PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman - Shri Sudhir Krishna

Case of Hritek R Khosla V/S Manipal Cigna Health Insurance Co. Ltd.

Complaint Ref. No.: CHD-H-053-2021-0758

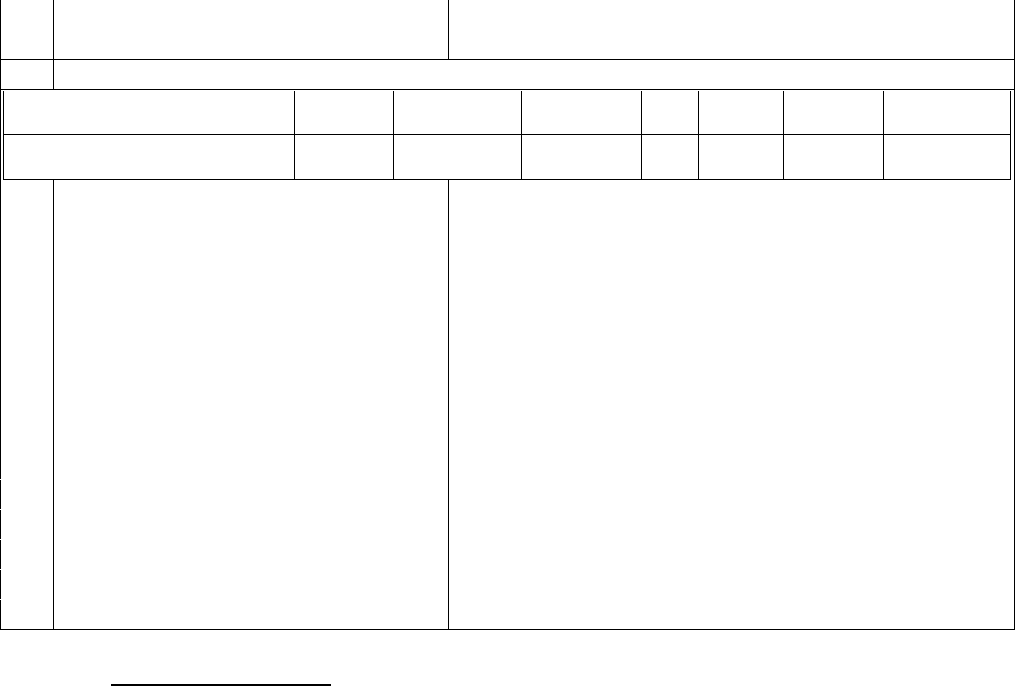

1.

Name & Address of the Complainant

Shri Hritek R Khosla S/o Shri Rajinder S Khosla,

House No. 199, Panna Lal Marg, Dhariwal,

Distt. & Tehsil- Gurdaspur, Punjab- 143519

Mobile No.- 8727053799

2.

Policy No:

Type of Policy

Duration of policy/Policy period

100200081905/00/00

Group Health Insurance

31-01-2021 To 30-01-2022

3.

Name of the insured

Name of the policyholder

Poonam Seth

M/S Bajaj Finance Ltd.

4.

Name of the insurer

Manipal Cigna Health Insurance Co. Ltd.

5.

Date of Repudiation

04.02.2021

6.

Reason for repudiation

Non-disclosure

7.

Date of receipt of the Complaint

25-03-2021

8.

Nature of complaint

Rejection of Mediclaim

9.

Amount of Claim

Rs.345977/-

10.

Date of Partial Settlement

N.A

11.

Amount of relief sought

Rs.3,45,977/-

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation of

claims by an insurer

13.

Date of hearing/place

10.09.2021/ Online hearing

14.

Representation at the hearing

For the Complainant

Shri Hritek R Khosla, the complainant

For the insurer

Shri Jaswinder Singh Shekhawat, Manager (Legal)

15

Complaint how disposed

Recommendation under Rule 16

16

Date of Award/Order

10.09.2021

17. Brief Facts of the Case: Shri Hritek R Khosla (hereinafter, the complainant) has filed this

complaint against Manipal Cigna Health Insurance Co. Ltd. (hereinafter, the insurers) alleging

incorrect denial of claim.

18. Cause of Complaint:

a) Complainant’s argument: His mother Poonam Seth bought a health insurance policy online

of Bajaj Allianz health insurance through Bajaj finance acting as an agent on 1

st

February

2018 and paid premium regularly. On 26

th

December 2020, she got a call from Bajaj Finance

to renew the policy. Firstly, he explained all the benefits which were same as per our

ongoing policy but in the end of call changed the health insurance company’s name from

Bajaj Allianz to Manipal Cigna and got approval from her by misleading her. The

complainant’s mother was detected cancer positive on 29

th

Jan. 2021. Her treatment started

from 1

st

February2021 at DMCH Ludhiana but when hospital requested for cashless

treatment the claim was rejected multiple times by the Manipal Cigna providing the reason

that proposer had not disclosed the disease in proposal form. No proposal form was filled

by us and had requested for renewal of the policy on 26

th

December 2020 which is almost

more than one month before detecting of disease. The complainant further stated that they

have all the records and recordings which prove the fraud and misleading done by insurance

and finance companies.

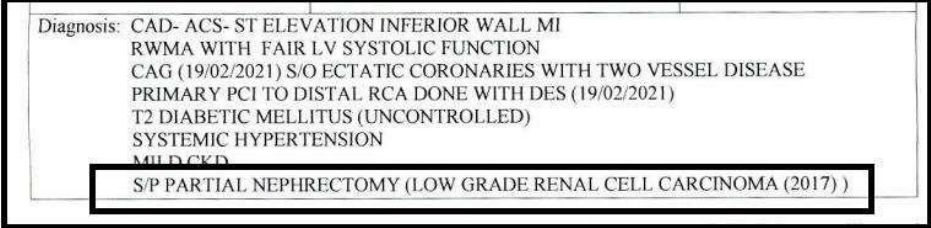

b) Insurers’ argument: As per SCN, the Complainant on 1st February 2021 had registered a

cashless claim amounting Rs. 2,00,000/- for his mother’s hospitalization at Dayanand

Medical College And Hospital (DMC hospital), Ludhiana for CA CERVIX (cervical cancer). On

perusal of the discharge summary dated 23rd January 2021 from Dayanand Medical College

and Hospital, Ludhiana, it was found that the Complainant’s mother was diagnosed with

cervical carcinova IVa (cervical cancer- stage IV) on 21st January 2021 i.e 9 days before the

policy inception. Since there was a non-disclosure of material fact by the Complainant’s

mother at the time of application, which is material to the policy decision, the claim was

found to be non-admissible. Therefore, the claim was rejected by the Company for non-

disclosure of material information under Clause VI.1 (Duty of Disclosure) of the terms and

conditions and the same and was intimated to the Complainant vide rejection letter dated

04 Feb 2021. In lines with the above referred clause of policy terms & conditions, the

Company terminated the Policy of the Complainant.

19. Reason for Registration of Complaint: Incorrect denial of claim.

20. The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offer to review the claim and settle it as per the terms and

conditions of the policy, if the Complainant submits the required documents for the

reimbursement claim. The Complainant agrees to submit the required documents within

one week. Thus an agreement of conciliation could be arrived at between the Complainant

and the Insurers, which I consider as fair and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall review the claim and settle it

as per the terms and conditions of the policy, for which the Complainant shall submit the

required documents within one week.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman

September, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Sudhir Krishna

Case of Shri Sandeep Kumar V/S The United India Insurance Co. Ltd.

Complaint Ref. No. : CHD-H-051-2021-0765

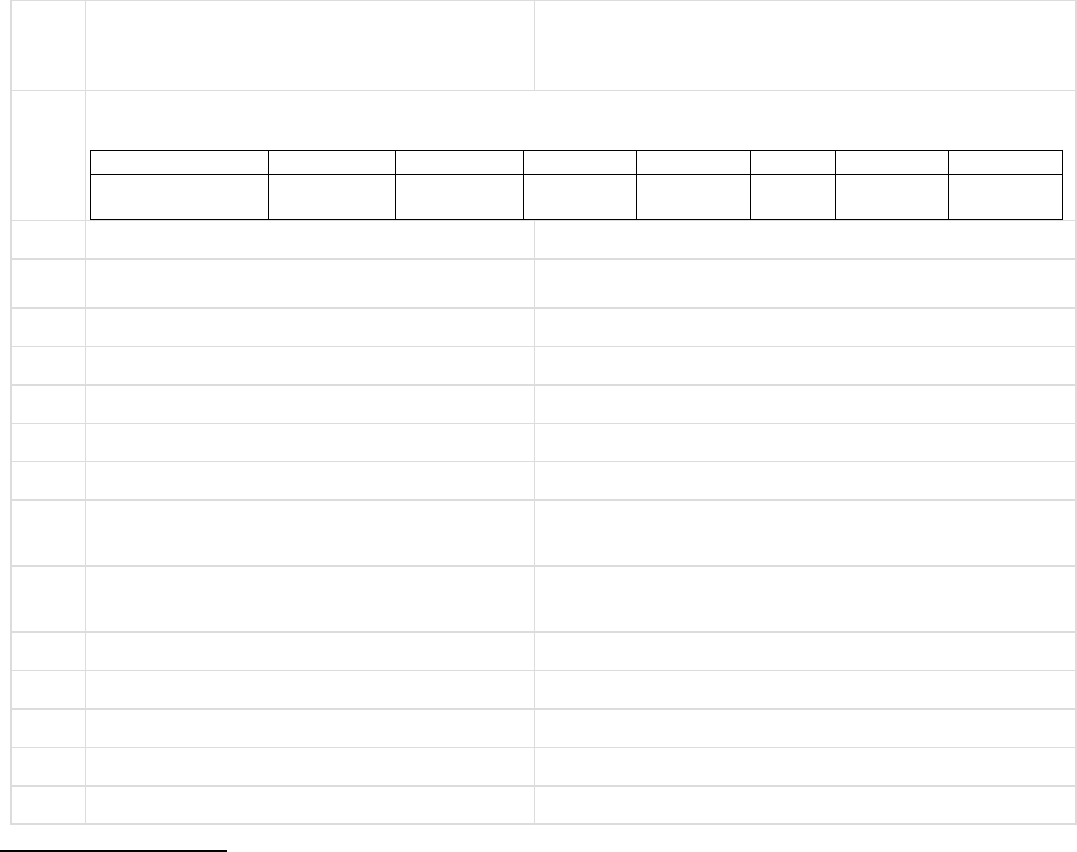

1.

Name & Address of the Complainant

Shri Sandeep Kumar

R/o H. No.- 709 B1, New Rathpur Colony, Pinjore,

Distt.- Panchkula, Haryana- 134102

Mobile No.- 9996425099

2.

Policy No:

Type of Policy

Duration of policy/Policy period

5001002819P111085979

Group Mediclaim

01.10.2019 TO 30.09.2020

3.

Name of the insured

Name of the policyholder

Sandeep Kumar

BOB _ IBA

4.

Name of the insurer

The United India Insurance Co. Ltd.

5.

Date of Repudiation

07.12.2020

6.

Reason for repudiation

No active line of treatment

7.

Date of receipt of the Complaint

26-03-2021

8.

Nature of complaint

Non settlement of health claim

9.

Amount of Claim

Rs. 174524/- + Dom. Claim amount

10.

Date of Partial Settlement

NA

11.

