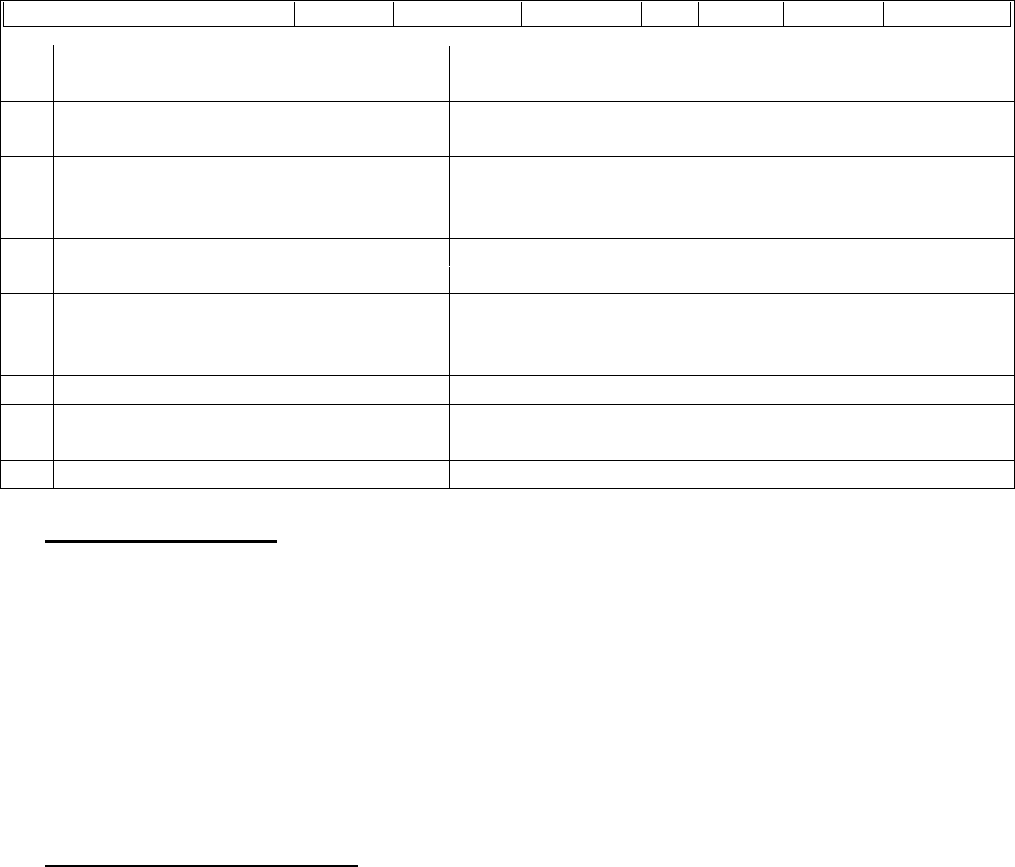

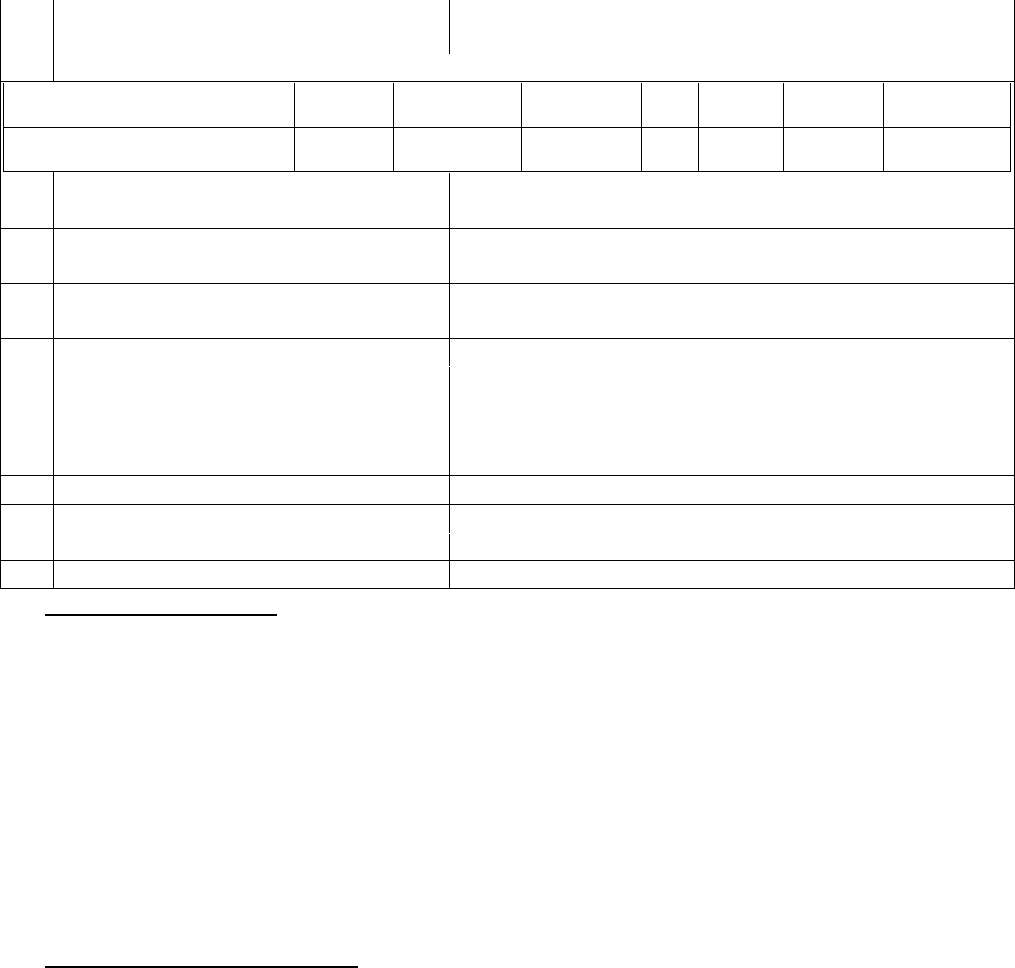

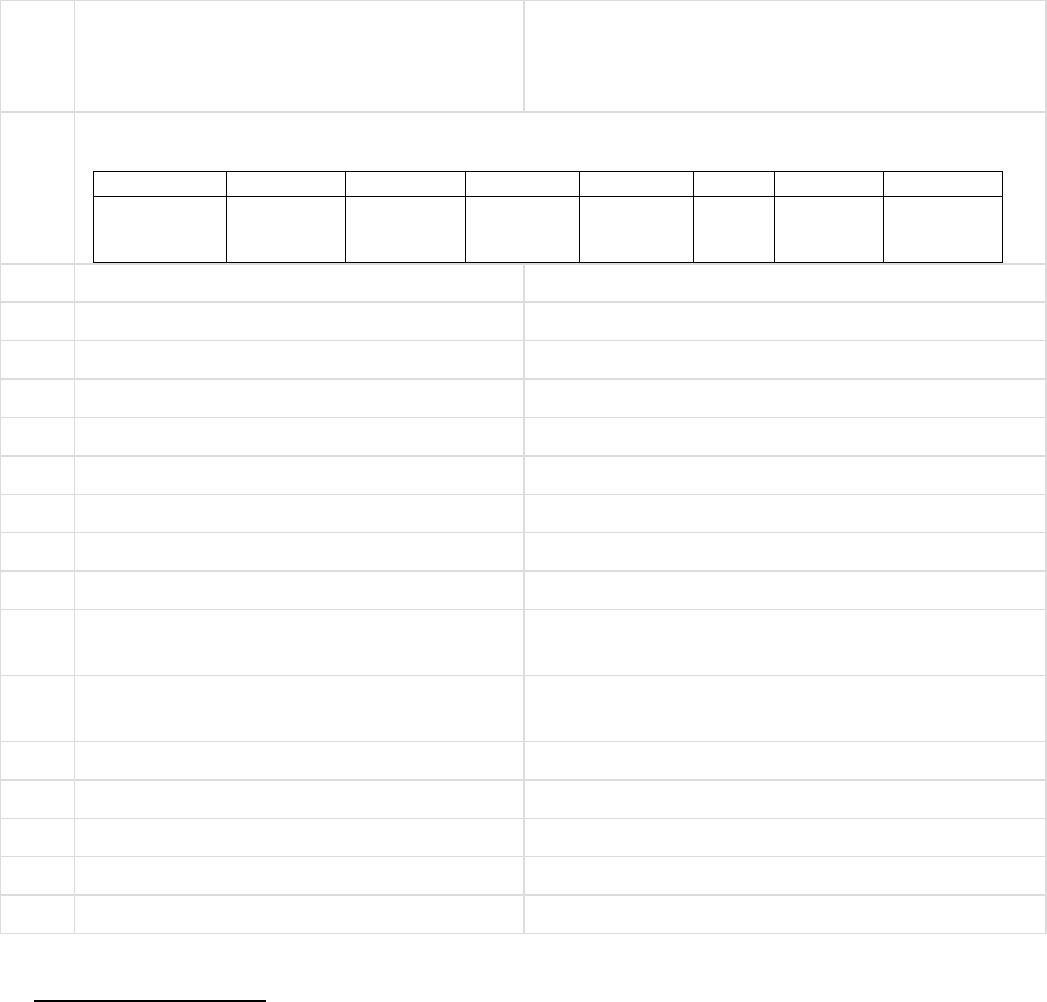

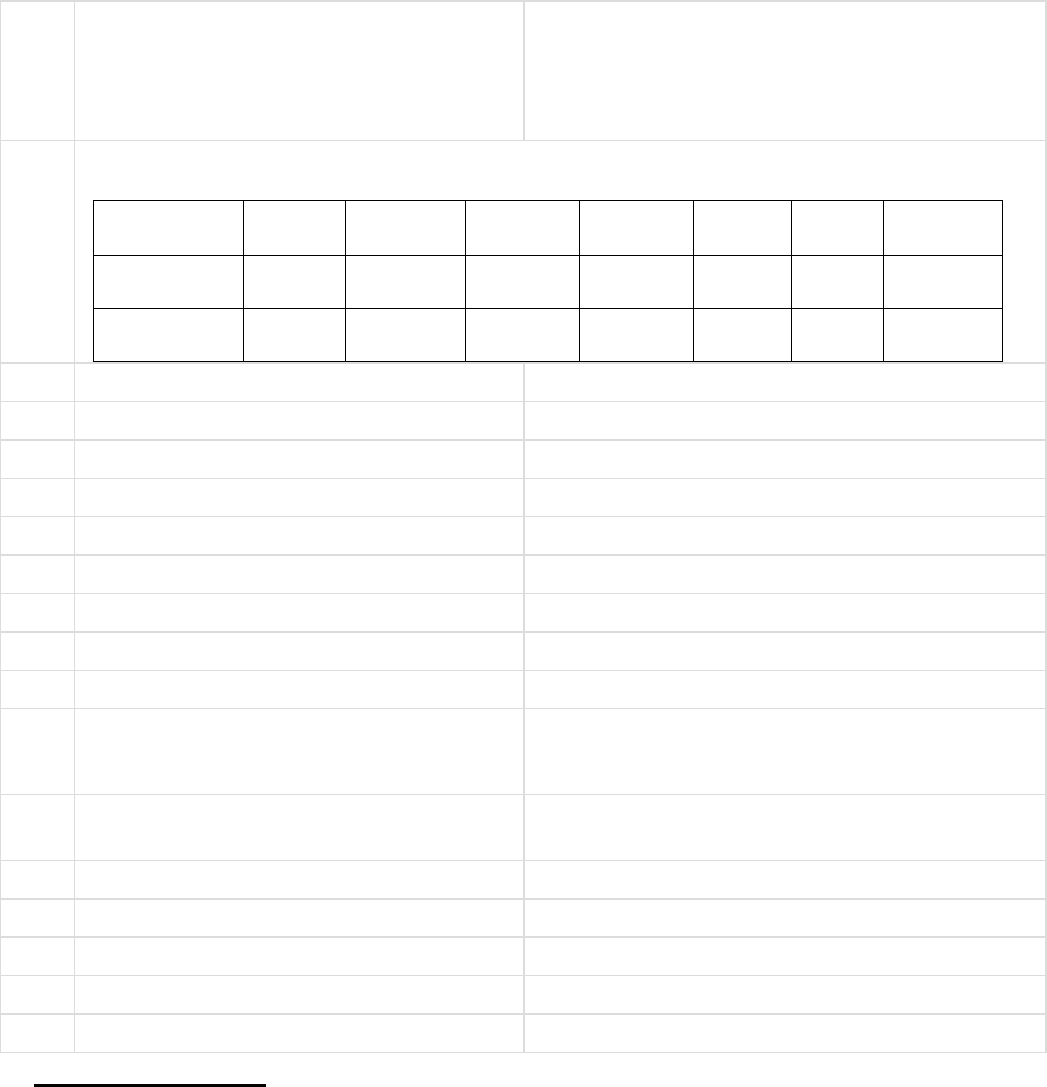

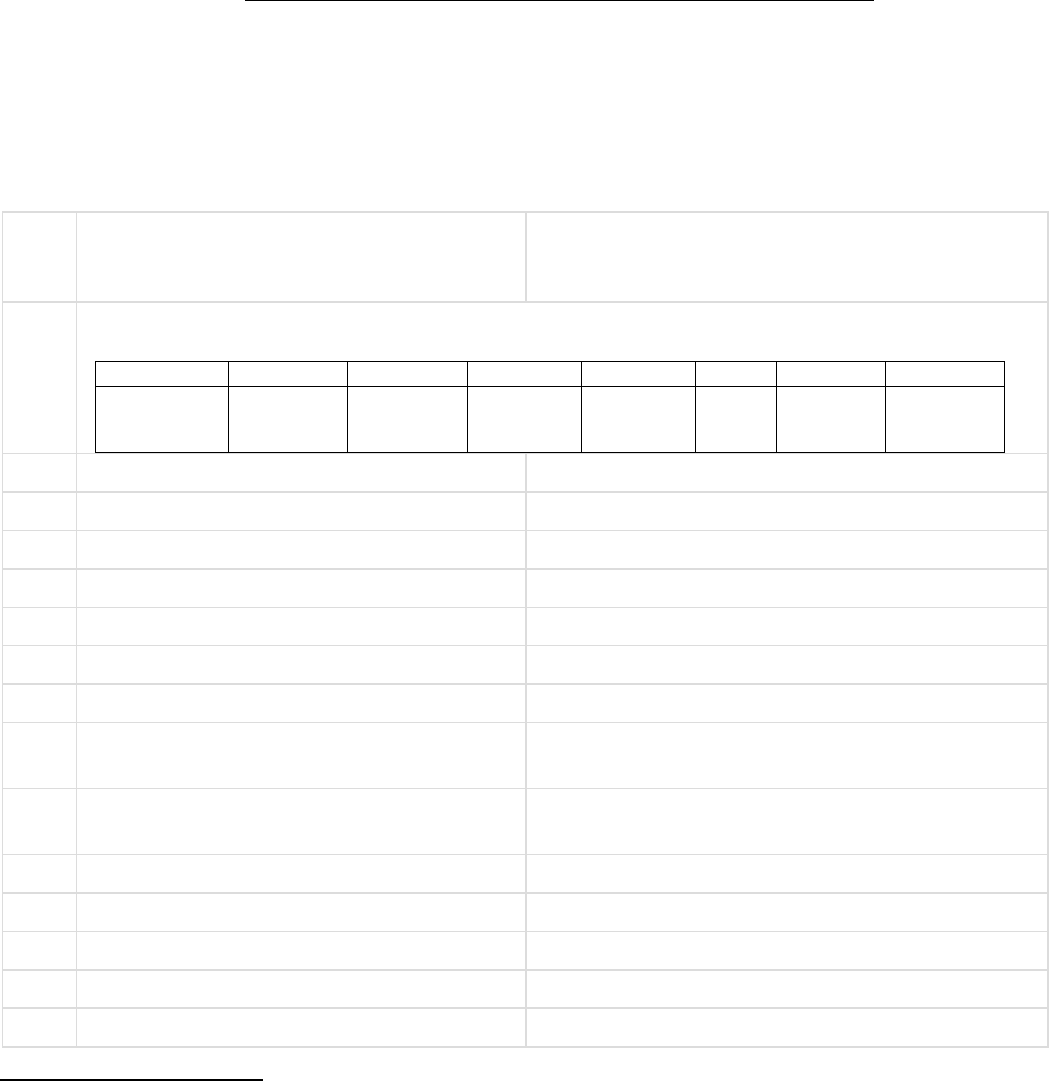

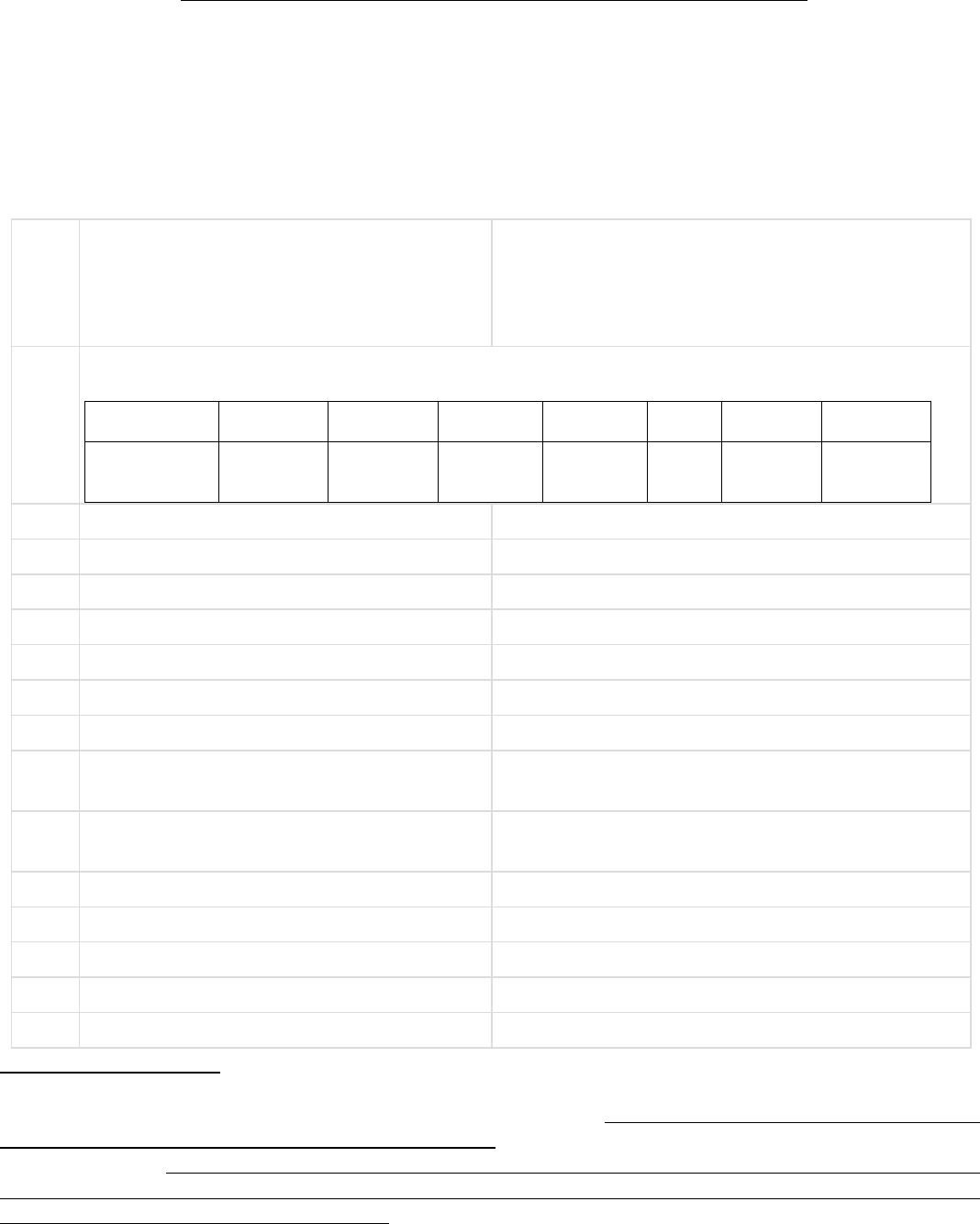

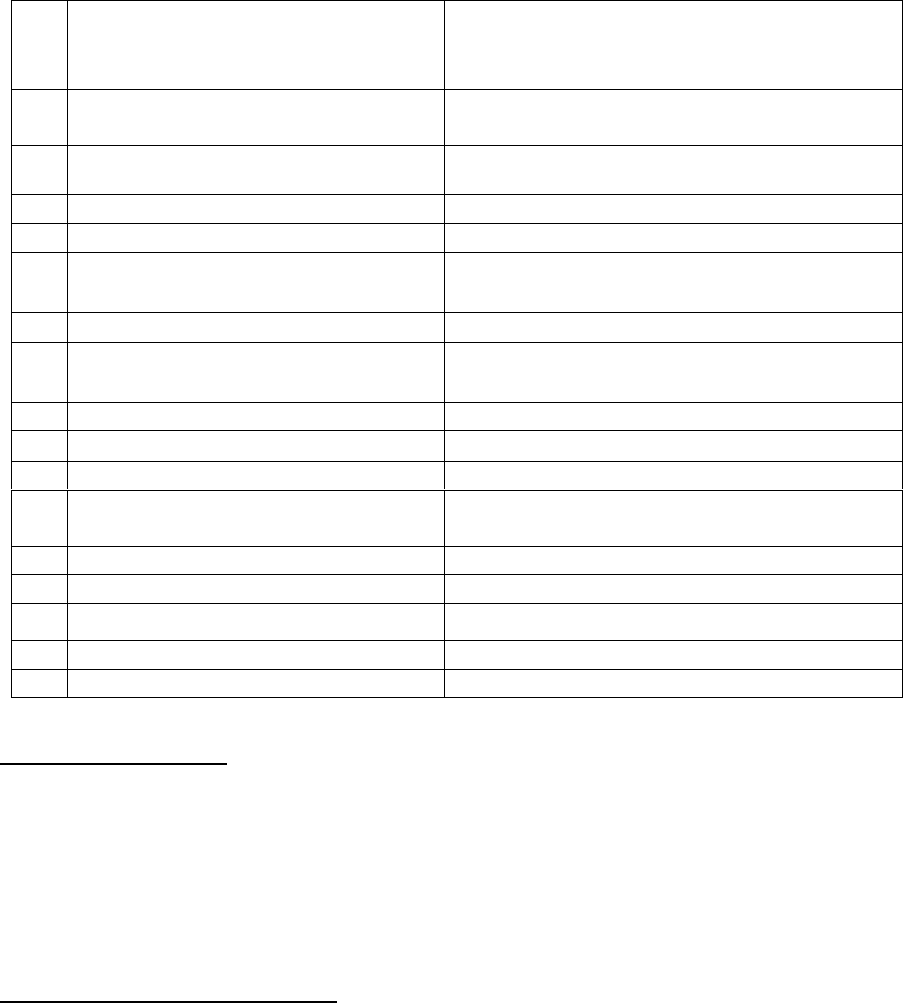

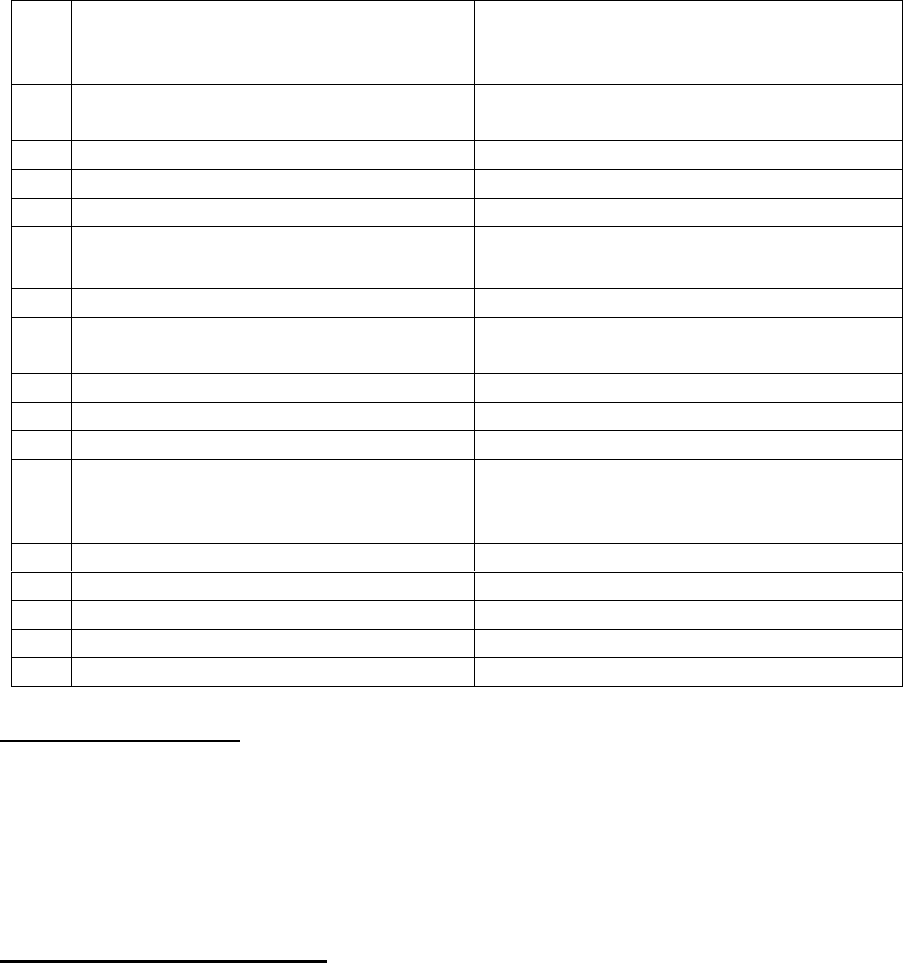

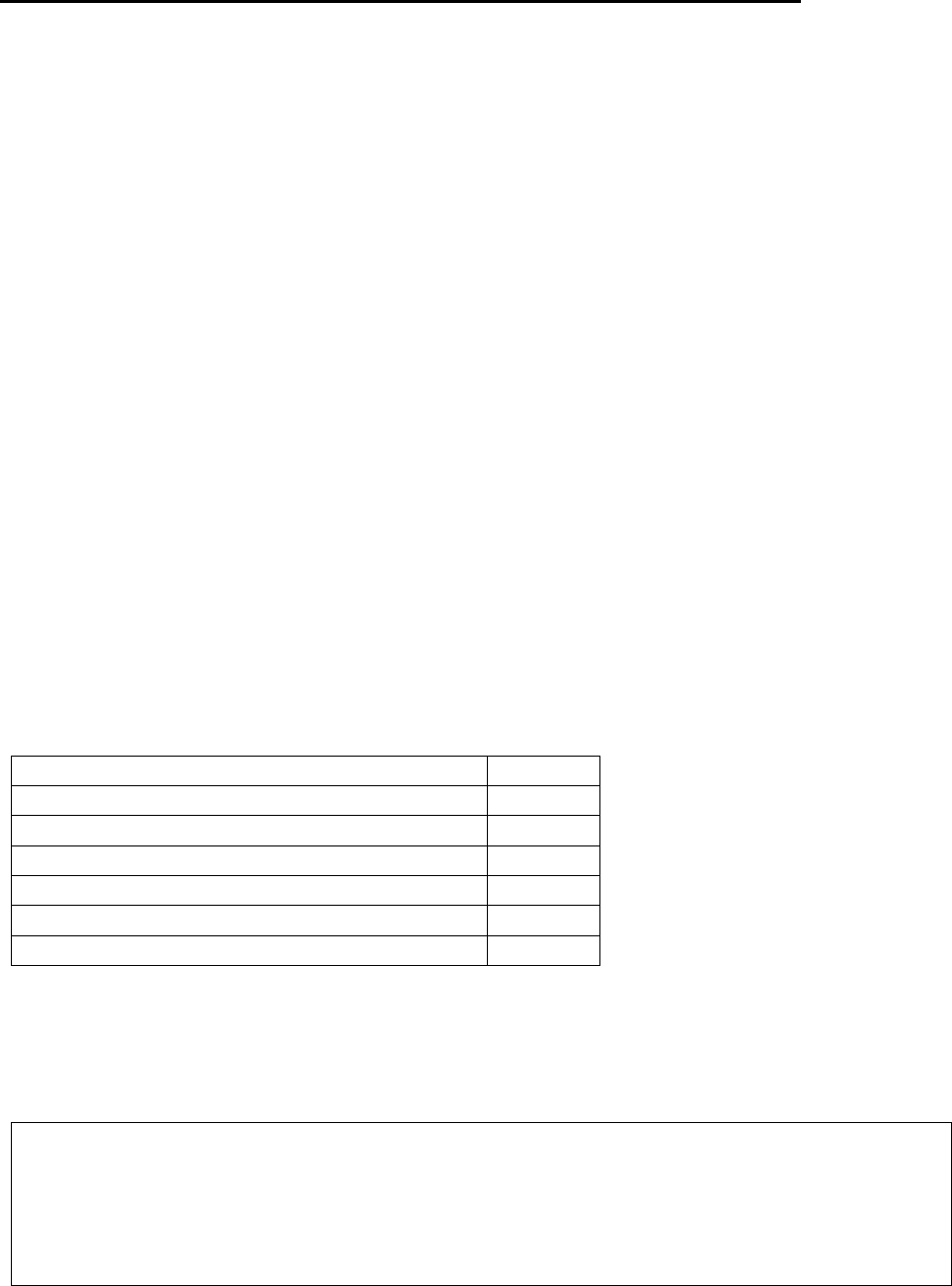

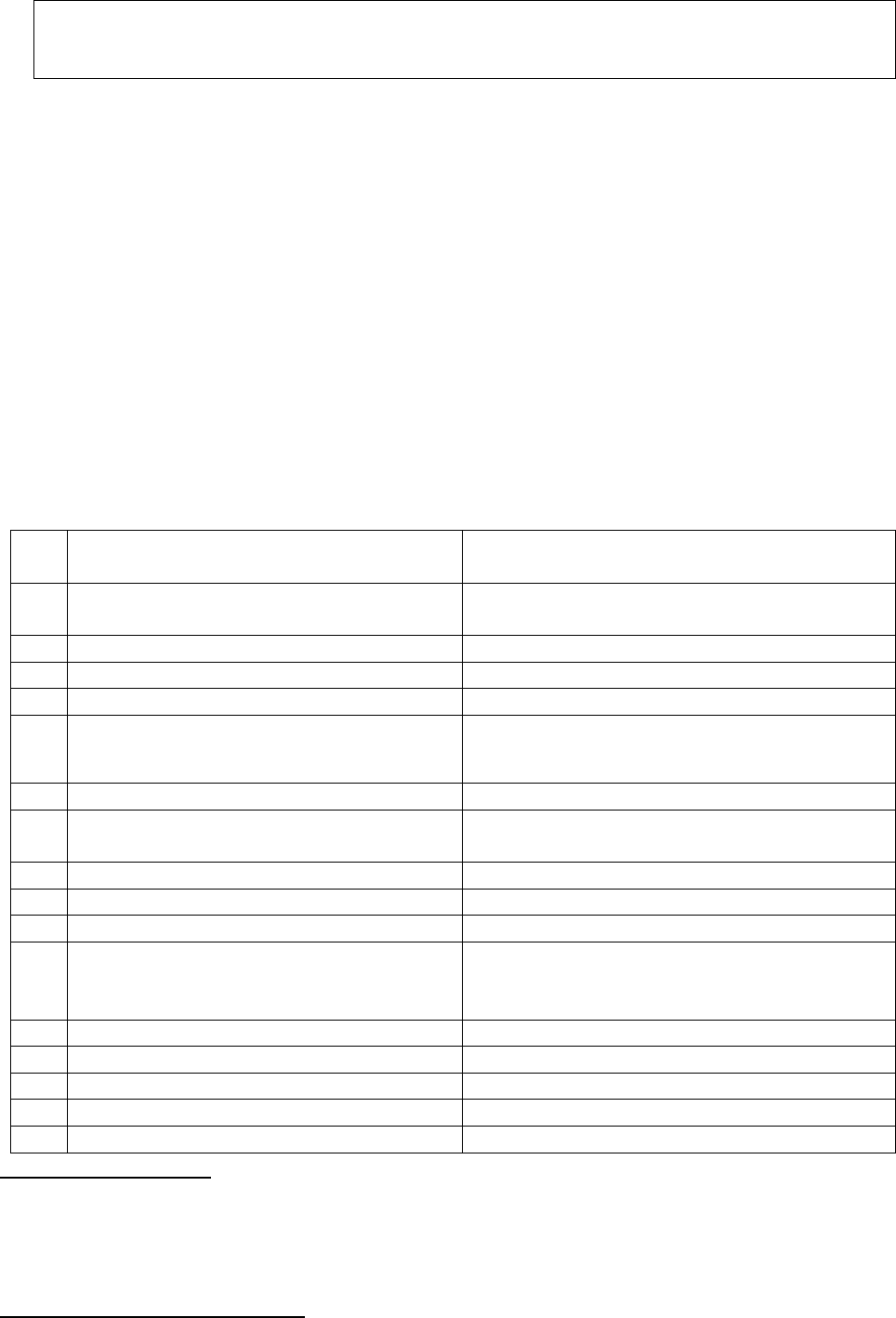

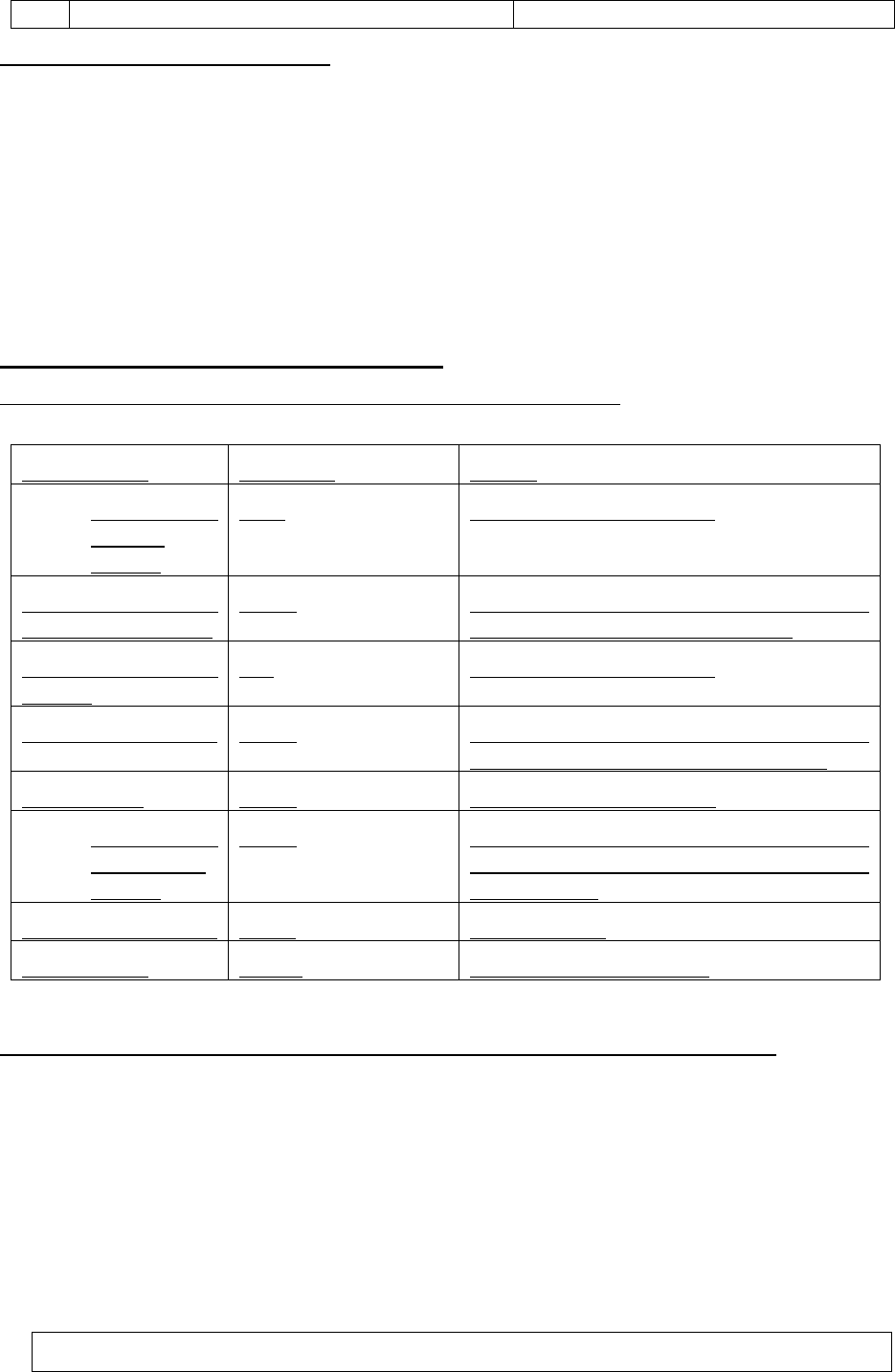

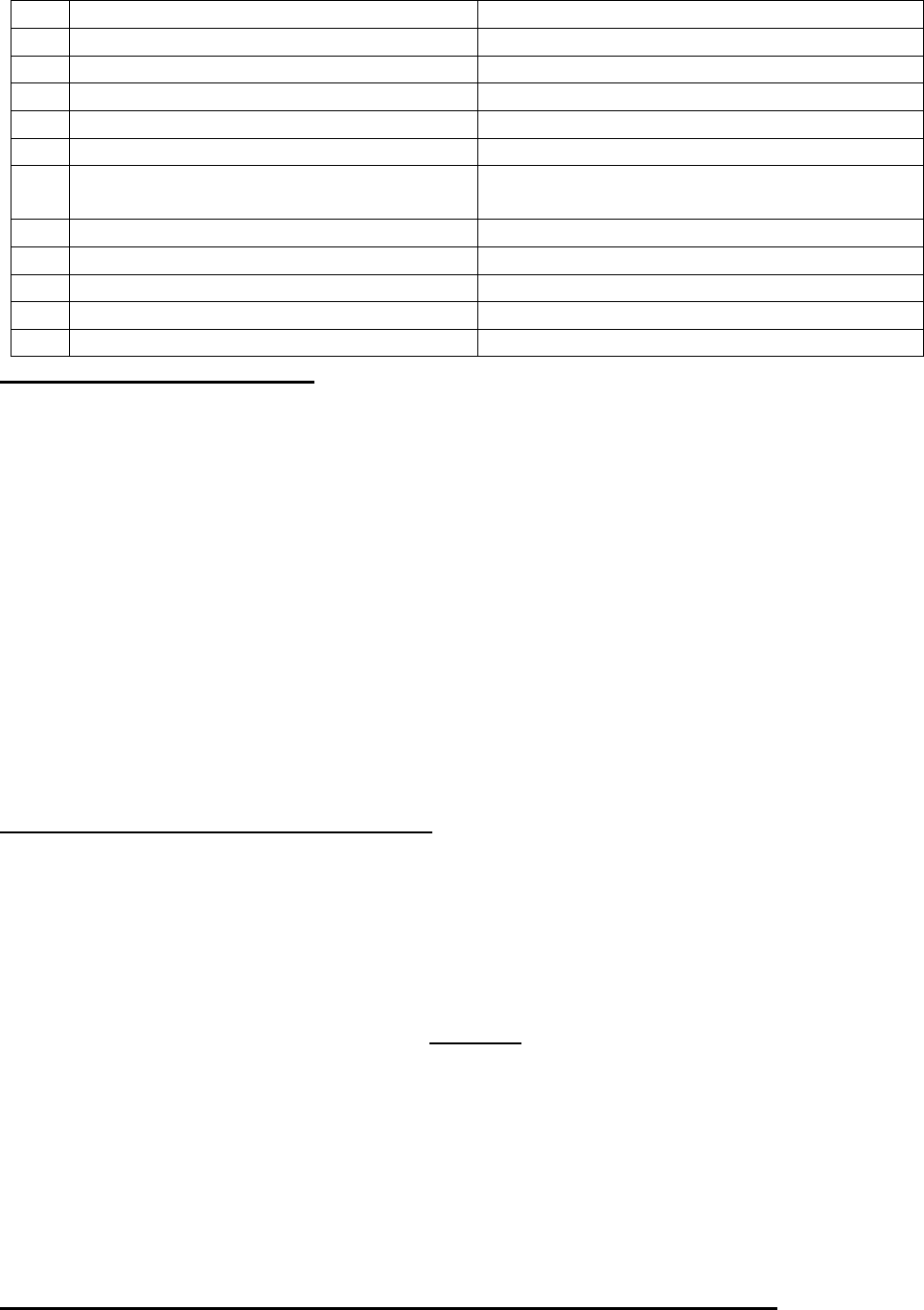

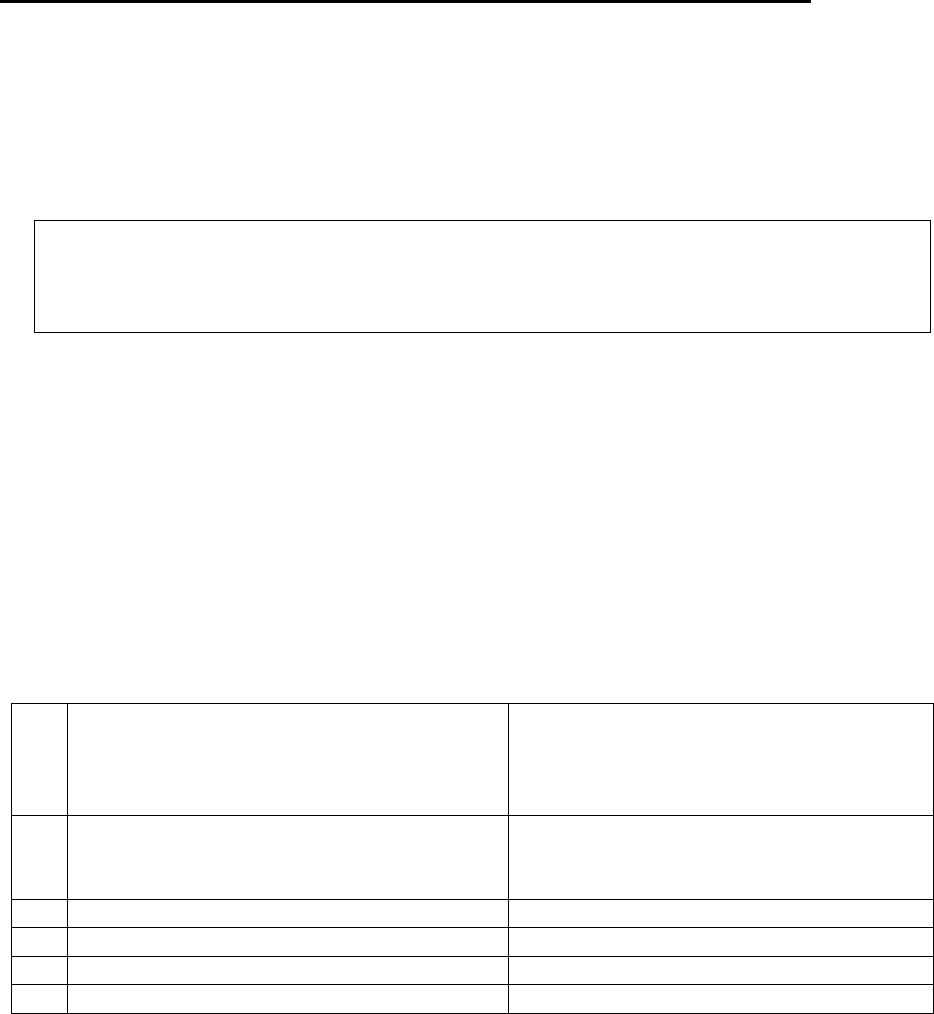

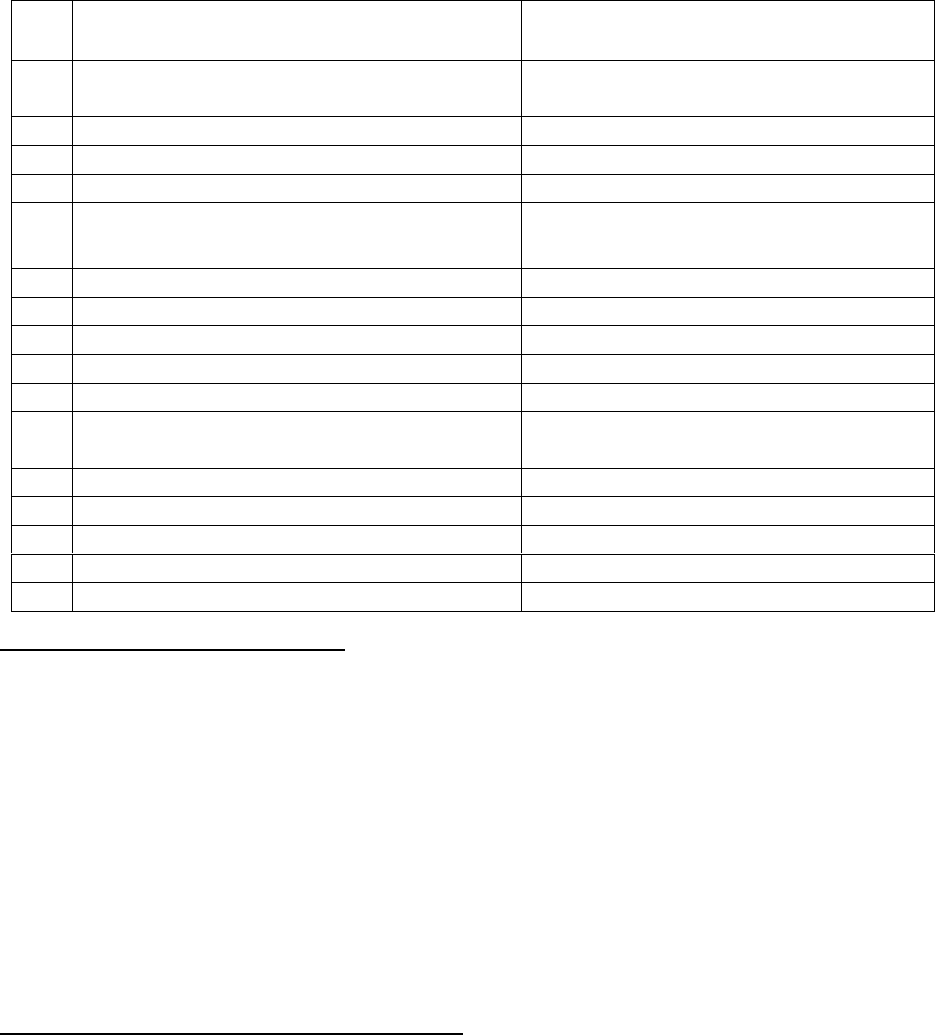

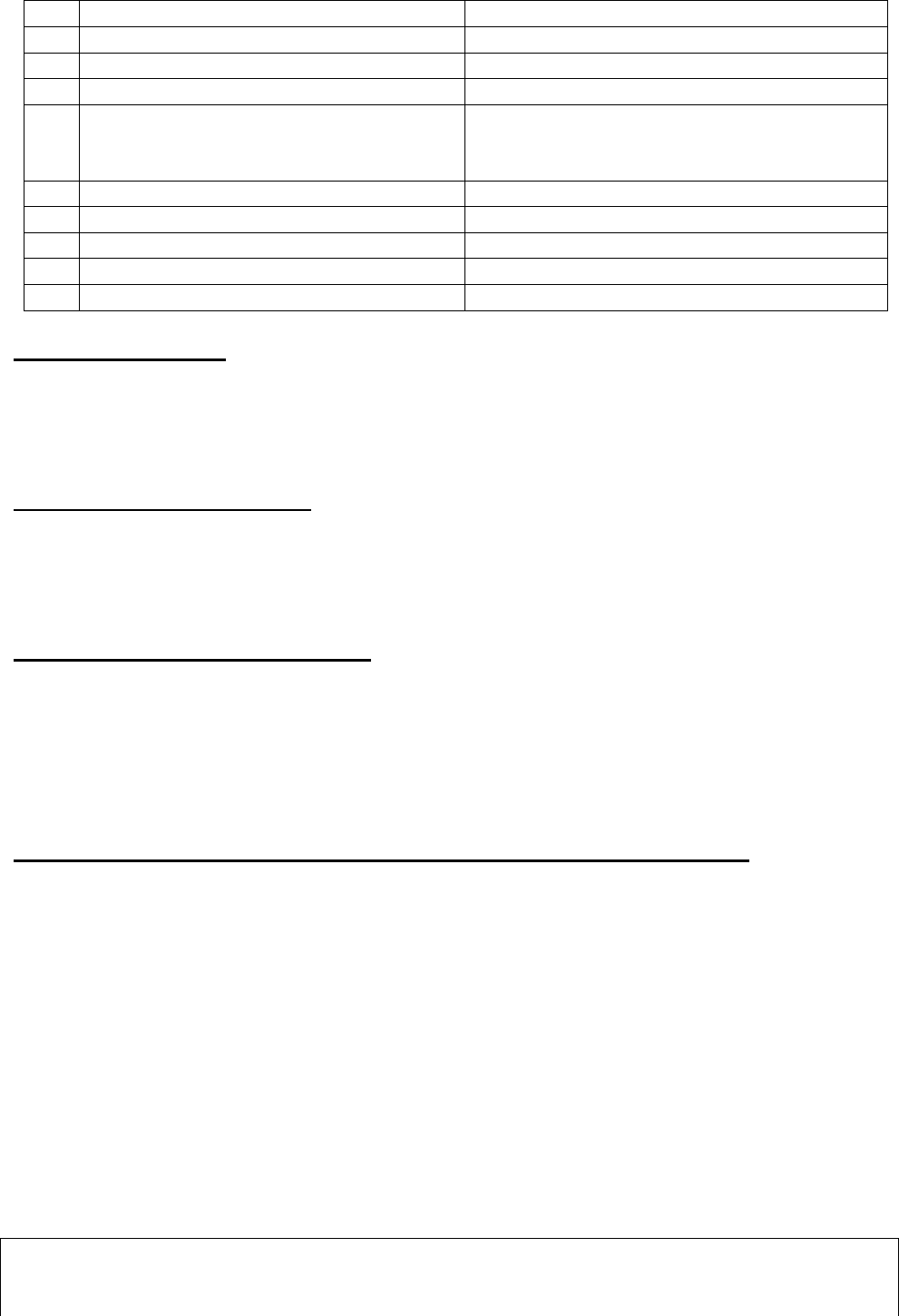

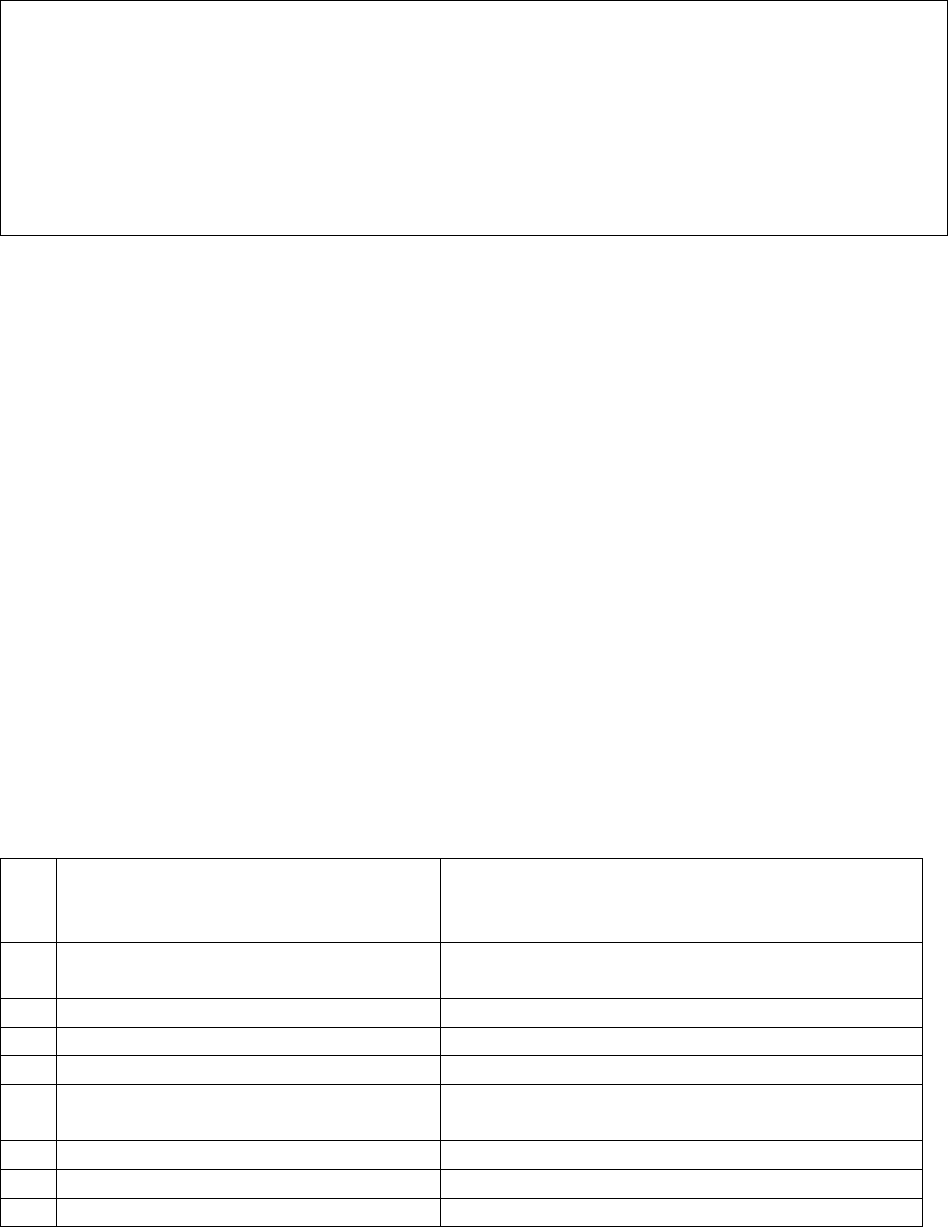

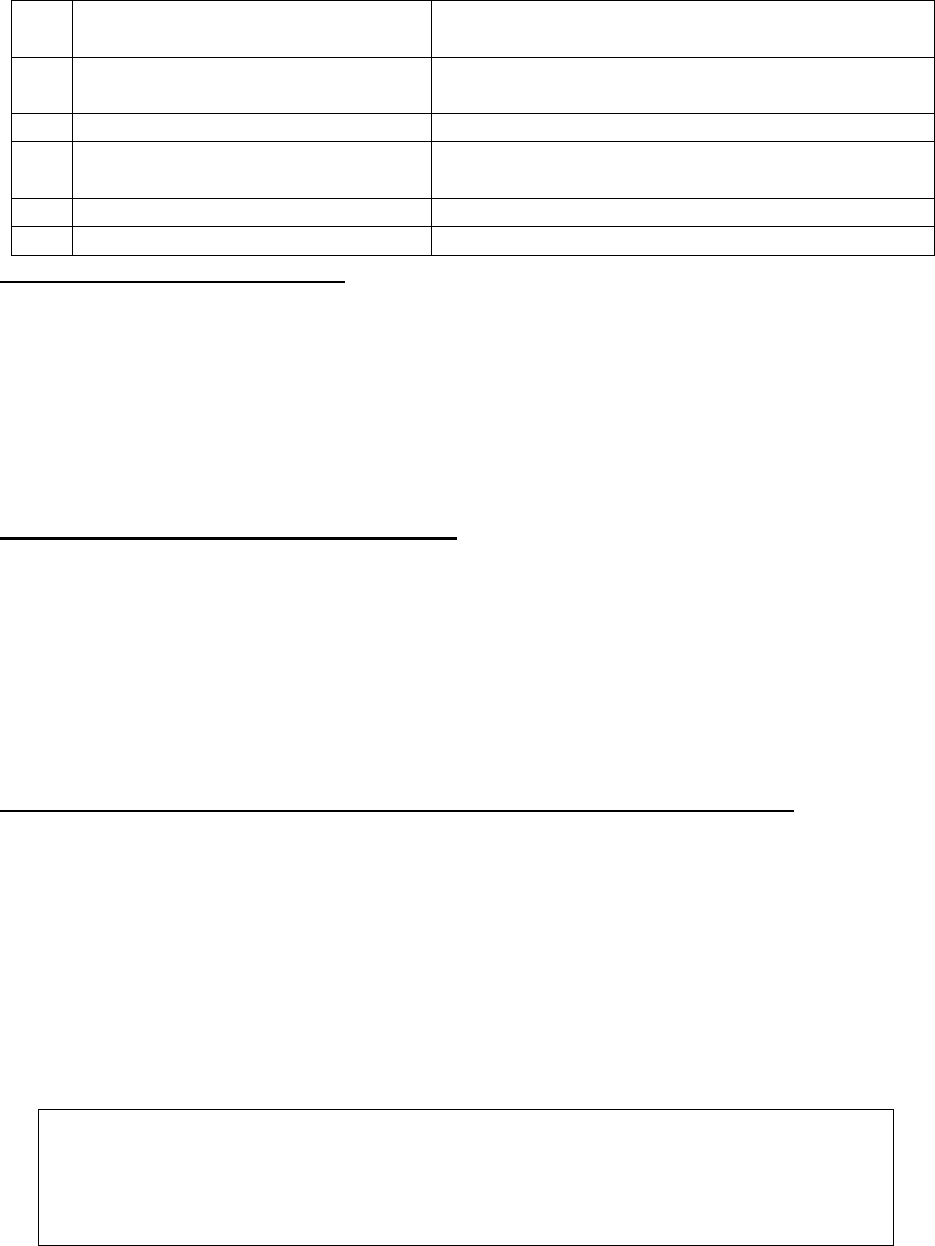

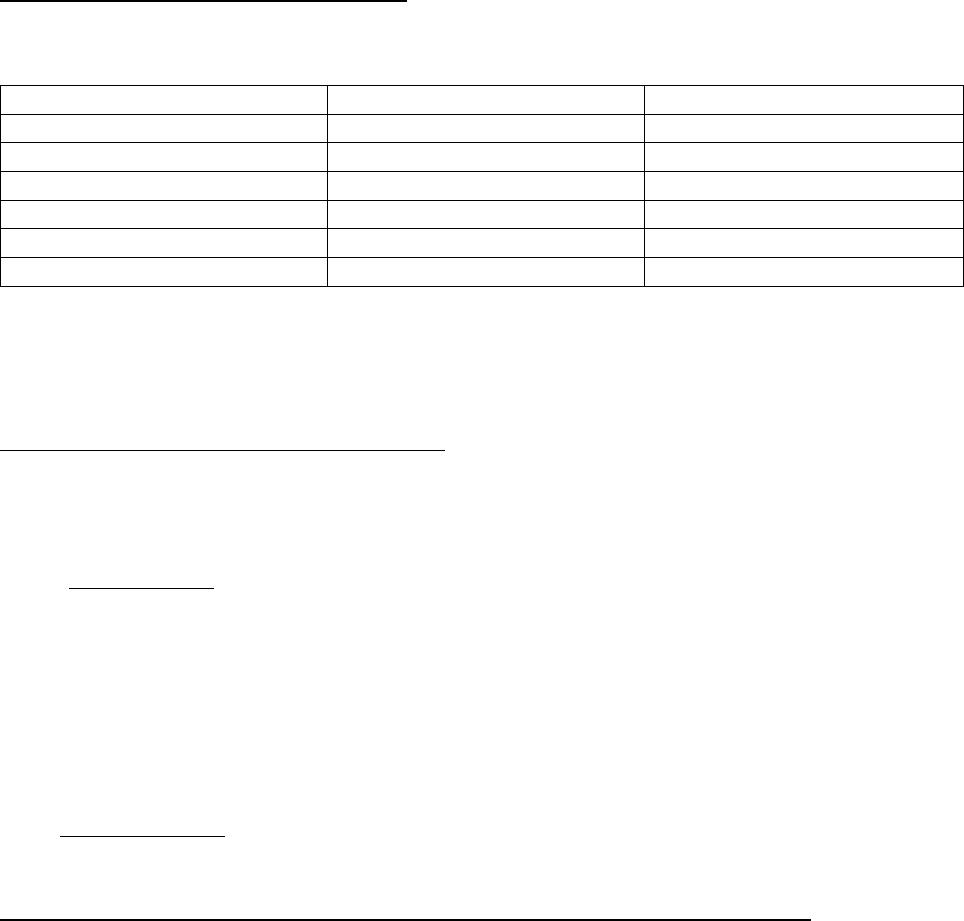

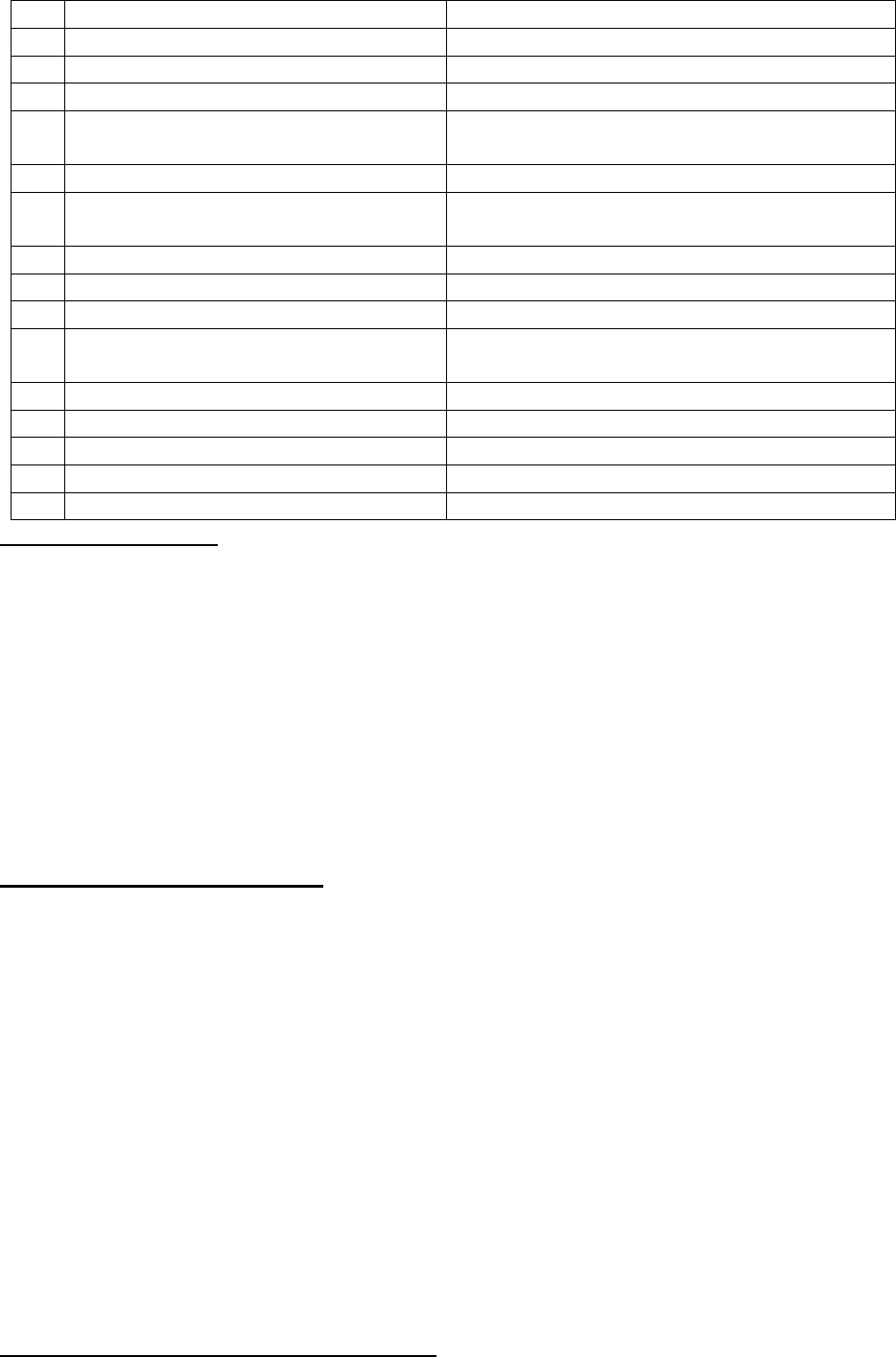

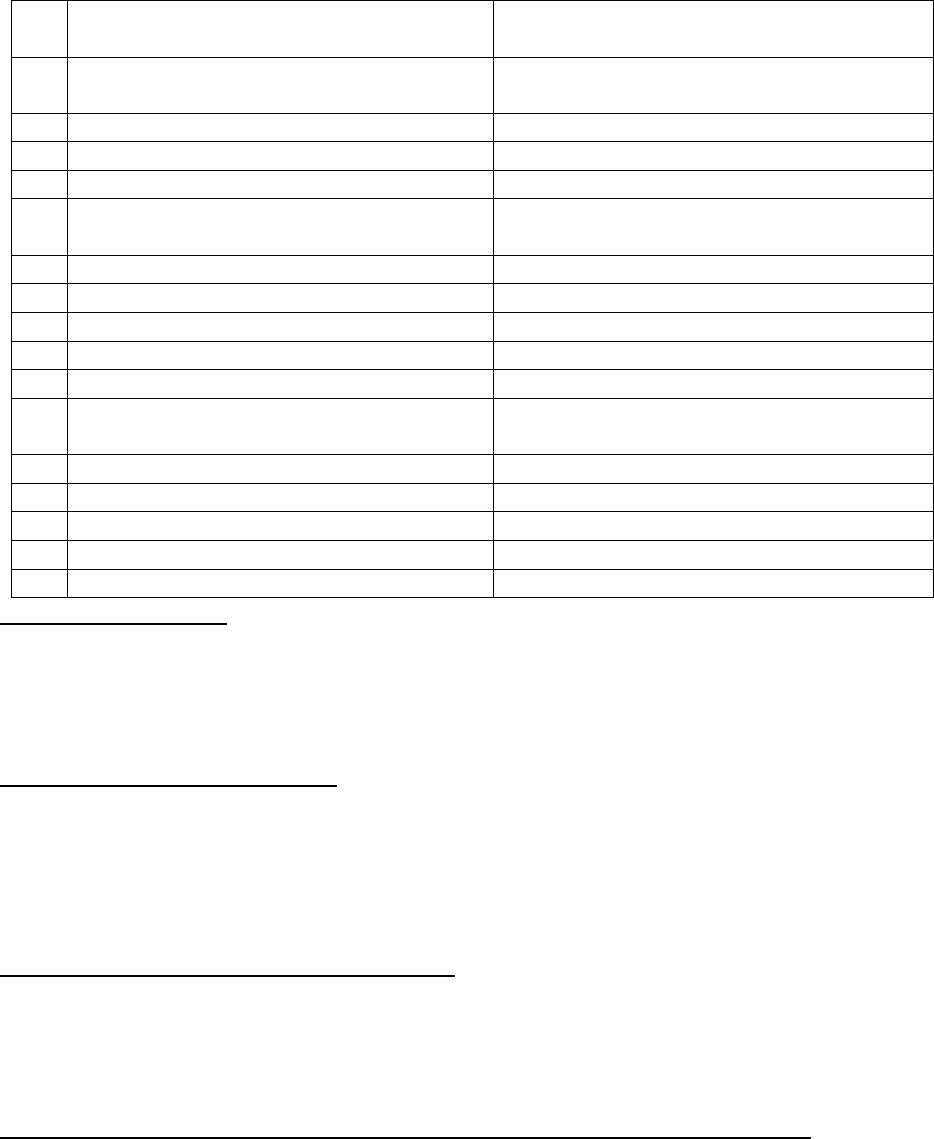

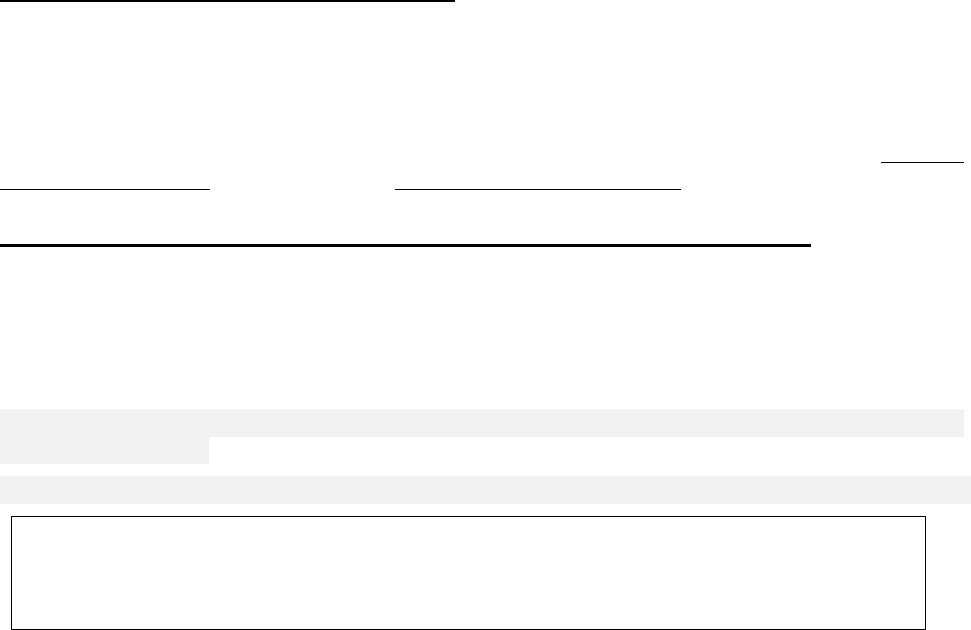

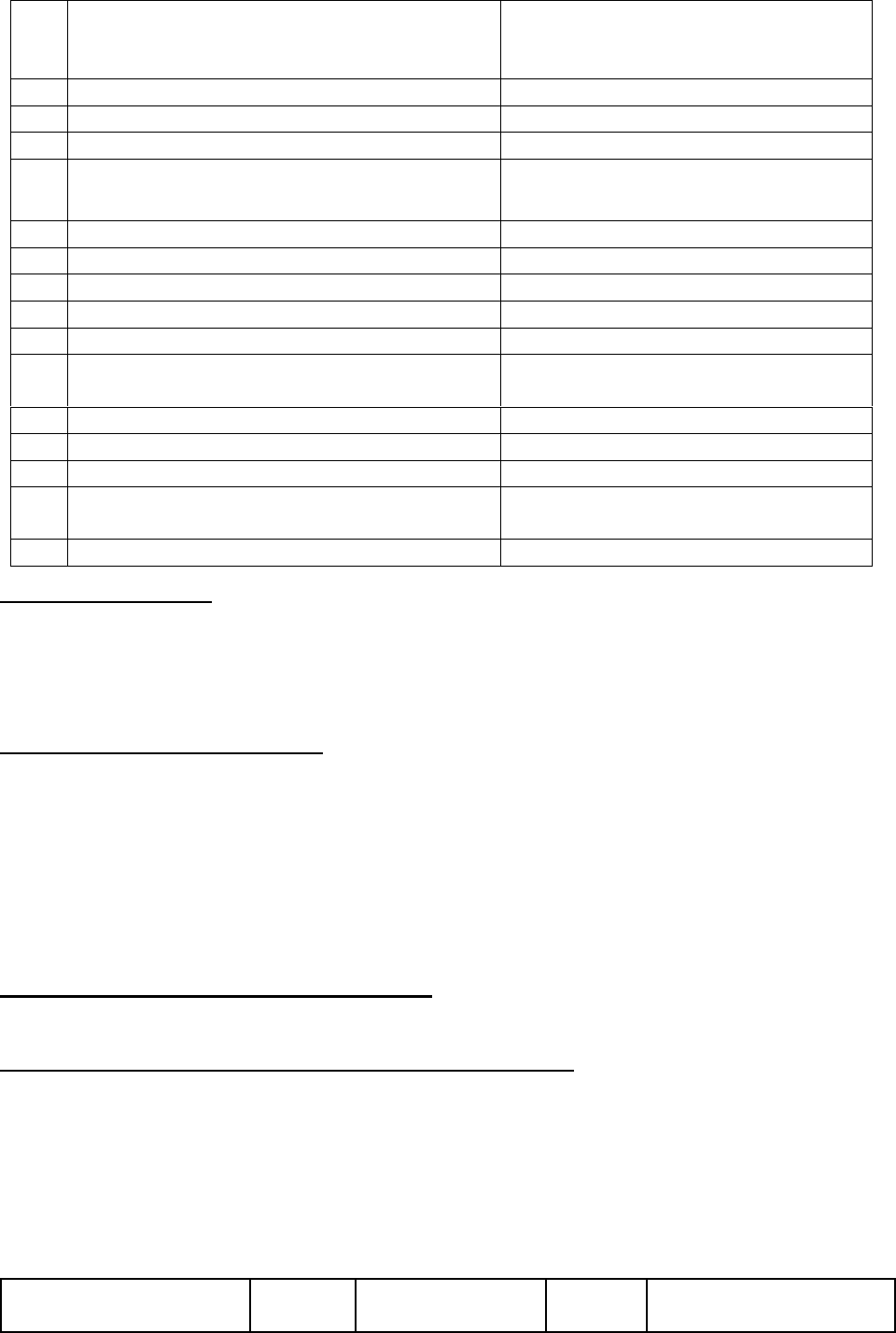

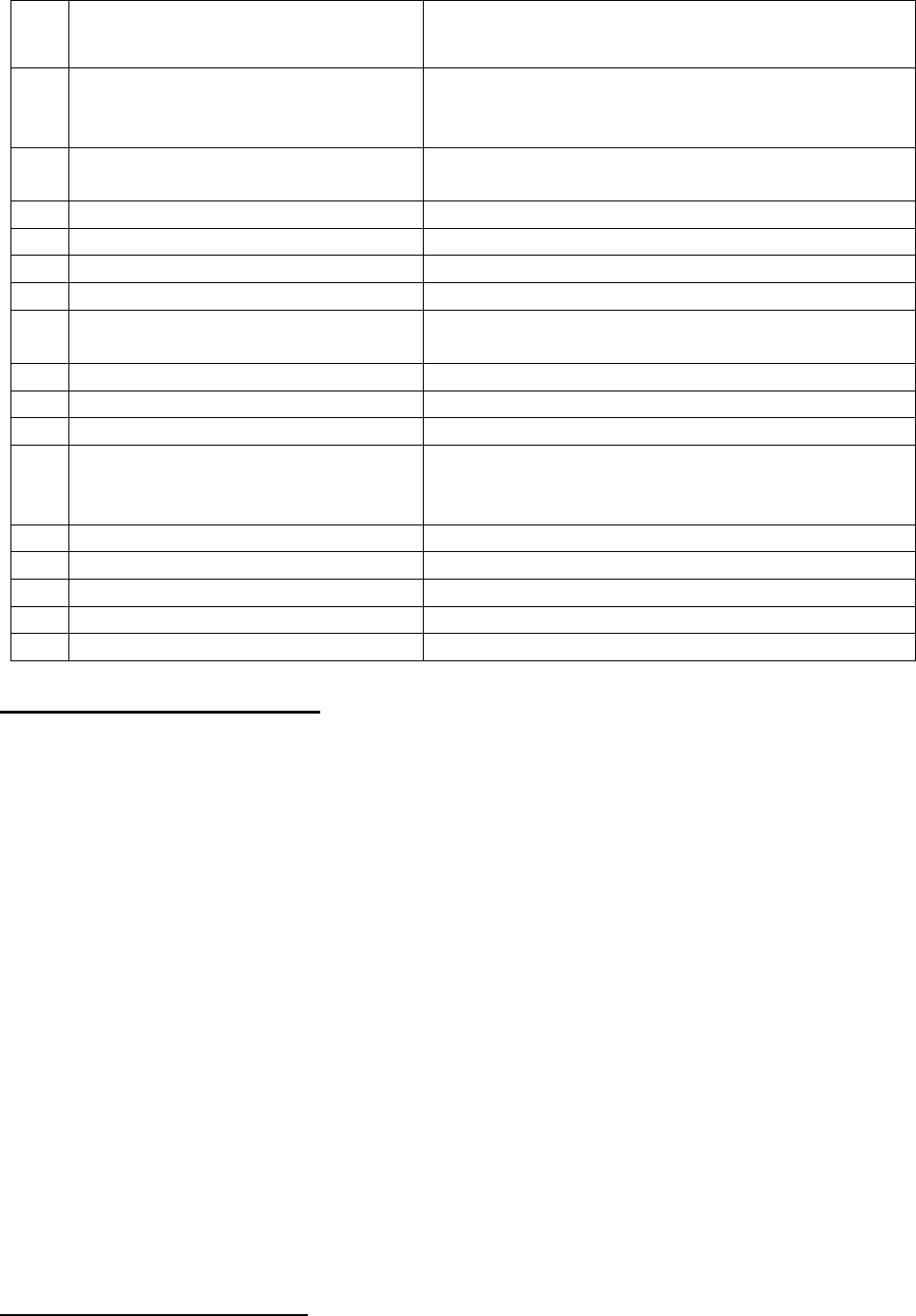

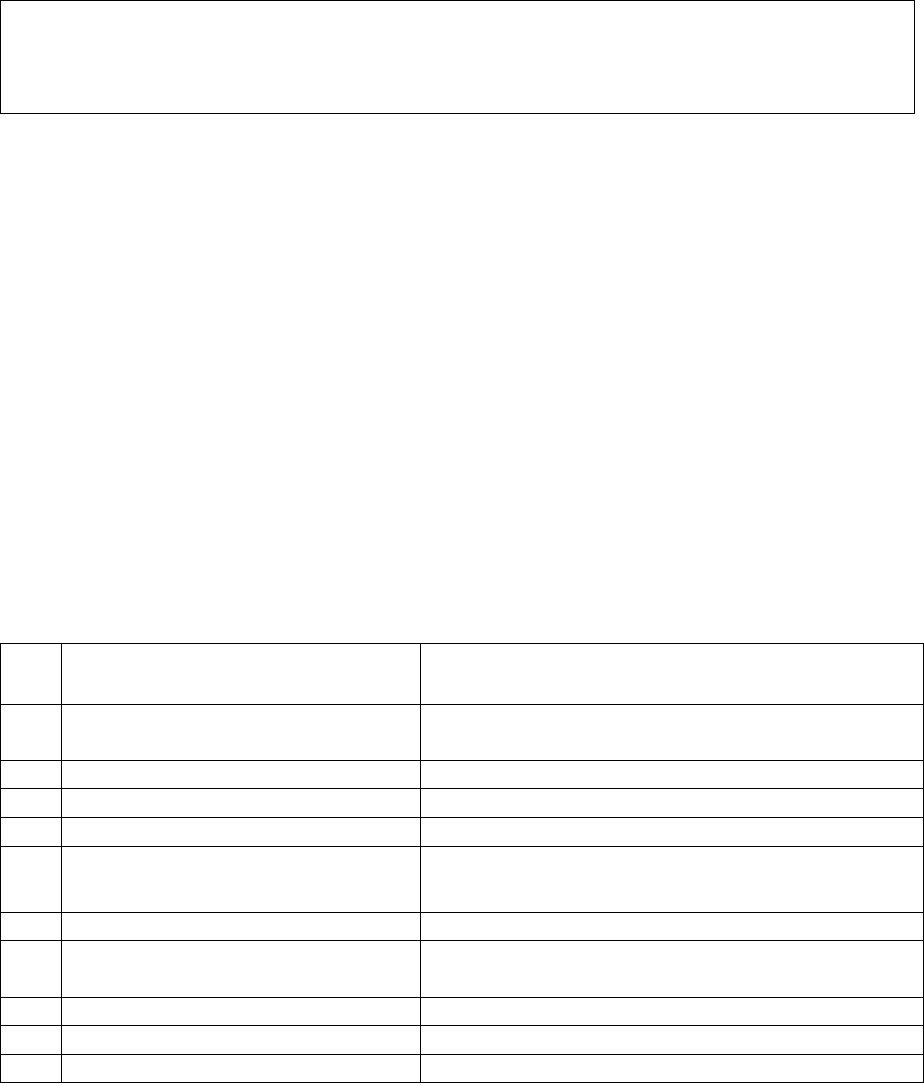

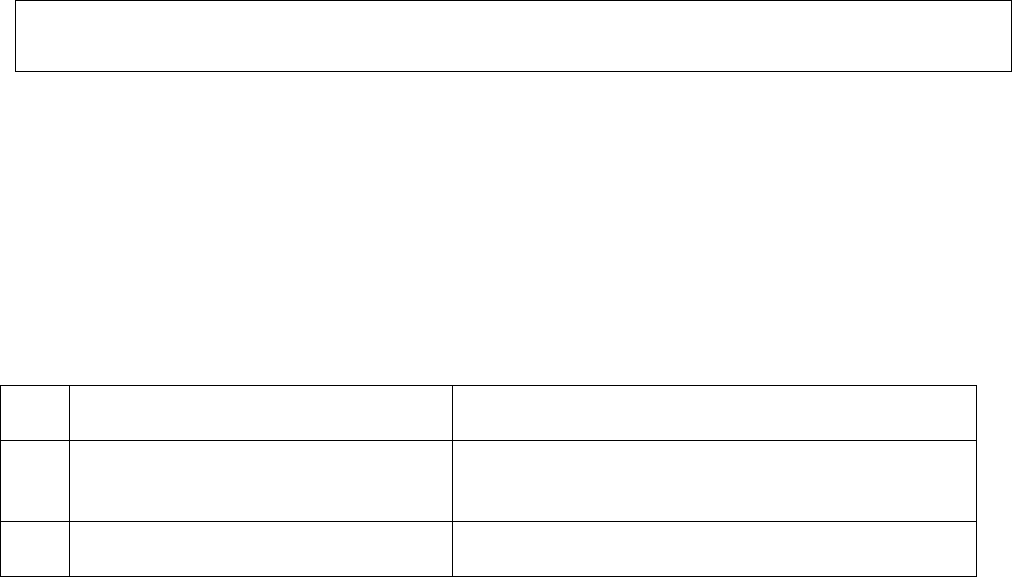

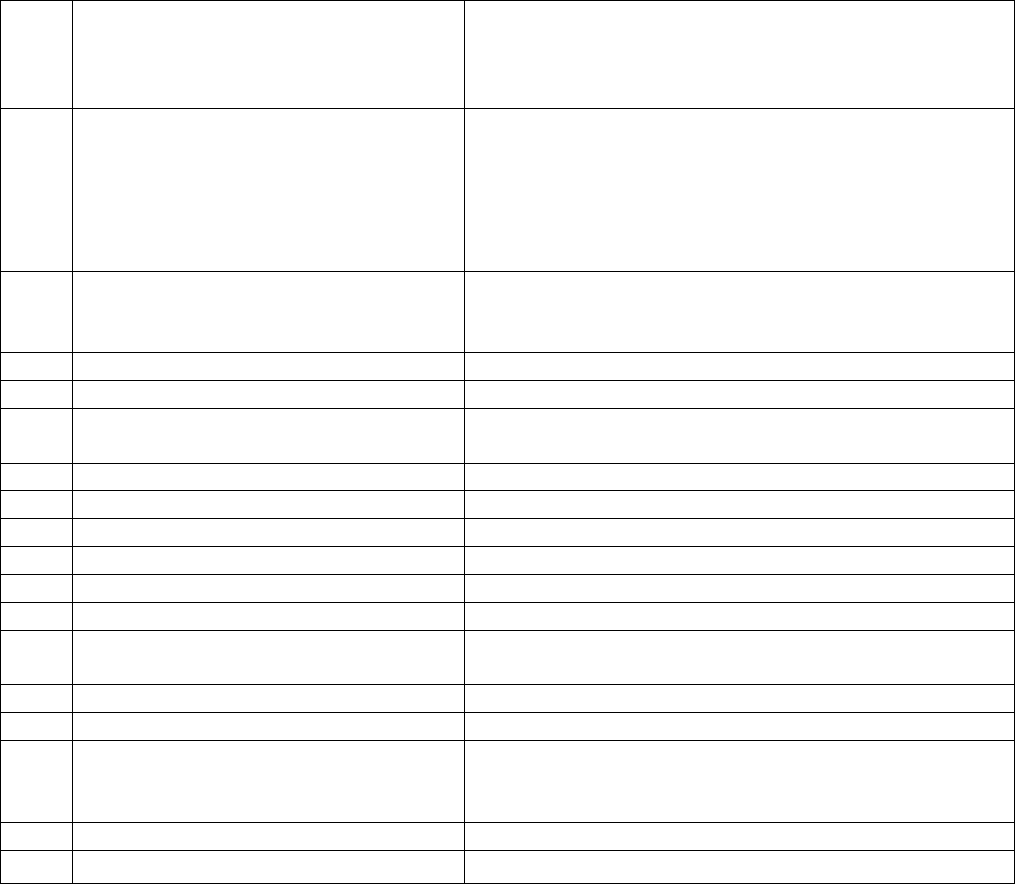

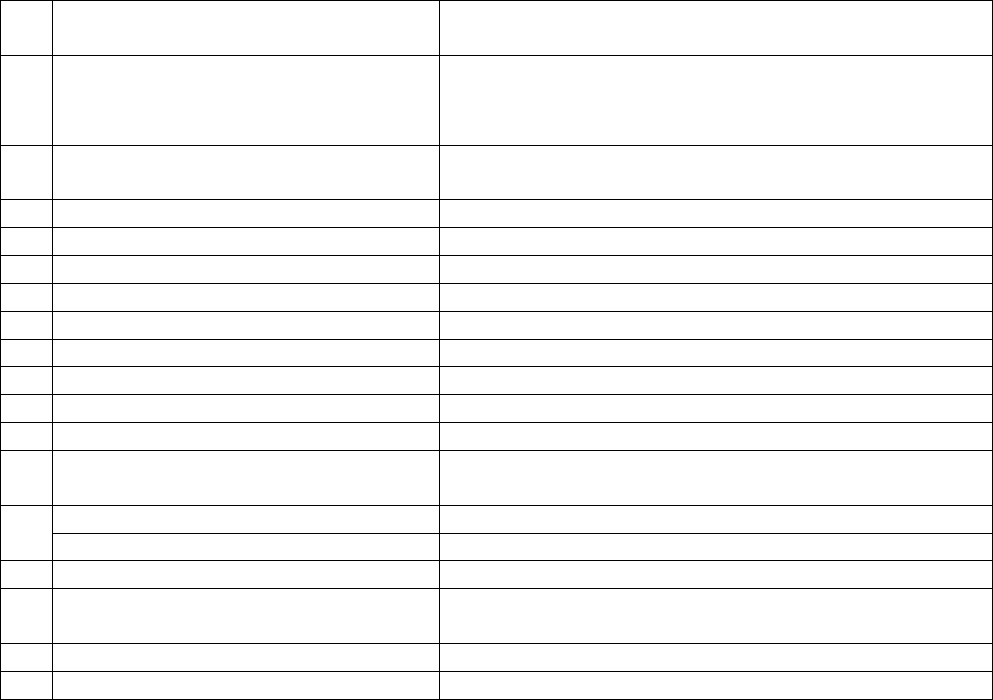

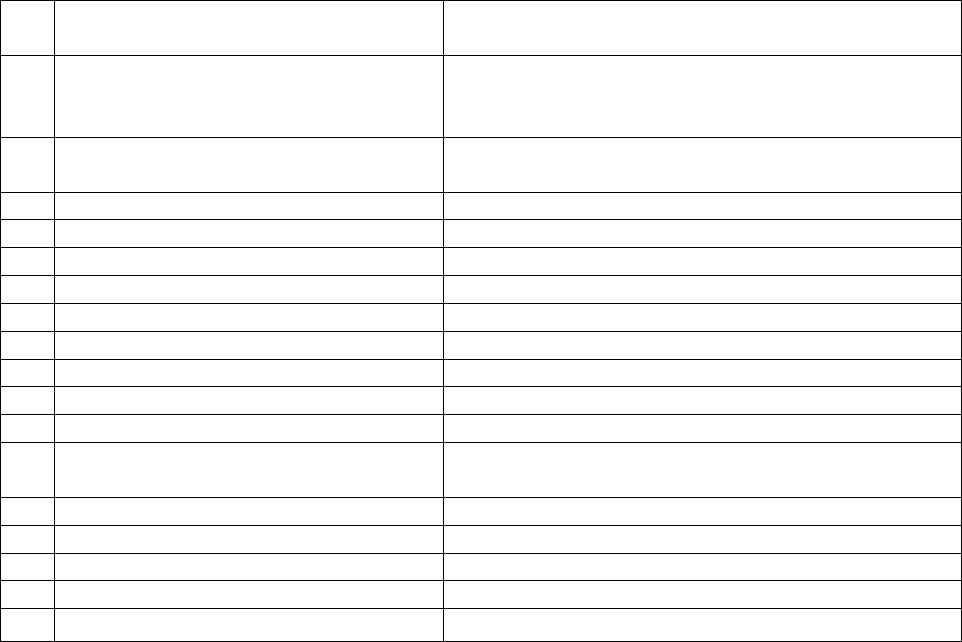

1

Name & Address of the Complainant

Mr. Sunil Anant Jinralkar

Ekdanta Residency, Omkar Wing, Flat No. S1

Raghunath Pet, Angol, Belgaum

Karnataka - 574106

Mobile: 9886484444

Email: [email protected]

2

