Consolidated Coverage Dossier

April 2020

Coverage compilation from:

April 1 to April 30, 2020

Coverage compilation on "PNB MetLife India Insurance From April 01, 2020 To April 30, 2020"

No.

Publication/Portal

Headline

Date

1

The Hindu Business Line

How insurers are ensuring business

continuity

April 02, 2020

2

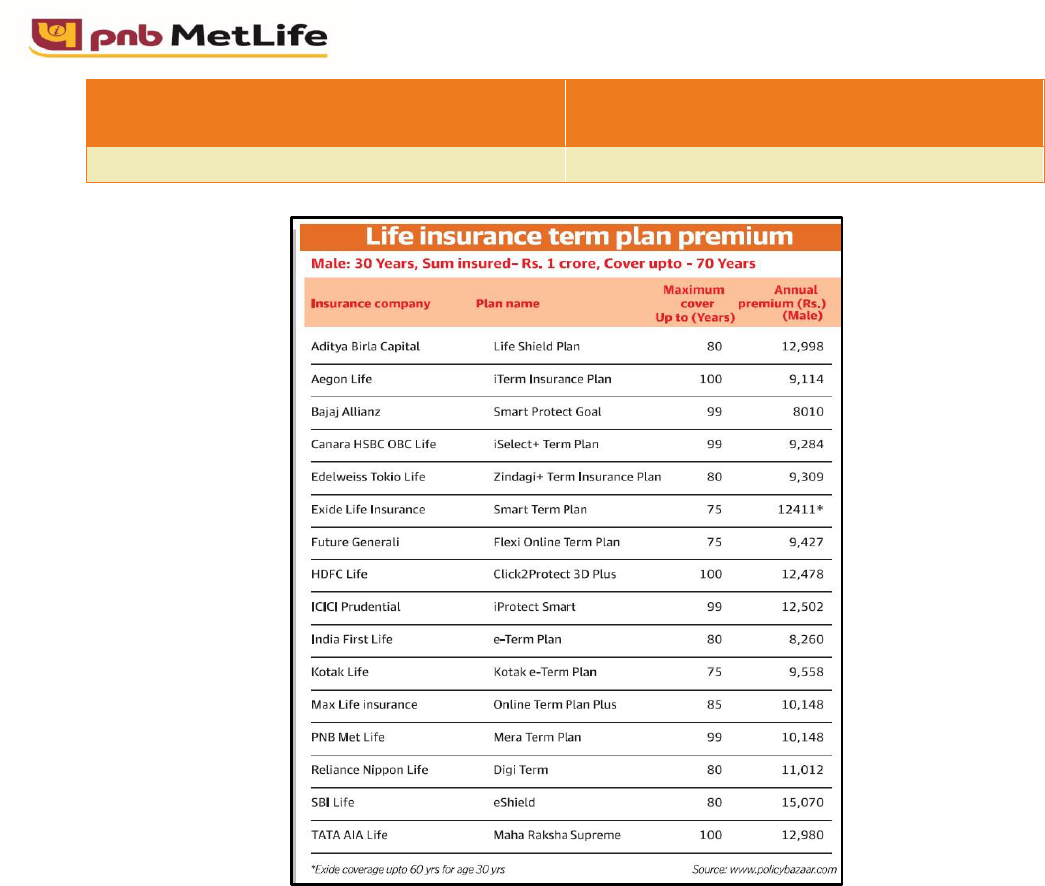

The Hindu

Life insurance term plan premium

April 06, 2020

3

Mint

Log in to get insurance without medical

tests

April 13, 2020

4

Raj Express

PNB to continue part in two insurance

companies

April 13, 2020

5

The Indian Express

PNB to retain stake in two life insurance

cos

April 13, 2020

6

Samay Paribartan

PNB to retain stake in two life insurance

ventures

April 13, 2020

7

The Times Of India

PNB to retain stake in two life insurance

ventures

April 13, 2020

8

Millennium Post

PNB to retain stake in two life insurance

ventures as Irdai gives nod

April 13, 2020

9

Hari Bhoomi

PNB will continue with 2 Life Insurance

cos

April 13, 2020

10

Business Standard (Hindi)