Amount of relief sought

All domiciliary amount + balance payable amt out of

Rs. 174524/-.

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation of

claim by an insurer

13.

Date of hearing/place

10.09.2021/ Online hearing

14.

Representation at the hearing

For the Complainant

Shri Sandeep Kumar, the Complainant

For the insurer

Smt. Pamela Pinto, Dy. Manager (LCD), Mumbai

15.

Complaint how disposed

Recommendation under Rule 16

16.

Date of Award/Order

10.09.2021

17) Brief Facts of the Case: Shri Sandeep Kumar (hereinafter, the Complainant), has filed

this complaint against the United India Insurance Co. Ltd. (hereinafter, the Insurers) for non-

settlement of his health claim.

i. Cause of Complaint:

a) Complainants argument: He is suffering from some ailment since December 2017 and

since been admitted in many hospitals like PGI, Chandigarh, Alchemist Panchkula. In

Medanta Hospital, after some tests actual ailment was diagnosed as Quona Equeda

Syndrom with G mutation, i.e. Spinal TB with Resistant type. Actual right medicine was

started on 8th April 2019. He was admitted to hospital so many times and all claims were

settled by insurance company. Initially unaware, he came to know about domiciliary claim

from a new colleague and then have sent all the unclaimed bills for the policy period from

November 2019 to September 2020 including hospitalization bill, which were received by

TPA Medi Assist dt. 26.09.2020. On 15.11.2020 they uploaded the status that ‘denial reason

entered’. On follow up, they told him that it was a ‘hospitalization reimbursement claim for

24.01.2020 to 25.01.2020 and patient was on oral medication only’ so claim is not

admissible. In the whole claim amount medicine and consultation bills were of Rs. 141680/-

and hospitalization bills were of Rs. 32844/- only. Company has just classified the whole

claim of Rs. 174524/- as hospitalization expenses reimbursement claim for two days i.e. for

24.01.20 to 25.01.20, although he sent all the medical history papers, original consultation

and medicine bills for the period November 2019 to 15.09.2020. He admitted that

unknowingly he sent both claim papers jointly, because it would have taken a separate

claim form only that needs to be annexed with the 2

nd

claim domiciliary or hospitalization.

b) Insurers’ argument: Company received a claim of Rs.174524/- pertains to Insured

Sandeep Kumar, who was admitted in Medanta Hospital, Gurugram on 24/1/2020 and

discharged on 25/1/2020. He is k/c/o drug resistant TBM on ATT since April 2019 with Right

Lower Poliomyelitis and Cauda Equina Syndrome admitted with c/o back pain. On

Hospitalization, he underwent MRI of dorsal spine. He was treated with ATT (Anti-

Tuberculosis Treatment), intravenous fluids, multivitamins and other supportive treatment.

He responded well and discharged in stable condition. They had denied the claim as the

treatment of the patient was done by oral medications only. No I.V. administration of

medicine was given and no active line of treatment is seen. He was admitted only for pain

management. Hence the claim is not admissible and stands repudiated under Clause No.

1.1. of the policy.

19) Reason for Registration of Complaint:- Non settlement of health claim.

20) The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

a) Result of Personal hearing with both parties (Observations & Conclusion):

b) Case called. Parties are present and recall their arguments as noted in Para 18 above.

The Insurers offer to admit the claim and settle the same as per the provisions for

Domiciliary Treatment under the Policy.

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offer to review the claim and settle it as per the terms and

conditions of the policy for Domiciliary Treatment. The Complainant accepts this offer. Thus

an agreement of conciliation could be arrived at between the Complainant and the Insurers,

which I consider as fair and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall review the claim and settle it

as per the terms and conditions of the policy, for Domiciliary Treatment.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman

September, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 17 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Sudhir Krishna

Case ofAjay KumarV/SBharti AXA GeneralInsuranceCo. Ltd.

Complaint Ref. No.: CHD-H-007-2021-0764

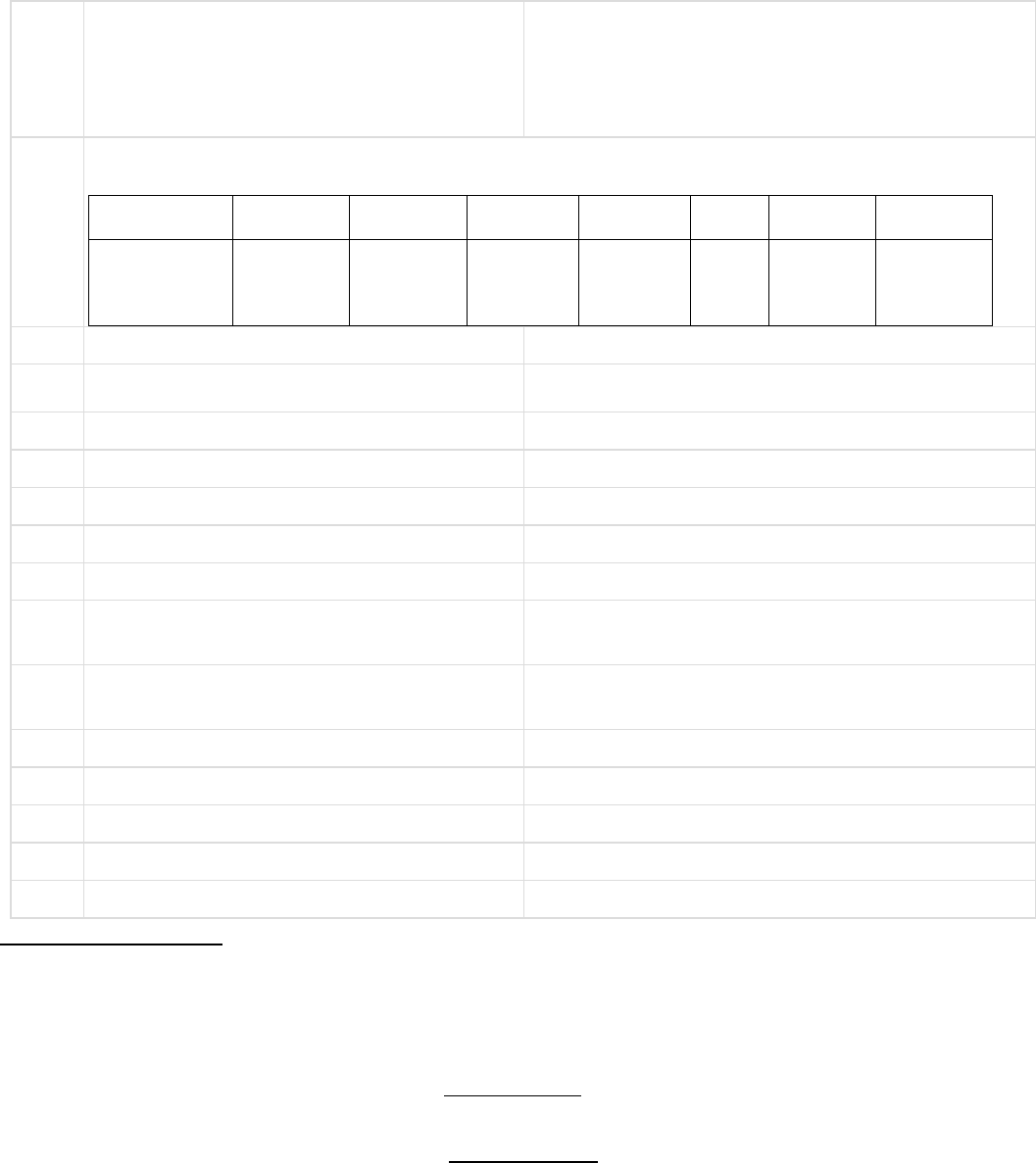

1.

Name & Address of the Complainant

Shri Ajay Kumar

Mata Mohalla, H. No. 259/3,

VPO- Radaur, Dist. Yamunanagar, Haryana- 135133

Mobile No.- 7206895580

2.

Policy No:

Type of Policy

Duration of policy/Policy period

Q1099664

Group Hospital Cash

15-12-2019 To 14-12-2020

3.

Name of the insured

Name of the policyholder

Ajay Kumar

Ajay Kumar

4.

Name of the insurer

Bharti AXA General Insurance Co. Ltd.

5.

Date of Repudiation

06.03.2021

6.

Reason for repudiation

Fraudulent claim

7.

Date of receipt of the Complaint

26-03-2021

8.

Nature of complaint

Repudiation of claim

9.

Amount of Claim

Rs. 1,10,000/-

10.

Date of Partial Settlement

NA

11.

Amount of relief sought

Rs. 1,10,000/-

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation of

claim by an insurer

13.

Date of hearing/place

17.09.2021 / On line hearing

14.

Representation at the hearing

For the Complainant

Shri Ajay Kumar, the complainant

For the insurer

Shri Rishi Kant, Senior Manager (Legal)

15

Complaint how disposed

Award under Rule 17

16

Date of Award/Order

19.09.2021

17. Brief Facts of the Case:Shri Ajay Kumar (hereinafter, the Complainant), has filed this complaint

against the Bharti AXA General Insurance Co. Ltd.(hereinafter, the Insurers) for non-settlement of

his health claim.

18. Cause of Complaint:

a) Complainants argument:He had bought a policy no. Q1099664 from the Insurers andhad filed a claim in

Oct. 2020 for repayment of his medical treatment expenses. After follow up through mails and calls for

five months, they rejected his claim in the month of March 2021.

b) Insurers’ argument: He got admitted at Krishna Hospital, Radaur, Yamuna Nagar from 09-09-2020 to

18-09-2020 for the first time and then again on 21-09-2020 to 02-10-2020 having complaint of vomiting,

abdomen pain & fever. The Insured was managed with conservative treatment from 09-09-2020 till 18-09-

2020 thereafter the Insured complained of the same issue after 3 days & thereafter got admitted in the

same hospital from 21-09-2020 till 02-10-2020.However, there was discrepancy found in the hospital

records as the hospital did not maintain the ICP and has provided a declaration regarding the same.ICP

(indoor case paper) is mandatorily & routinely maintained by Hospital for patients that are admitted for

treatment. The hospitalization of the Insured could not be ascertained because of incomplete Indoor

Papers provided by the Hospital coupled with the fact that none in the vicinity of the Insured confirmed

much about the Hospitalization during investigation done at the residence of Patient.Also, as per the

Registration certificate, the treating Doctor is a Bachelor of Ayurveda, Medicine but the treatment

provided is allopathic which happens to be an exclusion of the Policy. The relevant provisions of exclusion

applicable in this case are Section 4– Disclosure of information and section 4.VI – Fraud. The complainant

is guilty of Misrepresentation of Facts and violation of Policy Terms and Conditions. In light of the above,

the claim of the Complainant was repudiated vide repudiation letter dated 06-03-2021.

19. Reason for Registration of Complaint: Repudiation of health claim.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion)

Case called. Parties are present and recall their arguments as noted in Para 18 above. At the

outset, the Insurers inform that their company is now merged with ICICI Lombard GIC. The

Complainant states that he had submitted all the documents in his possession to the Insurers.

The Insurers state that the Indoor Case Papers for the days of both the hospitalization were not

made available either by the Complainant or by the Hospital, as a result of which, it was not

possible to ascertain the facts of the treatment. Also, the treating physician was Ayurvedic, who

had administered allopathic drugs to the Complainant, which was against the norms. Upon

examination of the arguments and the evidence submitted by both the parties, it is concluded

that the definition of Medical Practitioner clause was not satisfiedby the treating physician and

also the required documents were not made available to the Insurers. In these circumstances,

the Insurers were justified in repudiating the claim.Pursuantly, the complaint would deserve to

be rejected.