Policy Number

Type of Policy

Duration of Policy/ Policy Period

P/700002/01/2021/027129

Health (Individual) Corona Kavach Policy

27.07.2020 to 08.05.2021

3

Name of the Policyholder/Proposer

Name of the Insured

Mr. Sunil Anant Jinralkar

Self

4

Name of the Insurer

Star Health and Allied Insurance Co. Ltd.

5

Date of repudiation

NA

6

Reason for repudiation

NA

7

Date of receipt of the Annexure VI A

23.03.2021

8

Nature of complaint

Short Settlement of health claim (COVID-19)

9

Amount of claim

Claim # 0255659

Claim # 0276431

Rs.99,451/-

Rs.6,05,979/-

10

Date of Partial Settlement

28.11.2020

06.01.2021

11

Amount of relief sought

Upto the sum insured limit

12

Complaint registered under Rule no.

13 (1) (b) of Insurance Ombudsman Rules, 2017

13

Date of hearing through Online VC

23.07.2021

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Dr. Umadevi M.B. (Sr. Manager)

Mr. Virupaksha (Legal Dept.)

15

Complaint how disposed

Disallowed

16

Date of Award/Order

02.09.2021

17. Brief Facts of the Case:

The complaint emanated from short settlement of health claims by Respondent Insurer

(hereafter referred to as RI). Complainant represented to Grievance Redressal Officer (GRO)

of RI for reconsideration of his claim. However his plea was not considered favourably. Hence

the complainant approached this Forum for resolution of his grievance.

