PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- NEERJA SHAH

In the matter of: Mr. S S SATISH V/s UNITED INDIA INSURANCE COMPANY LTD

Complaint No: BNG-H-051-2021-0385 to 0391, 0393

Award No: IO/BNG/A/HI/0244 to 0251/2020-21

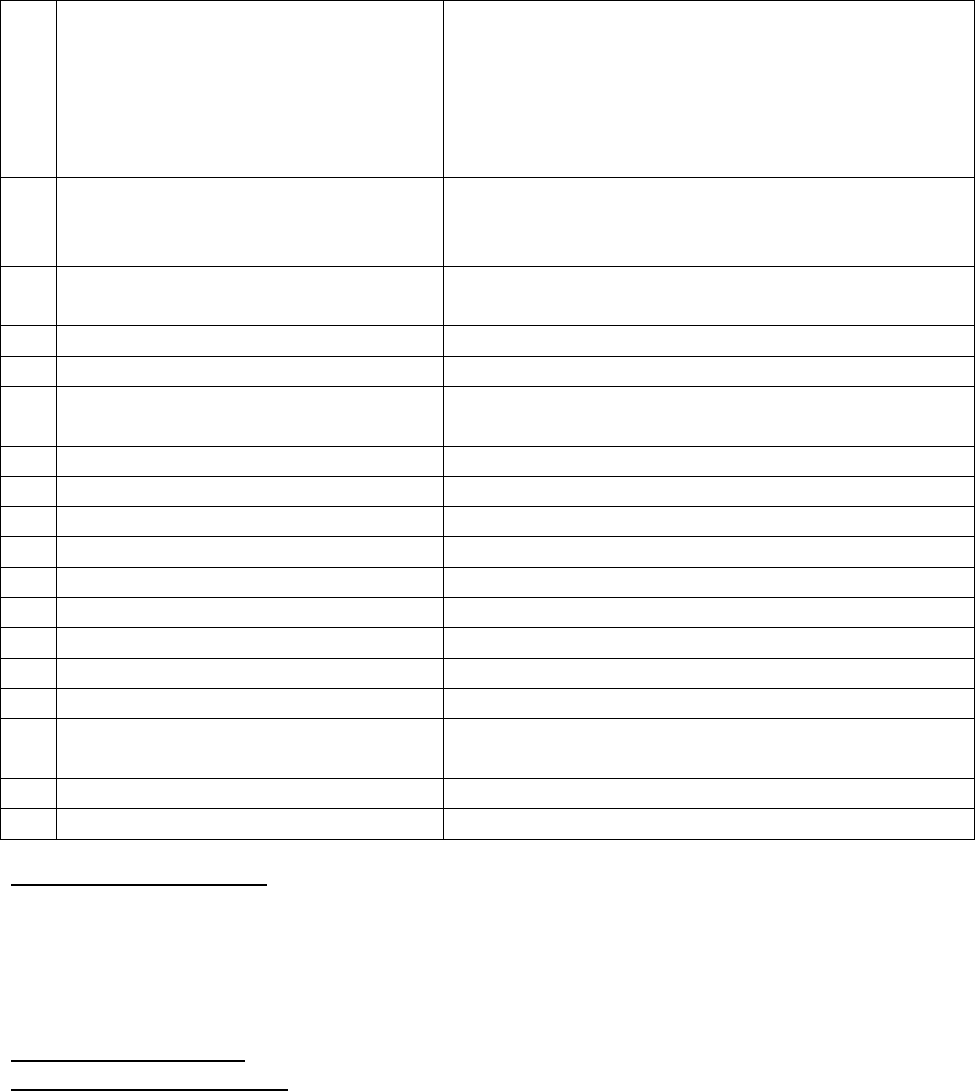

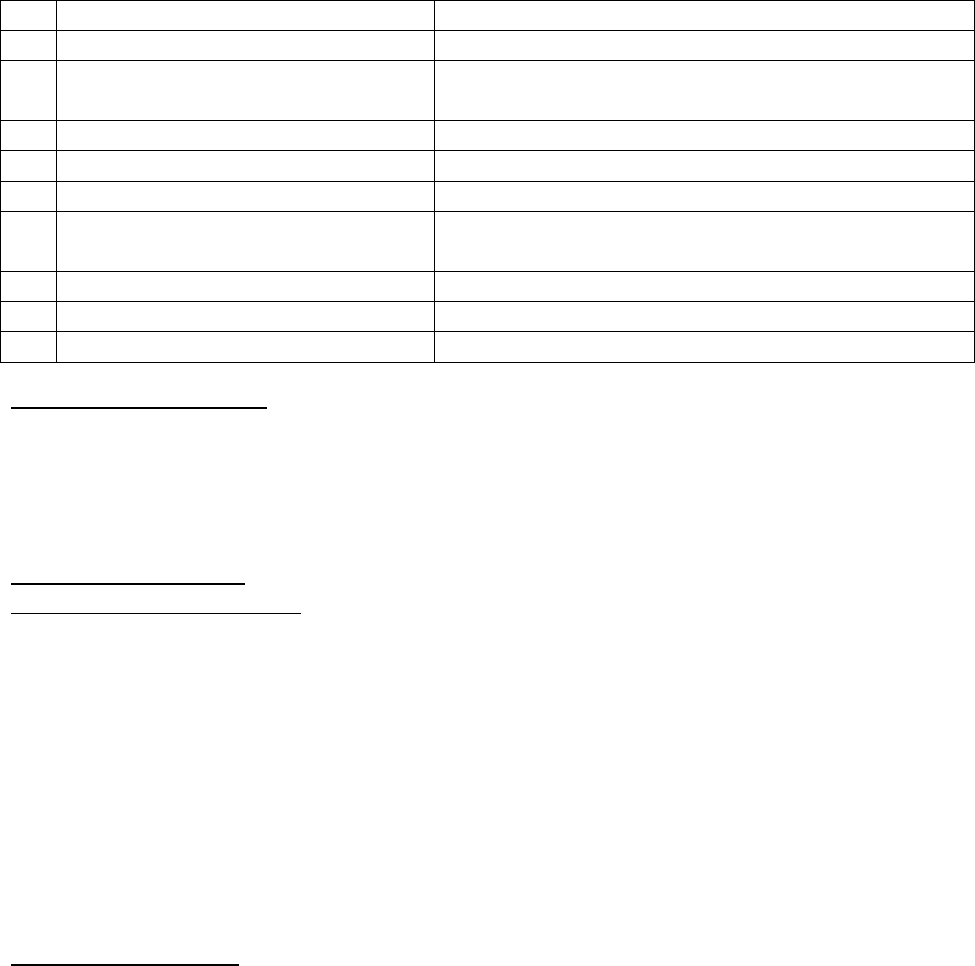

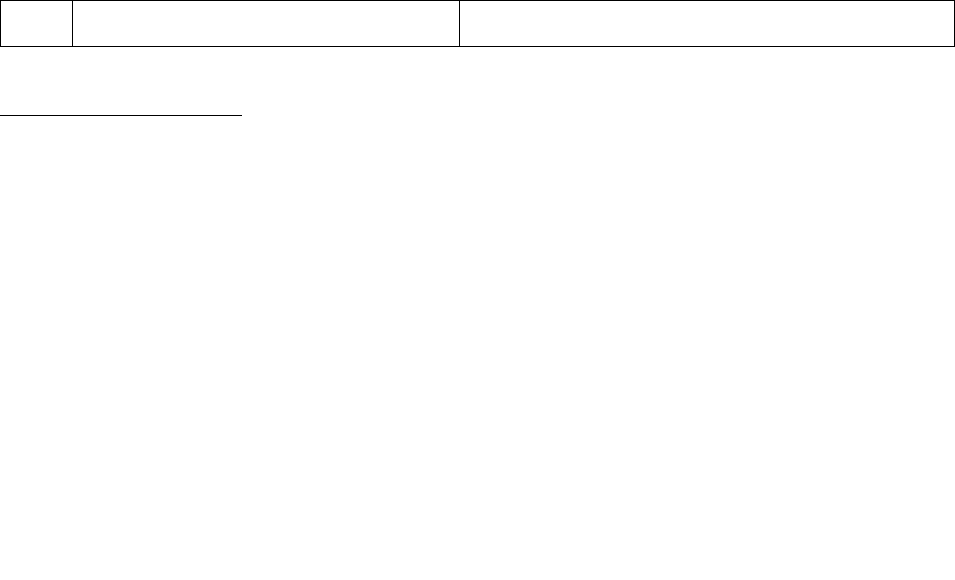

1

Name & Address of the Complainant

Mr. S S Satish

# 538, 5

th

Main, Vijaya Bank layout,

Bannerghatta Road

BENGALURU – 560 076

Mobile # 9449003535

E-mail: [email protected]

2

Policy No.

Type of Policy

Duration of Policy/Policy Period

5001002819P112575620

IBA Policy – BoB Employees

01.11.2019 to 31.10.2020

3

Name of the Insured/ Proposer

Name of the policyholder

Mrs. S S Jyoti – Spouse

IBA Policy - Bank Of Baroda

4

Name of the Respondent Insurer

United India Insurance Company Limited

5

Date of Repudiation

17.01.2020

6

Reason for repudiation/rejection

Treatment not listed under allowed list of Day Care

procedures

7

Date of receipt of Annexure VI A

28.10.2020

8

Nature of complaint

Rejection of medi-claim

9

Amount of claim

₹. 2,54,272/-

10

Date of Partial Settlement

NA

11

Amount of relief sought

₹. 2,54,272/- + Interest

12

Complaint registered under Rule no

13 (1) (b) of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

23.12.2020 / Online VC

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Ms. H A Pannaga, Dy Manager

Dr Komal Shinde, TPA

15

Complaint how disposed

DISALLOWED

16

Date of Award/Order

08.01.2021

17. Brief Facts of the Case

The complaint emanated from the rejection of the claim on the grounds that standalone

administration of inj. Bevatas is not payable under allowed list of day care procedures as per

policy terms and conditions. Hence, the Complainant approached this Forum for settlement of

claims.

18. Cause of complaint:

a. Complainant’s argument:

Complainant alongwith his wife (Insured Person – hereafter referred as IP) was covered under the

Employer provided GMC policy issued by RI vide policy number 5001002819P112575620 from

01.11.2019 to 31.10.2020. In Jul 2018, IP was diagnosed with Ovary Cancer. She was advised 6

chemotherapy cycles and 17 cycles for Adjuvant Chemotherapy. Injection Bevatas was

administered under the Adjuvant chemotherapy regime to the IP on various occasions at Sri

Shankara Cancer hospital & Research Centre. He was having one more health policy from RI vide

policy no 0726002818P113957782 wherein adjuvant chemotherapy treatment (Adminsitration of

Inj Bevatas) was paid for the period 19.06.2019 to 16.11.2019. However same treatment was

rejected for 11

th

cycle and onwards under the Group policy issued by RI under IBA Policy. He

submitted that treatment was prescribed oncologist, yet his genuine claim has been denied by RI.

Hence he requested intervention of the Forum for resolution of his grievance.

b. Insurer’s argument:

The Respondent Insurer, in their Self Contained Note dated 14.12.2020 sent on e-mail dt

15.12.2020, whilst confirming the policy issuance and rejection of claims, submitted that the IP

was administered Inj. Bevatas at Sri Shankara Cancer hospital & research Centre on various

occasions. As per IP’s medical records, she was given standalone dosage of Bevatas injection and

the hospitalisation was for less than 24 hours on each occasion. RI submitted that Inj. Bevatas is

type of immunotherapy. Immunotherapy works by encouraging the body's own immune system

to attack the tumor cells and stop the growth of cancer. Immunotherapy is payable only if it forms

a part of inpatient treatment in case of hospitalization or part of discharge advice upto the limits

for post hospitalization. However it is not payable if hospitalization is done only for administration

of medicine/drugs. Policy covers parenteral chemotherapy under list of allowed day care

procedure as per clause 3.3 of policy terms and hence the claims were repudiated as per terms

and conditions of the policy.

19. Reason for Registration of complaint:

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017 and so, it was

registered.

20. The following documents were placed for perusal:

a. Complaint along with enclosures,

b. SCN of the Respondent Insurer along with enclosures and

c. Consent of the Complainant in Annexure VI-A and Respondent Insurer in VII-A.

21. Result of the personal hearing with both the parties (Observations & Conclusions):

The issue which require consideration is whether the treatment is payable under clause 3.3 Day

Care Treatment list of the policy terms and conditions. The Forum has perused the documentary

evidence available on record and the submissions made by both the parties.

Personal hearing by the way of online Video-conferencing through Goto Meet was conducted in

the said case. Mr Satish (Complainant) and Ms. H A Pannaga along with Dr Komal

(Representative(s) of RI) presented their case. Confirmation from all the participants about the

clarity of audio and video was taken and to which the participants responded positively.

During the Personal Hearing, both the parties reiterated their earlier submissions.

From the submission made by complainant in his complaint and documents available on record,

Forum observes that IP was diagnosed as Primary peritoneal Carcinoma - Stage 4. She underwent

3 chemotherapy cycles on 27.11.2018, 18.12.2018 and 08.01.2019 at Basavatarakam Indo-

American Cancer Hospital & Research Institute, Hyderabad. Thereafter she had a major surgery

(optimal interval cytoreduction) on 18.02.2019. Thereafter she was hospitalised on 25.03.2019 to

26.03.2019 at Sri Shankara Cancer Hospital & Research Centre, Bengaluru and received 4

th

cycle of

chemotherapy as per Paclitaxel/Carbolatin regimen. It is pertinent to note here that Discharge

Summary of this hospitalisation reveals that Inj Bevacizumab was to be added from 5

th

cycle

onward for total of 1 year. Her Discharge Summary dt 27.05.2019 of Basavatarakam Indo-

American Cancer Hospital & Research Institute, Hyderabad reveal that she has completed 6 cycles

of chemo with Inj Pacil and Inj Carboplatin and was administered Inj Bevatas and methotraxat.

Thereafter she was treated at Sri Shankara Cancer Hospital & Research Centre, Bengaluru.

Discharge Summary of Sri Shankara Cancer Hospital & Research Centre, Bengaluru reveals that IP

was now planned to receive chemotherapy as per Bevacizumab regimen.