PNB will maintain stake in 2 Life Insurance

firms

April 13, 2020

11

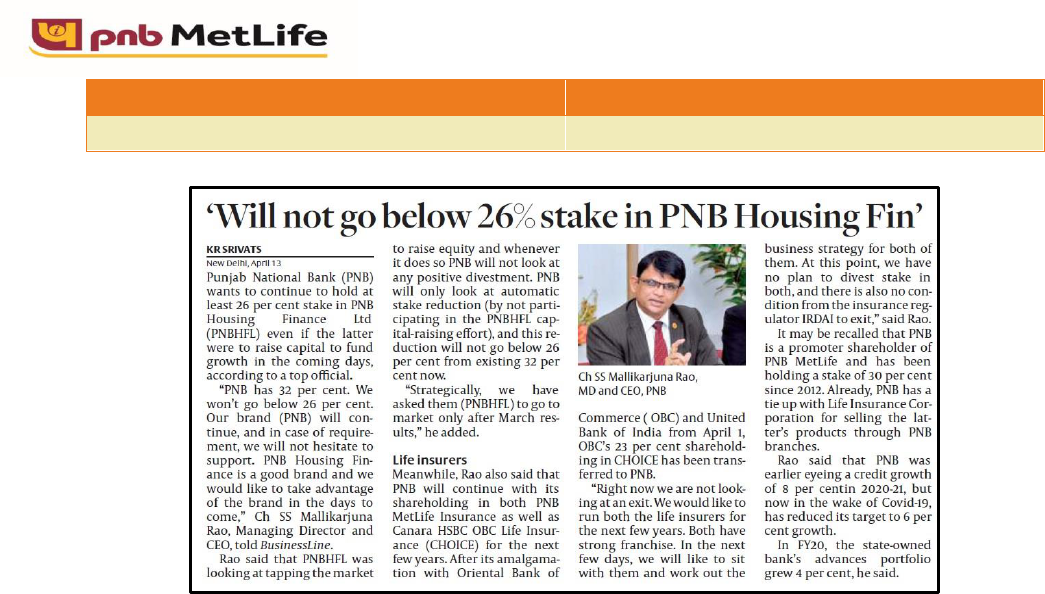

The Hindu Business Line

Will not go below 26% stake in PNB

Housing Fin

April 14, 2020

12

The Hindu

Life insurance term plan premium

April 20, 2020

13

The Economic Times Wealth

Why you must not rush for the Ulip

settlement option

April 20, 2020

14

Business Standard

Covid crisis: Irdai eases medical insurance

process

April 23, 2020

15

The Times Of India

Union Bank to lower stake in IndiaFirst to

below 10%

April 27, 2020

16

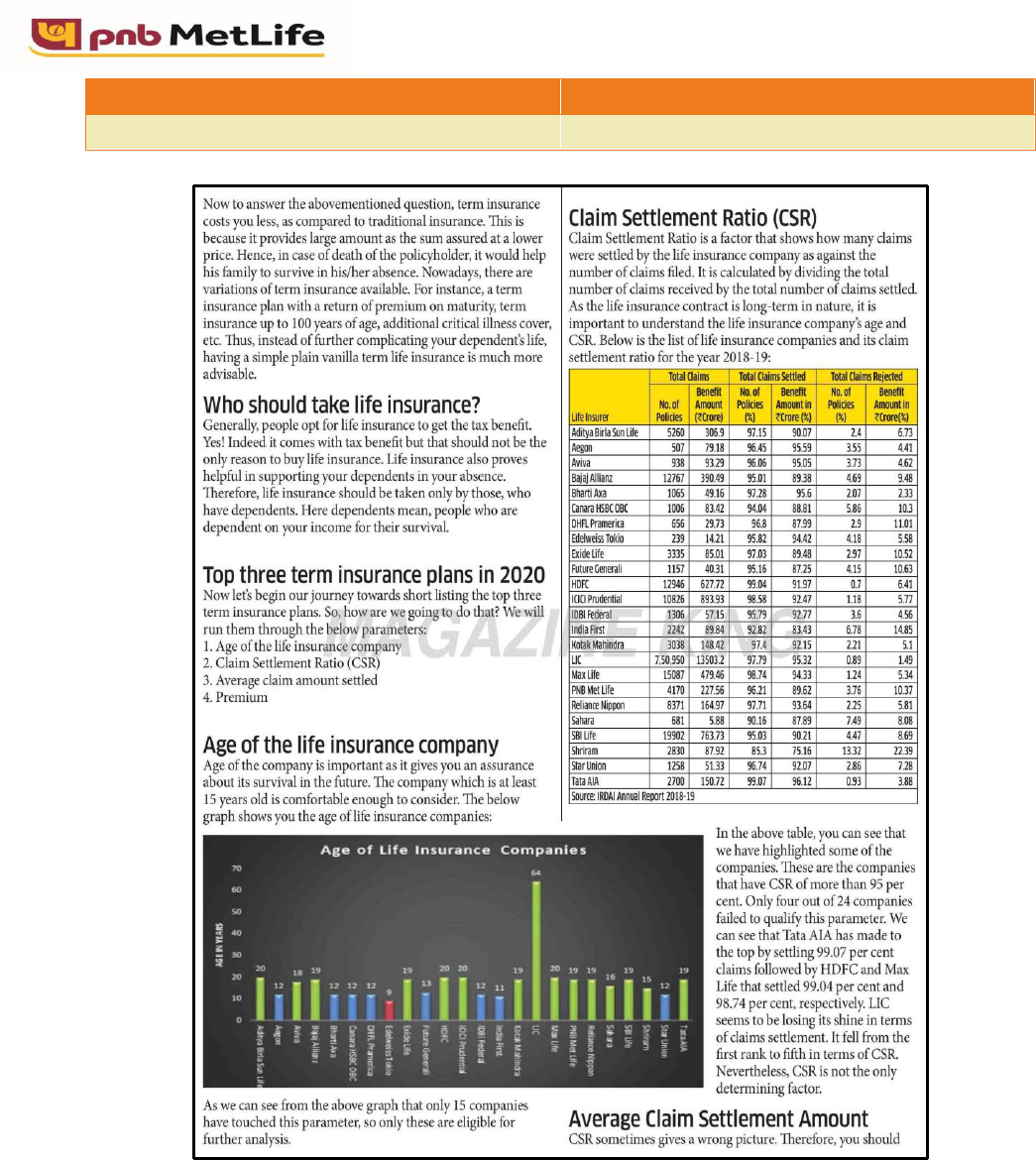

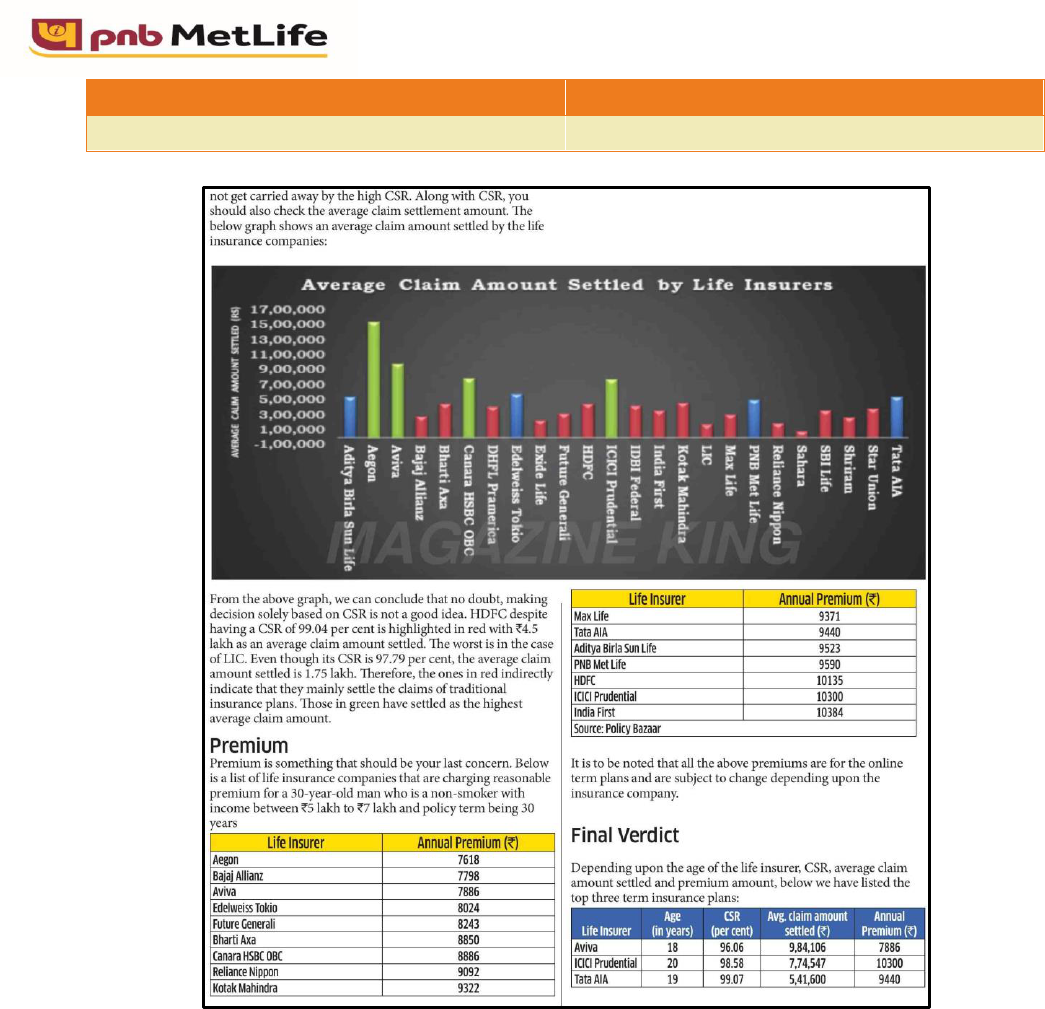

Dalal Street

Life Insurance Buying Guide For 2020

April 29, 2020

Online

1

ET CIO

PNB Met Life India Insurance elevates CIO

April 01, 2020

Samrat Das as new COO

2

The Economic Times

RevFin gives loan to e-rickshaw customers

during Covid-19 crisis

April 01, 2020

3

Moneycontrol

PSBs merger impact: IRDAI extends

duration of existing bank-insurance

partnerships by a year

April 08, 2020

4

The Economic Times

PNB to retain stake in two life insurance

ventures as Irdai gives nod

April 12, 2020

5

Mint

Log in to get insurance without medical

tests

April 12, 2020

6

The Hindu Business Line

‘PNB not to go below 26 per cent in PNB

Housing Finance’