18. Cause of Complaint:

a) Complainant’s arguments: The Complainant (Insured Person - IP) submitted that he was

covered under Corona Kavach Policy with RI vide policy no. P/700002/01/2021/027129 with

a sum insured of Rs.5,00,000/- for a period from 27.07.2020 to 08.05.2021. IP was diagnosed

with COVID-19 and he was admitted at Venugram Hospital, Belgaum from 22.08.2020 to

26.08.2020. Further IP was admitted at Apoorva Multispeciality Hospital, Belgaum from

28.08.2020 to 11.09.2020. The IP applied reimbursement claims of Rs.99,451/- and

Rs.6,05,979/- whereas the RI settled for Rs.58,377/- and Rs.2,35,000/- for first and second

hospitalisation respectively. The Complainant represented to GRO of the RI for consideration

of his balance claim amount upto the sum insured limit. The Complainant did not get any

favourable reply from the RI. Hence he approached this Forum for help in getting his eligible

claim amount from the RI.

b) Respondent Insurer’s Arguments: The RI in their Self Contained Note (SCN) dated

23.04.2021, whilst admitting issuance of policy submitted that IP was diagnosed with COVID-

19 positive and he was hospitalized at Apoorva Multispeciality Hospital, Karnataka for the

period during 28.08.2020 to 11.09.2020 wherein he was diagnosed with COVID Positive,

ARDS (Acute Respiratory Distress Syndrome) with B/L (Bilateral) Pneumonia. The IP

submitted claim documents for reimbursement of medical expenses of Rs.6,05,979/-. Based on

the available claim documents an amount of Rs. 2,35,000/- was settled to the IP vide NEFT

Transaction No. 101097523304 dated 11.01.2021. An amount of Rs.3,70,979/- was deducted

for the reason as follows:

1.The ICU and ROOM PACKAGE IS INCLUSIVE OF MEDICINES, INVESTIGATION,

O2 and OTHER CHARGES. Hence, Rs.3,70,979/- was deducted.

In view of their submissions, the RI prayed for passing an appropriate order.

19. Reason for Registration of complaint:

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017.

20. The following documents were placed for perusal:

• Complaint along with enclosures,

• Respondent Insurer’s SCN along with enclosures and

• Consent of the Complainant in Annexure VIA & and Respondent Insurer in

VII A

21. Result of personal hearing with both the parties (Observations & Conclusions):

Personal hearing by the way of online Video-conferencing through GoTo Meet was conducted

in the said case. Complainant and Representatives of RI joined using online VC and presented

their case. Confirmation from all the participants about the clarity of audio and video was taken

to which the participants responded positively.

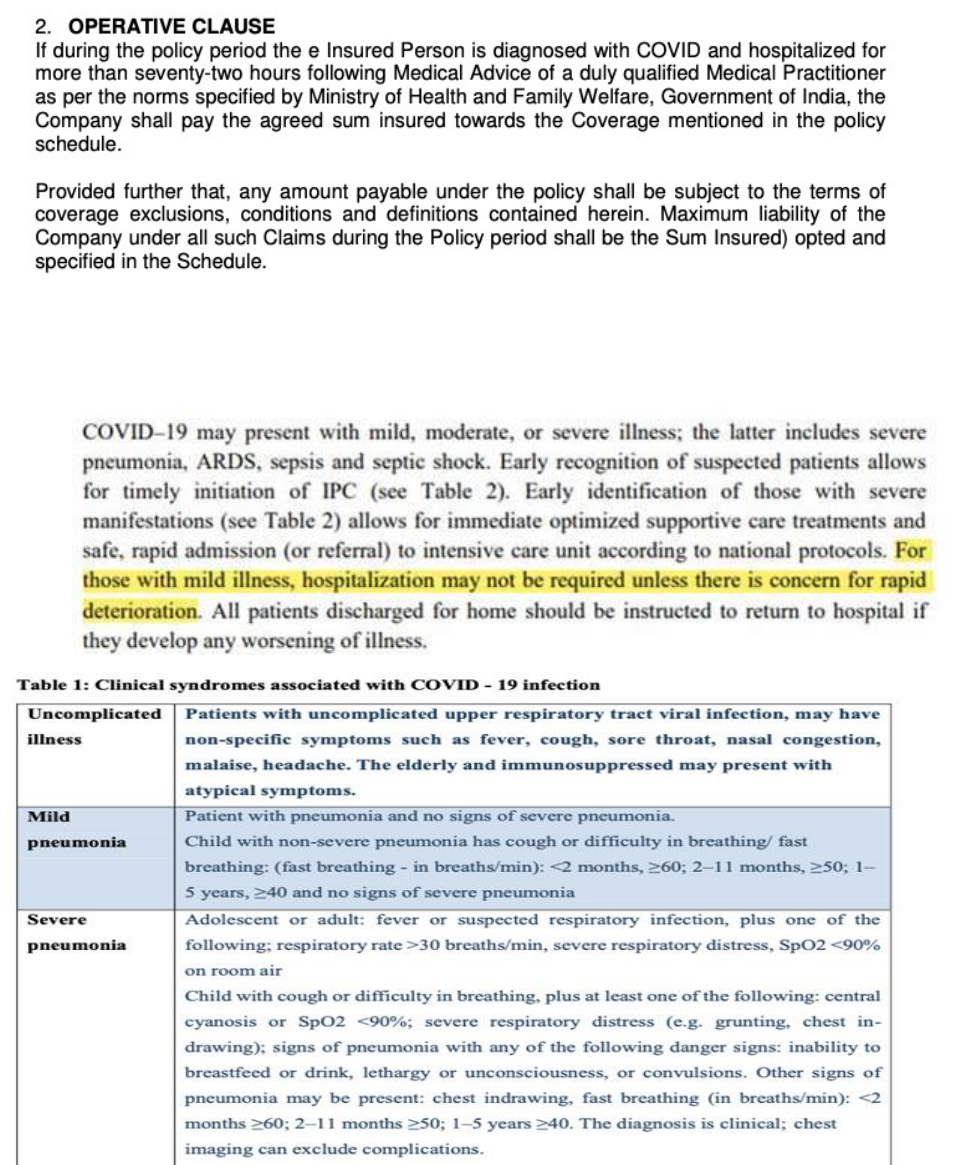

The Complainant strongly argued that the claims should be settled upto the sum insured limit

i.e. Rs.5,00,000/- combining both the claims as per terms and conditions of the policy. The RI

strongly contended that considering the GIC circular they have paid package charges as per

Government of Karnataka notification dated 23.06.2020. The RI further added that the IP was

given injection ACTEMRA 400MG and which is not recommended in case of COVID. They

submitted that there are two different versions of bills and thus there are discrepancies in

hospital billing and suppression of fact by the IP and there could be a fraudulent activity

involved. They also highlighted the exorbitant charges made by the hospitals in both the claims.

Internet studies reveal that ACTEMRA (Tocilizumab) 400 MG INJECTION is a medicine used

alone or with other medications to treat moderate to severe rheumatoid arthritis. The Forum

asked the IP if he was suffered with rheumatoid arthritis and he responded negative.

The Forum directed the RI to investigate for the bills raised and medication/lab-reports given

by the hospitals. They discussed with the hospital’s representative Dr. Shivanand Haligouder

and furnished a report vide their email dated 23.08.2021 which is reproduced as follows:

1. Indication for extended ICU stay - Justified that Mr. Sunil had fluctuating oxygen levels

and severe drop noted, hence admission was extended. Agreed to send complete ICU notes

2. Two different bills- No proper clarification given, said management will be questioned.

3. Administration of multiple antibiotics- No clarification given

4. Unauthenticated lab reports- No pathologist available in Belgaum

5. Chronological order pharmacy bills- No clarification given

6. Indication for Tocilizumab - Not clarified

7. Details about previous admission- He couldn't clarify

Summary of the discussion - The treating doctor couldn't clarify many of the points raised

and repeatedly said admission was made as he had breathlessness, no other issue was

addressed, he also confirmed he will be submitting complete indoor case records, video

recordings and other related papers, but till date it was not provided.

Forum has perused the documentary evidence available on records and the submissions made

by both the parties during the personal hearing pertaining to both the claim numbers. Forum

notes that the complainant filed a single complaint mentioning two claim numbers towards his

hospitalisations. Both the claims were considered under single complaint.

The dispute is whether partial settlement of health claims under the policy is in order or not.

Claim # 0255659 pertaining to 1

st

hospitalisation at Venugram Hospital, Belgaum from

22.08.2020 to 26.08.2020 the IP claimed Rs.99,451/- and RI settled it for Rs.58,377/- by

applying the package charges as per Government of Karnataka notification dated 23.06.2020.

Claim # 0276431 pertaining to 2

nd

hospitalisation at Apoorva Multispeciality Hospital,

Belgaum from 28.08.2020 to 11.09.2020 the IP claimed Rs.6,05,979/- and RI settled it for

Rs.2,35,000/- stating ICU and room package is inclusive of medicines, investigation, O2 and

other charges.

Forum notes from the hospital bills in both hospitalizations that the charges for COVID

isolation ward, Covid private ward and COVID ICU are exorbitantly billed at per day rate of

Rs.15,000/- Rs.18,000/- and Rs.20,000/- respectively. The medical document and the pharmacy

bill reveal that the IP was administered with the injection ACTEMRA 400MG which is not

prescribed for the treatment of COVID patient.

In the absence of proper justification of the exorbitant ward/room/ICU charges and

administration of irrelevant medications/injections by the hospital the Forum concludes that

the instant case is having many inconsistencies. Therefore the claims are fraudulent in nature

and the benefits under the claims cannot be given to the IP.

Forum observes that RI has already settled a total amount of Rs.2,93,377/- (i.e. Rs.58,377/- in

Claim # 0255659 and Rs.2,35,000/- in Claim # 0276431) which could have been denied based

on the discrepancies in claim documents. The Forum notes that having settled an amount

beyond the policy coverage, no recovery of the same can now be made by RI. The Forum

maintains the status quo in regard to claim settlement. The complaint is disallowed.

A W A R D

Taking into account of the facts and circumstances of the case and the submissions made by

both the parties and documents submitted, the Forum maintains the status quo in respect of

claim settlement made by the RI.

The Complaint is DISALLOWED.

Dated at Bangalore on the 02

nd

day of September, 2021.

(POONAM BODRA)

INSURANCE OMBUDSMAN

ADDITIONAL CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – Smt.POONAM BODRA

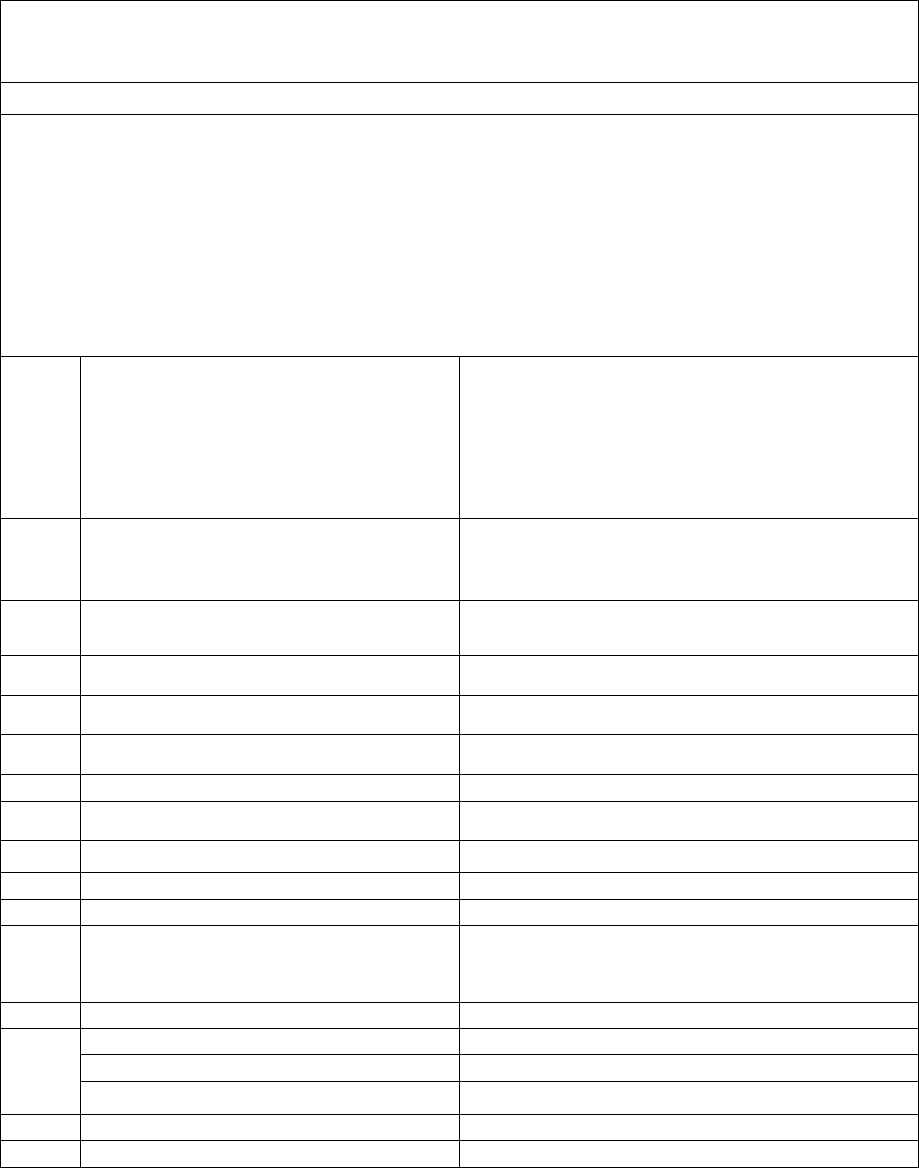

In the matter of Sri MURALI MOHAN PN V/s MANIPAL CIGNA HEALTH

INSURANCE LTD.