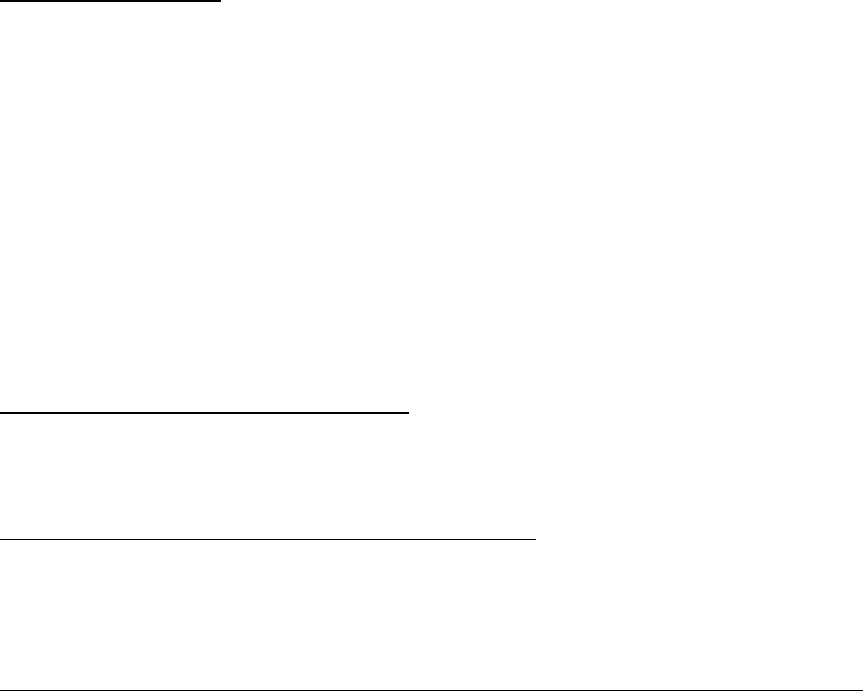

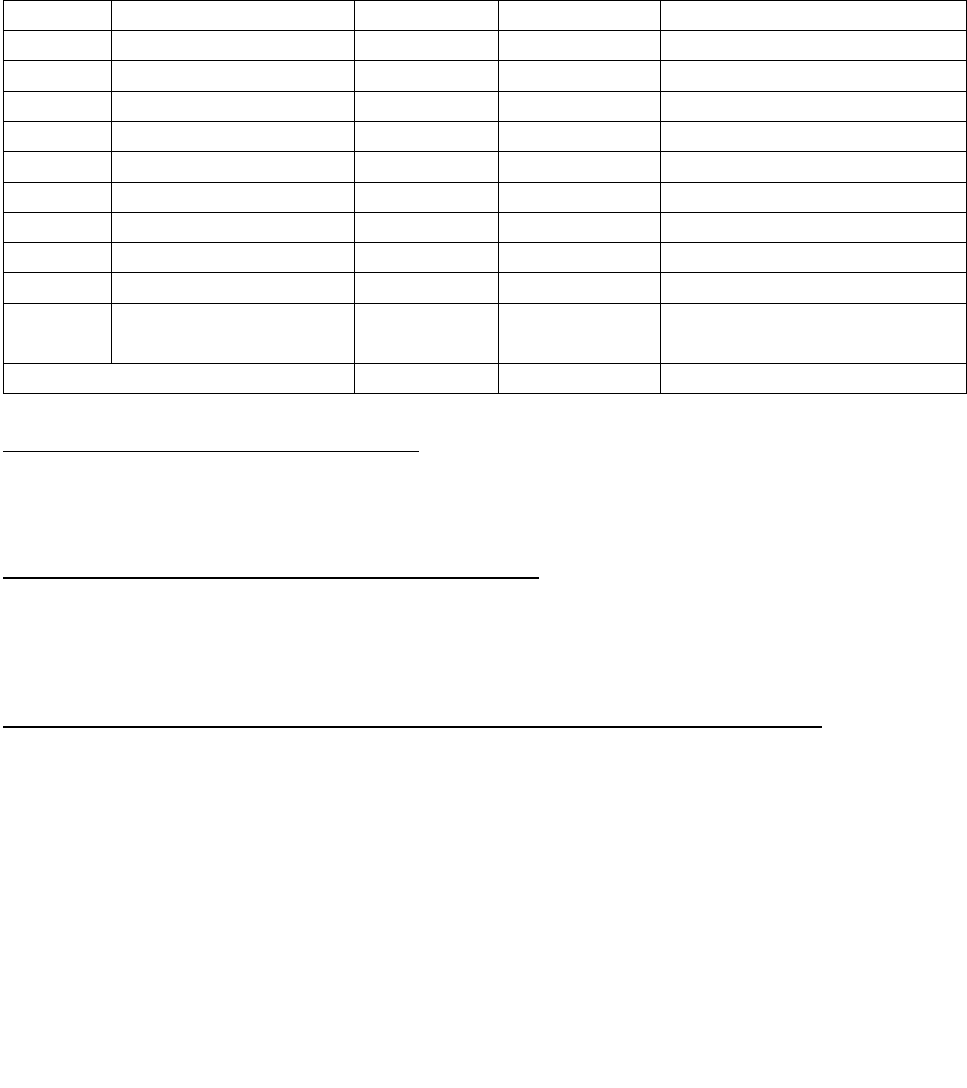

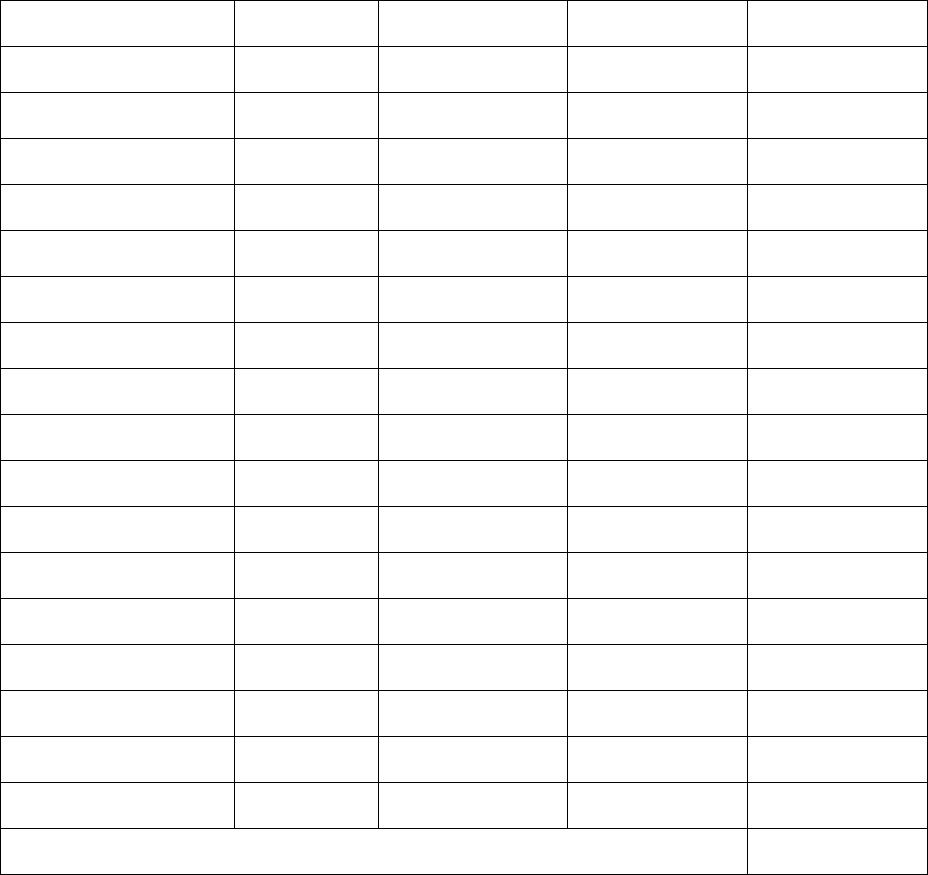

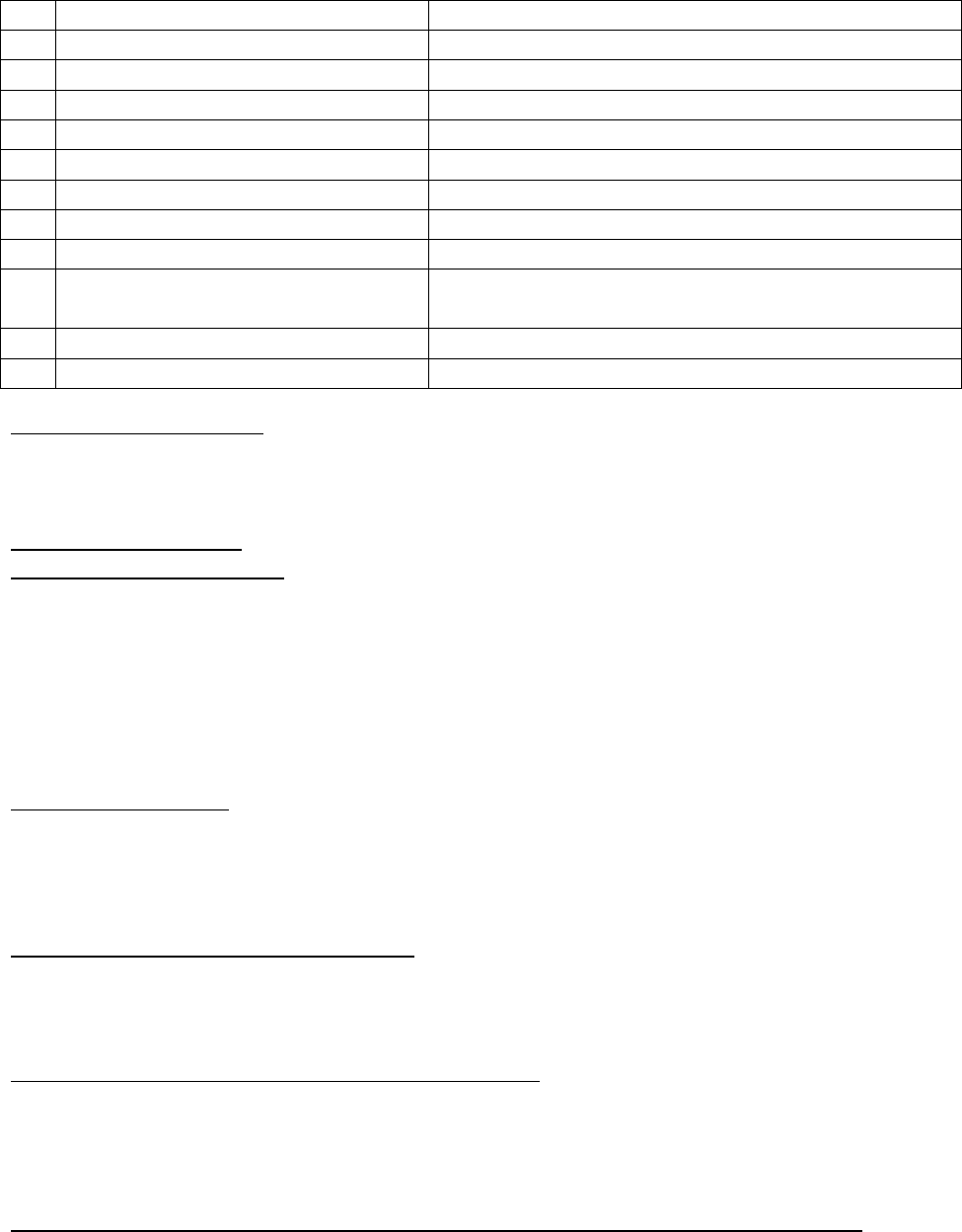

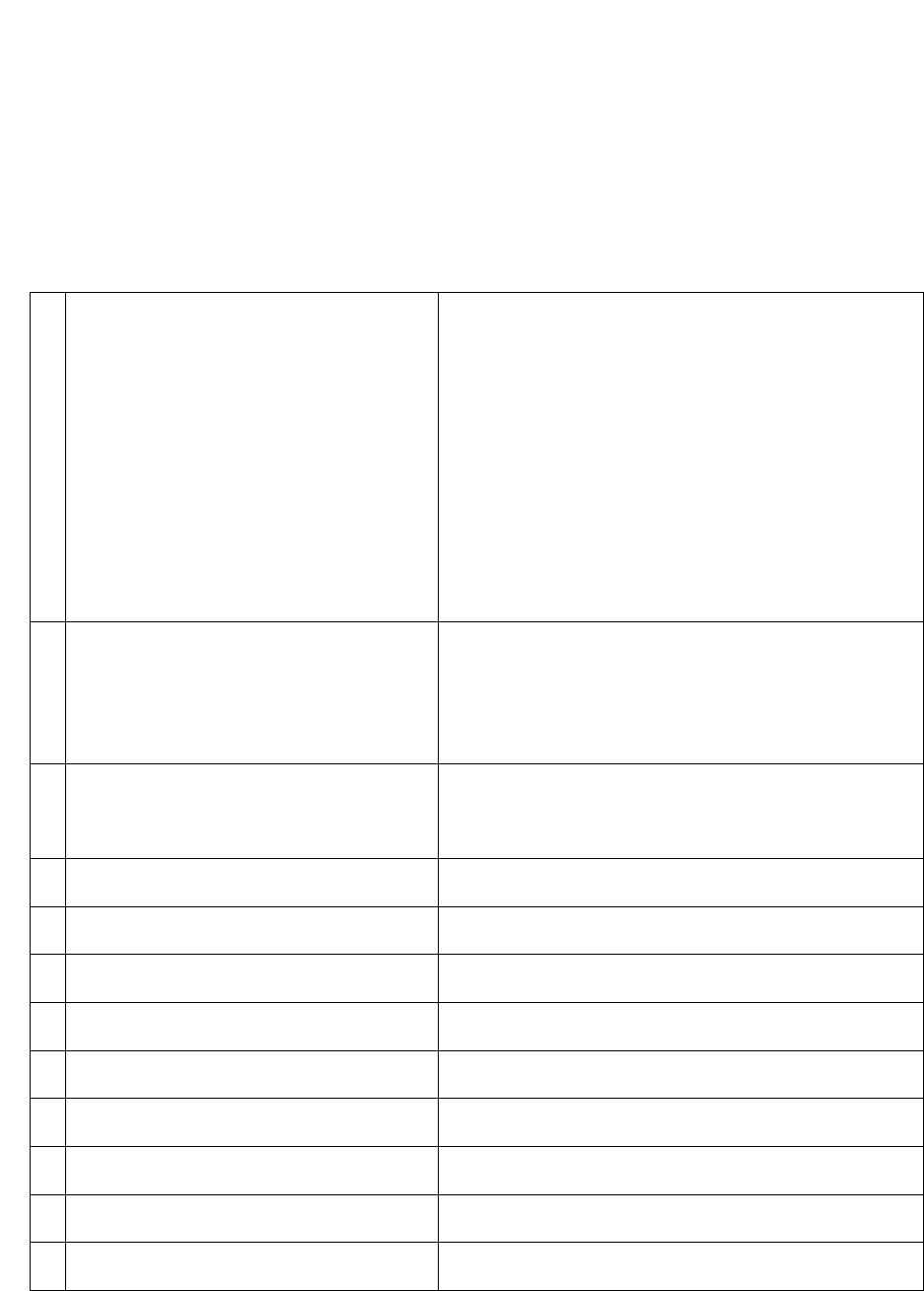

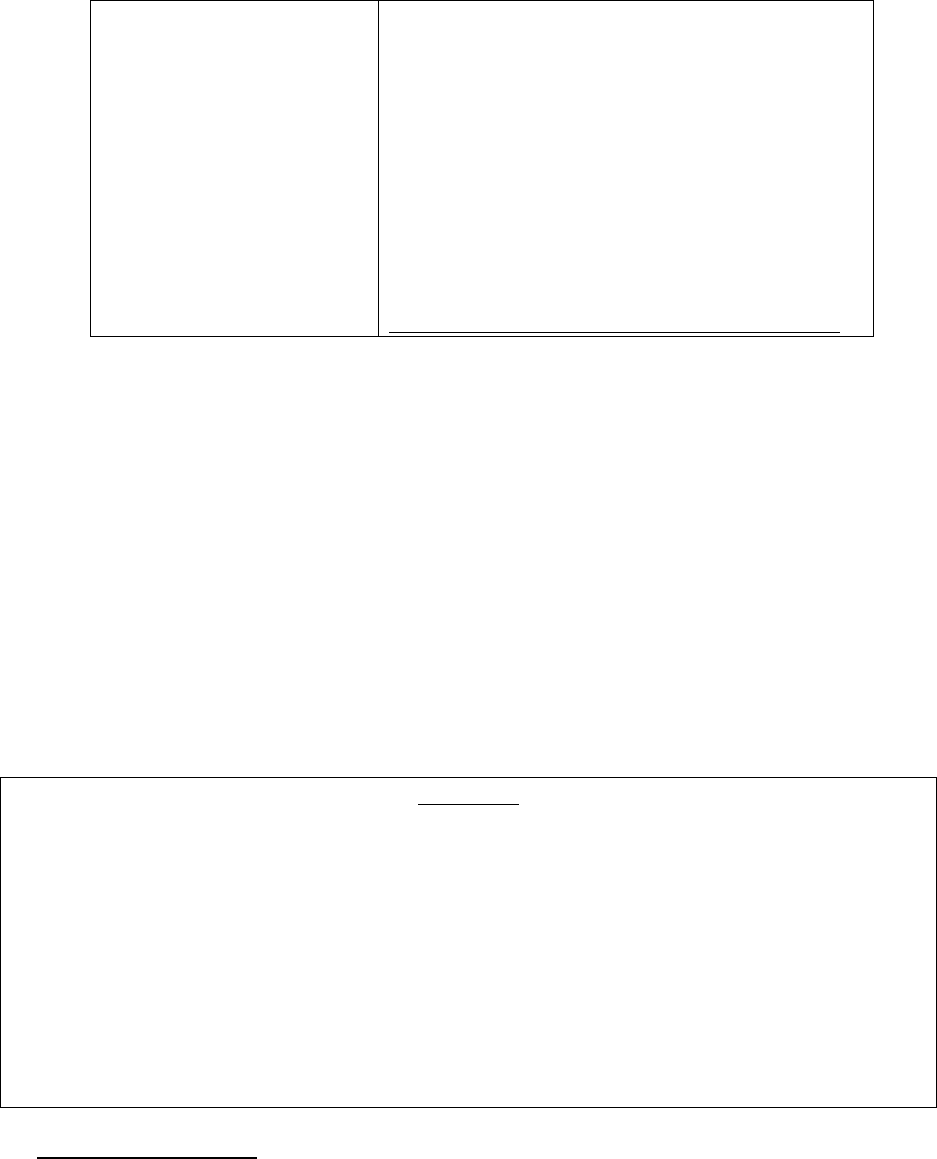

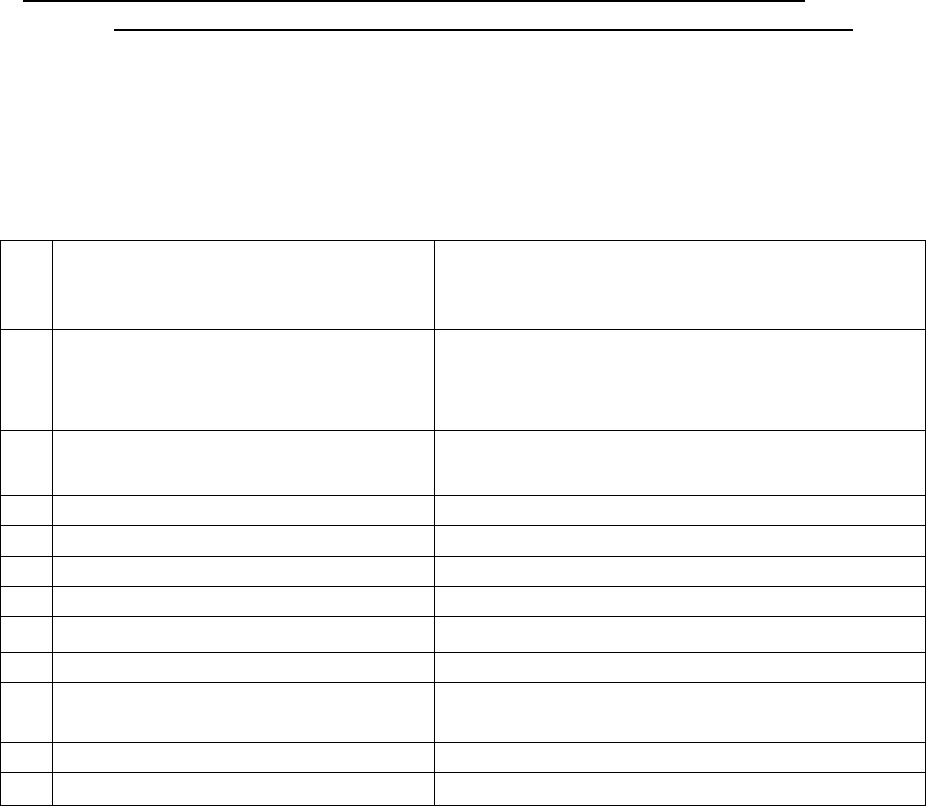

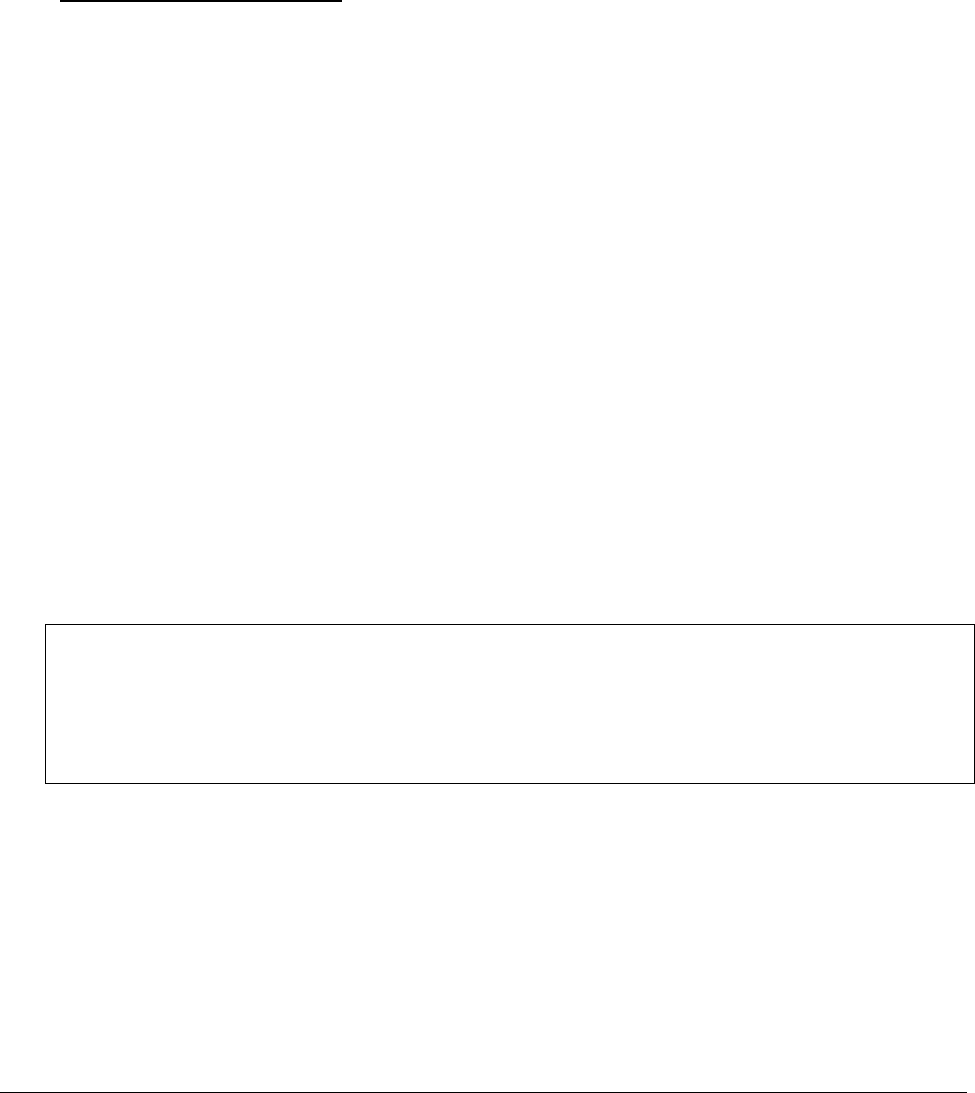

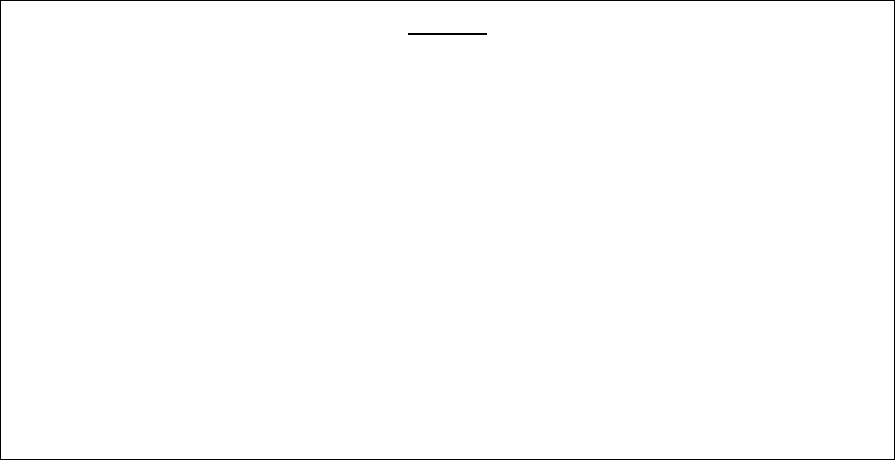

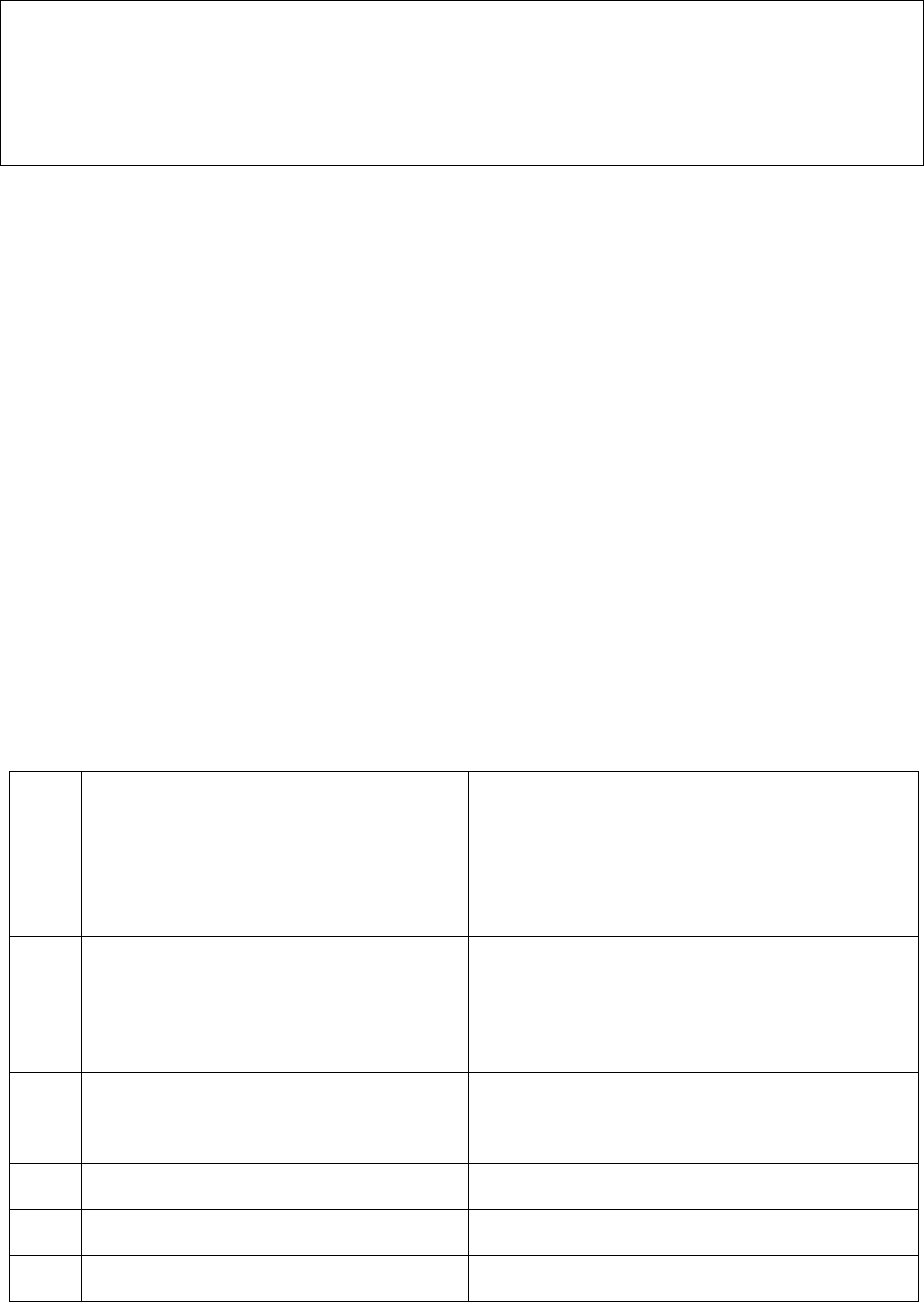

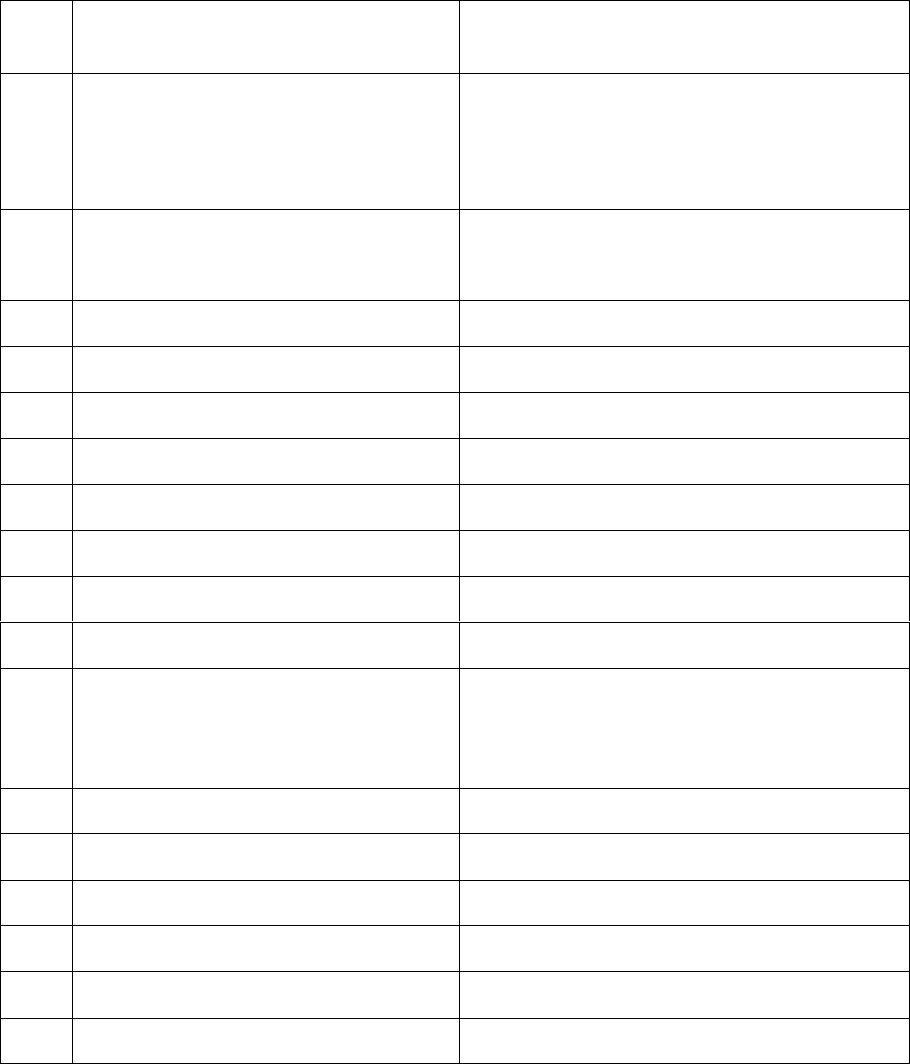

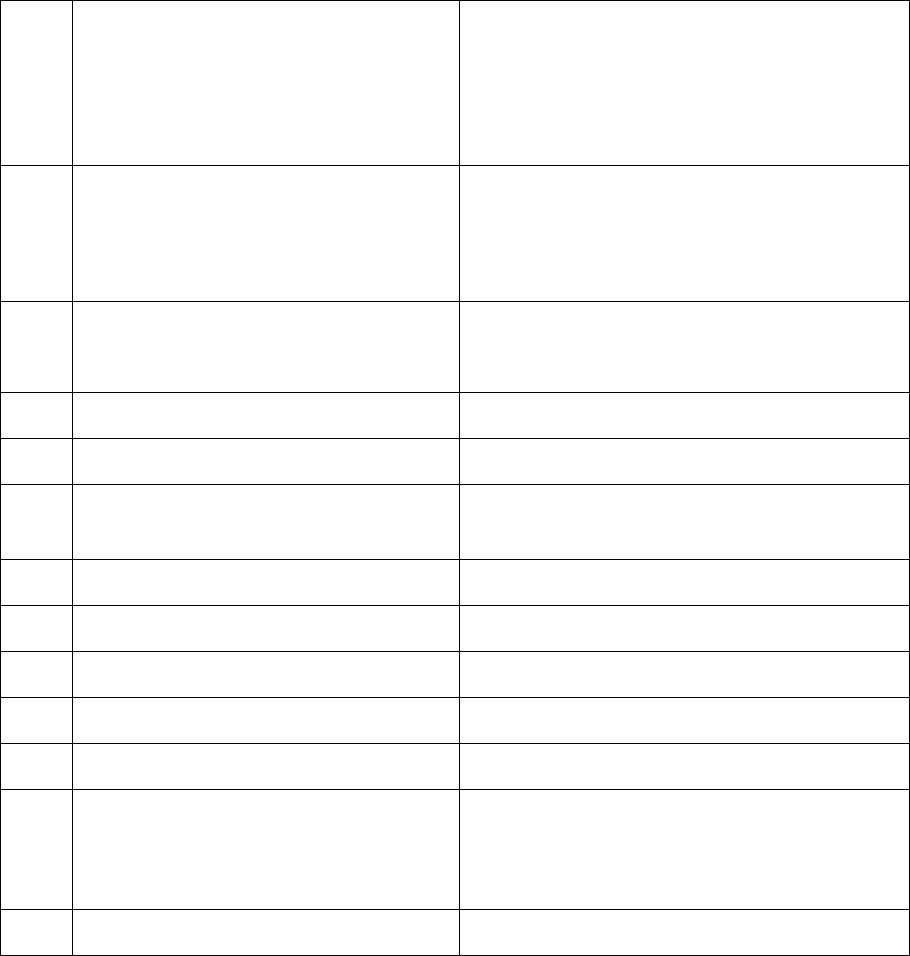

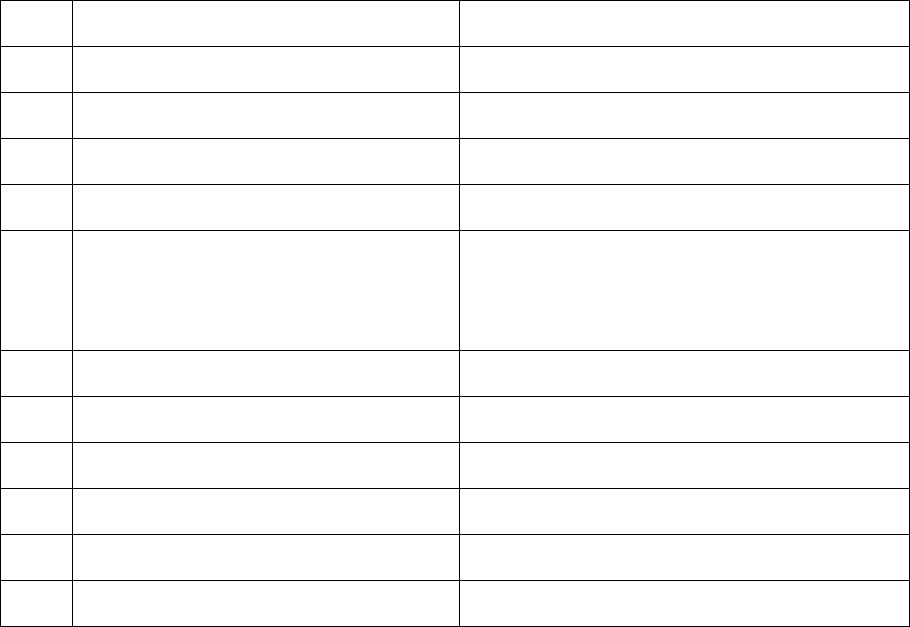

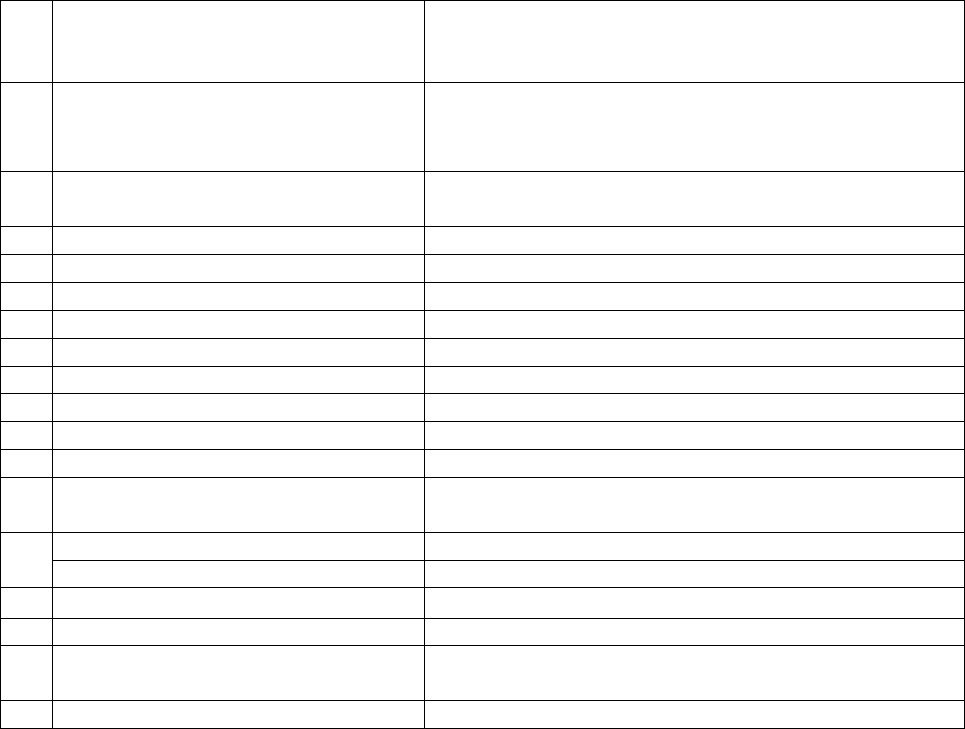

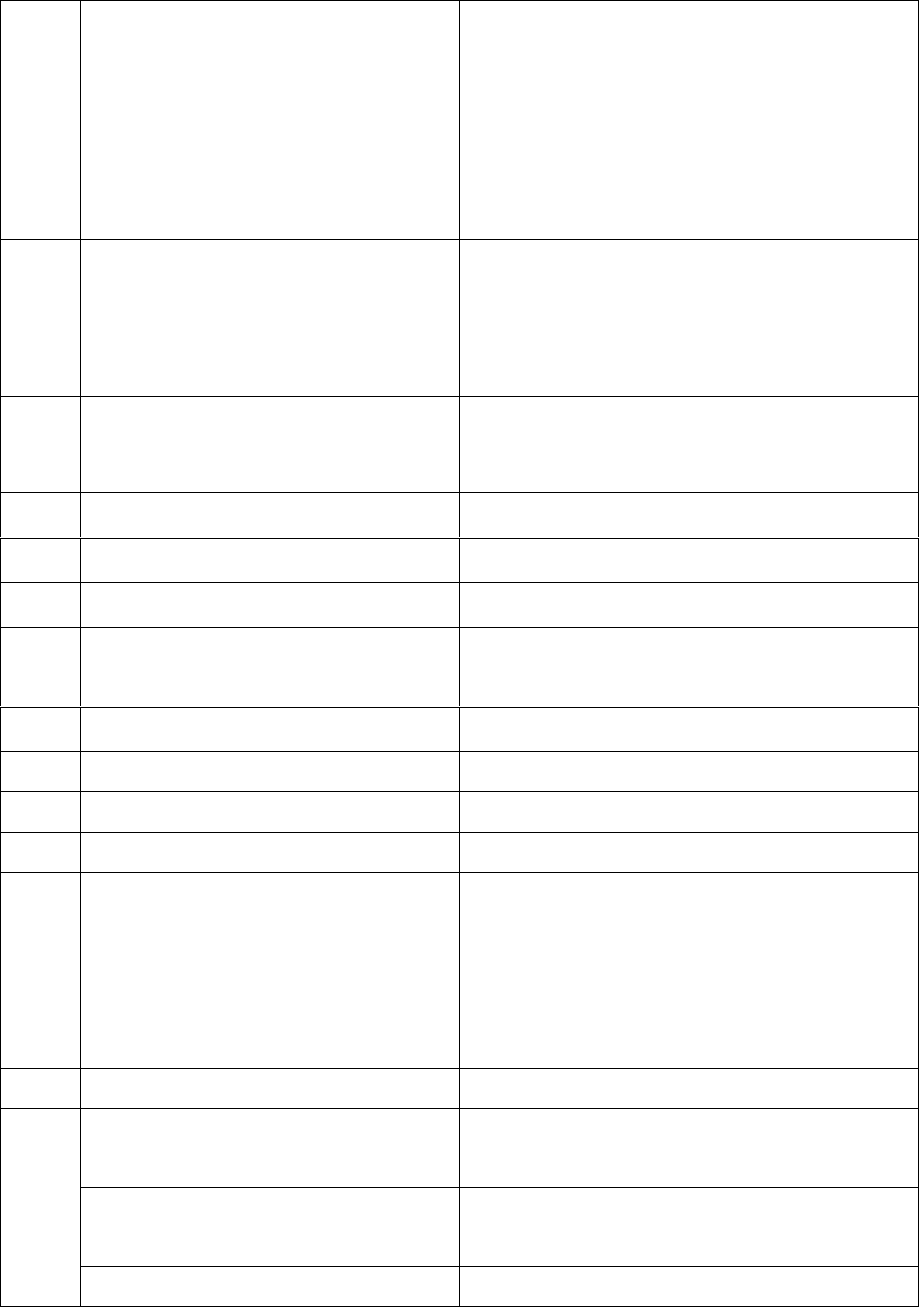

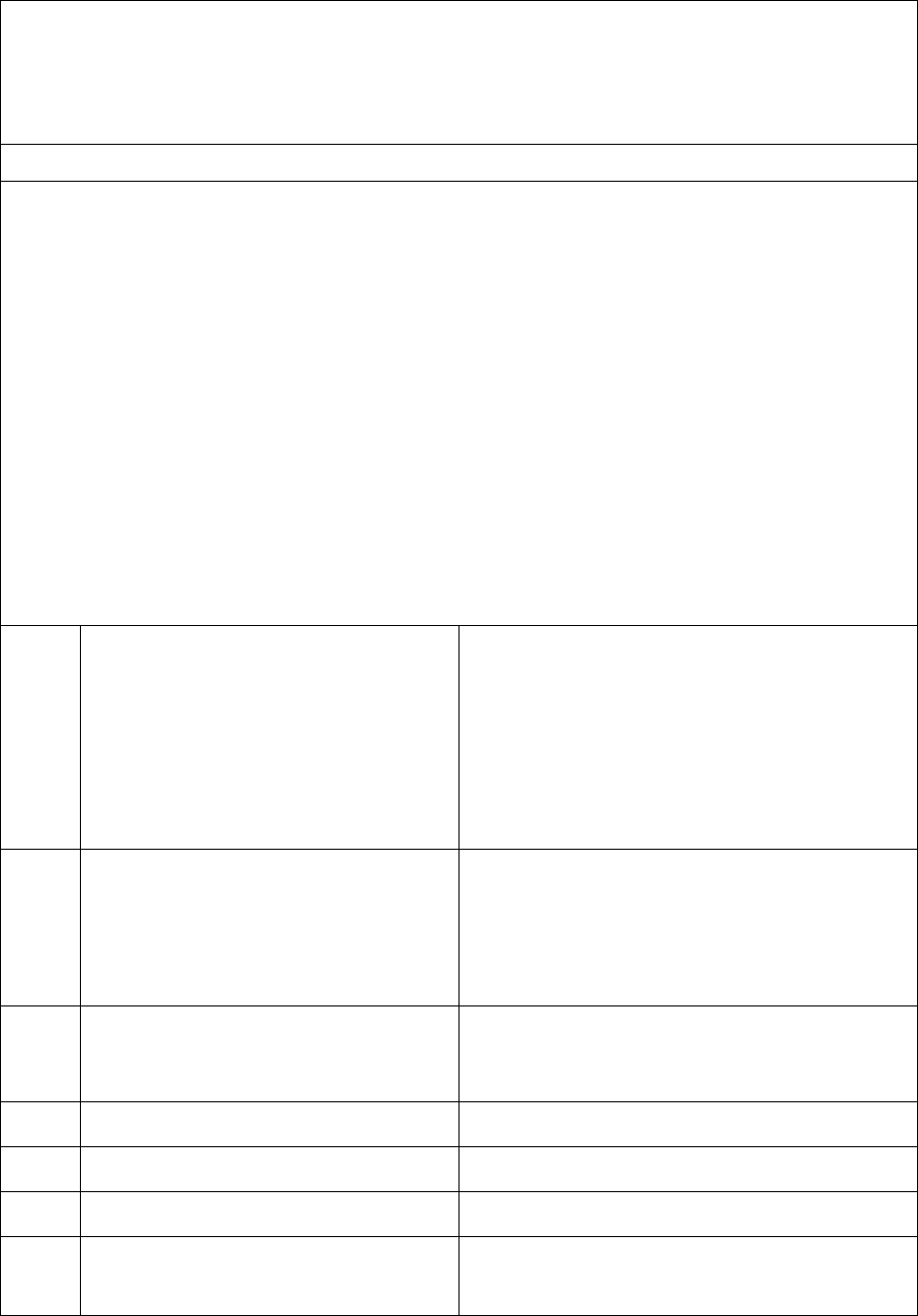

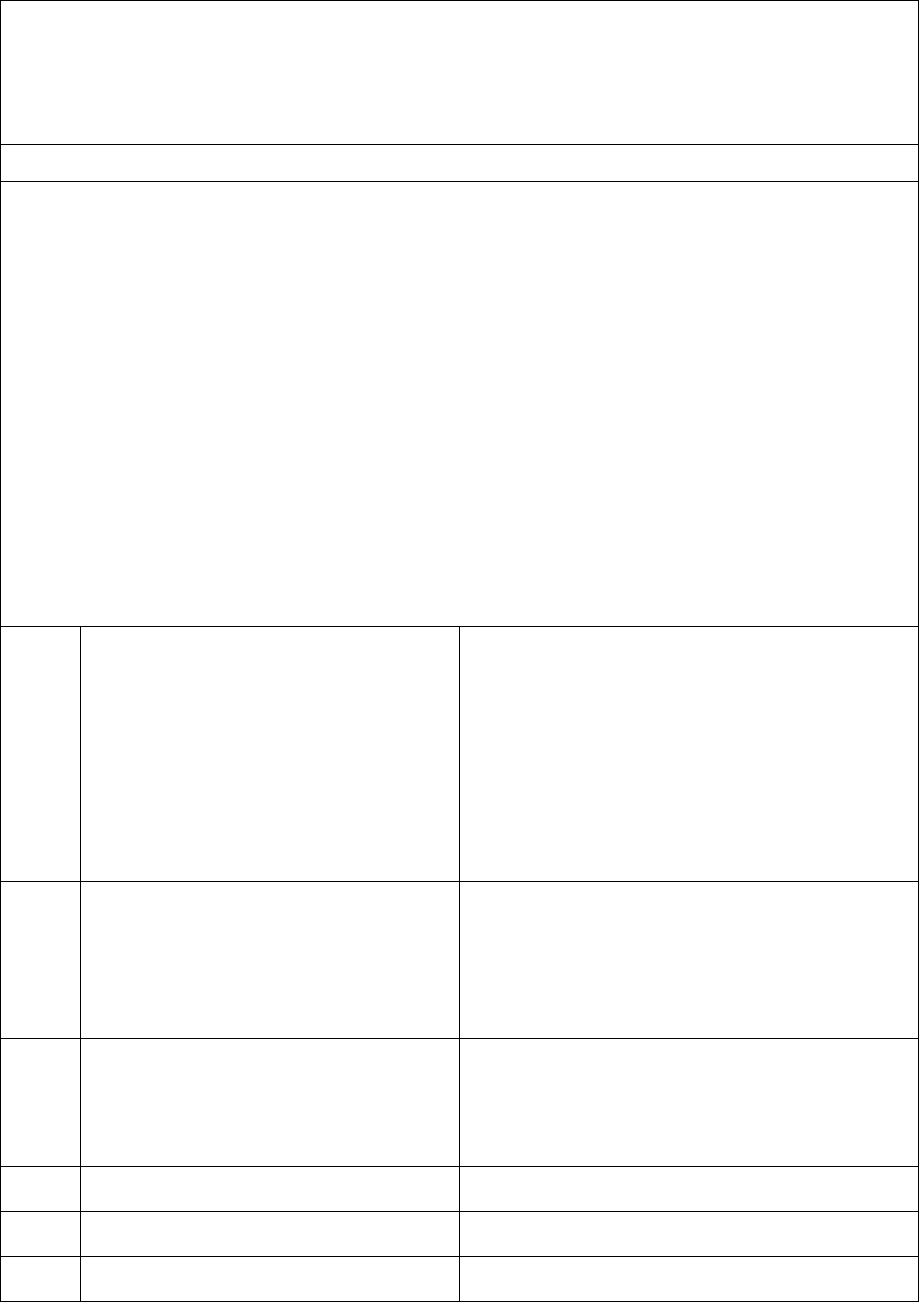

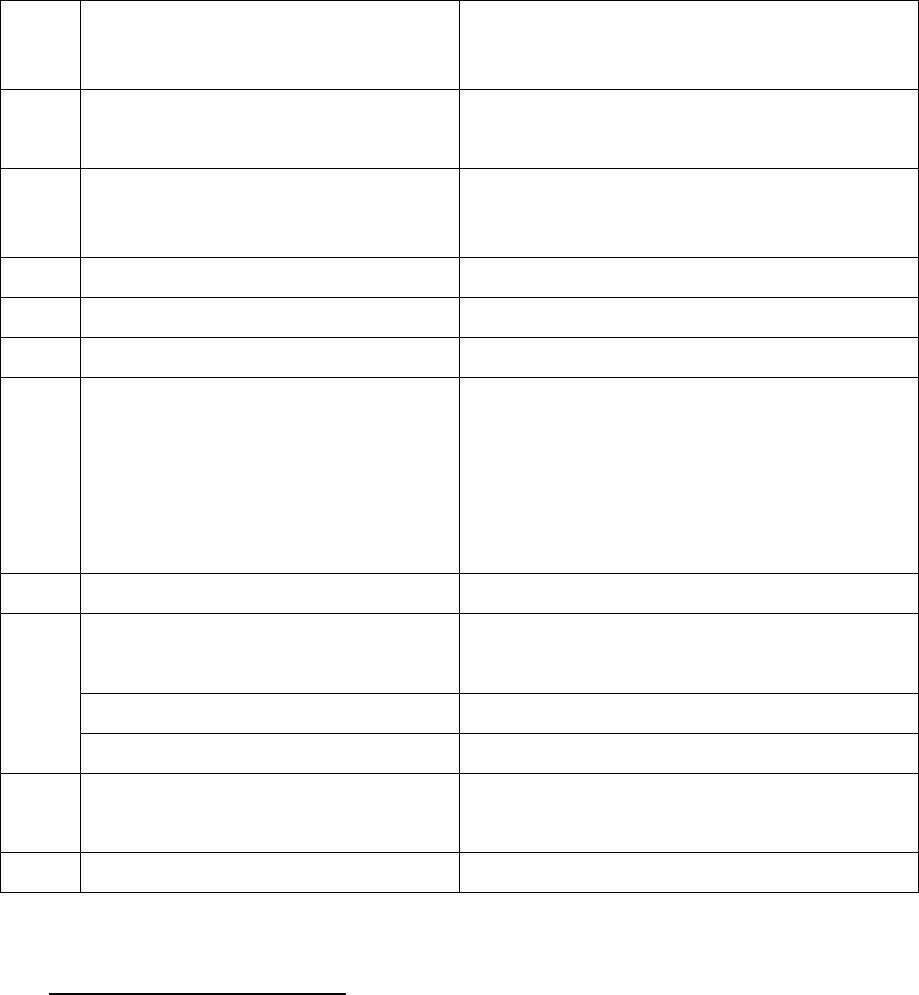

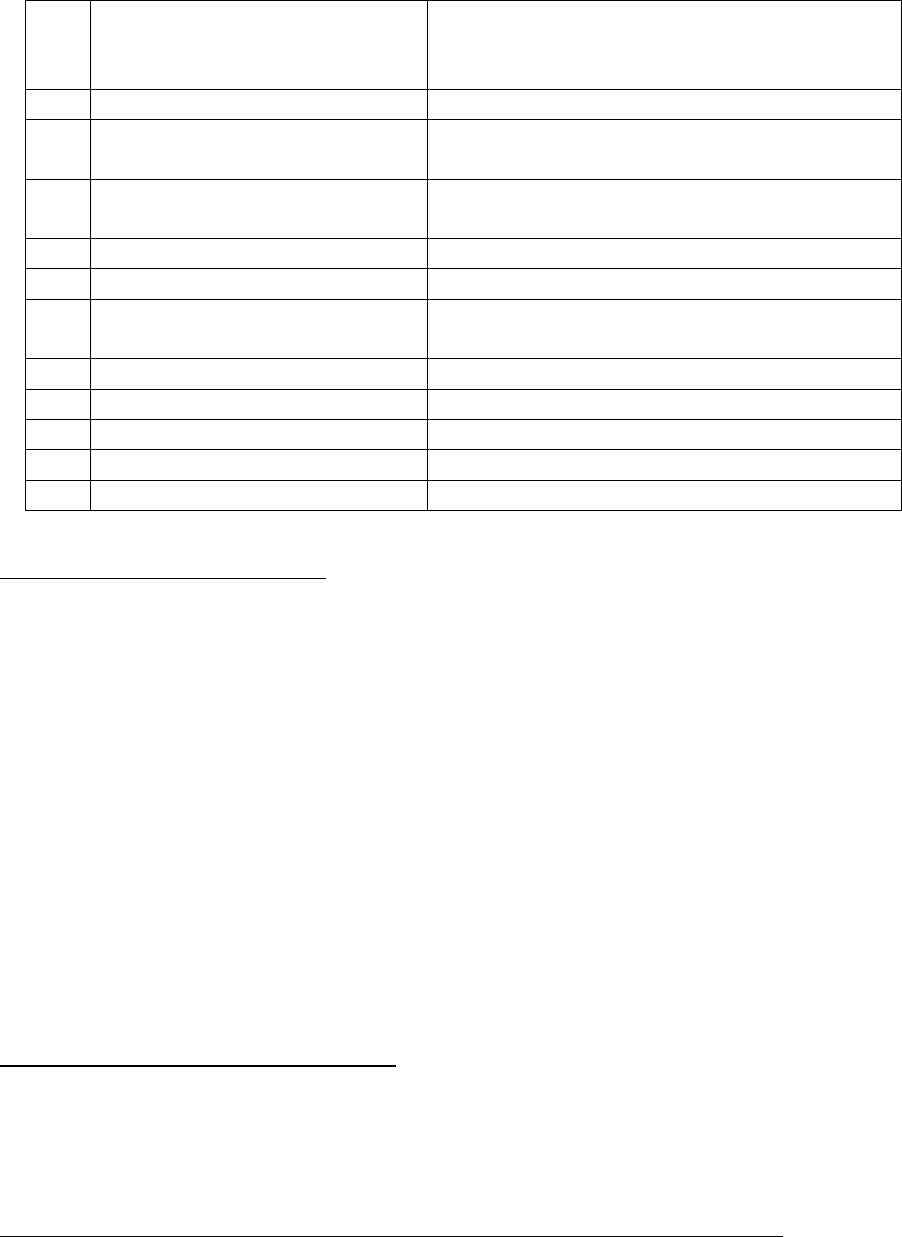

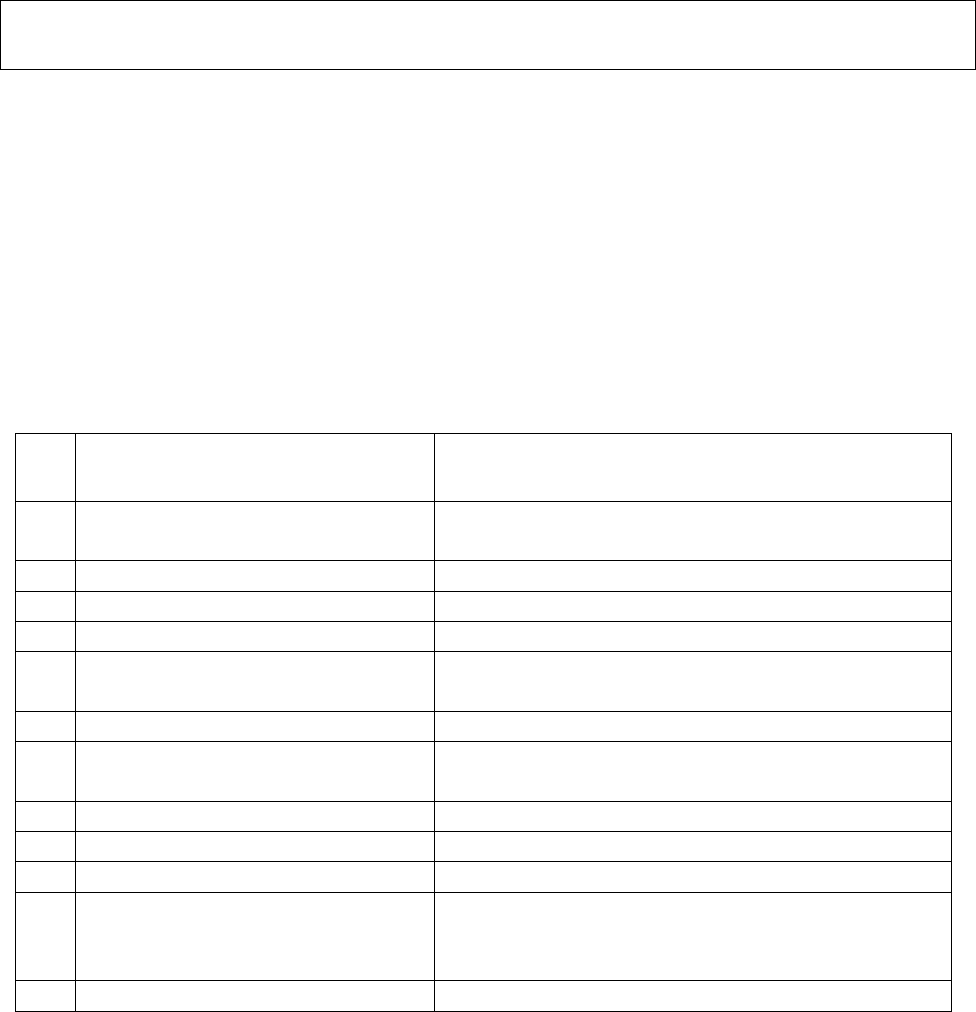

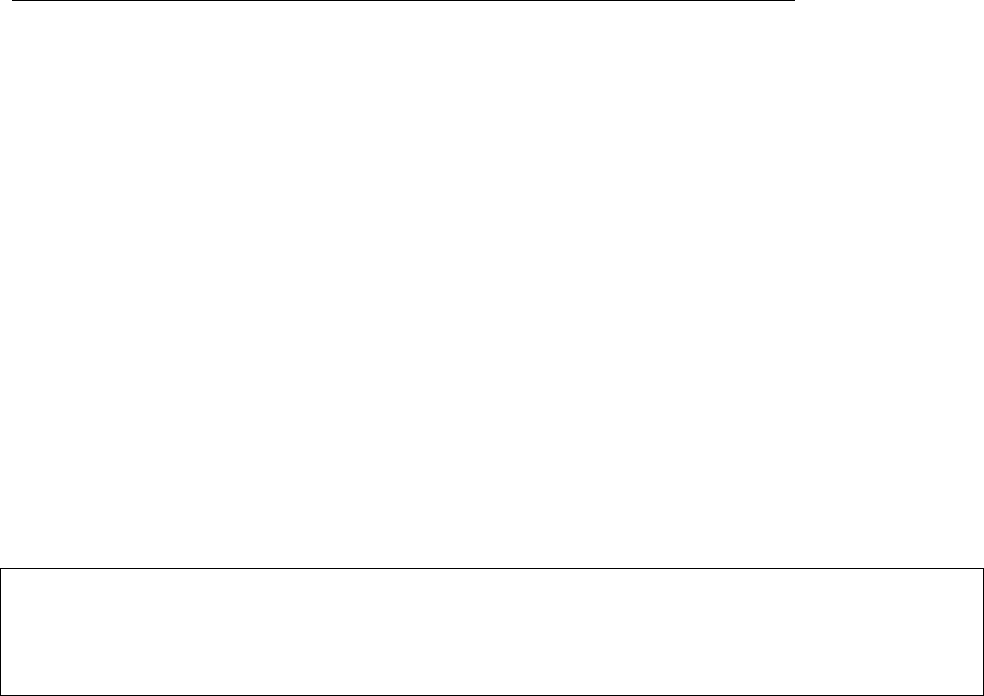

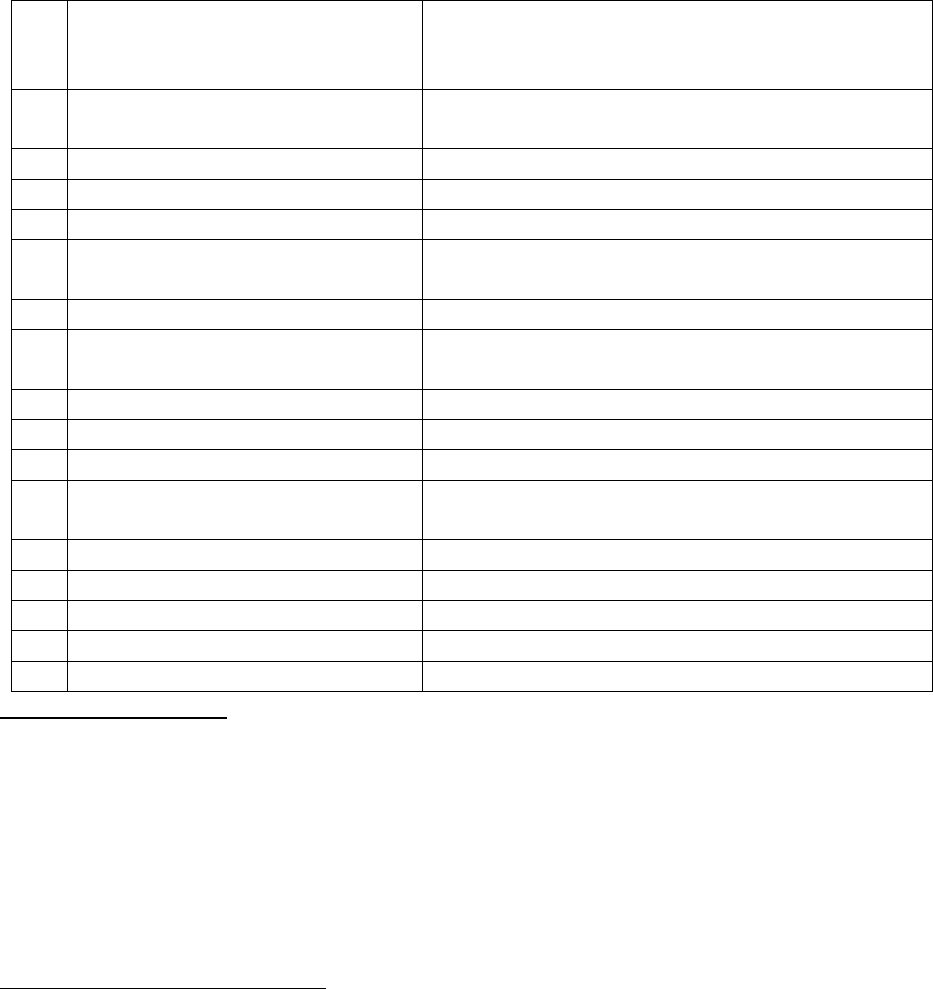

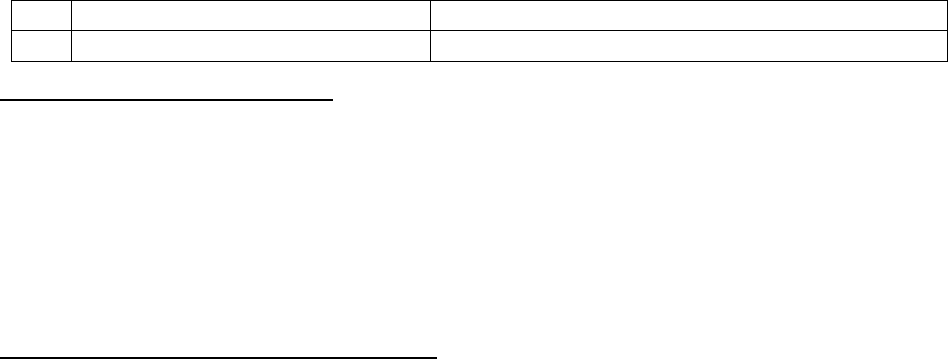

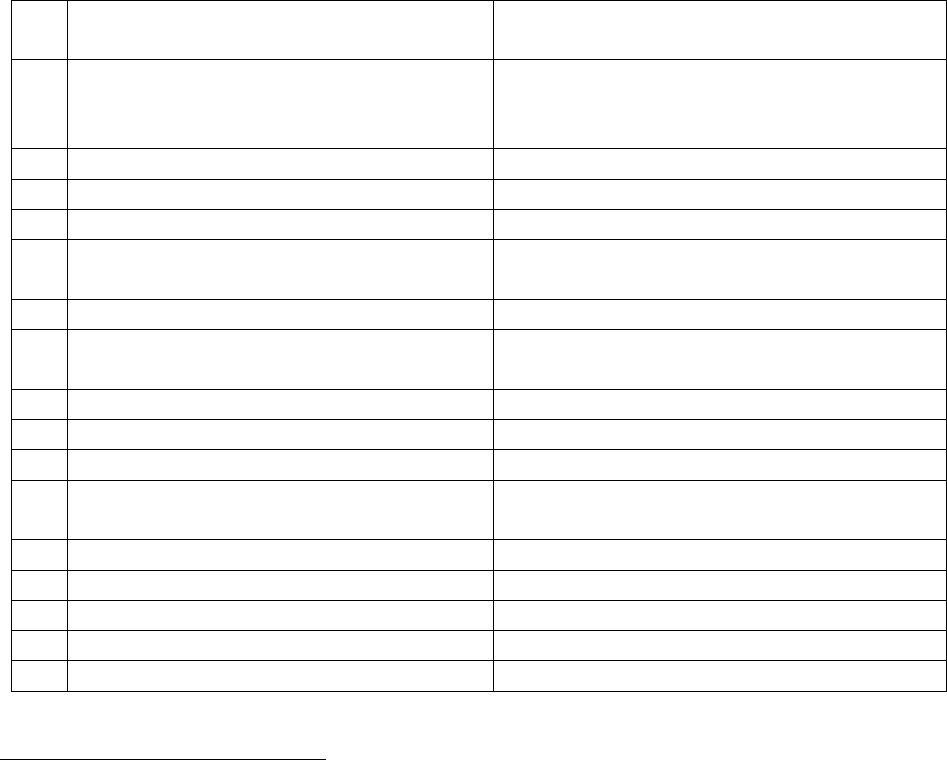

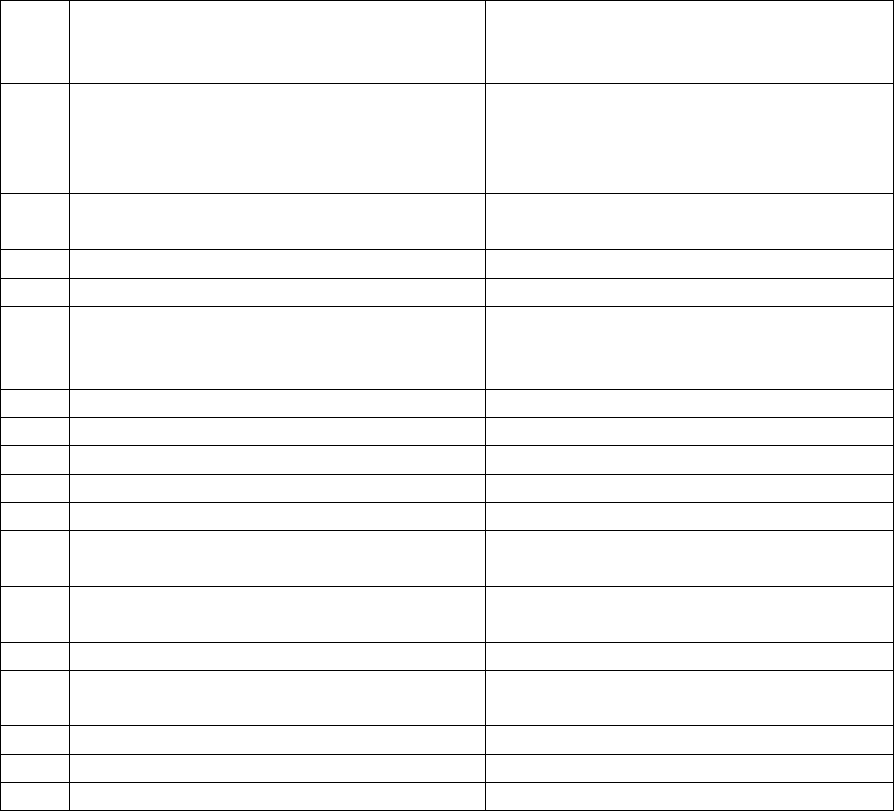

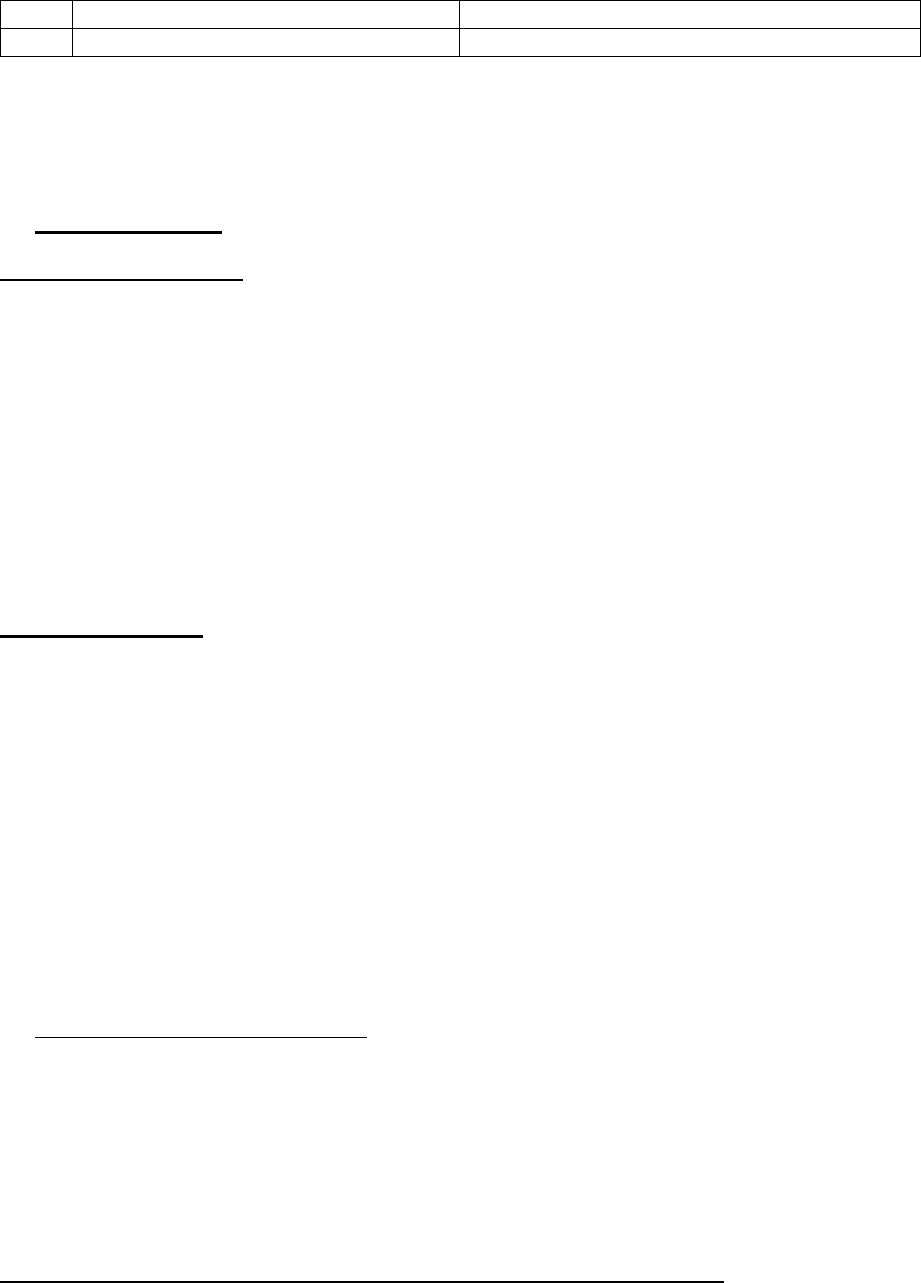

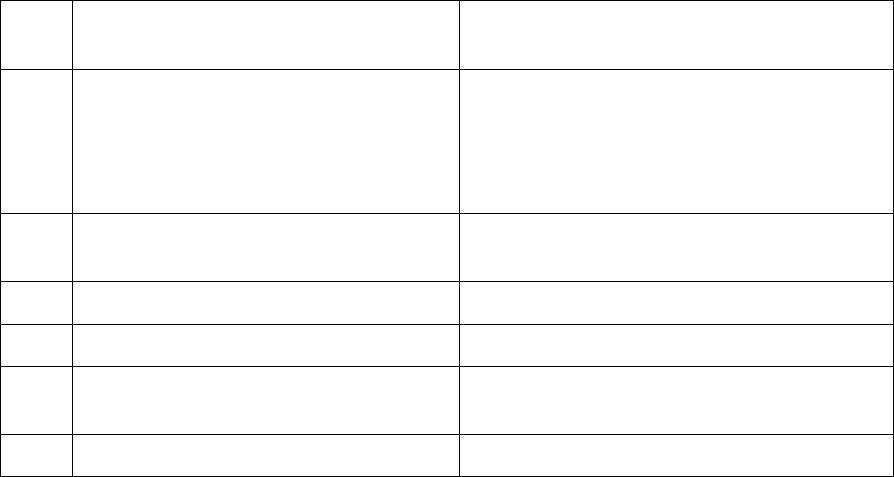

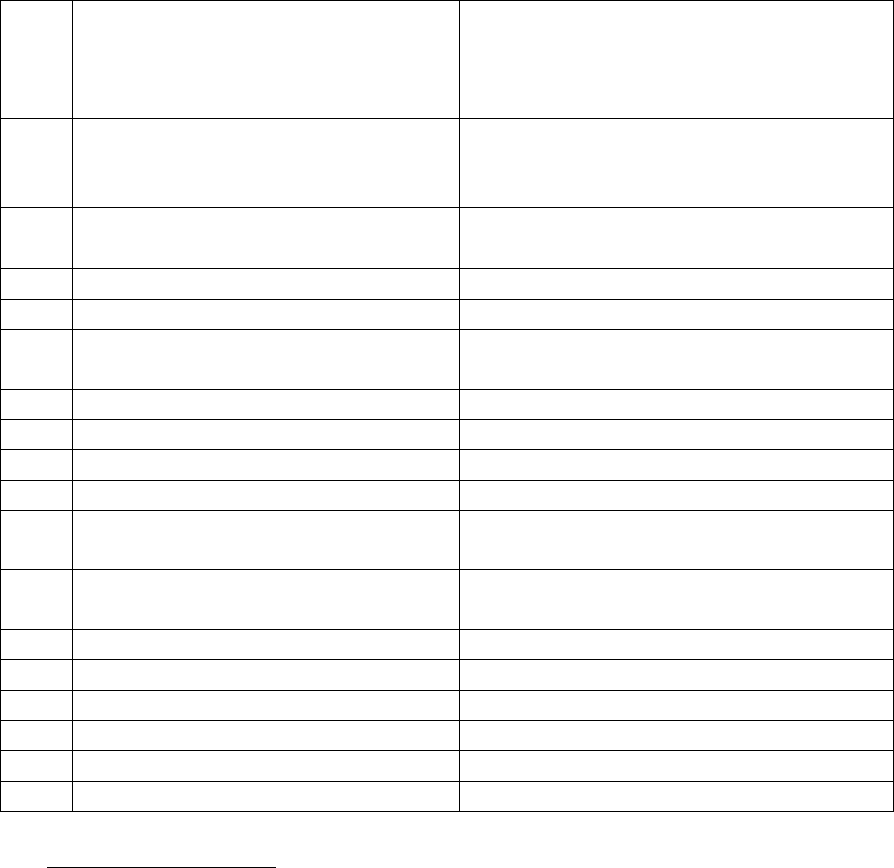

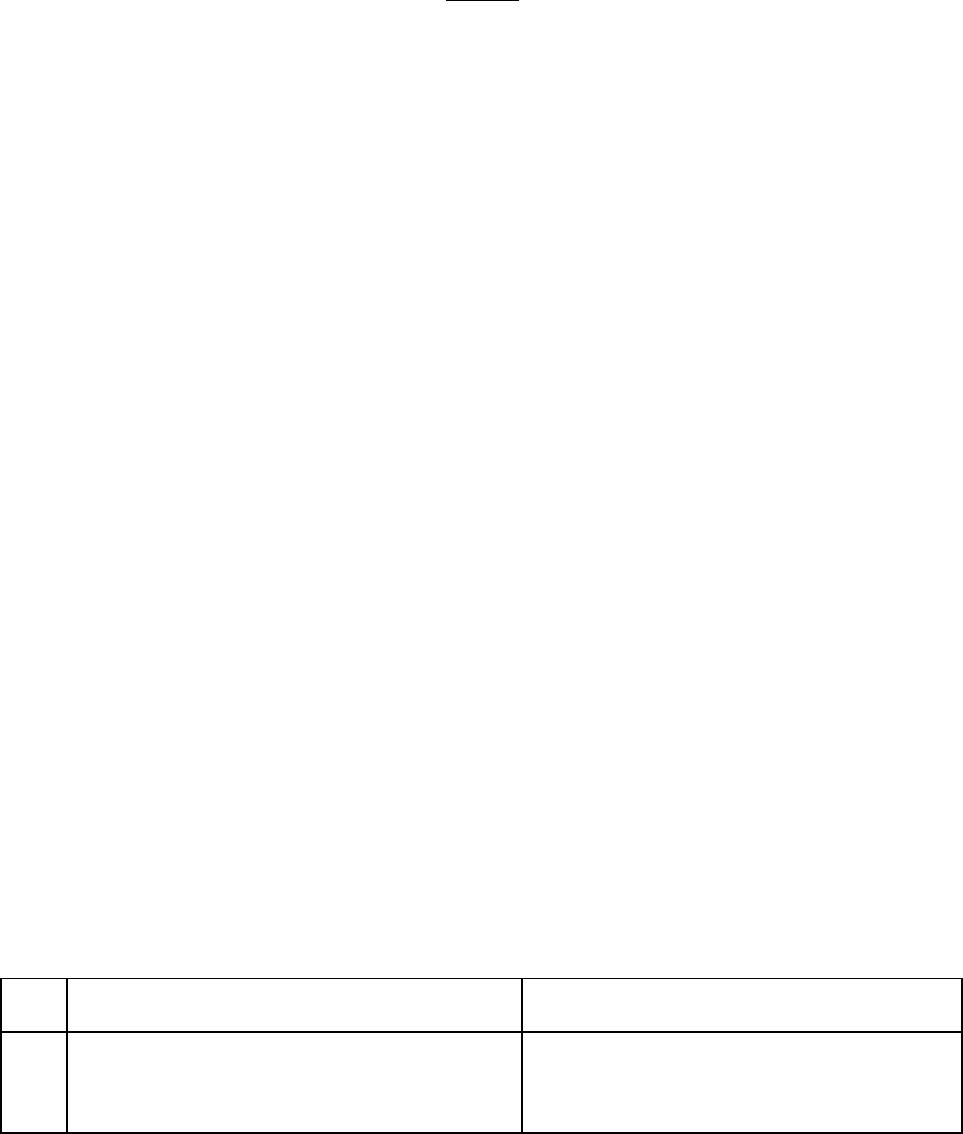

Present dispute is with regard to claim for cycle 11 to 17 of the planned treatment. The details of

claims disallowed under the policy are given below:

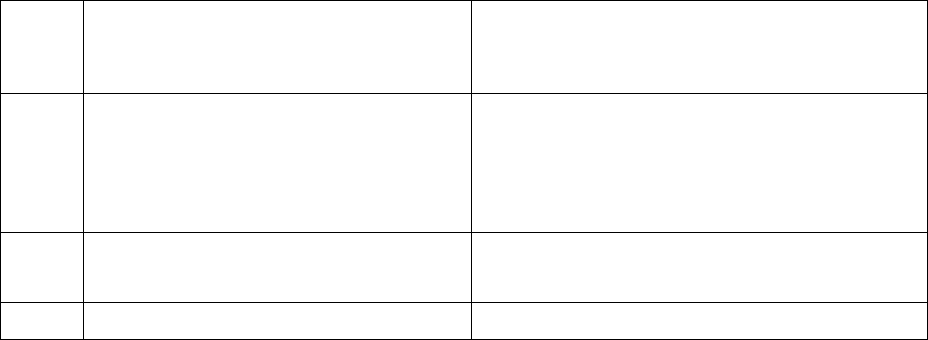

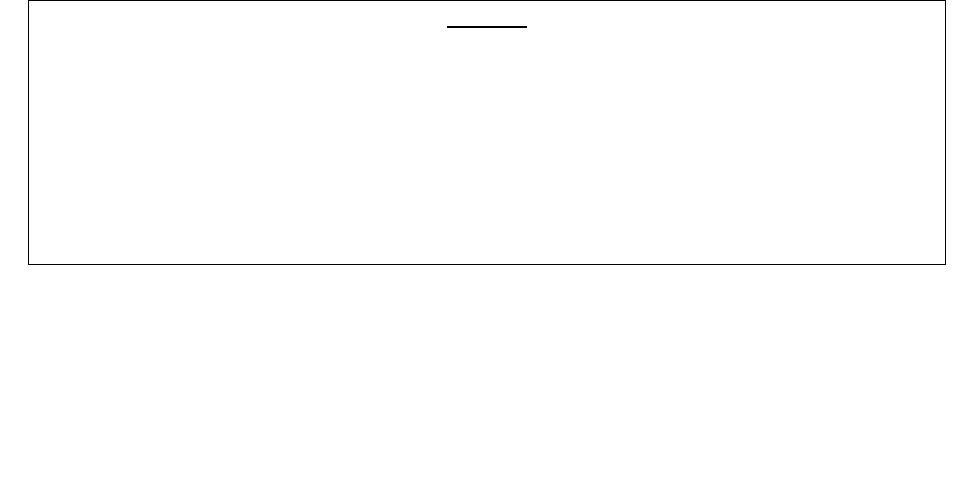

S. No

Claim No & Date of Hospitalisation

Amount

Treatment

1

21208836 dt 02.12.2019

Rs 40,144/-

Administered 11

th

dose of Inj Bevatas

as per Bevacizumab regimen

2

21271883 dt 20.12.2019

Rs 39,995/-

Administered 12

th

dose of Inj Bevatas

as per Bevacizumab regimen

3

21523098 dt 10.01.2020

Rs 39,900/-

Administered 13

th

dose of Inj Bevatas

as per Bevacizumab regimen

4

21611704 dt 01.02.2020

Rs 41,610/-

Administered 14

th

dose of Inj Bevatas

as per Bevacizumab regimen

5

21782603 dt 20.02.2020

Rs 39,933/-

Administered 15

th

dose of Inj Bevatas

as per Bevacizumab regimen

6

22141038 dt 21.03.2020

Rs 3,812/-

Administered 16

th

dose of Inj Bevatas

as per Bevacizumab regimen

7

22116269 dt 02.04.2020

Rs 38,878/-

Administered 17

th

dose of Inj Bevatas

as per Bevacizumab regimen

8

22306052 dt 06.06.2020

Rs 10,000/-

Medical follow-up on OPD basis

Web study reveals that Bevatas (also sold as Inj Bevacizumab or Inj Avastin) is recombinant

humanized monoclonal antibody. It is administered along with chemotherapy to treat cancer that

has spread to other parts of the body that cannot be removed by surgery, or has returned after

treatment with other chemotherapy medications. Bevacizumab injection products are in a class of

medications called antiangiogenic agents. They work by stopping the formation of blood vessels

that bring oxygen and nutrients to tumors which slows the growth and spread of tumors. In

contrast Chemotherapy drugs attack fast-growing cells, like cancer cells directly.

Further study reveals that Avastin, in combination with carboplatin and paclitaxel, followed by

Avastin as a single agent, is indicated for the treatment of patients with stage III or IV epithelial

ovarian, fallopian tube, or primary peritoneal cancer following initial surgical resection. The

scrutiny of medical bills of the IP reveals that Dexona-Cort-S injection was used along with Inj.

Bevatas. People with cancer undergoing chemotherapy are often given dexamethasone to

counteract certain side effects of their antitumor treatments. However none of the

aforementioned drugs are classified as chemotherapy drugs.

The Forum takes cognisance of clarification letter dt 02.12.2019, 20.12.2019, 10.01.2020,

02.04.2020 issued by treating doctor which stated that Bevacizumab was administered as a

chemotherapeutic agent. However the pharmacy bills submitted for aforementioned dates did

not establish that Inj Bevatas was purchased along with any other chemotherapeutic drug for

administration on IP. It was not clear from the Discharge Summary of IP if Inj Bevacizumab was

given as standalone medication or along with other chemotherapeutic agents as per Bevacizumab

regimen. Thus time was given to complainant to produce clarification letter from doctor regarding

the nature of treatment given to IP to ascertain the facts of the case. Complainant vide mail dt

08.01.2020 produced the clarification certificate dt 05.01.2021 from treating doctor stating that

17 doses of Inj Bevacuzimab alone were administered to IP from 27.05.2019 to 02.04.2020.

Thus it is clear that standalone administration of Inj. Bevatas or in combination with Dexona-Cort-

S Inj. is distinct from chemotherapy. Only certain defined medical procedures are permitted under

Day care procedures clause 3.3 including Parenteral Chemotherapy and Radiotherapy.

Further, since administration of injection Bevatas does not involve any anaesthetic administration,

the said treatment is not covered under the definition of Day Cay procedure under clause 2.10 -

“Day care Treatment means the medical treatment and/or surgical procedure which is

i. undertaken under general or local anaesthesia in a hospital/day care centre in less

than 24 hours because of technological advancement, and

ii. Which would have otherwise required a hospitalisation of more than 24 hours.

Treatment normally taken on an outpatient basis is not included in the scope of this

definition.”

Complainant contested that previous claim for standalone administration of Bevatas Injection was

allowed by RI under a different policy. Since the claims have been paid by RI under that policy, the

Forum does not wish to interfere with the decision of the RI and restrict its scope to present policy

under dispute.

Hon’ble Supreme Court of India in the case of Suraj Mal Ram Niwas Oil Mills (P) Ltd. v. United

India Insurance Co. Ltd. & Anr., interalia held that:

“Before embarking on an examination of the correctness of the grounds of repudiation of

the policy, it would be apposite to examine the nature of a contract of insurance. It is trite

that in a contract of insurance, the rights and obligations are governed by the terms of the

said contract. Therefore, the terms of a contract of insurance law have to be strictly

construed and no exception can be made on the ground of equity.

Thus, it needs little emphasis that in construing the terms of a contract of insurance

important, and it is not open for the court to add, delete or substitute any words. It is also

well settled that since upon issuance of an insurance policy, the insurer undertakes to

indemnify the loss suffered by the insured on account of risk covered by the policy, its terms

have to be strictly construed to determine the extent of liability of the insurer. Therefore,

the endeavour of the court should always be to interpret the words in which the contract is

expressed by the parties.”

Under the circumstances, the Forum concurs with the decision of RI and the rejection of claim is

found to be in order. The Complaint is disallowed.

AWARD

Taking into account the facts & circumstances of the case and the personal submissions made

by both the parties and the information/documents placed on record, the rejection of claim is

found to be in order and in consonance with the terms and conditions of the policy and does

not require any interference at the hands of Ombudsman.

The Complaint is Disallowed.

Dated at Bengaluru on the 08

th

day of January, 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- NEERJA SHAH

In the matter of: Mr. B A RAMAMURTHY V/s ROYAL SUNDARAM ALLIANCE INSURANCE CO LTD

Complaint No: BNG-H-038-2021-0419

Award No: IO/BNG/A/HI/0255/2020-21

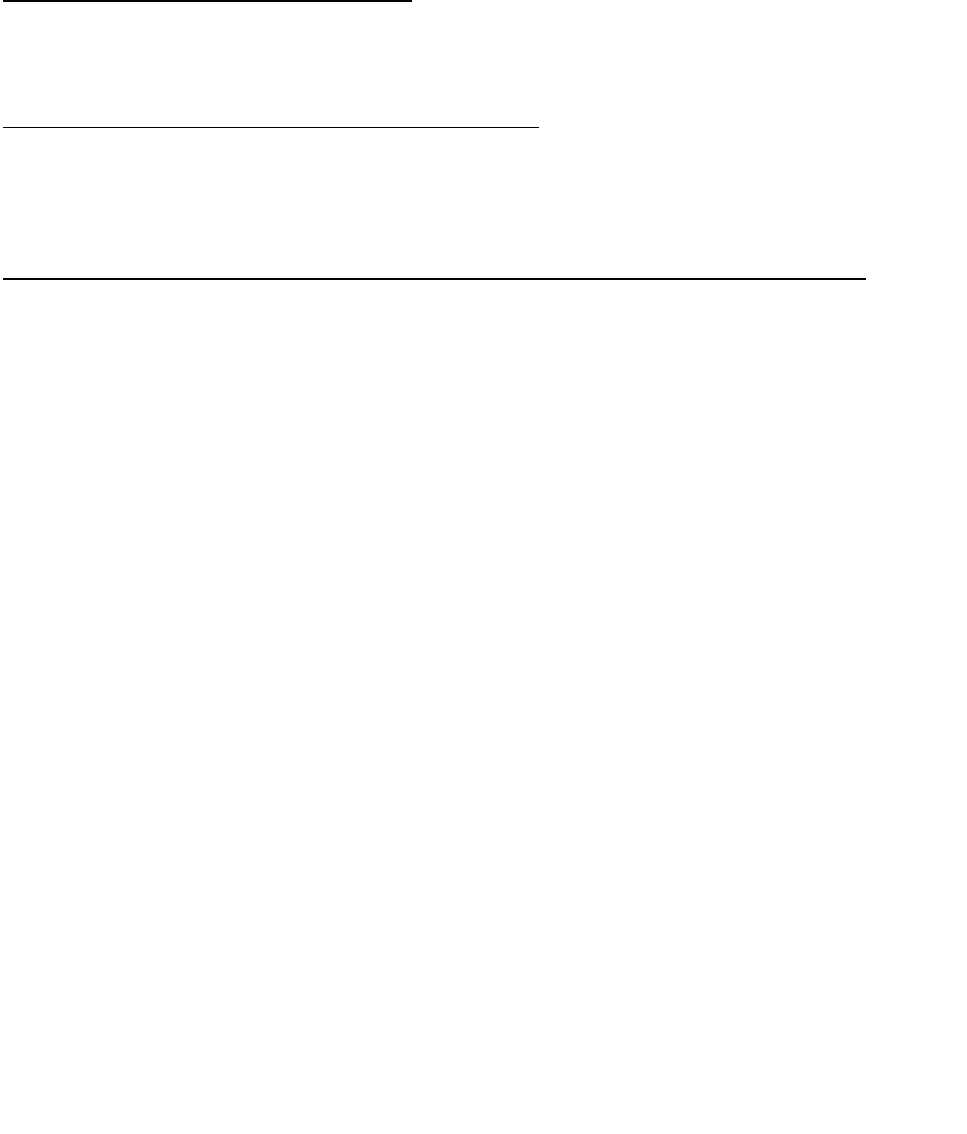

1

Name & Address of the

Complainant

Mr. B A RAMAMURTHY

#43, II Cross, C R Layout, J P Nagar I Phase

BENGALURU – 560 078

Ph No 080-26530137

E-mail: NA

2

Policy No.

Type of Policy

Duration of Policy/Policy Period

MFH0004229000103

Family Health Floater Policy

02.07.2019 to 01.07.2020

3

Name of the Insured/ Proposer

Name of the policyholder

SBI Cards & Payment Services

Mr. B A Ramamurthy – Self

4

Name of the Respondent Insurer

Royal Sundaram Alliance Insurance Co Limited

5

Date of Repudiation

NA

6

Reason for repudiation/rejection

NA

7

Date of receipt of Annexure VI A

17.11.2020

8

Nature of complaint

Non-Issuance of Policy

9

Amount of claim

NA

10

Date of Partial Settlement

NA

11

Amount of relief sought

Renewal of Policy plus suitable monetary

compensation

12

Complaint registered under Rule no

13 (1) (f) of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

13.01.2021 / Online VC

14

Representation at the hearing

a) For the Complainant

Self

Ms. Rashmi - Daughter

b) For the Respondent Insurer

Mr. Jaikumar T S, Manager

15

Complaint how disposed

Disallowed

16

Date of Award/Order

15.01.2021

17. Brief Facts of the Case

The complaint emanated due to non-issuance of policy by Respondent Insurer (RI). He

represented to Grievance Redressal Officer (GRO) of RI for renewal of policy, however his request

was not considered favourably. Hence, the Complainant approached this Forum for issuance of

policy.

18. Cause of complaint:

a. Complainant’s argument: Complainant alongwith wife and daughter were covered under

Group Family Health Floater policy issued by RI to customers of SBI Cards vide Master policy

reference no HS00000779000113. He is covered with RI since past 15+ years without any break.

The individual policies covering all 3 for present year were due for renewal on 01.07.2020.

Complainant was charged Rs 19,250/- as premium for insurance coverage for period 02.07.2019

to 01.07.2020. He submitted cheque for Rs 19,250/- to RI on 10.06.2020 based on previous

premium amount, which was encashed by RI on 23.07.2020. He submitted despite taking the

premium, policies have not been issued till date. Despite repeated reminders to RI for issuance of

policies on priority considering that he is a senior citizen and with entire world under the grip of

COVID-19, there was no response. Aggrieved by conduct of RI, he approached this Forum for

renewal of previous policy.

b. Insurer’s argument: The Respondent Insurer, in their Self Contained Note dated 30.12.2020

sent on e-mail dt 30.12.2020, submitted that complainant along with his wife and dependent

children was insured under Family Health Floater Policy since 02.07.2016, which has been

continuously renewed without break till 01.07.2020. However since the aforementioned product

was financially unviable, RI withdrew the product from market w.e.f. 01.04.2020. He was given an

option to migrate to alternate Group Health policy. Based on the revision, the premium payable

for new policies was Rs 35,644/- and same was informed to complainant vide mail dt 17.06.2020.

However, complainant had remitted an amount of Rs. 19,250/- based on premium amount of

previous year vide cheque dated 10.06.2020. The same was received by RI on 21.07.2020.

Thereafter he was requested to deposit additional amount of Rs 16,394/- for issuance of policies.

However complainant did not agree for the same and approached the Forum for issuance of

policies. Therefore, RI vide letter dated 27.11.2020 enclosing cheque for Rs. 19,250/- returned the

premium amount paid by him, which was not encashed by the complainant. Further, RI informed

that though the actual renewal premium for the migrated policies works out to Rs.61,496/-, but

since it had sent the renewal notices for Rs.35,644/-, complainant was requested to pay the

balance amount of Rs.16,394/- only as per original notice. RI also informed that it is ready to

extend the cover with all continuity of benefits once complete premium amount is received by

them.

19. Reason for Registration of complaint:

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017 and so, it was

registered.

20. The following documents were placed for perusal:

d. Complaint along with enclosures,