Award

The complaint is rejected.

(Sudhir Krishna)

Insurance Ombudsman

September 19, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Sudhir Krishna

Case of Sham Sunder Garg V/S The United India Insurance Co. Ltd.

Complaint Ref. No.: CHD-H-051-2122-0007

1.

Name & Address of the Complainant

Shri Sham Sunder Garg

1/1, Old Jawahar Nagar, Ladowali Road, Jalandhar

City, Jalandhar, Punjab- 144001

Mob. no. 9417327577, 9056374506

2.

Policy No:

Type of Policy

Duration of policy/Policy period

5001002819OP111833956

Group Health Mediclaim Policy

01-11-2019 To 31-10-2020

3.

Name of the insured

Name of the policyholder

Sham Sunder Garg

Indian Bank’s Association

4.

Name of the insurer

The United India Insurance Co. Ltd.

5.

Date of Repudiation

Not applicable

6.

Reason for repudiation

Not applicable

7.

Date of receipt of the Complaint

30-03-2021

8.

Nature of complaint

Deduction in health claim

9.

Amount of Claim

Rs. 26946/- (Out of this Rs.9420/- recd.)

10.

Date of Partial Settlement

09.04.2021

11.

Amount of relief sought

Rs.26946/-

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation of

claim by an insurer

13.

Date of hearing/place

24.09.2021/ Online hearing

14.

Representation at the hearing

• For the Complainant

Shri Sham Sunder Garg, the complainant

• For the insurer

Smt. Srijani S., Asstt. Manager (LCB), Mumbai

15

Complaint how disposed

Recommendation under Rule 16

16

Date of Award/Order

24.09.2021

17. Brief Facts of the Case: Shri Sham Sunder Garg (hereinafter, the Complainant), has filed this

complaint against the United India Insurance Co. Ltd. (hereinafter, the Insurers) for non-

settlement of his claim.

18. Cause of Complaint:

a) Complainants argument: Initially he had filed a complaint regarding non-settlement of medical

bills of heart bypass surgery at Fortis Mohali on 24.06.2020. He informed that all original

documents sent to Health India TPA by speed post dt. 28.10.2020 and delivery confirmed on

02.11.2020, but no action was taken. Later on, Complainant vide form VI-A has informed that he

received Rs. 9420/- on 09.04.2021 that is after 8 moths. He insisted that out of deduction of Rs.

17526/-, company must pay essential charges for Covid test before surgery, medicines, and

consumables etc.

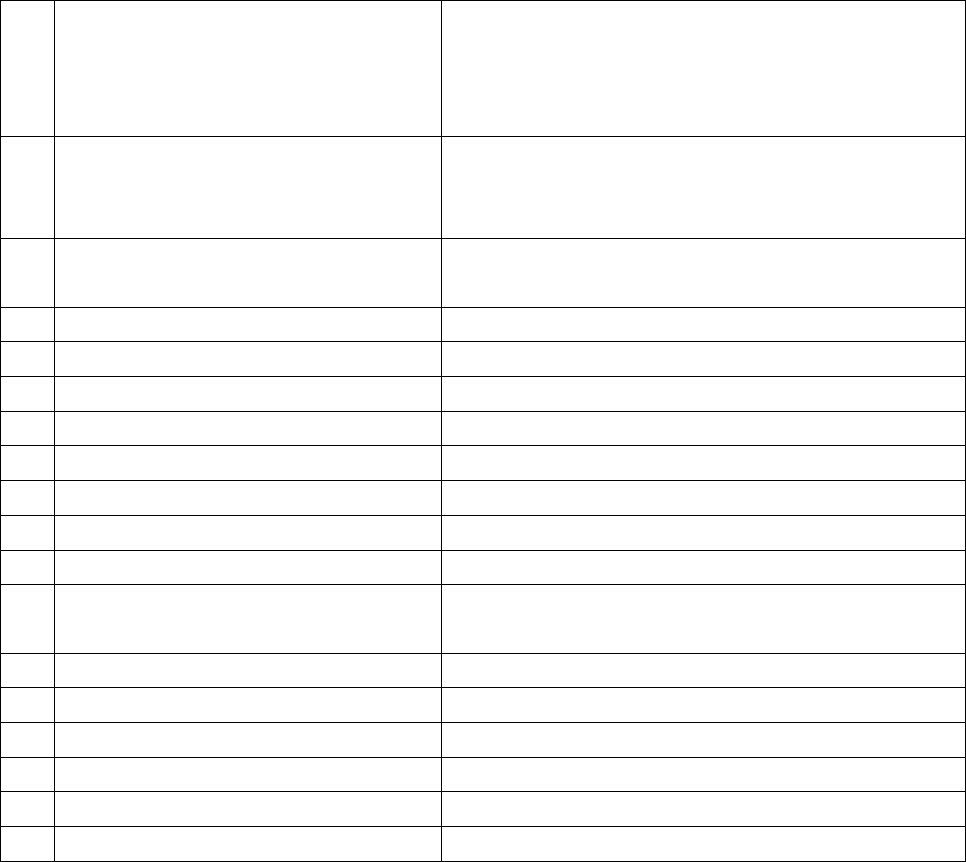

b) Insurers’ argument: As per SCN submitted by Insurers, a claim of Rs. 26946/- from the

Complainant for his hospitalization from 22.06.2020 to 03.07.2020 in Fortis Hospital, Mohali with

diagnosis of CAD-TVD, HTN, DM, LVEF has been received by company. Against claimed amount of

Rs. 26946/-, company settled the claim for Rs. 9420/- and paid on 09.04.2021 subsequent to