Complaint No: BNG-H-053-2021-0823

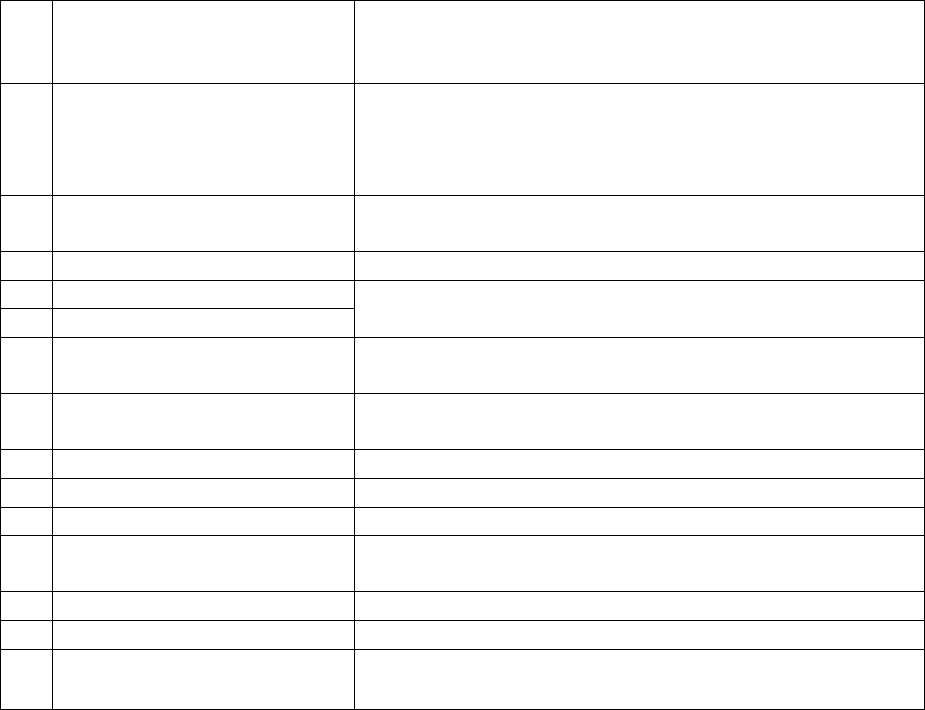

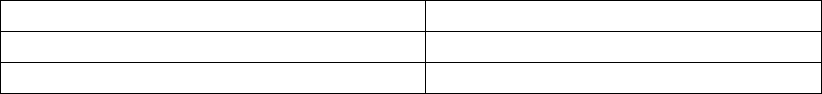

Award No.: IO/(BNG)/A/HI/0056/2021-22

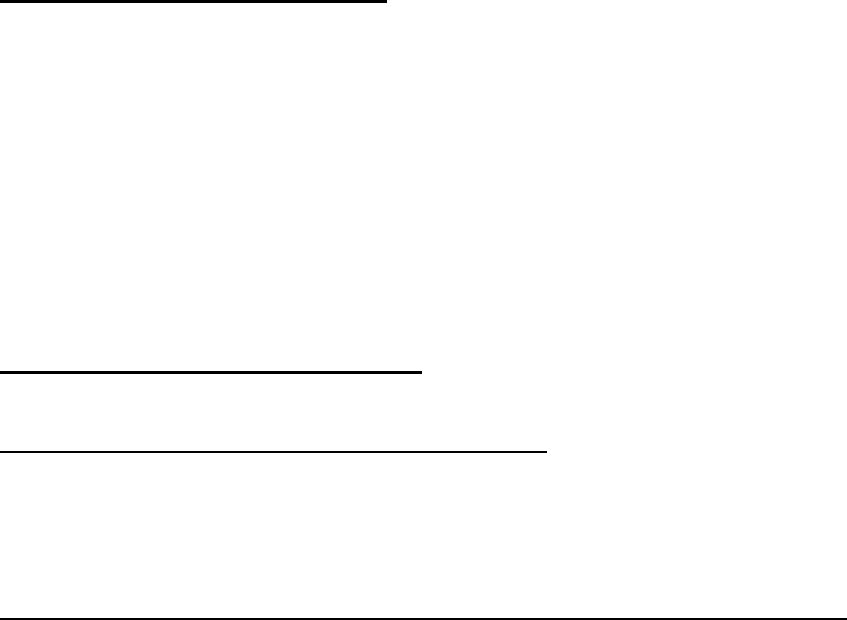

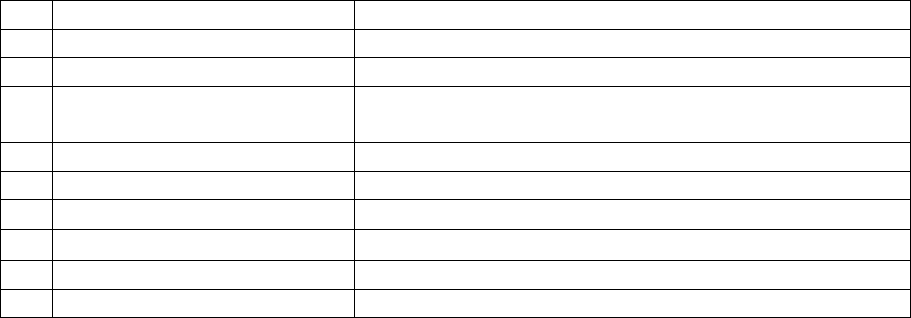

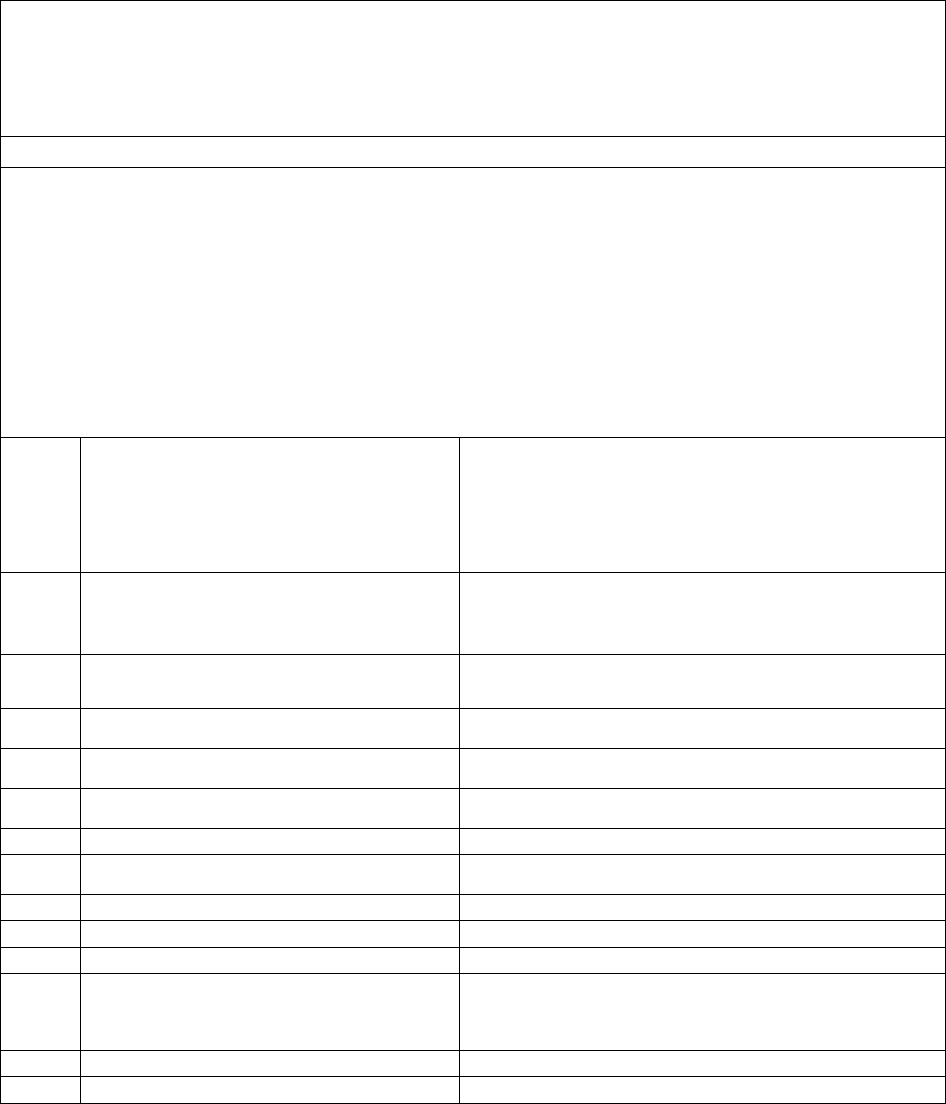

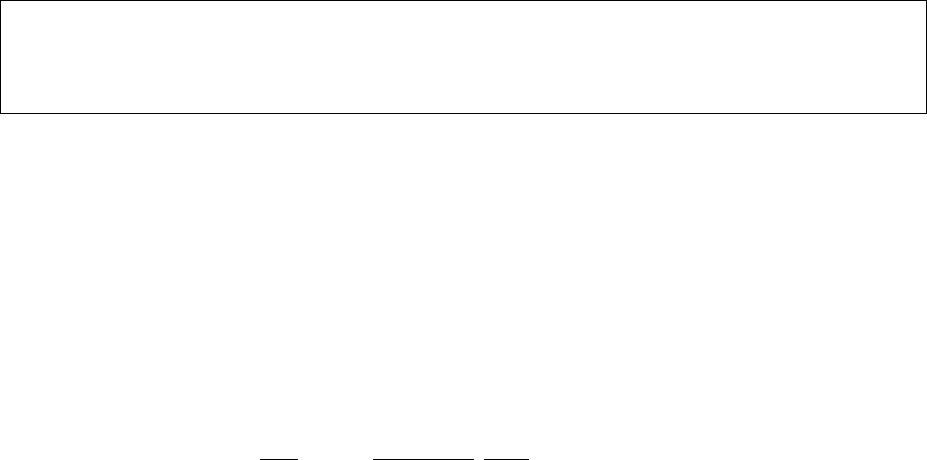

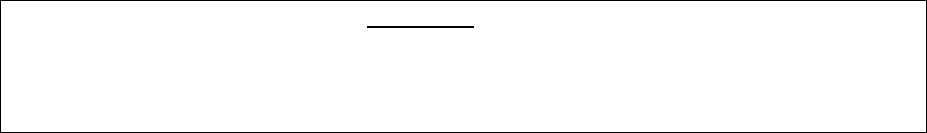

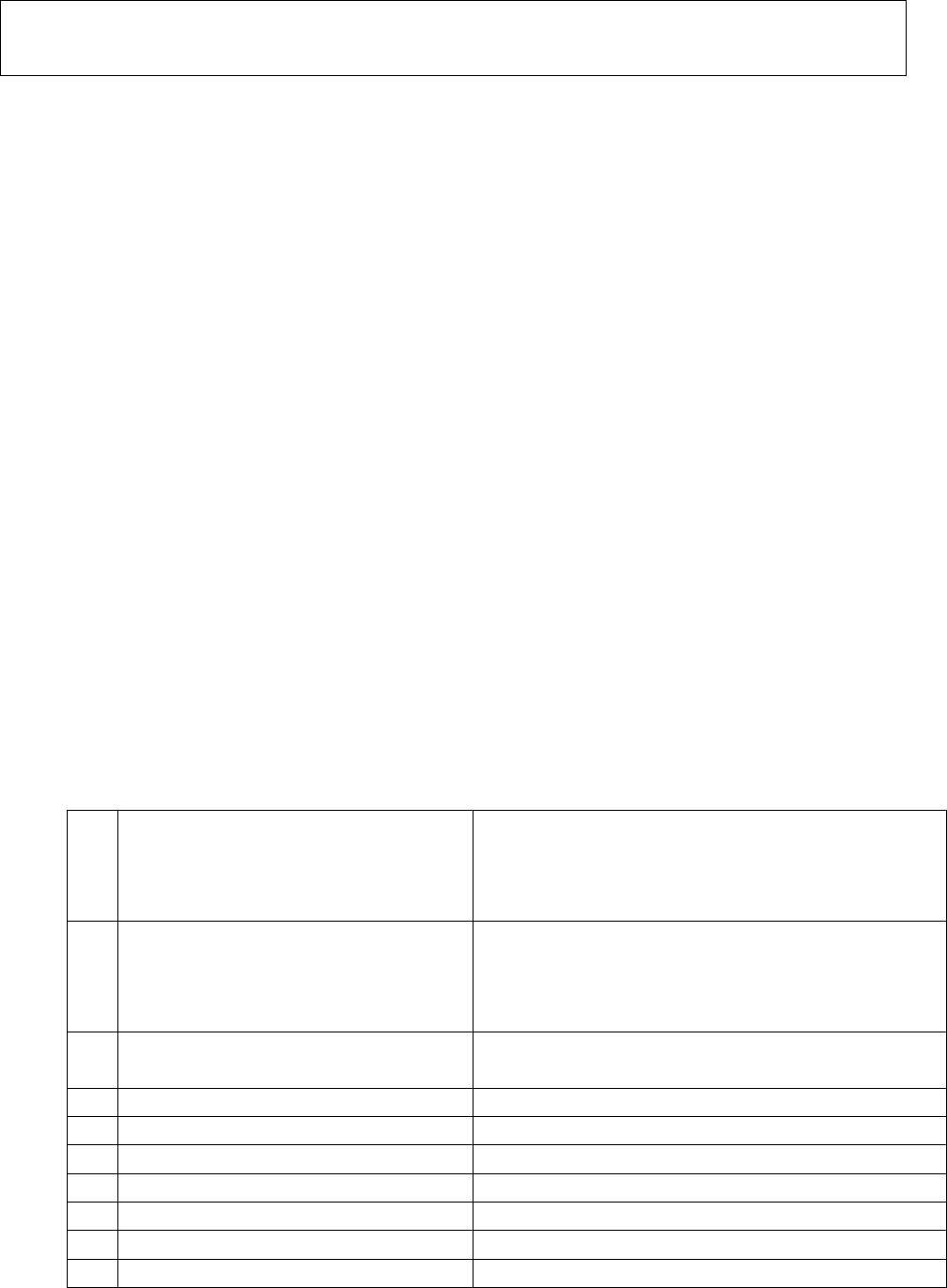

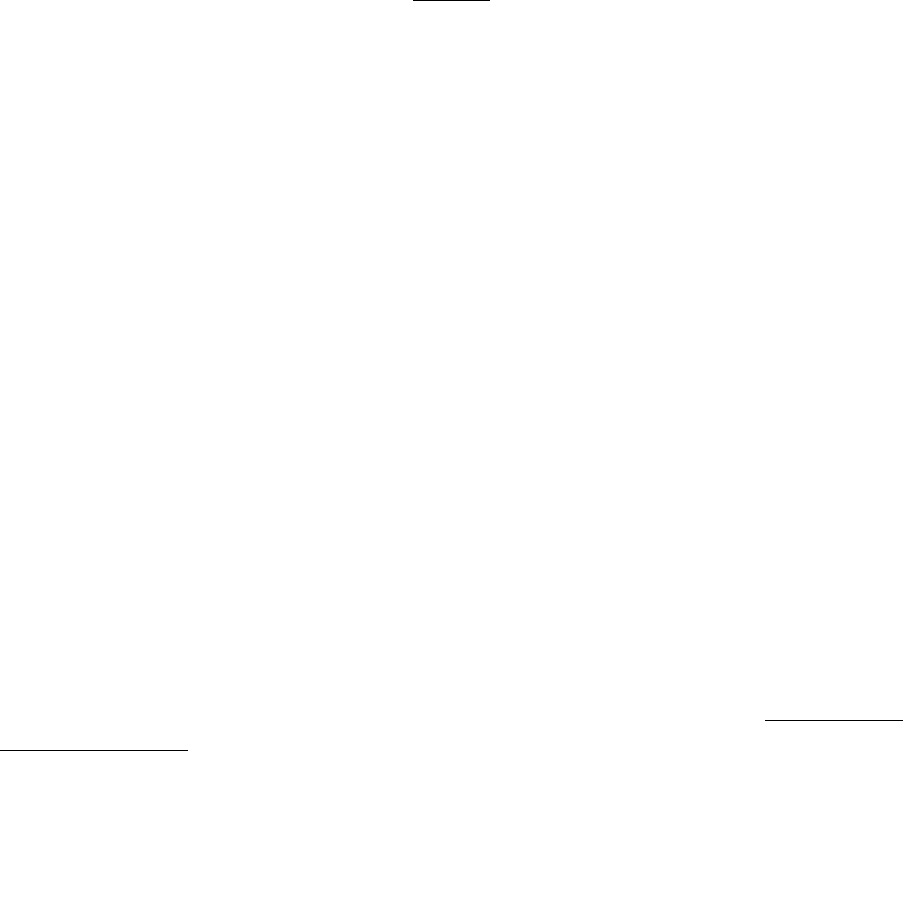

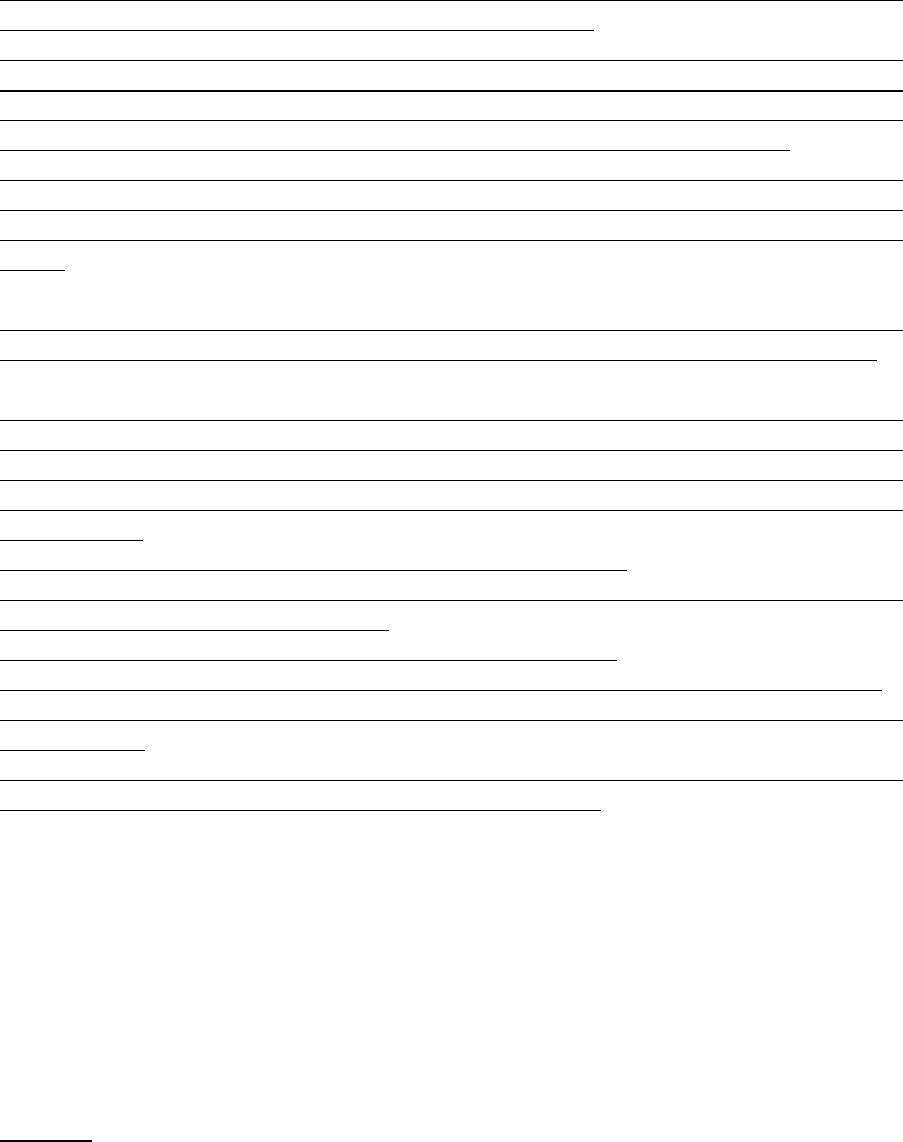

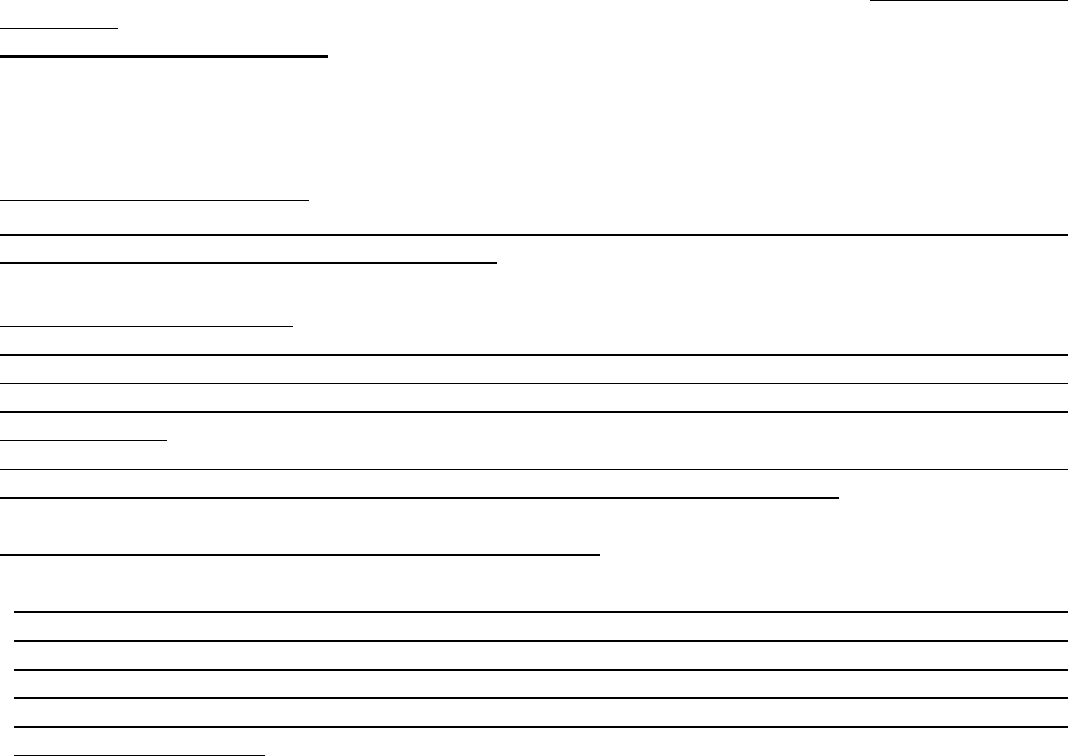

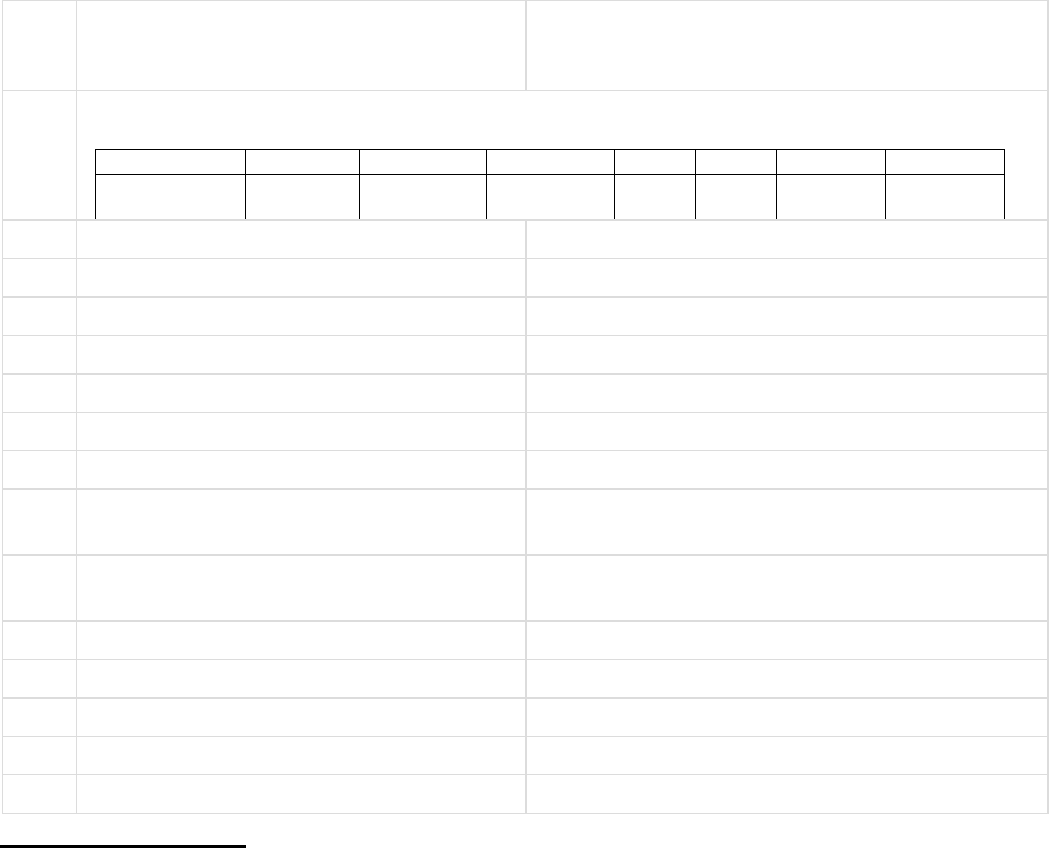

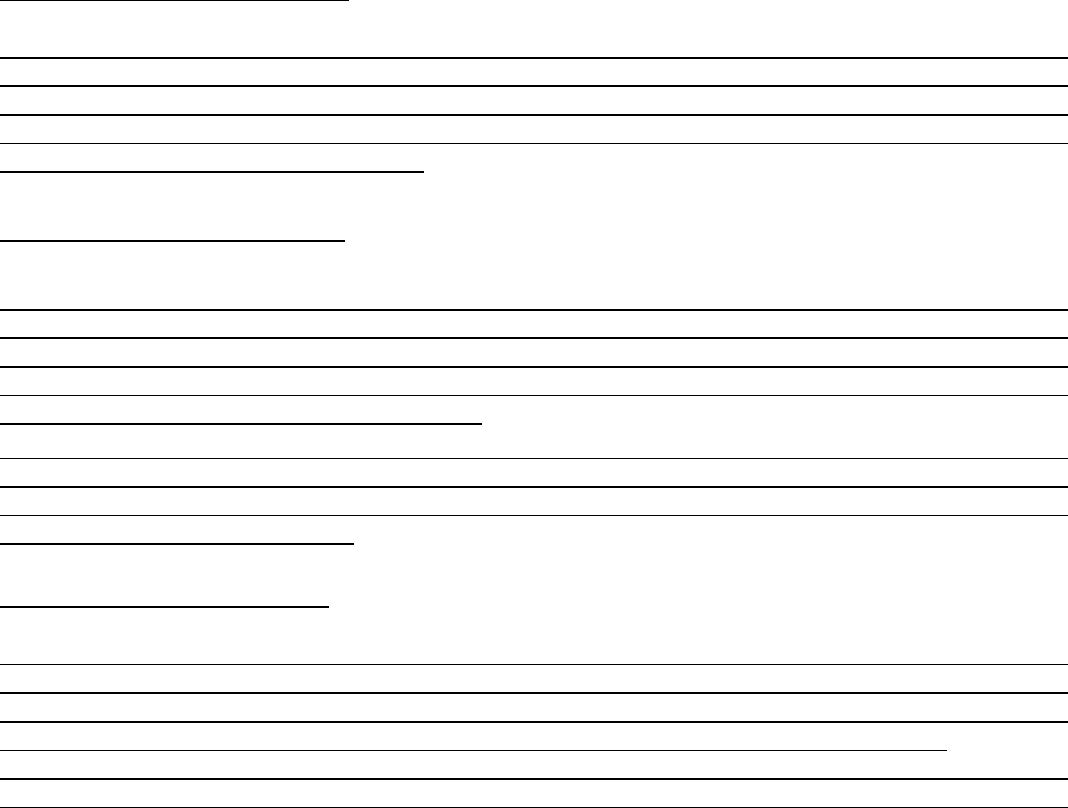

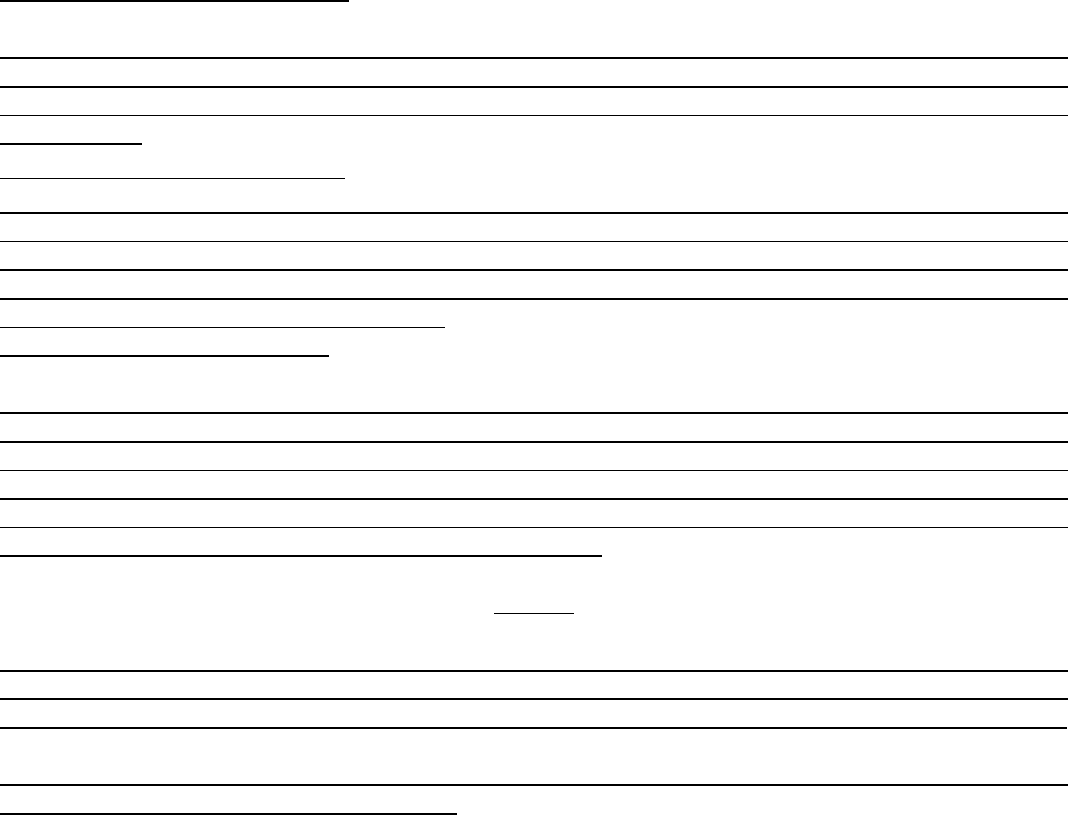

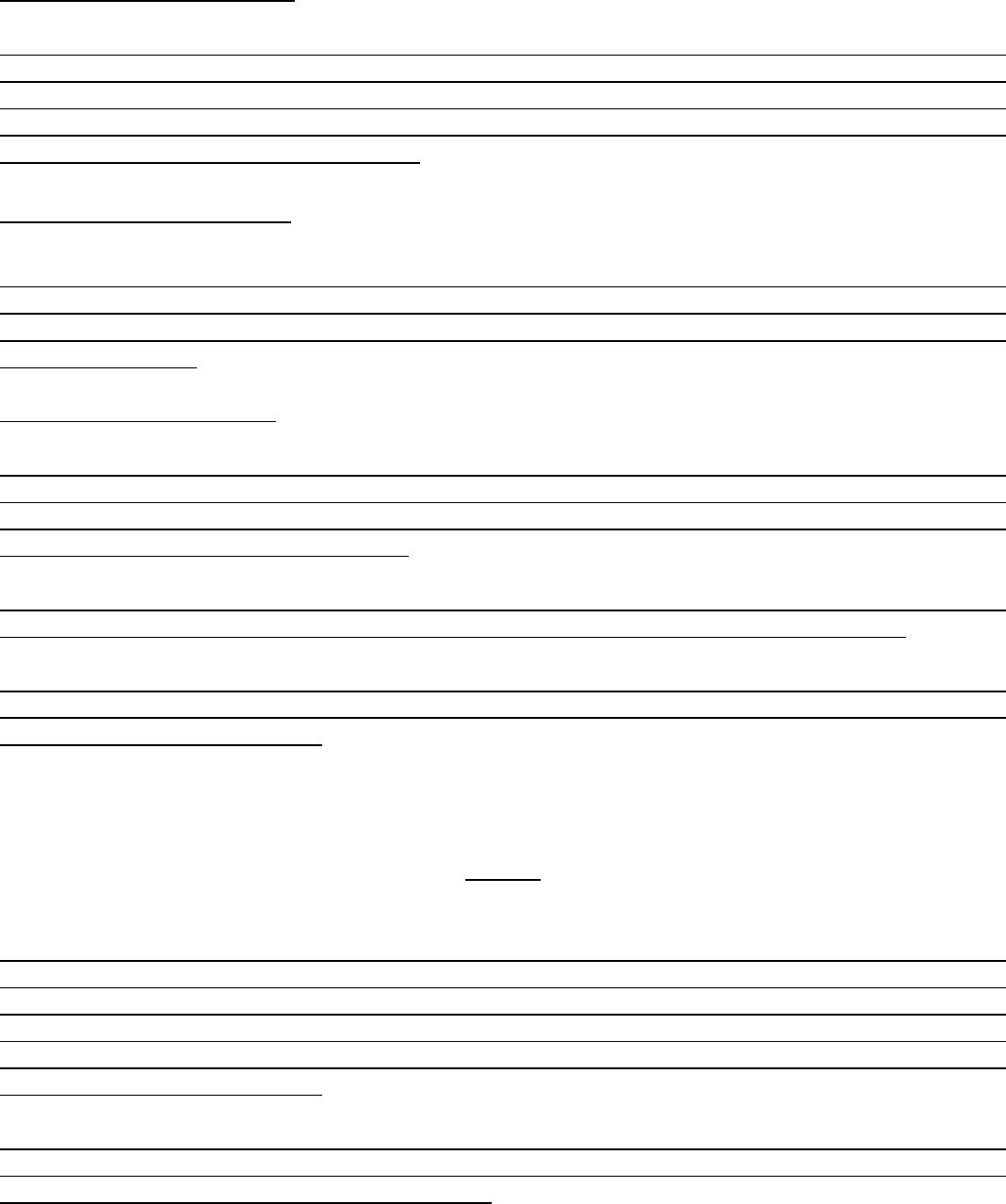

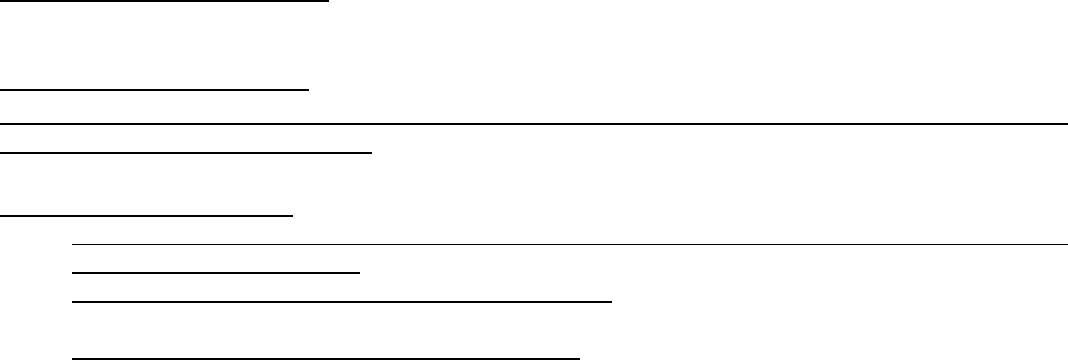

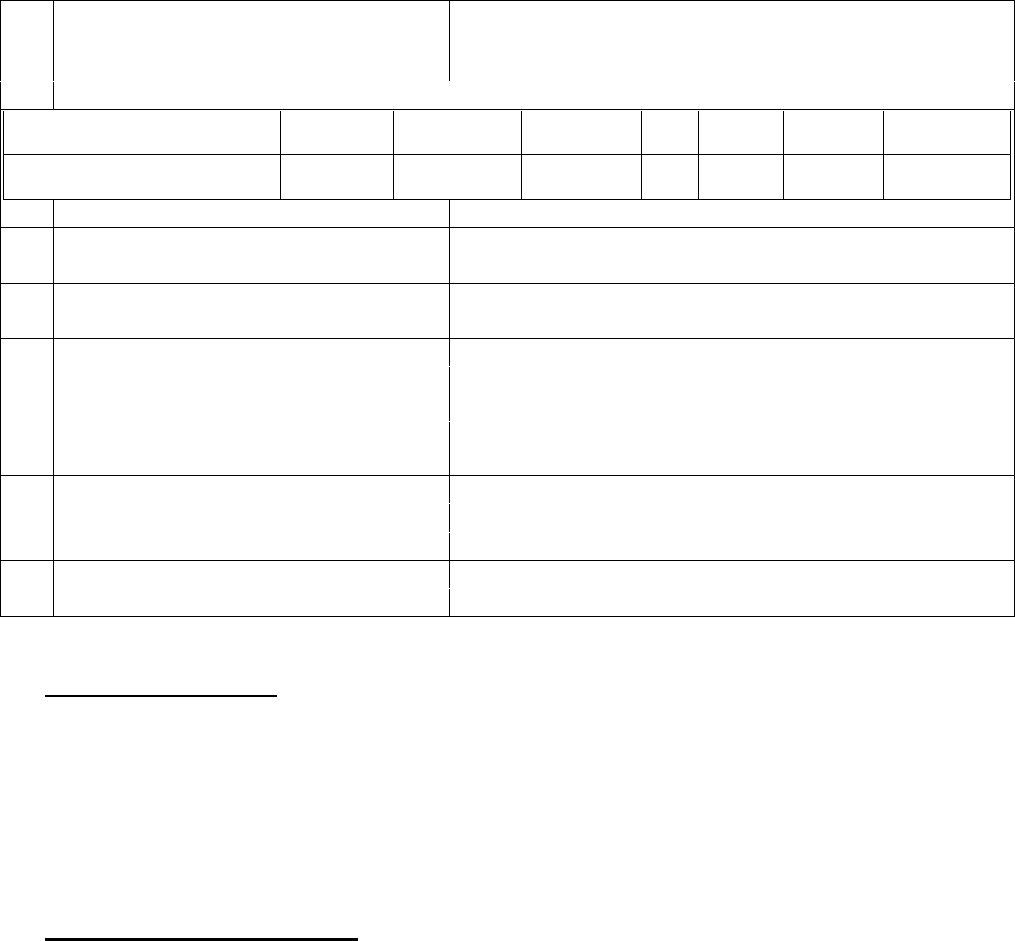

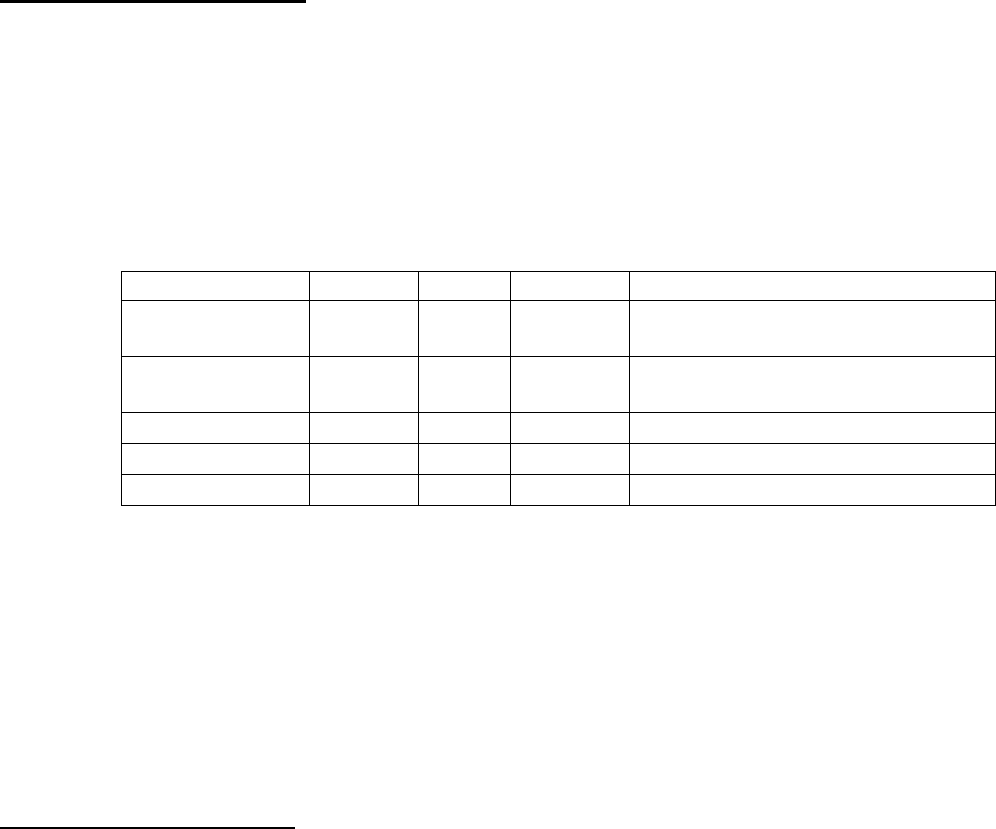

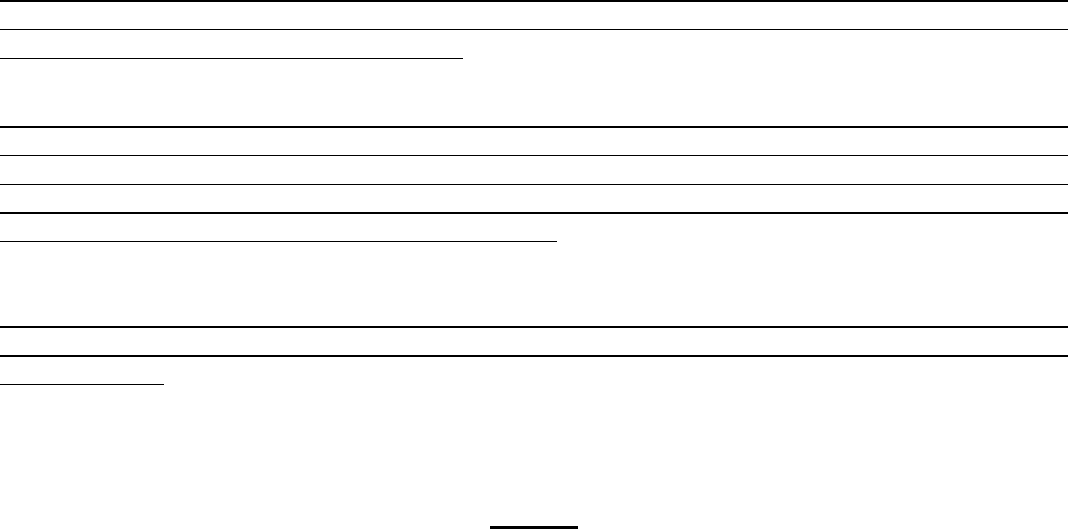

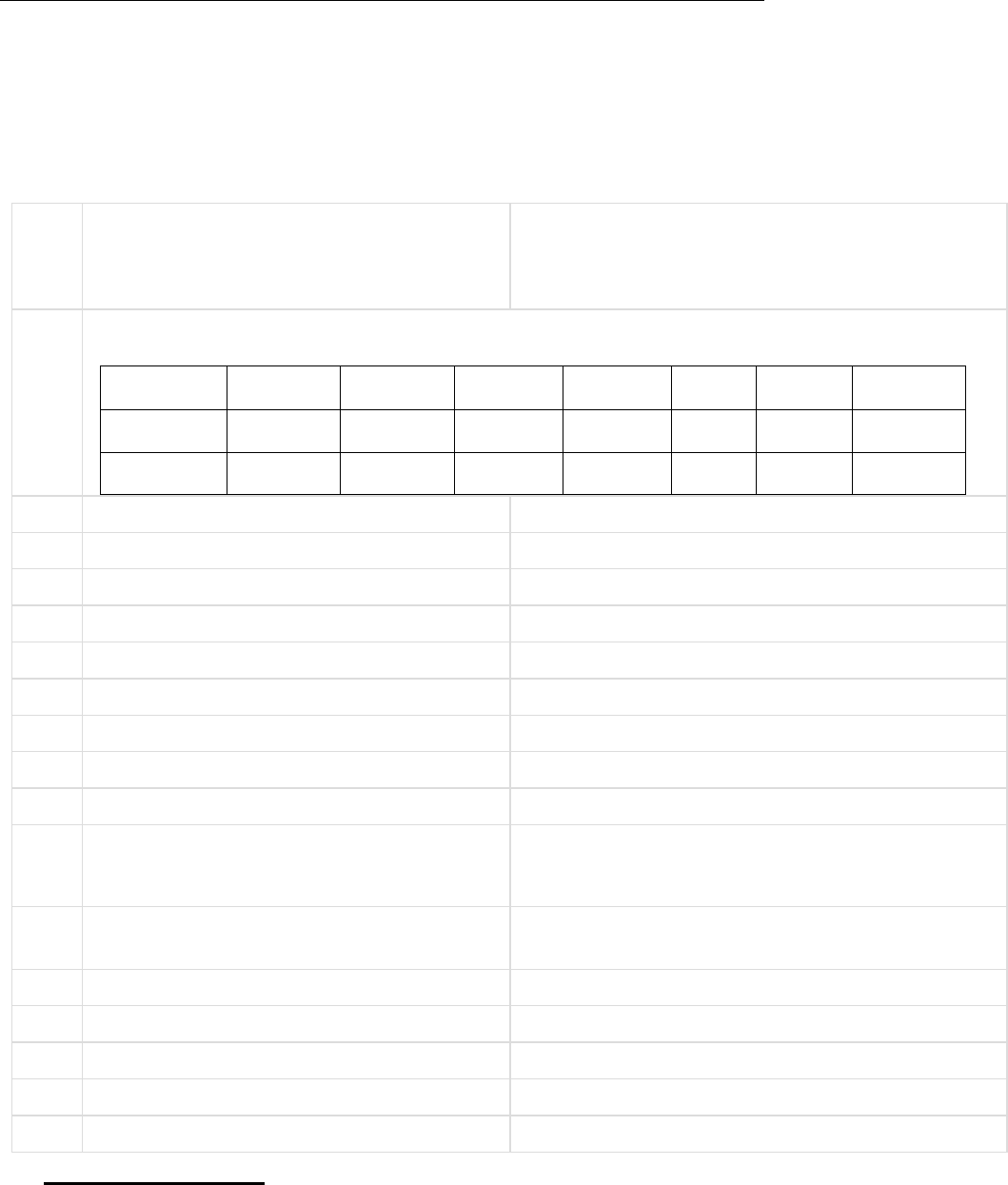

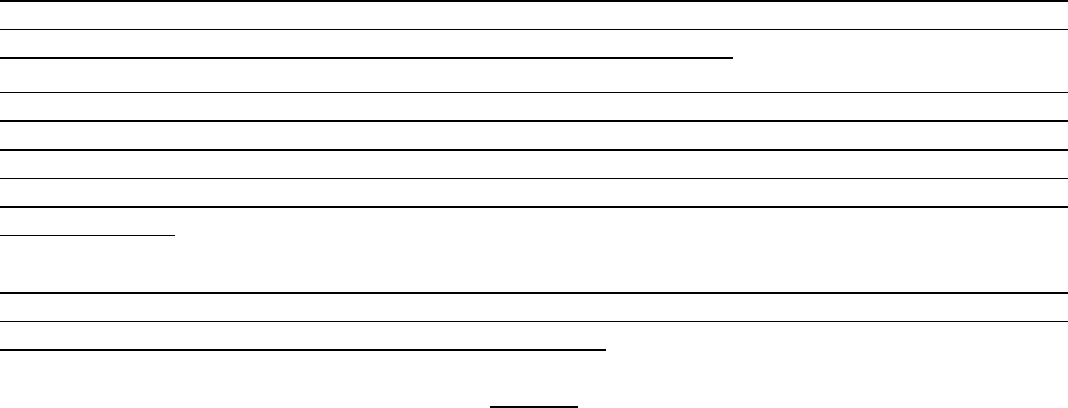

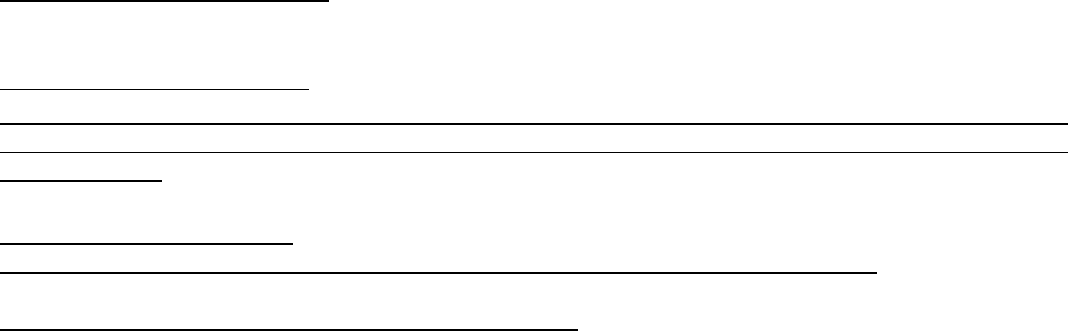

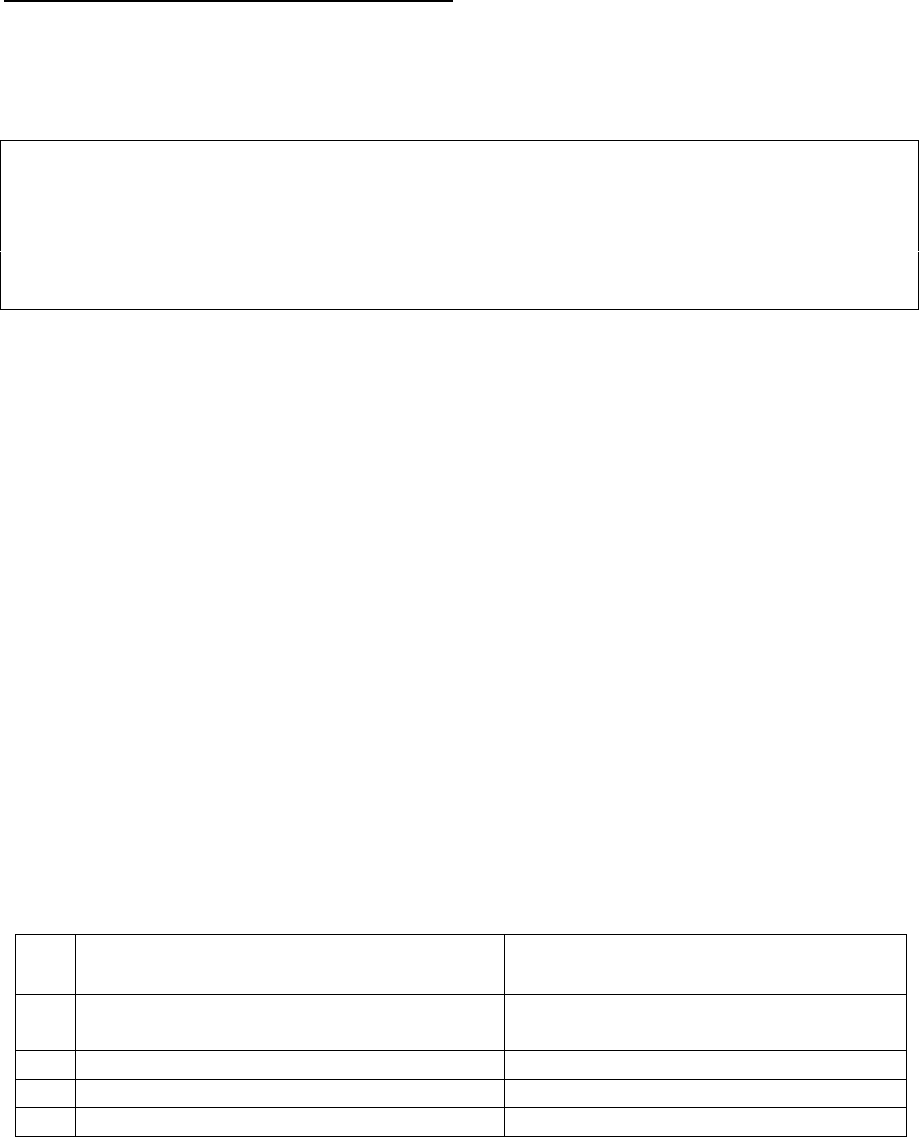

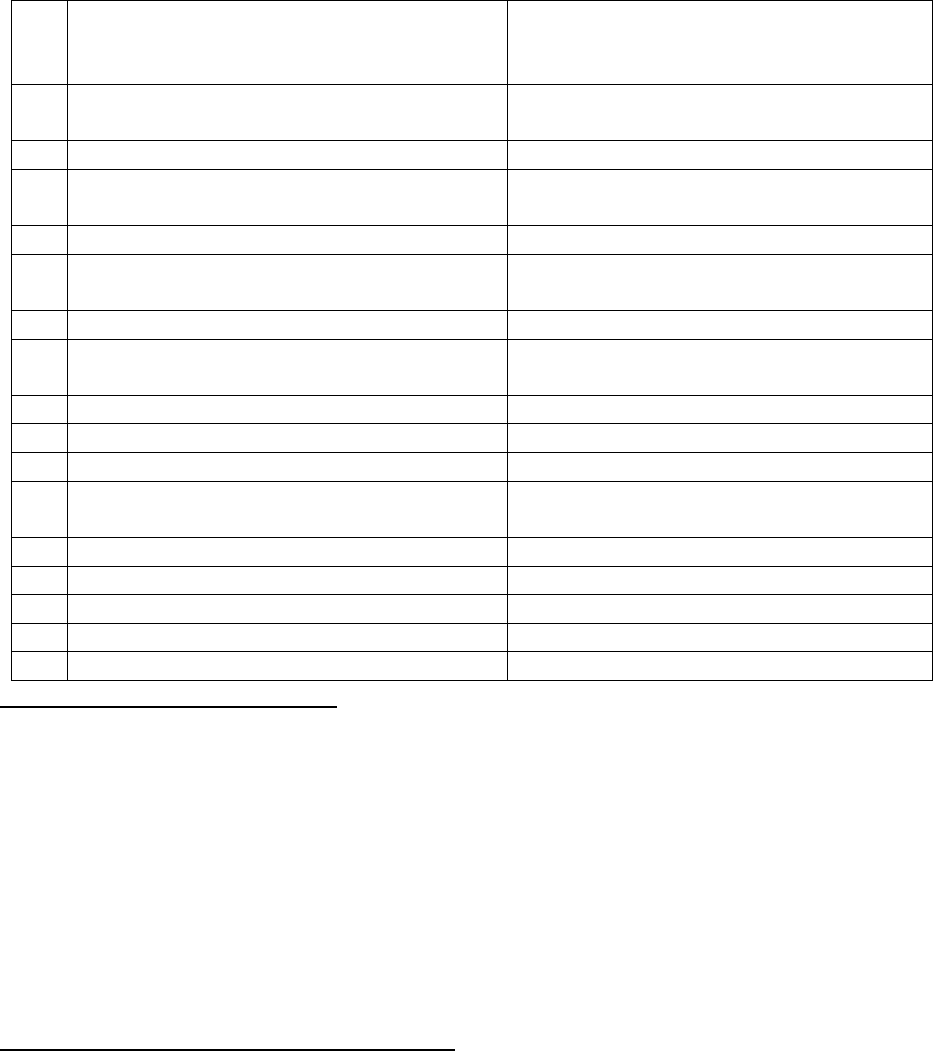

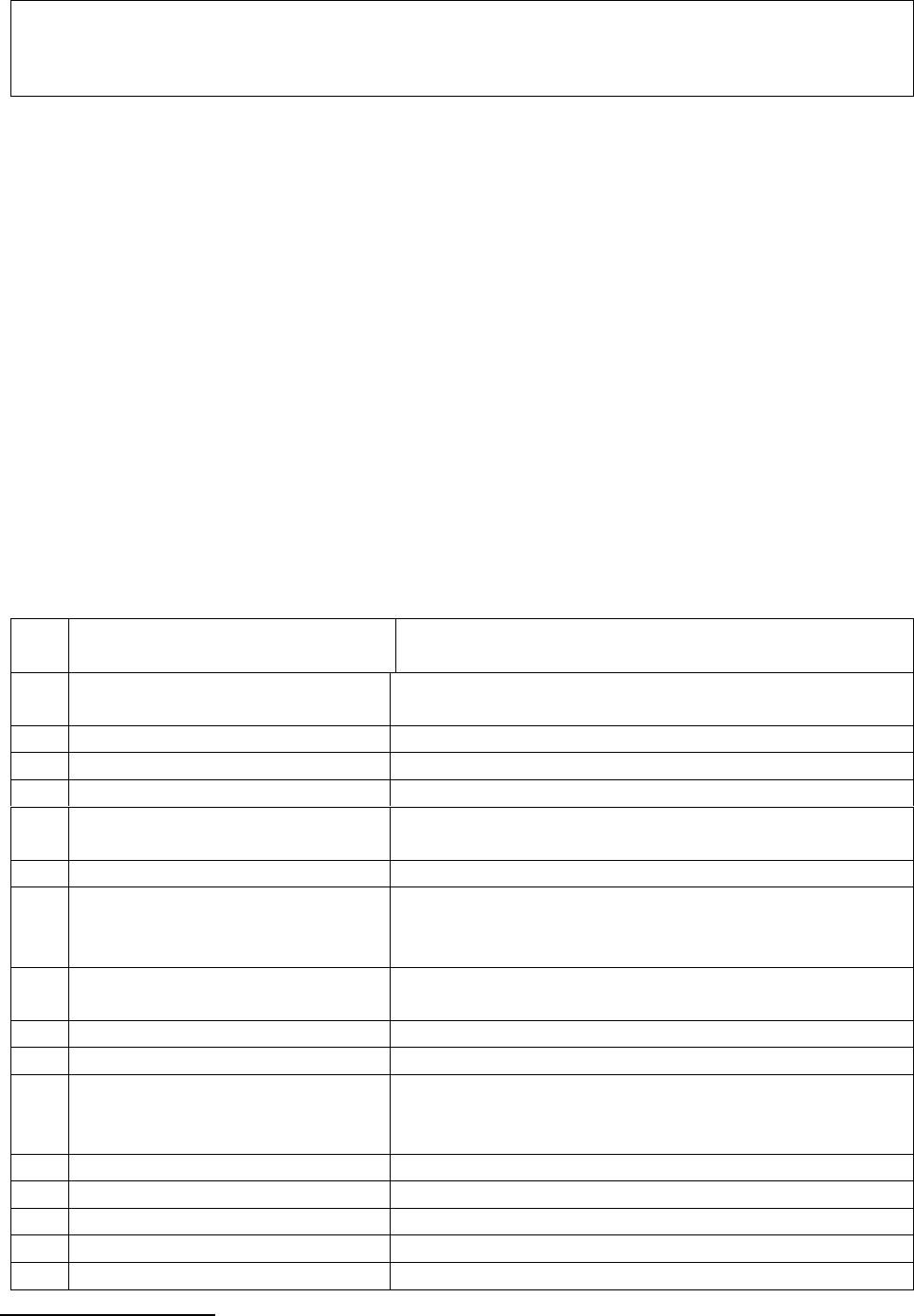

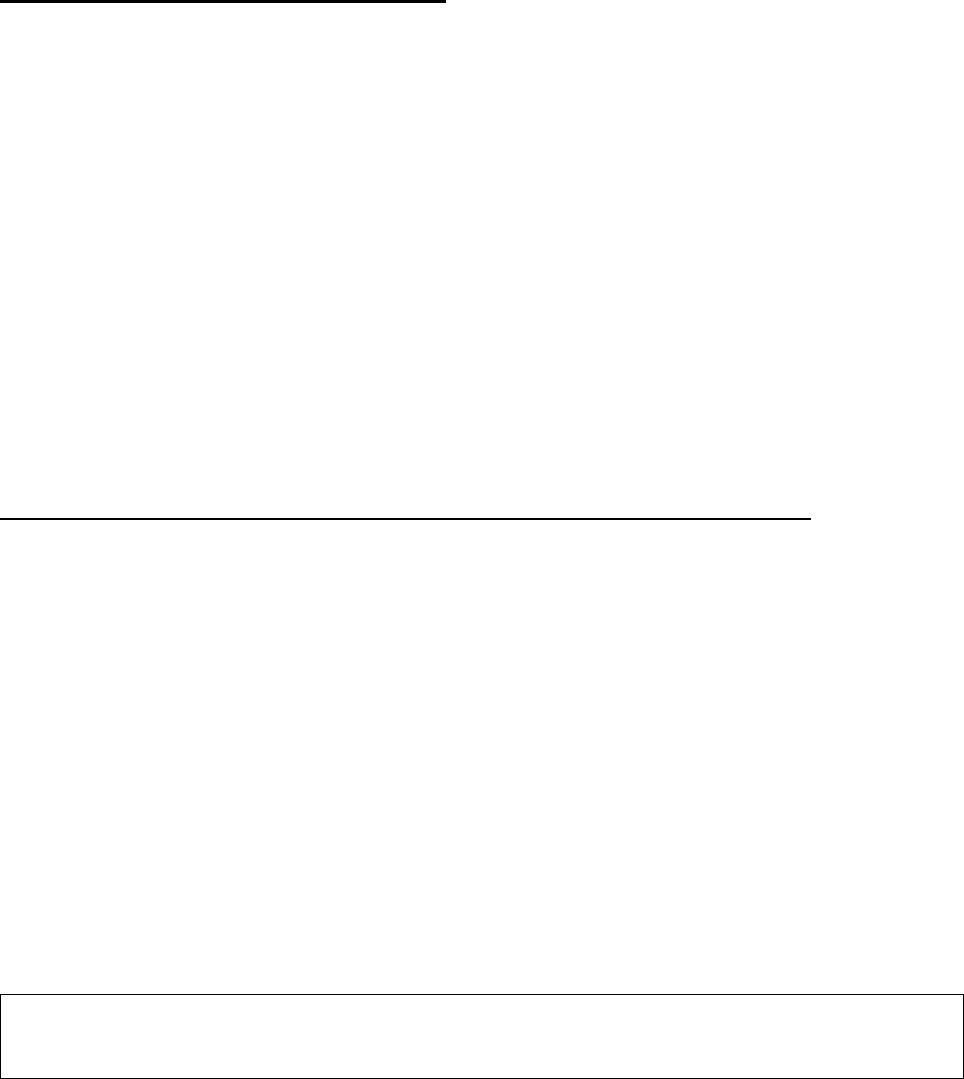

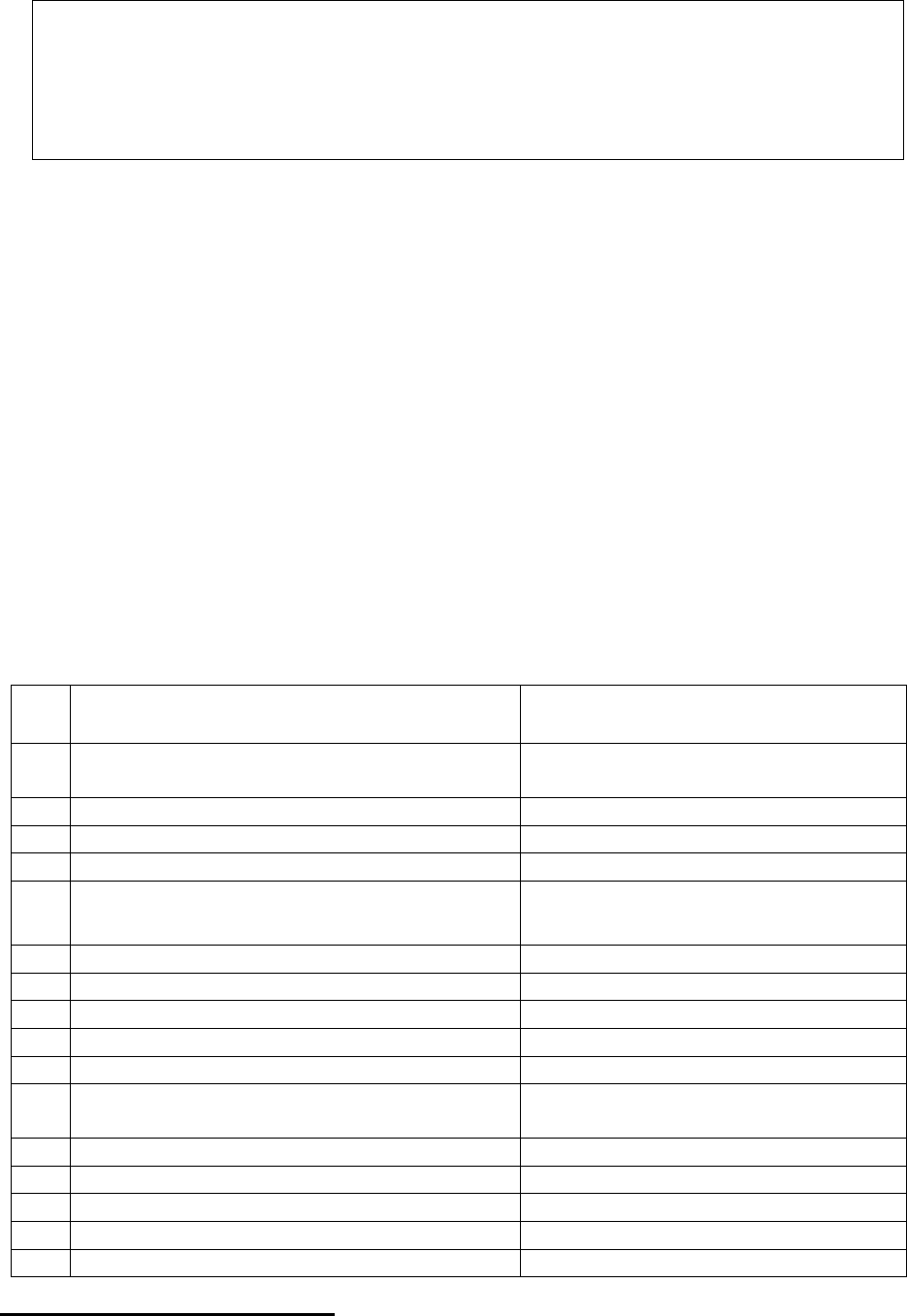

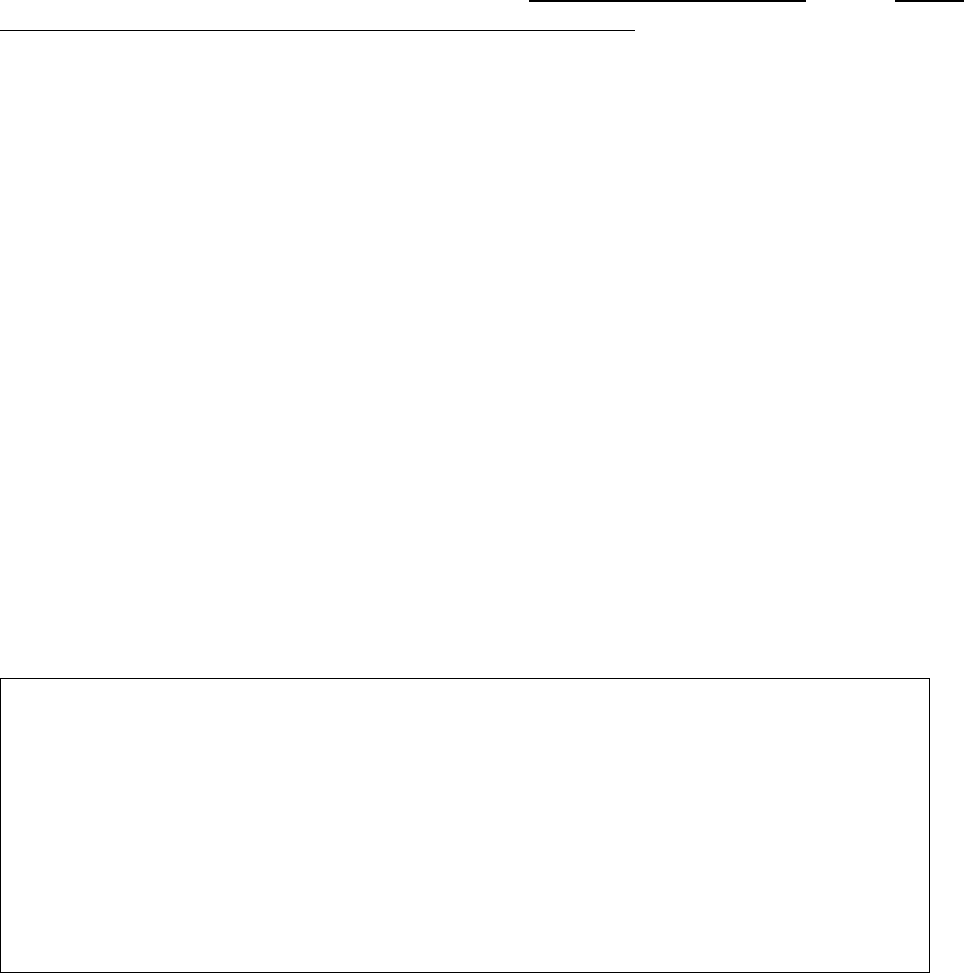

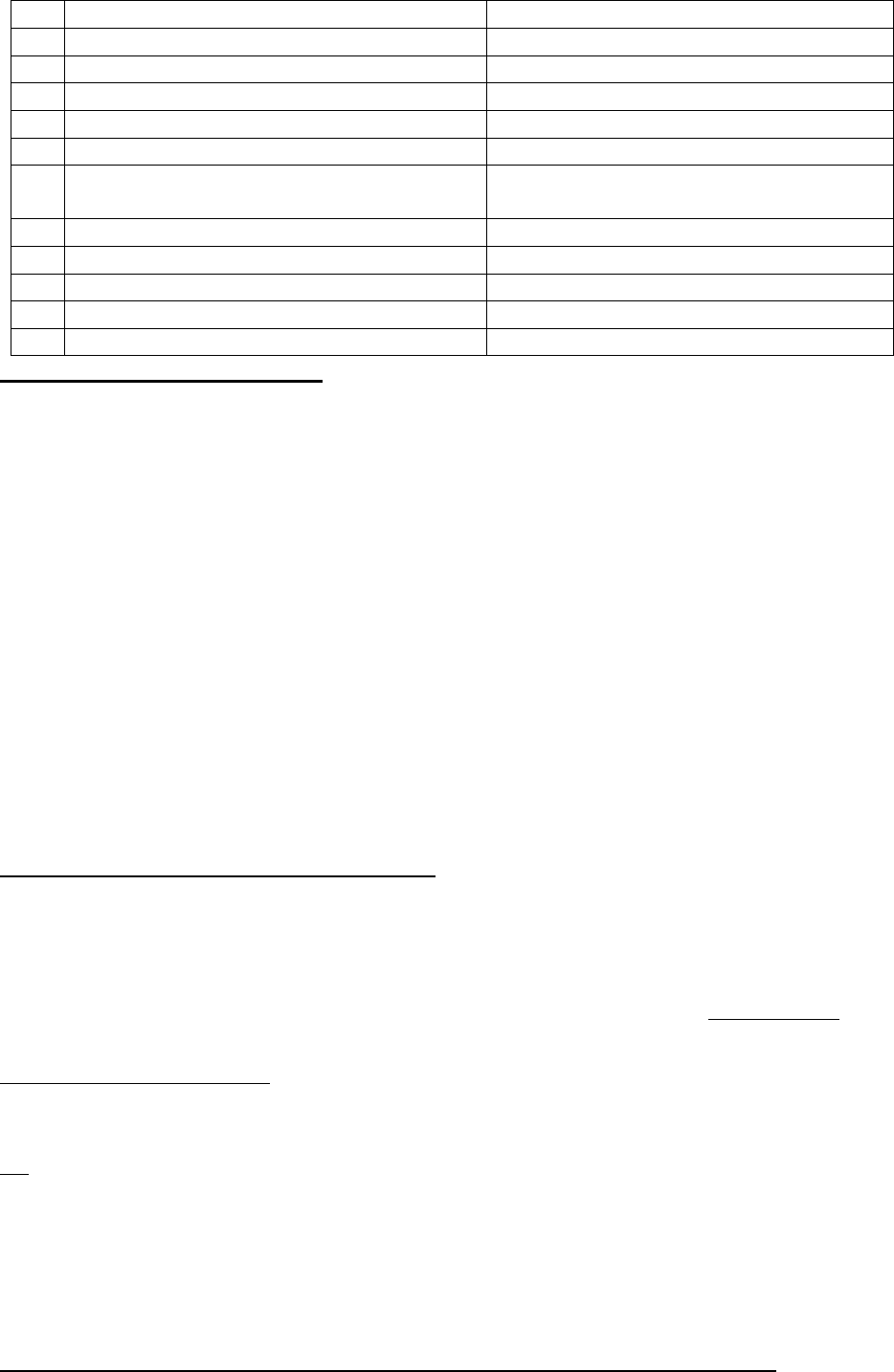

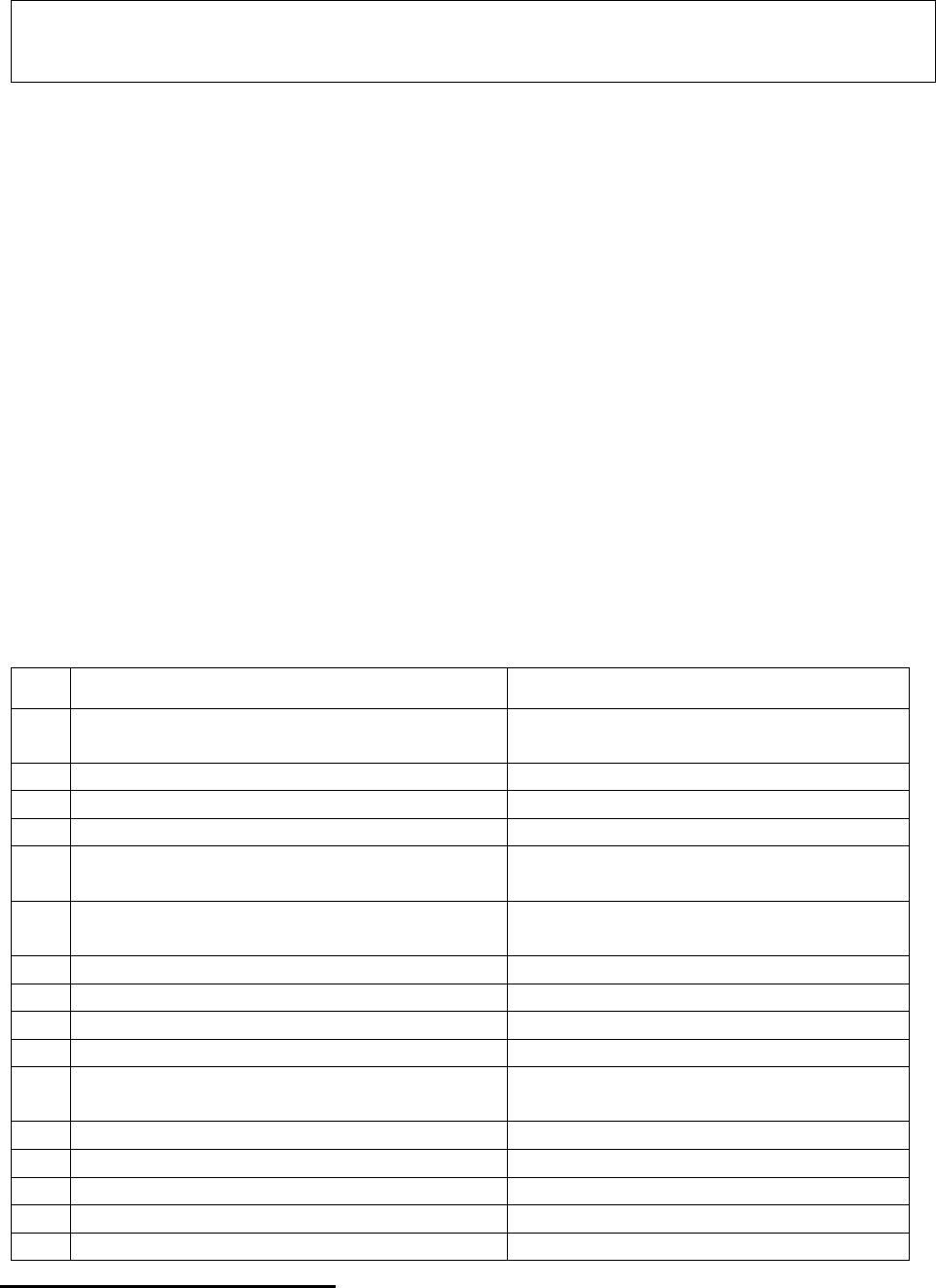

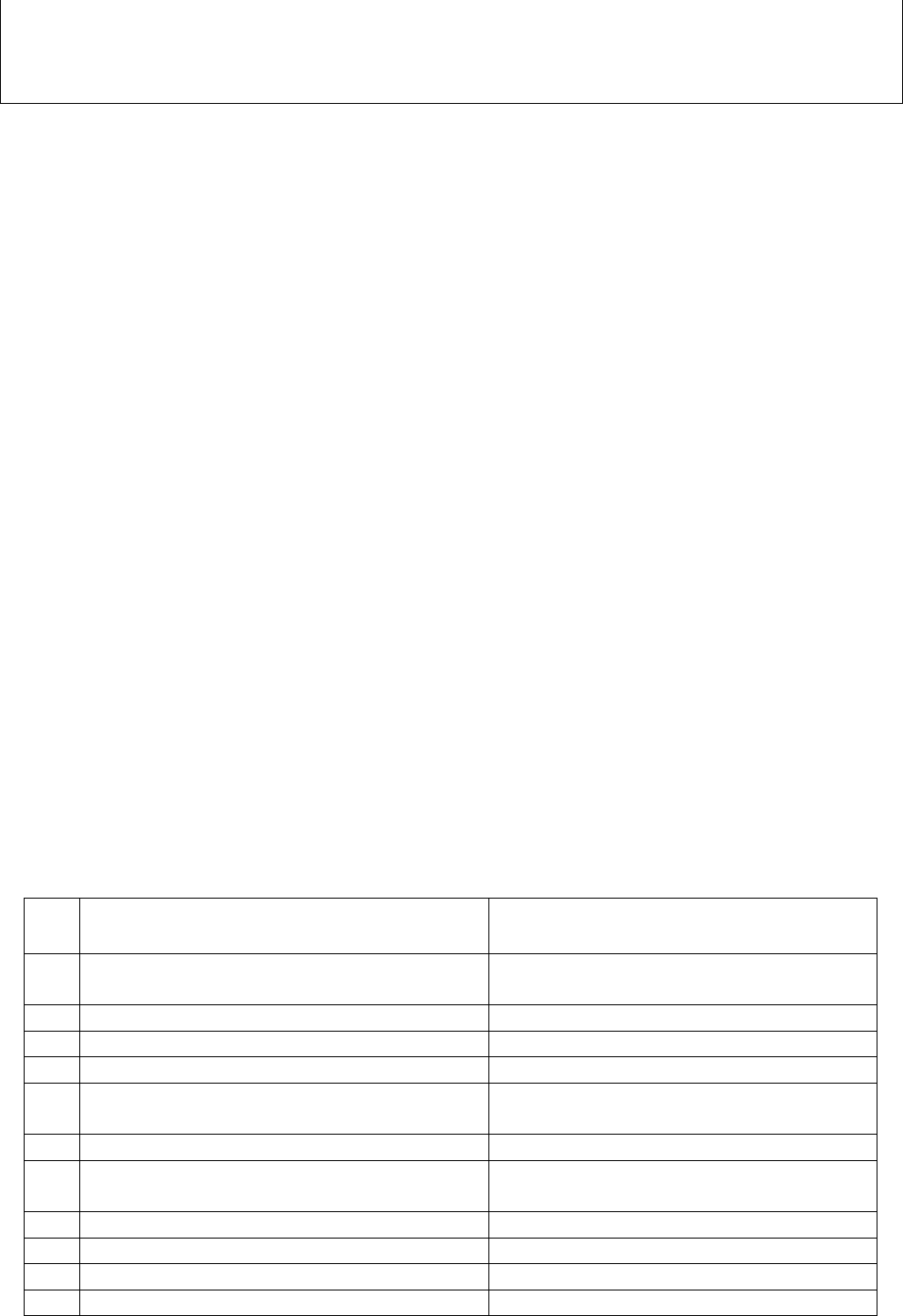

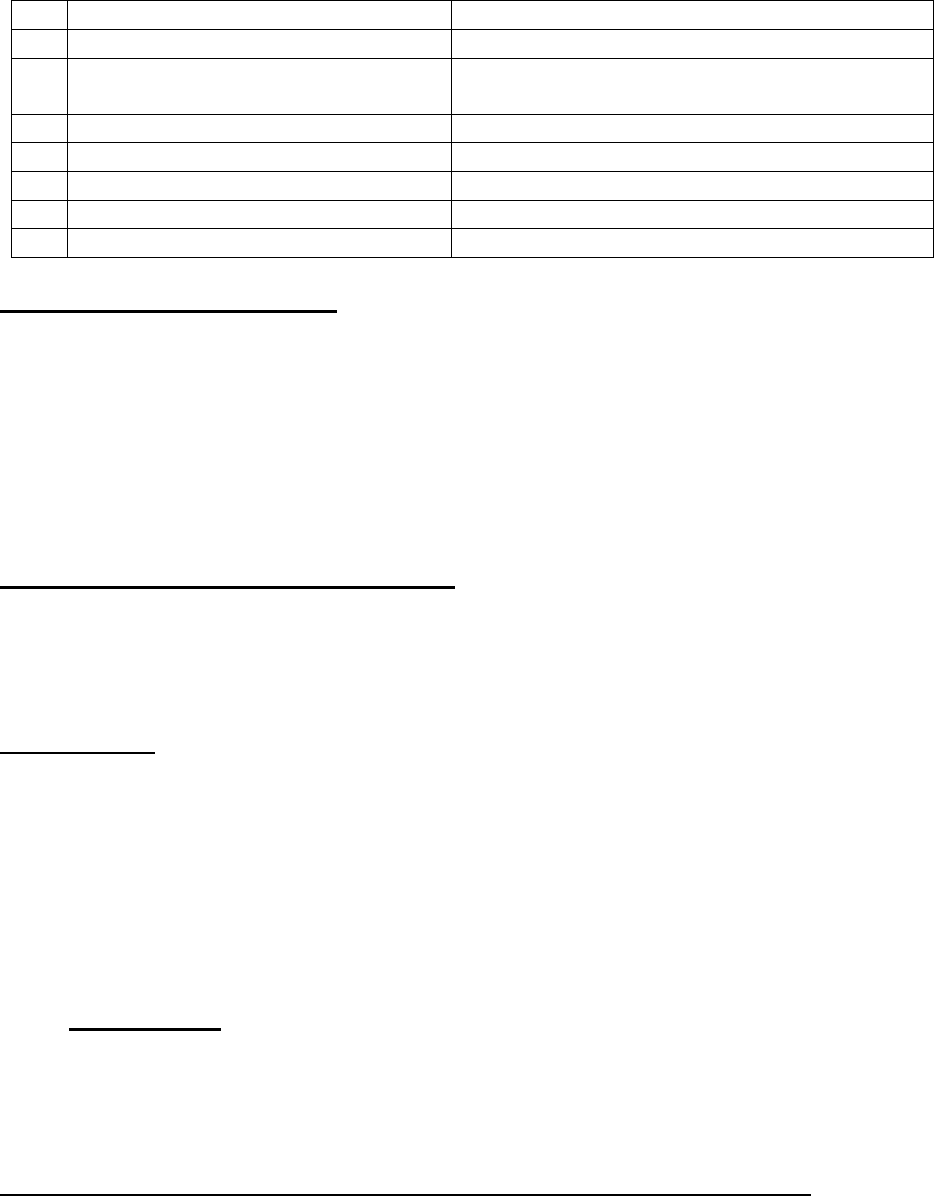

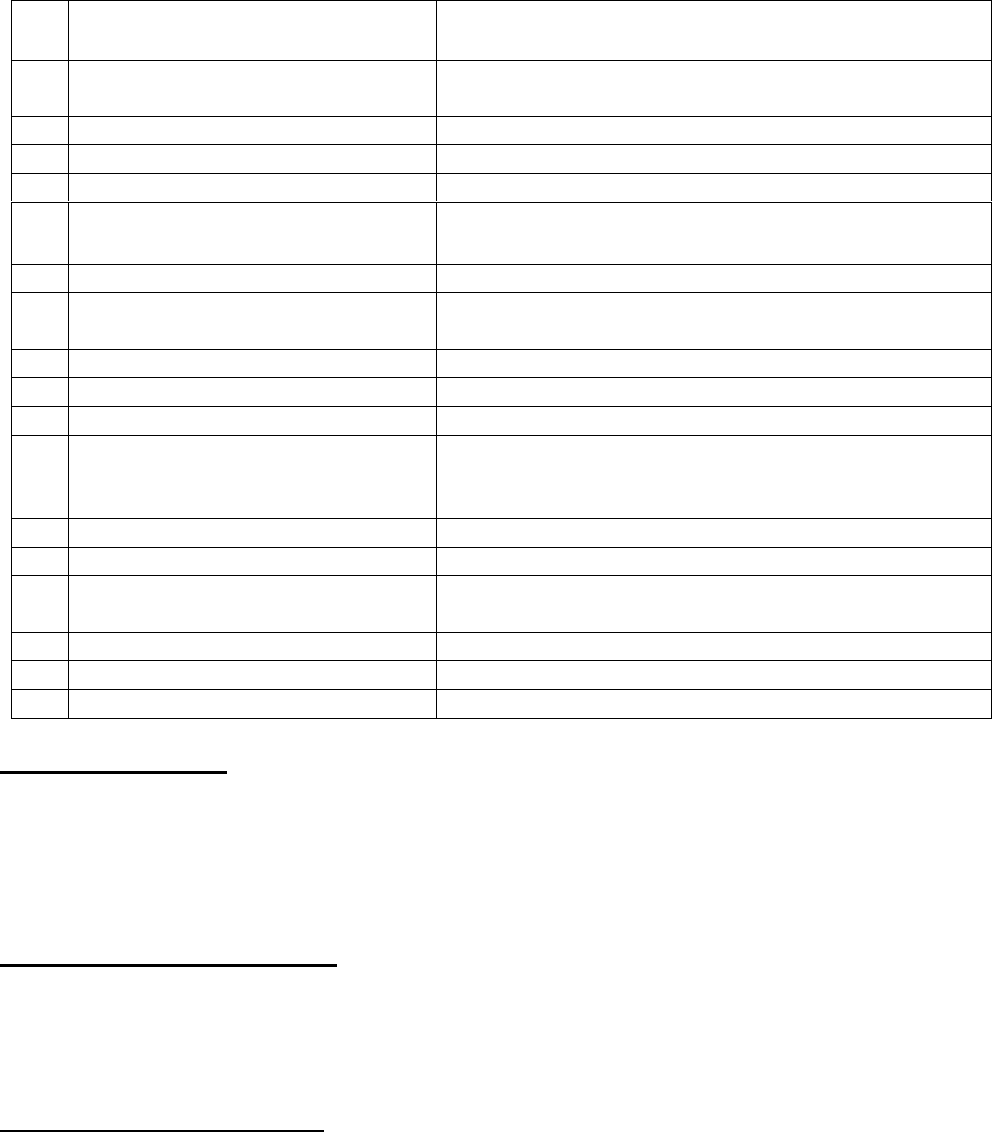

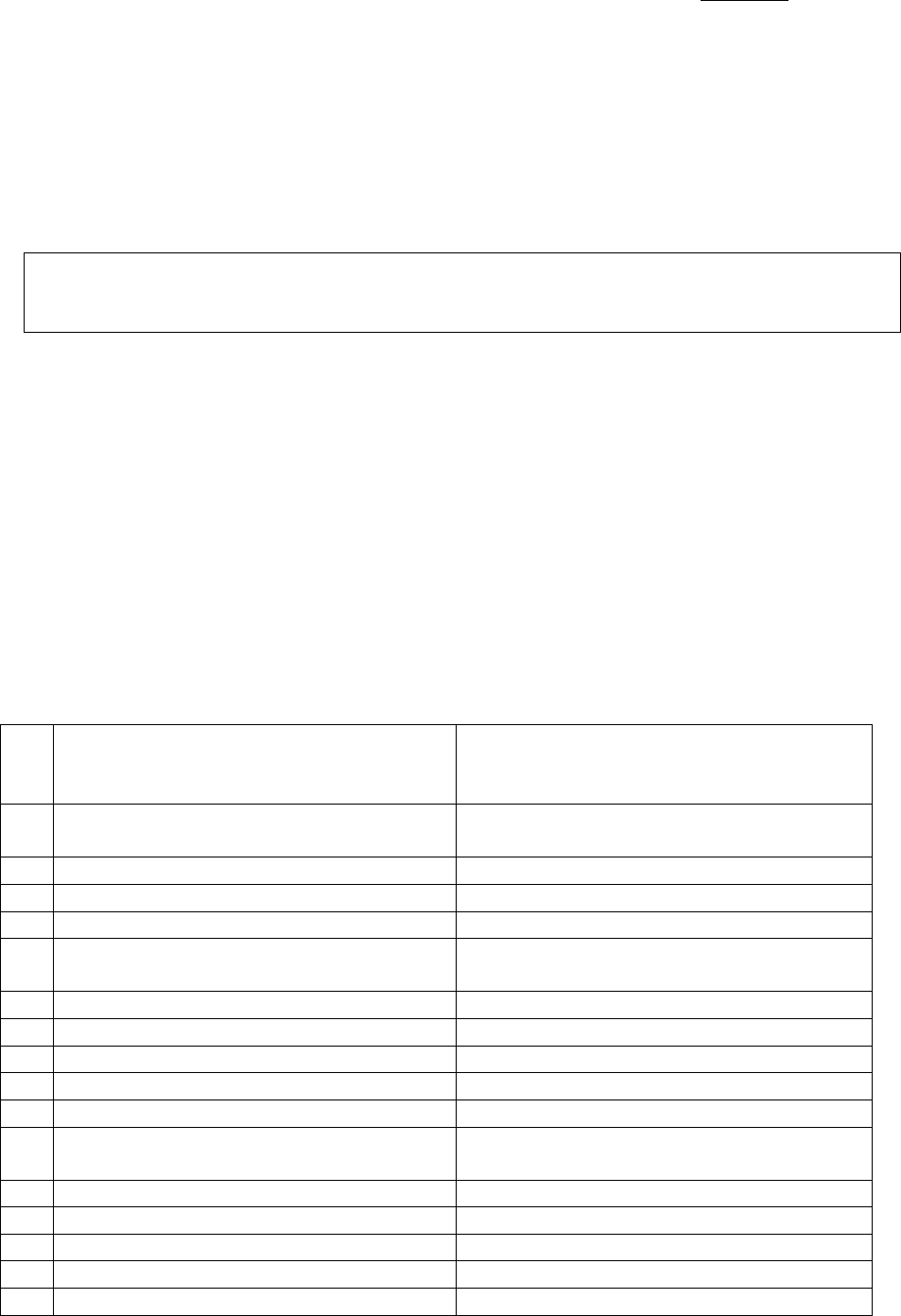

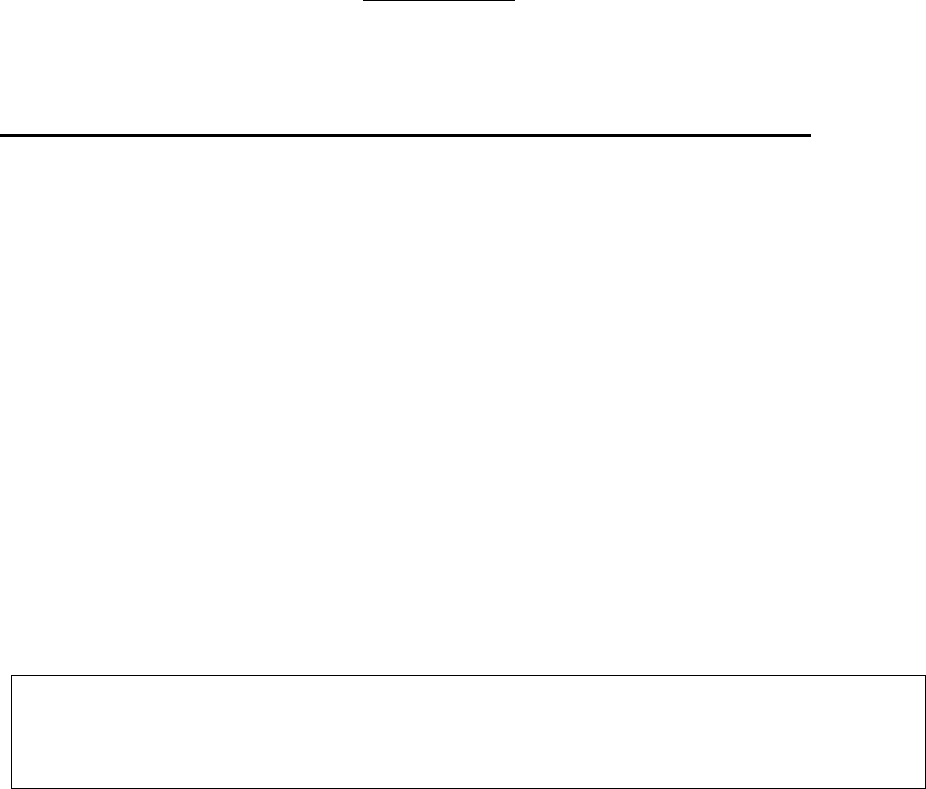

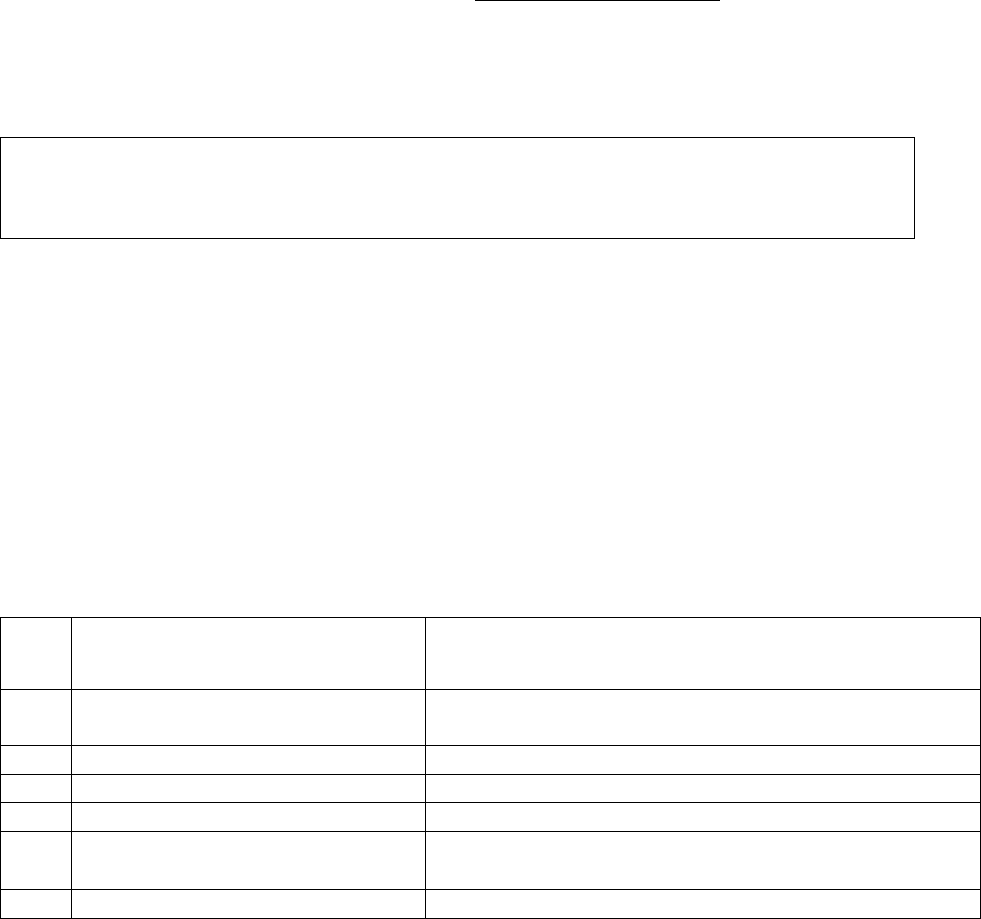

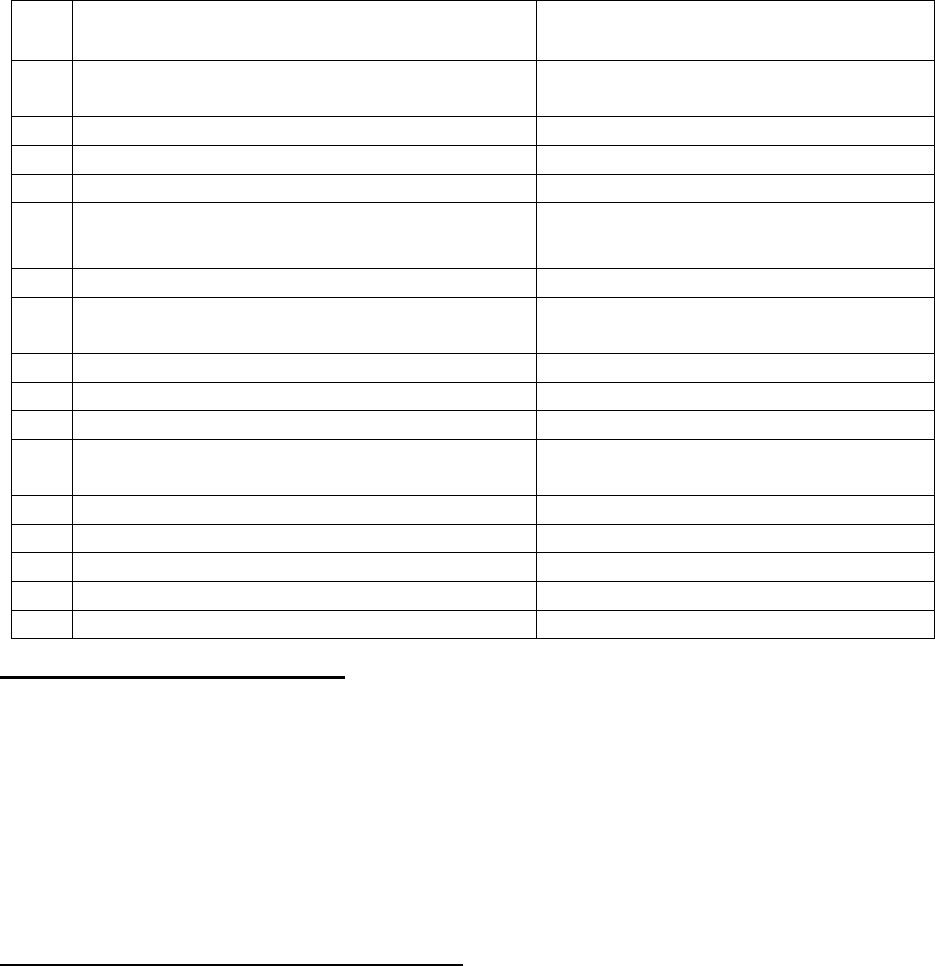

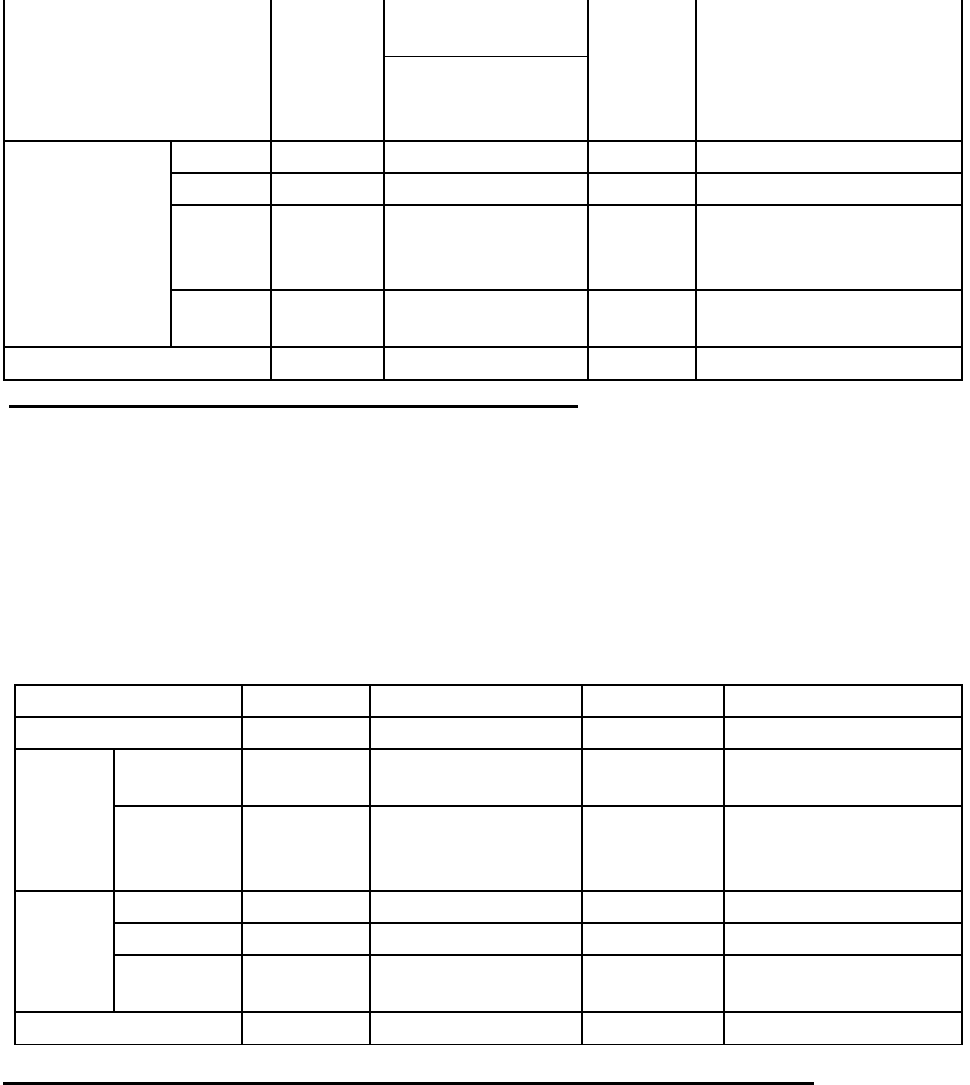

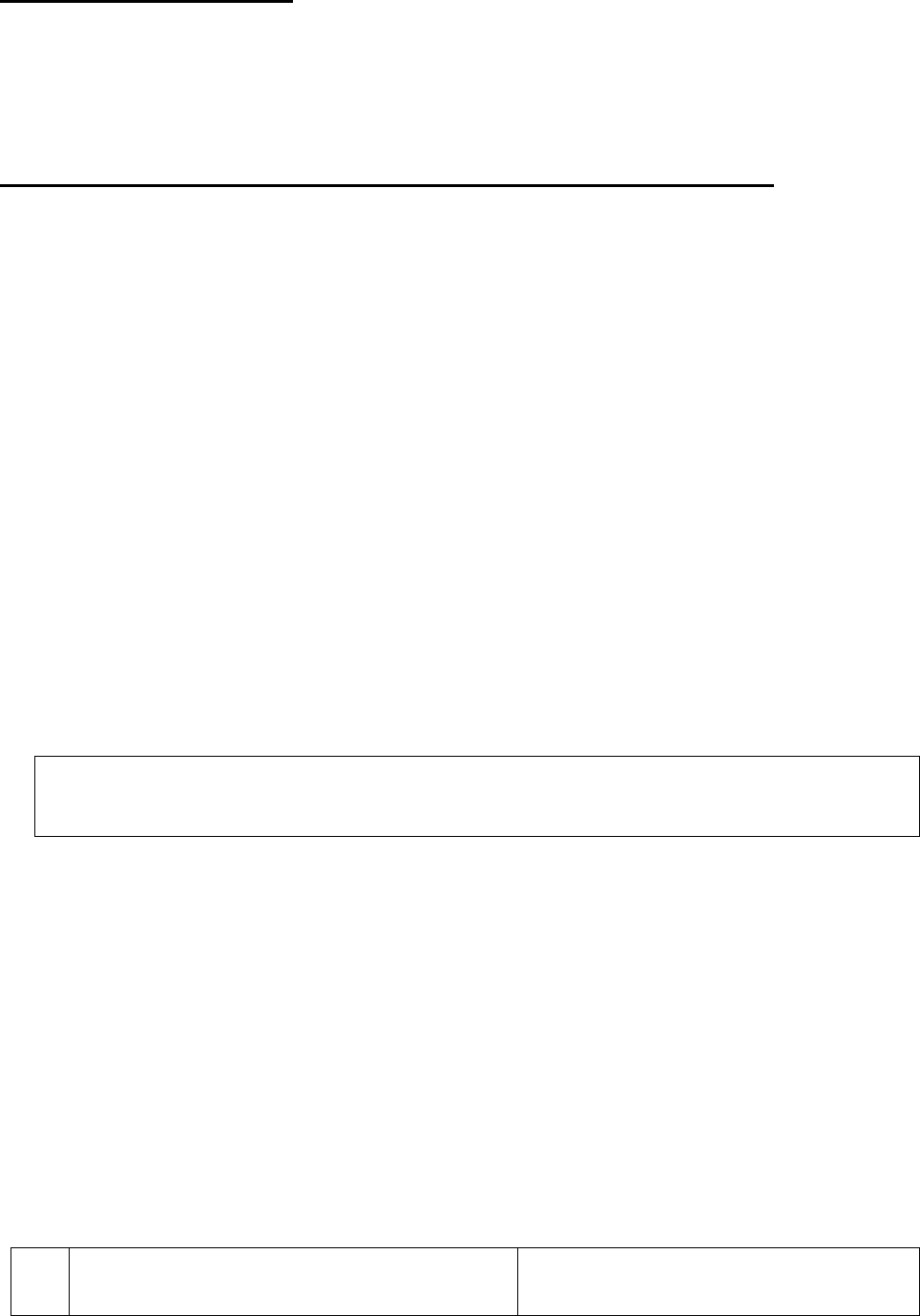

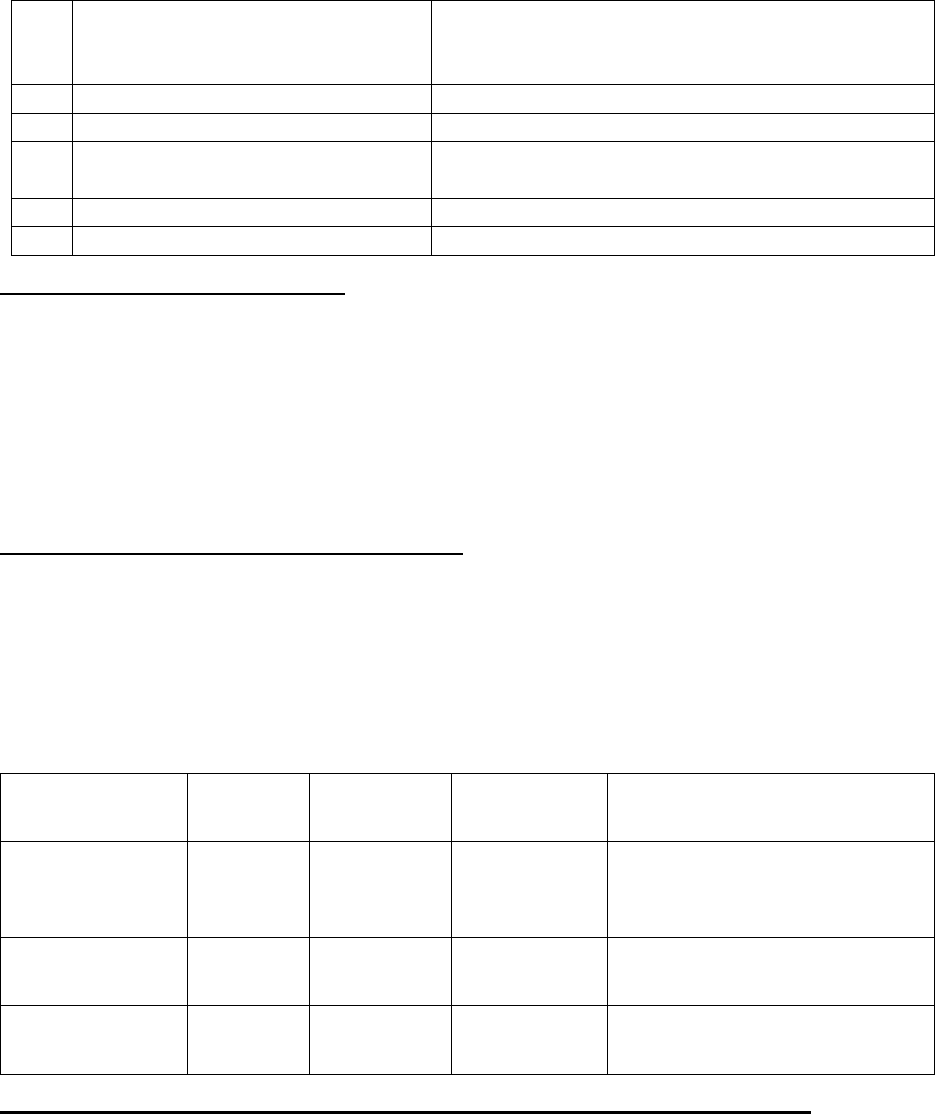

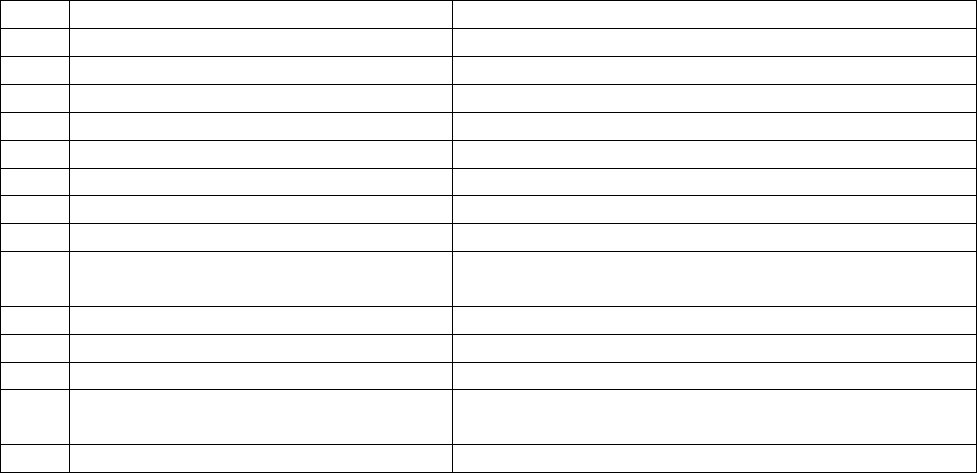

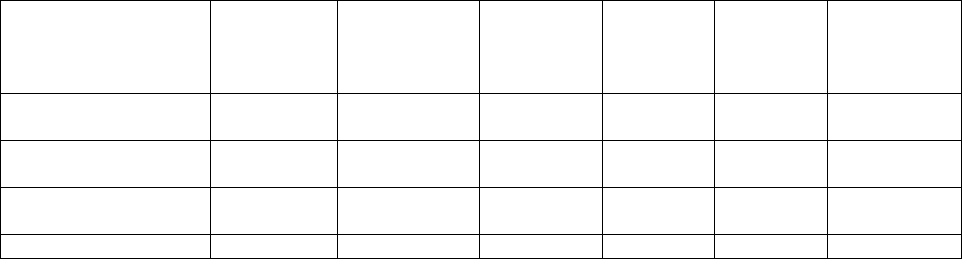

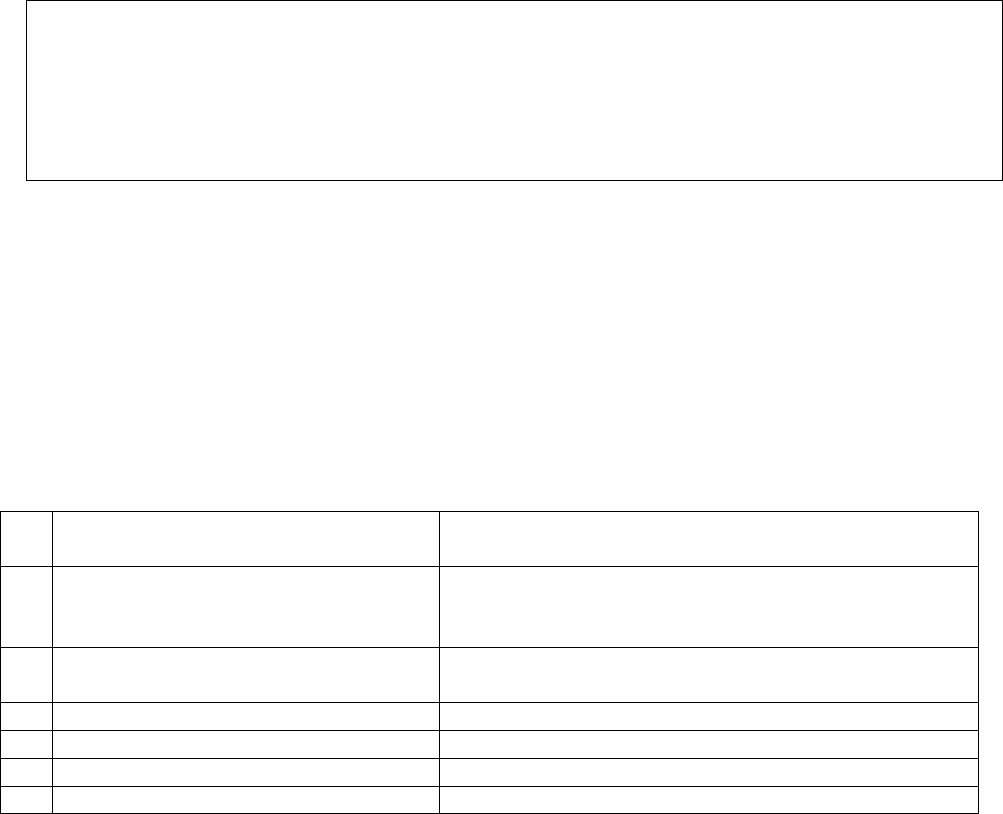

1

Name & Address of the

Complainant

Sri. Murali Mohan P.N

No.94, 2

ND

Main 3rs cross,

Vittal Nagar, ISRO Lay out,

Bangalore

KARNATAKA -560 111

Mob.No. 9972398800

Mail ID :[email protected]

2

Policy No.

Type of Policy

Duration of Policy/ Policy

Period

PROHLR010200106

Pro Health Plus Individual Health Insurance

Policy

26-08-2020 to 25-08-2021

3

Name of the Insured/ Proposer

Name of the policyholder

Sri. Murali Mohan P.N

Self

4

Name of the Respondent

Insurer

Manipal Cigna Health Insurance Company

Limited

5

Date of repudiation

NA

6

Reason for repudiation

Settled as per terms and conditions

7

Date of receipt of Annexure

VI-A

29.03.2021

8

Nature of complaint

Partial settlement of Covid -19 claim

9

Amount of claim

Rs.1,76,891/-

10

Date of Partial Settlement

NA

11

Amount of relief sought

Rs.1,76,891/-

12

Complaint registered under

Rule no:

13(1) (b) Insurance Ombudsman Rules,

2017

13

Date of hearing/place

26.07.2021 / Bengaluru

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Smt.Swetha Nair- Legal

15

Complaint how disposed

Dismissed

16

Date of Award/Order

01.09.2021

17. Brief Facts of the Case: It is a case of partial settlement of claim towards hospitalization

for Covid-19.. The Complainant took up the matter with the Grievance Cell of the

Respondent Insurer (RI) and the same was not considered favourably.

18. Cause of Complaint:

a) Complainant’s arguments: The Complainant submitted that he was hospitalized at

Ramakrishna Hospital, Jayanagar for Covid-19 treatment. The Respondent Insurance (RI) did

not consider major medication expenses and settled partial claim.

His representation to GRO along with doctor’s recommendation was not considered favourably.

Hence he approached forum for relief.

b) Respondent Insurer’s Arguments:

RI submitted their Self Contained Note by mail dated 21.04.2021 admitting the issuance of

policy, partial settlement of claim as per terms and conditions of policy.

The Complainant on 28th December 2020 registered a reimbursement claim bearing No.

23583925 (Annexure C) claiming Rs. 5,09,363/-. The reimbursement claim was filed for his

treatment at Ramakrishna Hospital, Bengaluru, Karnataka from 26th October 2020 to 4th

November, 2020 due to Covid Pneumonitis with Covid -19 positive.

After due scrutiny of the claim documents, the Company settled the claim of the Complainant

as per the policy terms and conditions and after making deductions in accordance with the

ceiling provided by GIC circular (Annexure D). It is submitted that in order to allay the fears

of all insurance policyholders and to bring complete clarity and transparency in the treatment

of Covid-19 insurance claims, the General Insurance Council, in discussion with expert

medical professionals employed by member insurance companies, has brought about a

Schedule of rates for Covid-19 claims being filed with its member insurance companies.

Insurance companies shall be guided by the Treatment Protocols prescribed by ICMR. These

rates are broadly based on the schedule of rates suggested for covid-19 treatment by NitiAyog

Panel.

Hence, in accordance with the GIC prescribed rates, the Company settled the claim of the

Complainant for Rs. 2,56,869/- through NEFT no. 021501624GN00009 on 15th February 2021

taking into consideration Category of the Hospital under ‘B’ . For the Complainant’s claim, the

deductions amounting Rs. 2,52,494/- were made being in excess of GIC prescribed rates. The

same was communicated to the Complainant through claim settlement letter dated 16th

February 2021 with detailed reasons for deduction.

It is important to mention herein that as per Annexure D, per day expenses including

Consultation, Nursing Charges, Room Stay & Meals, COVID testing, Monitoring &

Investigations–Biochem & Imaging; Physiotherapy, PPE, Drugs & Medical Consumables,

Biochemical Waste Management & other Protective gear and Bed side procedures like Ryles

tube insertion, urinary tract Catheterization forms part of the per diem cost mentioned in the

above referred table.

The Complainant subsequently approached the grievance cell of the Company for

reconsideration of the deductions.

That as per Annexure D, investigations are also part of the Per Diem cost, however in cases

where diagnostics need to be conducted more frequently, capping has been put for those tests.