April 13, 2020

7

Business Standard

Quick approval, grace period: Medical

insurance process eased amid Covid-19

April 23, 2020

8

The Economic Times

Insurers to soon offer e-KYC to make

buying life insurance policies easier in

lockdown

April 25, 2020

9

The Financial Express

Aadhaar eKYC update: Modi govt notifies

new entities for Aadhaar authentication

service – Check full list

April 25, 2020

10

Hindustan Times

29 insurance, 9 stock firms allowed to

perform Aadhaar authentication services

April 25, 2020

11

The Financial Express

Union Bank plans to lower stake in

IndiaFirst Life to less than 10 per cent

April 26, 2020

12

Mint

Buying an insurance policy will be easier

as govt allows use of Aadhaar for KYC

April 26, 2020

13

The Hans India

Finance Ministry allows 29 insurance, 9

securities entities to use Aadhaar

Authentication Services

April 26, 2020

14

Zee News

Insurance, Security agency not to ask for

Aadhaar card for KYC

April 26, 2020

15

The Sentinel Assam

Two notifications issued to allow Aadhaar

authentication

April 27, 2020

Publication : The Hindu Business Line

Edition : Chennai

Date : April 02, 2020

Page: 14

Publication : The Hindu

Edition : Bangalore, Noida, Mumbai, Kochi,

Hyderabad, Chennai

Date : April 06, 2020

Page: 13

Publication : Mint

Edition : Ahmedabad, New Delhi, Mumbai,

Kolkata, Hyderabad, Chennai, Bangalore

Date : April 13, 2020

Page: 10

Publication : Raj Express

Edition : Indore

Date : April 13, 2020

Page: 8

Publication : The Indian Express

Edition : Mumbai, New Delhi

Date : April 13, 2020

Page: 11

Publication : Samay Paribartan

Edition : Kolkata

Date : April 13, 2020

Page: 7

Publication : The Times Of India

Edition : Kochi

Date : April 13, 2020

Page: 9

Publication : Millennium Post

Edition : Kolkata, New Delhi

Date : April 13, 2020

Page: 11

Publication : Hari Bhoomi

Edition : New Delhi

Date : April 13, 2020

Page: 10

Publication : Business Standard (Hindi)

Edition : Indore, New Delhi

Date : April 13, 2020

Page: 1

Publication : The Hindu Business Line

Edition : Chennai, Kochi

Date : April 14, 2020

Page: 12

Publication : The Hindu

Edition : Bangalore, Noida, Mumbai, Kochi,

Hyderabad, Chennai

Date : April 20, 2020

Page: 13

Publication : The Economic Times Wealth

Edition : All

Date : April 20, 2020

Page: 8

Publication : Business Standard

Edition : Ahmedabad, New Delhi, Mumbai

Date : April 23, 2020

Page: 9

Publication : The Times Of India

Edition : Kochi

Date : April 27, 2020

Page: 9

Publication : Dalal Street

Edition : National

Date : April 29, 2020

Page: 52

Publication : Dalal Street

Edition : National

Date : April 29, 2020

Page: 53

Publication : Dalal Street

Edition : National

Date : April 29, 2020

Page: 54

Headline : PNB Met Life India Insurance elevates

CIO Samrat Das as new COO

Domain : ET CIO

Date : April 01, 2020

Journalist: Riya Pahuja

https://cio.economictimes.indiatimes.com/news/corporate-news/pnb-met-life-india-insurance-

elevates-cio-samrat-das-as-new-coo/74934591

Samrat Das, CIO, PNB Met Life India Insurance has been promoted as COO. He is associated with the

group since 2016 when he joined as a CIO. He has successfully led various technology an business

initiatives for the organisation.

Before joining PNB Met Life India Insurance, Das was the CIO of Tata AIA Life Insurance Company, which

he had joined in March 2010.

PNB MetLife is a partnership between leading global life insurance provider MetLife and India’s

nationalized bank PNB. Present in over 7,000 locations in India, PNB MetLife provides a wide range of

life, health and retirement insurance products.

In a career spanning around 20 years, Das has worked as Associate Director – Technology at Fidelity

International and as Assistant Vice President – IT at SBI Life Insurance Company. He started his career as

a Business Analyst with global pharmaceutical company Pfizer.

Headline : RevFin gives loan to e-rickshaw

customers during Covid-19 crisis

Domain : The Economic Times

Date : April 01, 2020

Journalist: ET Online

https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/revfin-gives-loan-to-e-rickshaw-

customers-during-covid-19-crisis/articleshow/74928495.cms

RevFin is extending help for its e-rickshaw customers by providing a loan of Rs 2100 at 0% to support

them during the global crisis. In this the customers can repay the loan in up to eight installments.

The company will allow EMI repayment moratorium up to three months to its customers who have

earlier taken loan for e-rickshaw,amidst the lockdown.

RevFin provides loans to individuals and charge them interest on the amount. "We are concerned about

the impact of the lockdown on our customers, who are primarily daily wage earners. We are committed

to ensuring the financial well-being of our customers and to put their minds at ease during this global

crisis," says Sameer Aggarwal, Founder & CEO, RevFin, in a statement.

RevFin had partnered with PNB MetLife to provide protection to the customers through life insurance

on their loans.

Headline : PSBs merger impact: IRDAI extends

duration of existing bank-insurance partnerships

by a year

Domain : Moneycontrol

Date : April 08, 2020

Journalist:

https://www.moneycontrol.com/news/business/companies/psbs-merger-impact-irdai-extends-

duration-of-existing-bank-insurance-partnerships-by-a-year-5123881.html

Insurance regulator IRDAI has allowed Punjab National Bank, Canara Bank, Indian Bank and Union Bank,

who have acquired other banks as part of the public sector bank (PSB) merger process, to continue the

existing bancassurance (banks selling insurance) agreements for the next 12 months.

Insurance Regulatory and Development Authority of India (IRDAI) has said that even if the number of

bancassurance tie-ups exceed three each in life, non-life and standalone health category, banks can

continue with the partnerships for one more year.

Current insurance laws prohibit banks from tying up with more than three insurers in each category (life,

non-life and health) to sell policies.

As part of the merger, Oriental Bank of Commerce and United Bank will be merged into Punjab National

Bank while

Two banks coming from south – Canara Bank and Syndicate Bank – will be merged.

Andhra Bank and Corporation Bank will be merged into Union Bank. The fourth one will be the

consolidation of Indian Bank with Allahabad Bank.

Since the bank merged into larger banks sell insurance products, these partnerships will automatically

pass on to the acquirer bank.

Further, the acquirer banks (Punjab National Bank, Canara Bank, Union Bank and Indian Bank) will also

receive renewal commissions for the insurance products sold. This is subject to these banks entering

into servicing partnerships with the insurance companies.