e. SCN of the Respondent Insurer along with enclosures and

f. Consent of the Complainant in Annexure VI-A and Respondent Insurer in VII-A.

21. Result of the personal hearing with both the parties (Observations & Conclusions):

The dispute is with regard to non-renewal of an existing withdrawn product.

Personal hearing by the way of online Video-conferencing through Goto Meet was conducted in

the said case. Complainant along with his daughter & Representative of RI presented their case.

Confirmation from all the participants about the clarity of audio and video was taken and to which

the participants responded positively.

The Forum has perused the documentary evidence available on record and the submissions made

by both the parties.

Complainant submitted that existing policy was valid till 01.07.2020 and they had submitted

cheque for renewal of policies on 10.06.2020 to RI for amount of Rs 19,250/- based on the

previous year premium since there was no communication from RI. Same was credited to the

bank account of RI on 23.07.2020. He averred that despite taking the premium amount, RI did not

issue renewed policies till date. He also informed that complaint was registered with National

Human Rights Commission for the unnecessary harassment and mental agony undergone by them

for non-issuance of policies at a time when COVID-19 pandemic was prevalent in the world. His

daughter informed that RI has been continuously calling them for compromise settlement even

though the matter was sub-judice before this Forum. She also informed that RI cannot escape

from their responsibility merely be sending E-mail communications, when the preferred method

of communication is Indian Postal Services.

Representative of RI informed that since the product was withdrawn from market after approval

of the Regulator, the request of the complainant to renew existing policy as per previous year

policy premium rates was not possible as the same was financially unviable. However considering

the long-standing association with the customer, Representative of RI informed that they are

willing to provide coverage to customer subject to receipt of premium in full. The premium and

policy terms and conditions would be subject to new policy which has been approved by IRDAI,

but the complainant was not agreeable to the same. During the course of hearing he informed

that complainant has been provided with two options to opt in in lieu of withdrawn product –

Royal lifeline policy for which premium amount payable is Rs 61,496/- or the Group Health Policy

for which premium amount payable is Rs 35,644/-. He acknowledged that there was a deficiency

in service during the renewal of the policy, but objected to the argument of complainant

regarding allegations of harassment stating that RI is committed to customer satisfaction. He

submitted that COVID-19 pandemic has disrupted the service chain in year 2020 and it was

universal phenomenon that caused inconvenience to everyone.

Forum notes that Family Floater Health policy offered to complainant was a Customised Group

Product of RI which was specifically available for the customers of SBI Cards.

Complainant’s daughter contention was that it was mandatory on the part of RI to send Postal

hard copies of renewal letter, but no such communication was made by RI. Forum notes that

IRDAI circular IRDAI/CAD/CIR/PPHI/059/04/2019 dt 10.04.2019 has issued the following

guidelines:

“All insurers shall send all communication relating to issuance and servicing of insurance

policies such as proposal registration, further requirements for completing proposals and

various requirements of underwriting and/or relating pre-acceptance surveys etc, wherever

applicable in general insurance, information about policy issuance i.e acceptance /rejection

of proposals, renewal/lapse intimations/premium reminders wherever sent, bonus accrued

in life insurance participating policies, value of ULIP polices, and all other information that

has a bearing on servicing of insurance policy, either in the form of a letter, e-mail, sms or

any other electronic from approved by the Authority.”

Furthermore, renewal notice is a service gesture and insurance company is not obliged to give

notice for renewal as iterated in IRDAI circular no IRDAI/HLT/REG/CIR/152/06/2020 dt 11.06.2020.

Forum notes that RI has fulfilled this obligation much before the renewal date of the policy.

As regards to dispute over amount of premium payable under the Insurance policy, Forum notes

that Sub-regulation (e) of Regulation 10 of the IRDAI Health Regulations 2016 states:

“Subject to Regulation (3) (b), changes in rates will be applicable from the date of approval

by the Authority and shall be applied only prospectively thereafter for new policies and

from the date of renewal for the existing policies.”

As per IRDAI Guidelines on Product Filing in Health Insurance Business issued vide reference:

IRDA/HLT/REG/CIR/150/07/2016 dt 29.07.2016:

“Modification in terms and conditions of products under File and Use (Applicable to Life,

General and Health Insurers):

1. …

2. Any revision or modification of any approved health insurance product filed under File

& Use Procedure shall also require the prior clearance of the Authority as per the

guidelines issued from time to time.

3. An insurer, wishing to make changes to an existing product/rider or Addon, shall submit

an application to the Authority on modular basis furnishing information of the relevant

section of the File and Use application setting out the details of the changes or

modifications in the terms and conditions and/or price. Any such modification shall

have prior approval of the PMC as may be applicable. The PMC shall evaluate the

modification to examine whether it has any impact on pricing and record the same.

Accordingly, the product may be filed with the Authority for modification

4. …

5. …

6. …

7. In case any existing product offered by a General or Health Insurer is modified and

launched, the earlier version of the product shall automatically cease to exist for new

business and the modified version of the product shall be launched subject to complying

with Clauses (3), (5), (6) and (7) of Chapter – VI of norms on withdrawal of the products

specified under these Guidelines

Implementation of the modified rates, terms and conditions shall be allowed only at the

time of renewal of the Policy for the products offered by the general insurers and health

insurers.”

In the instant case, the Forum notes that policy plan under which complainant was covered for

the period 02.07.2019 to 01.07.2020 was withdrawn from 01.04.2020. Thus the existing policy

plan under which complainant was covered ceased to exist as on date of renewal and it bears the

approval of the Regulator.

Regulation 17(i) of the IRDAI Health Regulations 2016 (as amended vide notification dt

19.11.2019) state that RI is required to offer a suitable product for an existing customer

consequent upon withdrawal of an existing insurance product under which he/she is covered. The

Forum notes that the RI had given the two option to the complainant to choose an alternative

product available with them. But the complainant was not agreeable to premium and policy terms

and conditions under the new product. Thus contention of the complainant for alleged

harassment by RI in regards to policy servicing is not established.

However, the Forum also places on record the inept action of RI for encashing the premium

cheque and not issuing the policies or refunding the premium after approx. 5 months.

Under the circumstances, considering the age of complainant and benefits accrued under the

policy, the Forum advises the complainant to continue with the policy coverage from the two

available options provided by the RI by paying the additional amount. In case he decides

otherwise, the Forum directs RI to refund the amount collected as premium along with interest

@2% above bank rate from date of encashing the premium cheque till the date of initiation of

original refund i.e. 27.11.2020. The complaint for issuance of Insurance policy on basis of previous

year policy premium amount is disallowed.

AWARD

Taking into account the facts & circumstances of the case and the personal submissions made

by both the parties and the information/documents placed on record, the Forum advises the

complainant to continue with the policy coverage from the two available options provided by

the RI by paying the additional amount. In case he decides otherwise, the Forum directs RI to

refund the amount collected as premium along with interest @2% above bank rate from date of

encashing the premium cheque till the date of initiation of original refund i.e. 27.11.2020

The Complaint for issuance of Insurance policy on basis of previous year policy premium amount

is Disallowed.

Dated at Bengaluru on the 15

th

day of January, 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – NEERJA SHAH

In the matter of Mr. MAYURA G N Vs HDFC ERGO GENERAL INSURANCE LIMITED

Complaint No: BNG-H-003-2021-0422

Award No.: IO/(BNG)/A/HI/0256/2020-21

1

Name & Address of the

Complainant

Mr. Mayura G N

B3-604, Kailash Block,

BDA Jnanabharathi Residential Enclave, Kengeri,

BENGALURU - 560059

Mobile # 9740084778

E-mail Id : [email protected]

2

Policy Number

Type of Policy

Duration of Policy/ Policy Period

2999201537516403000

Employer Provided GMC Policy

22.10.2019 to 21.10.2020

3

Name of the Insured/ Proposer

Name of the policyholder

Prysm Displays India Pvt Ltd

Mr. Mayura G N - Employee

4

Name of the Respondent Insurer

HDFC ERGO General Insurance Limited

5

Date of repudiation

NA

6

Reason for repudiation

NA

7

Date of receipt of Annexure VI-A

06.11.2020

8

Nature of complaint

Partial Settlement of COVID-19 claim

9

Amount of claim

₹. 20,773/-

10

Date of Partial Settlement

01.10.2020

11

Amount of relief sought

₹. 18,494/-

12

Complaint registered under Rule no:

13 (1) (b) of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

13.01.2021 / Online VC

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Mr Neeraj Shivangikar, AVP

15

Complaint how disposed

Disallowed

16

Date of Award/Order

15.01.2021

17. Brief Facts of the Case:

The complaint emanated from Partial settlement of claim towards hospitalization due to COVID -19 for

the period from 02.09.2020 to 07.09.2020. Despite representing to Grievance Redressal Officer (GRO)

of the Respondent Insurer (RI) for reconsideration of balance claim amount, but his plea was not

considered favourably. Hence the Complainant approached this Forum for settlement of his claim.

18. Cause of Complaint:

a) Complainant’s arguments:

The Complainant is covered under Employer provided GMC policy vide policy no

2999201537516403000 for a Sum Insured of ₹. 6,00,000/- from 22.10.2019 to 21.10.2020. He was

diagnosed as COVID-19 positive and hospitalised in Sparsh Hospital from 02.09.2020 to

07.09.2020. He submitted cashless claim request to RI vide claim no RC-HS20-11313421. For a bill

amount of Rs 1,21,342/-, the claim was settled for Rs 1,00,569/-. Rest expenses were disallowed

as non-medical expenses which was disputed by him. His representation to GRO for payment for

balance claim did not yield positive result. Hence he approached this Forum for resolution of

grievance.

b) Respondent Insurer’s Arguments:

RI in their Self Contained Note (SCN) dt 05.01.2021 submitted that Complainant (Insured Person –

hereafter referred to as IP) was insured with RI for SI of Rs. 6,00,000/-. IP was tested COVID-19

positive and was admitted at Sparsh Hospital from 02/09/2020 to 07/09/2020 for which claim

intimation was received by RI. After assessment of claim, it was settled for Rs. 1,11,439/- including

pre, post and main hospitalisation. Non-medical expenses of Rs 20,773/- were disallowed as per

the terms and conditions of the policy and guidelines issued by the IRDAI vide ref no