Though the investigations form part of Per Diem cost, the Company considered the expenses

for certain investigations, over and above the Per Diem cost for certain investigations namely,

ABG,X-ray, CBC, CT- Chest and D-dimer and paid as the additional amount mentioned against

respective test in below table of Annexure D. Thus, in accordance with the same the Company

paid an additional amount of Rs. 76,103/- to the Complainant towards investigations and the

same was communicated to him vide settlement letter dated 16th March 2021.

In the light of above submissions, it is submitted that the above mentioned claim has already

been settled and the Hon’ble Ombudsman may be pleased to absolve us from the liability.

The claims are paid out of common pool of funds belonging to all the policy holders of the

Company, which makes it obligatory upon the Company to check the genuineness of each claim

before honouring it in the larger interest of all policy holders. They adopt best business and

ethical practices and have dealt with the claims of the complainant with utmost authenticity.

In the light of the above the RI requested the Forum to absolve them from the complaint made.

19. Reason for Registration of complaint:-

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017

20. The following documents were placed for perusal.

(i) Complaint along with enclosures,

(ii) Respondent Insurer’s SCN along with enclosures and

(iii) Consent of the Complainant in Annexure VIA & and Respondent Insurer in VII

A

21. Result of personal hearing with both the parties (Observations & Conclusions):

Personal hearing was conducted through video conference and the participants confirmed the

clarity of audio and video. The complainant submitted that on the day of hearing he received

mail for the balance settlement of Rs.1,26,826/- for which he is not agreeable and argued

that he seek full settlement. Further he contended that as per Doctor’s advice post discharge

he hired oxygen, and commuted by ambulance to his residence hence the same has to be

allowed. The R.I explained in details the non-admissible expenses of Rs. 46,565/- as per

policy terms and conditions. They also submitted that the hospital bills are inflated.

The R.I was asked to submit calculation as per policy terms and conditions reasonable and

customary charges as the Forum noted that the Hospital charged separately for Room Rent,

Nursing Charges, RMO charges Etc.,and for the investigation charges are inflated . As the

complainant strongly contended that there was necessity for oxygen post discharge the RI was

asked to furnish Ct/X-ray results, and the complainant’s SP02 at the time of discharge.

Post hearing the R.I submitted the required details and the Forum has taken the cognizance

of the same while passing this order.

They submitted that bill inflation has been noted in the pathological investigation report,

nursing charges and RMO charges which was billed separately from room charges.

Investigations done are related to the diagnosis, however the charges are inflated. Eg HRCT

billed at 6000.The average cost is 3000-3500/ HRCT. Similarly for Xray the average cost is 500 ,

billed here for 900/xray.ABG test is on an average 400/test, here it has been billed at 900/day

and done daily. D-Dimer done at 1200

Moreover, the HRCT report shows minor covid infection in the chest. While Spo2 levels has

been near normal during hospitalisation, other vitals have remained normal and the

Complainant does not suffer from any co-morbidities. Symptomatically, the Complainant did

not exhibit severe breathing difficulty; nevertheless he has been administered 6 litres of

oxygen which is indicated when oxygen dips below 90%. On the other hand, throughout

admission, the SPO2 levels have remained above 90%.This also indicates inflation. Similarly,

the SPO2 level at discharge was 96%, which does not require oxygen administration at home

for a month. However Oxygen Cylinder to be used outside hospital is a specific non-payable

item under the Non-medical Expenses listed in the policy TnC.

Claim is re-evaluated in the light of reasonable and customary charges as per Clause II.1 of the

policyTnC.

Room rent includes RMO charges and bed charges. These are called out usually by hospitals.

In the policy RMO charges are not payable separately and are to be considered part of room

rent. As per Clause IX(Definitions) Room rent includes associated medical expenses which in

turn includes medical practitioner’s fees. Both definitions under the policy TnC are extracted

below:

“59.Room Rent - Room Rent means the amount charged by a Hospital towards Room and

Boardingexpenses and shall include the associated medical expenses.”

“6.Associated Medical Expenses shall include Room Rent, nursing charges, operation theatre

charges,fees of Medical Practitioner/ surgeon/ anesthetist/ Specialist and diagnostic tests,

excluding cost ofmedicine, conducted within the same Hospital wherethe Insured Person has

been admitted.”

The Nursing charges are usually 500/- day for a shared room, here billed at Rs.3400/- day.

This Forum has perused the documentary evidence available on record and the submissions

made by both the parties during the personal hearing.

The issue to be decided is whether partial settlement of covid-19 claims is in order .

Forum notes that IP was diagnosed with COVID-19 and he was admitted at Ramakrishna

Hospital, Bangalore with the complaint of fever since 1week and cough since 2 days from

26.10.2020 to 04.11.2020 diagnosed with Covid 19 Positive- severe illness with No history of

DM/HTN/Bronchial Asthma/Epilepsy,IHD/ Thyroid Disorder ( No Co morbid) . He was

admitted in Private ward-Unit 1 which is co-sharing ward. IP incurred a total expenses of

Rs.4,71,645/- towards the main hospitalisation bill and filed a reimbursement claim for the

same along with pre and post hospitalization amount of Rs. 13,315/- & 11,343/- respectively,

Health Check up cost of Rs. 11,260/-, Ambulance Rs.1800/- totalling to Rs. 5,09,363/- with

RI. The RI initially settled the claim for an total amount of Rs.2,56,869/- considering the GIC

guidelines and pre post hospitalization amount and further settled Rs.76,103/- towards high

end investigations totalling to Rs.3,32,972/-.