It is likely that a similar flexibility could be given for banks holding promoter stake in insurance

companies.

Clarity is awaited on what happens to banks where there is an insurance joint venture. After the PSB

merger, Union Bank will be tagged as promoter of both Star Union Dai-ichi Life Insurance as well as

IndiaFirst Life (where Andhra Bank is a promoter). Similarly, Punjab National Bank will be tagged as

promoter of both PNB MetLife Insurance and Canara HSBC OBC Life Insurance (where Oriental Bank of

Commerce holds stake).

As per insurance laws, one bank cannot hold promoter-level stake (more than 10 percent) in multiple

insurers in the same category, be it life, non-life or health.

Headline : PNB to retain stake in two life

insurance ventures as Irdai gives nod

Domain : The Economic Times

Date : April 12, 2020

Journalist: PTI

https://economictimes.indiatimes.com/markets/stocks/news/pnb-to-retain-stake-in-two-life-

insurance-ventures-as-irdai-gives-nod/articleshow/75106923.cms

State-owned Punjab National Bank (PNB) will retain stake in two life insurance ventures as the lender

has got permission from Insurance Regulatory and Development Authority of India (IRDAI).

Following the merger of Oriental Bank of Commerce on April 1 with PNB, 23 per cent of stake of the

former in Canara HSBC OBC Life Insurance stands transferred to latter.

Already, PNB is a promoter of PNB Metlife Insurance with the highest stake of 30 per cent since 2012.

Founded in 2001, PNB Metlife's other shareholders include US-based Metlife with 26 per cent, Elpro (21

per cent) and M Pallonji & Company (18 per cent).

"At this point of time there is no compulsion to exit. We have spoken to Irdai. There is a continuity.

There is a time we will take a decision on that," PNB Managing Director S S Mallikarjuna Rao told PTI

when asked if regulation restricts a lender having stake in two life insurers.

"Irdai says there is no regulation to restrict currently. So, both can continue," he added.

Further, there is tie up with Life Insurance Corporation of India (LIC) for selling its products through the

bank's branches.

Rao further said PNB has started focussing on growth post merger and planned a series of capital raising

initiatives, including rights issue and FPO, in the third quarter this fiscal.

At the moment, the bank is adequately capitalised with the capital adequacy ratio of 14.04 per cent at

the end of December 2019, he said.

The government provided Rs 16,091 crore to PNB and Rs 1,666 crore to United Bank of India in

September for enhancing the capital base of these two lenders.

Going forward, Rao said, the bank plans to further infuse capital during the current fiscal, including

through follow-on public offer (FPO).

Sharing details of the capital raising plan, Rao said the bank is looking to raise Rs 3,000 crore through

additional Tier-I (AT-1) bonds in the next couple of months.

"The board of the bank has already given approval and now we are contemplating approval from the

government of India," he said, adding the bank is preparing to raise AT-1 bonds during the first quarter

itself, depending on how quickly normalcy is restored.

Under the Basel-III norms, AT-1 bonds come with loss absorbency features, meaning that in case of

stress, banks can write off such investments or convert them into common equity if approved by the

RBI.

AT-1 bonds, which qualify as core or equity capital, are one of the means of raising capital by banks.

In the third quarter of the current fiscal, Rao said, "we are planning to go to the market either of QIP or

follow on public offer or for the rights issue".

Headline : Log in to get insurance without

medical tests

Domain : Mint

Date : April 12, 2020

Journalist: Tinesh Bhasin

https://www.livemint.com/money/personal-finance/log-in-to-get-insurance-without-medical-tests-

11586715070525.html

The threat of getting infected with the covid-19 or the novel coronavirus, which has sent India into a

lockdown, has reinforced the importance of having adequate health insurance and life insurance, if you

have financial dependants. If you don’t already have these two basic covers, don’t wait for the lockdown

to get over and buy them now. If you are thinking that may not be possible because you would need to

undergo medical tests before buying a life or health insurance cover, you need not worry. In order to be

able to issue policies in the midst of the lockdown, without meeting customers, insurers have relaxed

norms and are adopting alternative evaluation methods instead of relying on medical tests.

Typically, a representative of the insurer visits the applicant to collect blood samples for the required

medical tests. Now, insurance companies are looking at credit scores of applicants, using tele-

underwriting or relying on health declarations by applicants themselves. “Instead of doing a medical

test, both health and life insurers are doing tele-underwriting. Under this, a doctor from the insurance

company calls up the customer to understand their medical history and condition," said Santosh

Agarwal, chief business officer, life insurance, Policybazaar, an online marketplace for insurance.

Some insurers were already issuing policies using evaluation methods like tele-underwriting but only for

a few low-risk products. For life insurers, those with lower covers are low-risk as the claims will be only

that much, while for general insurers, high-value covers are low-risk as more claims are likely to be filed

in low-value covers. Insurers have lifted such criteria now, and those that had not adopted alternative

ways of evaluation are tying up with third-party administrators (TPAs) to offer policies online, added

Agarwal.

Alternative Methods

Life insurance: Most life insurers already offer a cover up to ₹50 lakh online. For a cover higher than ₹50

lakh, the applicant needs to go for a mandatory medical screening, which will require a representative to

visit the applicant. Amid the lockdown, however, some insurers have raised this limit to ₹2.5 crore. But

the policies are issued online depending on many parameters such as income, age, medical history and

the current health status of the person.

Also, different insurers have different sum assured limits to issue a policy without medical screening. For

instance, PNB MetLife India Insurance Co. Ltd offers a cover of ₹50 lakh without medical tests for young

customers. “For some customer profiles, determined on the basis of age, credit score, income,

education and occupation, we offer covers of up to ₹2.5 crore with tele-medical consultation. We ask for

medical test only if something that requires further investigation comes up in the consultation," said

Mohit Garg, head, products, PNB Metlife India Insurance.

The sum assured for a policy issued without a medical test can vary depending on where the company is

sourcing customers from—online partners, banking partners or other channels.

Some other life insurance companies that are offering a cover of more than ₹50 lakh online include

HDFC Life Insurance Co. Ltd, Max Life Insurance Co. Ltd and Tata AIA Life Insurance Co. Ltd.

Health insurance: Medical tests for a health insurance policy, typically, depends on the age of the

customer. Medical screening could be mandatory for those above 40 or 60 years of age, depending on

the insurer. Many companies are now offering health insurance for those below 60 on the basis of the

customers’ declarations and tele-underwriting.

After the individual fills up the proposal form online, the case moves to the tele-underwriting team.

“Based on the health declarations, a medical professional from the insurance company calls up the

customer and tries to understand the current health status and medical and family health history," said

Manish Dodeja, head, claims and underwriting, Religare Health Insurance Co. Ltd.

According to Dodeja, in case a customer declares a disease, the medical professional will seek more

details pertaining to it. If the customer, for example, declares that he has diabetes, the company

representative may enquire how long the customer has had the illness, the medicines he is taking, other

symptoms he has, precautions advised by doctors, and so on.

DO they work?

The alternative evaluation mechanism can help a customer get a policy issued faster.