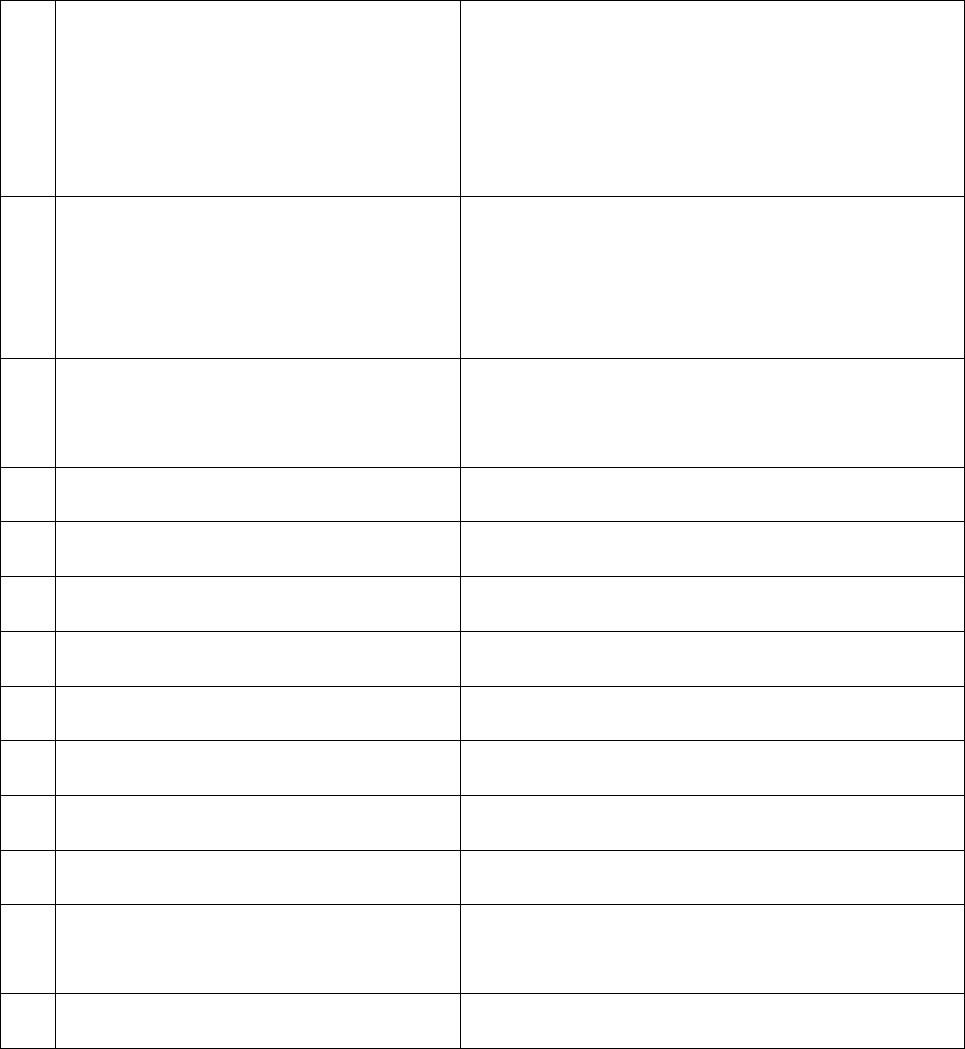

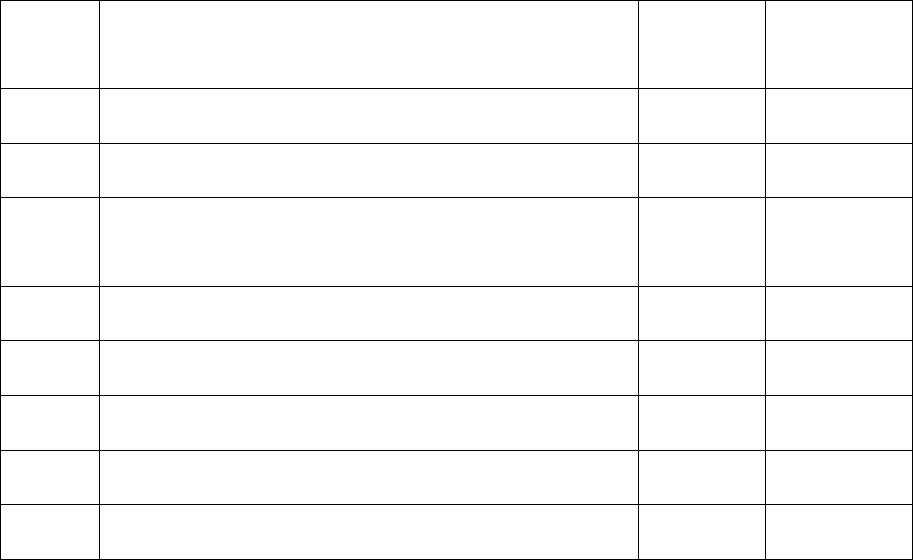

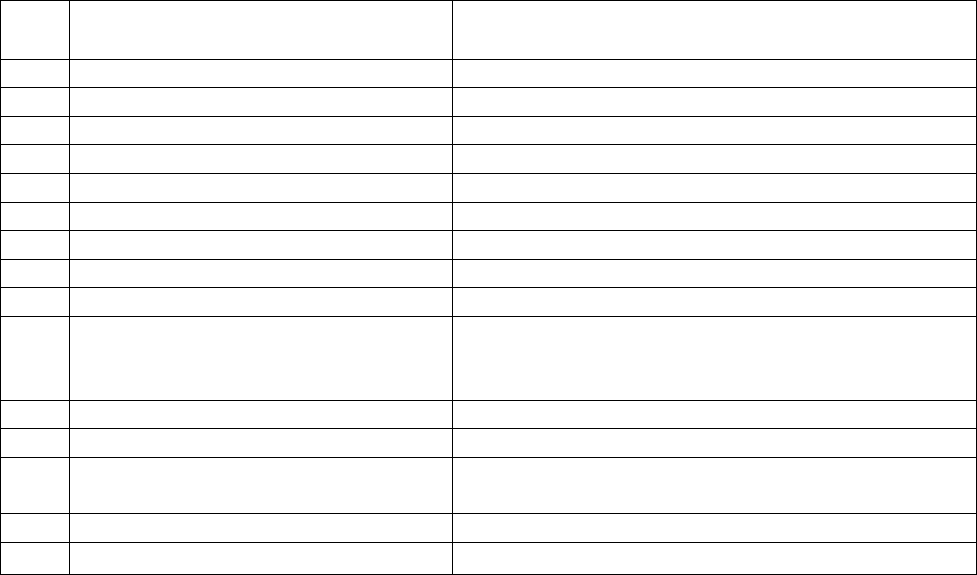

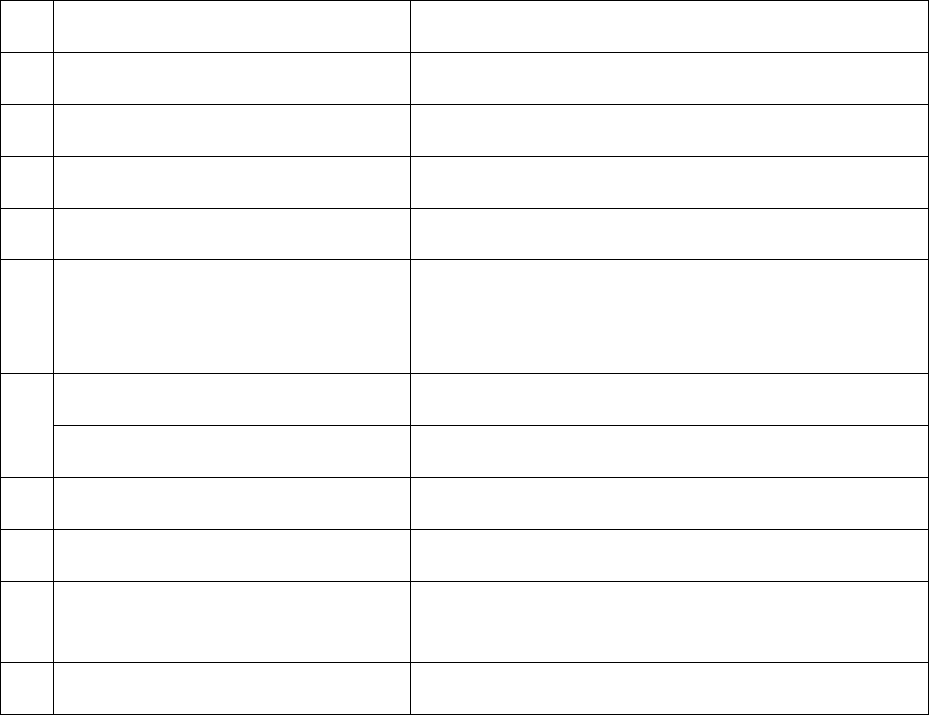

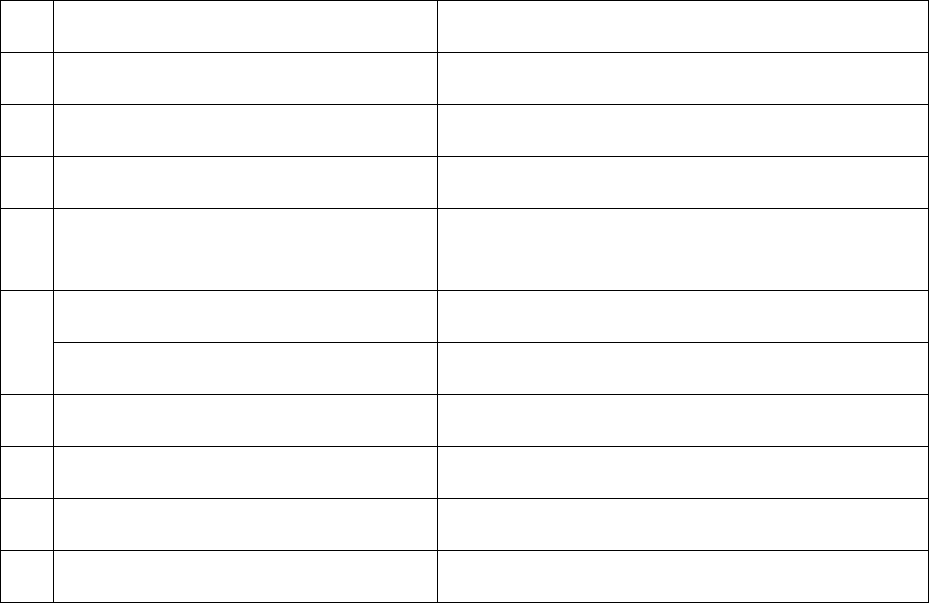

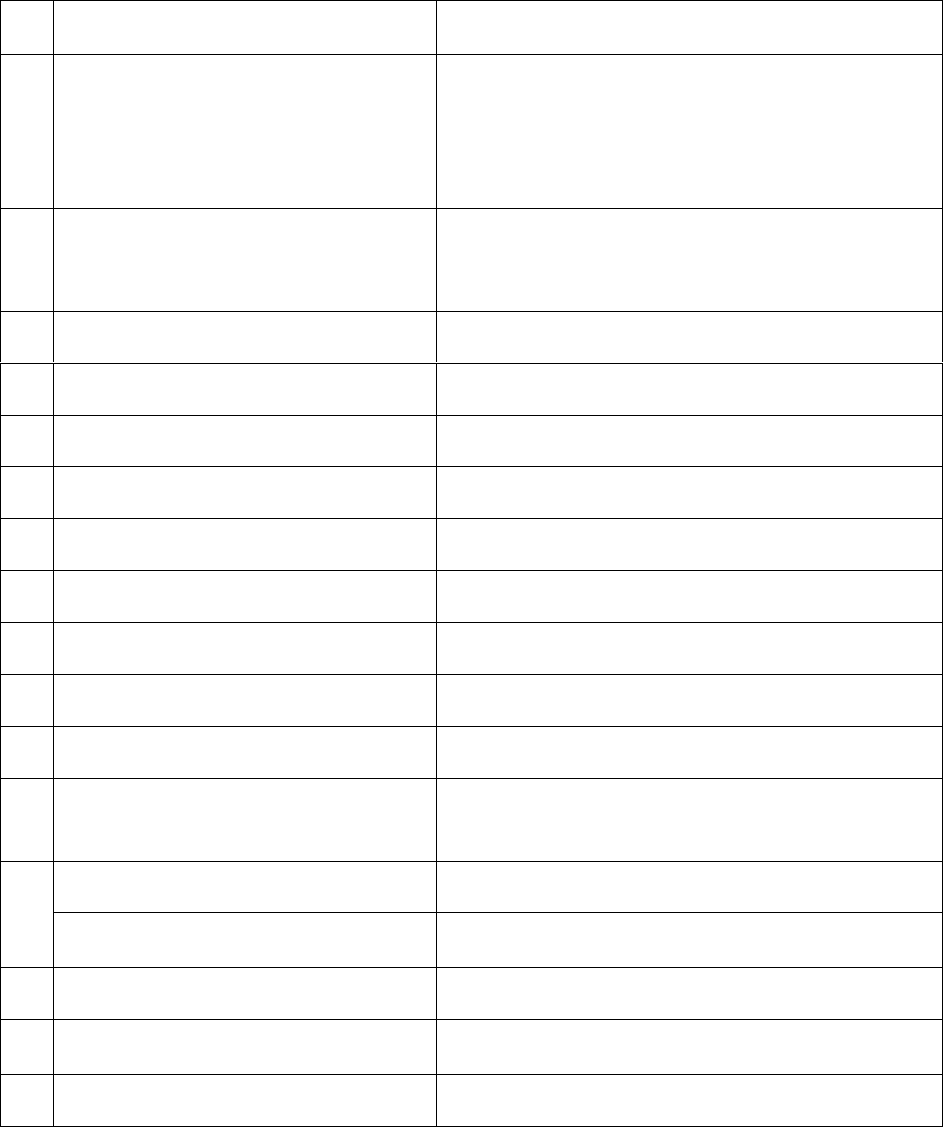

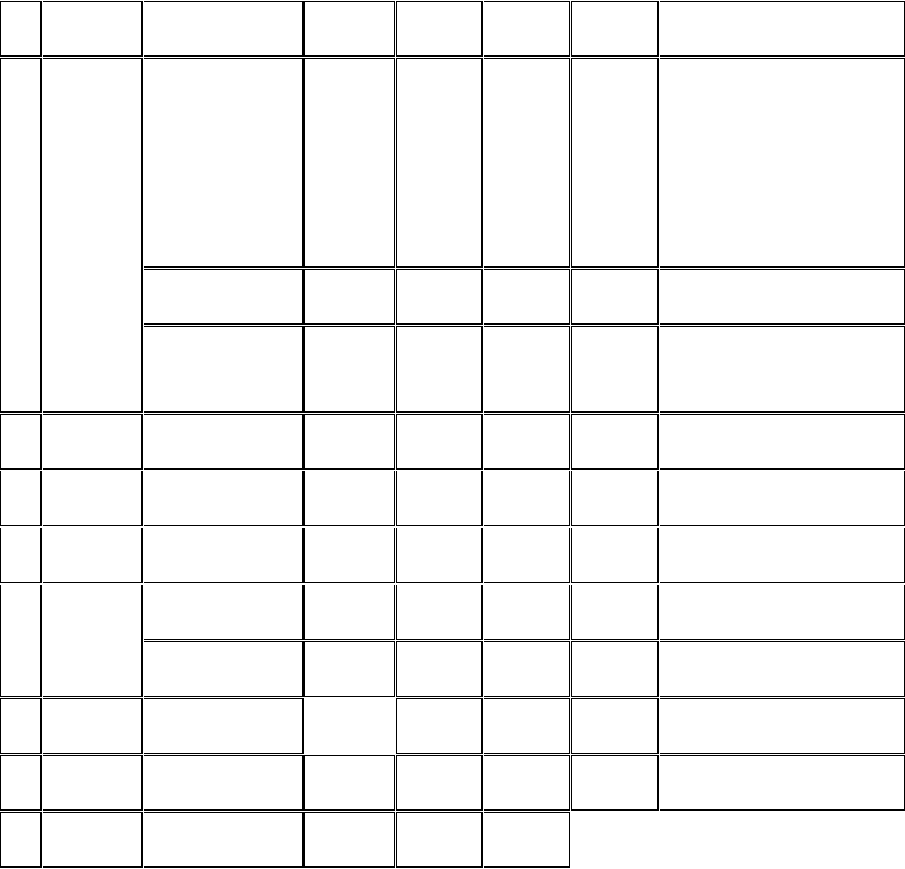

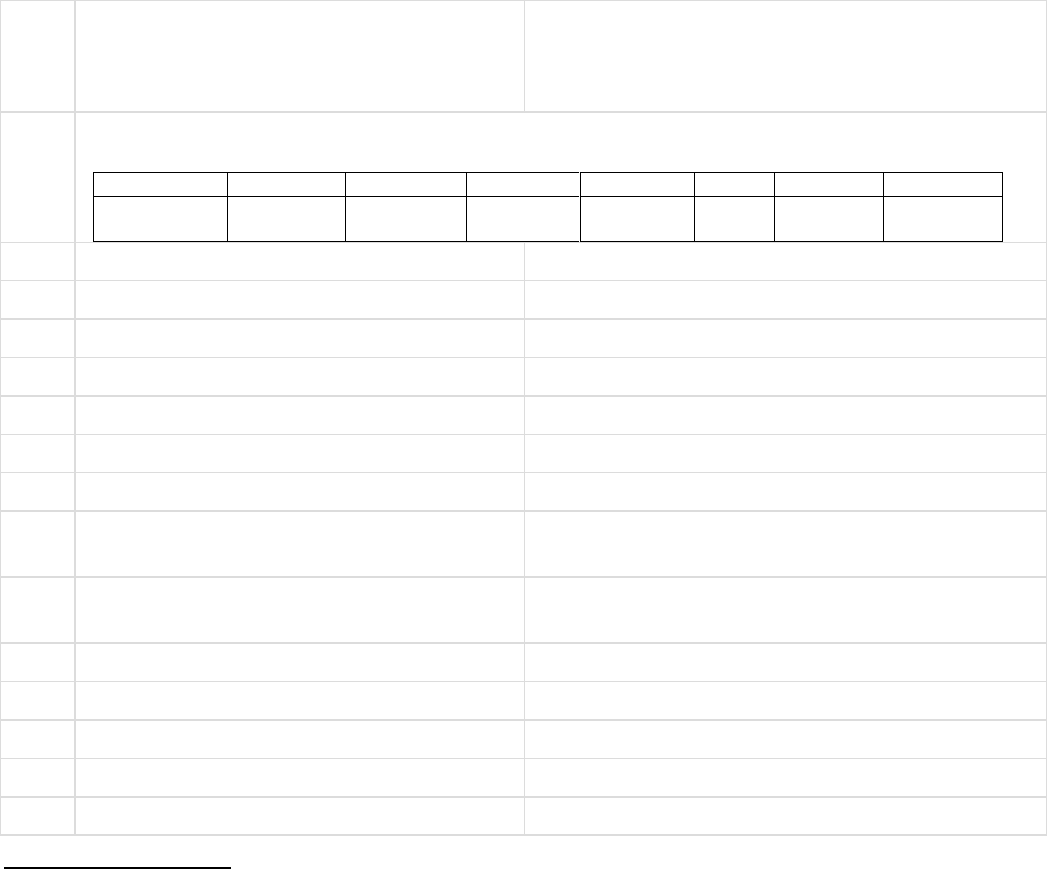

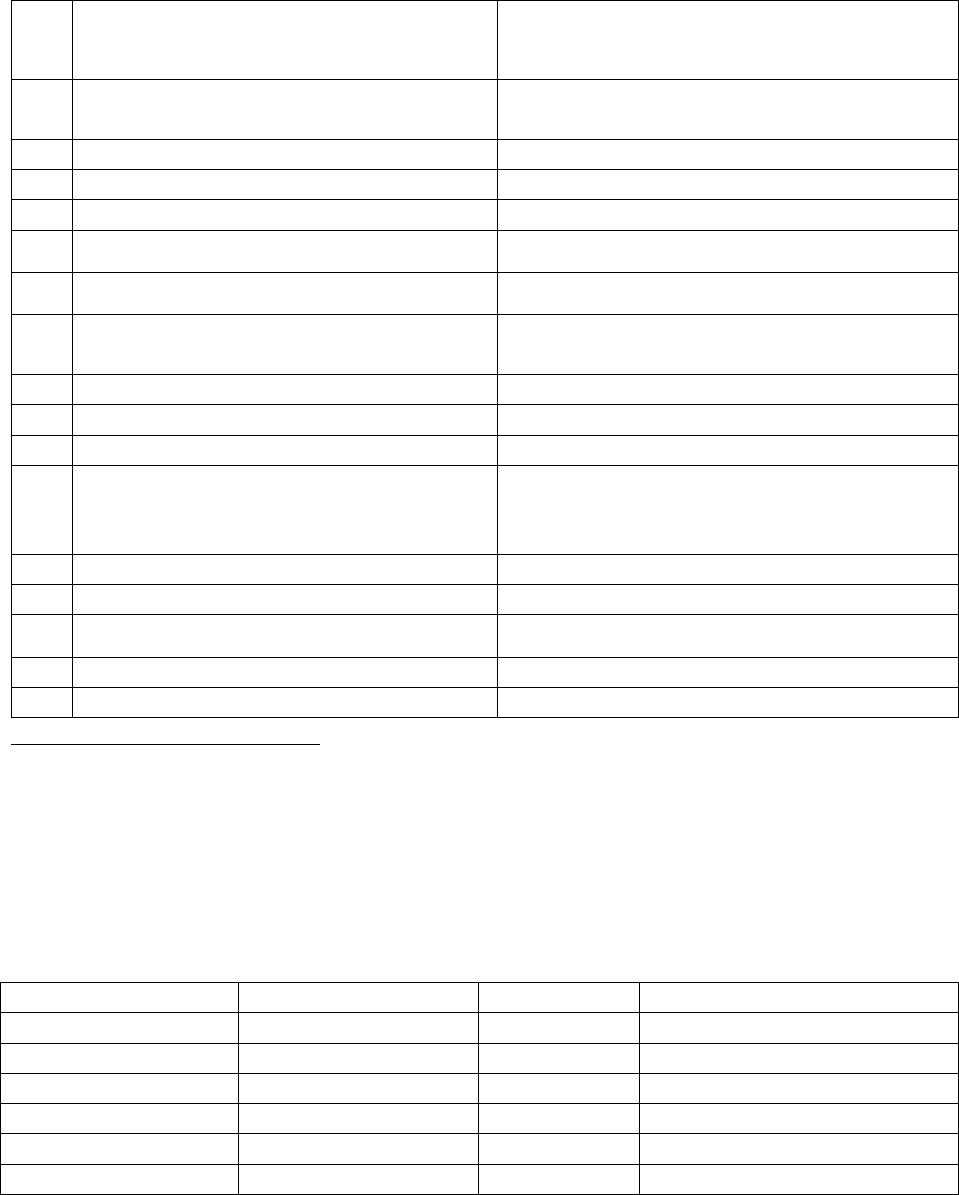

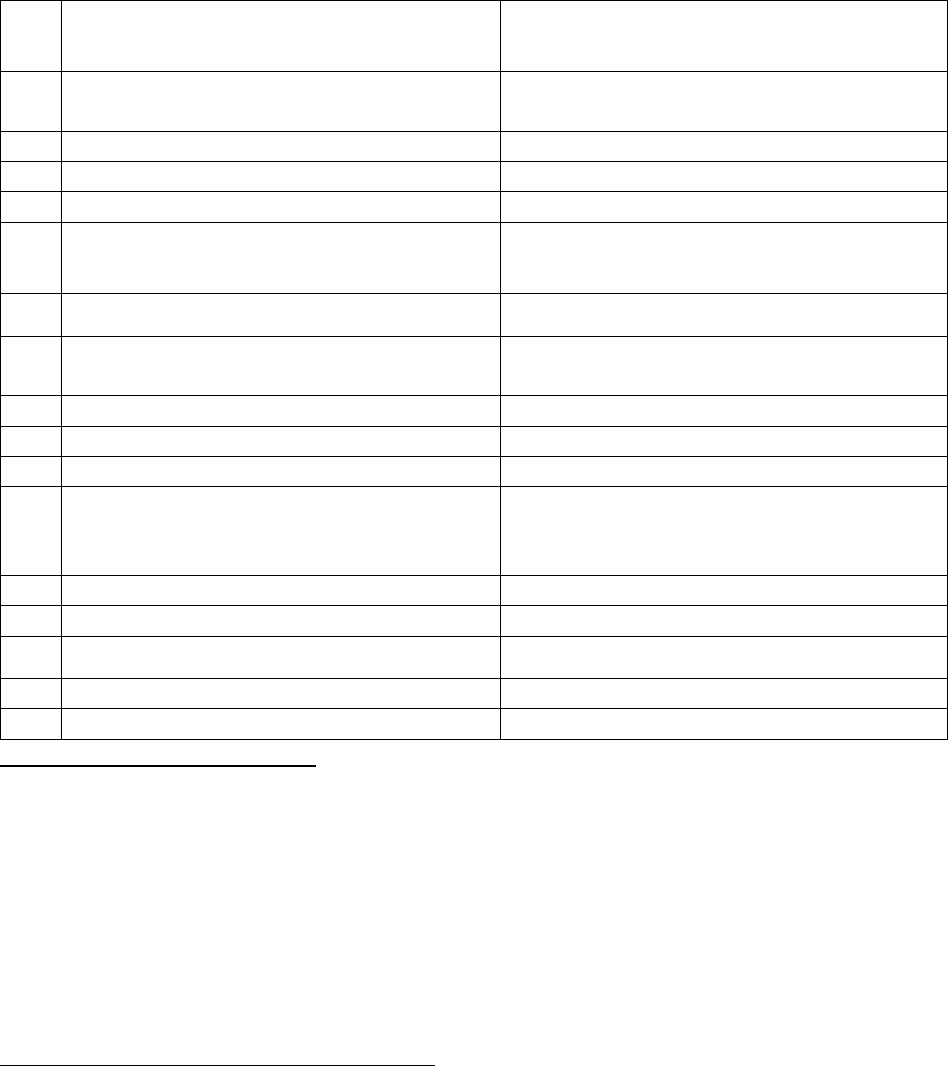

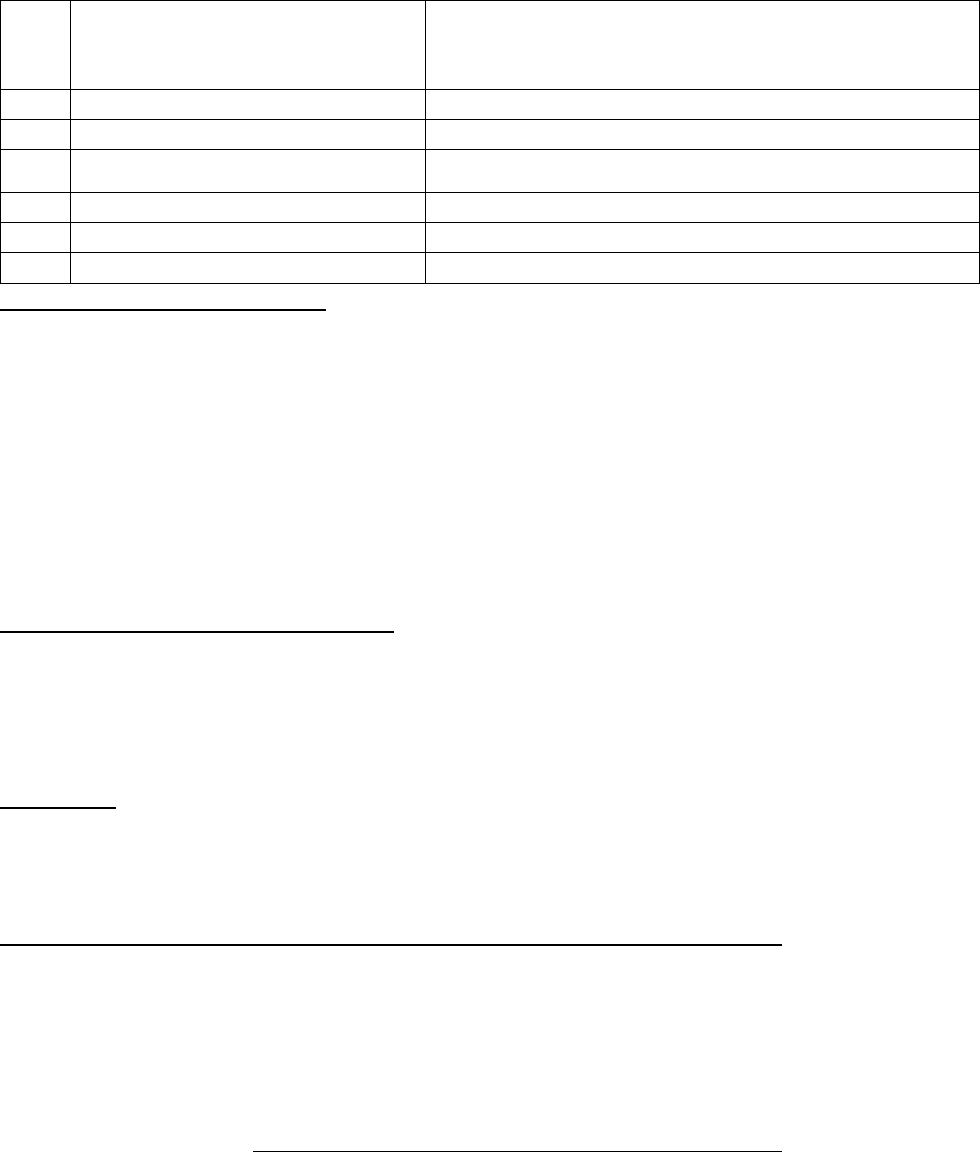

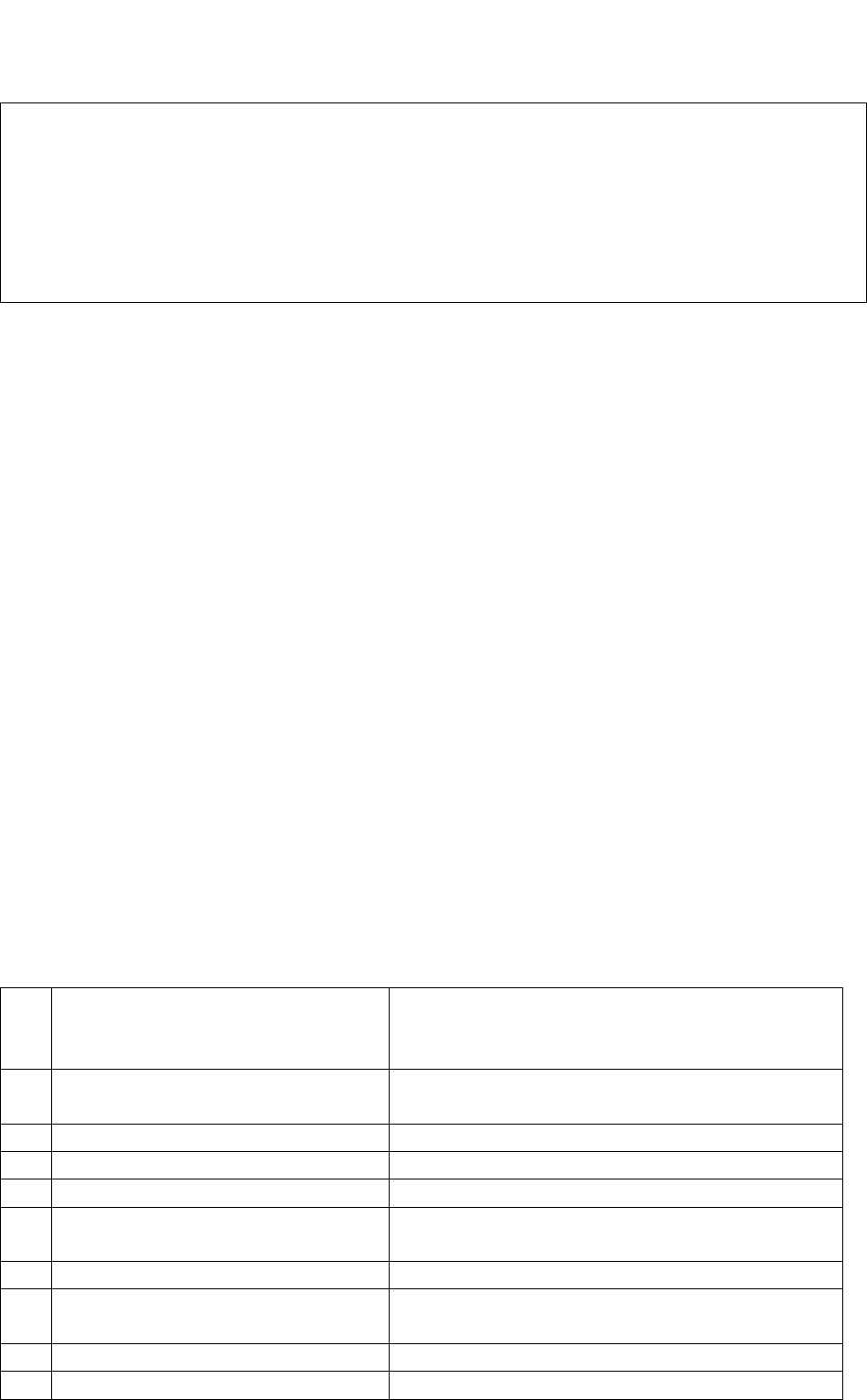

Ombudsman complaint. Details of deduction of Rs. 17526/- is as under:

Bill date

Remark/reason

Bill Amt

Deducted

Amt.

27.07.20

Consultation charges/Consulting note not submitted

1850

1850

22.06.20

COVID 19 SARS COV/ Not related to current ailment

4500

4500

29.07.20

Home health care charge/ No details available not

payable

10000

10000

21.08.20