Post hearing the R.I informed the forum that vide transaction No.121102643GN002178 dt.

30.07.2021 they paid balance amount of Rs. 1,26,826/- . Hence found that the R.I settled total

amount of Rs. 4,59,798/-less non payable amount of Rs. 49,565/- .

The Forum has gone through the details of disallowed expenses provided by the R.I and notes

that the expenses towards Oxygen post discharge is an exclusion as per Annexure IV- Under

EXTERNAL DURABLE DEVICES Sl.No136 and the Ambulance charges are payable only

from the residence to the hospital as per II.6 Ambulance cover where as the complainant is

claiming from the hospital to his residence after the discharge. Accordingly he is not entitled

and other disallowed expenses are in order as per terms and conditions of policy.

The Forum observed that the hospital inflated bill by charging under different heads for

Room ,Nursing charges and for the RMO charges beyond the scope of policy coverage as per

the definition No. 59 Room Rent and No.6. Associated Medical Expenses . Accordingly,

the complainant is not entitle for RMO charges . The consultation charges (general Medicines)

are billed for 16 Nos. for the duration of hospitalization period of 10 days found to be inflated

the bill. The R.I Settled the claim beyond the eligible amount even considering towards

nursing charges @Rs.3500/- for 10 days which should have been the part of Room rent.

The Forum also notes that the R.I settled Rs. 1,26,826/- after the hearing on 30.07.2021 which

is before passing order from the Forum found to be not in order when the Forum asked the R.I

to furnish the calculation as per terms and conditions of policy.

The complainant also did not inform the Forum the receipt of Rs.1,26,826/- after the hearing ,

when he sought relief from the Forum for Rs. Rs.1,76,891/- which is not appreciable. In view

of which the Forum considers the disputed amount is Rs.49,565.00 only.

The Forum relies on :

The Hon’ble Supreme Court of India in the case of Suraj Mal Ram Niwas Oil Mills (P) Ltd.

Vs. United India Insurance Co. Ltd. & Anr., interalia held that:

“Before embarking on an examination of the correctness of the grounds of

repudiation of the policy, it would be apposite to examine the nature of a contract

of insurance. It is trite that in a contract of insurance, the rights and obligations

are governed by the terms of the said contract. Therefore, the terms of a contract of

insurance law have to be strictly construed and no exception can be made on the

ground of equity”.

The claims are paid out of common pool of funds belonging to all the policy holders of the

Company , the R.I cannot settle the claim beyond the scope of the policy in the larger interest

of all policy holders. Hence the R.I is strictly advised to adhere the policy terms and conditions

while admitting the claim.

Considering the above the Forum found that the complainant was paid more than the entitled

amount and deduction of Rs. 49,565/- is in order.

Hence, the Complaint is DISMISSED

A W A R D

Taking into account of the facts and circumstances of the case, the documents and

the oral submissions made by both the parties, this Forum found that the

complainant was paid more than the entitled amount beyond the policy terms

and conditions and deduction of Rs. 49,565/- towards disallowed expenses are in

order.

Hence, the Complaint is DISMISSED.

Dated at Bangalore on the 1

st

day SEPTEMBER of 2021.

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA

AND ADDL. CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- Smt. POONAM BODRA

In the matter of: Mr. Santhosh K S Vs Star Health And Allied Insurance Co. Ltd.

Complaint No: BNG-H-044-2122-0137

Award No: IO/BNG/A/HI/0055/2021-22

• The Complaint emanated from repudiation of Covid-19 claim under policy No.-

P/141116/01/2021/007300 and Claim No.-CIR/2022/141116/2405508 on the ground of

unwarranted hospitalisation. Representation along with the RI could not be resolved. Hence

the Complainant approached this Forum for relief. The complaint was registered on

26.05.2021.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I

vide mail dt. 30.08.2021 informed the complainant that they reviewed the claim and agreed

to settle Rs. 2,50,000/-against claimed amount of Rs.2,50,000/-. The Forum sent the mail

to the complainant for his consent if agreeable. The complainant agreed for the settlement

and gave his consent. The complainant has confirmed the receipt of amount Rs. 2,51,541/-

to the Forum vide his mail dt. 31.08.2021.

• The complaint was resolved on compromise basis wherein both have agreed for the same

and hence, the Complaint is treated as Closed and Disposed off accordingly.

Dated at Bangalore on the 1

st

day of September 2021.

(Smt. POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL. CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF

KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Sri.D.R.MANJUNATH V/s STAR HEALTH AND ALLIED INSURANCE

COMPANY LIMITED

Complaint No: BNG-H-044-2122-0161

Award No: IO/BNG/A/HI/0061/2021-22

• The Complaint emanated from rejection of Covid-19 claim under policy No.

P/141214/01/2020/004750 Claim No.CIR/2021/141214/0355496 on the ground of

discrepancy in the hospital records. Representation with the RI could not be resolved.

Hence the Complainant approached this Forum for the relief. The complaint was registered.

• After scrutiny of the documents the Forum informed the R.I to relook the claim . The R.I

reviewed the claim and agreed to settle Rs.7,07,384/- against claimed amount of

9,66,000/- as per limits, terms and conditions of the policy. The complainant agreed for the

settlement and gave his consent to close the complaint. The R.I confirmed the payment

made through

NEFT –SBI –N247211624855285 dt. 04/09/2021.

The complaint was resolved on compromise basis wherein both have agreed for the same and

hence, the Complaint is treated as Closed and Disposed of accordingly.

Dated at Bangalore on the 13

th

day of SEPTEMBER 2021

(POONAM BODRA)

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA

AND ADDL.CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- POONAM BODRA

In the matter of: Ms Mumtaz Habib Lala Vs Star Health And Allied Insurance Co. Ltd.

Complaint No: BNG-H-044-2122-0262

Award No: IO/BNG/A/HI/0060/2021-22

• The Complaint emanated from the partial settlement of Covid-19 claim for Rs. 31069/-

against claimed amount of Rs. 73,322/- under policy No.-P/181314/01/2021/008201 and

Claim No.-CIR/2022/181314/2603394 . Representation along with the RI could not be

resolved. Hence the Complainant approached this Forum for relief. The complaint was

registered on 04.08.2021.

• After scrutiny of the documents the Forum informed the R.I to relook the claim. The R.I

vide mail dt. 08.09.2021 informed the Forum that they reviewed the claim and agreed to

settle Rs. 14,805/- after deduction of an amount of Rs. 10,886/- already paid via NEFT

( UTR No.- N222211596891848 ) dated 10.08.2021 . The Forum sent the mail to the

complainant for his consent if agreeable. The complainant agreed for the settlement and

gave his consent.

• The complaint was resolved on compromise basis wherein both have agreed for the same

and hence, the Complaint is treated as Closed and Disposed off accordingly.

Compliance of Award:

Attention of the Complainant and the Insurer is hereby invited to the following:

c) The Complainant shall submit all requirements/Documents required for settlement of

award within 15 days of receipt of the award to the Respondent Insurer.

b. According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer shall

comply with the award within thirty days of the receipt of the award and intimate

compliance of the same to the Ombudsman.

Dated at Bangalore on the 13

th

day of September 2021.

( POONAM BODRA )

INSURANCE OMBUDSMAN

FOR THE STATE OF KERALA AND

ADDL. CHARGE FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE - THE INSURANCE OMBUDSMAN, STATE OF M.P. & C.G.

(UNDER RULE NO: 16(1)/17 OF THE INSURANCE OMBUDSMAN RULE 2017)