Tele-underwriting reduces ambiguity: Direct consultation assures the insurers that the declarations

made are genuine. “Many times, people may not understand technical terms for the disease. They may

not know, for instance, that hypertension is the technical term for what is colloquially called blood

pressure. When a medical professional has a consultation with the customer, such ambiguities are taken

care of," said Dodeja.

Sometimes, people are not even aware that they have an ailment, and simply follow a doctor’s

prescription. The insurance medical professional can take a call on the current health condition on the

basis of the prescribed medicine.

Medical tests are not totally reliable: The purpose of pre-acceptance medical screening is to find out

whether applicants have any illness at the time of buying the insurance policy. But some insurers feel

that these tests may not give a clear picture.

Before issuing the policy, insurers typically do electrocardiogram (ECG) to understand the health of the

heart, check blood pressure, and sugar and creatinine levels to know conditions of the kidneys. “Pre-

acceptance medical screening only gives insurers a bird’s eye view of a person’s health. It does not give

detailed information. Despite all the tests, insurers still get claims in the first few months after policy

issuance," said Dr S. Prakash, managing director, Star Health and Allied Insurance.

According to him, if ECG is normal, it doesn’t mean that the person doesn’t have any heart problems.

Similarly, a person’s blood sugar may be higher or lower, but the person may still be healthy. Also, if a

customer is taking medication, his sugar or blood pressure levels would be normal.

Many insurers also find problems with laboratories to whom they outsource the tests. “We have de-

panelled a lot of laboratories for different reasons. There must be about 4,000 labs in the country. Only

10% maintain high standards and have proper accreditation. We often faced problems with labs outside

metros, in tier-2 and tier-3 cities," said Prakash.

Credit scores, income levels work for life cover: To decide on the amount of life insurance cover,

insurers now look at the credit score of the applicant as one of the parameters. According to industry

experts, there’s a correlation between credit scores and the lifestyle of an individual. Those with a

higher credit score not only have financial discipline but also have better lifestyle. If an individual is

better organized, disciplined, self-conscious, and responsible, then the assumption is that he will also

focus on keeping himself fit," said Agarwal.

Insurers are also looking at credit scores to understand the income level of the customer, especially

while issuing a high-value cover. There’s a correlation between income and mortality— those with

higher income typically have lower mortality rates. It also helps insurers decide whether the customer

would be able to pay premiums in the future. Most insurers prefer a credit score of 650 or more for

salaried and above 700 for self-employed individuals.

Insurance is important and the pandemic has brought home the point emphatically. If you are someone

who hasn’t ticked off this important task yet, buy these covers online as soon as possible. When filling

out the form, ensure that you give out the correct details about your health.

Headline : ‘PNB not to go below 26 per cent in

PNB Housing Finance’

Domain : The Hindu Business Line

Date : April 13, 2020

Journalist: KR Srivats

https://www.thehindubusinessline.com/money-and-banking/pnb-not-to-go-below-26-per-cent-in-

pnb-housing-finance/article31331399.ece

Punjab National Bank (PNB) wants to continue to hold at least 26 per cent stake in PNB Housing Finance

Ltd (PNBHFL) even if the latter were to raise capital to fund growth in the coming days, according to a

top official.

“PNB has 32 per cent. We won’t go below 26 per cent. Our brand (PNB) will continue, and in case of

requirement, we will not hesitate to support. PNB Housing Finance is a good brand and we would like to

take advantage of the brand in the days to come,” Ch SS Mallikarjuna Rao, Managing Director and CEO,

told BusinessLine.

Rao said that PNBHFL was looking at tapping the market to raise equity and whenever it does so PNB

will not look at any positive divestment. PNB will only look at automatic stake reduction (by not

participating in the PNBHFL capital-raising effort), and this reduction will not go below 26 per cent from

existing 32 per cent now.

“Strategically, we have asked them (PNBHFL) to go to market only after March results,” he added.

Life insurers

Meanwhile, Rao also said that PNB will continue with its shareholding in both PNB MetLife Insurance as

well as Canara HSBC OBC Life Insurance (CHOICE) for the next few years. After its amalgamation with

Oriental Bank of Commerce ( OBC) and United Bank of India from April 1, OBC’s 23 per cent

shareholding in CHOICE has been transferred to PNB.

“Right now we are not looking at an exit. We would like to run both the life insurers for the next few

years. Both have strong franchise. In the next few days, we will like to sit with them and work out the

business strategy for both of them. At this point, we have no plan to divest stake in both, and there is

also no condition from the insurance regulator IRDAI to exit,” said Rao.

It may be recalled that PNB is a promoter shareholder of PNB MetLife and has been holding a stake of 30

per cent since 2012. Already, PNB has a tie up with Life Insurance Corporation for selling the latter’s

products through PNB branches.

Rao said that PNB was earlier eyeing a credit growth of 8 per centin 2020-21, but now in the wake of

Covid-19, has reduced its target to 6 per cent growth. In FY20, the state-owned bank’s advances

portfolio grew 4 per cent, he said.

On non-performing assets, Rao said there were SMA2 accounts to the tune of ₹1,800 crore as on March

1 that could not pay by March 31. This is the main impact of Covid-19 as on date, he added.

Headline : Quick approval, grace period: Medical

insurance process eased amid Covid-19

Domain : Business Standard

Date : April 23, 2020

Journalist: Sanjay Kumar Singh

https://www.business-standard.com/article/pf/quick-approval-grace-period-medical-insurance-

process-eased-amid-covid-19-120042300025_1.html

The COVID-19 pandemic has brought home the significance of health and life insurance like nothing else

earlier. Even those who were blasé about these covers in the past are now looking to buy a new policy

or want to enhance the sum insured on their existing ones. Meanwhile, the Insurance Regulatory and

Development Authority of India (IRDAI) has been issuing a slew of guidelines to health/general and life

insurance companies aimed at easing matters for customers.

MEDICAL INSURANCE:

Pay health insurance premiums in instalments: Through a circular dated April 20, 2020, the regulator has

permitted companies offering health insurance to allow customers to pay their premiums in

instalments. With many customers expected to face financial hardships amid the lockdown, this step will

ease customers’ burden. “It is an attempt to provide an affordable option to customers, and encourage

more people to buy health insurance," says Prasun Sikdar, managing director and chief executive officer

(CEO), ManipalCigna Health Insurance.

Some insurers will charge the same premium under all options. “The premium amount will remain the

same irrespective of the mode of payment," says S. Prakash, managing director, Star Health and Allied

Insurance. Brokers, however, inform that some companies may charge you an extra amount if you go for

any option other than annual.

The burden of paying the premium does get eased in a frequent-payment option. “In some COVID-19

cases, treatment costs have gone as high as Rs 14-15 lakh due to accompanying complications. If the

sum insured on your family floater is not adequate, use the monthly payment option to enhance your

cover,” suggests Amit Chhabra, business head, health insurance, Policybazaar.com.

Approval within two hours: At the time of admission, patients sometimes have to wait for a long time

before the insurer gives its pre-authorisation for cashless treatment. IRDAI has directed insurers to give

it within two hours (the same limit applies at the time of discharge). IRDAI had also said earlier that

COVID-19 cases should be treated on a priority basis and before any claim for this ailment is rejected, it

should be reviewed by the claims review committee (a high-level committee) of the insurer. IRDAI has

also asked insurers to simplify procedures, which means they should not ask for too many documents or

conduct time-taking checks.