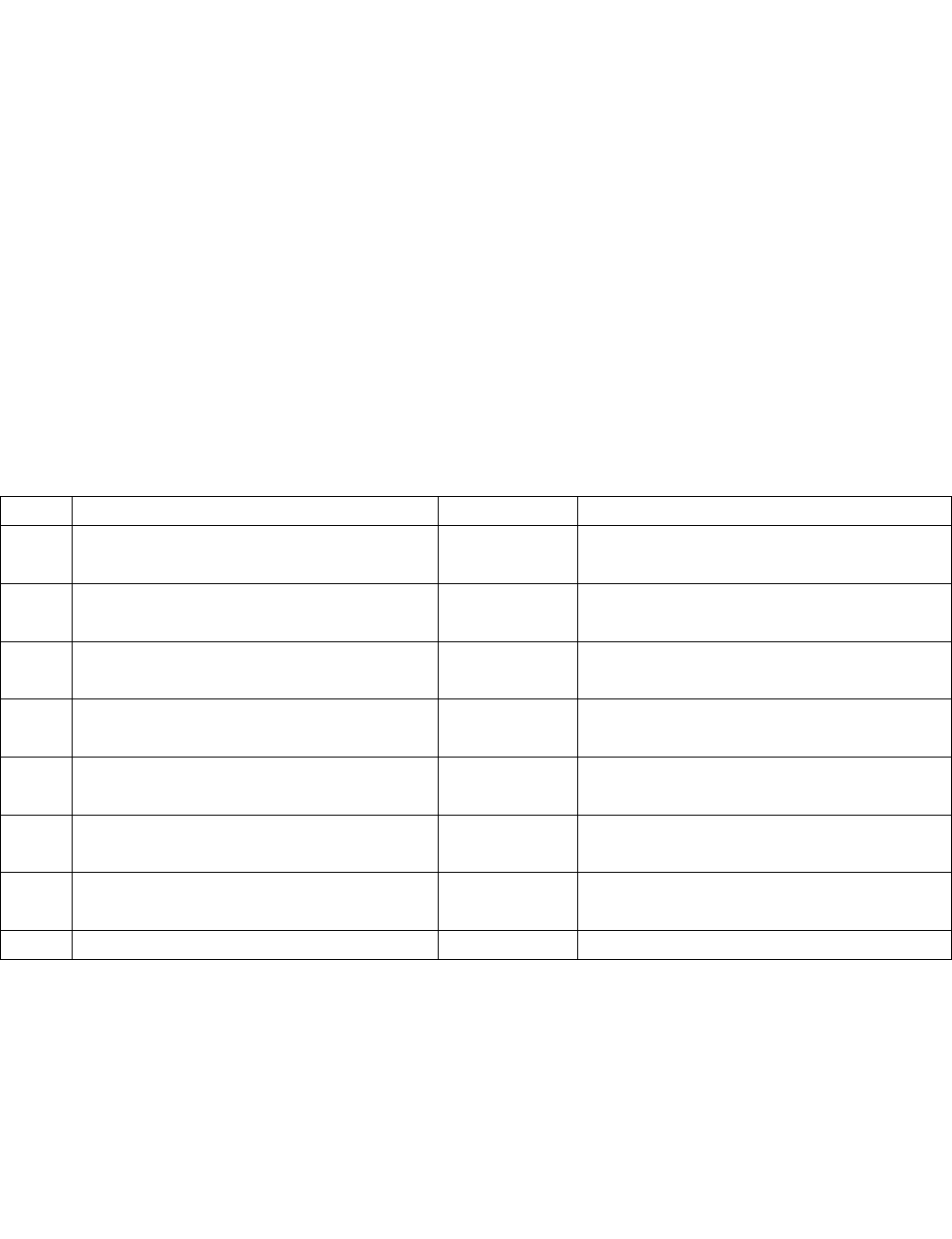

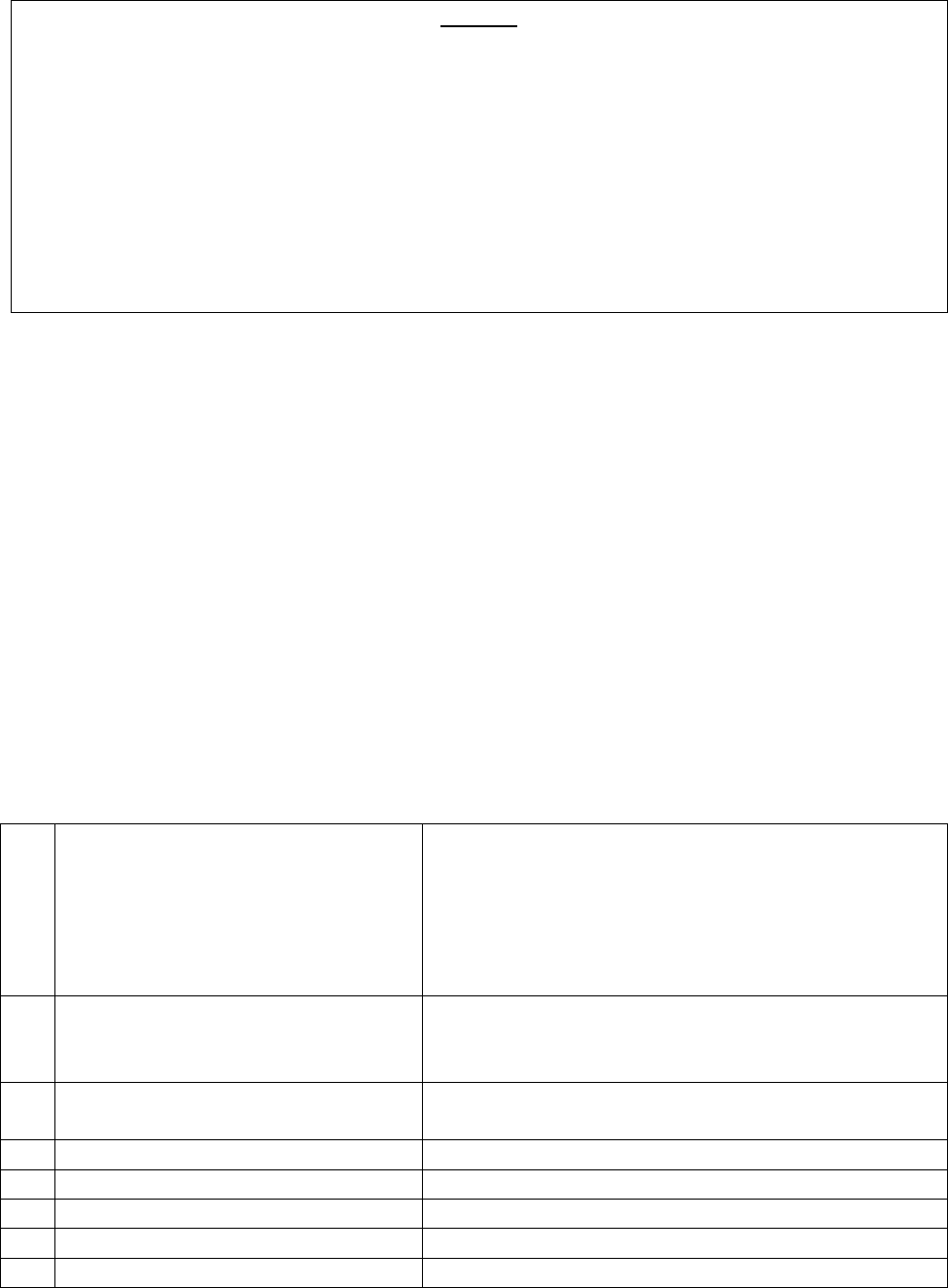

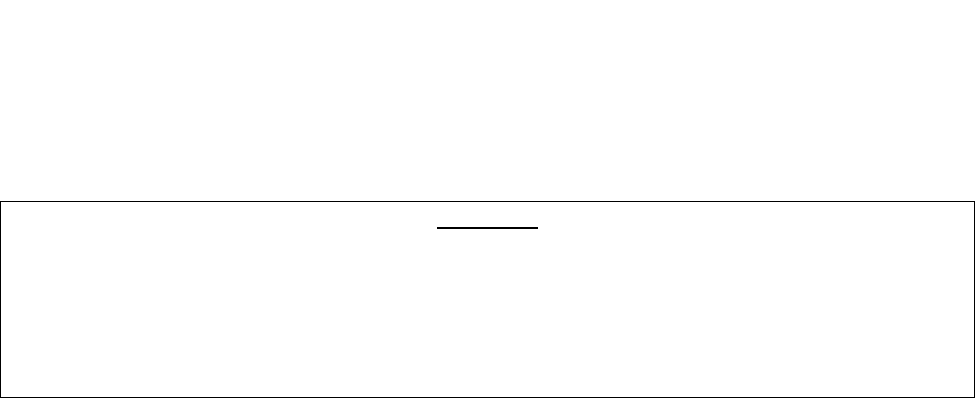

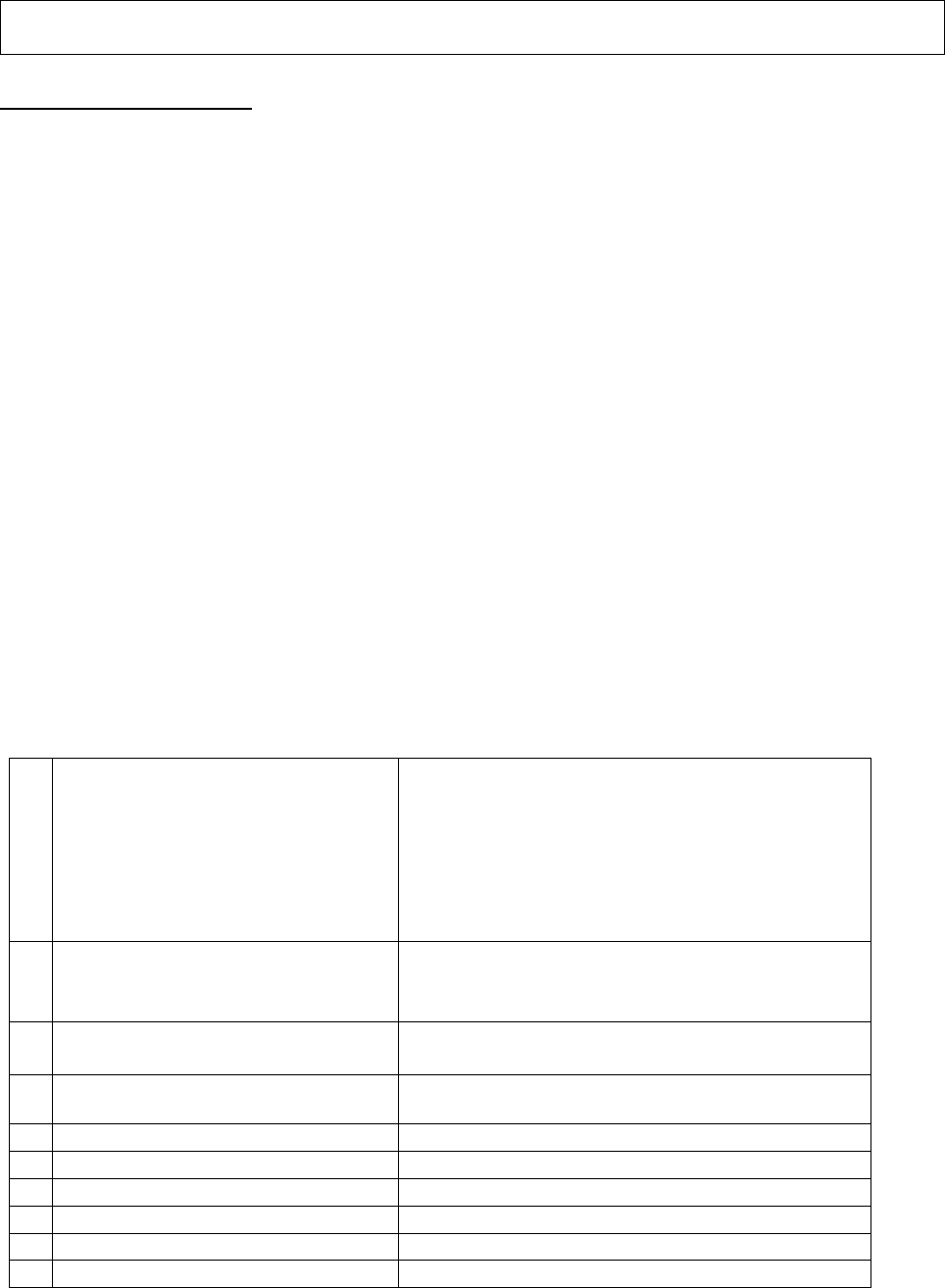

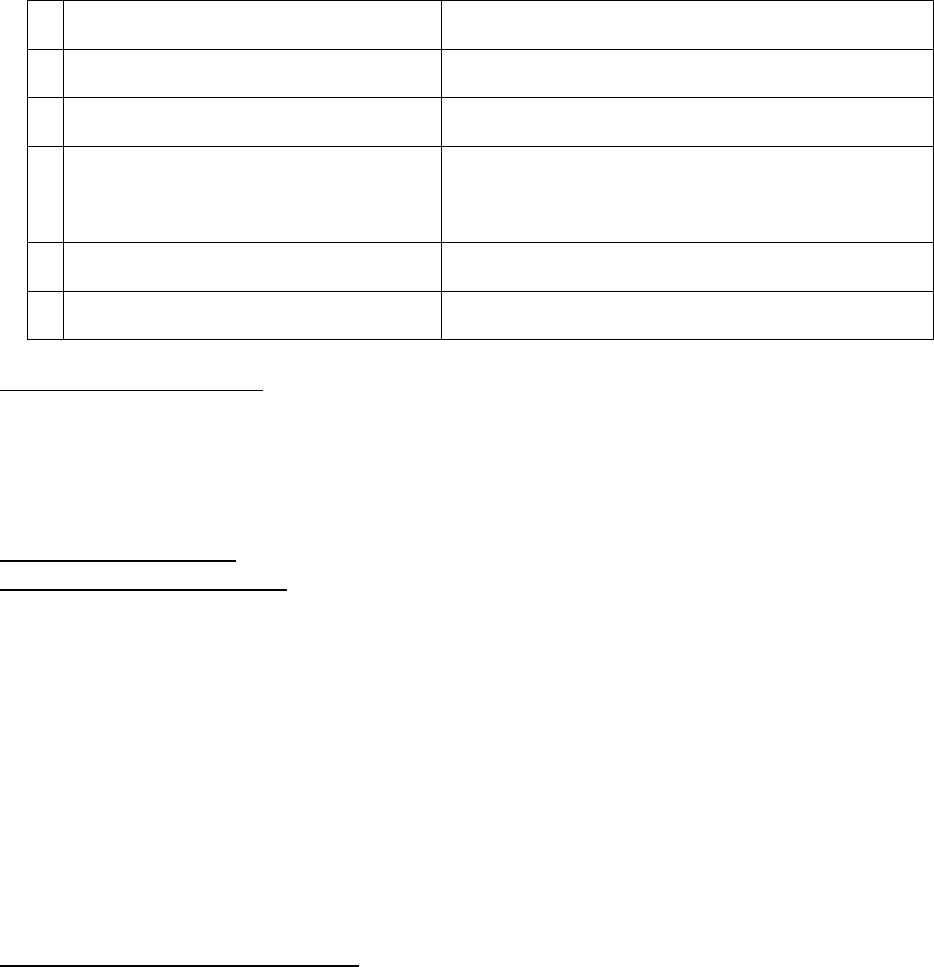

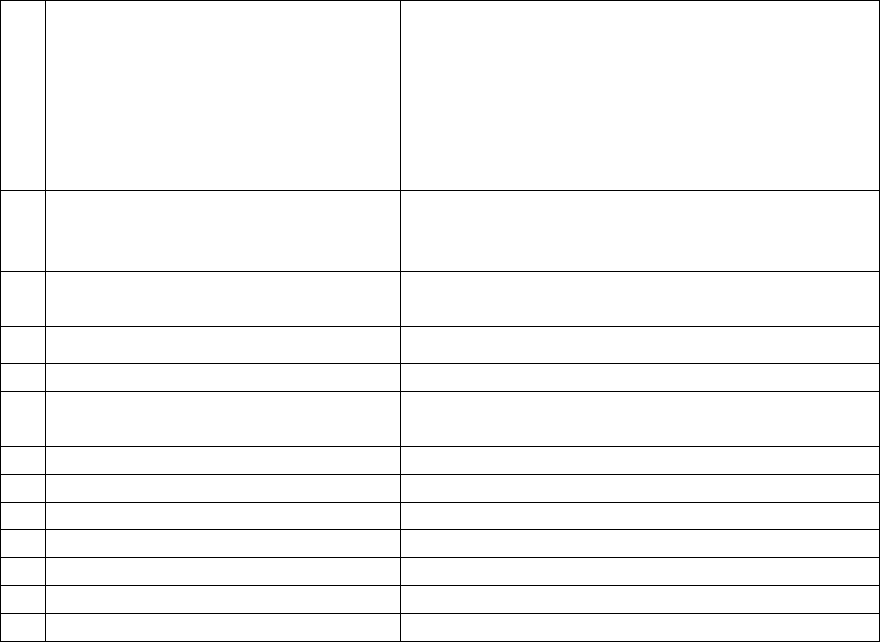

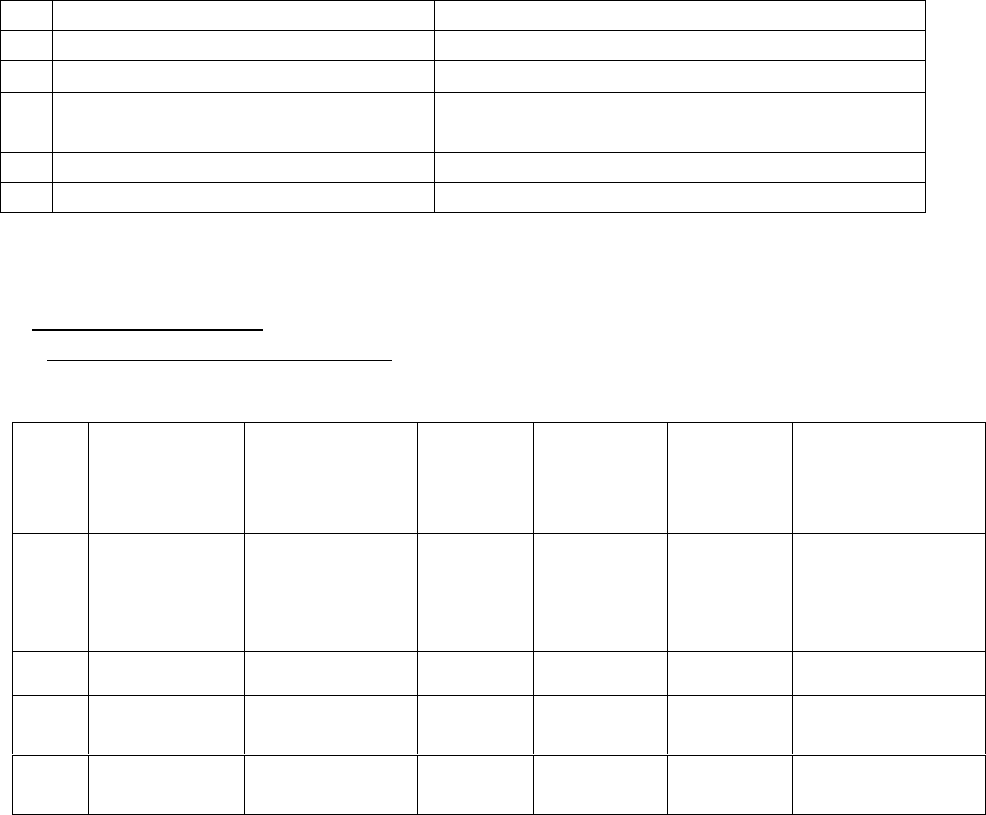

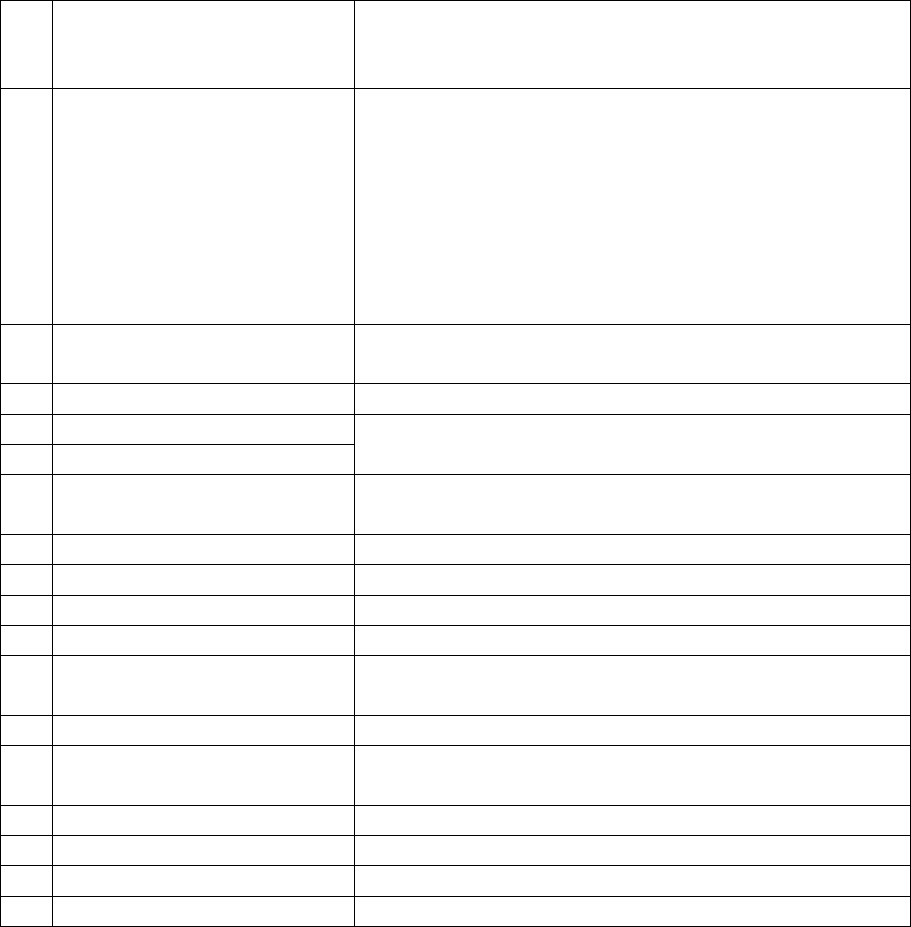

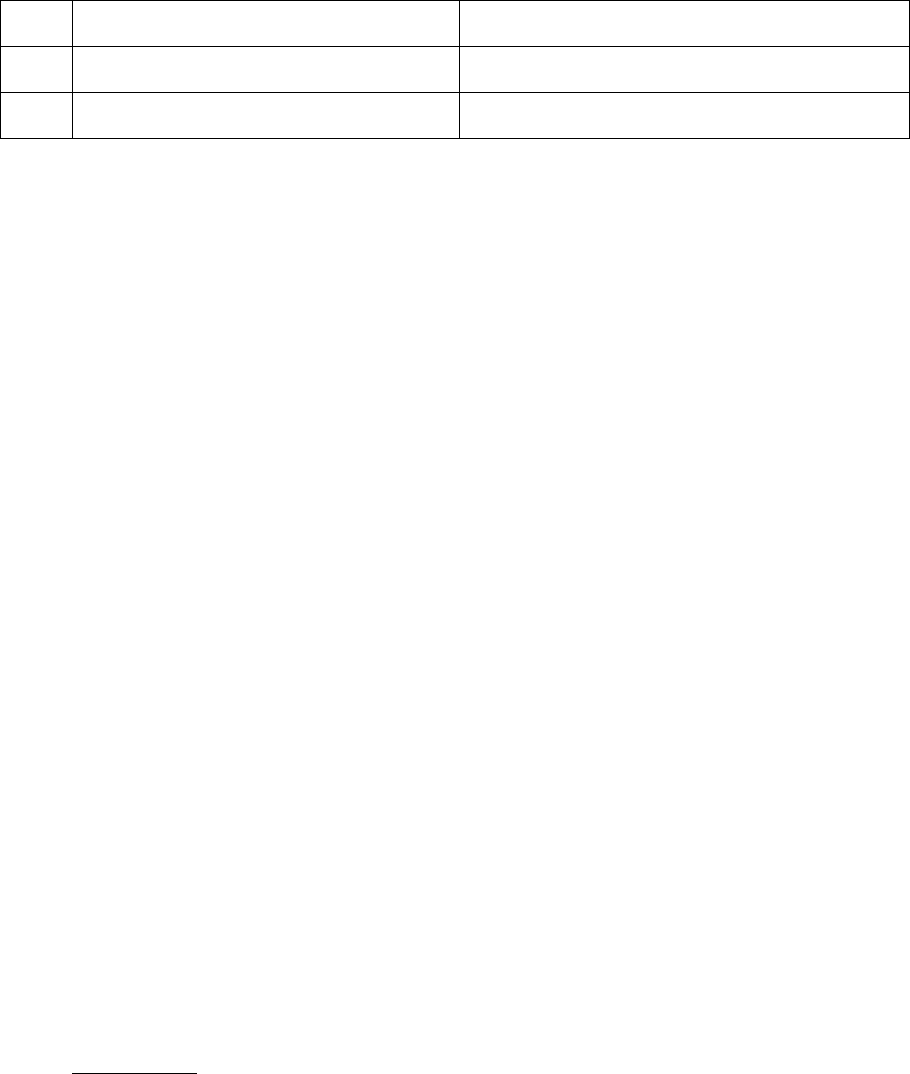

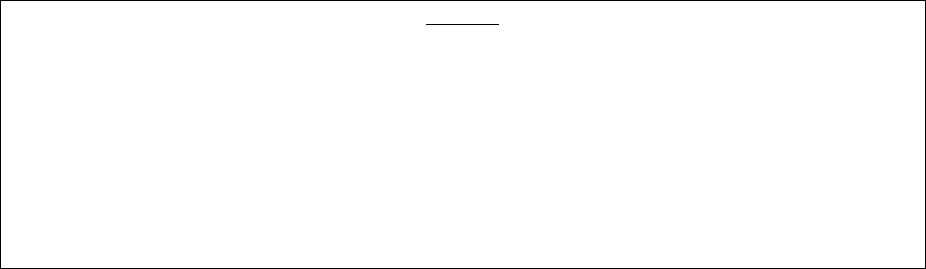

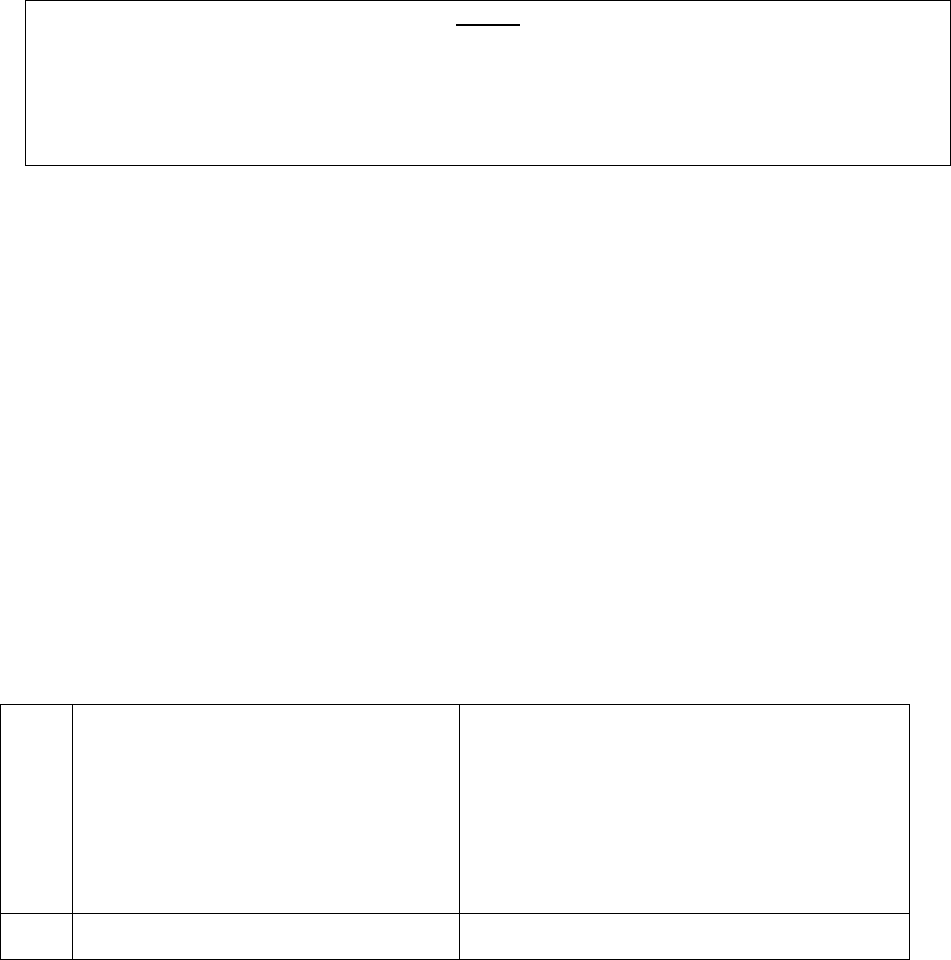

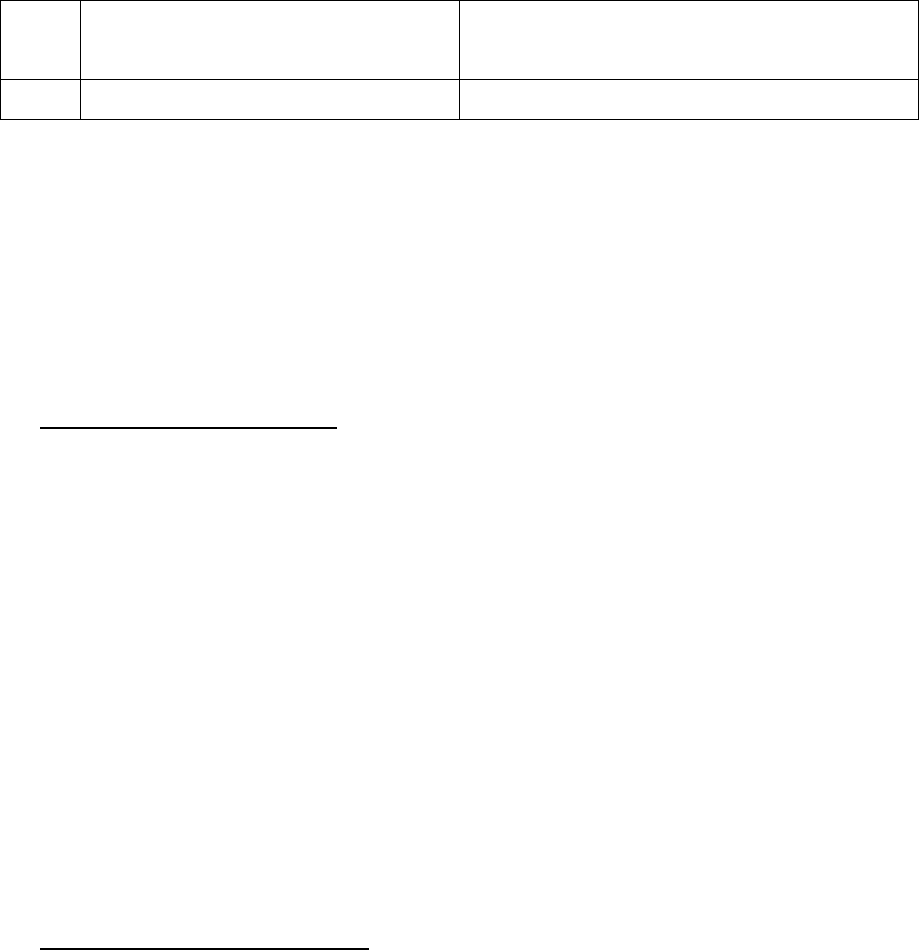

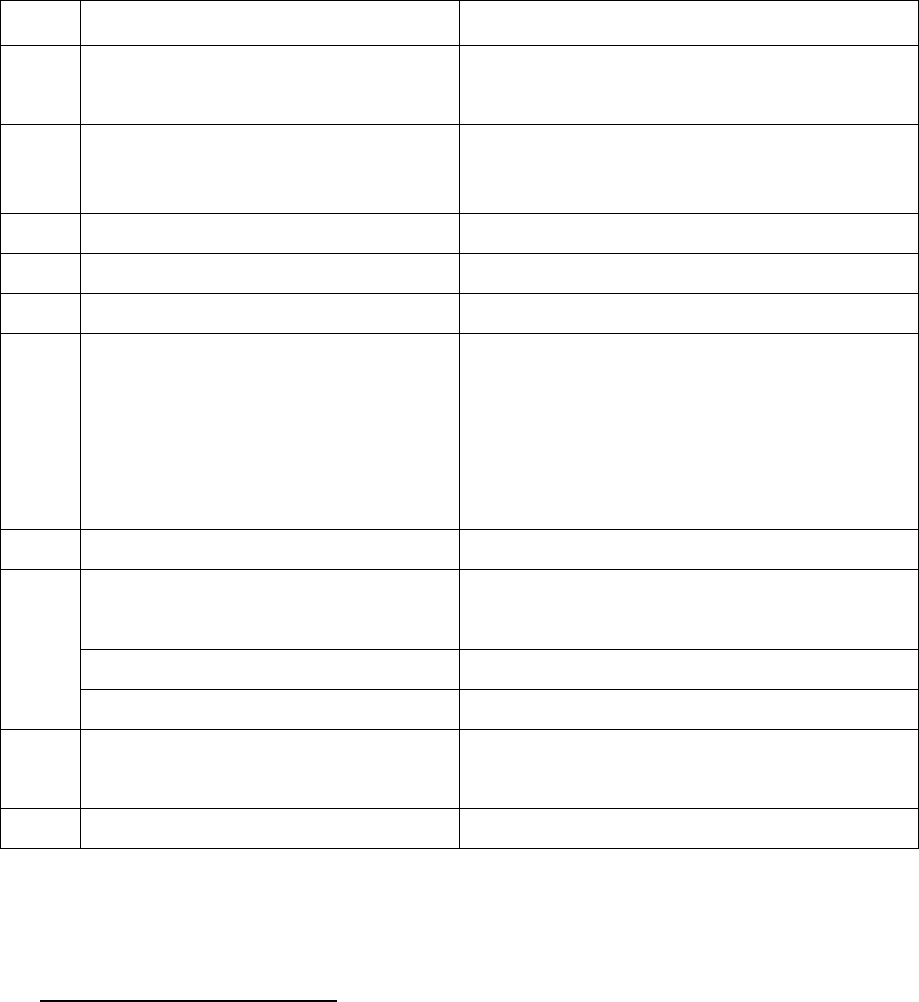

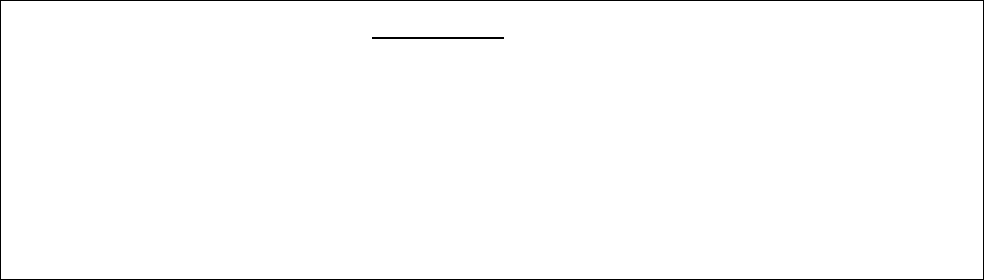

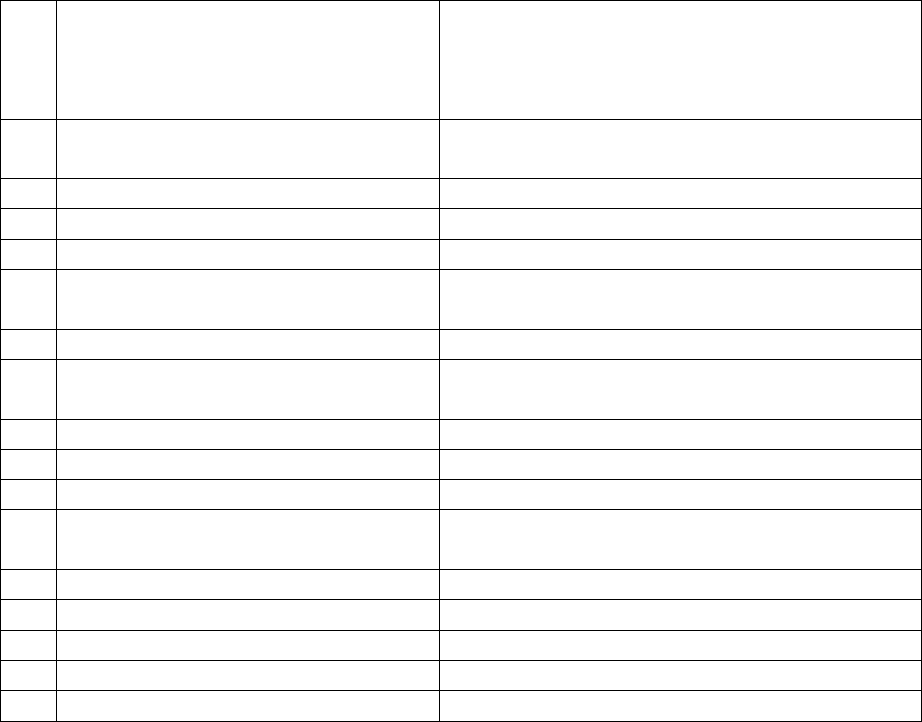

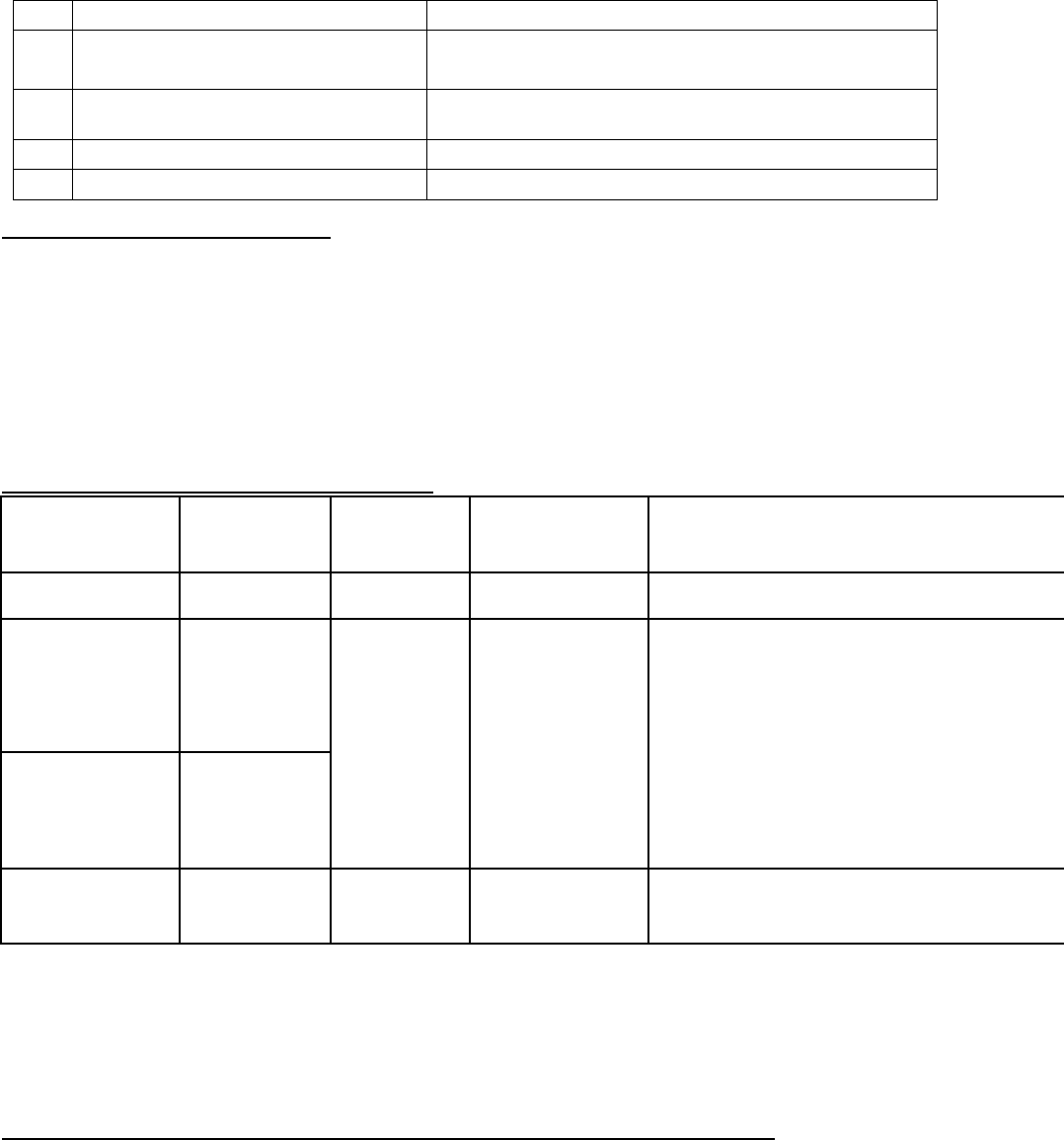

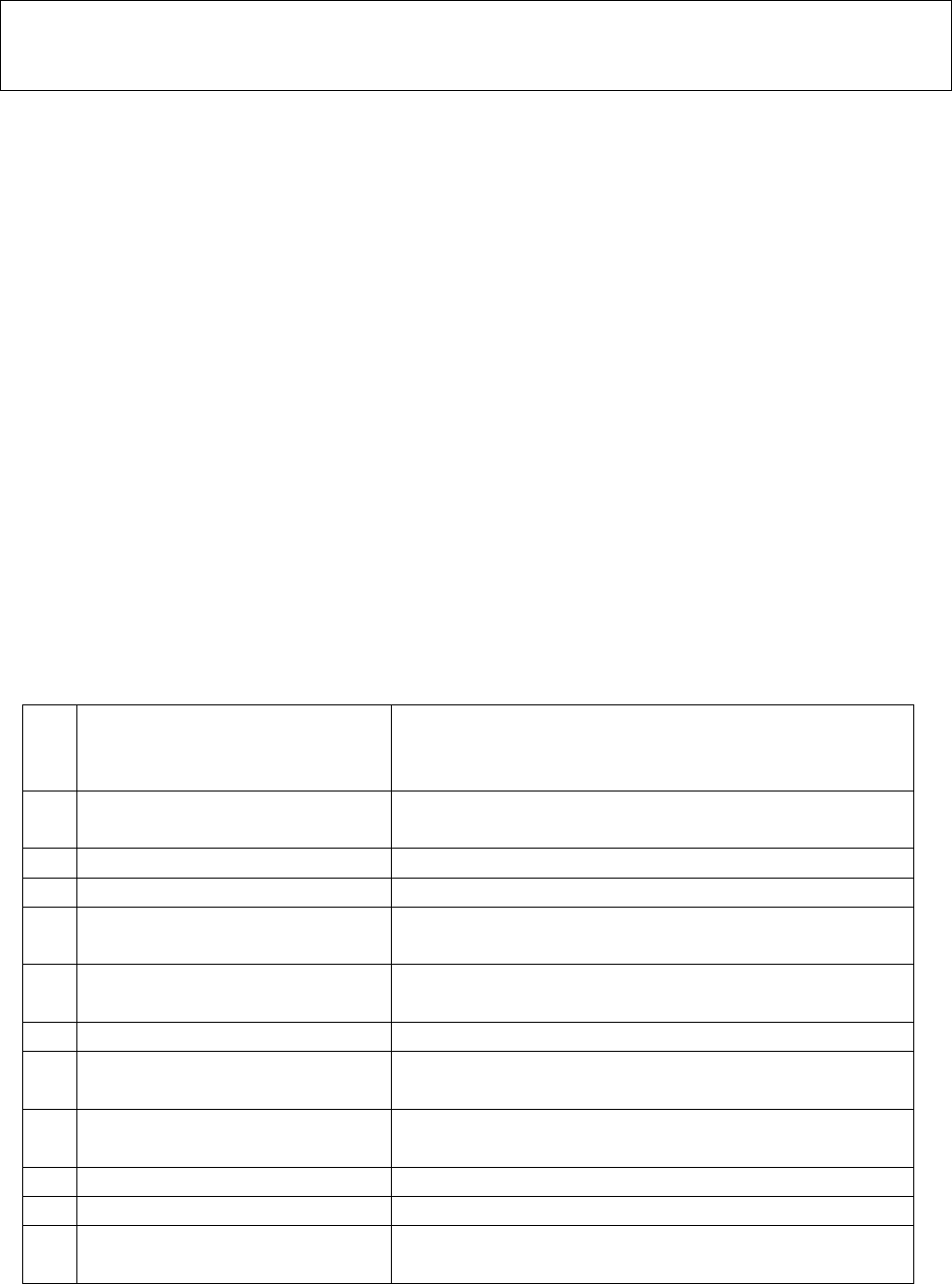

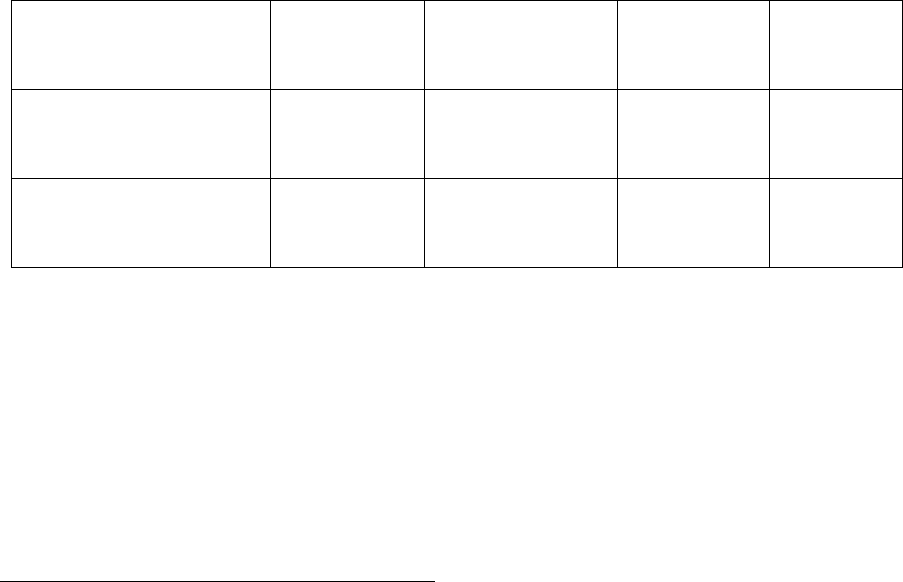

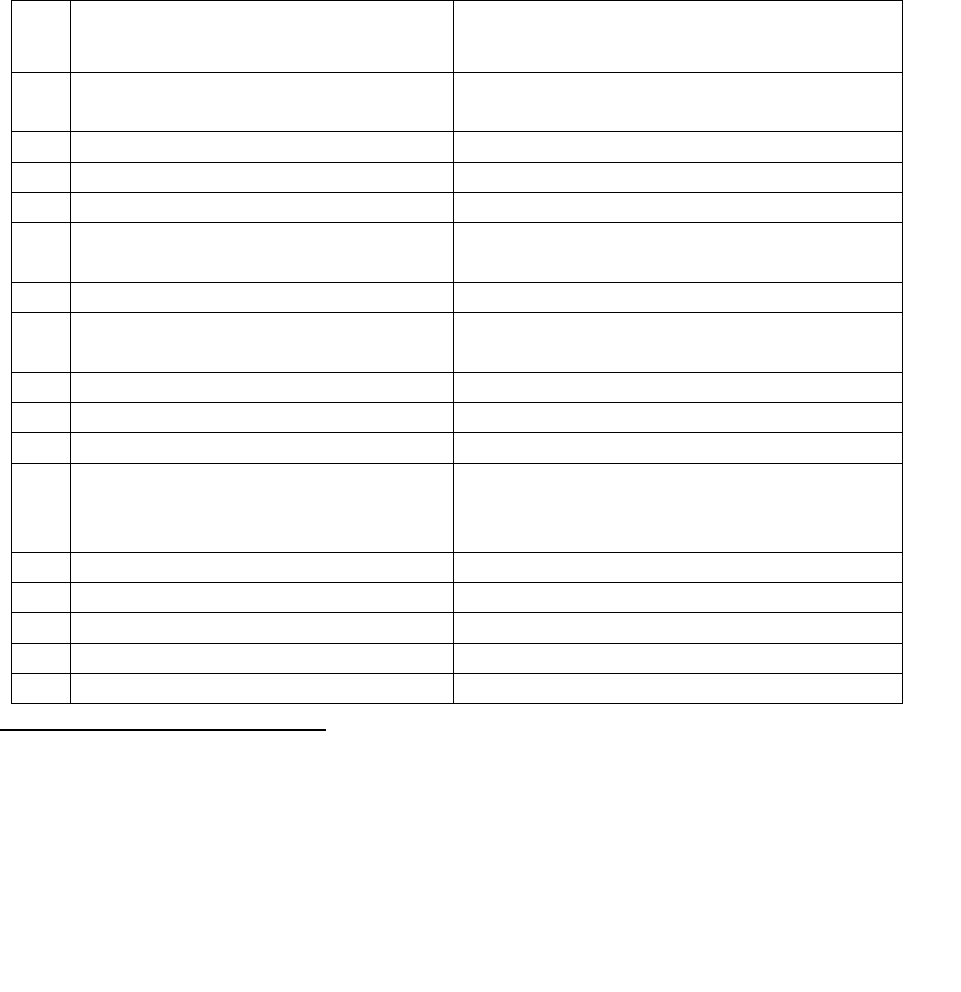

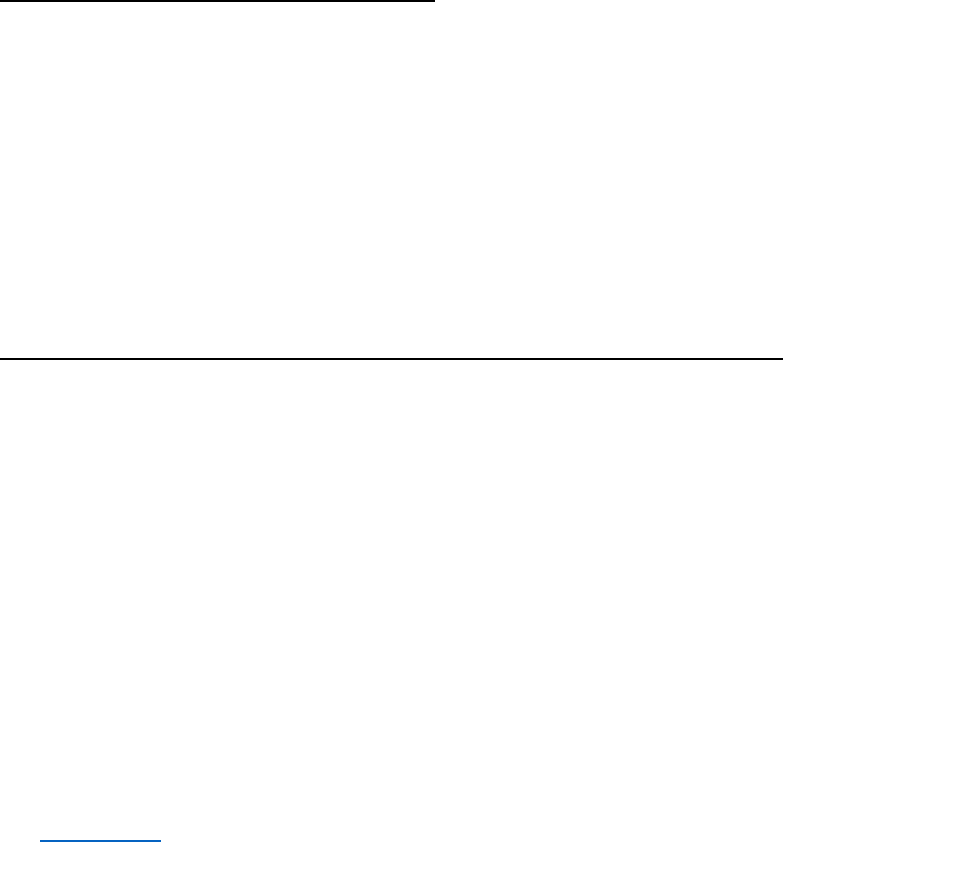

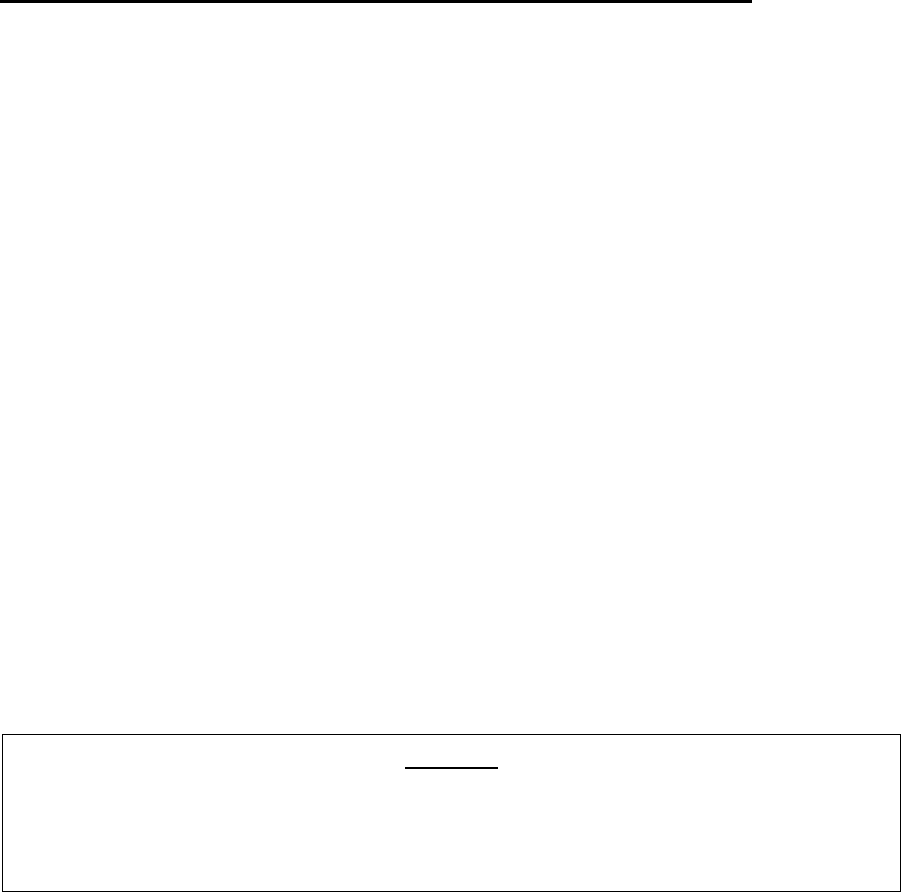

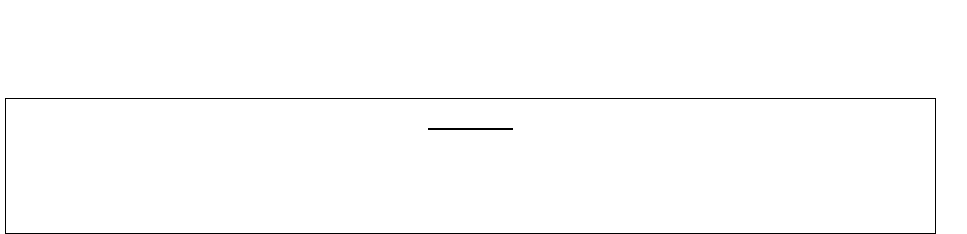

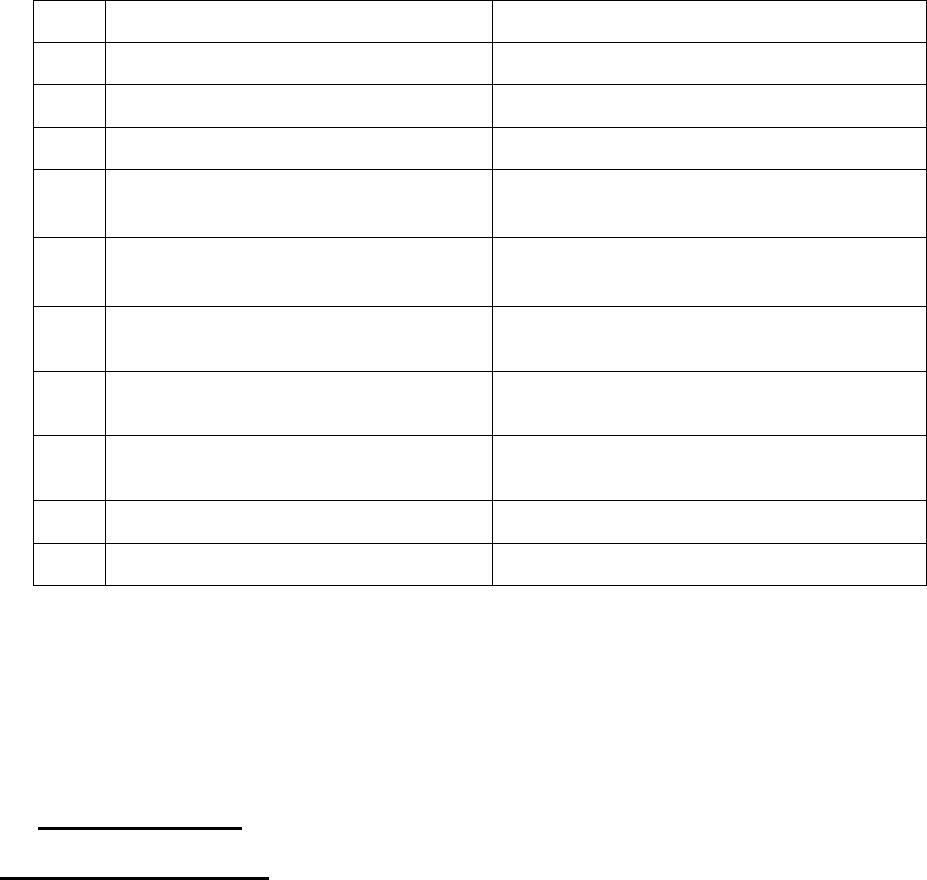

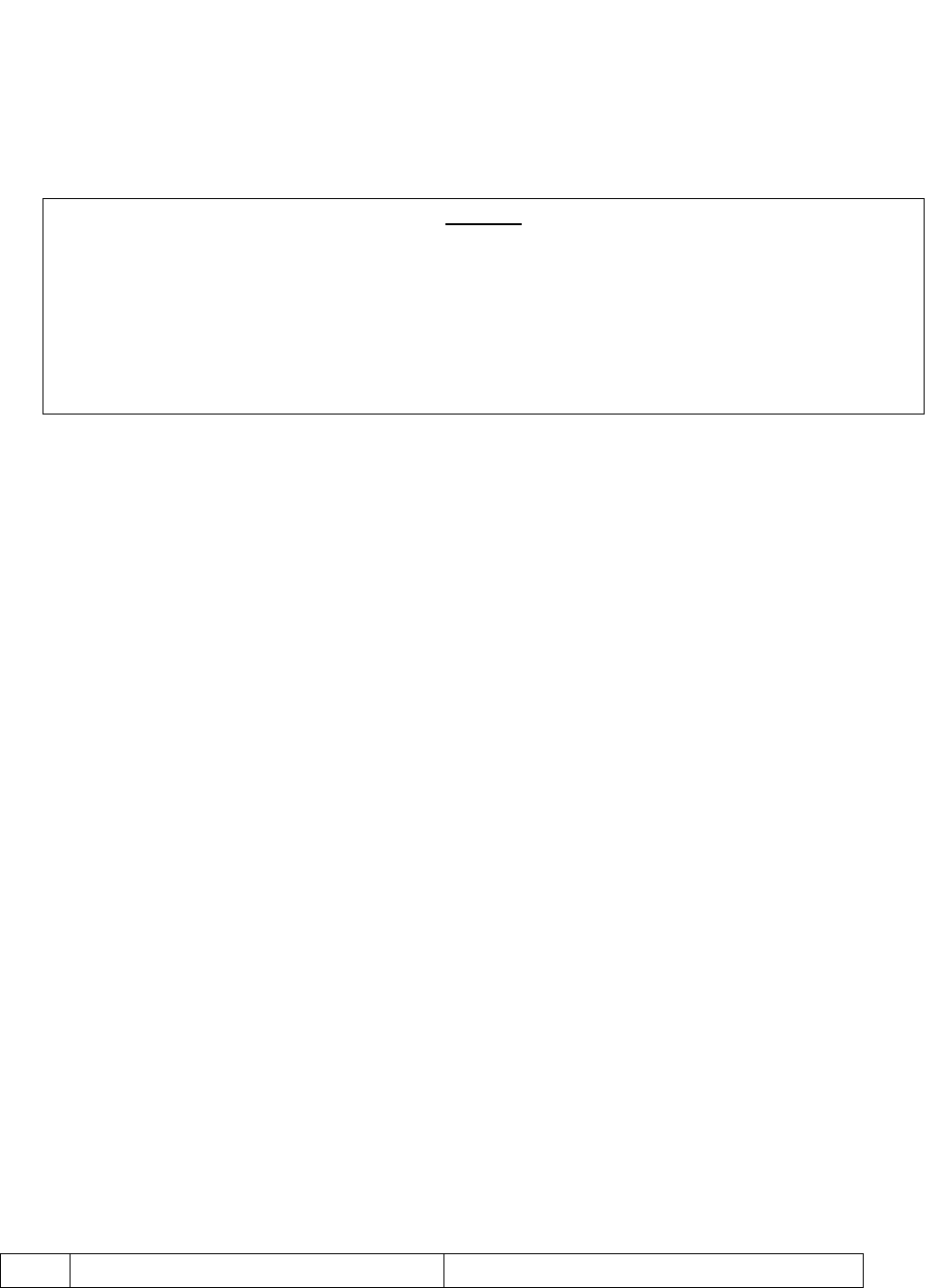

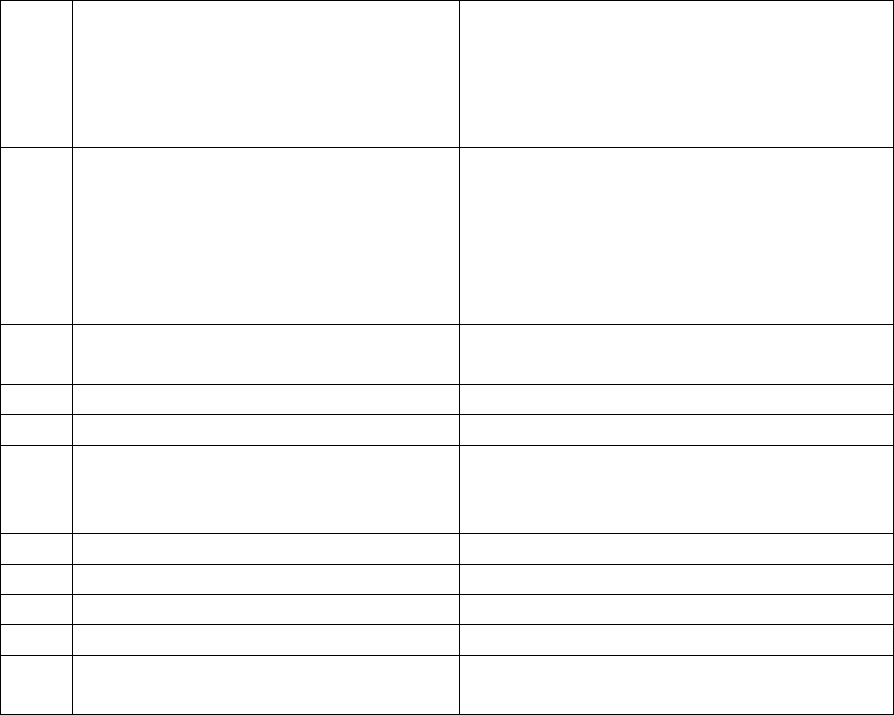

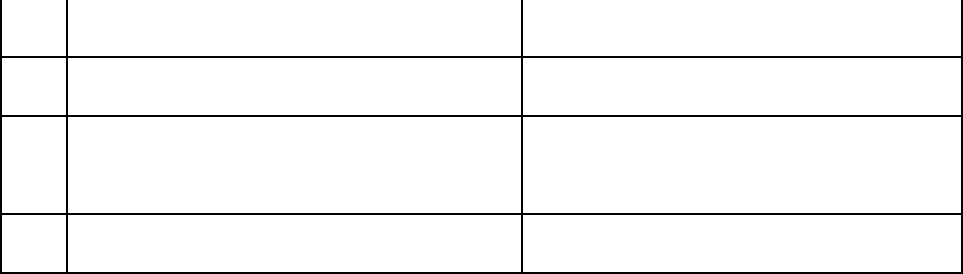

IRDA/HLT/REG/CIR/146/07/2016 dt 29.07.2016. The details of disallowed items are reproduced

below:

Bill No.

Service Type

Claimed

Amount

Deduction

Amount

Remarks – Not payable

items

086

Miscellaneous charges

880

880

Admission charges not

payable

86

Pharmacy Bill Head

6500

6500

Mask

86

Pharmacy Bill Head

1345

1345

Face Shield

86

Miscellaneous charges

660

660

Documentation charges

86

Pharmacy Bill Head

4035

4035

FACE SHIELD

86

Pharmacy Bill Head

210

210

Povidone

86

Pharmacy Bill Head

2000

2000

Gloves

86

Pharmacy Bill Head

60

60

COTTON BALS

86

Pharmacy Bill Head

99

99

GAUZE SWAB

86

Pharmacy Bill Head

1614

1614

Face Shield

86

Pharmacy Bill Head

310

310

DIGITAL THERMOMETER

86

Miscellaneous charges

3000

3000

Food Charges

86

Miscellaneous charges

60

60

Registration Charges not

payable

TOTAL

20773

20773

19. Reason for Registration of complaint:-

The complaint was registered as it falls within the scope of the Insurance Ombudsman Rules,

2017.

20. The following documents were placed for perusal.

a. Complaint along with enclosures,

b. Respondent Insurer’s SCN along with enclosures and

c. Consent of the Complainant in Annexure VIA & and Respondent Insurer in VII A.

21. Result of personal hearing with both the parties (Observations & Conclusions):

The dispute is with regard to short settlement of hospitalisation claim by RI.

Personal hearing by the way of online Video-conferencing through Goto Meet was conducted in

the said case. Mr Maurya G N (Complainant) and Mr. Neeraj (Representative of RI) presented their

case. Confirmation from all the participants about the clarity of audio and video was taken and to

which the participants responded positively.

This Forum has perused the documentary evidence available on record and the submissions made

by both the parties during the personal hearing.

Complainant has disputed the following deductions made under the claim:

1. Rs 15,494/- is deducted towards Masks, Gloves & Face Shield

2. Rs 3,000/- deducted towards Food.

The policy coverage clause is reproduced below:

“NOW THIS POLICY WITNESSETH that subject to the terms, conditions, exclusions and

definitions contained herein, or endorsed or otherwise expressed hereon, the Company

undertakes that if during the period stated in the Schedule, or during the continuance of

this policy by renewal, any INSURED PERSON shall contract any DISEASE or sustain any

INJURY and if such DISEASE or INJURY shall require any such INSURED PERSON, upon the

advice of a duly qualified MEDICAL PRACTITIONER to incur hospitalisation or DOMICILIARY

HOSPITALISATION EXPENSES for medical/surgical treatment at any HOSPITAL in India as an

inpatient, the Company will pay the amount of such expenses as would fall under different

heads mentioned below, and as are reasonably and necessarily incurred thereof by or on

behalf of such INSURED PERSON but not exceeding the sum insured for the person in any

one period of insurance as mentioned in the scheduled hereto.

a. Room, Boarding Expenses as provided by the HOSPITAL;

b. Nursing Expenses;

c. Surgeon, Anaesthetist, Medical Practitioner, Consultants, Specialist Fees;

d. Anaesthesia, Blood, Oxygen, Operation theatre Charges, Surgical Appliances,

Medicines and Drugs, Diagnostic Materials and X-Ray, Dialysis, Chemotherapy,

Radiotherapy, Cost of Pacemaker, artificial Limbs and similar expenses.”

Government of Karnataka vide notification no HFW 228 ACS2020 dt 23.06.2020 notified that

“in exercise of the powers conferred under the Disaster Management Act, 2005, the

undersigned in his capacity of chairman of the State Executive committee, under the

Powers vested under Section 24(f) and Section 24(l) of the Disaster Management Act, 2005,

issues the following orders to share the number of beds in private hospitals between

Government referred and Private patients and to regulate the package rates to be charged

by the PHPs for the treatment of Government referred COVlD-19 patients and the package

rate ceiling for treating Private COVID-19 patients

1. …

2. The following package rates inclusive of PPEs and other consumables shall apply for

the treatment of COVID Patients:

(a) …

(b) Package rate ceilings for private COVID-19 patients directly admitted by PHPs

making cash payment (non-insurance) shall be as follows

(1) General ward - Rs.10,000/-

(2) HDU - Rs.12,000/-

(3) Isolation ICU without ventilator - Rs.15,000/-

(4) Isolation ICU with ventilator Rs.25.000/-“

Thus Government of Karnataka has prescribed ceiling package rates to be charged by Hospitals for

treatment of COVID-19 positive patients. Though para 3 of the aforementioned notification states that

these rates are not applicable for patients subscribing to insurance packages, the Forum finds that they

represent the usual and customary charges as per policy definition:

“REASONABLE AND CUSTOMARY CHARGES means the charges for services or supplies,

which are the standard charges for the specific provider and consistent with the prevailing

charges in the geographical area for identical or similar services, taking into account the

nature of the illness / injury involved.”

Forum further finds that RI has taken the room category as ICU during the time of settlement.

Therefore per diem rate of Rs 15,000/- is payable to complainant as per aforementioned circular.

Thus the total package rate for hospitalisation of 5 days shall be Rs 75,000/- under reasonable and

customary charges.

Forum takes cognisance of the certificate dt 21.10.2020 issued by the Hospital stating that

separate billing for N-95 masks, face shield and encore Hand glove was required for the safety of

the staff. However the package rate given by Government of Karnataka is inclusive of all individual

itemised charges including but not limited to nursing charges, investigations including COVID-19

testing, food, drugs and consumables and PPE kits.

Since claim has already been settled for Rs 1,00,569/- towards the main hospitalisation bill under

cashless facility, the argument of the complainant that his claim has not been fully settled is not

established. The Forum notes that having settled an amount higher than the eligible amount, no

recovery of the same can be made by RI. In the interest of complainant, the Forum maintains the

status quo in regard to claim settlement. The complaint is disallowed.

A W A R D

Taking into account of the facts and circumstances of the case and the submissions made by both