OMBUDSMAN – JUSTICE ( RETD.) ANIL KUMAR SRIVASTAVA

Mr Sumeet Bhandawat ..…………………..…………………..……………………………………Complainant

V/S

Manipal Cigna Health Ins Co Ltd………………..……..………..…………………………………Respondent

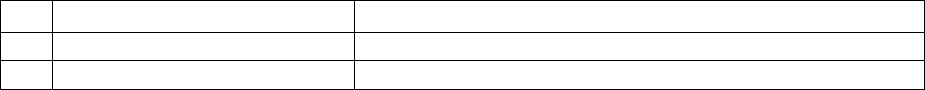

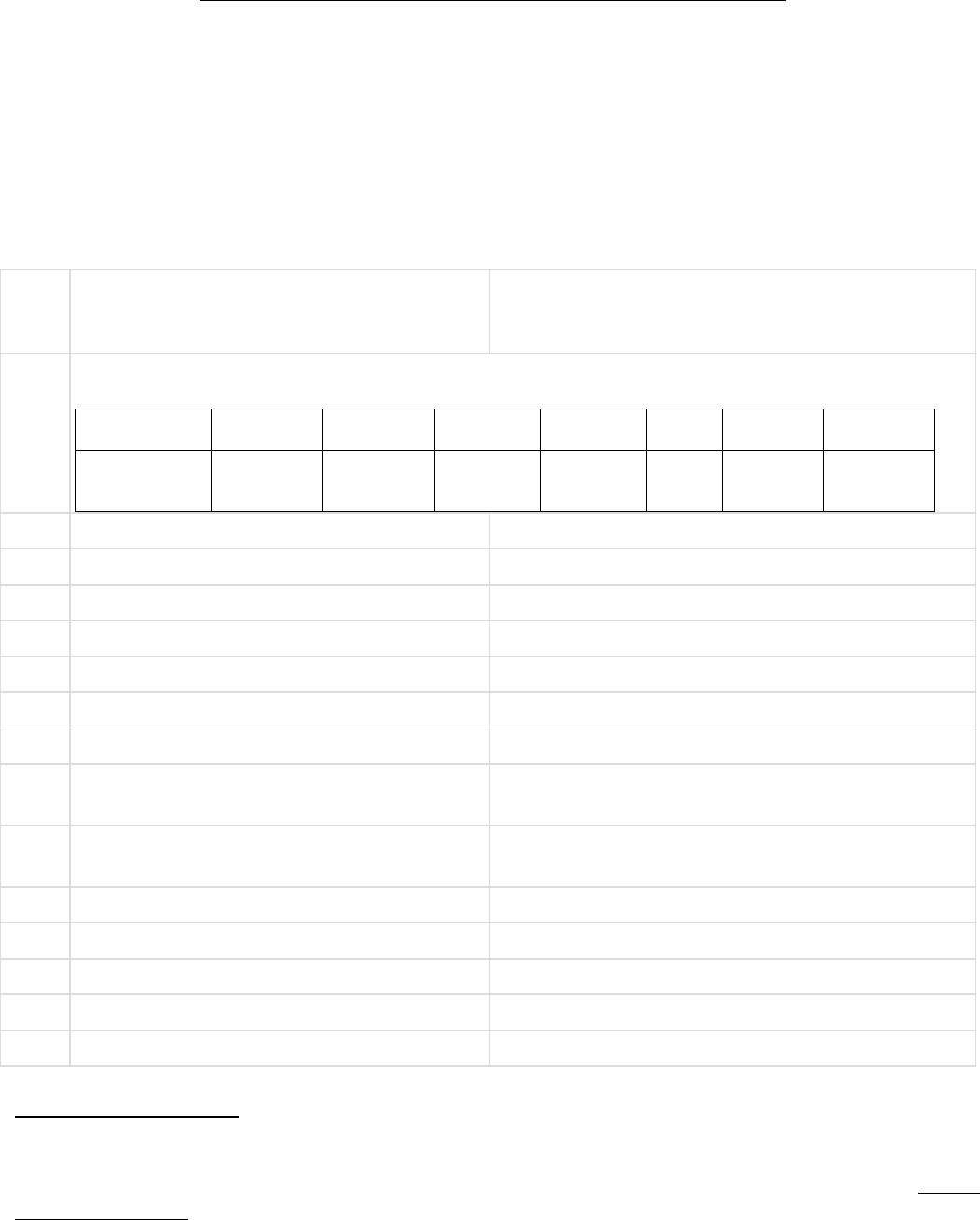

COMPLAINT NO: BHP-H-053-2122-0019 ORDER NO: IO/BHP/A/HI/ /2021-22

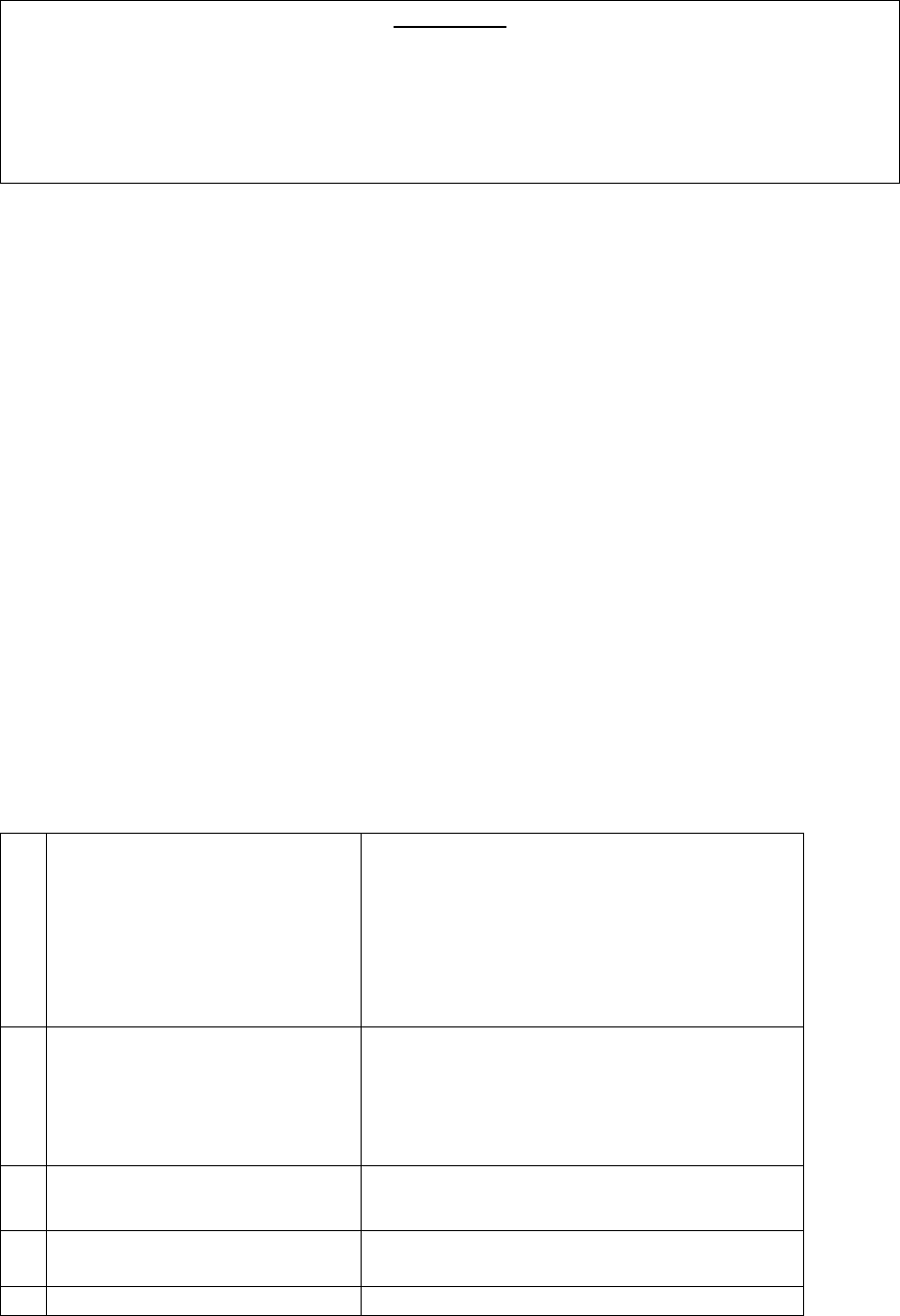

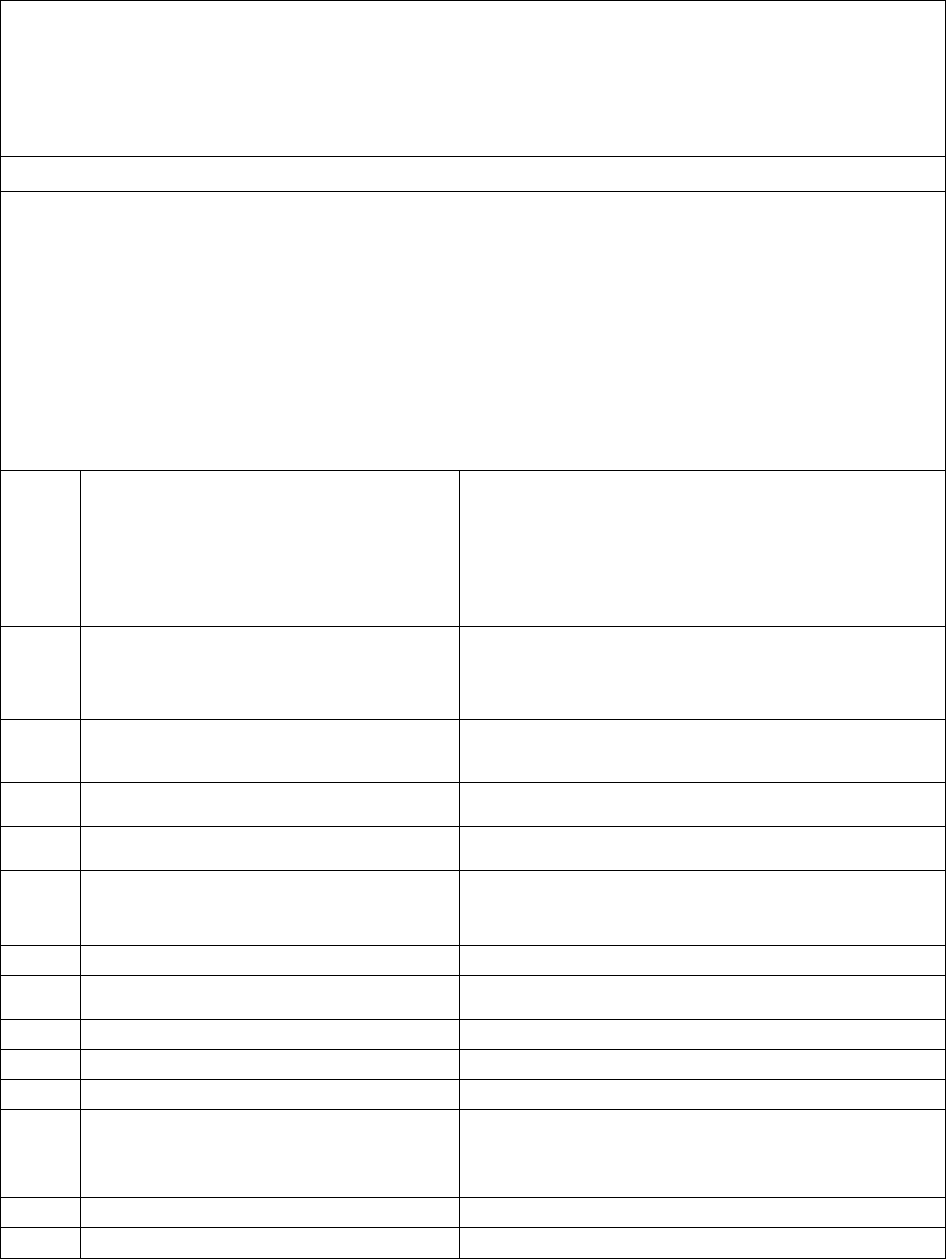

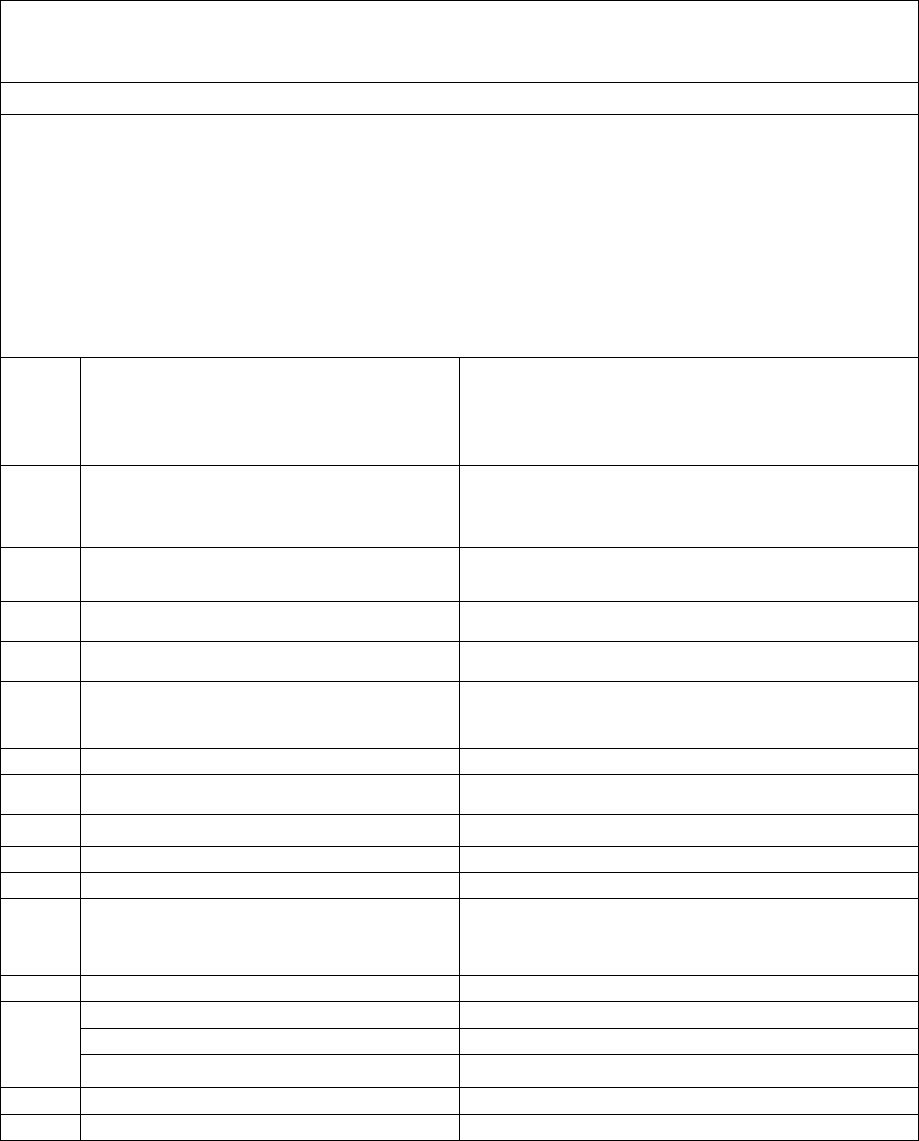

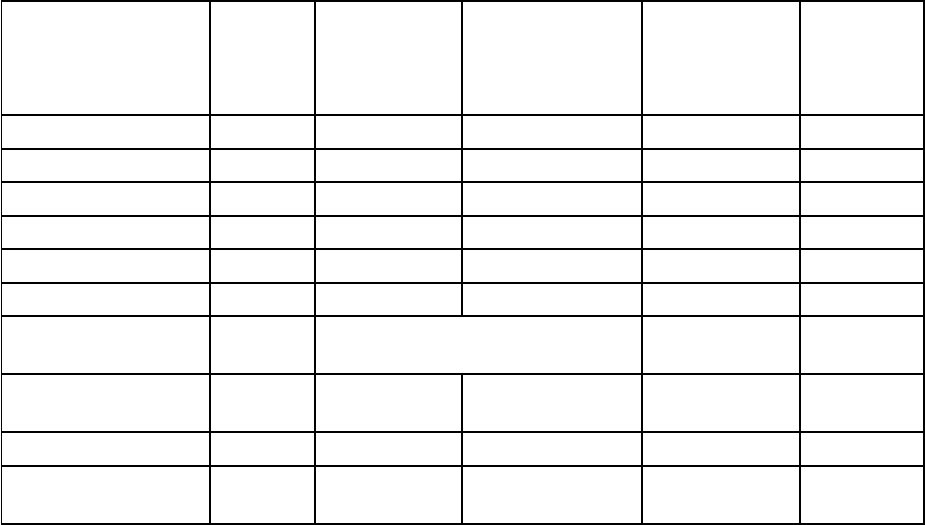

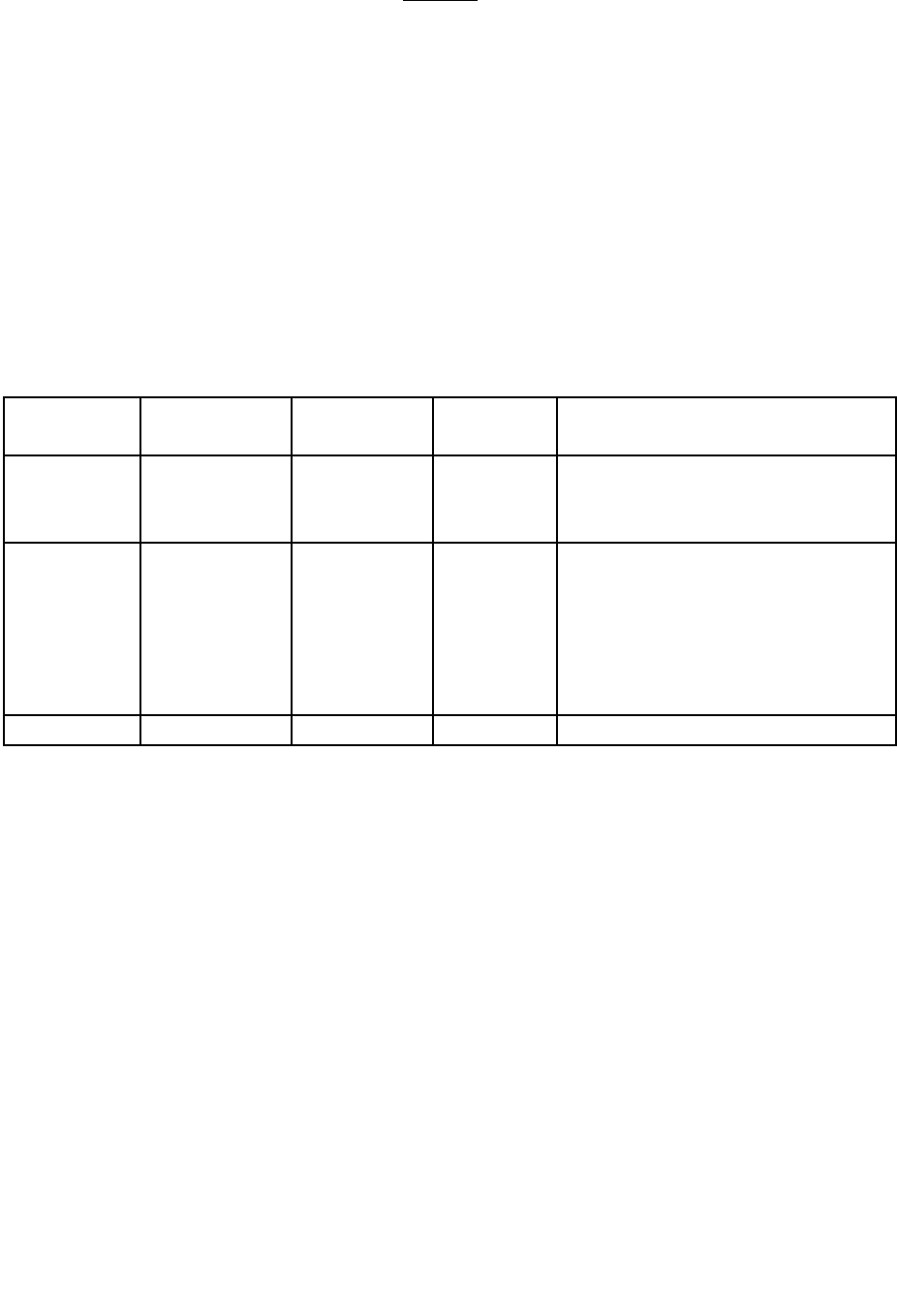

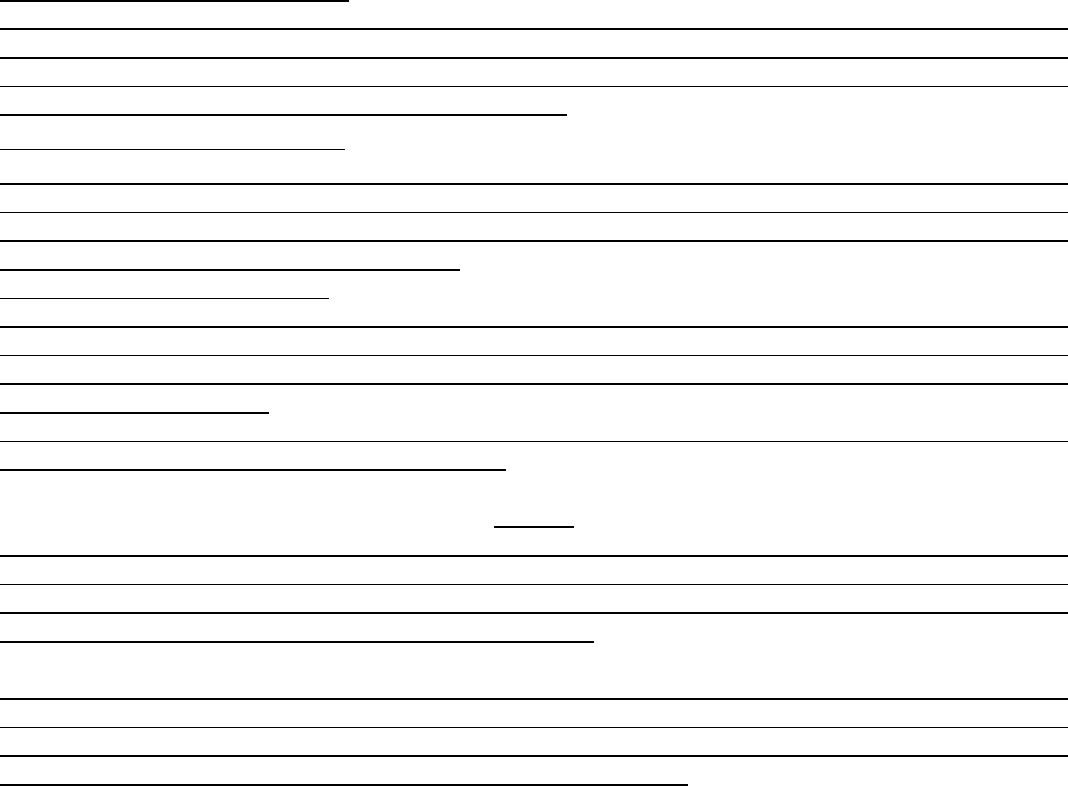

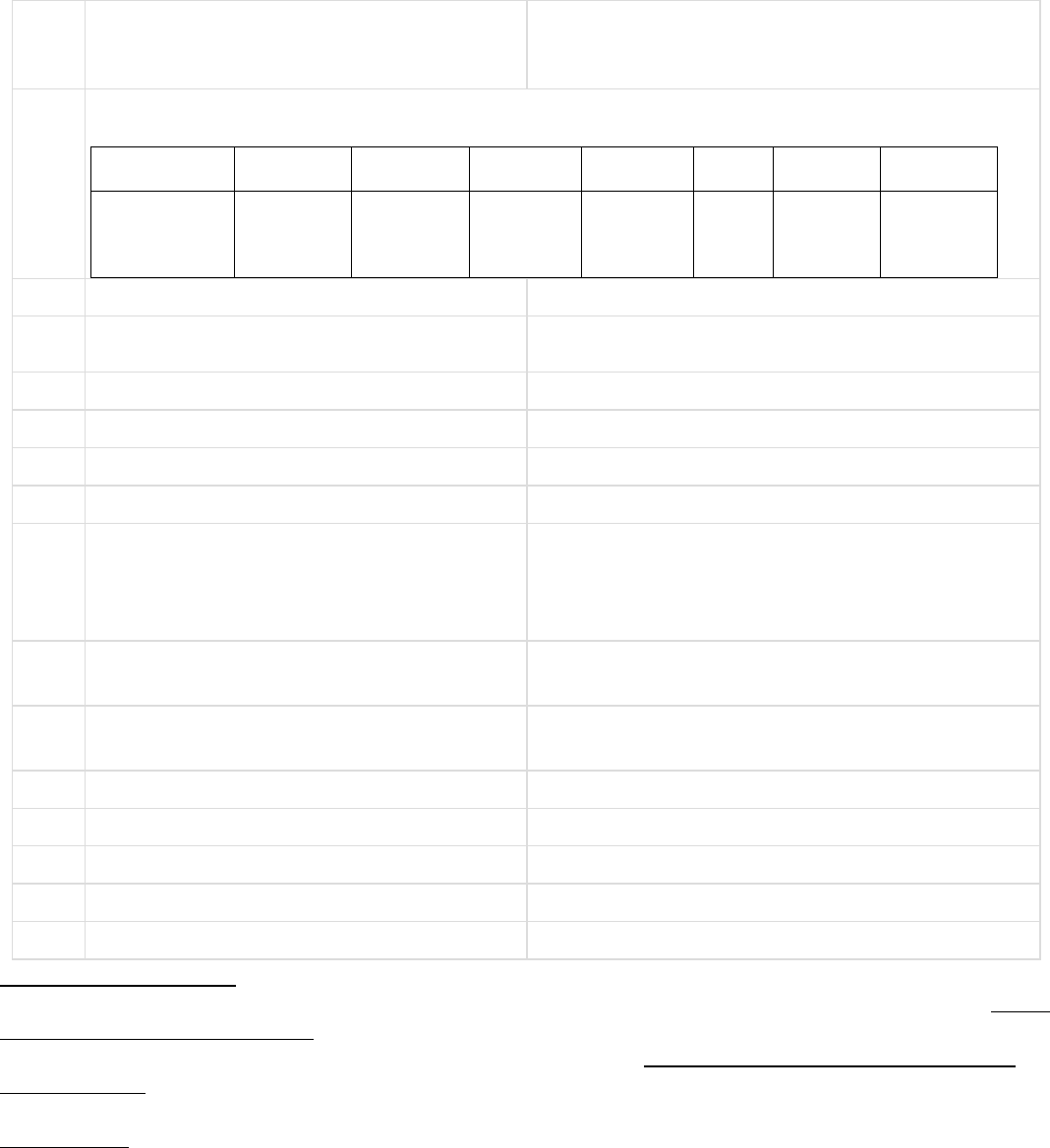

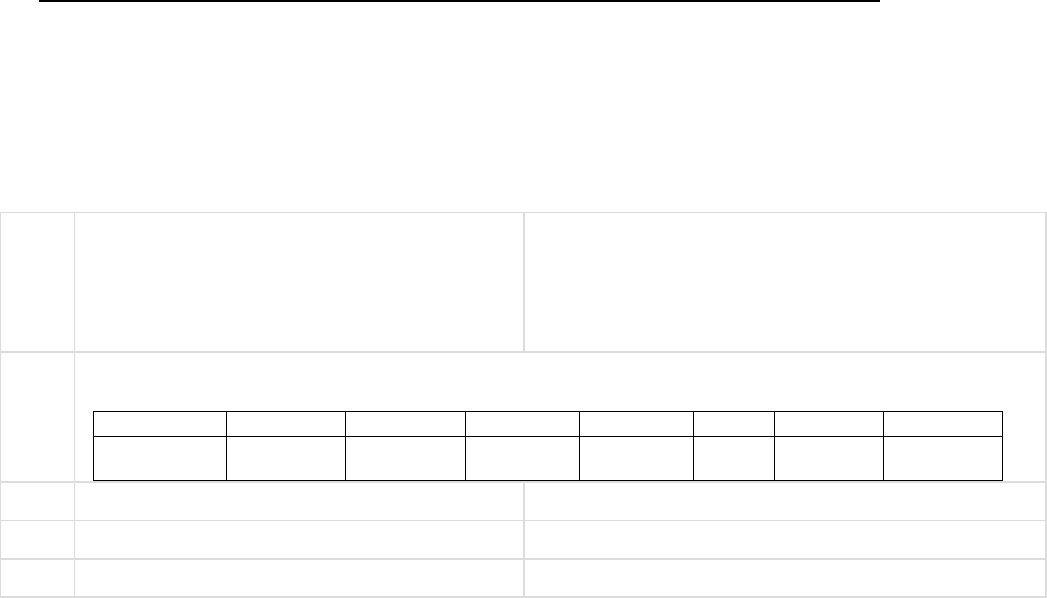

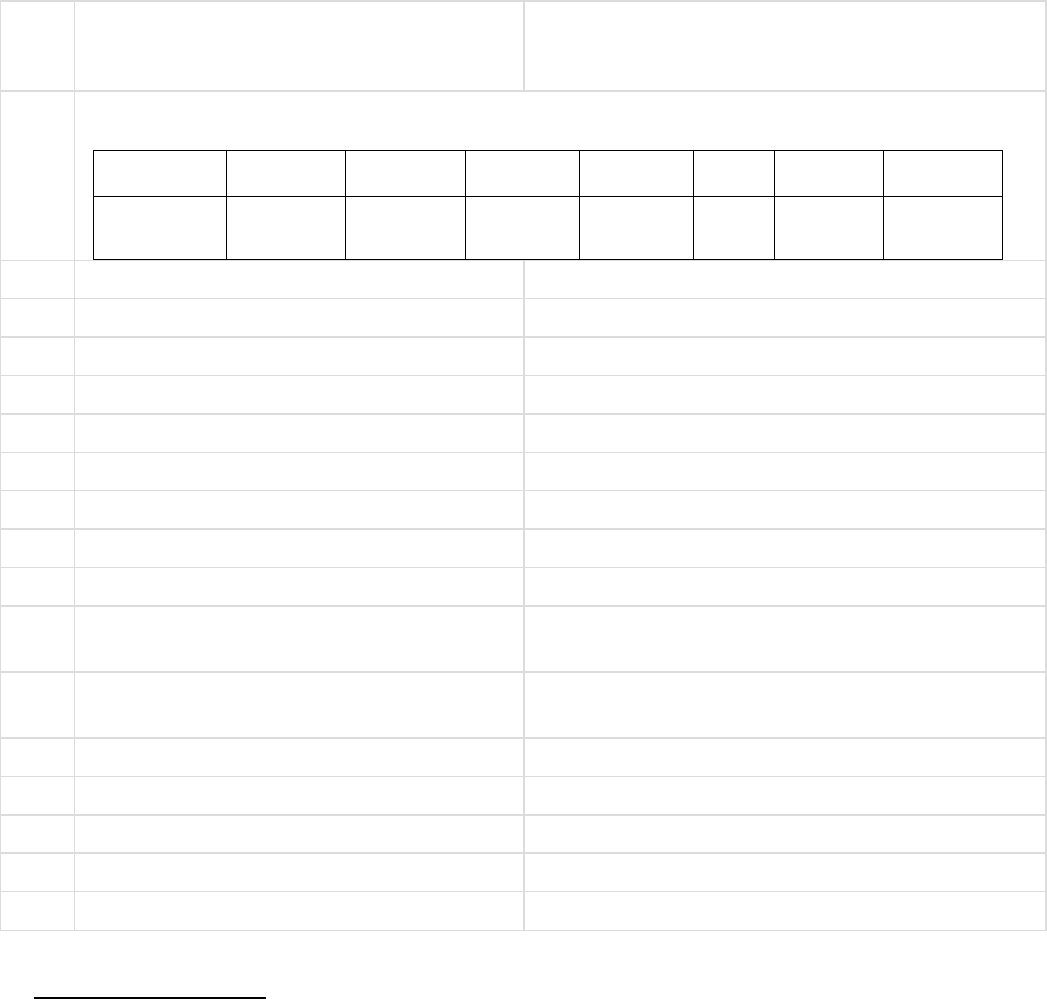

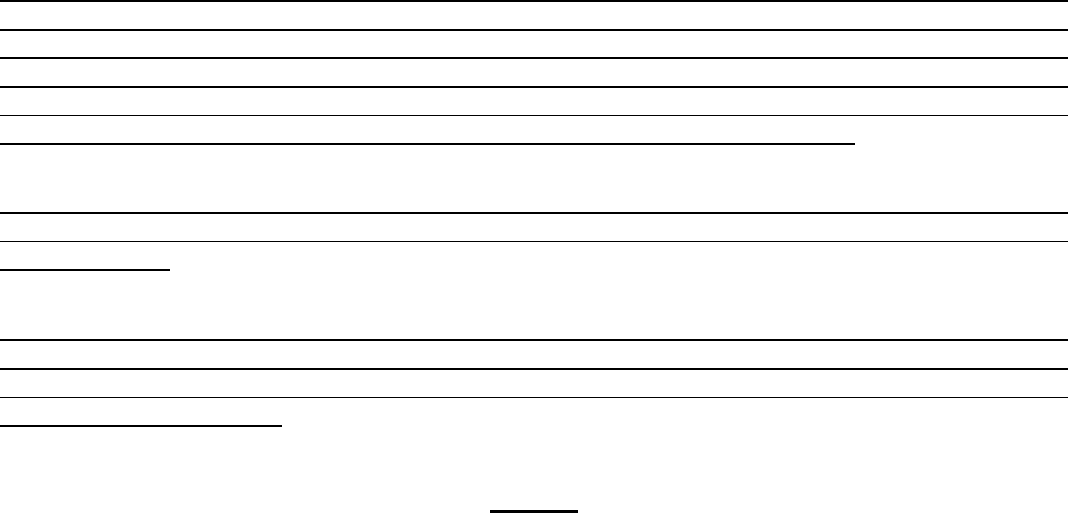

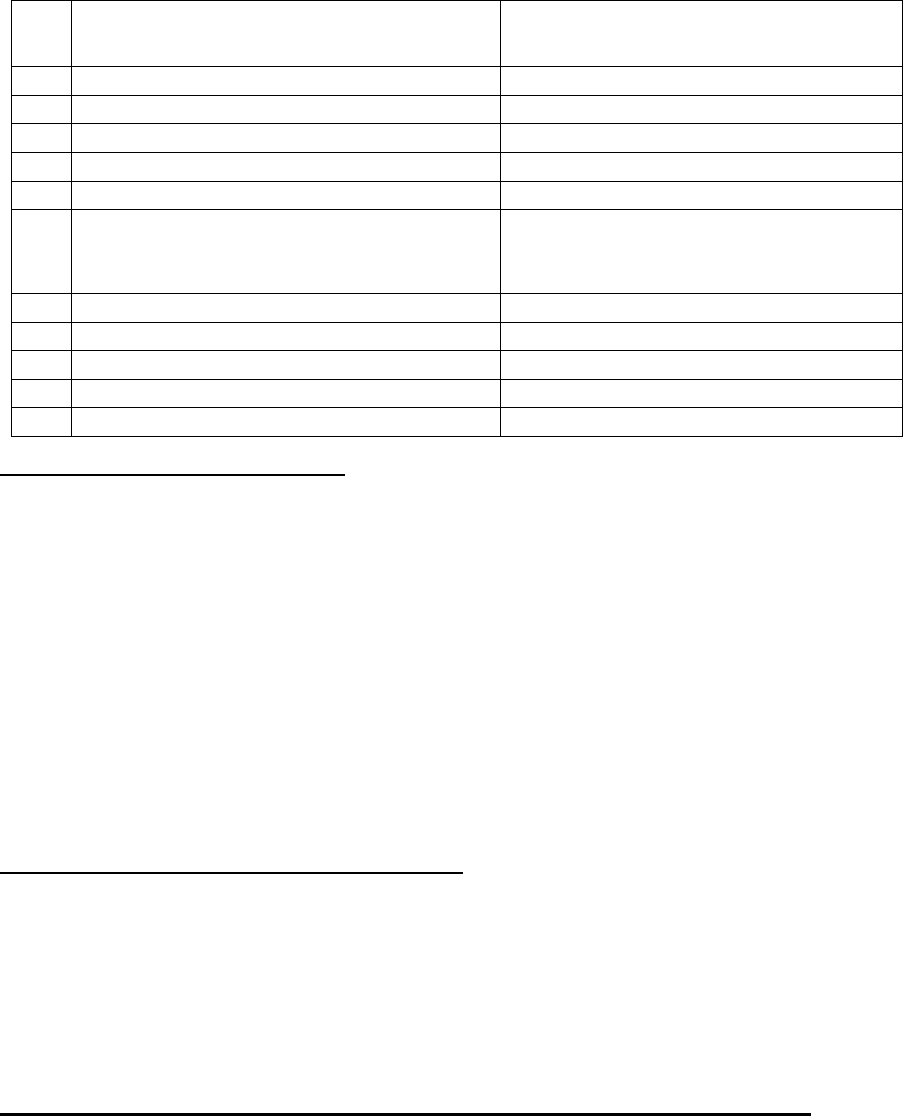

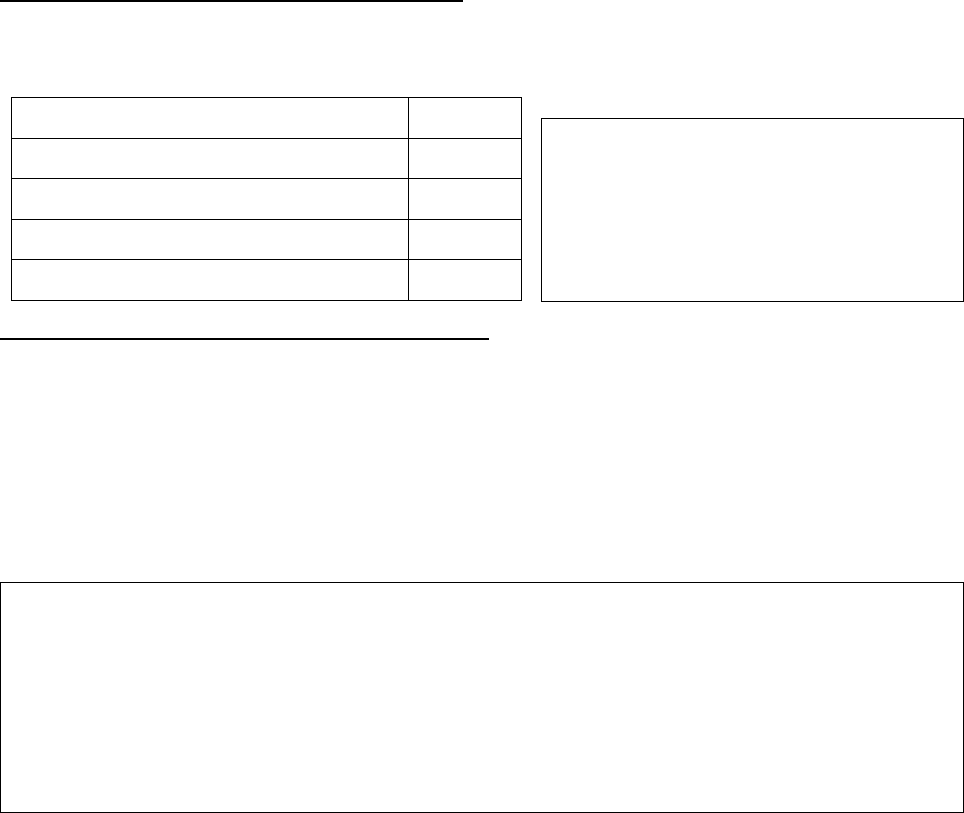

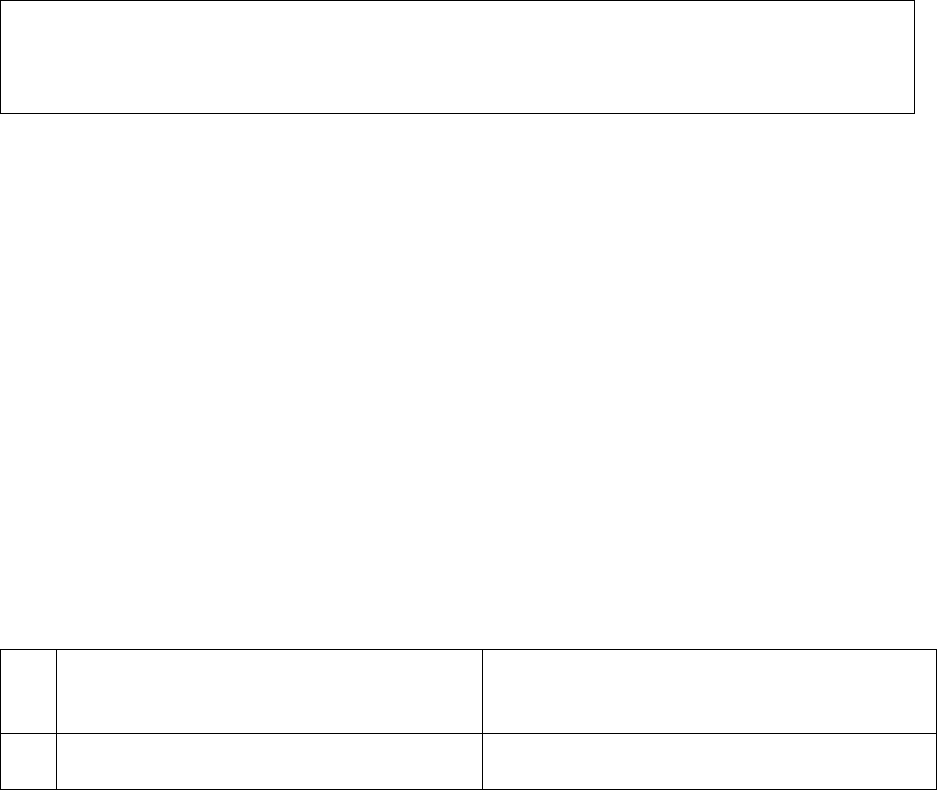

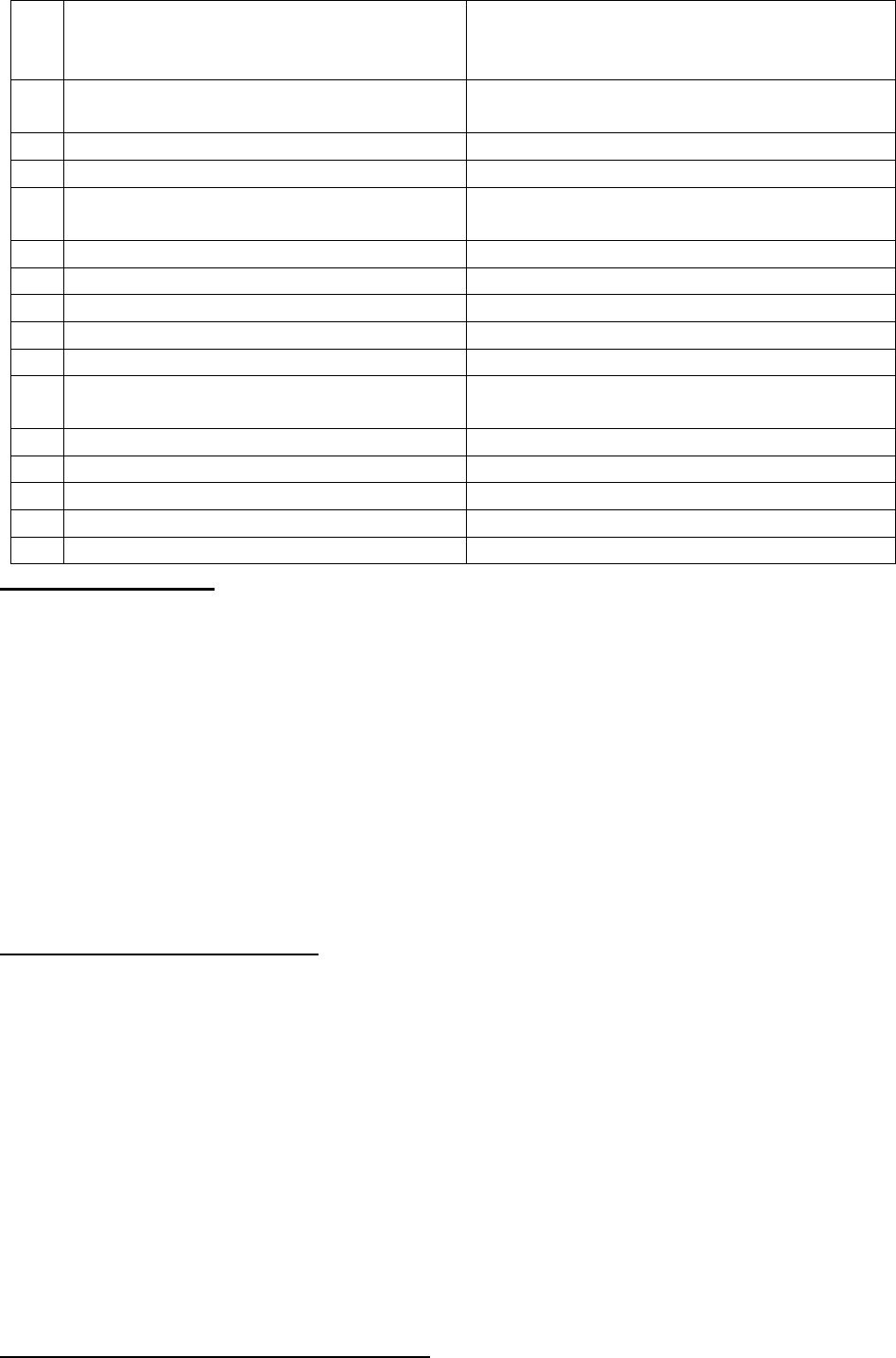

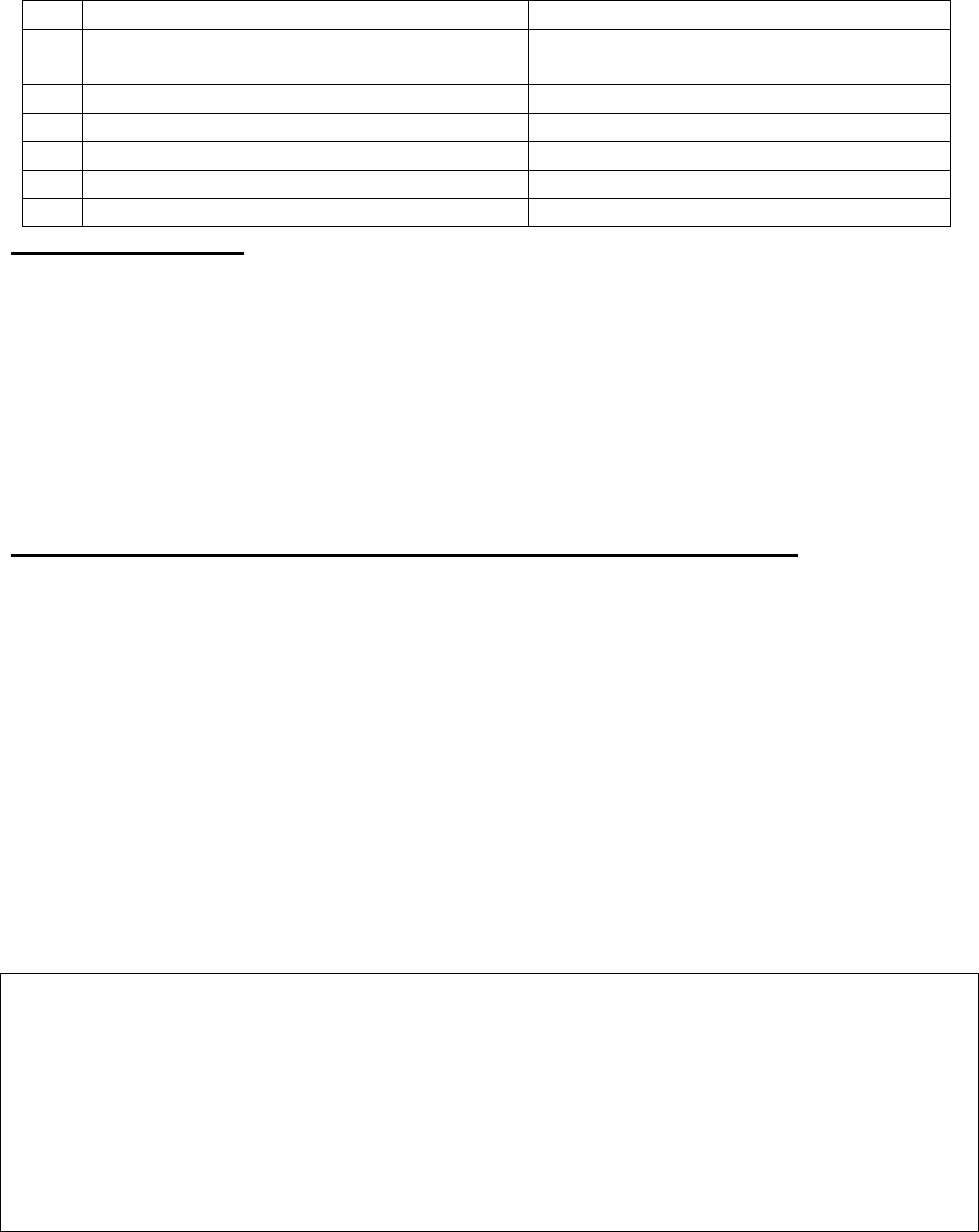

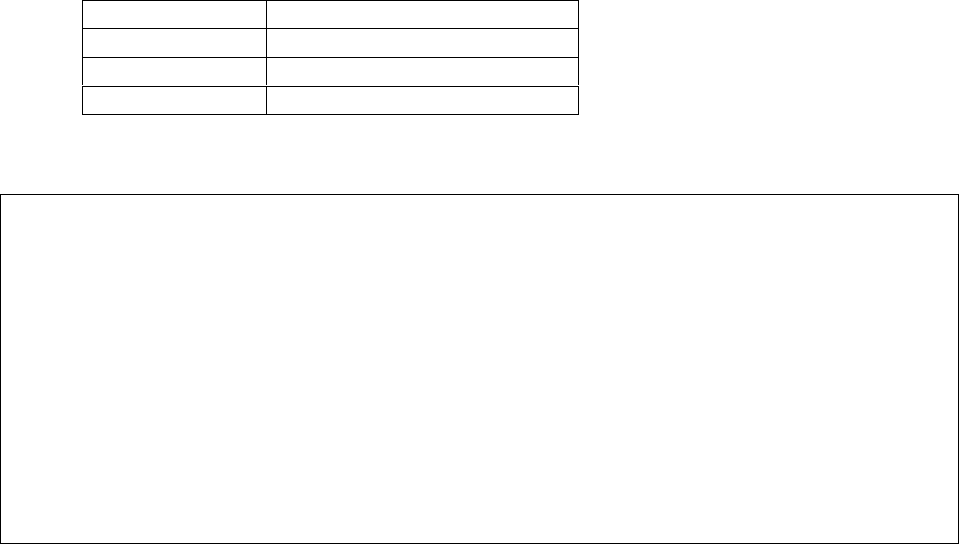

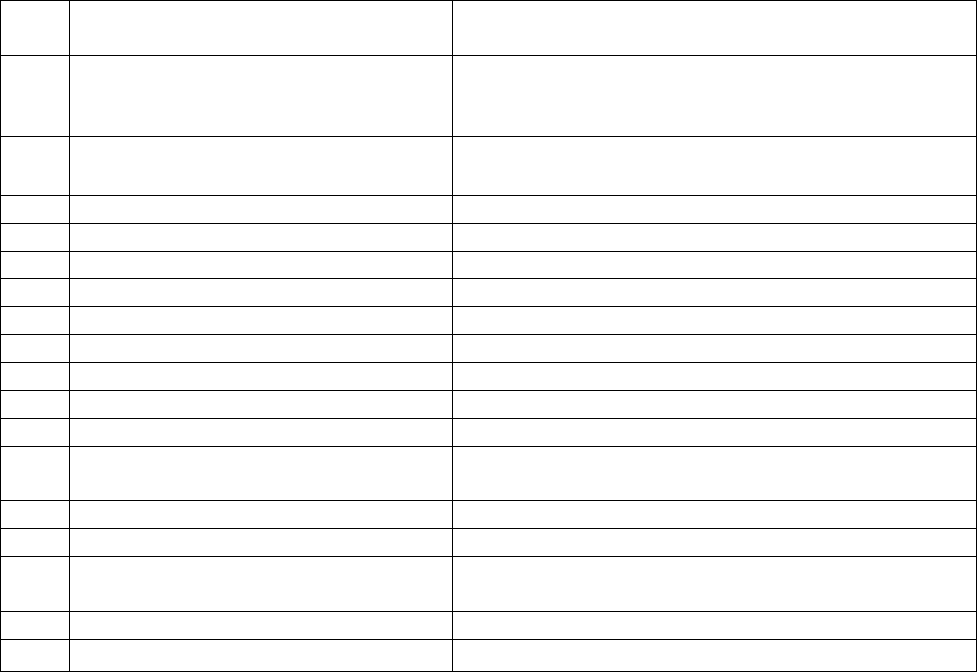

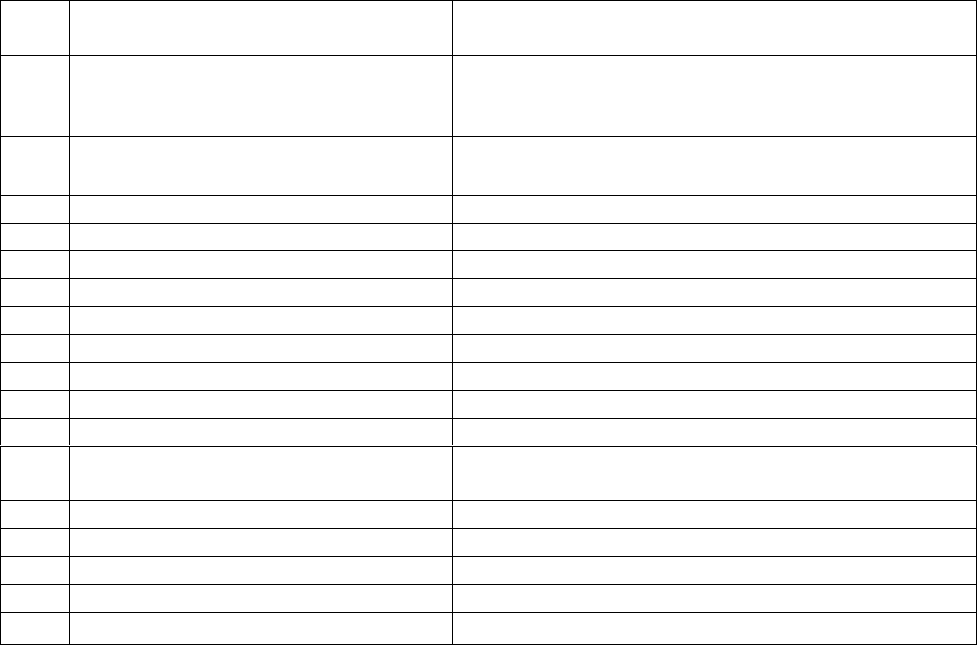

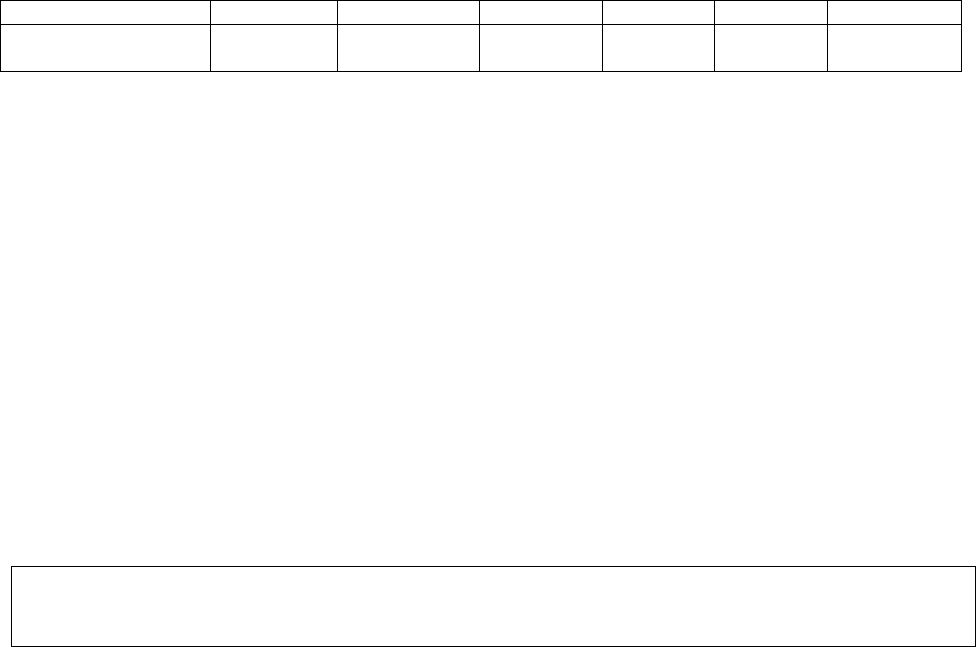

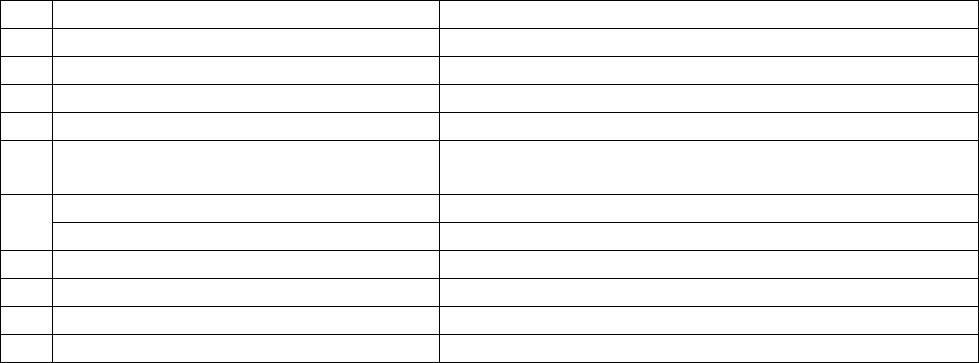

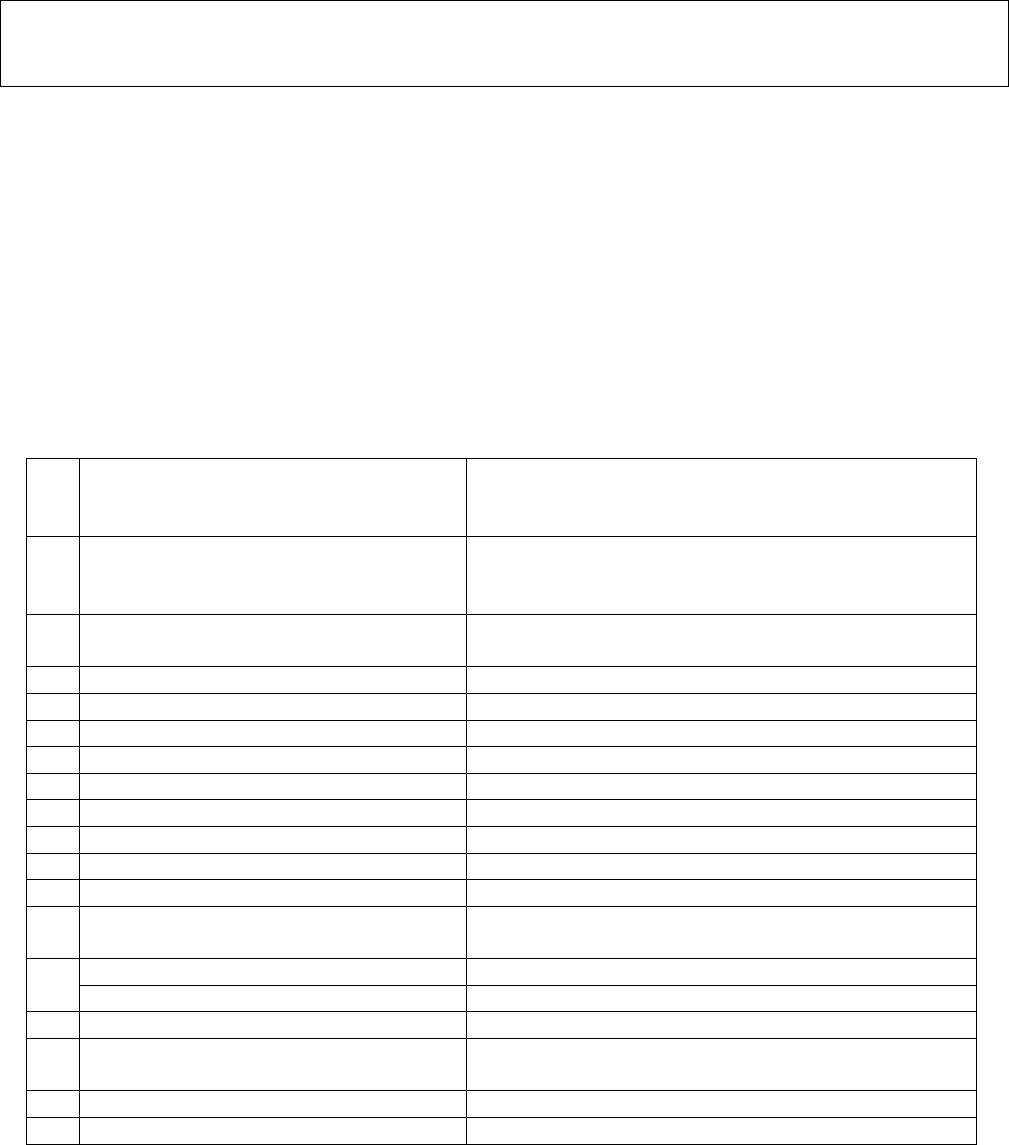

17. Mr. Sumeet Bhandawat (Complainant) has filed a complaint against Manipal Cigna

Health INS Co Ltd (Respondent) alleging rejection of his claim.