Thirty days’ grace period: Most health policies offer a grace period of 30 days for payment of renewal

premium. Now, IRDAI has offered an additional grace period of 30 days, so that customers who use

offline payment modes like cheques are able to pay once the lockdown ends. “Both continuity of cover

and continuity of benefits will be available to customers if they pay within the grace period,” says

Prakash.

Health policies have a waiting period for pre-existing diseases (PEDs) ranging from two-four years. If you

fail to renew within the grace period, you will have to buy a new policy and the waiting period for PEDs

will begin all over again.

Claims procedure simplified: The regulator has also asked insurers to simplify the claims process for

COVID-19 deaths. “If the claim form states that a death took place due to COVID-19, we will not ask for

additional documents. We will process the claim based on just a death certificate or a hospital

document,” says Anil. Normally, insurers ask for treatment records, and sometimes they investigate

cases.

More time to pay premium: A 30-day grace period has been extended to life insurance customers too.

Life insurers offer a 15-day grace period in the monthly payment mode and a 30-day grace period in

other modes. Now, the effective grace period becomes 45-60 days.

If you fail to pay the premium within the grace period, you can revive the policy within the next six

months by paying the premium outstanding and the interest charge (sometimes waived by insurers). If

even this period has elapsed, you will have to undergo fresh medical check-ups.

Grace period for settlement in Ulips: In all unit-linked insurance plans (Ulips) that mature by May 31,

2020, the regulator has asked insurers to give customers the settlement option. Instead of receiving the

fund value as a lump sum, they can receive it over five years, with a minimum 20 per cent payout at the

end of each year. “This option has to be provided irrespective of whether this feature was originally

available in a Ulip product,” says Anil PM, head-legal and compliance, Bajaj Allianz Life.

If, after a couple of years, customers wish to withdraw the balance as a lump sum, they can do so. “The

net asset values (NAVs) of Ulips and their fund values have seen steep erosion in this market correction.

If customers avail of this extension, the markets will hopefully recover after some time and their fund

value will be protected,” says Mohit Garg, head of products, PNB MetLife Insurance.

Customers who don’t need the money urgently may go for this option. Besides recouping a part of their

fund value, they will get a tax-free income stream. “If the cover is at least 10 times the premium, then

even the settlement payouts will be tax-free,” says Sanjay Tiwari, director-strategy, Exide Life Insurance.

Headline : Insurers to soon offer e-KYC to make

buying life insurance policies easier in lockdown

Domain : The Economic Times

Date : April 25, 2020

Journalist:

https://economictimes.indiatimes.com/wealth/insure/life-insurance/insurers-to-soon-offer-e-kyc-to-

make-buying-policies-easier-in-lockdown/articleshow/75374456.cms

Insurance policy buyers will soon be able to complete KYC through a paperless process or e-KYC by

providing Aadhaar number as proof of identity to insurers, as per an IRDAI press release. This would

make the Know Your Customer (KYC) process much easier for policy buyers.

This e-KYC will also be very useful in the current lockdown in the country. To enable this the government

has allowed insurers to avail the Aadhaar-based authentication services of the Unique Identification

Authority of India (UIDAI) to fulfil the KYC norms of policyholders.

The IRDAI press release, issued on April 24, said, "To facilitate the general public to easily fulfil Know

Your Customer (KYC) norms while availing insurance services, IRDAI has recommended for allowing

insurance companies to avail Aadhaar Authentication Services of the Unique Identification Authority of

India. Central Government has permitted, vide Gazette notification dated April 23, 2020, some of the

insurance companies to undertake the Aadhaar authentication services."

Vaidyanathan Ramani, Head- Product & Innovation, Policybazaar.com said "The latest circular by the

regulator will help enable the policy purchase and KYC fulfillment process in a distance mode where

customers can do it from the comfort of their houses just with the click of a button. This will help the

insurers enhance the customer experience in this time of lockdown and social distancing and make the

insurance buying journey for consumers much easier."

This is a good move by Government to facilitate immediate KYC verification through online Aadhaar

authentication. Kayzad Hiramanek, EVP-Customer Service & Operations at Bajaj Allianz Life Insurance

said, "It will assist the industry to restart the process of paperless KYC for their online customer

onboarding journeys. Considering the present situation, this facility has been introduced at an

opportune time to make the on-boarding process digital, when meeting customers is almost

impossible."

The release further states that the interested customers/policyholders/claimants may avail paperless

KYC services in coming days from the following insurance companies:

S.No. Company Name

1 Bajaj Allianz Life Insurance Company Limited

2 Bharti AXA Life Insurance Company Limited

3 Exide Life Insurance Company Limited

4 HDFC Life Insurance Company Limited

5 ICICI Prudential Life InsuranceCompany Limited

6 India First Life InsuranceCompany Limited

7 Max Life Insurance Company Limited

8 PNB Metlife India Insurance Company Limited

9 SBI Life Insurance Company Limited

10 Future Generali India Life Insurance Company Limited

11 Reliance Nippon Life Insurance Company Limited

12 Aegon Life Insurance Company Limited

13 Shriram Life InsuranceCompany Limited

14 Aditya Birla Sun Life Insurance Company Limited

15 Pramerica Life Insurance Company Limited

16 Kotak Mahindra Life Insurance Company Limited

17 Star Union Dai-ichi Life Insurance Company Limited

18 IDBI Federal Life Insurance Company Limited

19 Edelweiss Tokio Life Insurance Company Limited

20 Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

21 Kotak Mahindra General Insurance Company Limited

22 Future Generali India Insurance Company Limited

23 Manipal Cigna Health Insurance Company Limited

24 ACKO General Insurance Limited

25 Religare Health InsuranceCompany Limited

26 Royal Sundaram General InsuranceCompany Limited

27 SBI General InsuranceCompany Limited

28 HDFC Ergo General Insurance Company Limited

29 HDFC ERGO Health Insurance Limited (Formerly Apollo Munich Health Insurance Company

Limited

Source: IRDAI

Normally, the process of KYC involves a lot of paperwork and forms etc., which makes the whole

procedure of application and verification very tedious. However, with the help of e-KYC through Aadhar,

policyholders may not be required to submit physical documents such as photographs, identity and

address proof to the insurer.