the parties and documents submitted, the Forum maintains the status quo in respect of claim

settlement made by the RI.

The Complaint is Disallowed.

Dated at Bangalore on the 15

th

day of January, 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – NEERJA SHAH

In the matter of MRS. JAGADAMBA Vs THE NATIONAL INSURANCE COMPANY LIMITED

Complaint No: BNG-H-048-2021-0425,0427,0429,0430,0431,0432,0433,0434,0435,

0438,0439,0440,0442,0444,0446,0449,0450

Award No.: IO/(BNG)/A/HI/0261 to 0277/2020-21

1

Name & Address of the Complainant

Mrs. Jagadamba

W/o Late Sri C K Parthasarathy, #70/2A

Prakruthi 6th Cross, Janatha Colony

Hulimavu, Bannerghatta Road

Bangalore, Karnataka – 560076

Mobile: 9986975481

Email: [email protected]

2

Policy Number

Type of Policy

Duration of Policy/ Policy Period

603901501810004113

Individual Mediclaim

01.02.2019 to 30.01.2020

3

Name of the Policyholder/Proposer

Name of the Insured

Mr. Parthasarthy C K

Mr. Parthasarthy C K

4

Name of the Insurer

The National Insurance Company Limited

5

Date of repudiation

20.02.2020 to 28.03.2020 (various dates listed in

the table of Observations and Conclusions)

6

Reason for repudiation

Insured underwent a day care procedure which

is beyond the scope of the policy.

7

Date of receipt of the Annexure VI-A

17.11.2020

8

Nature of complaint

Denial of health claim

9

Amount of claim

₹2,94,397/-

10

Date of Partial Settlement

NA

11

Amount of relief sought

₹2,94,397/-

12

Complaint registered under Rule no:

13 (1) (b) of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

13.01.2021 / Online VC

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Absent

15

Complaint how disposed

Disallowed

16

Date of Award/Order

19.01.2021

17. Brief Facts of the Case:-

The complaint emanated from repudiation of health claims (17 nos.) by the Respondent insurer

(hereafter referred to as RI). Complainant represented to Grievance Redressal Officer of RI to

reconsider the claim. However her plea was not considered favourably. Hence complainant

approached this Forum for resolution of her grievance.

18. Cause of Complaint:-

a) Complainant’s arguments:-

Complainant submitted that her husband Mr. Parthasarthy C K (Insured Person- hereby referred

as IP) was insured under policy no. 603901501810004113 for the period of 01.02.2019 to

31.01.2020. IP was a patient of multiple myeloma (plasma cell cancer in bone marrow), and he

was undergoing chemotherapy treatment at Fortis Hospital, Bannerghatta Road, Bangalore.

Reimbursement claims for all the medical bills were submitted to National Insurance Co. Ltd. and

United India Insurance Co. Ltd. All the 17 claims were rejected by the National Insurance Co. Ltd.

whereas other claims similar to these applied previously with United India Insurance were

reimbursed. Despite representing GRO of RI, the claims were not settled. Hence complainant

approached this Forum for resolution of her grievance.

b. Respondent Insurer’s Arguments:-

The Respondent Insurer submitted in their Self-Contained Note (SCN) vide letter dated 06.11.2020

that a mediclaim insurance policy was issued to Mr. Parthasarthy C K covering himself and his

spouse vide policy no: 603901501810004113 for the period of 01.02.2019 to 31.01.2020 with a

floater sum insured of ₹3,00,000/-. IP was a known case of multiple myeloma diagnosed in 2012,

status post autologous PBSCT in 2013, relapse in 2019. He has received four cycles of CyBorD

Chemotherapy. As he was in stringent CR, taken up for autologus PBSCT. Multiple relapses since

then and is on maintenance treatment for the same.

Final Diagnosis:

o Relapsed multiple myeloma

o Diagnosed with multiple myeloma in 2012,CYBORD 4 cycles

o Autologous PBSCT in 2013

o Relapse in 2015, 4 cycles of CYBORD

o Relapse in 2017,radiotherapy for plasmacytoma

o Relapse in 2019, started on KPD

Reason for the Repudiation:

The patient was admitted and discharged on the same day. Hence, 24 hours hospitalisation was

not completed.

As per the policy definition, hospitalisation is covered as follows:

"6.20 Hospitalisation means admission in a hospital for a minimum period of twenty four

consecutive hours except for specified procedures/treatments, where such admission could

be for a period of less than twenty four consecutive hours."

Additionally, the policy also covers Day Care treatment as follows:

"6.12 Day care procedure means medical treatment, and/or surgical procedure which is:

a) undertaken under General or Local Anaesthesia in a hospital/day care centre in less than

24 (twenty four) hrs because of technological advancement, and

b) which would have otherwise required a hospitalisation of more than 24 (twenty four)

hours.

Treatment normally taken on an out-patient basis is not included in the scope of this

definition."

As per the day care list attached with the policy, Chemotherapy is covered under Day Care.

However, as evident from the claim documents, Injection Carfilzomib was administered; whereas

the policy covers Parenteral Administration of Chemotherapeutic agents only. As Carfilzomib is a

Proteasome Inhibitor (Targeted/lmmuno Therapy) and is not a parenteral Chemotherapy drug.

Hence, it is not covered as a day care procedure.

19. Reason for Registration of complaint:-

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017.

20. The following documents were placed for perusal:-

a. Complaint along with enclosures,

b. Respondent Insurer’s SCN along with enclosures and

c. Consent of the Complainant in Annexure VIA & and Respondent Insurer in VII A

21. Result of personal hearing with both the parties (Observations & Conclusions):-

The dispute is for non payment of health claim under the policy.

Personal hearing by the way of online Video-conferencing through GoTo Meet was conducted in

the said case. Complainant (Mrs. Jagadamba) joined and presented her case. RI could not connect

to the VC link. Confirmation about the clarity of audio and video was taken to which the

participants responded positively.

Complainant reiterated her earlier submissions. He submitted that the claim for the similar

treatment was previously settled by United India Insurance Co. Ltd.

This Forum has perused the documentary evidence available on record and the submissions made

by complainant during the personal hearing. The complainant was asked to produce the relevant

documentary proof of settlement made by the previous Insurer for the earlier claims. This Forum

did not receive any supporting documents by the complainant till the date of this order.

Forum notes that IP was diagnosed with multiple myeloma in year 2012 and was undergoing

scheduled Chemotherapy in Fortis Hospital, Bannerghatta Road, Bangalore.

Complainant preferred health reimbursement claim under the policy for the medical expenses

incurred. The claims were rejected by the RI as per the Clause 6.20 and 6.12 of the policy which

are reproduced as under:

6.20 Hospitalisation means admission in a hospital for a minimum period of twenty four

consecutive hours except for specified procedures/ treatments, where such admission

could be for a period of less than twenty four consecutive hours.

6.12 Day care treatment means medical treatment, and/or surgical procedure (as listed in

Annexure I) which is:

(i) undertaken under general or local anesthesia in a hospital/day care centre in less than

twenty four hrs because of technological advancement, and

(ii) which would have otherwise required a hospitalisation of more than twenty four hours.

Treatment normally taken on an out-patient basis is not included in the scope of this

definition.