18. Brief facts of the Case-

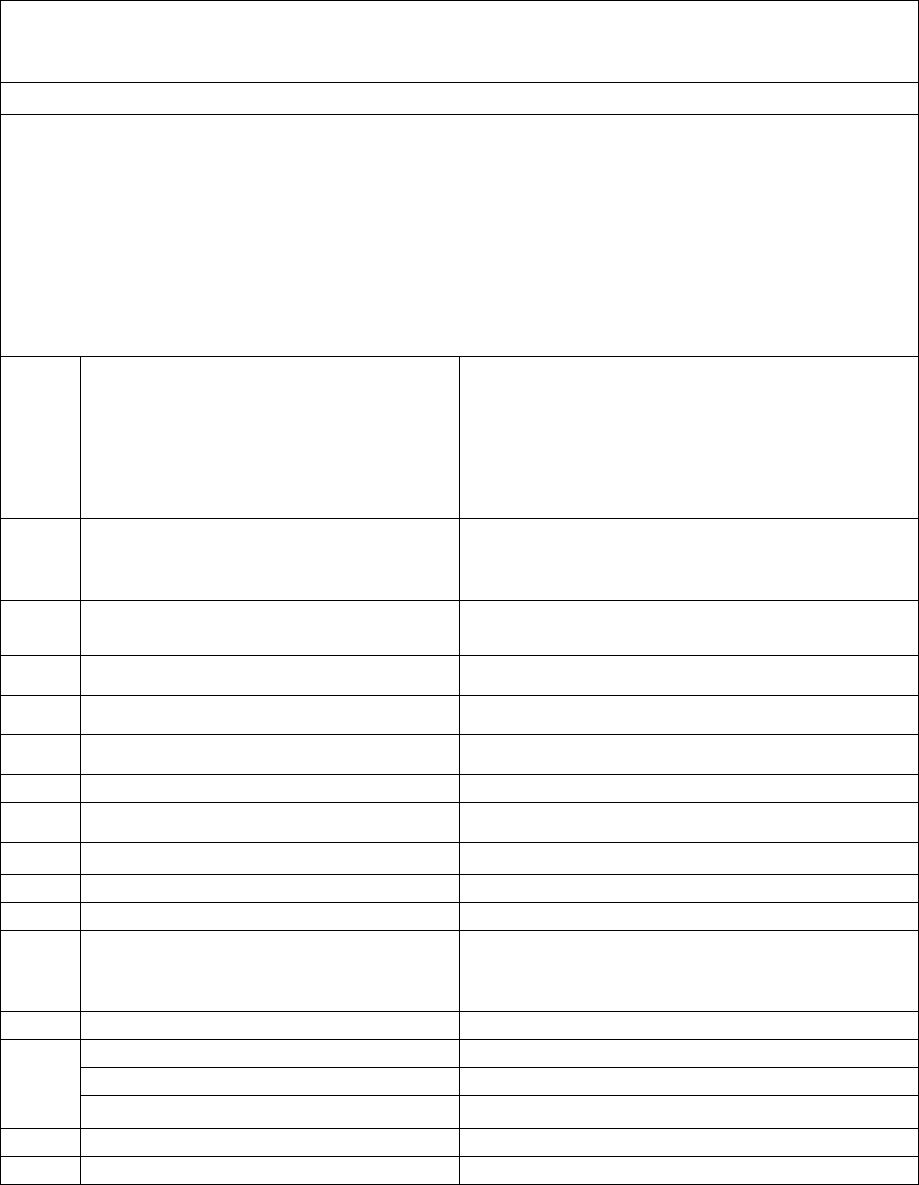

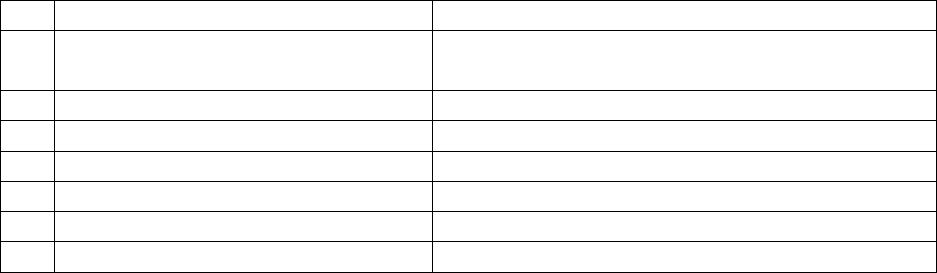

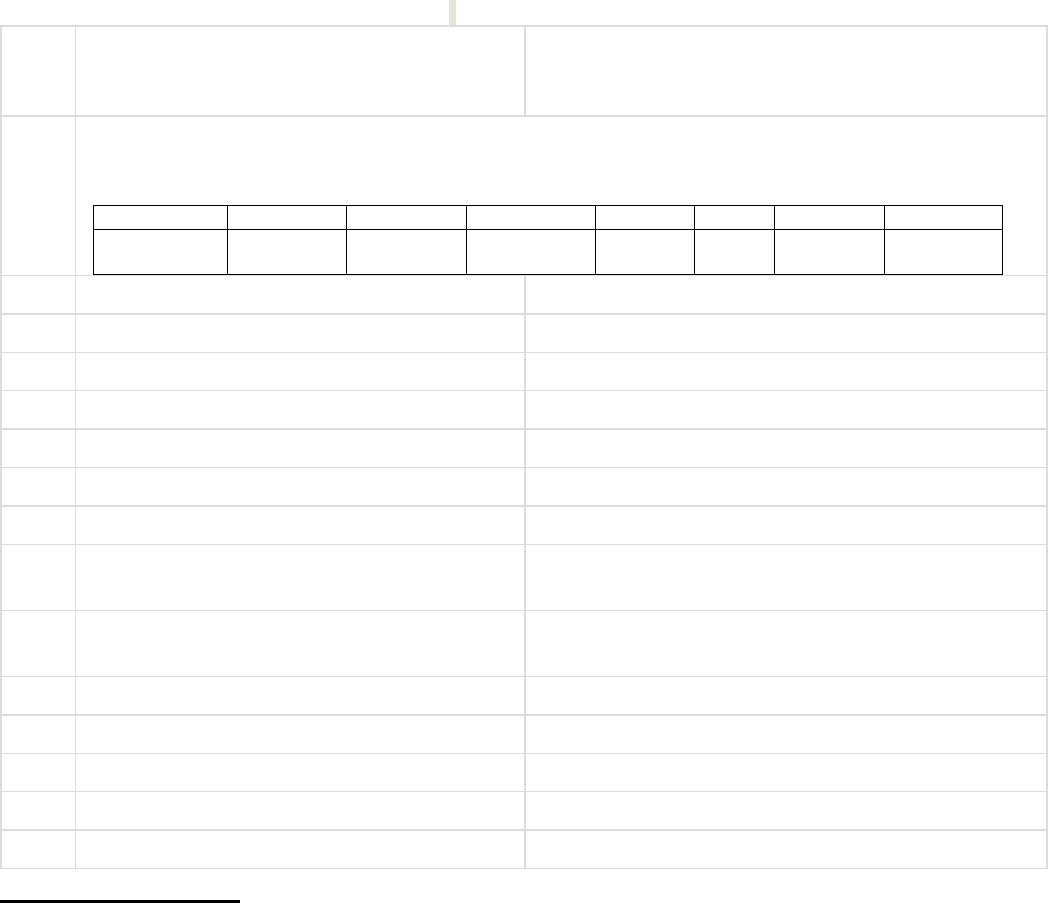

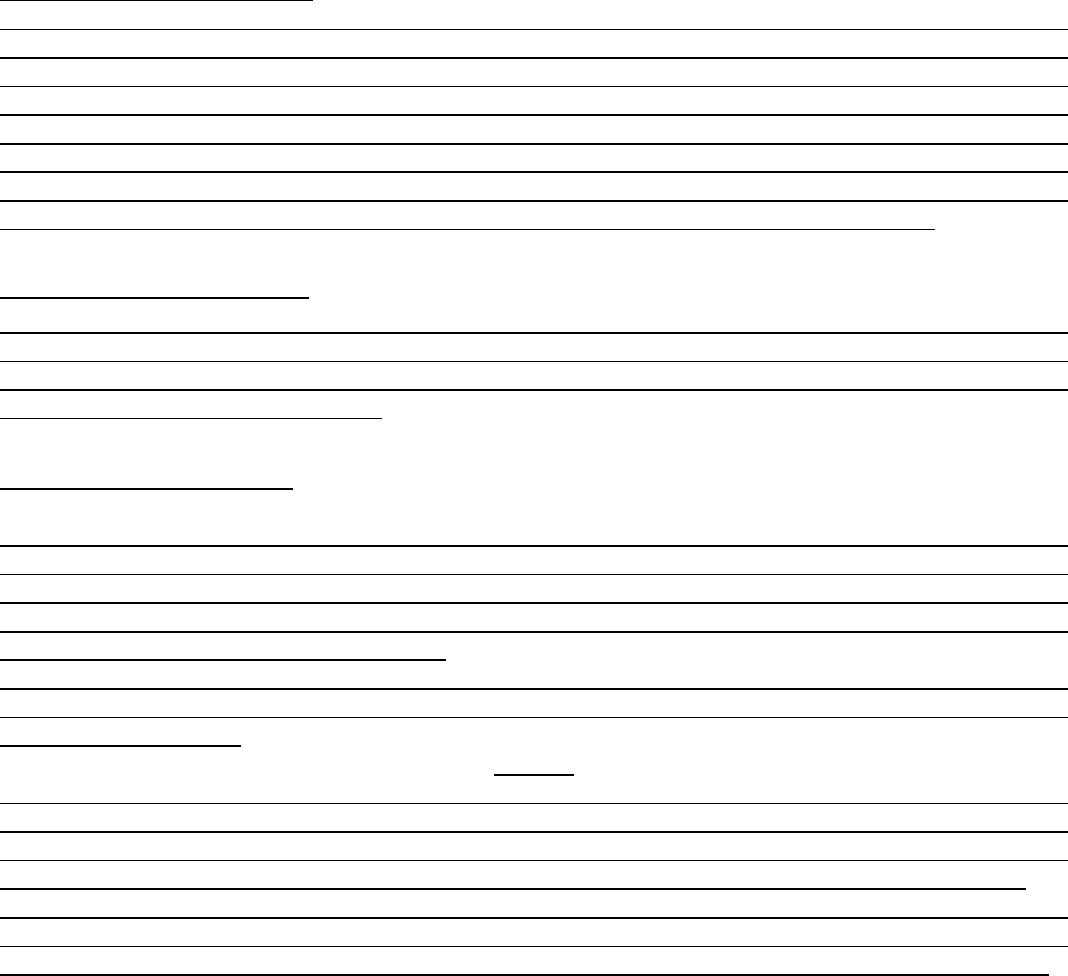

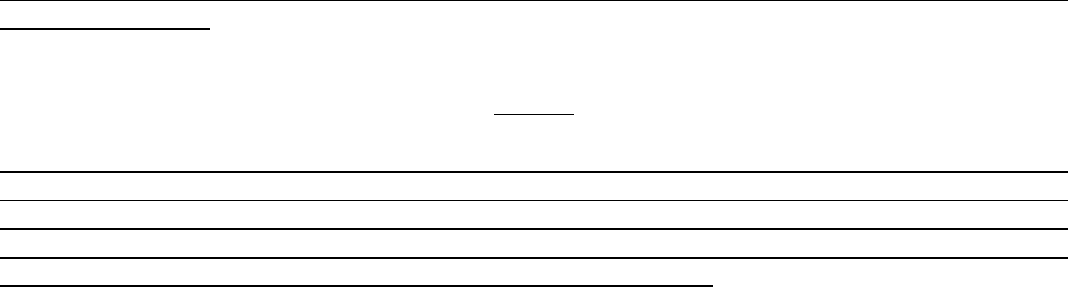

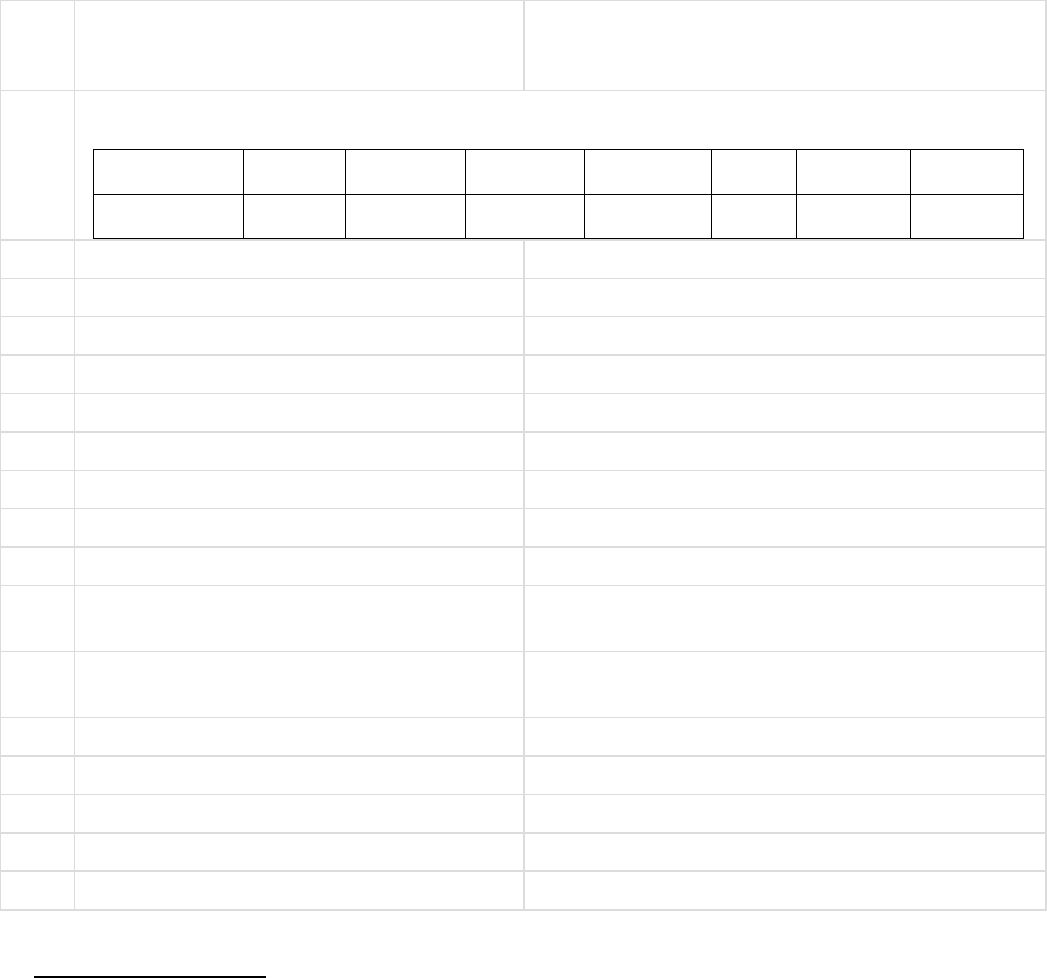

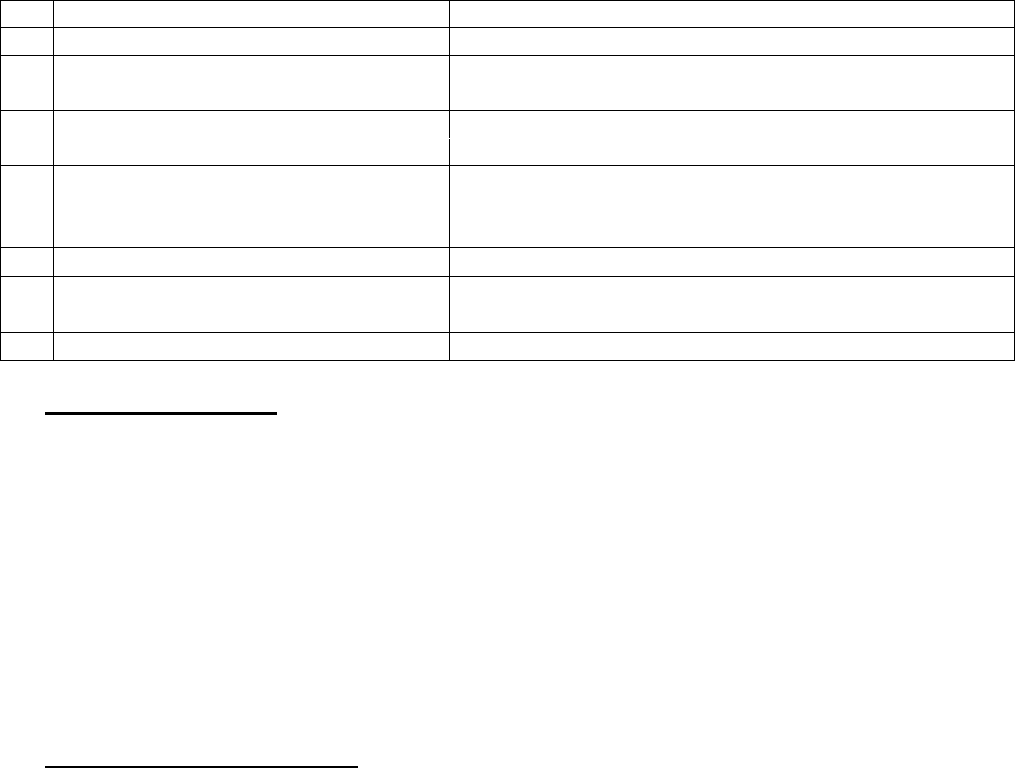

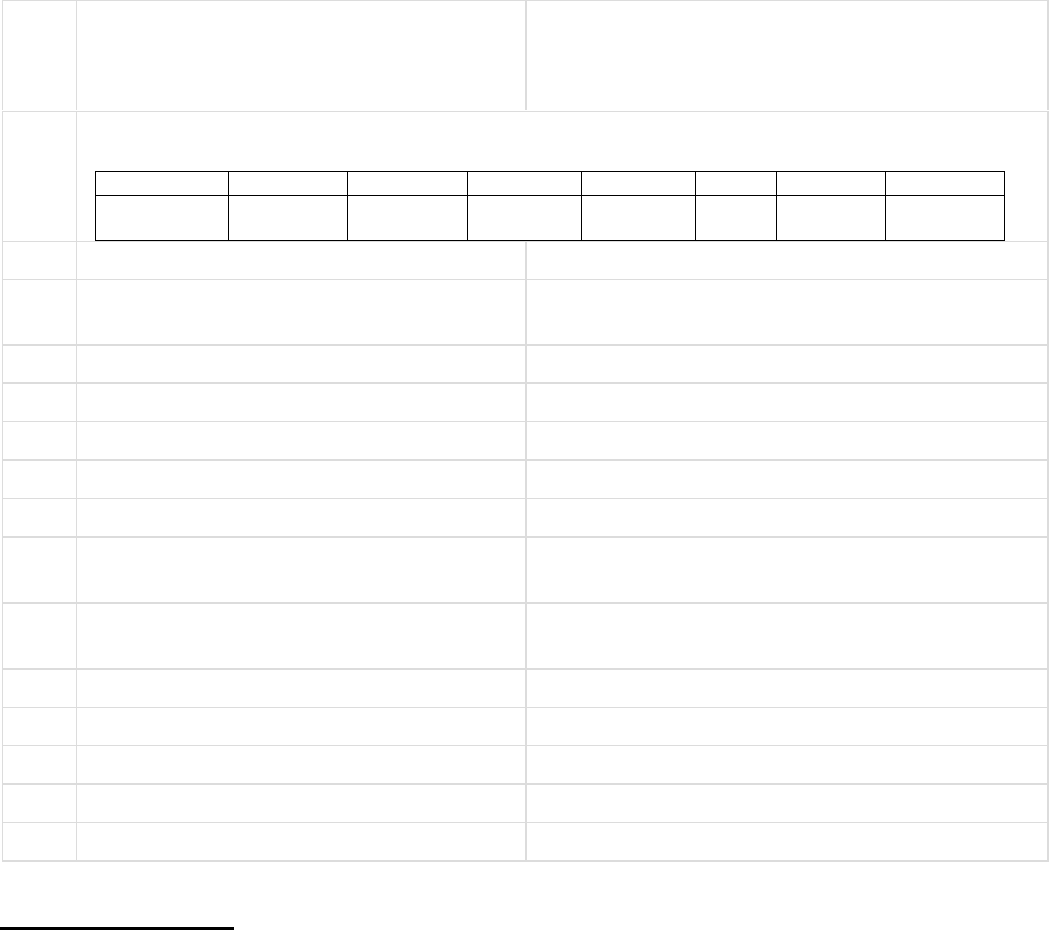

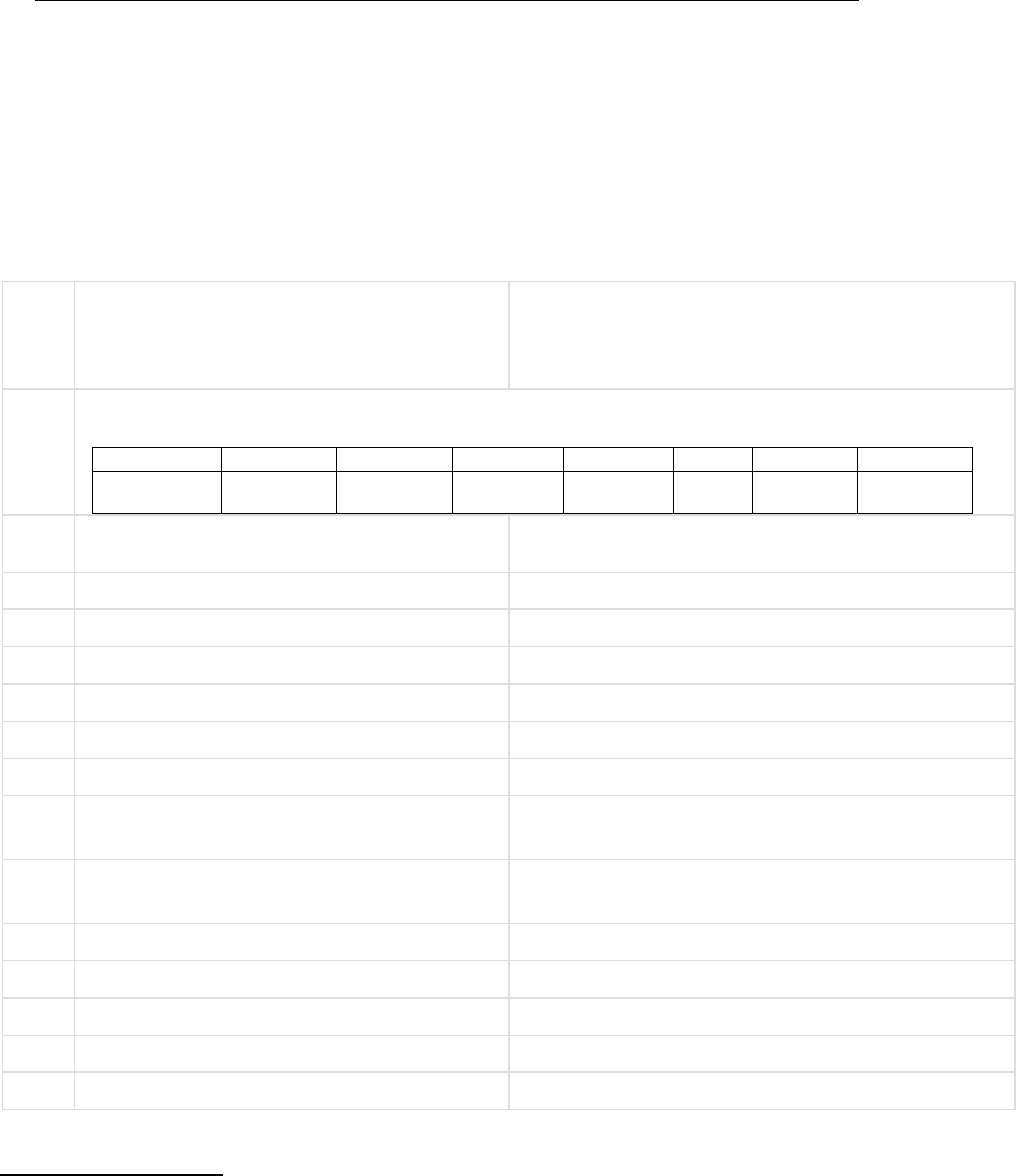

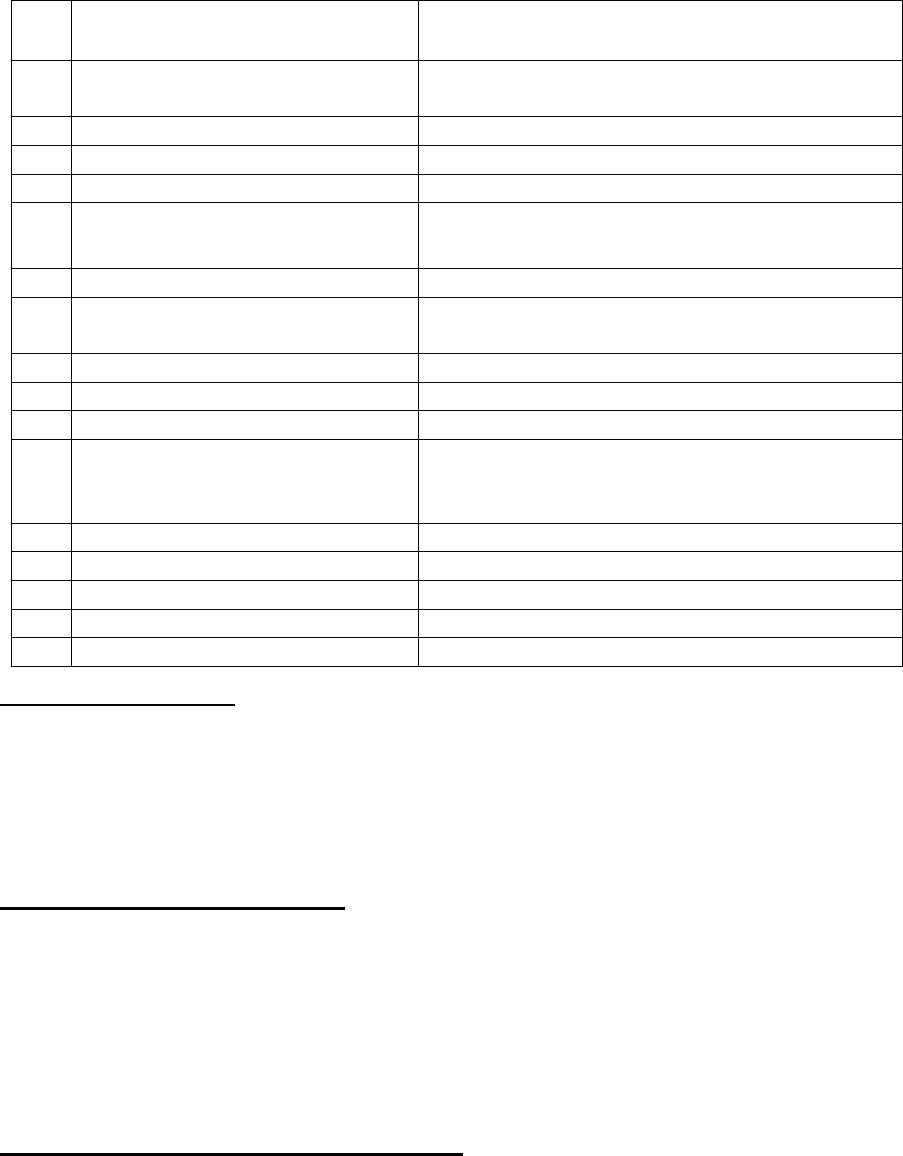

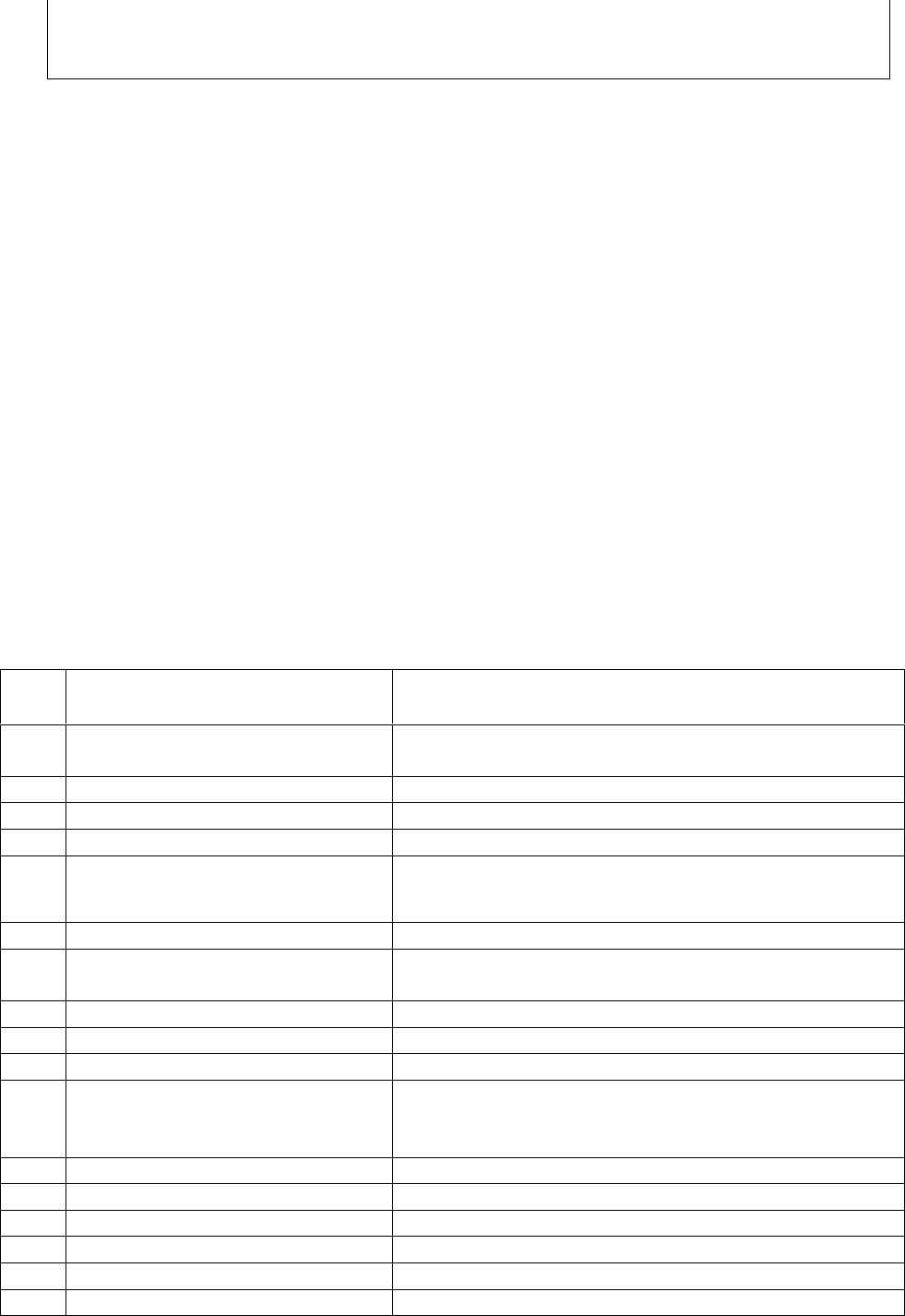

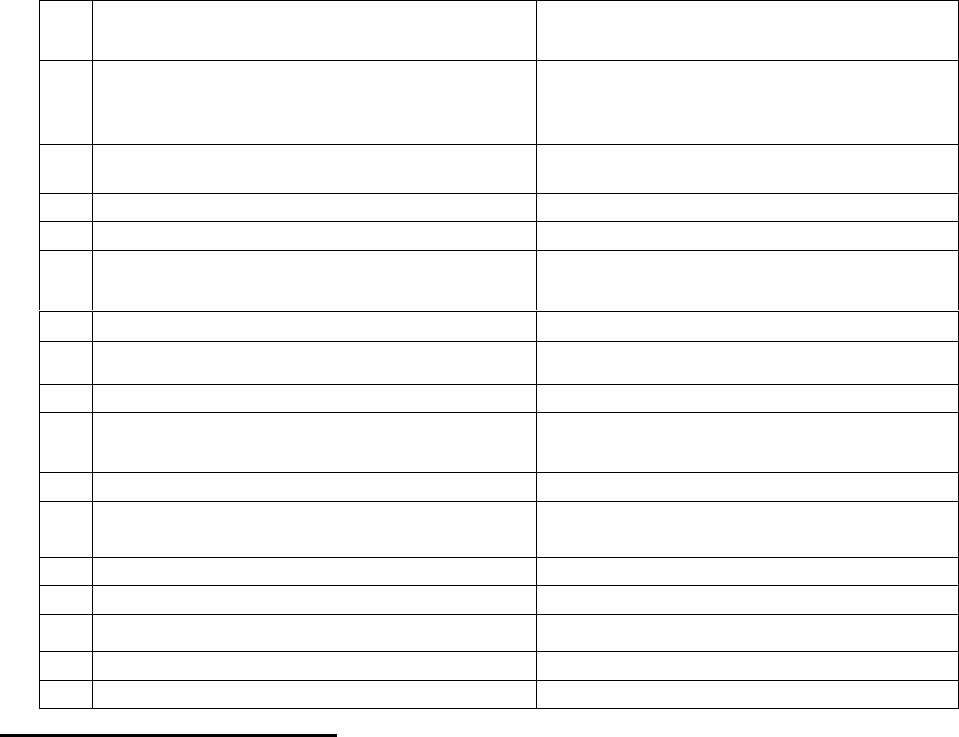

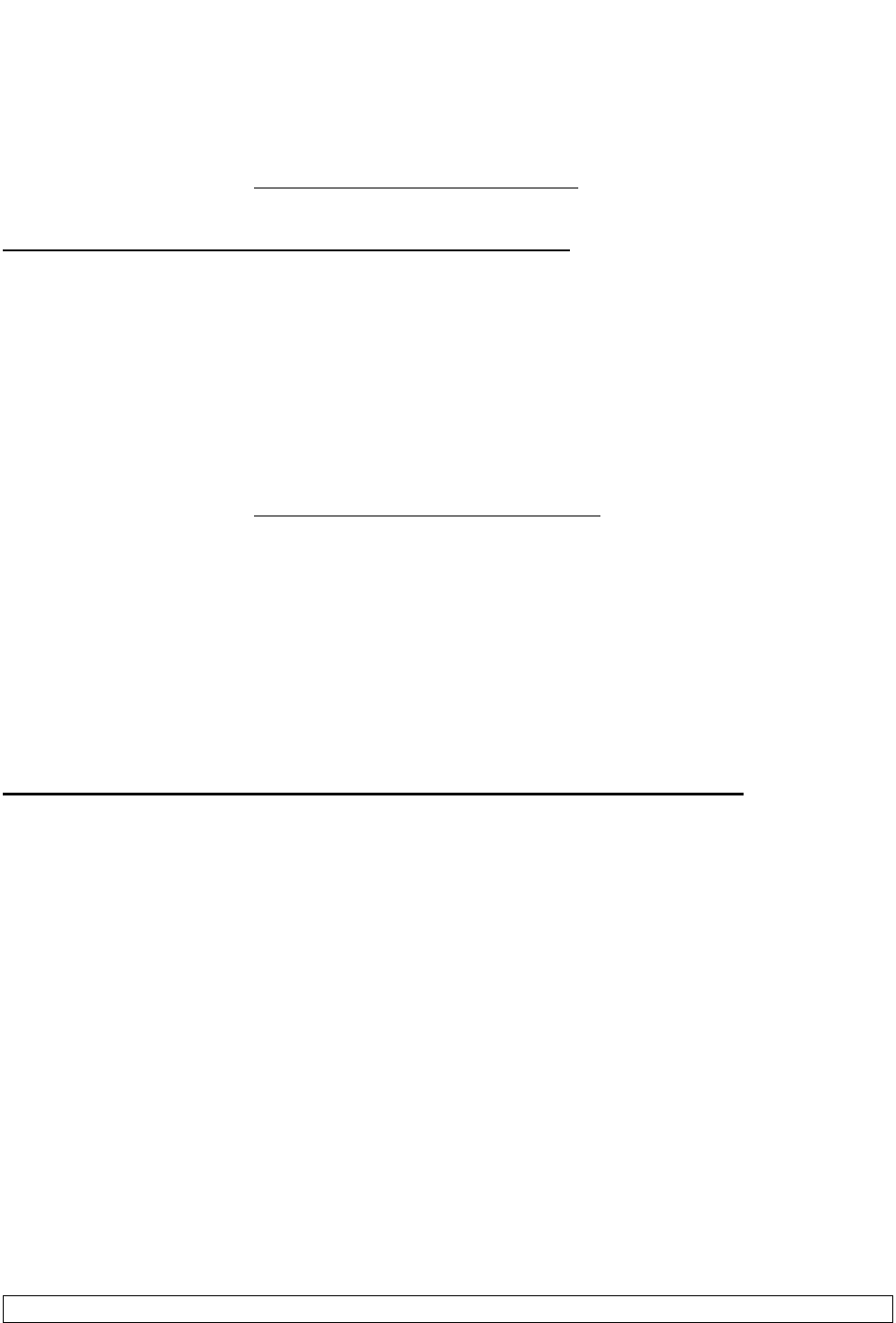

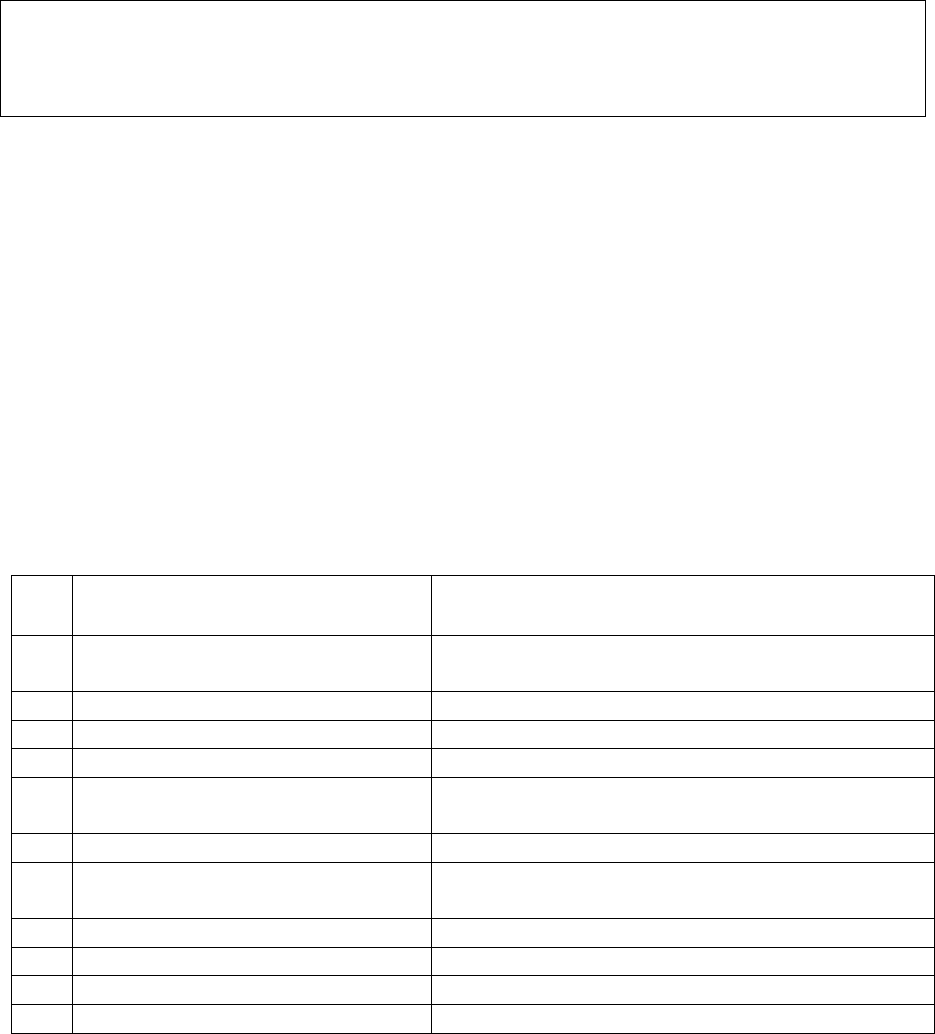

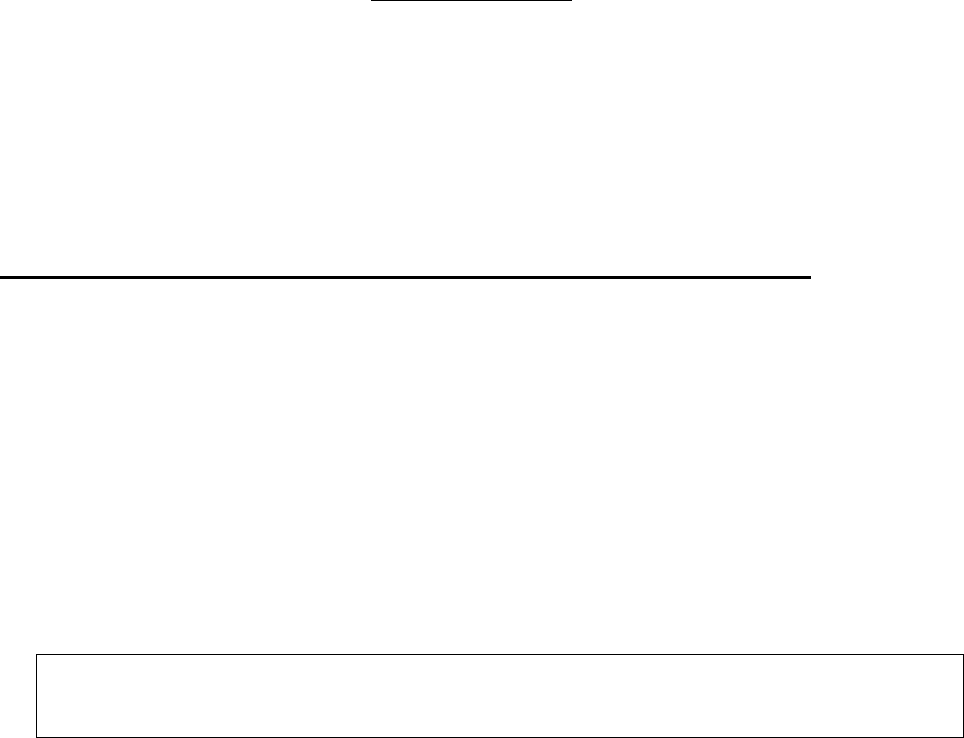

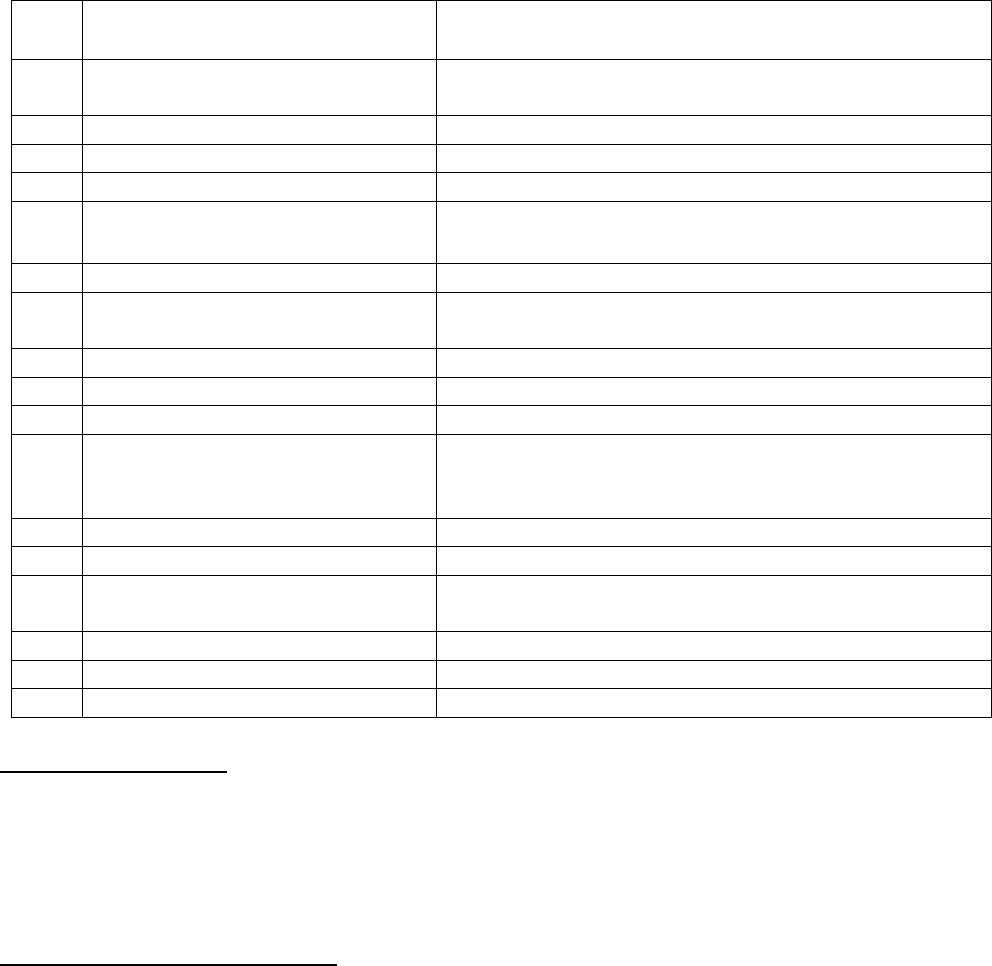

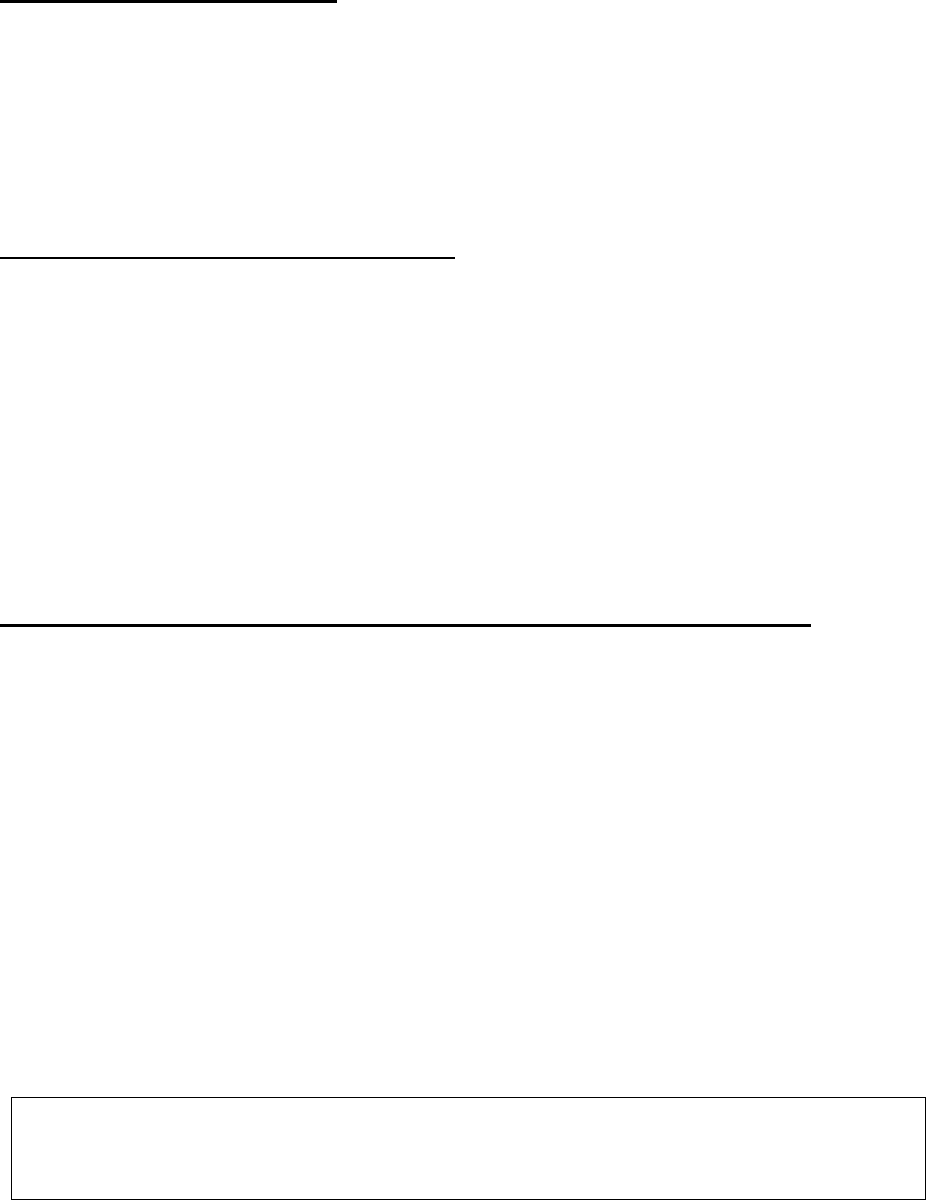

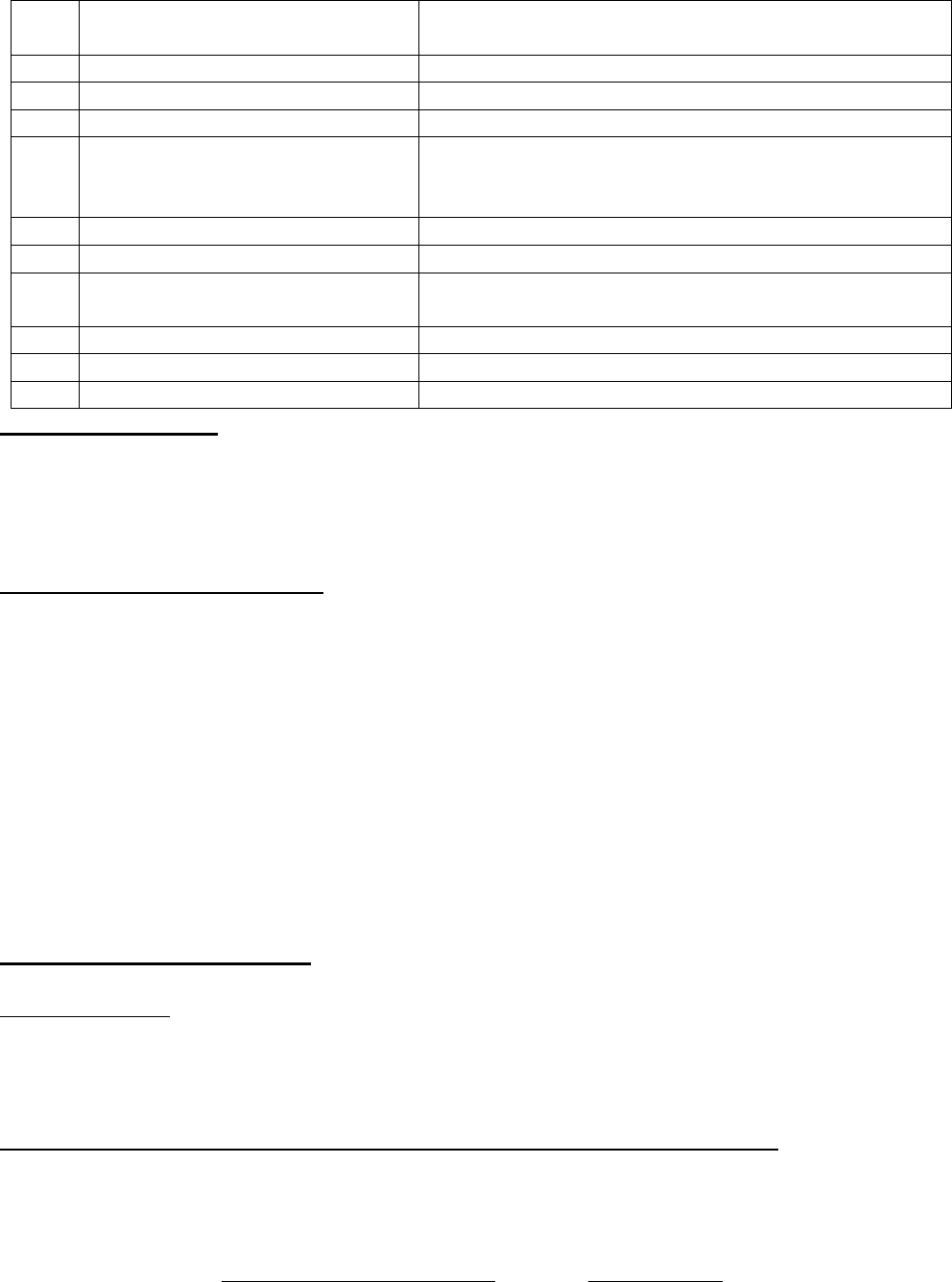

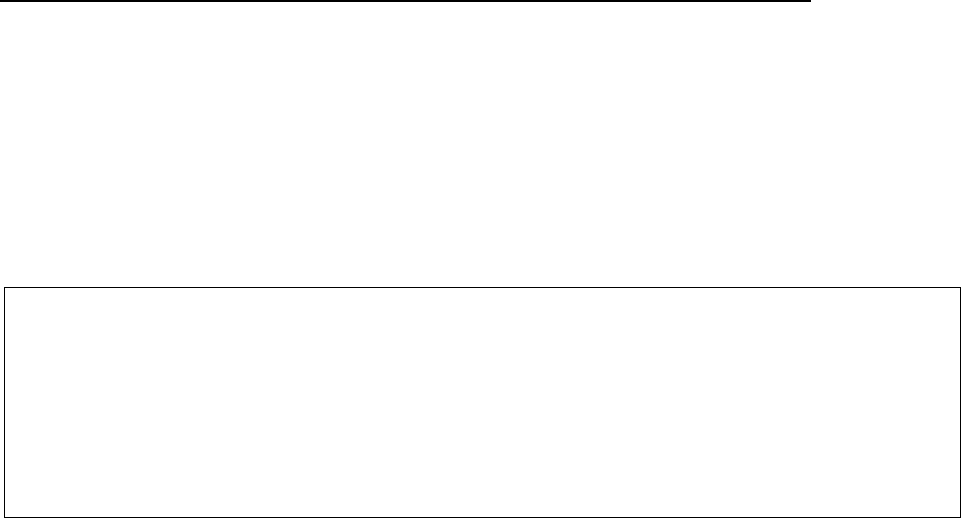

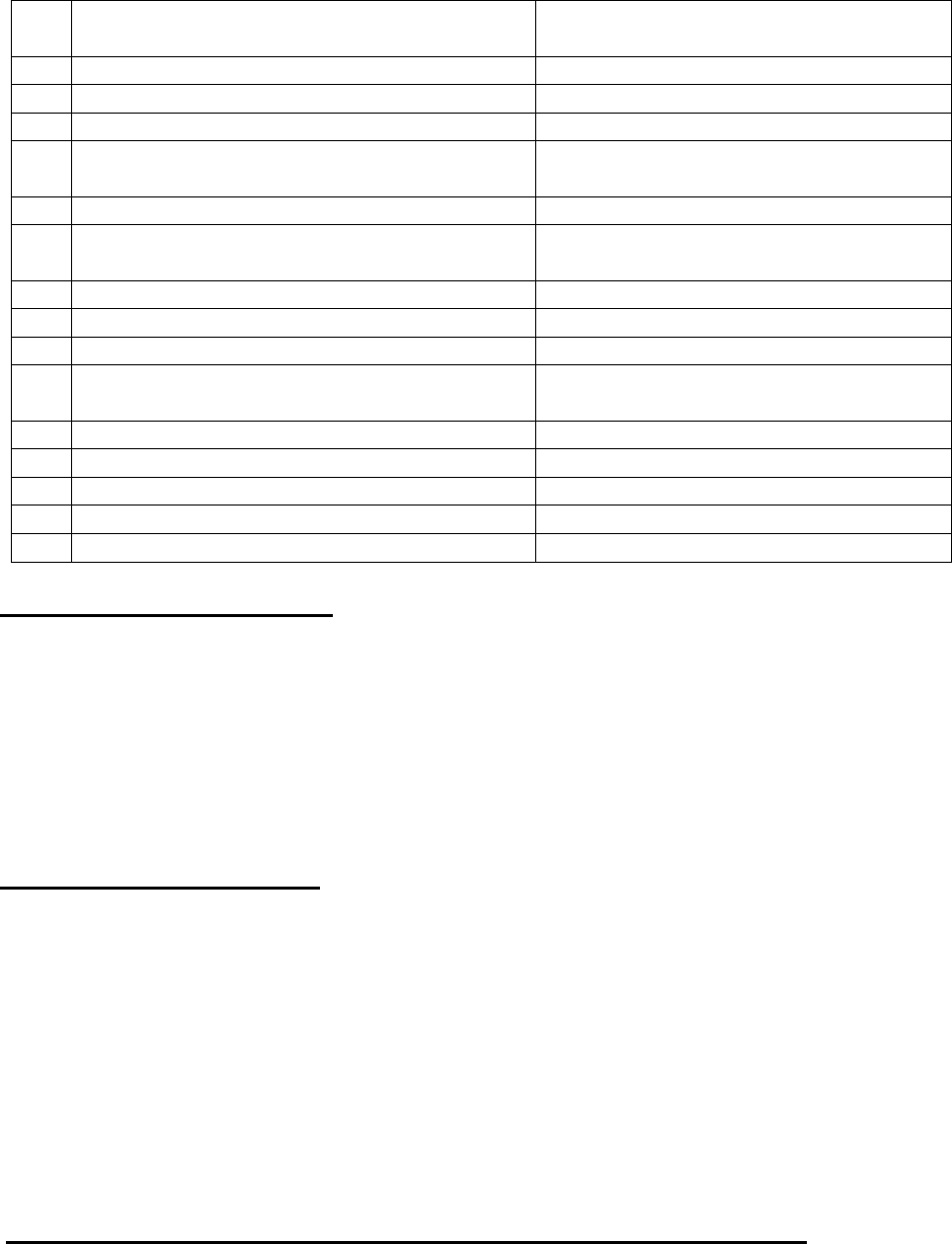

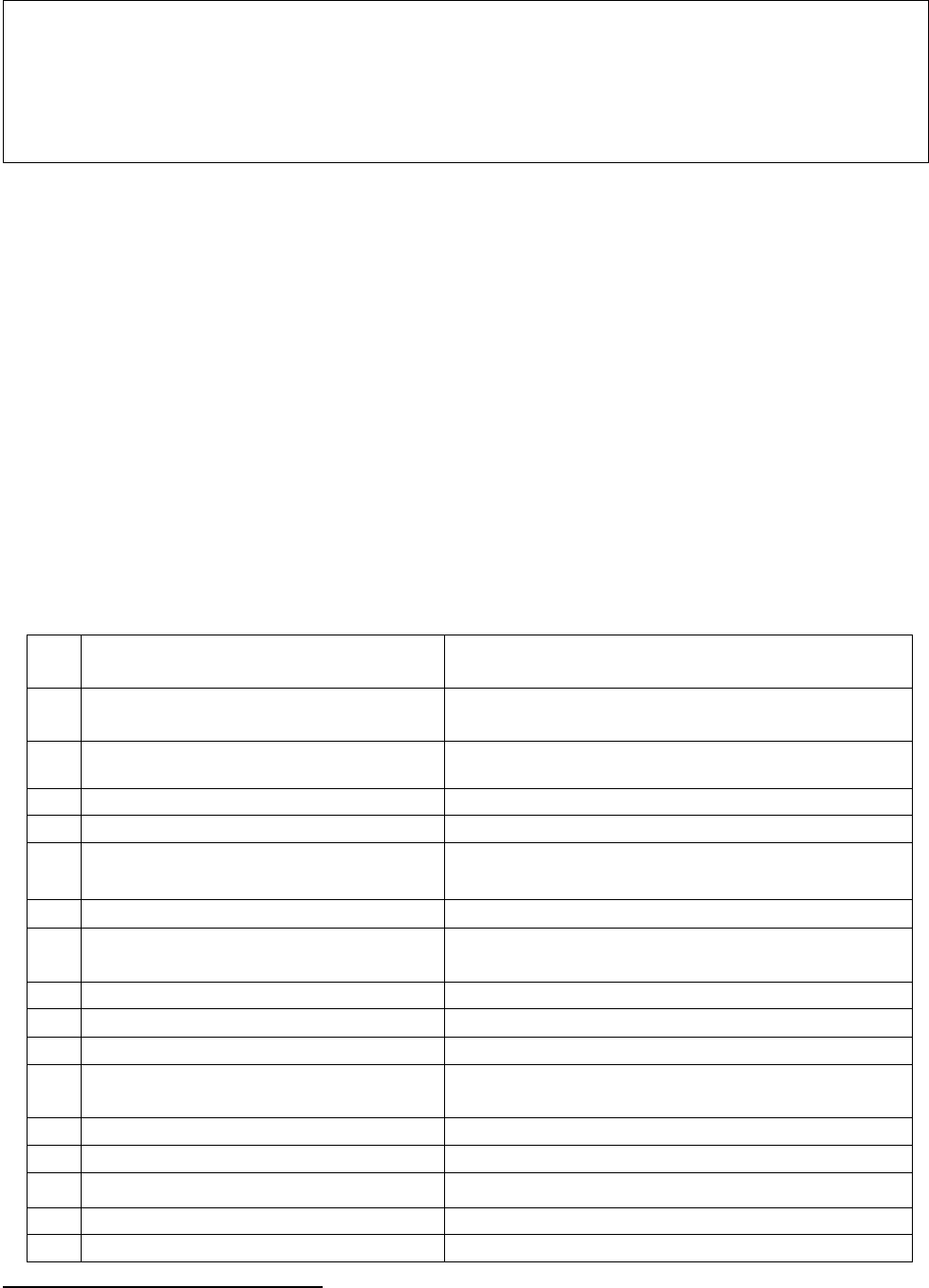

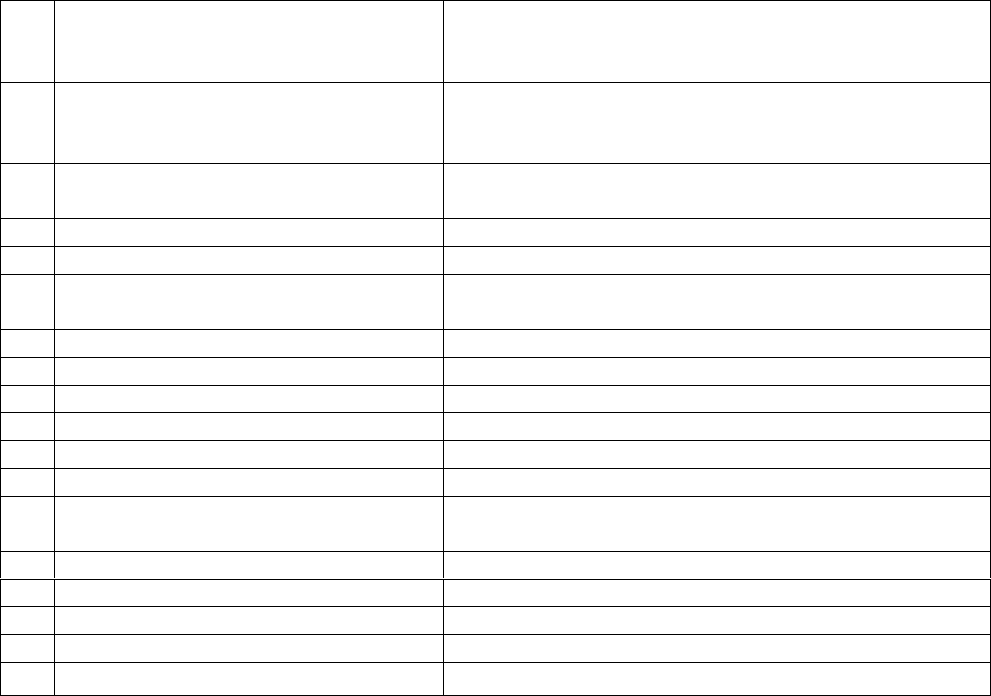

1.

Name & Address of the

Complainant

Mr. Sumeet Bhandawat

H.No-217,W.NO-08, Pachore Road

Shujalpur City Shajapur

Madhya Pradesh 465 333

2.

Policy No:

Type of Policy

Duration of policy/Policy period

PROHLR410021080

Manipal Cigna Pro Health Ins. Policy

20.02.2020 to 19.02.2021

3.

Name of the insured

Name of the policyholder

Mr. Sumeet Bhandawat

As above

4.

Name of the insurer

Manipal Cigna Health Ins Co Ltd

5.

Date of Repudiation/ Rejection

22.01.2021

6.

Reason for Repudiation/

Rejection

Fraudulent Claim

7.

Date of receipt of the Complaint

07.04.2021

8.

Nature of complaint

Non Settlement of Claim

9.

Amount of Claim

Rs.2, 37,690/-

10.

Date of Partial Settlement

--

11.

Amount of relief sought

Rs.2,37,690/-

12.

Complaint registered under Rule

Rule No. 13(1)(b) Ins. Ombudsman Rule

2017

13.

Date of hearing/place

On 17.09.2021 at OIO, LUCKNOW

14.

Representation at the hearing

• For the Complainant

Mr Sumeet Bhandawat

• For the insurer

Mrs Swetha Nair

15.

Complaint how disposed

Award

16.

Date of Award/Order

17.09.2021

a) Contention of the complainant- The complainant has stated that he has purchased

a Health policy from respondent and have been paying its premium regularly. On

29.10.2020 he was diagnosed covid positive and admitted in the city hospital Shujalpur

M.P. As his condition got deteriorated and as per city scan report his lungs were infected

to the extent 40 to 50 %, he was referred to Sai Hospital Indore and hospitalized from

03.11.2020 to 13.11.2020. On discharge he has incurred the expenses of Rs.2,37,690/-.

The treatment bills was submitted to the respondent. But respondent has rejected the

claim on baseless ground of unjust and highly unfair and stating that claim documents

were found to be manipulated during verification and claim stands repudiated under

clause VIII.19 “ Fraudulent Claim of the policy”.

B) Contention of the respondent - The respondent in their SCN have stated that the

Complainant submitted proposal form on dated 20

th

February, 2017 for purchasing

health insurance policy for his family. Respondent has issued Policy vide

No.PROHLR410021080 w.e.f 20.02.2017 to 19.02.2018 and in continuation till

19.03.2021 to 18.03.2022 for the S.I Rs.4.50 lakhs. The Complainant on 27

th

November,

2020 registered a reimbursement claim for his alleged hospitalization in Sai Hospital,

Indore due to covid-19 infection from 3

rd

November, 2020 to 13

th

November, 2020 for

reimbursement of Rs.2,37,690/- incurred during hospitalization. On scrutiny of the

documents it has been observed that there were multiple discrepancies owing to which

thE claim was found to be not genuine i.e (1) As per initial assessment sheet patient was

admitted with complaints of fever. Vitals show patient to be a febrile (Not having fever).

Billing has been done for O-2 given at 6 times. On admission patient had 92% on RA,