Medicines charges (betadine)/Non medical items ded.

4905

306

27.07.20

Medicines charges (gloves)/Non medical items ded.

4558

500

22.06.20

Registration charges N.P.

100

100

27.07.20

X ray charges / Report is not submitted

270

270

Total

17526

19. Reason for Registration of Complaint: Deduction in health claim.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of hearing with the parties (Observations & Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage the Insurers offer to settle the balance claim as follows:

(a) Consultation charges (Rs. 1850) shall be paid upon submission of an undertaking by the

Complainant, for which the contents shall be conveyed by the Insurers shortly;

(b) Covid-19 Test charges (Rs. 4500) shall be paid;

(c) Post-hospitalisation Home Healthcare charges (Rs. 10000) shall be paid on submission of

details from the Wecare; and

(d) X-ray charges (Rs. 270) shall be paid on submission of X-ray film/copy.

(e) The remaining 3 items are non-admissible/not payable.

The Complainant accepts this offer and assures to provide the required documents very shortly.

Thus an agreement of conciliation could be arrived at between the Complainant and the insurers,

which I consider as fair and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the insurers. Accordingly, the Insurers shall reimburse the balance claim in

respect of 4 items as mentioned above, for which the Complainant shall provide the required

documents.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman

September 24, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Abhay Aggarwal Versus New India Assurance Company Ltd.

Complaint Ref. No.: DEL-H-049-2122-0281

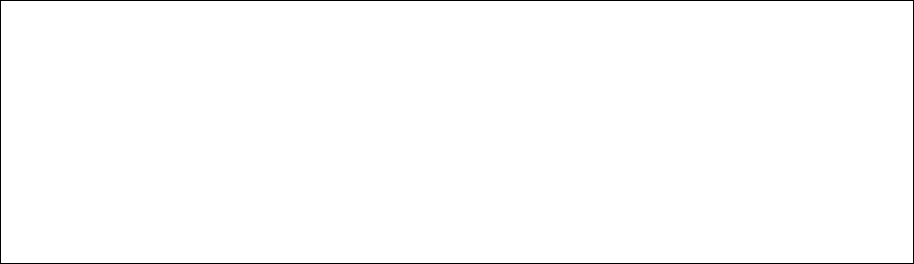

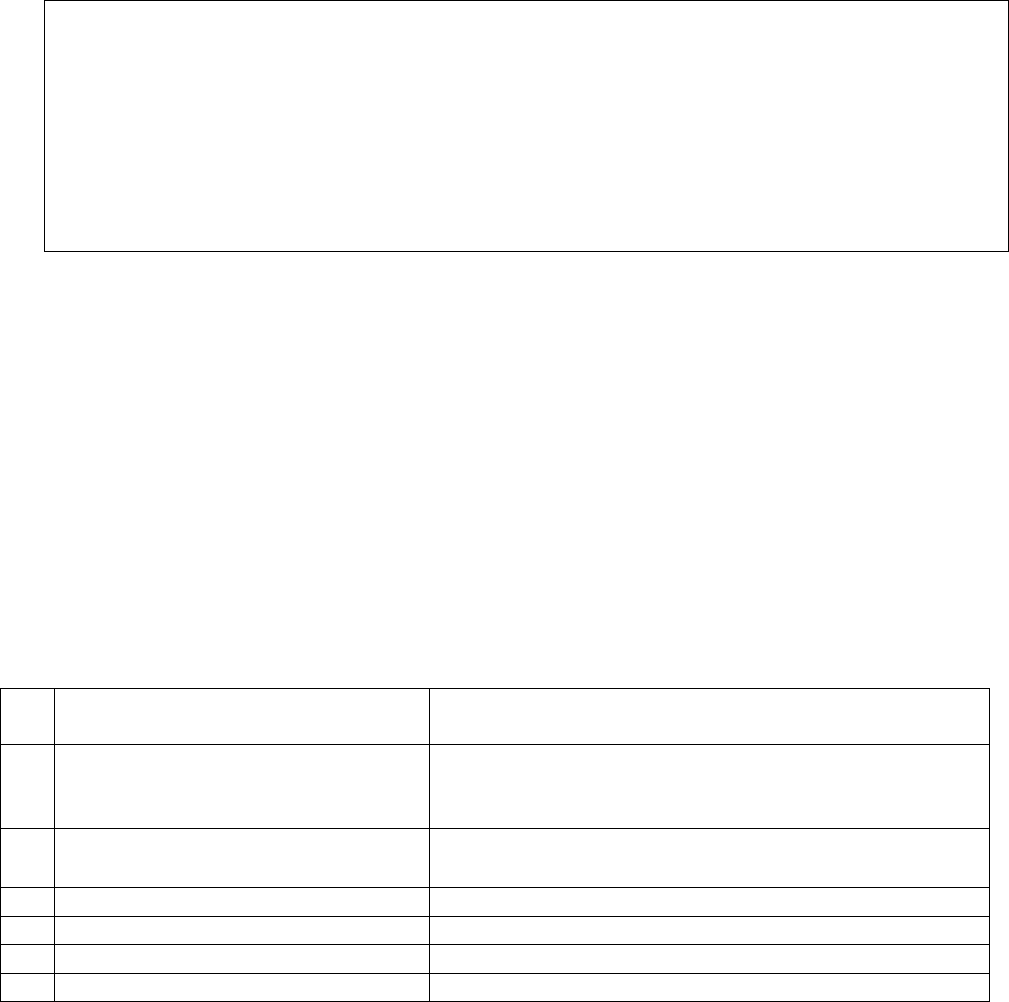

1.