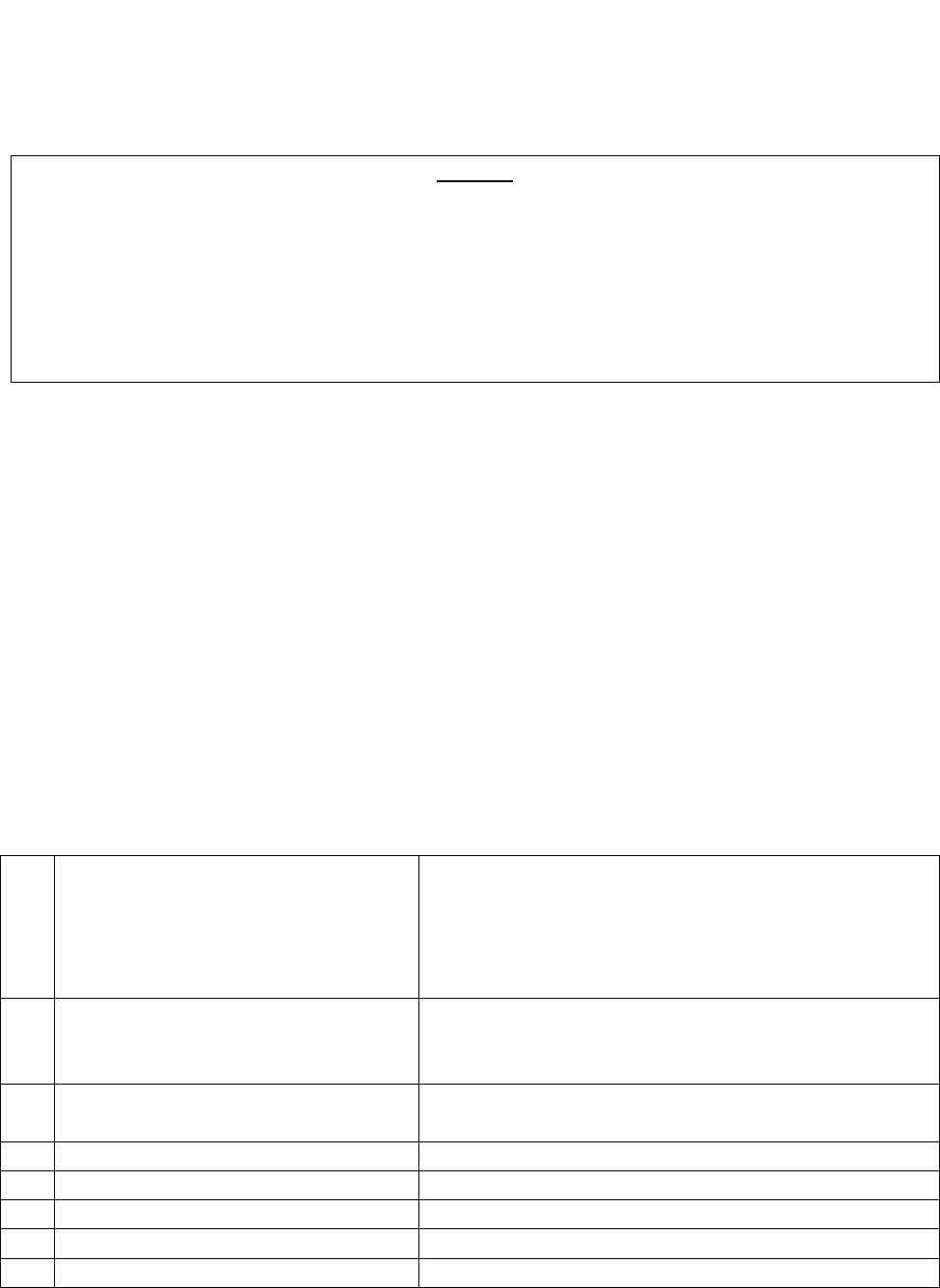

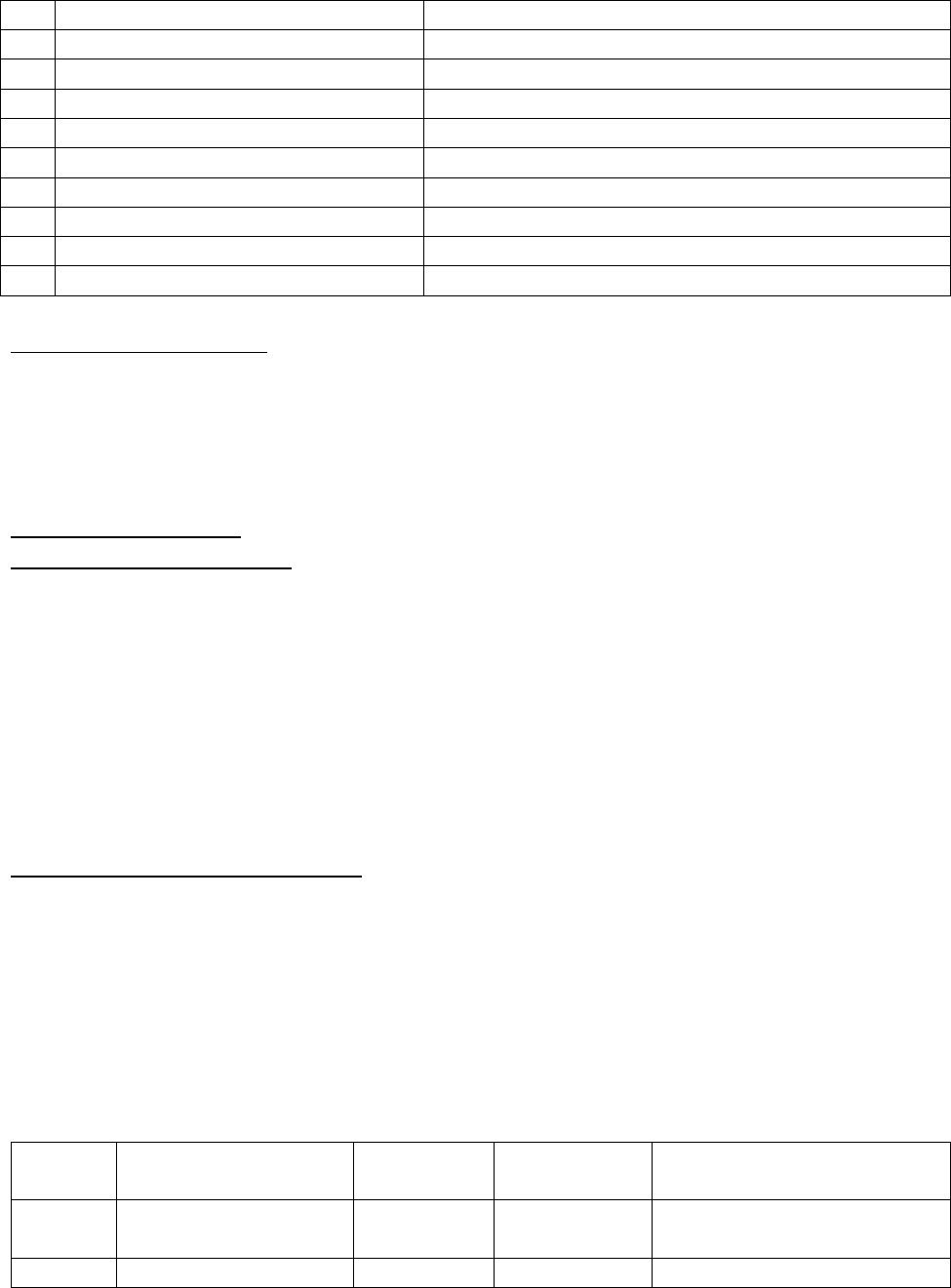

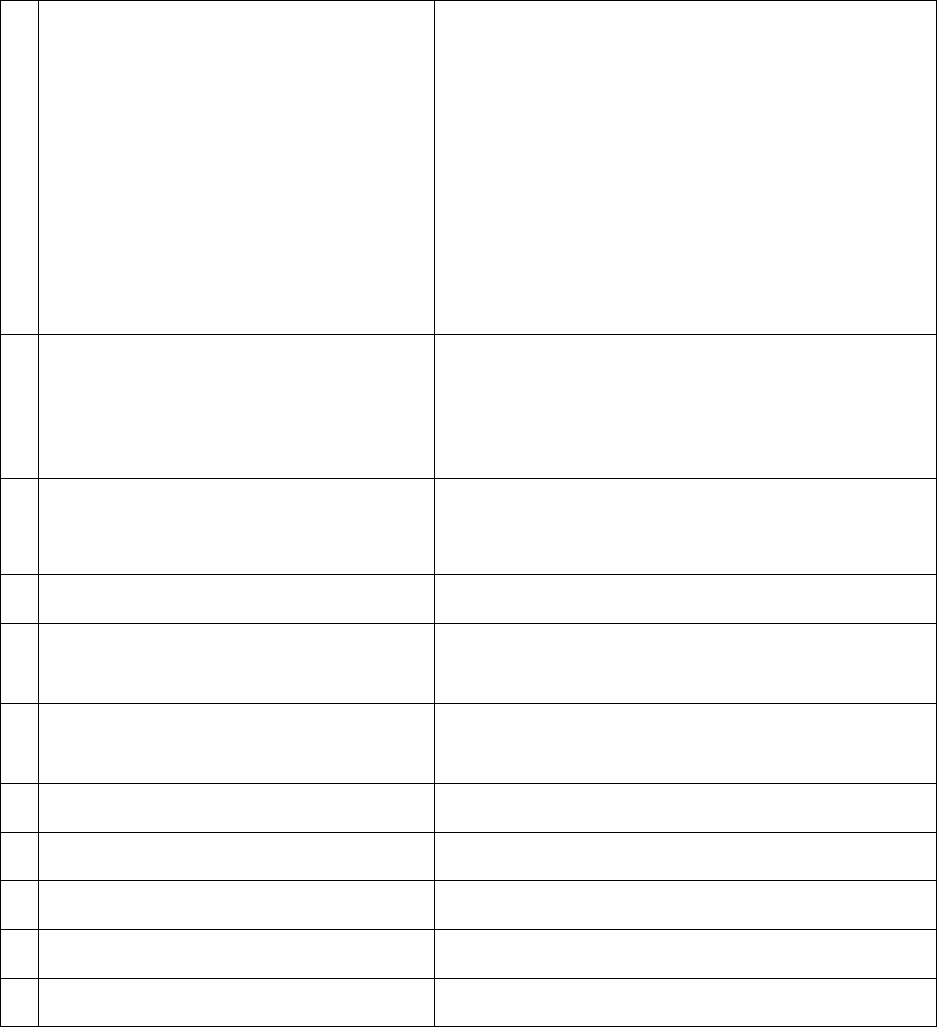

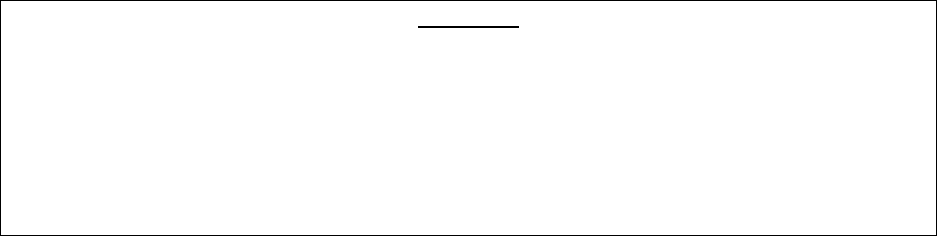

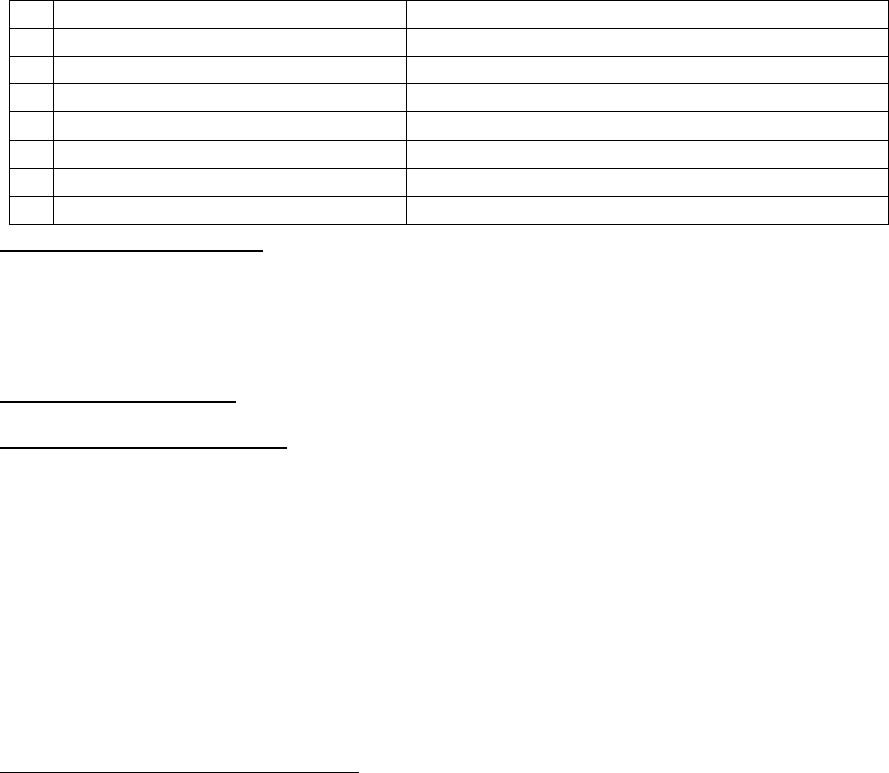

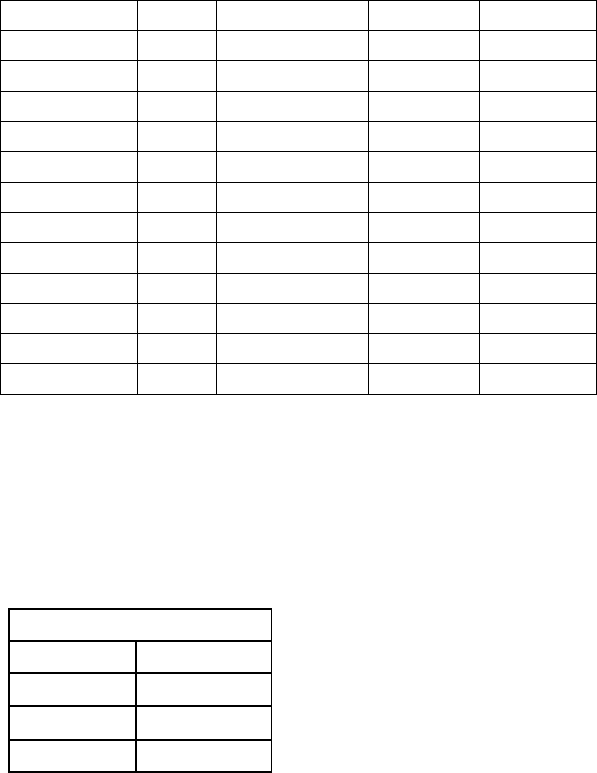

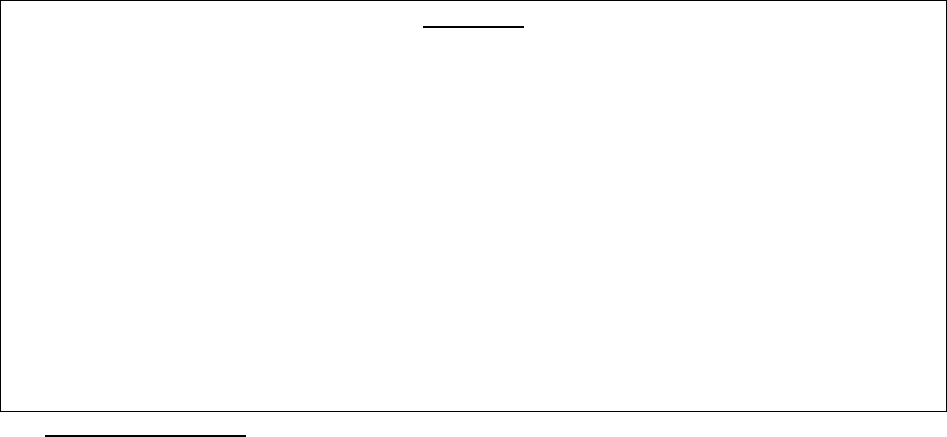

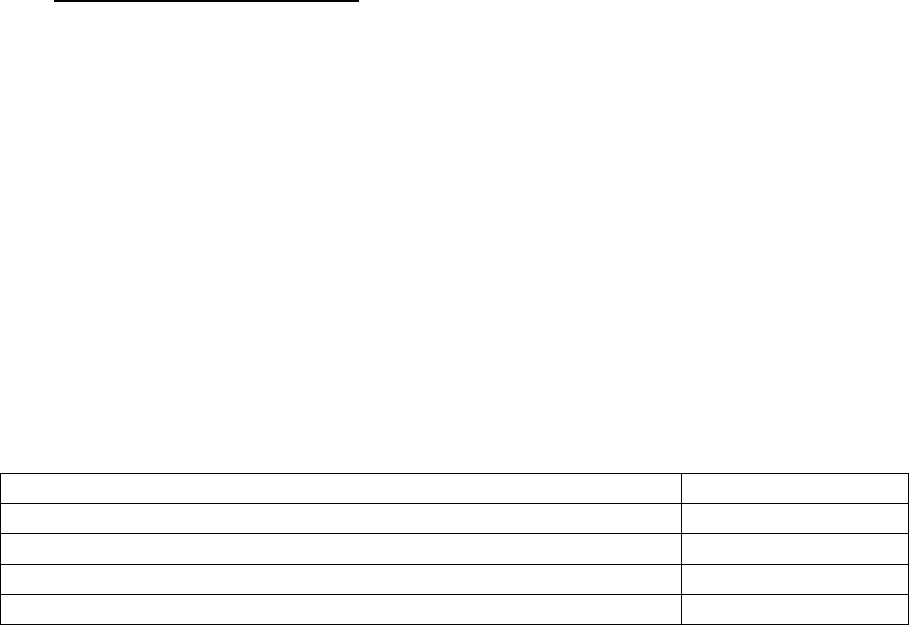

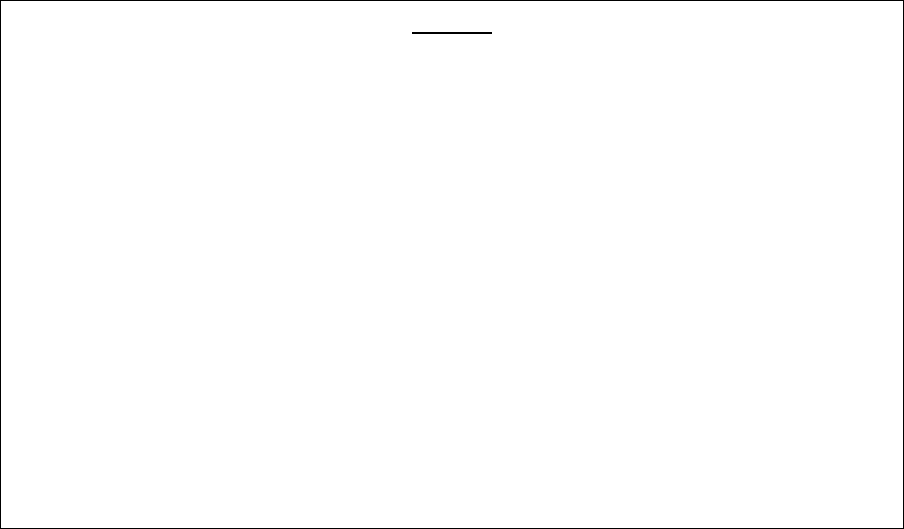

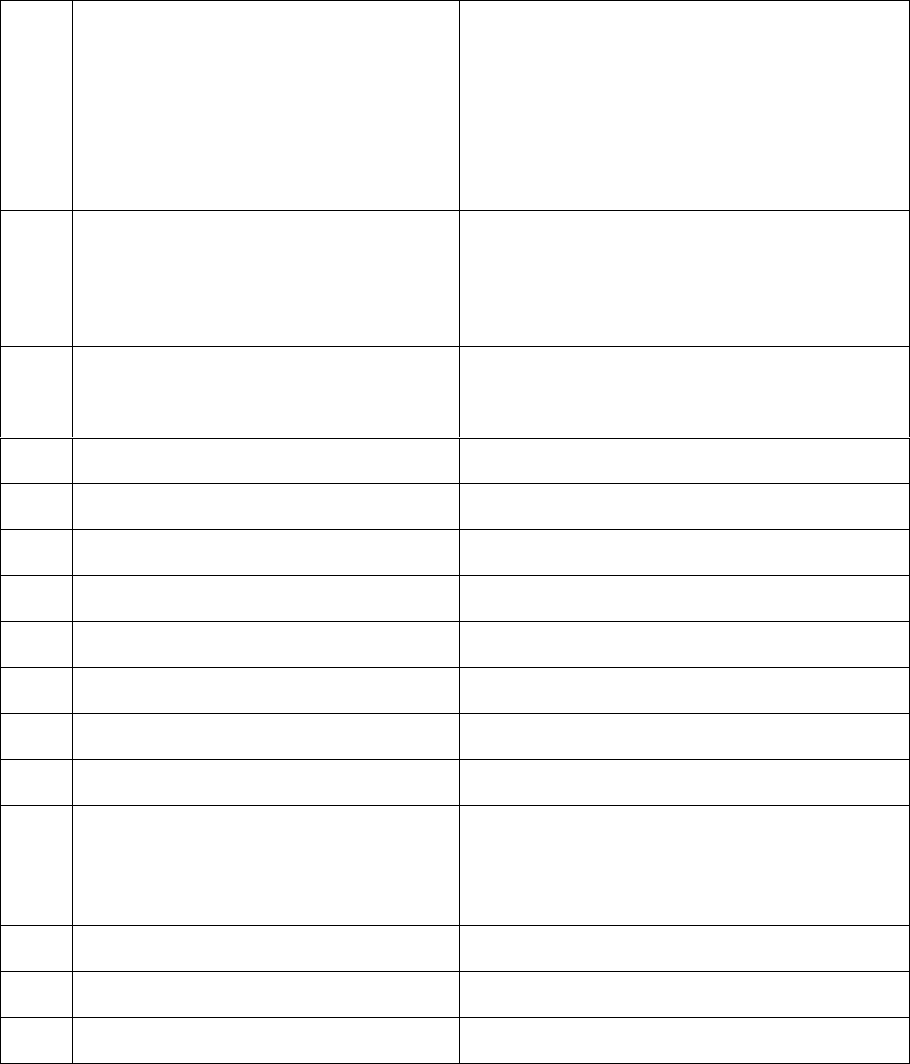

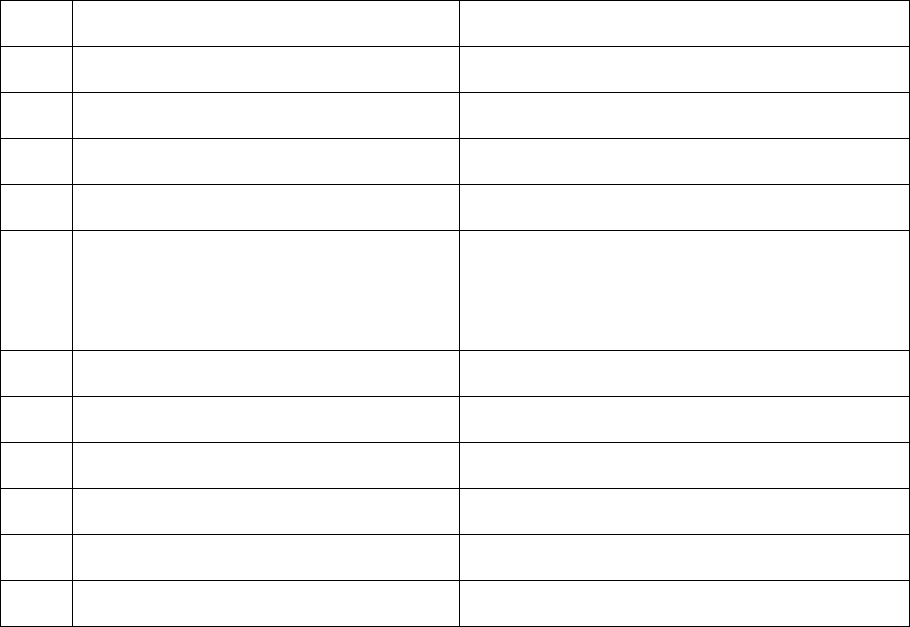

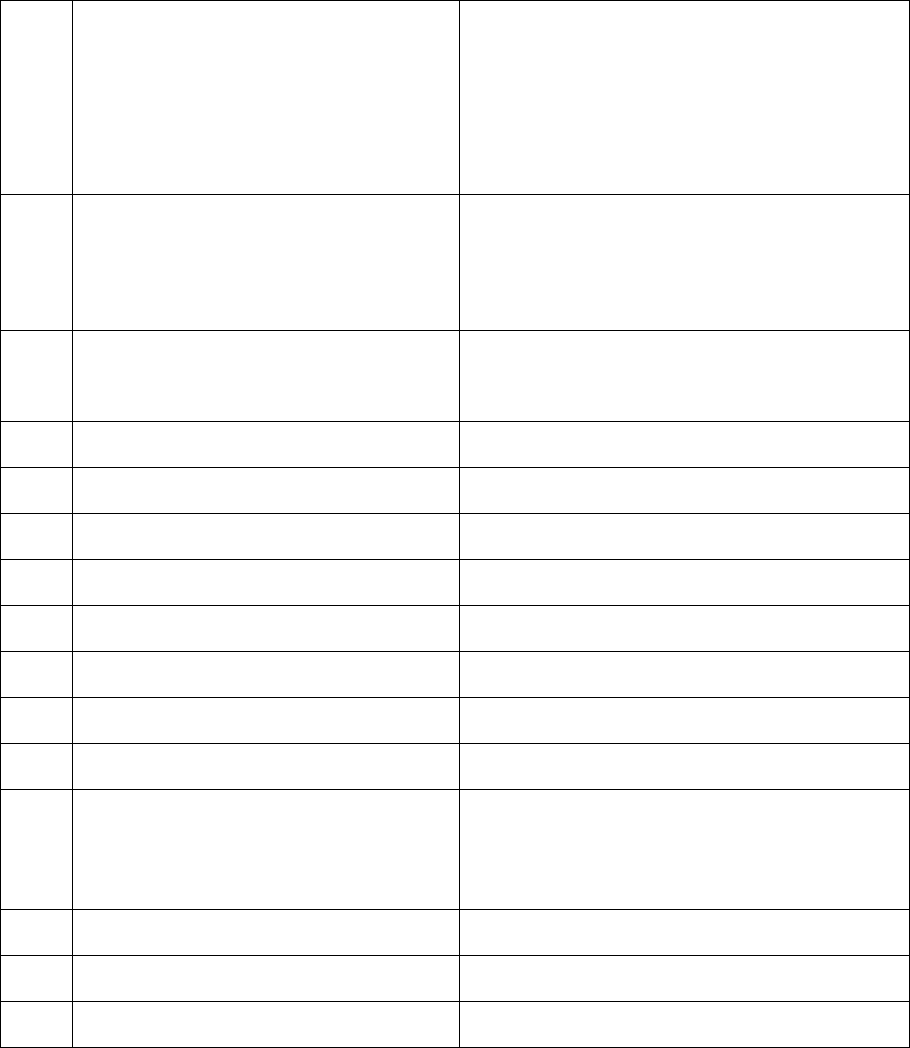

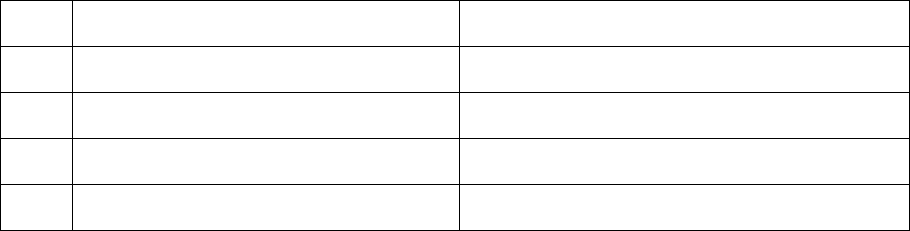

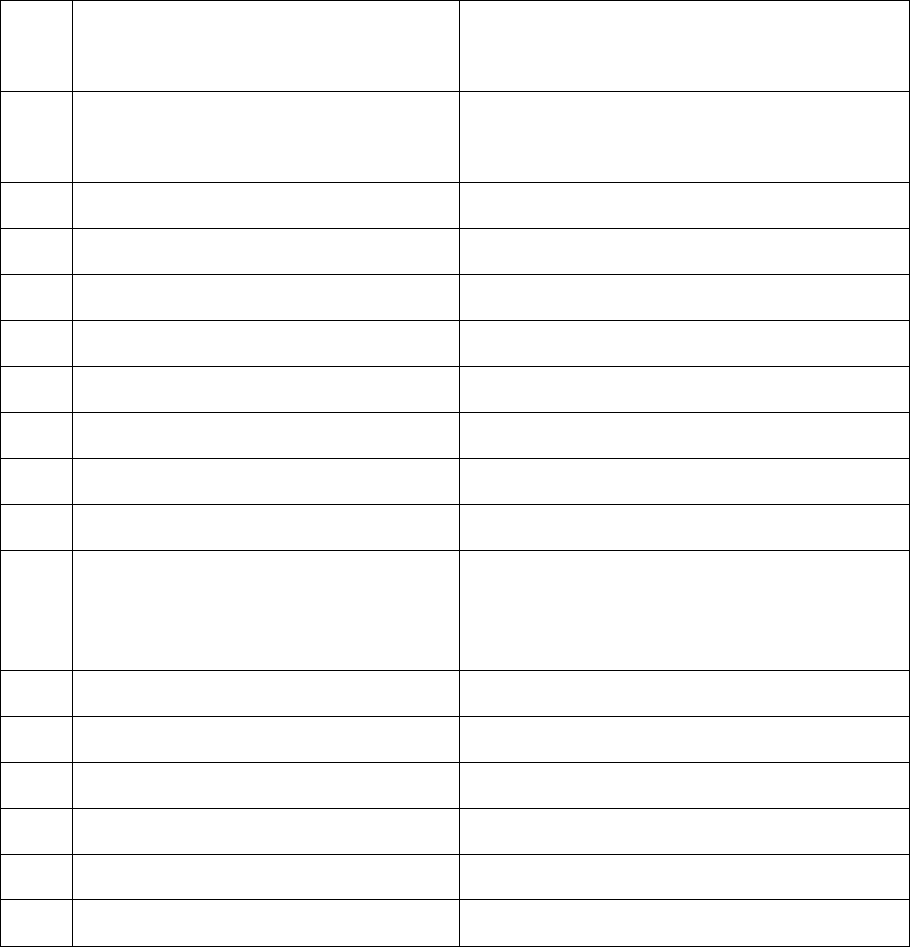

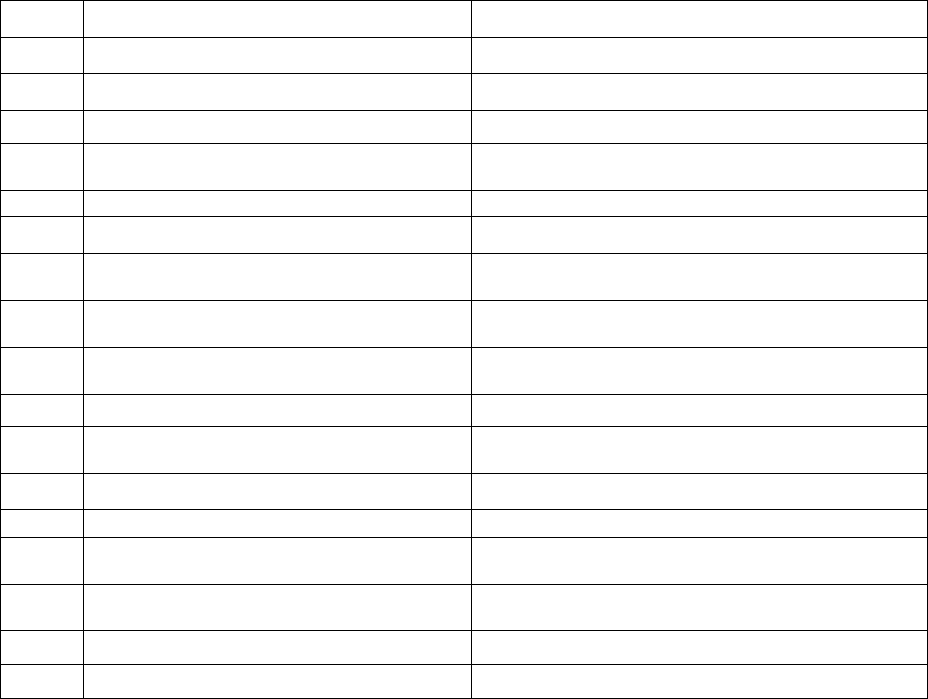

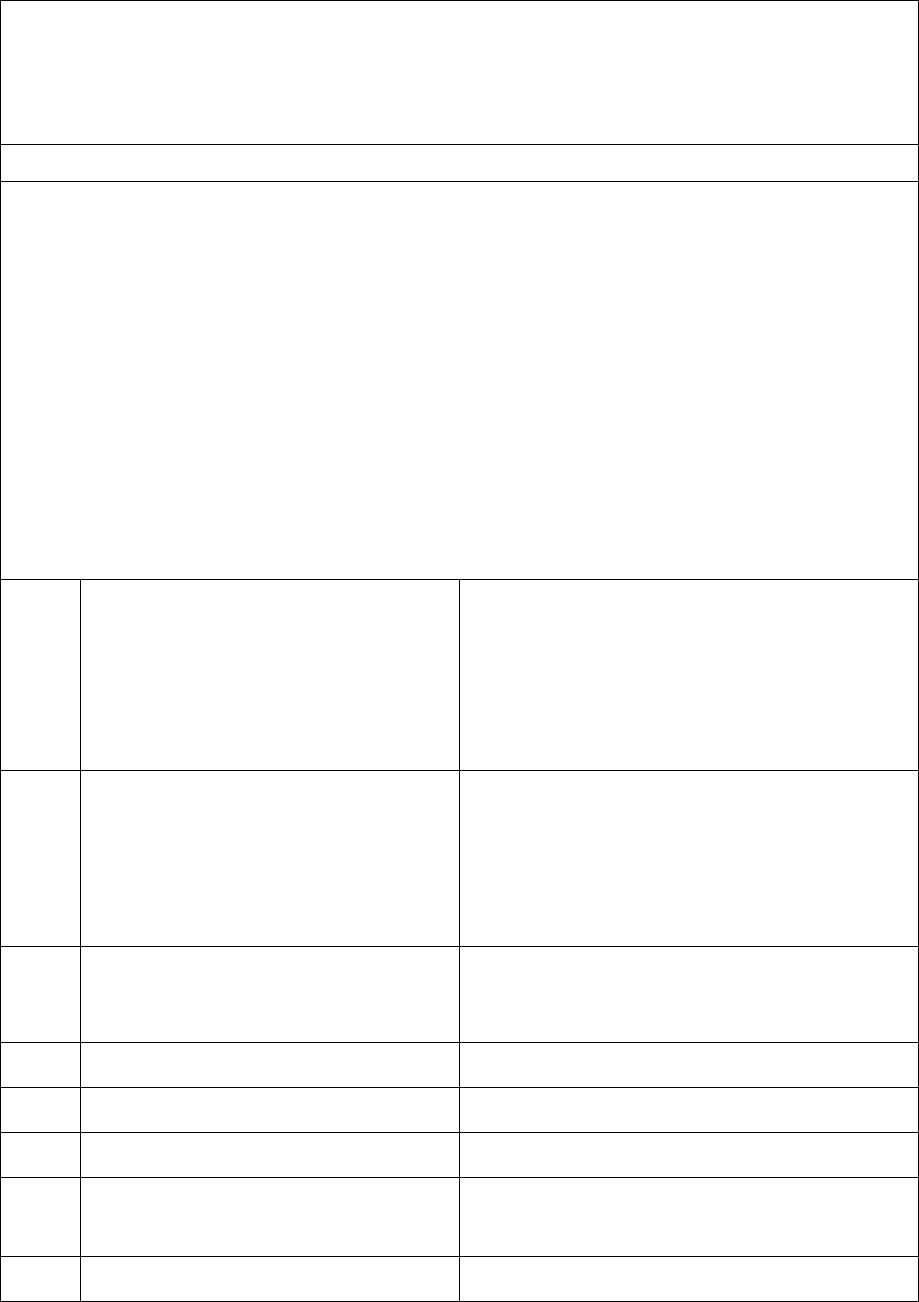

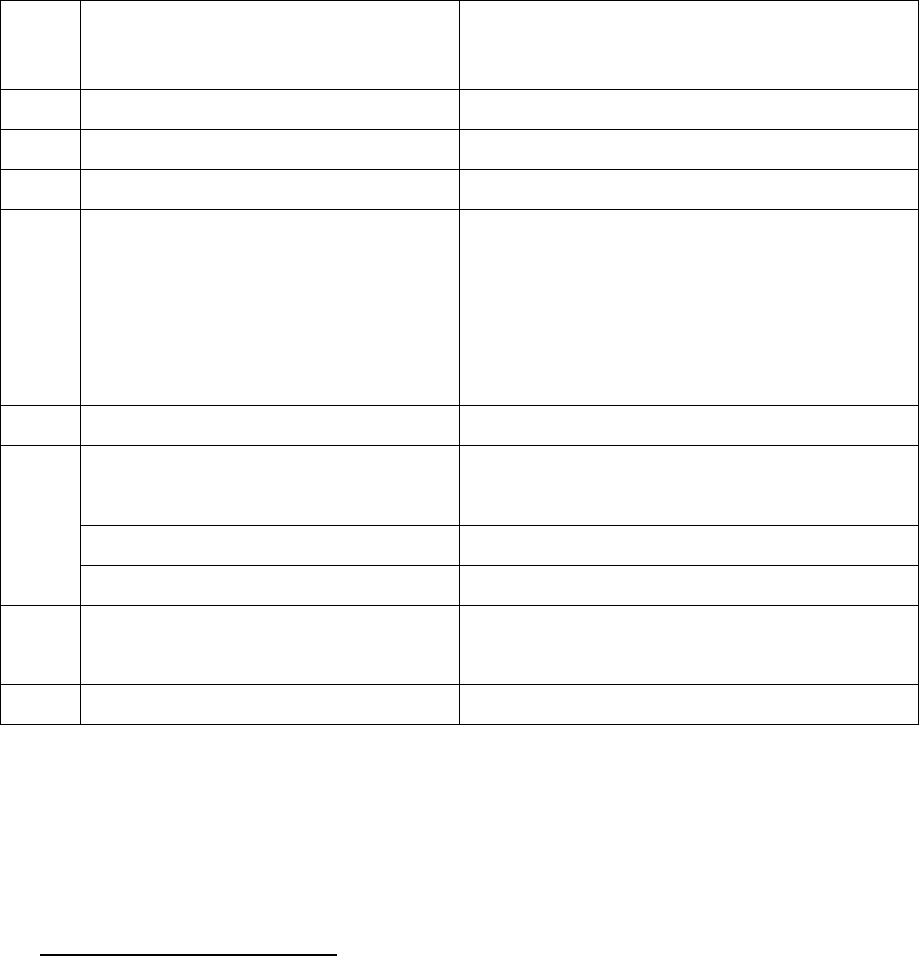

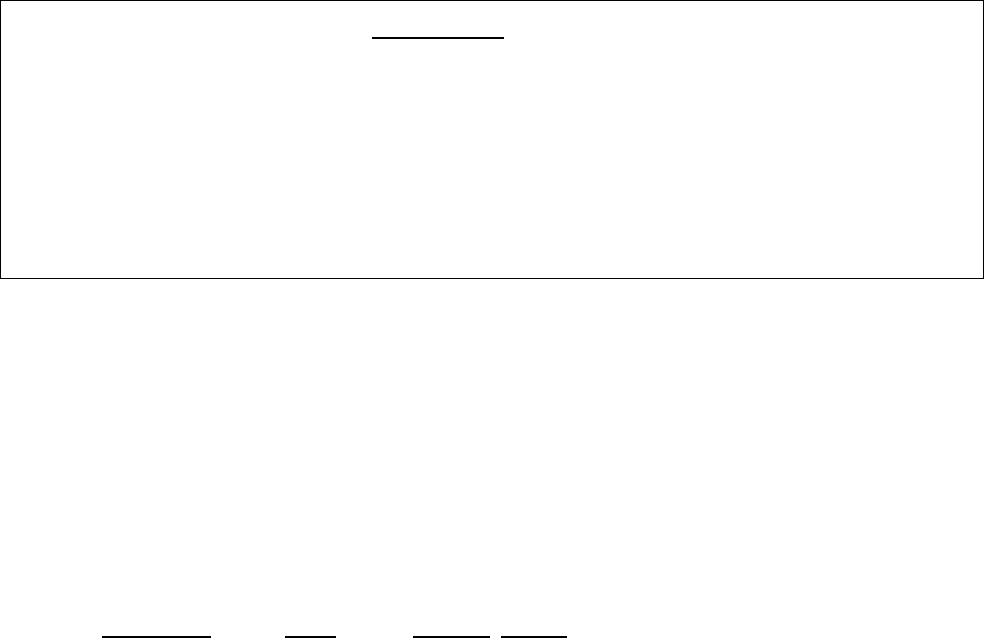

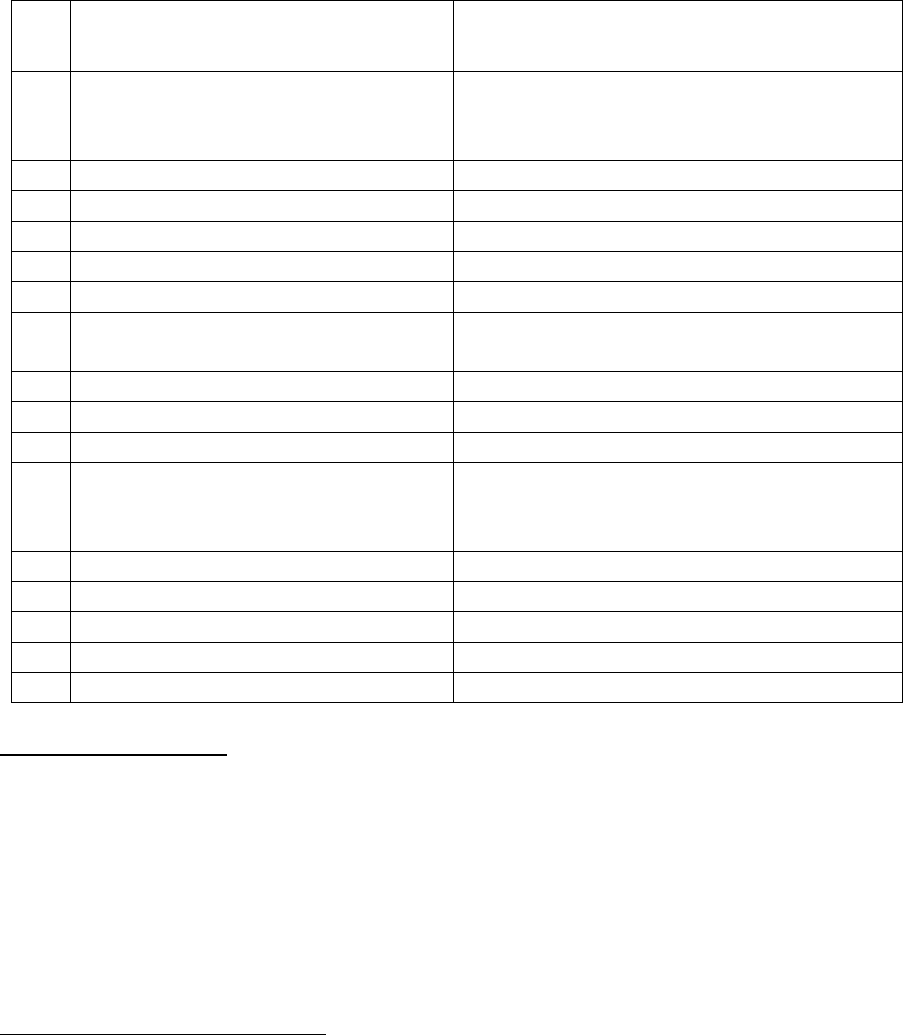

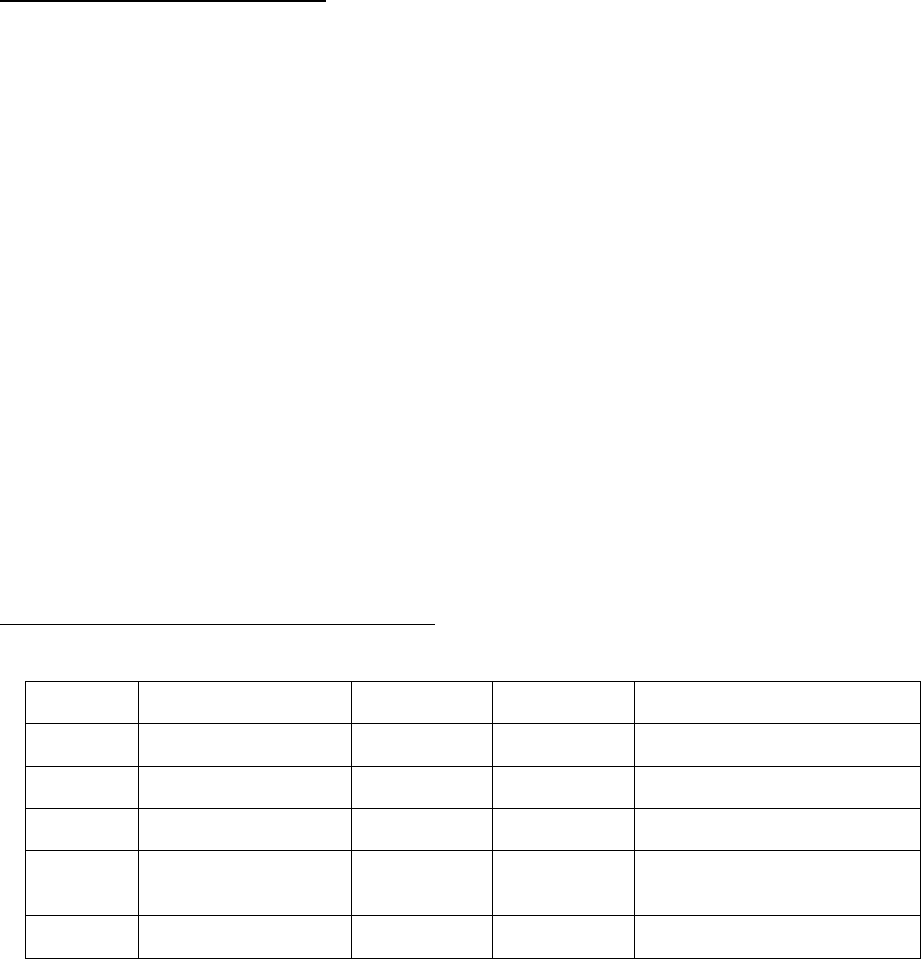

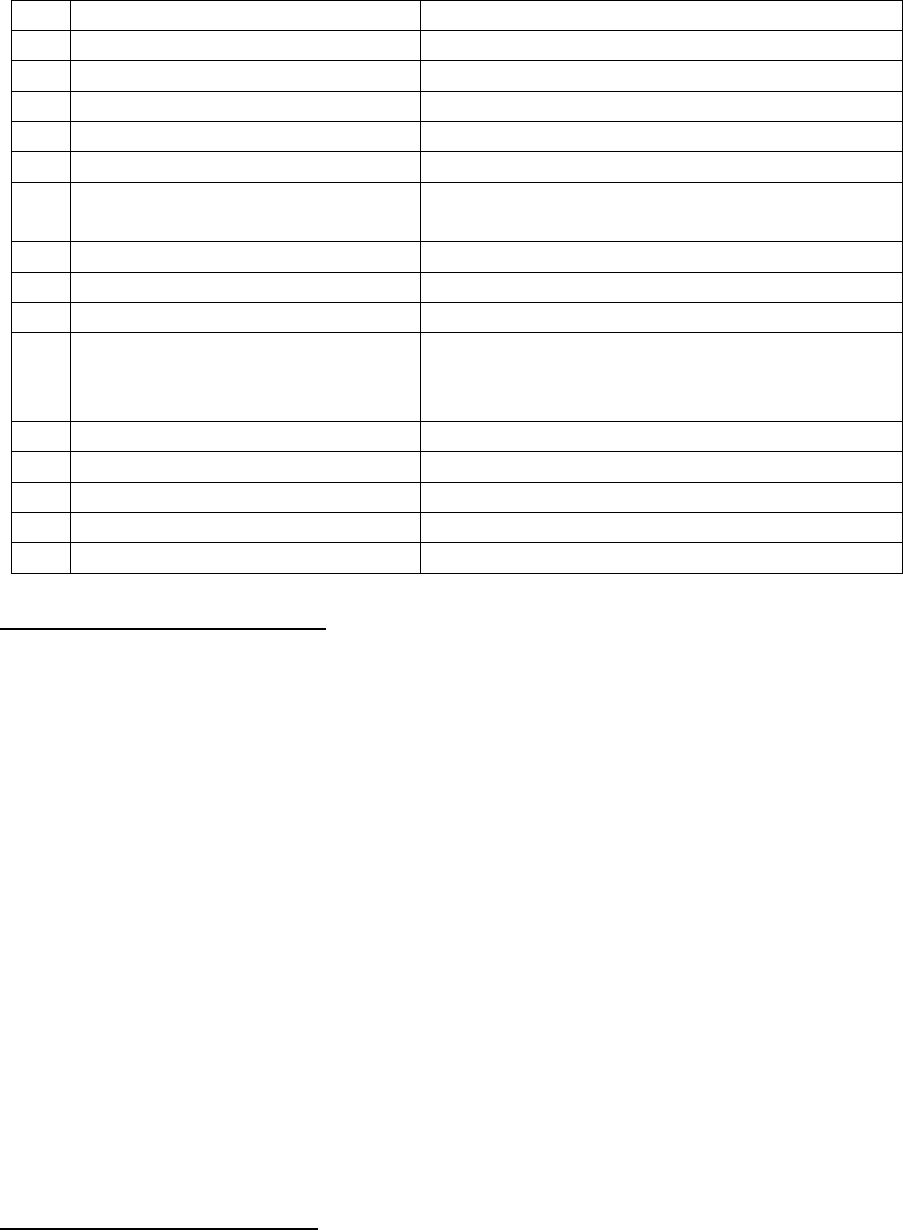

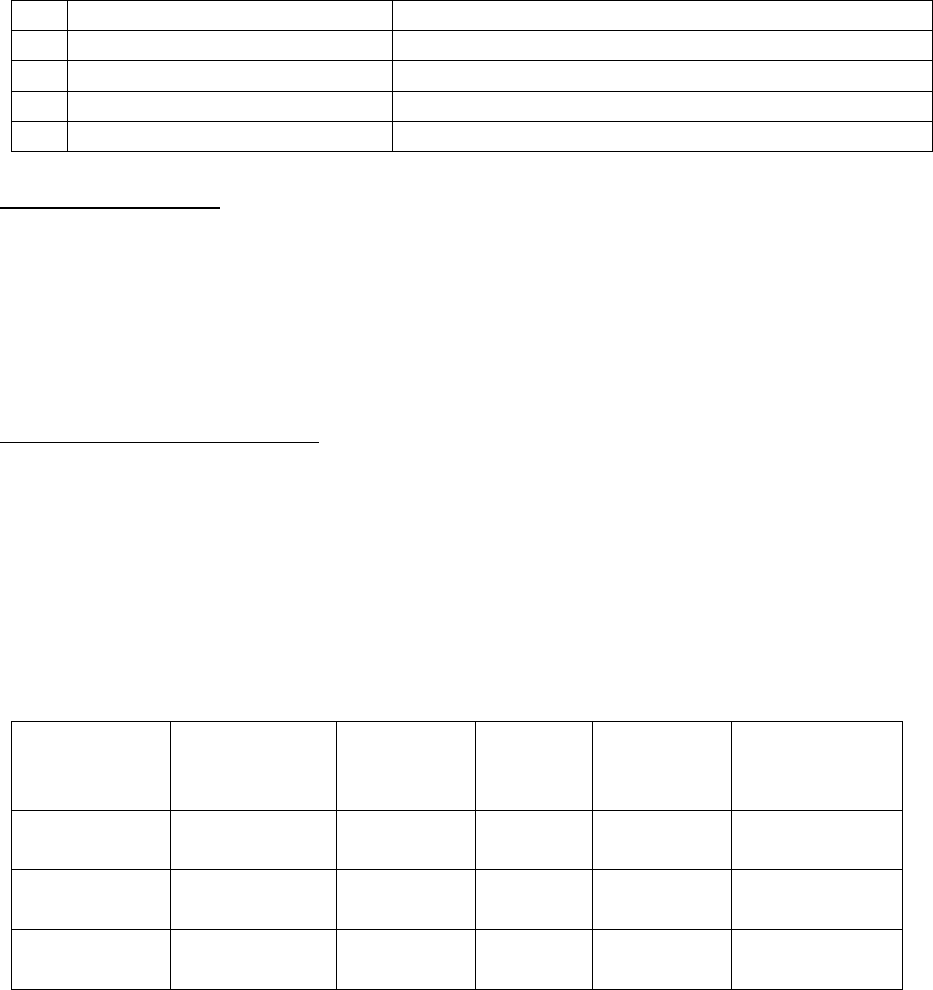

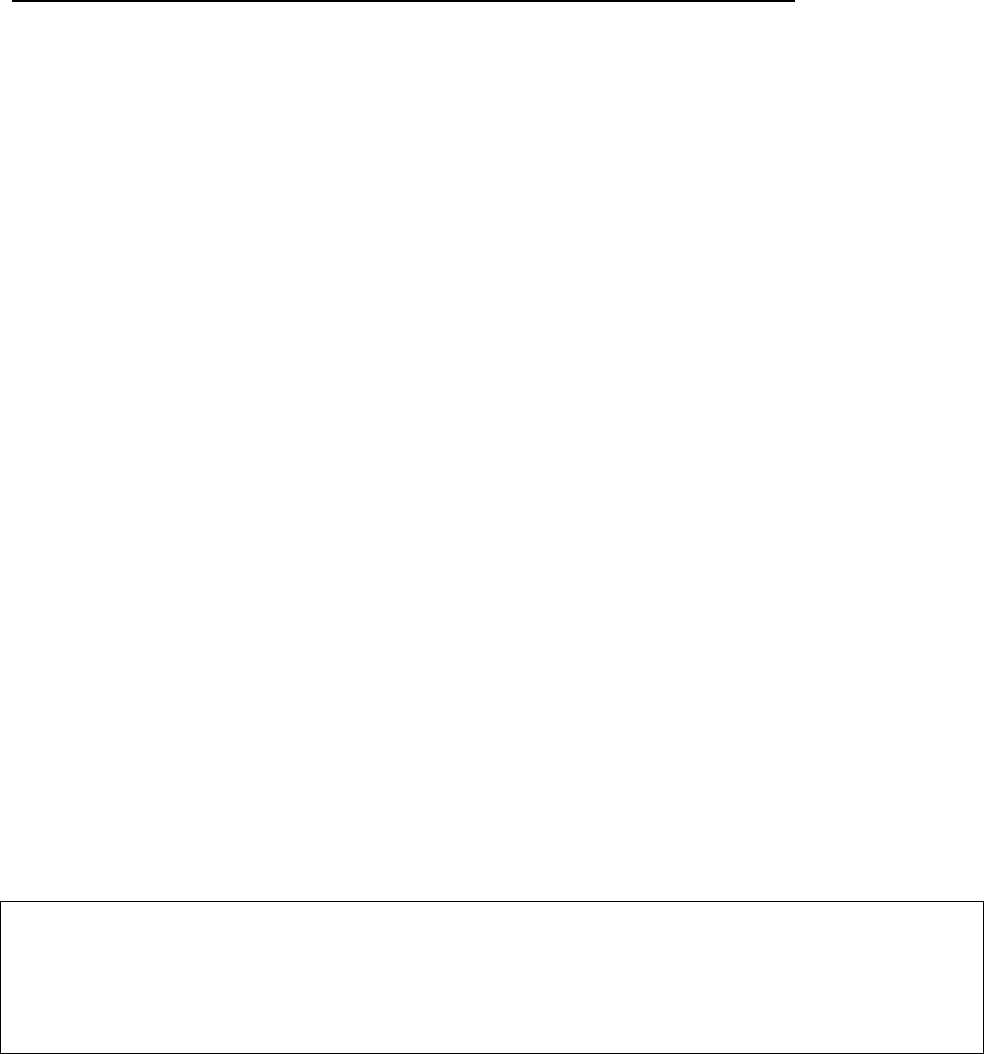

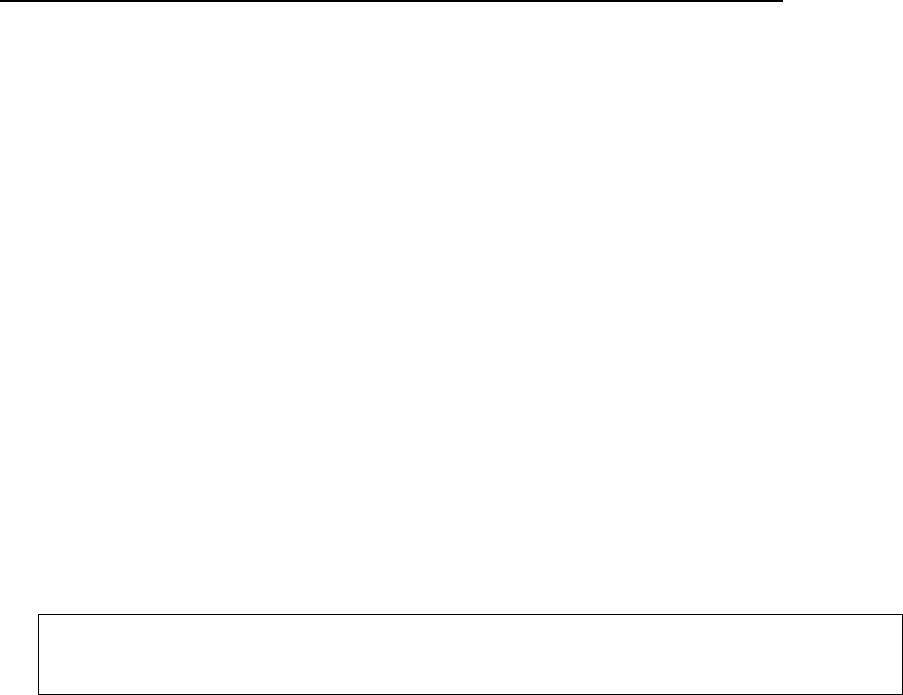

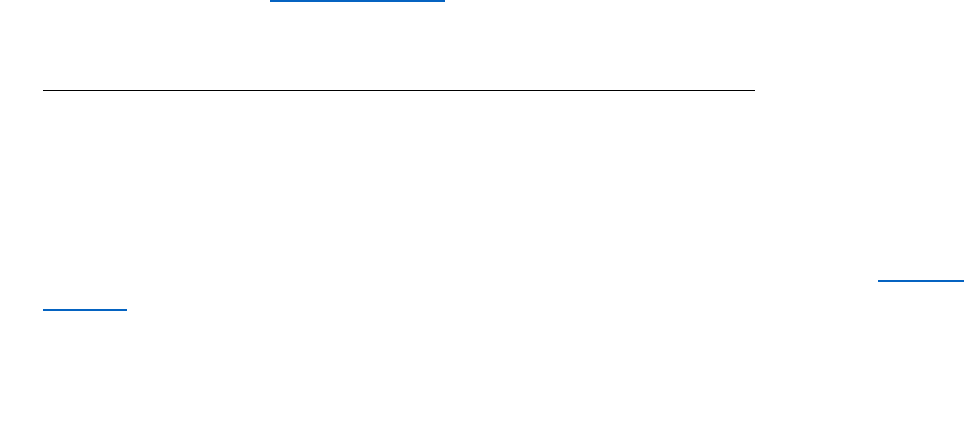

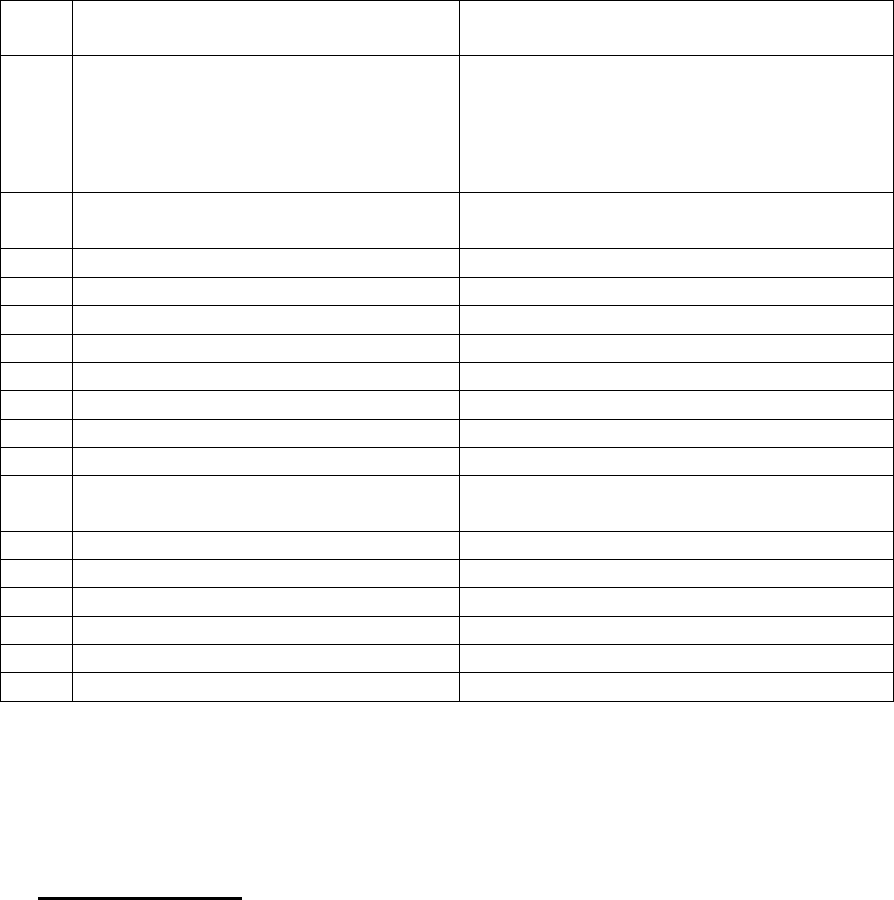

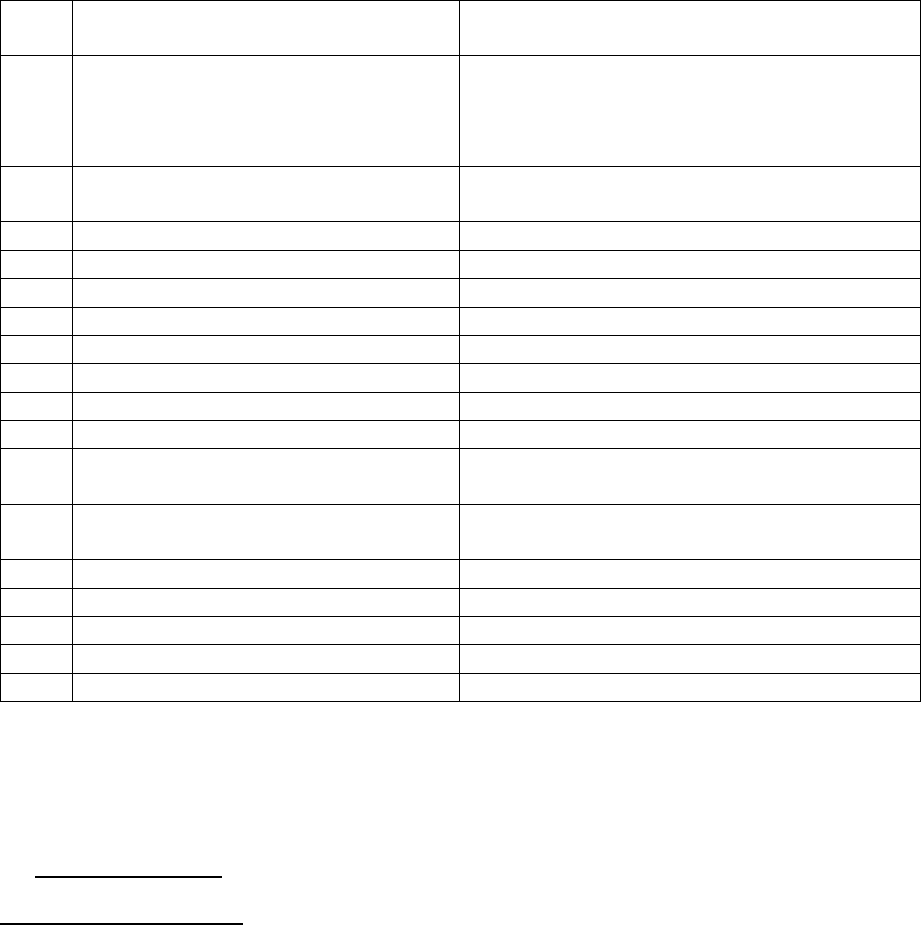

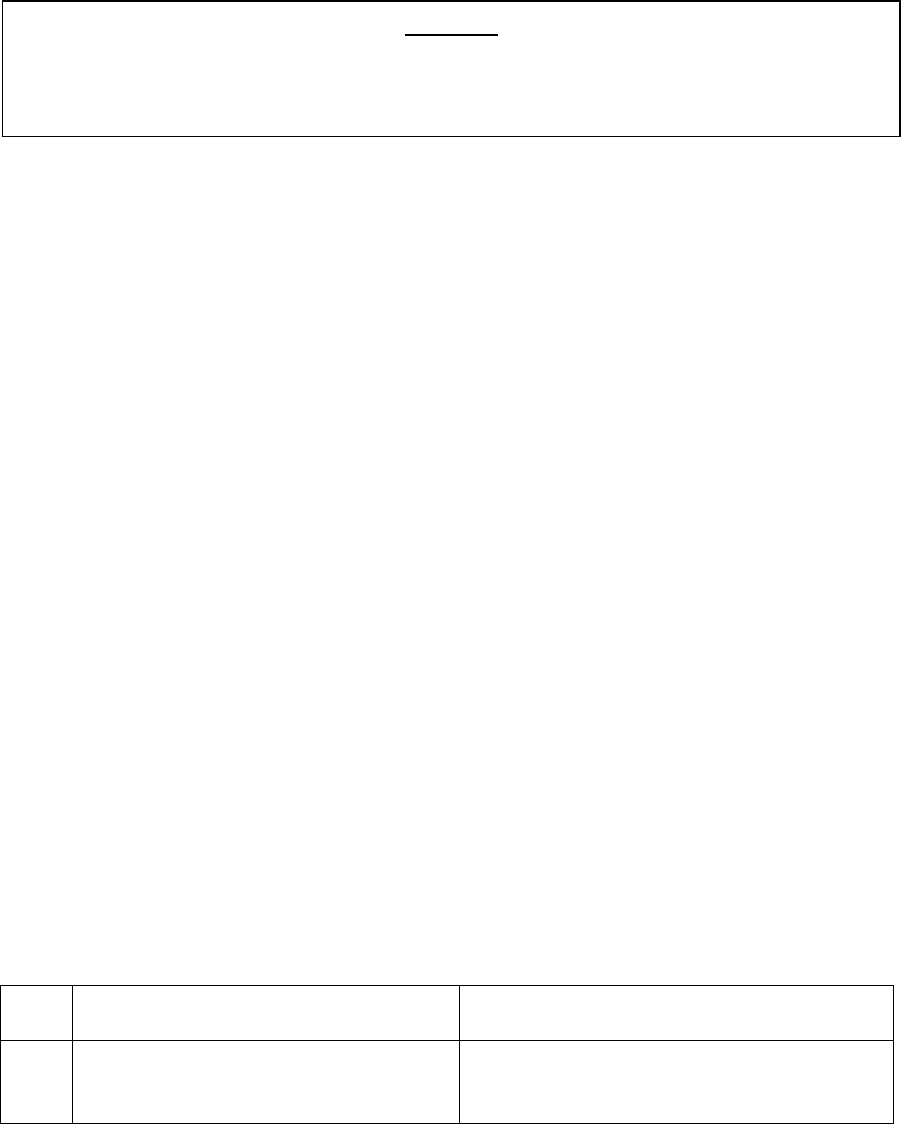

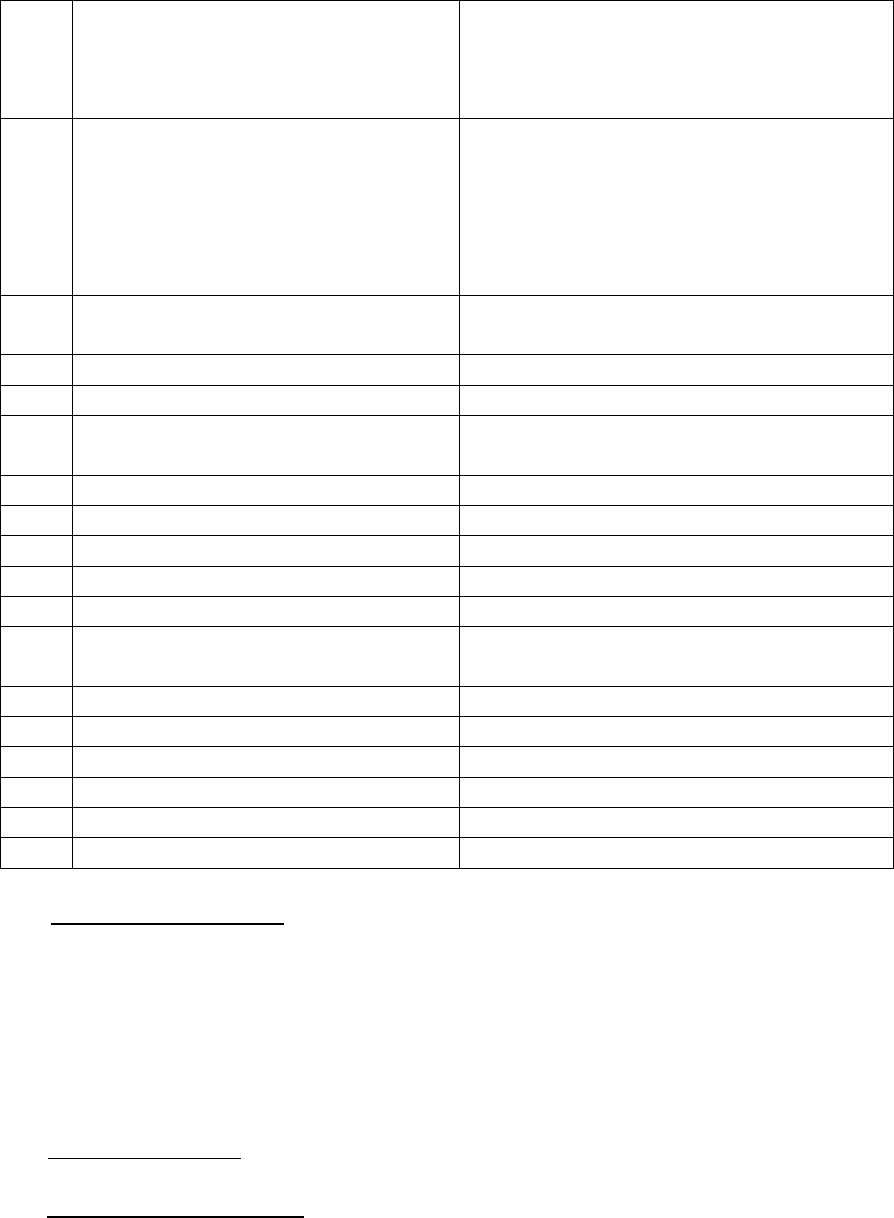

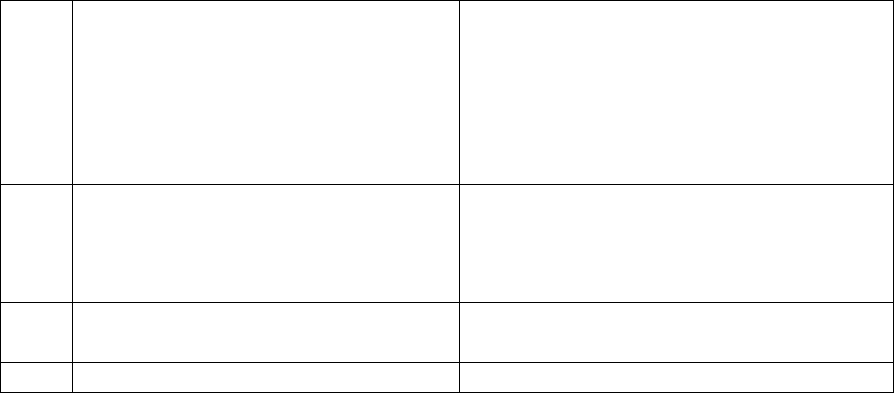

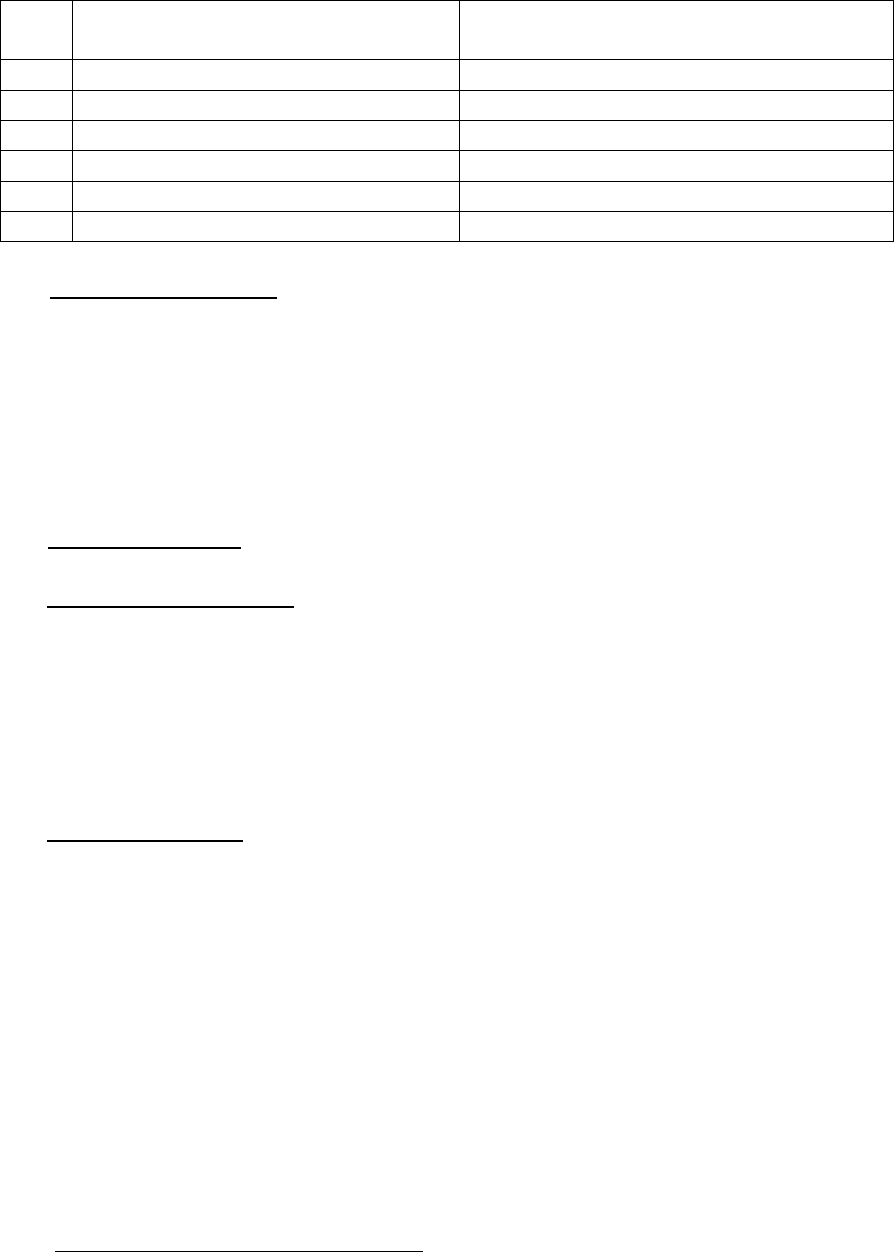

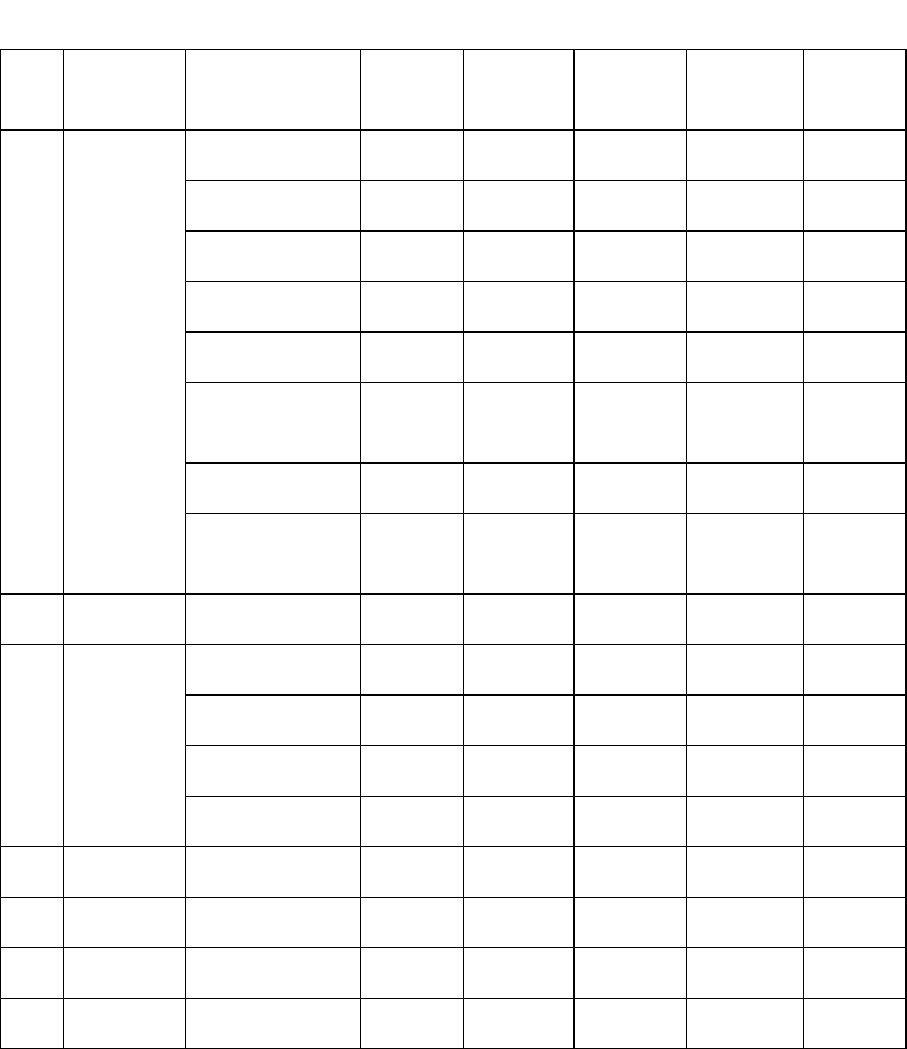

Complainant has filed 17 claims, the details of which are given below:

Complaint Reg. No.

RI Claim No.

Date of Treatment

Date of Rejection

Claim Amount(₹)

BNG-H-048-2021-0425

MDI5366932

24-04-19

22-02-20

14381

BNG-H-048-2021-0427

MDI5366951

06-06-19

21-03-20

14776

BNG-H-048-2021-0429

MDI5366967

05-06-19

16-03-20

32767

BNG-H-048-2021-0430

MDI5365962

14-05-19

20-02-20

13747

BNG-H-048-2021-0431

MDI5367025

21-05-19

28-03-20

14429

BNG-H-048-2021-0432

MDI5367041

22-05-19

24-03-20

14983

BNG-H-048-2021-0433

MDI5367067

22-06-19

22-02-20

14865

BNG-H-048-2021-0434

MDI5366026

15-05-19

16-03-20

14099

BNG-H-048-2021-0435

MDI5365920

18-07-19

21-03-20

15644

BNG-H-048-2021-0438

MDI5366083

19-07-19

22-02-20

15206

BNG-H-048-2021-0439

MDI5366983

11-07-19

22-02-20

26173

BNG-H-048-2021-0440

MDI5366895

12-07-19

22-02-20

14144

BNG-H-048-2021-0442

MDI5367000

05-07-19

22-02-20

15394

BNG-H-048-2021-0444

MDI5366011

04-07-19

22-02-20

21426

BNG-H-048-2021-0446

MDI5366057

12-06-19

22-02-20

18636

BNG-H-048-2021-0449

MDI5366913

11-06-19

22-02-20

14775

BNG-H-048-2021-0450

MDI5366038

21-06-19

21-03-20

18952

Total Claim Amount

294397

Forum notes that in all the 17 cases the complainant was treated with injection Carfilzomib.

Forum finds from web search that Carfilzomib is a targeted therapy drug. It is prescribed along

with other cancer drugs but it is distinct from chemotherapy drug.

Forum note that targeted-therapy/immuno-therapy is not permissible day care treatment under

the policy.

Further, since administration of injection Carfilzomib does not involve any anaesthetic

administration, the said treatment is not covered under the definition of Day Cay Procedure as

per policy terms and conditions.

The Complainant submitted that her previous claims for similar treatment were allowed by United

India Insurance Company under a policy taken by her with that company. Forum notes that the

terms and conditions of one policy cannot be read into the terms and condition of another policy.

It is noted that the claims have been repudiated by the RI strictly in terms of the impugned policy.

In view of the above Forum does not find flaw with the decision of the RI in repudiating the claims

as per terms and conditions of policy. Hence the complaints are disallowed.

A W A R D

Taking into account of the facts and circumstances of the case and the submissions made by

both the parties and documents available on record, rejection of the claim by the Respondent

Insurer is found to be in order and in consonance with the terms and conditions of the policy

which does not require any interference in the hands of Ombudsman.

The Complaints are Disallowed.

Dated at Bangalore on the 19

th

day of January, 2021.

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN –NEERJA SHAH

In the matter of: Mr. Jeevith Shetty Sowkoor Vs United India Insurance Company Limited

Complaint No: BNG-H-051-2021-0557

Award No.: IO/(BNG)/A/HI/0278/2020-21

● The Complaint emanated from the non settlement of health claim amount of Rs.4,69,063/-

vide claim number BLR-0520-PA-0002849 under the policy number

2405022819P106379826 issued by Respondent Insurer (RI) for a risk period from

19.08.2019 to 18.08.2020.

● Complainant was diagnosed with mitral valve prolapsed (mvp) symptomatic severe mr,

normal coronaries, good lv-functions. He was hospitalised at Aadarsh hospital, Udupi from

26.05.2020 to 26.05.2020.

● Cashless authorization for the above hospitalisation was rejected by RI. Post discharge

complainant filed for reimbursement claim which was rejected by RI on the ground of pre

existing disease (PED) waiting period under the policy.

● Complainant approached Grievance cell of RI vide mail dated 03.06.2020 requested to

consider the claim, but his plea was not considered favourably.

● Thereafter the complainant approached this forum vide letter dated 27.11.2020 for

settlement of claim. Complaint is posted for personal hearing on 03.02.2021

● After the intervention of this Forum, RI settled the claim as per term and conditions of the

policy.

● Complainant vide his mail dated 18.01.2021 addressed to this Forum confirmed the receipt

of claim amount and requested to withdraw the complaint.

● Since the complaint was resolved on compromise basis wherein both parties have agreed

for the same, the complaint is treated as Closed and Disposed off accordingly.

Dated at Bangalore on the 19

th

day of January, 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- NEERJA SHAH

In the matter of: Mr. K SRISHAILAN V/s UNITED INDIA INSURANCE COMPANY LTD

Complaint No: BNG-H-051-2021-0499

Award No: IO/BNG/A/HI/0282/2020-21

1

Name & Address of the

Complainant

Mr. K Srishailan

Sriniketana, Near KVS Choultry, Keelukote

KOLAR – 563 101

Mobile # 9448586881

E-mail: [email protected]

2

Policy No.

Type of Policy

Duration of Policy/Policy Period

5001002819P112345074

IBA Policy – Corporation Bank

01.11.2019 to 31.10.2020

3

Name of the Insured/ Proposer

Name of the policyholder

Mrs. NCS Krupa Jyothsna - Wife

Corporation Bank

4

Name of the Respondent Insurer

United India Insurance Company Limited

5

Date of Repudiation

NA

6

Reason for repudiation/rejection

NA

7

Date of receipt of Annexure VI A

24.11.2020

8

Nature of complaint

Delay in settlement of claim

9

Amount of claim

₹. 13,300/-

10

Date of Partial Settlement

NA

11

Amount of relief sought

₹. 24,364/-

12

Complaint registered under Rule no

13 (1) (a) of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

20.01.2021 / Online VC

14

Representation at the hearing

a)For the Complainant

Self

b)For the Respondent Insurer

Ms H A Pannaga, Dy manager

Dr. Sunil, TPA – Vipul MedCorp

15

Complaint how disposed

Partially Allowed

16

Date of Award/Order

21.01.2021

17. Brief Facts of the Case

The complaint emanated from delay in settlement of claim. Hence, the Complainant approached

this Forum for settlement of claims.

18. Cause of complaint:

a. Complainant’s argument:

Complainant along with his wife (Insured Person – hereafter referred as IP) was covered under the

Employer provided GMC policy issued by Respondent Insurer (RI) for the period 01.11.2019 to

31.10.2020. IP was diagnosed for mass – Dorsum of nose and underwent excision of the same

under General Anaesthesia on Out-patient basis on 02.11.2019 at Anugraha Health Care.

Reimbursement claim was submitted to RI. However inspite of reminders, the claim was not

settled.

b. Insurer’s argument:

The Respondent Insurer, in their Self Contained Note dated 06.01.2021 vide mail dt 06.01.2021,

submitted that based on the complaint received from this Forum, no details regarding intimation

of claim or submission of claim documents is available with RI or TPA (Vipul Medcorp).

19. Reason for Registration of complaint:

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017 and so, it was

registered.

20. The following documents were placed for perusal:

g. Complaint along with enclosures,

h. SCN of the Respondent Insurer along with enclosures and

i. Consent of the Complainant in Annexure VI-A and Respondent Insurer in VII-A.

21. Result of the personal hearing with both the parties (Observations & Conclusions):

The dispute is regard to delay in settlement of claim. The Forum has perused the documentary

evidence available on record and the submissions made by both the parties.

Personal hearing by the way of online Video-conferencing through Goto Meet was conducted in

the said case. Complainant and Representatives of RI presented their case. Confirmation from all

the participants about the clarity of audio and video was taken and to which the participants

responded positively.

After registration of complaint in this Forum, it came to the notice of the Forum that no

representation was made to the RI. The representation e-mail submitted by complainant to this

Forum was sent to an invalid e-mail address, the delivery failure notification of which was never

brought to the notice of this Forum at the time of registration of the complaint or anytime

thereafter. However, in the interest of the complainant, the complaint was not disposed off.

Forum notes that IP was insured in IBA Policy with Vipul Medcorp recorded as the TPA. After

registration of complaint, RI informed that based on the complaint copy received from this Forum,

they were not able to trace the claim details. RI enquired with complainant to ascertain claim

document submission. Separate correspondence was made to complainant by this Forum.

Complainant informed this Forum that claim documents have been submitted to Mediassist India,

which is also a TPA of the RI. Same was forwarded to RI.

RI informed that complainant was advised to submit original documents to either one of it’s own

branch/office or in the office of the policy servicing TPA. However complainant has submitted

Xerox copies of few documents which did not contain the Discharge Summary and IP Break up Bill.

Hence they were unable to ascertain the admissibility of the claim. Query was made to RI to

ascertain admissibility of claim based on the documents submitted to this Forum, subject to

submission of original documents by the Insured.

During the course of hearing, representative of RI submitted that the claim has been repudiated.

Representative of RI was asked to submit the repudiation letter to this Forum and the

complainant. RI vide mail dt 20.01.2020, the claim was repudiated on the basis of scanned copy

received by them. RI requested the Forum to advise complainant to submit the original medical

documents to RI or policy servicing TPA (Vipul Medcorp) for them to pursue the same.

Since original claim documents have not been submitted by the complainant to RI or policy

servicing TPA i.e. Vipul Medcorp, the Forum advises the complainant to submit the same to RI for

processing.

Under the circumstances, the Forum cannot provide any relief to complaint without submission of

original documents. However it directs RI to ensure that claim is entertained on merits on receipt

of original documents subject to terms and conditions of the policy. The complaint is partially

allowed.

AWARD

Taking into account the facts & circumstances of the case and the personal submissions made

by both the parties and the information/documents placed on record, Forum finds no deficiency

in service of RI. Under the circumstances of the case, the Forum advises complainant to submit

the original documents to RI as per the laid down claim intimation criteria and directs RI to

consider the same on merits subject to terms and conditions of the policy.

The Complaint is Partially Allowed.

22. Compliance of Award:

The attention of the Complainant and the Insurer is hereby invited to the following:

a. The Complainant shall submit all requirements/Documents required for compliance of award

within 15 days of receipt of the award to the Respondent Insurer

b. As per Rule 17(6) of Insurance Ombudsman Rules, 2017, the insurer shall comply with the

award within thirty days of the receipt of the award and intimate compliance of the same to

the Ombudsman

Dated at Bengaluru on the 21

st