Headline : Aadhaar eKYC update: Modi govt

notifies new entities for Aadhaar authentication

service – Check full list

Domain : The Financial Express

Date : April 25, 2020

Journalist:

https://www.financialexpress.com/aadhaar-card/aadhaar-authentication-service-update-full-list-of-

new-entities-by-irdai-sebi-uidai-for-e-kyc-modi-govt/1939443/

Aadhaar Authentication Service: The Ministry of Finance has notified lists of new reporting entities that

can undertake Aadhaar authentication service of the Unique Identification Authority of India (UIDAI)

under Section 11A of the Prevention of Money-laundering Act, 2002. The new list of reporting entities

includes Bajaj Allianz Life Insurance Company, Bharti AXA Life Insurance, Exide Life Insurance, HDFC Life

Insurance, ICICI Prudential Life Insurance, PNB Metlife India Insurance Company, SBI Life Insurance

Company Limited etc. In a Gazette notification (GSR 262 (E) dated 23rd April 2020) the Department of

Revenue, Ministry of Finance said that the Central Government, after consultation with UIDAI and the

Insurance Regulatory and Development Authority of India notifies the reporting entities (mentioned

below) to undertake Aadhaar authentication service of the Unique Identification Authority of India

under section 11A of the Prevention of Money Laundering Act, 2002. These agencies are:

1. Bajaj Allianz Life Insurance Company Limited

2. Bharti AXA Life Insurance Company Limited

3. Exide Life Insurance Company Limited

4. HDFC Life Insurance Company Limited

5. ICICI Prudential Life Insurance Company Limited

6. India First Life Insurance Company Limited

7. Max Life Insurance Company Limited

8. PNB Metlife India Insurance Company Limited

9. SBI Life Insurance Company Limited

10. Future Generali India Life Insurance Company Limited

11. Reliance Nippon Life Insurance Company Limited

12. Aegon Life Insurance Company Limited

13. Shriram Life Insurance Company Limited

14. Aditya Birla Sun Life Insurance Company Limited

15. Pramerica Life Insurance Limited

16. Kotak Mahindra Life Insurance Company Limited

17. Star Union Dai-ichi Life Insurance Company Limited

18. IDBI Federal Life Insurance Company Limited

19. Edelweiss Tokio Life Insurance Company Limited

20. Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

21. Kotak Mahindra General Insurance Company Limited

22. Future Generali India Insurance Company Limited

23. Acko General Insurance Limited

24. Royal Sundaram General Insurance Company Limited

25. SBI General Insurance Company Limited

26. HDFC Ergo General Insurance Company Limited

27. Apollo Munich Health Insurance Company Limited

28. Manipal Cigna Health Insurance Company Limited

29. Religare Health Insurance Company Limited

In another notification (G.S.R. 261 (E) dated 22nd April 2020) the Department of revenue, Ministry of

Finance said that Central Government, after consultation with the UIDAI and Securities and Exchange

Board of India (SEBI) notified the following entities to “undertake Aadhaar authentication service of the

Unique Identification Authority of India under section 11A of the Prevention of Money-laundering Act,

2002.” These entities are:

1. Bombay Stock Exchange Limited

2. National Securities Depository Limited

3. Central Depository Services (India) Limited

4. CDSL Ventures Limited

5. NSDL Database Management Limited

6. NSE Data and Analytics Limited

7. CAMS Investor Services Private Limited

8 Computer Age Management Services Private Limited

9. Link Intime India Pvt. Ltd.

Headline : 29 insurance, 9 stock firms allowed to

perform Aadhaar authentication services

Domain : Hindustan Times

Date : April 25, 2020

Journalist:

https://www.hindustantimes.com/india-news/govt-allows-aadhaar-authentication-services-to-

insurance-and-securities-entities/story-QbGoMntxYKDEMNRZ1W1dMI.html

The finance ministry has allowed 29 insurance companies and nine securities entities, including the

Bombay Stock Exchange (BSE) and the National Securities Depository Limited to undertake Aadhaar

authentication services, the department of revenue said on Saturday.

The department has issued two separate notifications to allow these entities to use Aadhaar

authentication services with necessary standard security and privacy measures. This would help these

entities to perform in real time and make e-KYC (know your customer) that would reduce cost of

transaction, an official statement said.

“This would also be beneficial to the customers or the investors, especially the small and retail investors,

as they need not submit physical papers or documents for KYC,” a statement quoting finance secretary

Ajay Bhushan Pandey said. Earlier, he held the position of CEO of Unique Identification Authority of India

(UIDAI).

The ministry has allowed these insurance and securities entities to use Aadhaar authentication services

subject to the satisfaction of their regulatory authorities -- the Insurance Regulatory Authority of India

(IRDA) and the Securities and Exchange Board of India (SEBI), it said.

Headline : Union Bank plans to lower stake in

IndiaFirst Life to less than 10 per cent

Domain : The Financial Express

Date : April 26, 2020

Journalist: PTI

https://www.financialexpress.com/industry/banking-finance/union-bank-plans-to-lower-stake-in-

indiafirst-life-to-less-than-10-per-cent/1940085/

Union Bank of India, which received 30 per cent stake in insurance joint venture IndiaFirst Life Insurance

by virtue of the mega bank consolidation exercise of the government, plans to pare its holding to less

than 10 per cent, a senior official said.

Union Bank received the stake after Andhra Bank was merged with the Mumbai-based lender, effective

April 1.

As per guidelines of the Insurance Regulatory and Development Authority of India (IRDAI), one promoter

cannot hold more than 10 per cent stake in two insurance ventures.

Union Bank also holds 25.10 per cent equity stake in Star Union Dai-ichi Life Insurance, with the other

partners being Bank of India and Dai-ichi Life Holdings of Japan. “We will continue the process started by

erstwhile Andhra Bank to divest the stake to bring it below 10 per cent,” Union Bank of India Managing

Director and Chief Executive Officer Rajkiran Rai G told PTI.

Last year, Andhra Bank had initiated the process for selling its part or full stake in the insurance venture

with Bank of Baroda (44 per cent stake) and Carmel Point Investments, owned by Warburg Pincus,

holding the remaining 26 per cent.

Both the insurance ventures are doing well and the valuation is going to improve further, he said, adding

the stake sale will happen at opportune time and at good valuation. As per the government’s mega

consolidation plan, 10 state-owned banks were merged into four to create global size lenders, beginning

April 1.

Besides Andhra Bank, Corporation Bank was also merged with Union Bank. United Bank of India and

Oriental Bank of Commerce were merged with Punjab National Bank; Syndicate Bank was merged with

Canara Bank; and Allahabad Bank was amalgamated with Indian Bank.

The merger of Oriental Bank of Commerce with PNB resulted in transfer of 23 per cent stake in Canara

HSBC OBC Life Insurance to the latter. This too created a similar situation as that of Union Bank of India,

as PNB is a promoter of PNB Metlife Insurance with the highest stake of 30 per cent.

Headline : Buying an insurance policy will be

easier as govt allows use of Aadhaar for KYC

Domain : Mint

Date : April 26, 2020

Journalist:

https://www.livemint.com/news/india/buying-an-insurance-policy-will-be-easier-as-govt-allows-use-

of-aadhaar-for-kyc-11587868976363.html

The government has now allowed insurance companies to collect Aadhaar card details under the

Prevention of Money Laundering Act, subject to compliance with standard security and privacy

measures as per the Aadhaar Act. The move is aimed at checking laundering of funds into insurance

companies and shell companies.

The finance ministry has released a list of 29 insurance companies like Bajaj Allianz Life Insurance, Bharti

AXA Life Insurance, ICICI Prudential Life Insurance, HDFC Life Insurance, HDFC Ergo General Insurance

and SBI General Insurance which can collect Aadhaar information from customers for KYC purposes.

Finance Secretary Ajay Bhushan Pandey said that the two notifications issued in this regard by the

Ministry of Finance “to allow these entities to use Aadhaar authentication services under Aadhaar Act

with necessary standard security and privacy measures would help these entities to perform in real

time, do e-KYC and would also reduce their cost of transaction".