Name & Address of the

Complainant

Shri Abhay Aggarwal, Cedar 3/406, Gulmohar

Enclave, Nehru Nagar-3, Ghaziabad-201001 (U.P.)

2.

Policy No:

Type of Policy

Duration of policy/Policy period

32370034190400000016

Group Mediclaim

07.10.2019-06.10.2020

3.

Name of the insured

Name of the policy holder

Abhay Aggarwal

Abhay Aggarwal

4.

Name of the insurer

New India Assurance Company Ltd.

5.

Date of repudiation

NA

6.

Reason for repudiation

NA

7.

Date of receipt of the complaint

02.08.2021.

1. Brief Facts of the Case: Shri Abhay Aggarwal (hereinafter referred to as the Complainant) has filed this

complaint against the decision of the New India Assurance Company Ltd. (hereinafter referred to as the

Insurers or the Respondent Insurance Company) alleging wrongly crediting the hospital an additional

amount actually due to the complainant.

18. Cause of Complaint:

a) Complainant's Argument: The Complainant was covered under the Group Mediclaim Policy. His new born

child was admitted in Yashoda Hospital, Ghaziabad from 05.04.2020 to 24.05.2020. The insurers had

made payment under cashless mode to the hospital towards the said hospitalization. The hospital had

wrongly recovered an amount of Rs 18109/- towards non-medical items from him. He represented to the

TPA for reimbursement of this amount along with an additional amount of Rs. 5417/-, which the Hospital

staff had inadvertently failed to incorporate. An amount of Rs 22142/- was approved by the insurer but

wrongly credited to the hospital account. The complainant has not received the amount as yet. He has

approached this forum to get his complaint redressed.

b) Insurers Argument: The Insurers in their SCN have stated that the complainant’s wife Vaishali was

admitted in the hospital for 32 weeks breach pregnancy with IVGR with severe PET with previous LSCS.

Case of Abhay Aggarwal Versus New India Assurance Company Ltd.

Complaint Ref. No.: DEL-H-049-2122-0281

They had settled an amount of Rs. 480019/-with the hospital and had deducted Rs 18109/- towards non-

medical items. The insurers reviewed the claim and it was found that the complainant was asking for the

non-payable items. The hospital also approached them for short payment. The insurer made the payment

to the hospital after review. The payment that was made by the insured to the hospital was on account of

non-medical items and is not recoverable under the policy. The Insurers have subsequently sent an email

intimating that they are ready to settle the balance amount of Rs. 5427/ -subject to original bills, if it is

payable as per policy terms and conditions.

19. Reason for registration of Complaint: Incorrect reimbursement to the hospital.

20. The following documents were placed for perusal:

a) SCN, Insurance policy, Claim Processing Sheet.

8.

Nature of complaint

Additional claim amount credited wrongly

9.

Amount of claim

Rs 22142/-

10.

Date of partial settlement

24.05.2020

11.

Amount of partial settlement

Rs.480019/-

12.

Amount of relief sought

Rs 23526/-+ Rs. 20000/-

13.

Complaint registered under Rule

No. of the Insurance Ombudsman

Rules, 2017

Rule 13(1) (b) – any partial or total repudiation of claim

by insurer.

14.

Date of hearing/place

13.09.2021, Delhi, Online, Via WebEx

15.

Representation at the hearing

For the Complainant

1. Shri Abhay Aggarwal, the Complainant

2. Shri Arvind K Aggarwal, F/o the Complainant

For the insurer

Shri Neeraj Sharma, Asst. Manager, Broker DO,

Laxminagar

16.

Date of Award/Order

Award under Rule 17/ 14.09.2021

b) List of Non Medical Items.

c) Letter to GRO

21. Result of hearing of the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

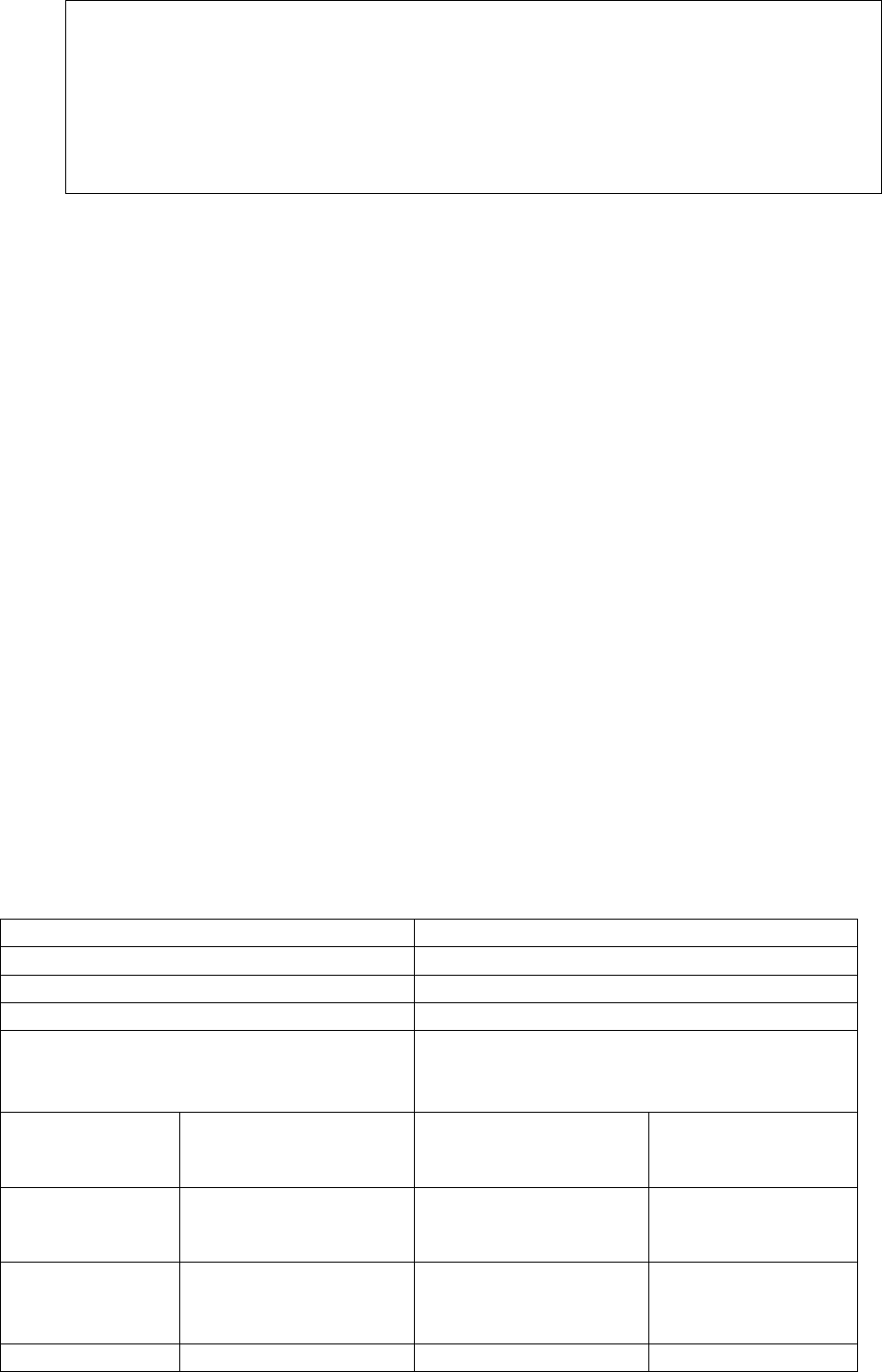

The Claim was for Rs. 5,45,550, against which Insurers have paid Rs. 4,80,019 to the Hospital after

adjusting for Hospital Discount of Rs. 47,422, leaving a balance of Rs. 18,109, which is the repudiated

sum. The main item disallowed was Incubator (Rs. 15750), treating it is an instrument. Other disallowed

items were Tegaderm paid for limited number and excess number was disallowed, Urobags & IV sets

treated as non-medical items, and admission charge as not payable. However, none of these items are

specifically disallowed in the policy, as the Insurers admitted during the hearing. The Insurers states that

in regard to the Tegaderm, they have followed some norm set by IRDAI, but admit that the same is not

stated in the Policy. In these circumstances, the repudiation of each of these items was not justified.

Pursuantly, the complaint would deserve to be allowed. The Insurers would also need to pay interest on

this amount in terms of the provision of the IRDAI (PPHI) Regulations 2017. As for the additional claim of

Rs. 5417, the Insurers have conveyed that they are ready to settle it, subject to original bills, if it is

payable as per policy terms and conditions.

Award

The complaint is allowed and the Insurers are directed to pay the repudiated amount of Rs. 18,109,

along with interest in terms of the provisions of the IRDAI (PPHI) Regulations 2017, to the

Complainant. As for the additional claim of Rs. 5417, the Insurers should settle the same, after

verifying the original bills, as per the terms and conditions of the policy.

Parties should implement this award within 30 days.

(Sudhir Krishna)