day of January, 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN- Smt.NEERJA SHAH

In the matter of SHRI PRAKASH GEORGE V/s MANIPAL CIGNA HEALTH INSURANCE COMPANY LIMITED(Mumbai)

Complaint No: BNG-H-053-2021-0485

Award No.: IO/(BNG)/A/HI/0286/2020-21

1

Name & Address of the Complainant

SHRI PRAKASH GEORGE ,

No.217, Kuteer Bliss Apartments,

Nobo Nagar, Bannerghatta Road,

Bangalore,

Karnataka-560 076

Mob.No. 08123890369

Mail ID : lissamma[email protected]m.

2

Policy No.

Type of Policy

Duration of Policy/ Policy Period

PROHLR340003518

Pro Health-Protect Family Floater Policy

05.09.2020 to 04.09.2021

3

Name of the Insured/ Proposer

Name of the policyholder

Smt.Lissamma Pa

SHRI PRAKASH GEORGE

4

Name of the Respondent Insurer

MANIPAL CIGNA HEALTH INSURANCE COMPANY

LIMITED(Mumbai)

5

Date of repudiation/rejection

09.10.2020

6

Reason for repudiation/rejection

Claim beyond the scope of policy coverage

7

Date of receipt of Annexure VI-A

06.11.2020

8

Nature of complaint

Rejection of claim under policy clause II.4

9

Amount of claim

13,920.00

10

Date of Partial Settlement

NA

11

Amount of relief sought

13,920.00

12

Complaint registered under Rule no:

13(1)(b)of Insurance Ombudsman Rules, 2017

13

Date of hearing/place

20.01.2021 / Bengaluru

14

Representation at the hearing

a) For the Complainant

Self

b) For the Insurer

Mrs.Swetha Nair-Assistant Manager,Legal

15

Complaint how disposed

Disallowed

16

Date of Award/Order

27.01.2021

17. Brief Facts of the Case:

The complaint emanated from the rejection of the claim on the ground of beyond the scope of

policy. Despite his taking up the matter with the GRO of Respondent Insurer (RI), his request was

not reconsidered. Hence he approached this Forum to get relief.

18. Cause of Complaint:

a. Complainant’s arguments: The Complainant submitted that he had taken Health Insurance

policy with the RI covering his family in the year 2016 and renewed there on. His spouse was

diagnosed with secondary hypothyroidism and she had under gone various tests as advised by the

doctor . He enquired with the customer care of the R.I about reimbursement of tests and the

same was assured by them. He took policy with the RI after verifying the websites of the RI

wherein they have advertised that the reimbursement of outpatient treatment and day care

facilities are allowed. Whereas, his claim reimbursement made towards various tests undergone

by his spouse was rejected by the R.I on the ground that OPD bills are not payable as per policy

clause II.4. His representation with the RI was not resolved favourably.

Hence, he approached this Forum for the relief.

b. Respondent Insurer’s Arguments:

The Respondent Insurer submitted their Self-Contained Note dated 18.01.2021 admitting the

insurance coverage. They submitted that the Complainant submitted proposal form bearing No.

PROHLR340003518 dated 6

th

July , 2017 for purchasing Health Insurance. The policy documents

along with a copy of the proposal form and the terms and conditions were duly delivered to the

Complainant’s registered address. The policy documents specifically states that policyholder

should check the enclosed policy documents carefully to make sure that all the details are correct.

However, the Insured did not notify the Company any discrepancy in the proposal form or in the

policy documents.

The Complainant on 30th September, 2020 registered a reimbursement claim bearing No.

22935129 for the reimbursement of expenses of Rs. 13,920/- incurred for the treatment taken at

Fortis Hospital from 10th August, 2020 to 15th August, 2020 due Hypothyroidism. On scrutiny of

the claim documents, it has been observed that the Complainant has availed only OPD treatment

and the bills submitted are all OPD bills Therefore, the claim was found to be not admissible as

policy covers only in- patient hospitalization of at least 24 hours or day care treatments as defined

in the policy. Accordingly the Company rejected the claim through rejection letter dated 9th

October, 2020.

It is submitted that Insurance is a contract between the insured and the insurer and the terms and

conditions of the Policy of Insurance are strictly binding upon the parties.

Relying on the decision of the Hon’ble Supreme Court in the case of Export Credit Guarantee

Corporation Of India Ltd. v. Garg Sons International (2013 (1) Scale 410), Suraj Mal Ram Niwas

Oil Mills (P) Ltd. Vs. United India Insurance Co. Ltd. [(2010) 10 SCC 567] and General Assurance

Society Limited vs.Chandumull Jain & Anr., (1966) 3 SCR 500 they requested the Forum to

absolve them from the complaint.

19. Reason for Registration of complaint:-

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017.

20. The following documents were placed for perusal.

d. Complaint along with enclosures,

e. Respondent Insurer’s SCN along with enclosures and

f. Consent of the Complainant in Annexure VI-A & and Respondent Insurer in VII-A

21. Result of personal hearing with both the parties (Observations & Conclusions):

Personal hearing was conducted through video conference and the participants confirmed the

clarity of audio and video.

This Forum has perused the documentary evidence available on record. The issue to be decided is

whether rejection of the claim on the ground of OPD treatment beyond the scope of policy

coverage is in order.

The Complainant and RI reiterated their contentions. The complainant strongly contended that

the advertisement in the website of the RI states that treatment taken under OPD are reimbursed

by the Insurance company. Hence he took the policy from the R.I. The Forum asked the

complainant whether the Insured Person was hospitalized for the treatment for which he replied

in negative. R.I submitted that as per policy terms the complainant is eligible for reimbursement

of Rs.500/- only towards OPD charges which has been already paid to him and the complainant

did raise any objection.

The policy defines Basic Cover under clause II and II.1 for Inpatient Hospitalization which are

reproduced as under.

‘cover Medical Expenses of an Insured Person in case of Medically Necessary Hospitalization

arising from a Disease/ Illness or Injury provided such Medically Necessary Hospitalization is for

more than 24 consecutive hours provided that the admission date of the Hospitalisation due to

Illness or Injury is within the Policy Year.

The R.I rejected the claim under policy Clause II.4. - Day Care Treatment which is reproduced as

under:

‘cover payment of Medical Expenses of an Insured Person in case of Medically Necessary Day Care

Treatment or Surgery that requires less than 24 hours Hospitalization due to advancement in

technology and which is undertaken in a Hospital / nursing home/Day-care Centre on the

recommendation of a Medical Practitioner. Any treatment in an outpatient department/OPD is not

covered ‘.

The Forum observes that the bills produced for reimbursement clearly show that the treatment

taken was on ’ Outpatient’ basis on different dates from 10

th

August 2020 to 23

rd

September

2020 . The supporting Doctor’s certificate dt.12.10.2020 of Fortis Centre for Diabetes and

Endocrinology shows that the IP consulted for follow up for the treatment for

Hypothyroidism(Secondary) for which she had to undergo MRI-Brain and various other hormonal

tests as prescribed by him on 16.09.2020. The Forum notes that the IP was neither hospitalized

nor took treatment under Day-care.

In view of the above Forum does not find flaw with the decision of R.I in restricting the claim.

This Forum also relies on decision of the Hon’ble Supreme Court of India in the matter of Export

Credit Guarantee Corp of India Ltd. Vs Ms.Garg Sons International held that “the insured cannot

claim anything more than what is covered by the insurance policy.”…the terms of the contract

have to be construed strictly, without altering the nature of the contract as the same may affect

the interests of the parties adversely.”

Hence the complaint is DISALLOWED.

A W A R D

Taking into account of the facts and circumstances of the case, the documents and the

oral submissions made by both the parties, this Forum does not find any flaw with the

decision of the Respondent Insurer in restricting the claim in accordance with the

terms and conditions of policy.

Hence the complaint is DISALLOWED.

Dated at Bangalore on the 27

th

day of JANUARY , 2021

(NEERJA SHAH)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORETHE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – NEERJA SHAH

In the matter of MRS. NAYANA SHETTY K Vs UNITED INDIA INSURANCE COMPANY LIMITED

Complaint No: BNG-H-051-2021-0448

Award No.: IO/(BNG)/A/HI/0287/2020-21

1

Name & Address of the Complainant

Mrs. Nayana Shetty K

E No 210808, Union Bank of India

Credit Risk Management Department

Head Office Pandeshwar,

Mangalore, Karnataka - 575001

Mobile no: 9448626501

Email ID: [email protected]om

2

Policy Number

Type of Policy

Duration of Policy/ Policy Period

5001002818P109891131

Group Mediclaim

01.10.2018 to 30.09.2019

3

Name of the Policyholder/Proposer

Name of the Insured

IBA (A/c: Corporation Bank)

Mrs. Nayana Shetty K

4

Name of the Insurer

United India Insurance Company Limited

5

Date of repudiation

NA

6

Reason for repudiation

NA

7

Date of receipt of the Annexure VI A

13.11.2020

8

Nature of complaint

Short Settlement of health claim

9

Amount of claim

Claim 1:- Rs.58,857/- and Claim 2:- Rs.1,475/-

10

Date of Partial Settlement

05.10.2019

11

Amount of relief sought

Rs.18,017/- [16542 + 1475]

12

Complaint registered under Rule no.

13 (1) (b) of Insurance Ombudsman Rules, 2017

13

Date of hearing through Online VC

20.01.2021

14

Representation at the hearing

a) For the Complainant

Self

b) For the Respondent Insurer

Srijani – Assistant Manager

Dr. Komal Sindhe

15

Complaint how disposed

Allowed

16

Date of Award/Order

27.01.2021

17. Brief Facts of the Case:

The complaint emanated from short settlement of health claim by Respondent insurer (hereafter

referred to as RI). Complainant represented to Grievance Redressal Officer (GRO) of RI for

reconsideration of her claim. However her plea was not considered favourably. Hence the

complainant approached this Forum for resolution of her grievance.

18. Cause of Complaint:

a) Complainant’s arguments:

The Complainant (Insured Person - IP) submitted that she was covered under a group health

insurance policy with RI vide policy no. 5001002818P109891131 with a sum insured of

Rs.3,00,000/- and a corporate buffer utilisation amount of Rs.1,00,000/- for the risk period from

01.10.2018 to 30.09.2019. IP was diagnosed with Aplastic Anaemia and she was admitted at

Father Muler Medical College Hospital, Mangaluru from 16.11.2018 to 23.11.2018. IP incurred an

expense of Rs.3,58,857/- and RI approved the claim of Rs.3,00,000/- and remaining Rs.58,857 was

claimed under the corporate buffer utilisation. Claim was further settled for Rs.42,315/- only. IP

represented to the GRO of RI for settling the balance amount of Rs.16,542/-. IP also incurred an

expense of Rs. 215 and Rs.1260/- in the month of July 2019 and Sep 2019 and claim for it under

the corporate bufer which also was not paid by RI to the IP. IP did not get any favourable

response. Hence, she approached this Forum for help in getting her eligible amount from RI.

b. Respondent Insurer’s Arguments:

The RI submitted in their Self Contained Note (SCN) vide email dated 19.01.2021 that a group

mediclaim policy has been issued to Corporation Bank employees vide policy

no. 5001002818P109891131 for a risk period 01-Oct-2018 to 30-Sep-2019. IP is included in the list

of insured persons under the family floater sum insured of Rs.3,00,000/-. This complaint is

pertaining to claim number CCN:19973266 and CCN:20348407. IP was admitted at Father Muller

Medical College Hospital, Mangaluru from 16.11.2018 to 23.11.2018. She is a known case of

Aplastic Anaemia and taking Tablet Revolade on a regular basis. IP submitted post hospitalization

claim of Rs.63082/-. Rs.4225/- was settled vide claim number CCN:19973266 and deducted the

remaining Rs.58857/- due to sum insured exhaust. Later, on receipt of the corporate buffer

approval, another claim was generated vide claim number CCN:20348407 and claim amounting to

Rs.42315/- was settled out of the remaining balance amount. While settling the claim, bills which

fall beyond the 90 days of hospitalization was not considered as per the policy terms and