“This would also be beneficial to the customers or the investors, especially the small and retail investors,

as they need not submit physical papers or documents for KYC," Pandey, who is also the Revenue

Secretary, said.

This would ease their KYC process and would reduce cost and time besides preventing money

laundering activities.

Other entities given this permission include Max Life Insurance, PNB Metlife India Insurance, SBI Life

Insurance Future Generali India, Reliance Nippon Life Insurance, Apollo Munich Health Insurance,

Manipal Cigna Health Insurance, Religare Health Insurance, NSE Data and Analytics, CAMS Investor

Services, Computer Age Management Services, and Link Intime India.

An official said use of Aadhaar authentication service by these entities is voluntary and if an investor

gives Permanent Account Number (PAN), he or she does not need to go for Aadhaar authentication.

Headline : Finance Ministry allows 29 insurance, 9

securities entities to use Aadhaar Authentication

Services

Domain : The Hans India

Date : April 26, 2020

Journalist: J K Jha

https://www.thehansindia.com/business/finance-ministry-allows-29-insurance-9-securities-entities-

to-use-aadhaar-authentication-services-619267

The Ministry of Finance has allowed 29 insurance and 9 securities entities, including the Bombay Stock

Exchange (BSE) and the National Securities Depository Limited, to use Aadhaar Authentication Services

under the Prevention of Money Laundering Act (PML Act).

Department of Revenue has permitted them to undertake Aadhaar Authentication services of UIDAI

subject to their complying with standard security and privacy measures as per Aadhaar Act and to the

satisfaction of their respective regulatory authorities, namely the Insurance Regulatory Authority of

India (IRDA) and the Securities and Exchange Board of India (SEBI) respectively.

Finance Secretary Dr Ajay Bhushan Pandey said the decision will help these entities to perform in real-

time, do e-KYC and would also reduce their cost of the transaction. He said, this will also be beneficial to

the customers or the investors, especially the small and retail investors, as they need not submit

physical papers or documents for KYC.

Entities functional under IRDAI that have been allowed to use the Aadhaar Authentication services

include

1) SBI Life Insurance Company Limited

2) Royal Sundaram General Insurance Company Limited

3) SBI General Insurance Company Limited

4) Future Generali India Life Insurance Company Limited

5) Reliance Nippon Life Insurance Company Limited

6) Bharti AXA Life Insurance Company Limited

7) Exide Life Insurance Company Limited

8) HDFC Life Insurance Company Limited

9) Bajaj Allianz Life Insurance Company Limited

10)ICICI Prudential Life Insurance Company Limited

11) India First Life Insurance Company Limited

12) Aditya Birla Sun Life Insurance Company Limited

13) Pramerica Life Insurance Limited

14) Kotak Mahindra Life Insurance Company Limited

15) Star Union Dai-ichi Life Insurance Company Limited

16) Max Life Insurance Company Limited

17) PNB Metlife India Insurance Company Limited

18) Aegon Life Insurance Company Limited

19) Shriram Life Insurance Company Limited

20) Kotak Mahindra General Insurance Company Limited

21) Future General India Insurance Company Limited

22) Acko General Insurance Limited

23) IDBI Federal Life Insurance Company Limited

24) Edelweiss Tokio Life Insurance Company Limited

25) Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

26) HDFC Ergo General Insurance Company Limited

27) Apollo Munich Health Insurance Company Limited

28) Manipal Cigna Health Insurance Company Limited

29) Religare Health Insurance Company Limited

Entities functional under SEBI who are allowed to use the Aadhaar Authentication services include

1) Bombay Stock Exchange Limited

2) National Securities Depository Limited

3) NSE Data and Analytics Limited

4) Central Depository Services (India) Limited

5) CDSL Ventures Limited

6) NSDL Database Management Limited

7) CAMS Investor Services Private Limited

8) Computer Age Management Services Private Limited

9) Link Intime India Pvt. Ltd.

Revenue Department, however, said that it is a voluntary measure and use of Aadhaar authentication

service is voluntary. It said, if some investor gives PAN, then they need not go for Aadhaar

authentication.

Headline : Insurance, Security agency not to ask

for Aadhaar card for KYC

Domain : Zee News

Date : April 26, 2020

Journalist: J K Jha

https://zeenews.india.com/india/insurance-security-agency-not-to-ask-for-aadhaar-card-copy-for-

kyc-2279134.html

In a step to ensure the protection of Aadhaar related information of people, the Finance Ministry has

ordered the insurance and security agency not to ask for the Aadhaar card photocopy for Know Your

Customer (KYC) process. Instead, the Ministry has recommended insurance companies and agencies to

use UIDAI - Aadhar Authentication Service in order to complete the verification process.

The step is taken by the Finance Ministry under the Prevention of Money Laundering Act.

Insurance companies will also ensure the security and privacy of Aadhaar related information under the

Aadhaar Act.

Aadhaar number is a 12-digit random number issued by the UIDAI to the residents of India after

satisfying the verification process laid down by the Authority. Any individual, irrespective of age and

gender, who is a resident of India, can enroll to obtain Aadhaar number. The Aadhaar card includes

details like name, date of birth, gender, permanent address, mobile number (optional) and email ID

(optional).

Headline : Two notifications issued to allow

Aadhaar authentication

Domain : The Sentinel Assam

Date : April 27, 2020

Journalist: Mili

https://www.sentinelassam.com/business/two-notifications-issued-to-allow-aadhaar-

authentication/

The Finance Ministry has issued two notifications to enable different insurance companies and

stock/securities entities to undertake Aadhaar authentication of UIDAI under the Prevention of Money

Laundering Act, subject to compliance with standard security and privacy measures as per the Aadhaar

Act.

The Ministry’s Department of Revenue has so far allowed 29 insurance companies and nine market

entities — including Bajaj Allianz Life Insurance, Bharti AXA Life Insurance, HDFC Life Insurance

Company, ICICI Prudential, BSE, NSE, NSDL, Central Depository Services — to use verification services of

Aadhaar and e-KYC in real time.

Finance Secretary Ajay Bhushan Pandey, formerly the CEO of Unique Identification Authority of India

(UIDAI), said on Saturday that the two notifications allow these entities to access the Aadhaar platform.

“The permission will help these entities to perform in real time, do e-KYC and also reduce their cost of

transaction,” he said.

“This will also be beneficial to customers or investors, especially small and retail investors, as they need

not submit physical papers or documents for KYC,” Pandey added

The ministry has allowed these insurance and securities entities to use Aadhaar authentication services

under the PMLA subject to the satisfaction of their regulatory authorities, namely the Insurance

Regulatory Authority of India (IRDA) and the Securities and Exchange Board of India (SEBI) respectively

that they are complying with the standard of privacy and security as per the Aadhaar Act.

This would ease their KYC process and would reduce cost and time besides preventing money

laundering activities.

Other entities given this permission include Max Life Insurance, PNB Metlife India Insurance, SBI Life

Insurance Future Generali India, Reliance Nippon Life Insurance, Apollo Munich Health Insurance,

Manipal Cigna Health Insurance, Religare Health Insurance, NSE Data and Analytics, CAMS Investor

Services, Computer Age Management Services, and Link Intime India.