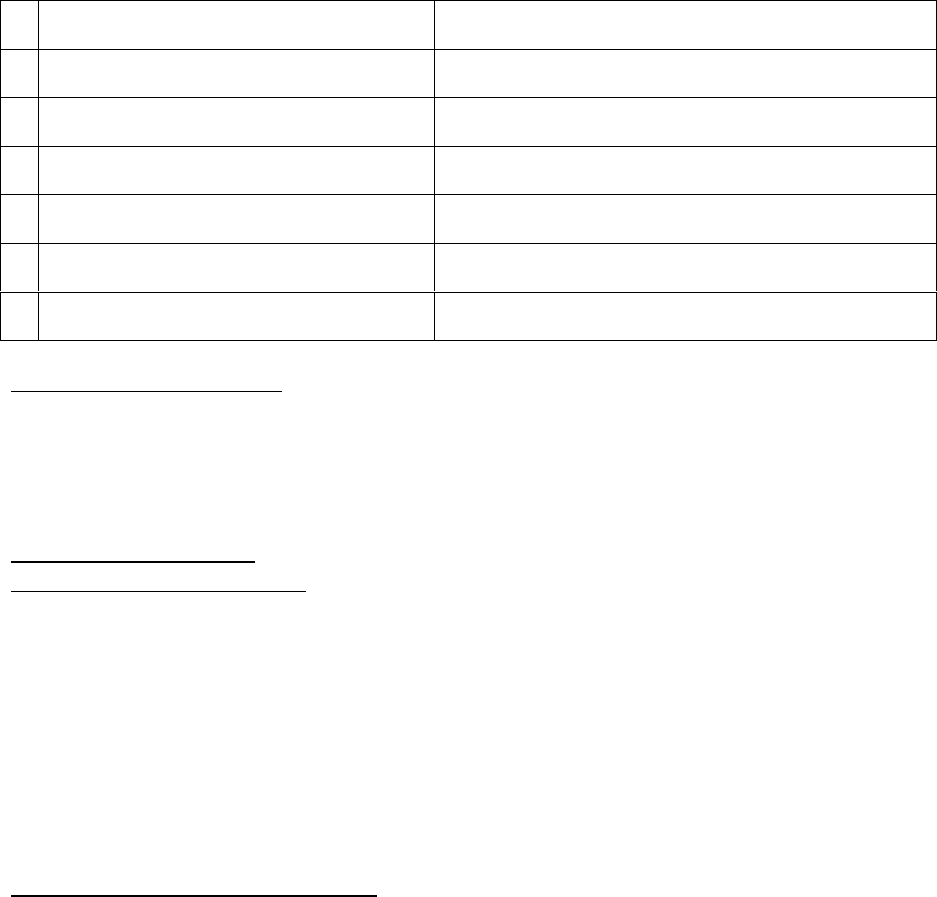

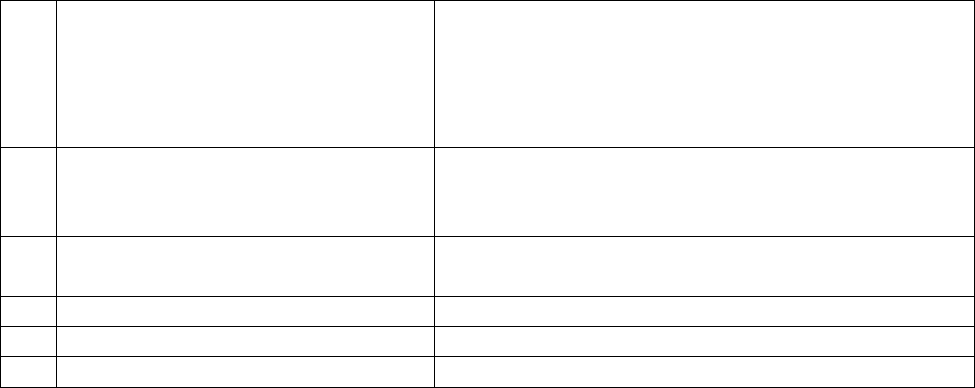

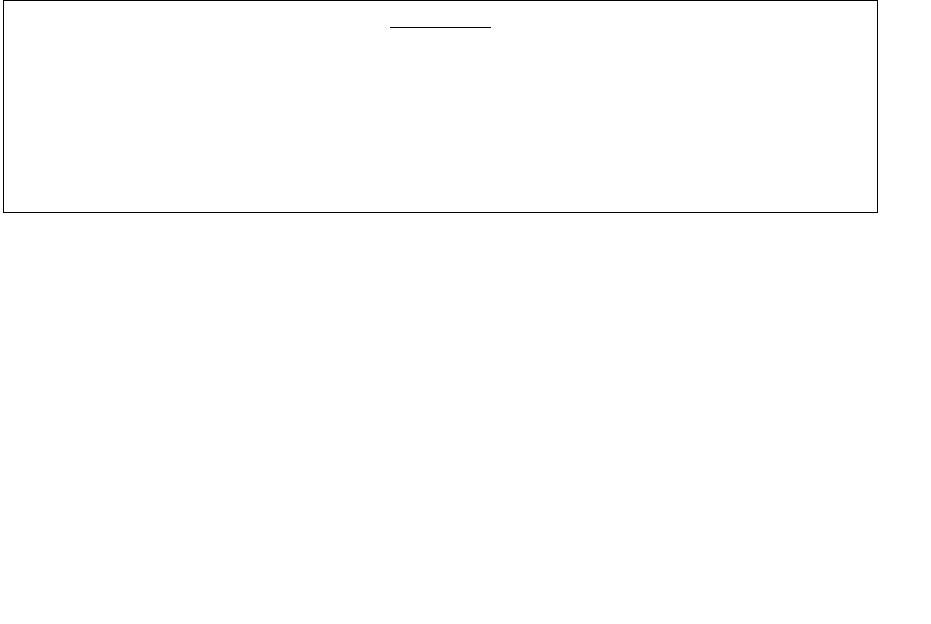

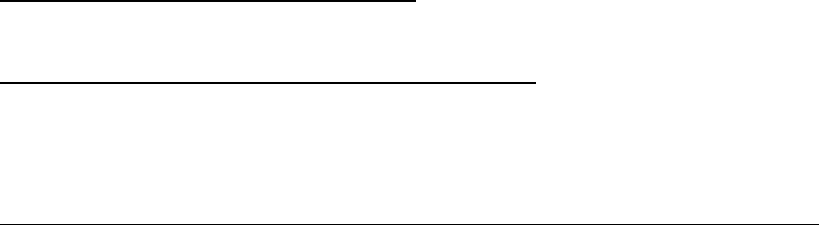

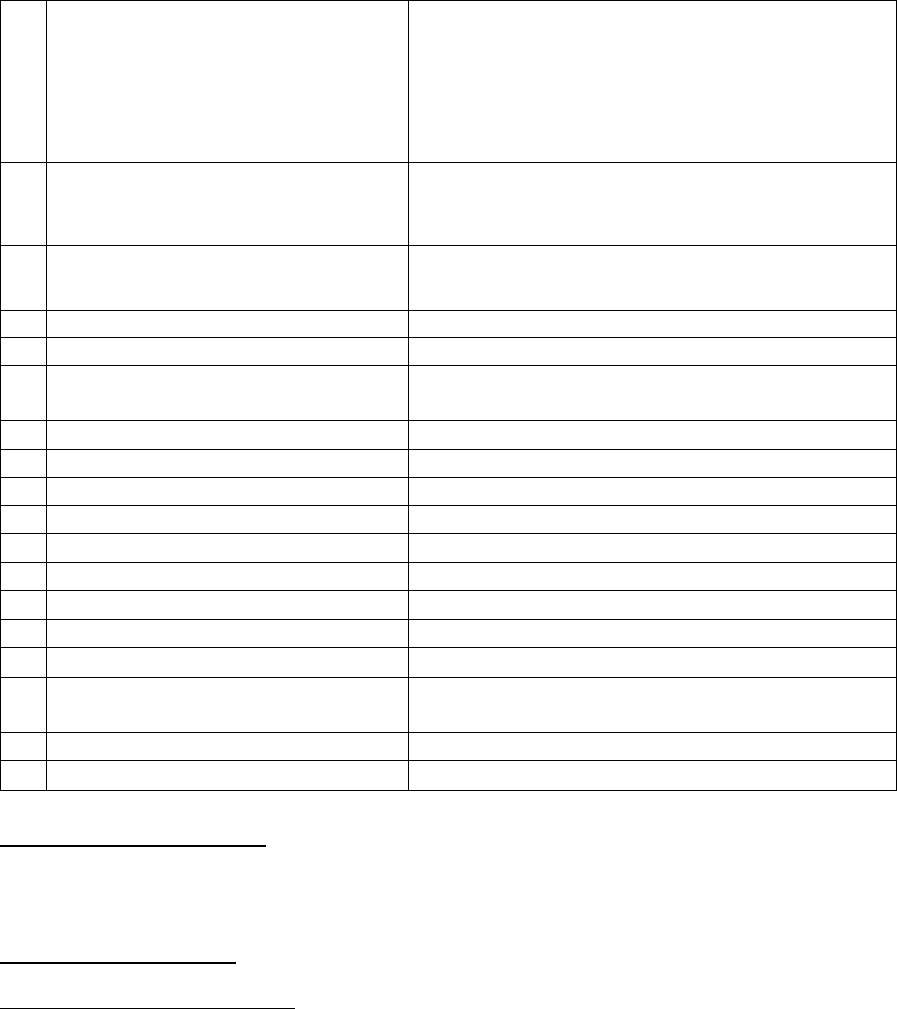

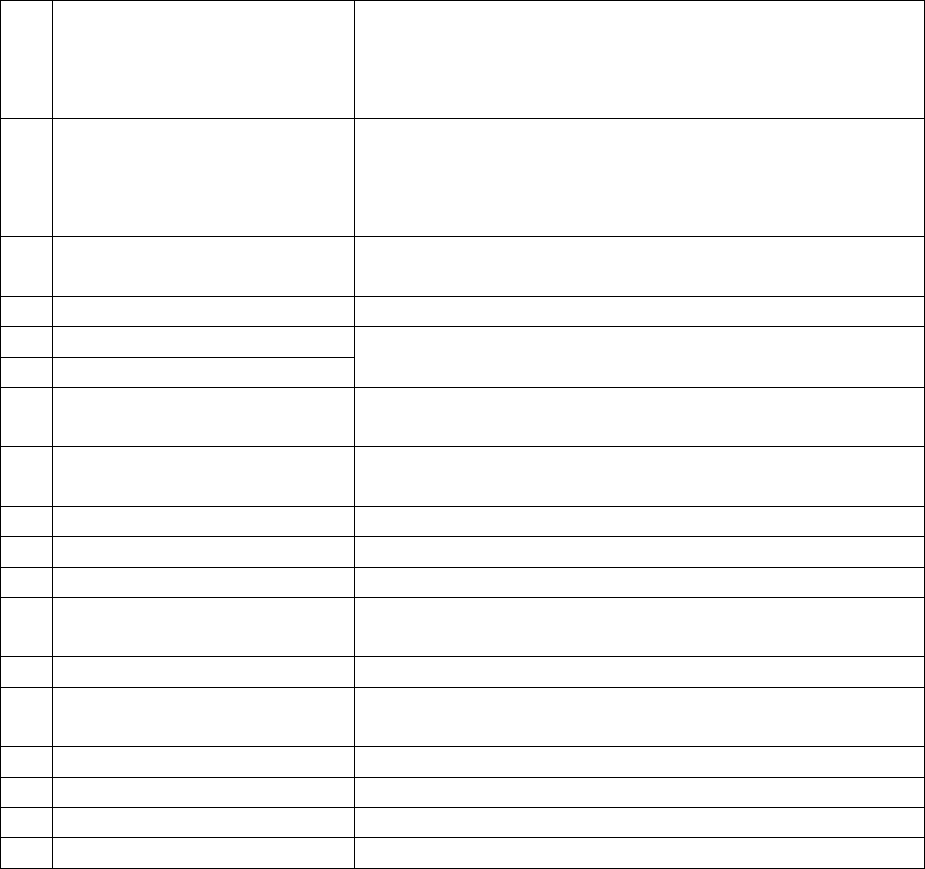

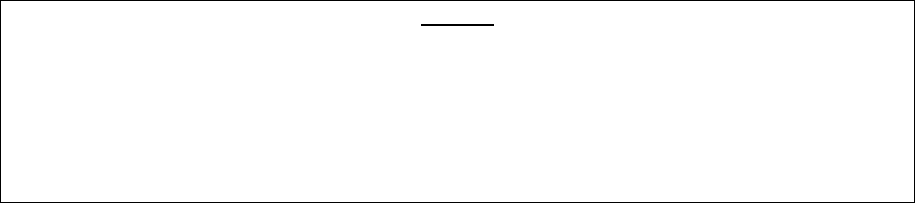

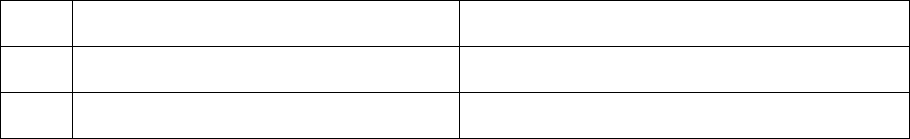

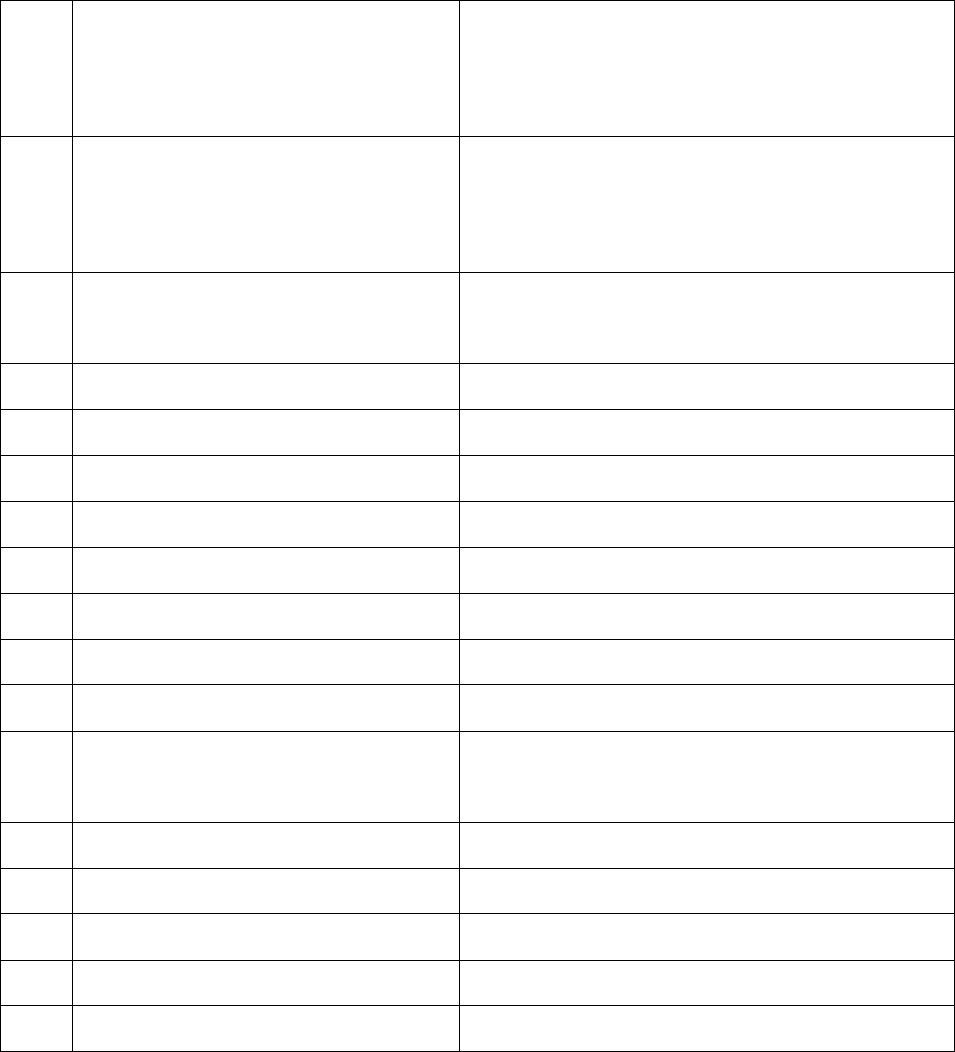

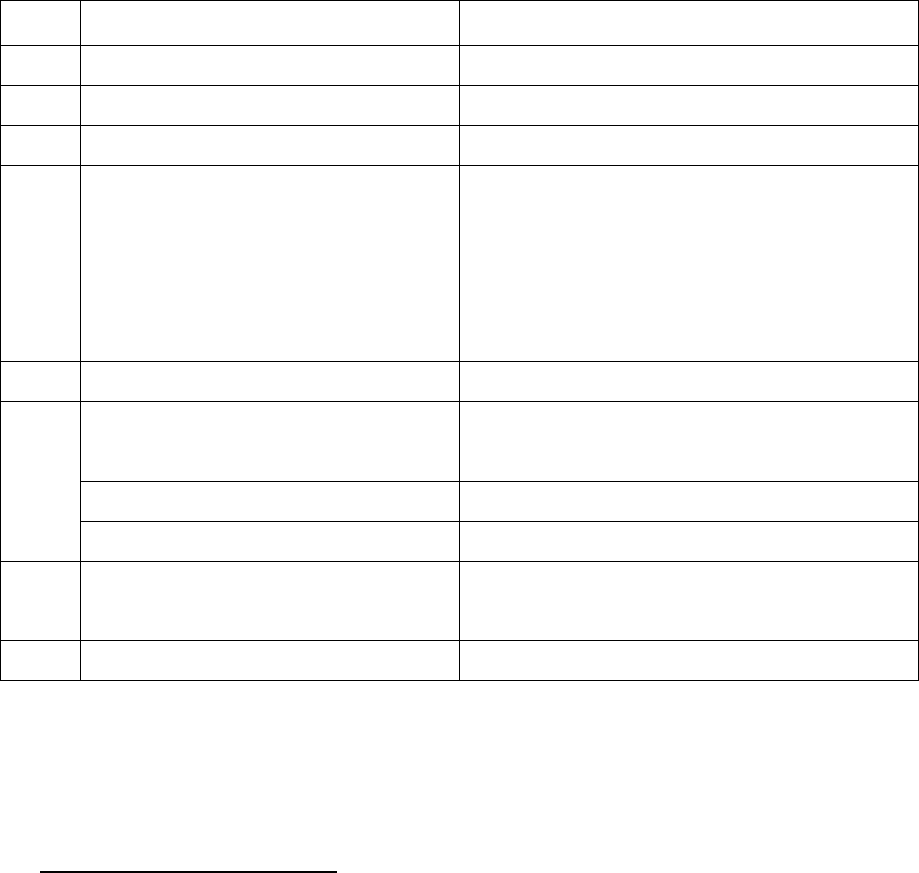

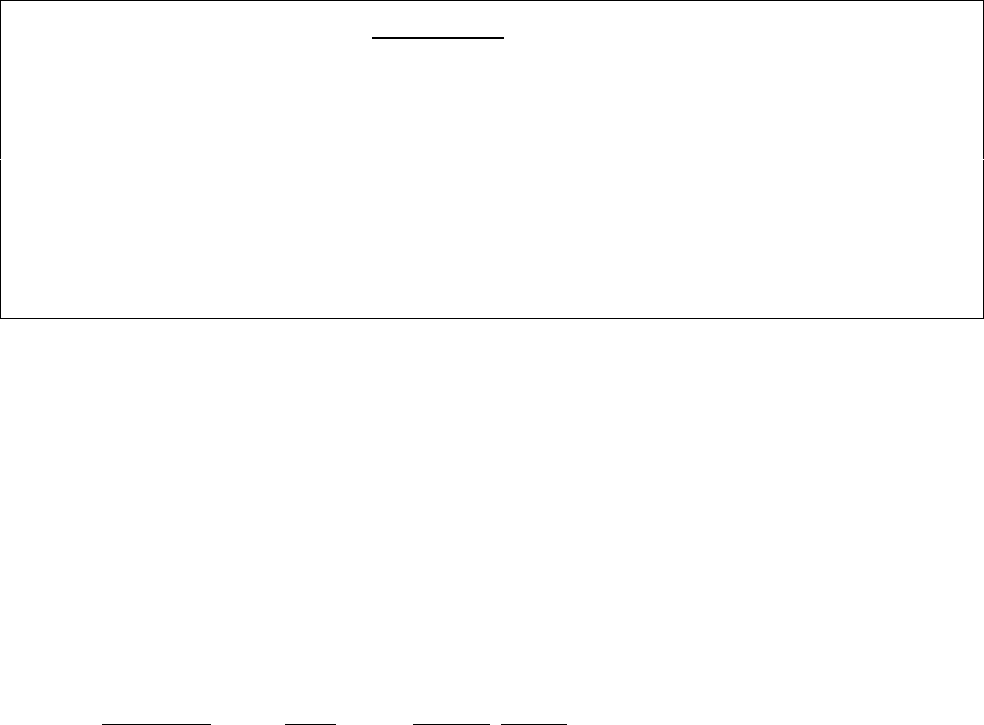

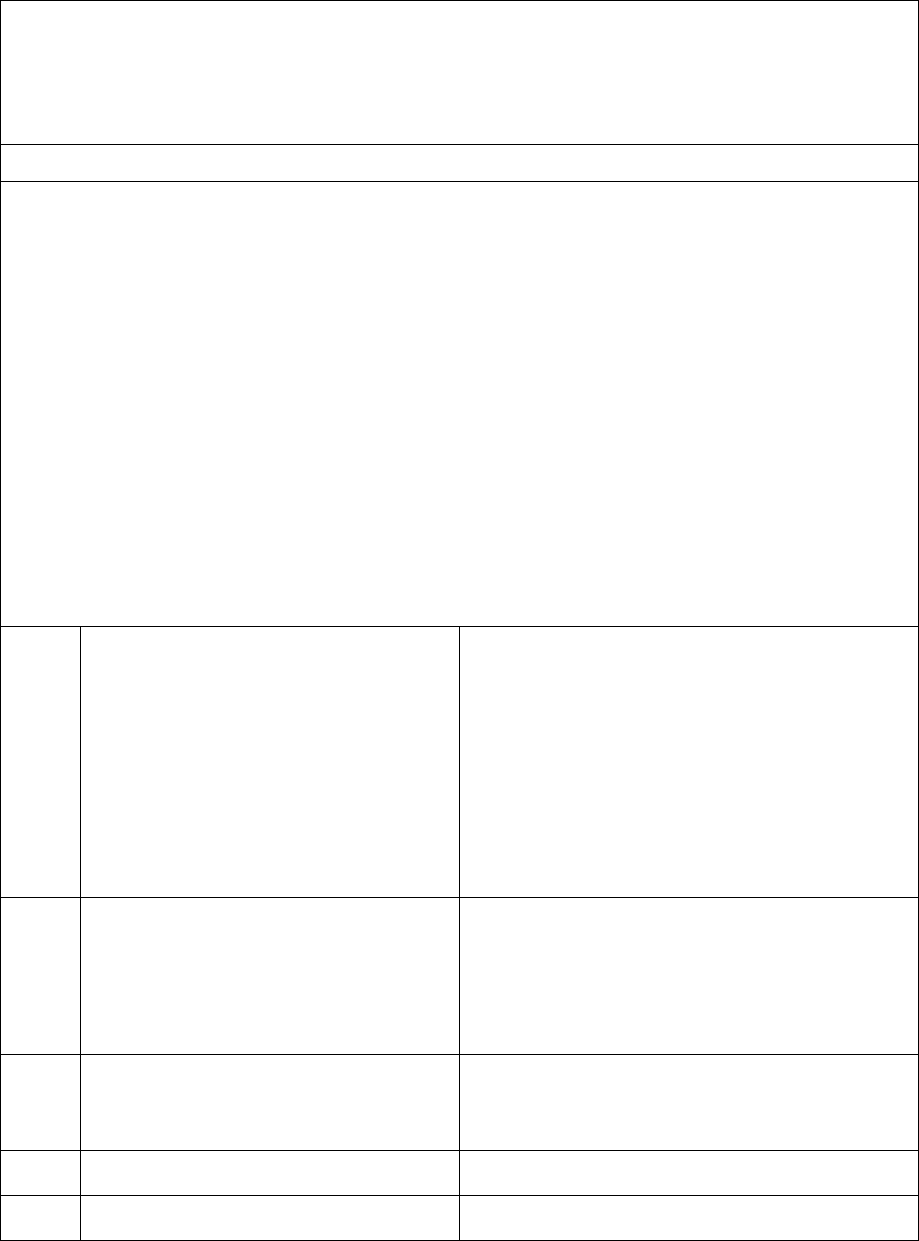

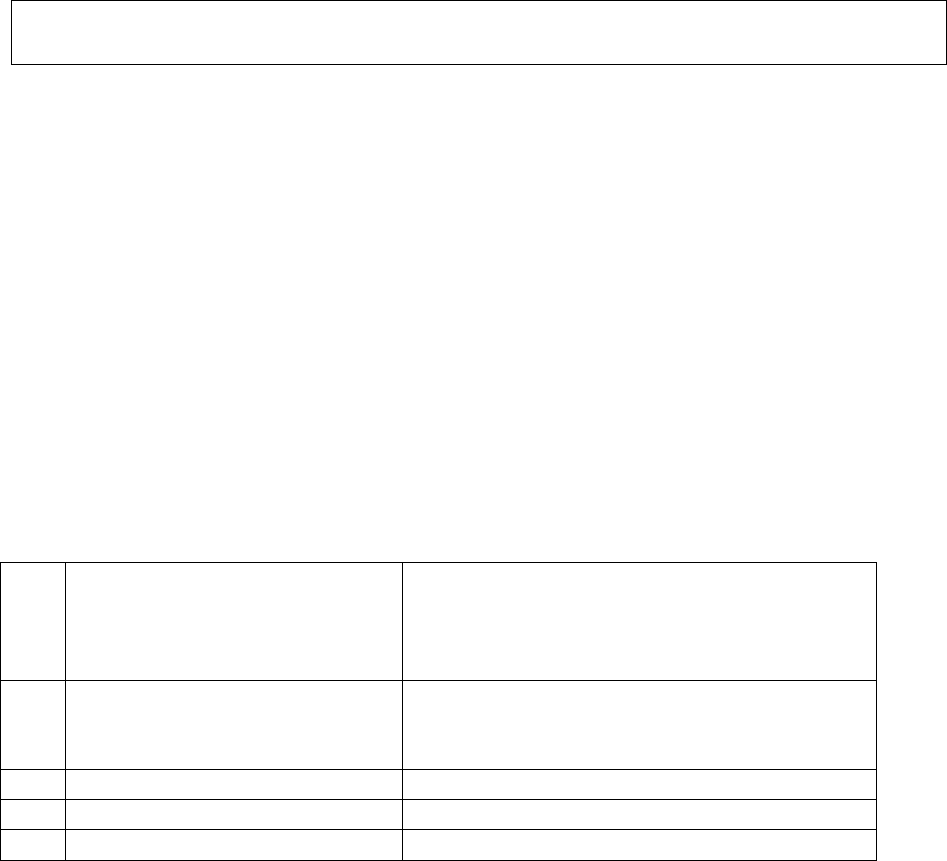

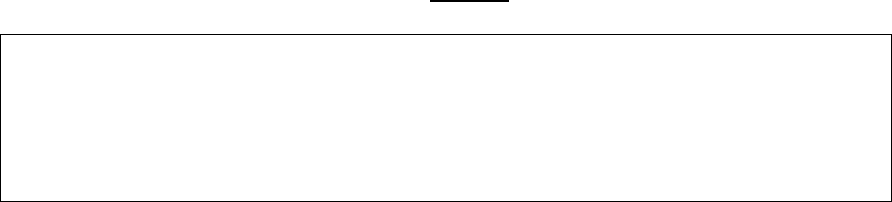

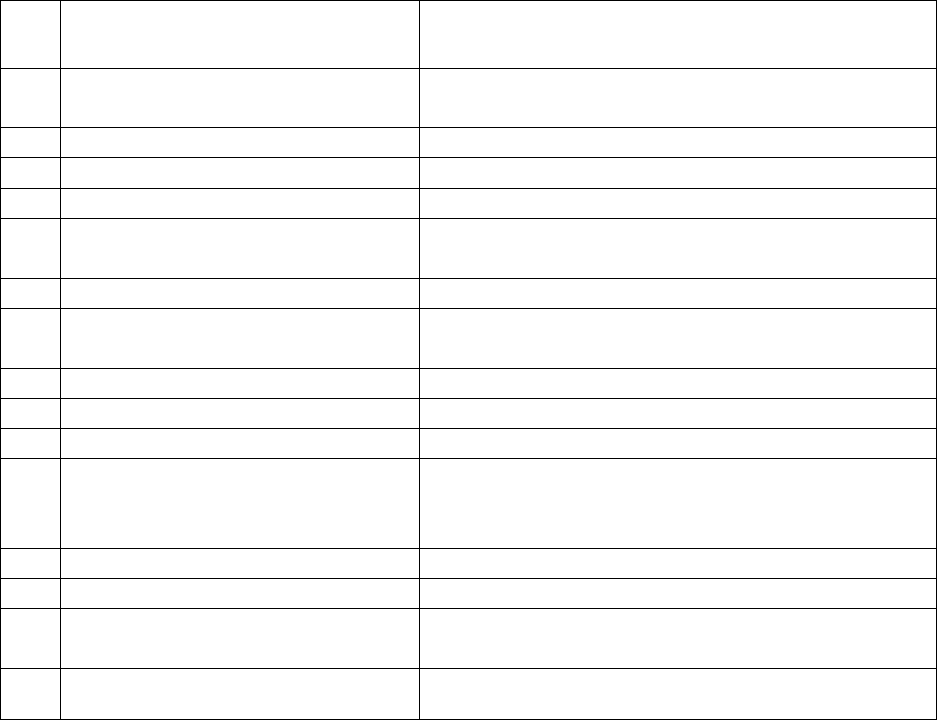

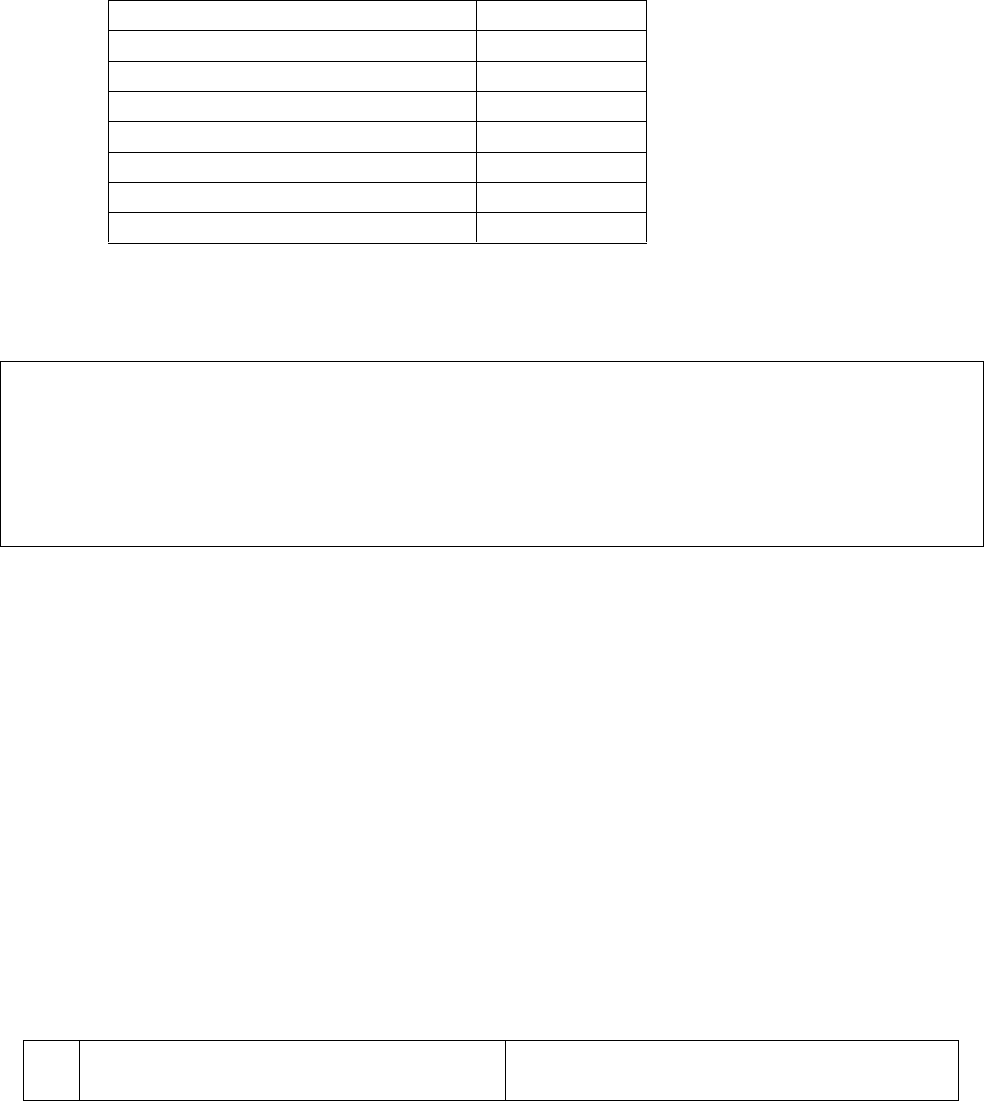

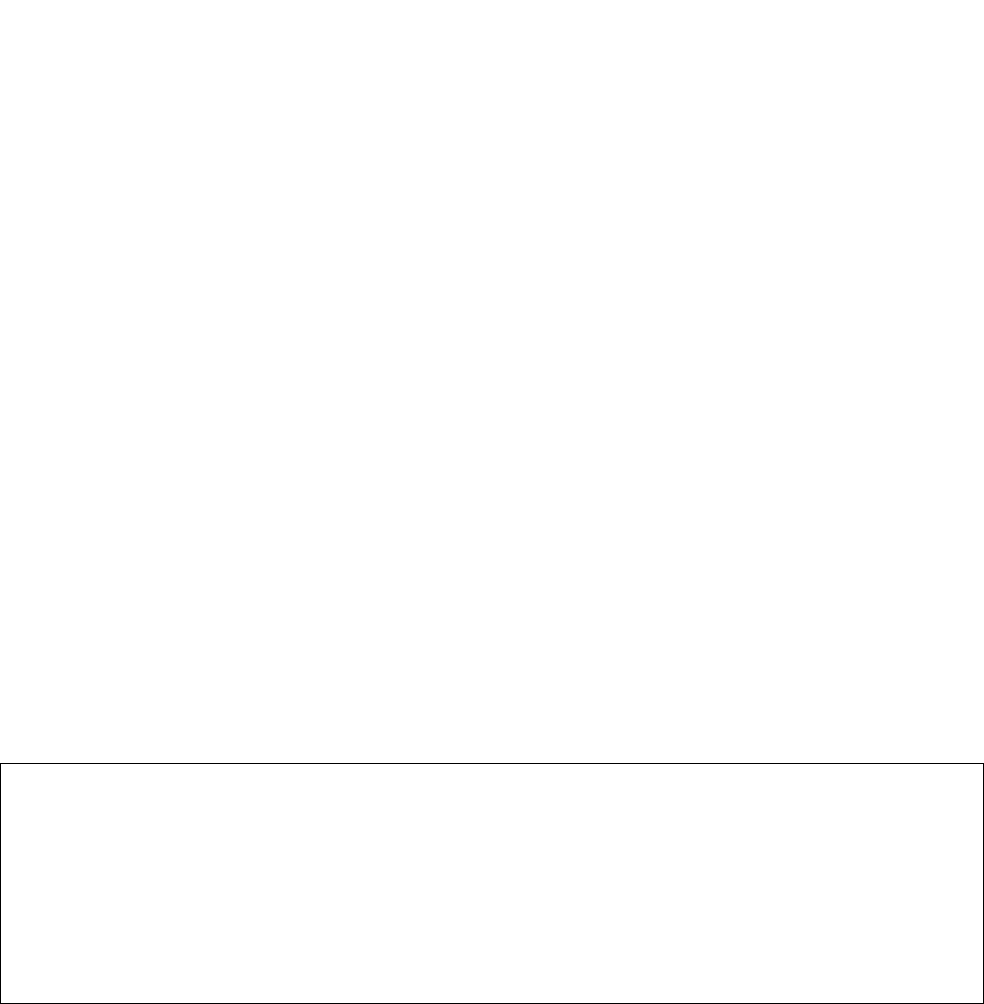

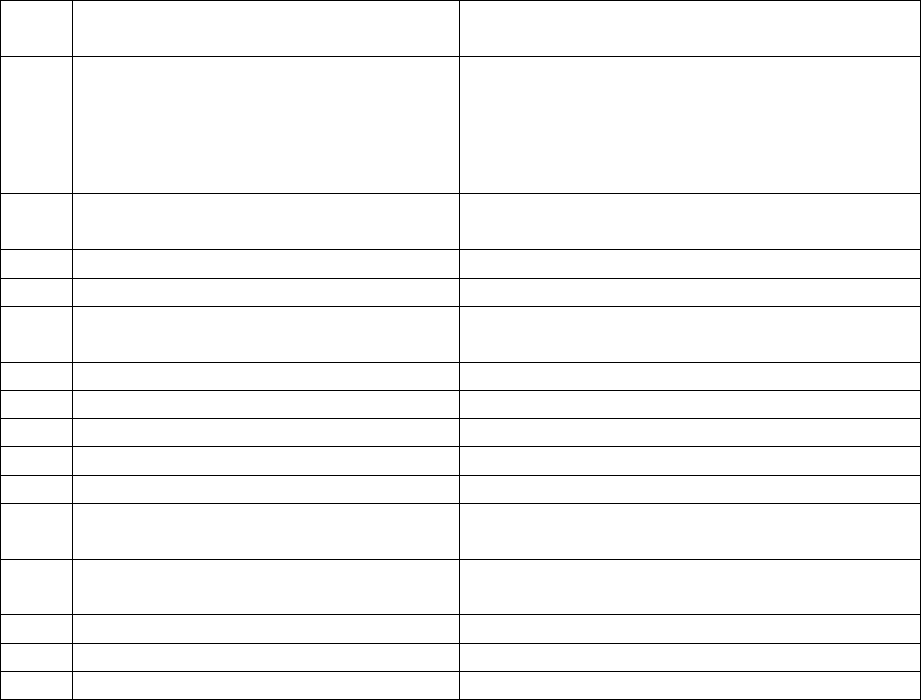

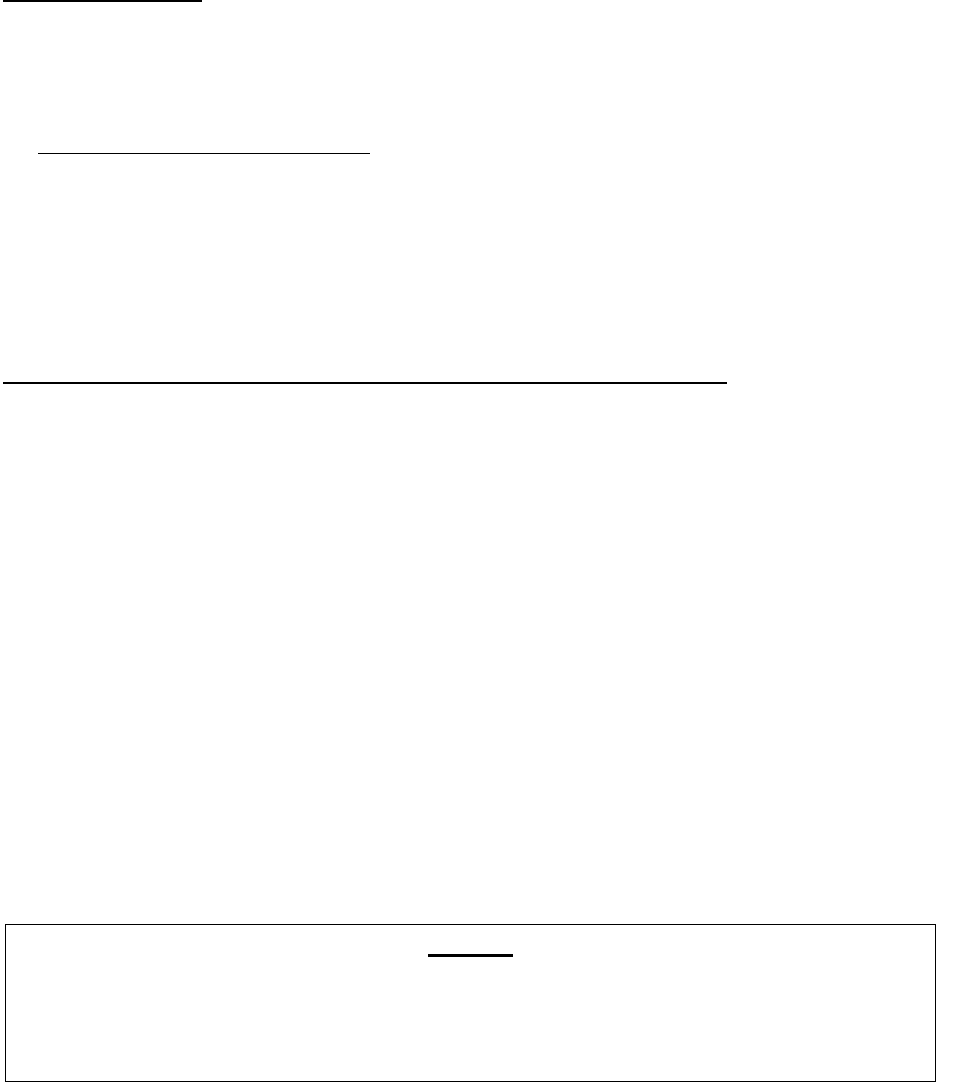

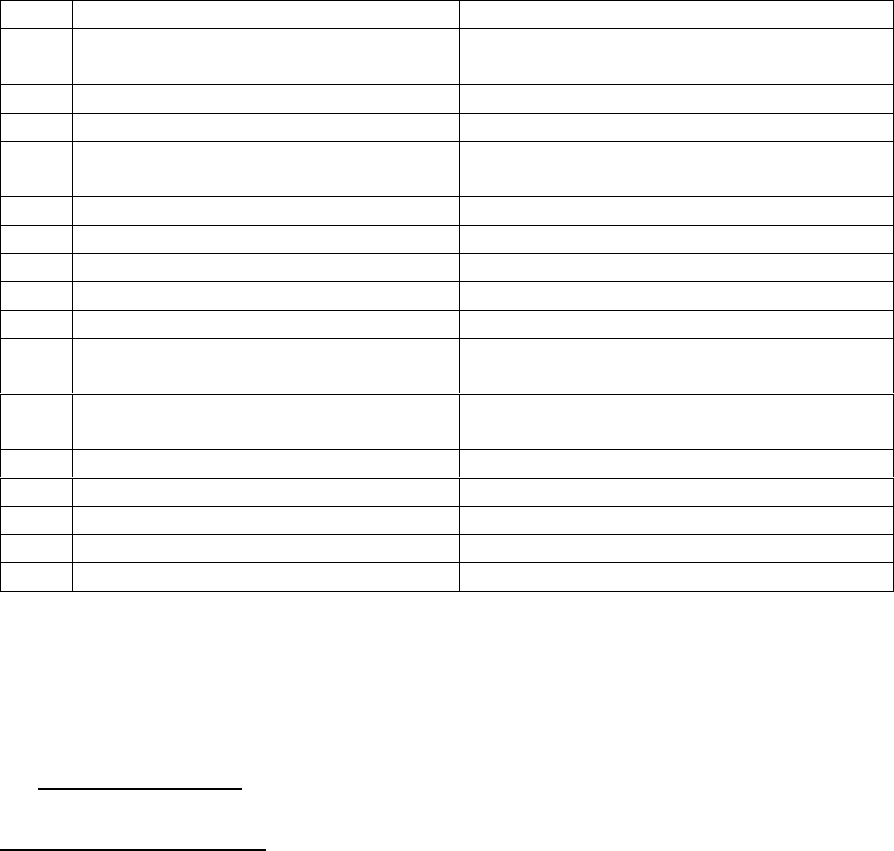

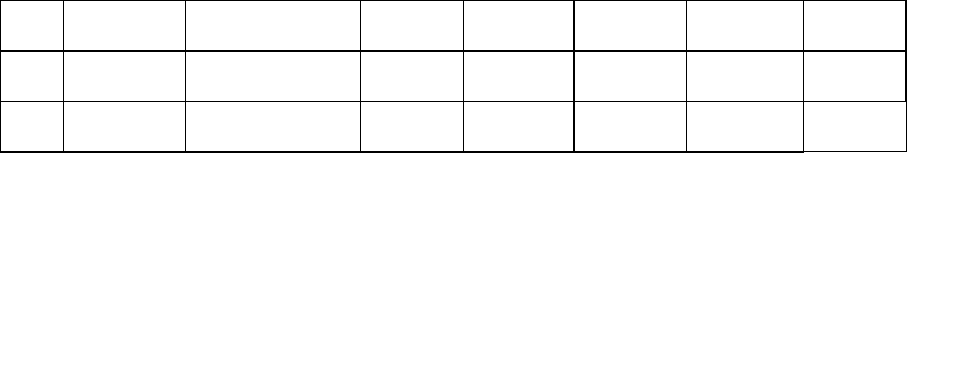

conditions. The calculation is as under:

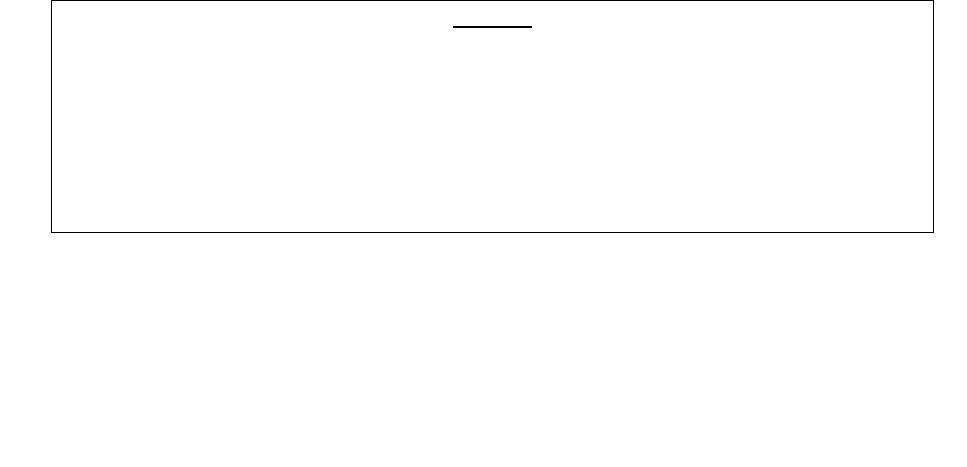

Post hospitalization limit (90 days after the discharge date) : 20/02/2019

Bill Date

Bill Amount

Paid

Not Paid

06/02/2019

Med

165.4

165.4

0

06/02/2019

Med

15700

15700

0

10/02/2019

Lab

265

0

265

13/02/2019

Med

222

222

0

13/02/2019

Med

339

339

0

14/02/2019

Med

14140

14140

0

20/02/2019

Med

274.3

274.3

0

20/02/2019

Med

15700

15700

0

27/02/2019

Med

261.9

0

261.9

27/02/2019

Med

15500

0

15500

28/02/2019

Lab

515

0

515

63082.6

46540.7

16541.9

Payment details

Claim id

Paid in INR

19973266

4225

20348407

42315

Total Paid

46540

While reviewing the claim, it is found that the bill dated 10.02.2019 amounting to Rs.265/- was

wrongly deducted and the same will be processed. The claim has been processed as per policy

terms and conditions. Clause 2.38 of the policy reads as under:

POST HOSPITALISATION MEDICAL EXPENSES

Relevant medical expenses incurred immediately 90 days after the Insured person is

discharged from the hospital provided that;

a. Such Medical expenses are incurred for the same condition for which the Insured

Person’s Hospitalisation was required; and

b. The In-patient Hospitalisation claim for such Hospitalisation is admissible by us.

Regarding the corporate buffer, Total Corporate Buffer of Rs.100 crores is allocated in the policy in

proportion to the total premium of all Banks to the individual premium of each bank. Final

adjustment of corporate buffer shall be done at the end of the policy depending upon the

deletions and additions made. Even though an implied condition it is declared that the corporate

buffer payments shall be subject to terms and conditions of the policy.

In view of their submissions, the RI prayed for passing an appropriate order.

19. Reason for Registration of complaint:-

The complaint falls within the scope of the Insurance Ombudsman Rules, 2017.

20. The following documents were placed for perusal.

a. Complaint along with enclosures,

b. Respondent Insurer’s SCN along with enclosures and

c. Consent of the Complainant in Annexure VIA & and Respondent Insurer in VII A

21. Result of personal hearing with both the parties (Observations & Conclusions):

The dispute is whether the settlement of health claim under the policy is in order or not.

Personal hearing by the way of online Video-conferencing through GoTo Meet was conducted in

the said case. Complainant and Representative of RI joined using online VC and presented their

case. Confirmation from all the participants about the clarity of audio and video was taken to

which the participants responded positively. Complainant and Representative of RI reiterated

their earlier submissions.

Forum has perused the documentary evidence available on record and the submissions made by

both the parties during the personal hearing.