Insurance Ombudsman

September 14, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

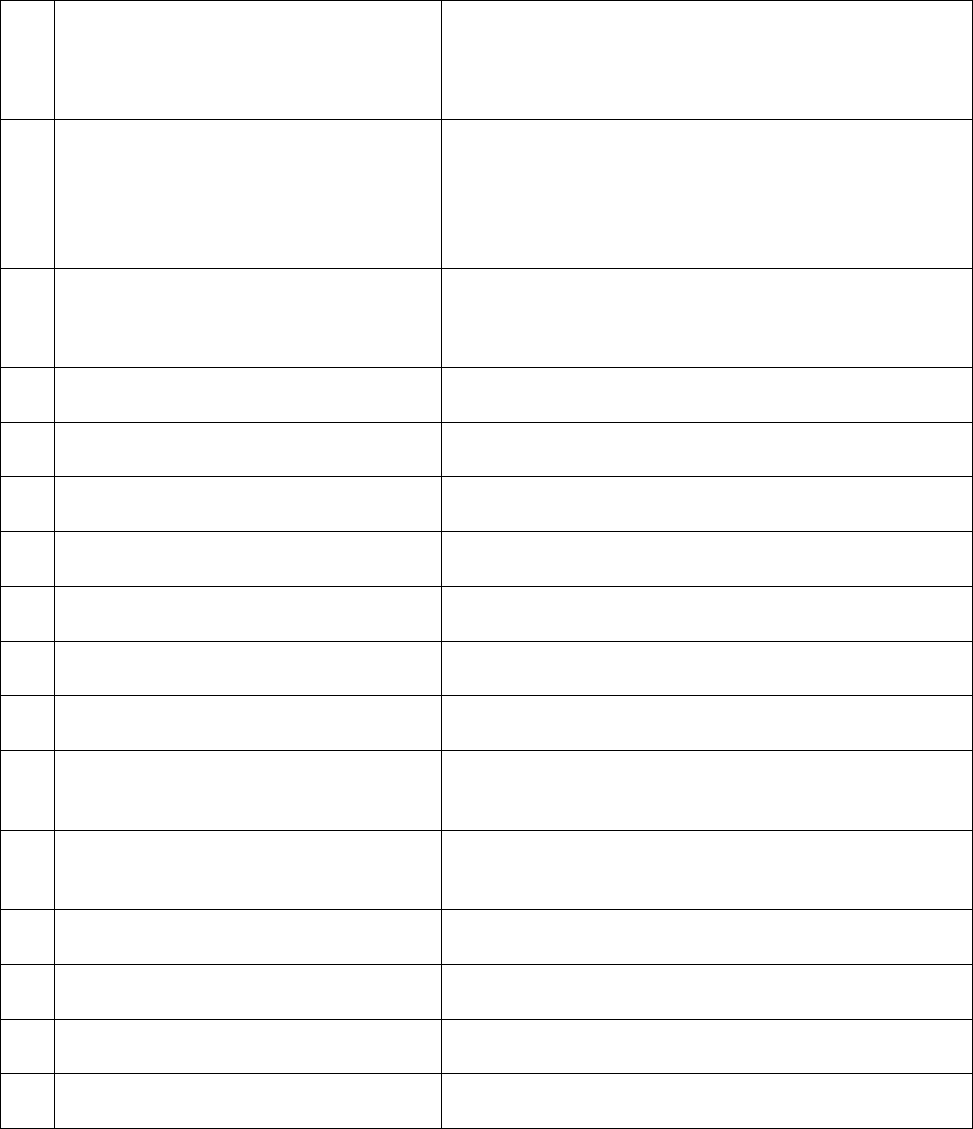

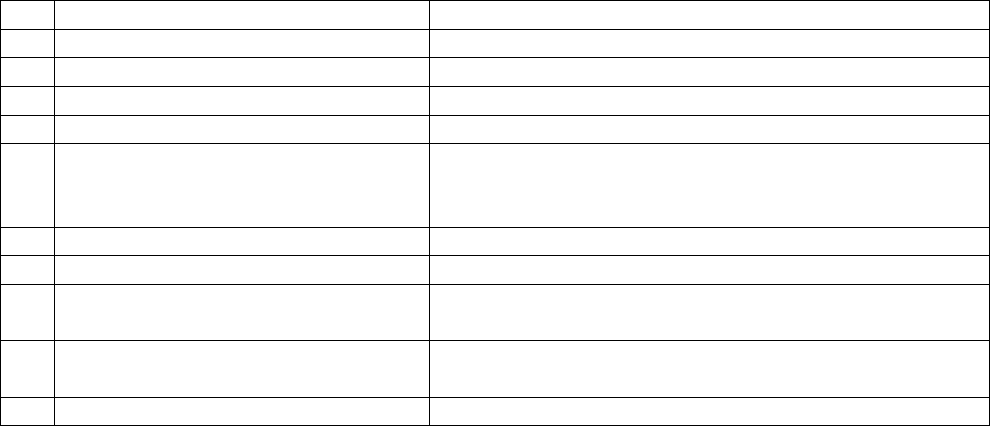

Case of Anil Kumar Bansal Versus HDFC ERGO General Insurance Company Ltd.

Complaint Ref. No.: DEL-H-003-2122-0294

1.

Name & Address of the Complainant

Shri Anil Kumar Bansal,

1170, Kuchapati Ram, Bazar Sita Ram, Delhi-

110006

2.

Policy No:

Type of Policy

Duration of policy/Policy period

PE01880435G

Group Mediclaim-Individual Plan (Bank customer)

Policy

29.11.2019-28.11.2020

17.Brief Facts of the Case: Shri Anil Kumar Bansal (hereinafter referred to as the Complainant) has filed this

complaint against the decision of the HDFC ERGO General Insurance Company Ltd. (hereinafter referred to

as the Insurers or the Respondent Insurance Company) alleging wrong rejection of his hospitalization claim

and cancellation of his mediclaim policy.

18. Cause of Complaint:

a) Complainant's Argument: The Complainant has stated that he was having the insurance cover under Easy

Health Group Insurance Plan of Apollo Munich Health Insurance since 21.10.2016. The said policy was auto-

renewed in 2017 and 2018. In 2019 the policy was not auto-renewed on 21.10.2019 as in previous years.

The insurers issued a new policy namely Group Assurance Health Plan via Canara Bank effective from

29.11.2019. He was admitted in Fortis Escorts Heart Institute on 01.02.2020 following a fall in the bathroom

with symptoms of slurred speech and drowsiness. He was diagnosed as a case of ICH with Hypertension

Left Hemiplegia. His cashless authorization was denied by the insurers on the ground of non-disclosure of

ailment of Obstructive Sleep Apnea (OSA) in the declaration form. Subsequently his policy was also

cancelled on 05.02.2021 for the same reason. He has stated that the attending doctor also certified that

OSA was not the cause of the stroke suffered by the complainant. He represented against the rejection of

his cashless claim and policy cancellation by reporting to IRDA. However the Respondents did not change

their stand. He then approached this Office to get his complaint redressed.

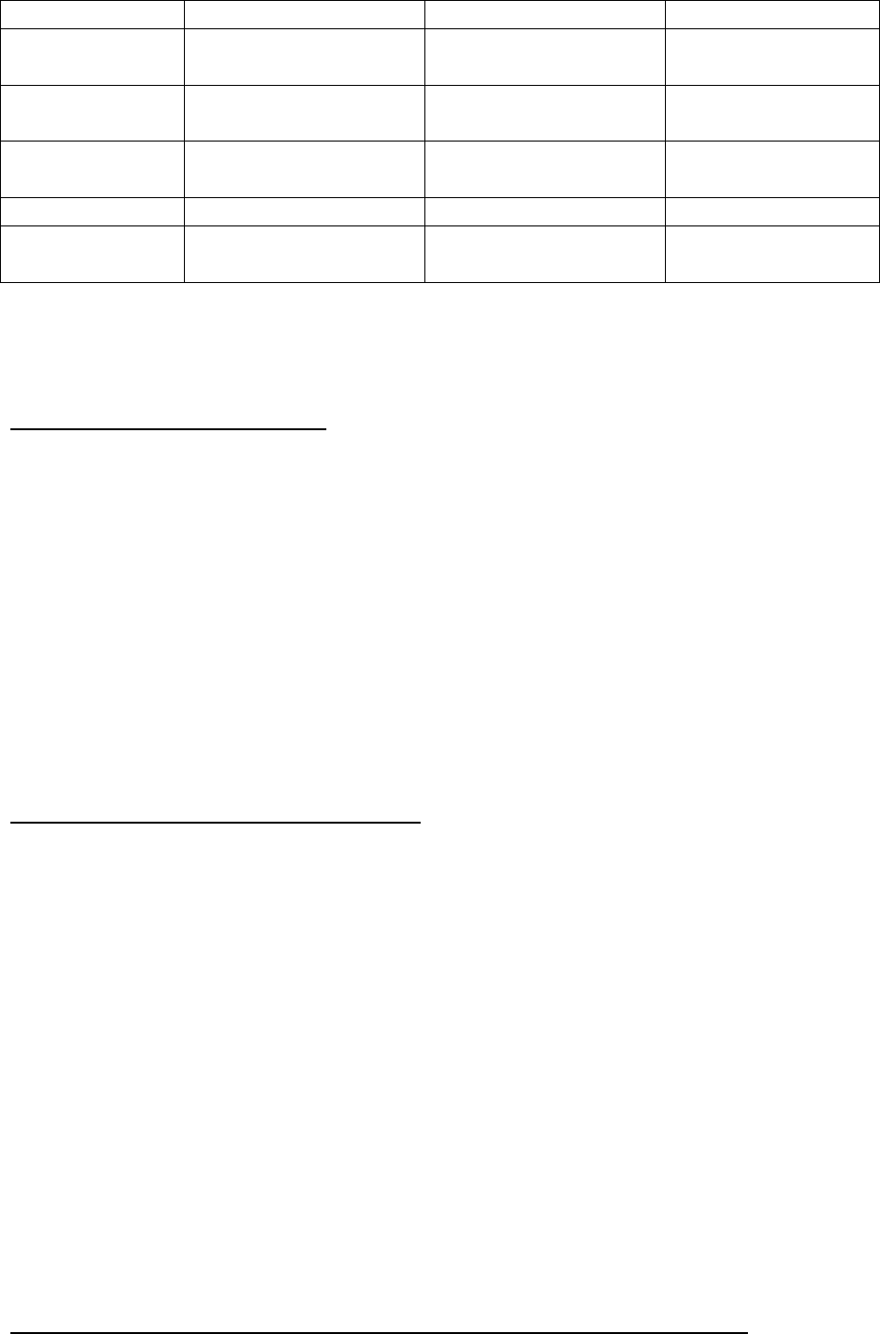

b) Insurers Argument: The Insurers in their SCN dated 20.09.2021 have stated that complainant had failed to

pay the renewal premium in October 2019 in spite of the repeated reminders sent by them. His policy

expired on 20.10.2019. They have stated that they received a fresh proposal from the Complainant on

29.11.2019 and he had provided the Health details as per Clause 7 of this form. Based on his declaration,

the insurance policy was issued to him from 29.11.2019-28.11.2020. The insurers received a Cashless

Preauthorization request from Escorts Heart Institute on 02.02.2020. On review of the documents

received from the hospital for preauthorization, they noted that the complainant had a history of OSA for

preceding 5 years. They have stated that the insured did not produce any document to prove his

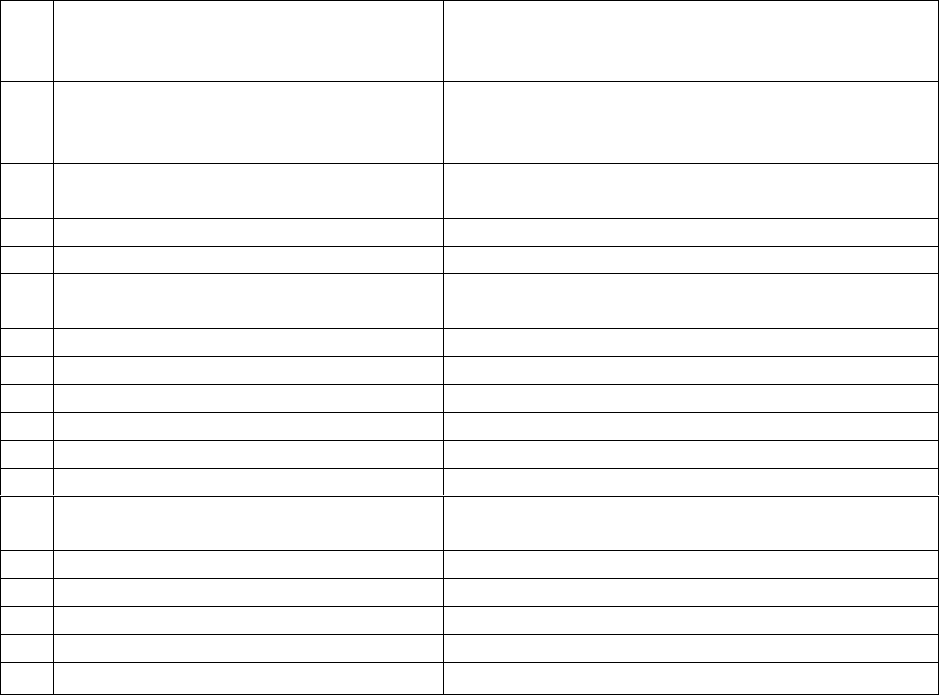

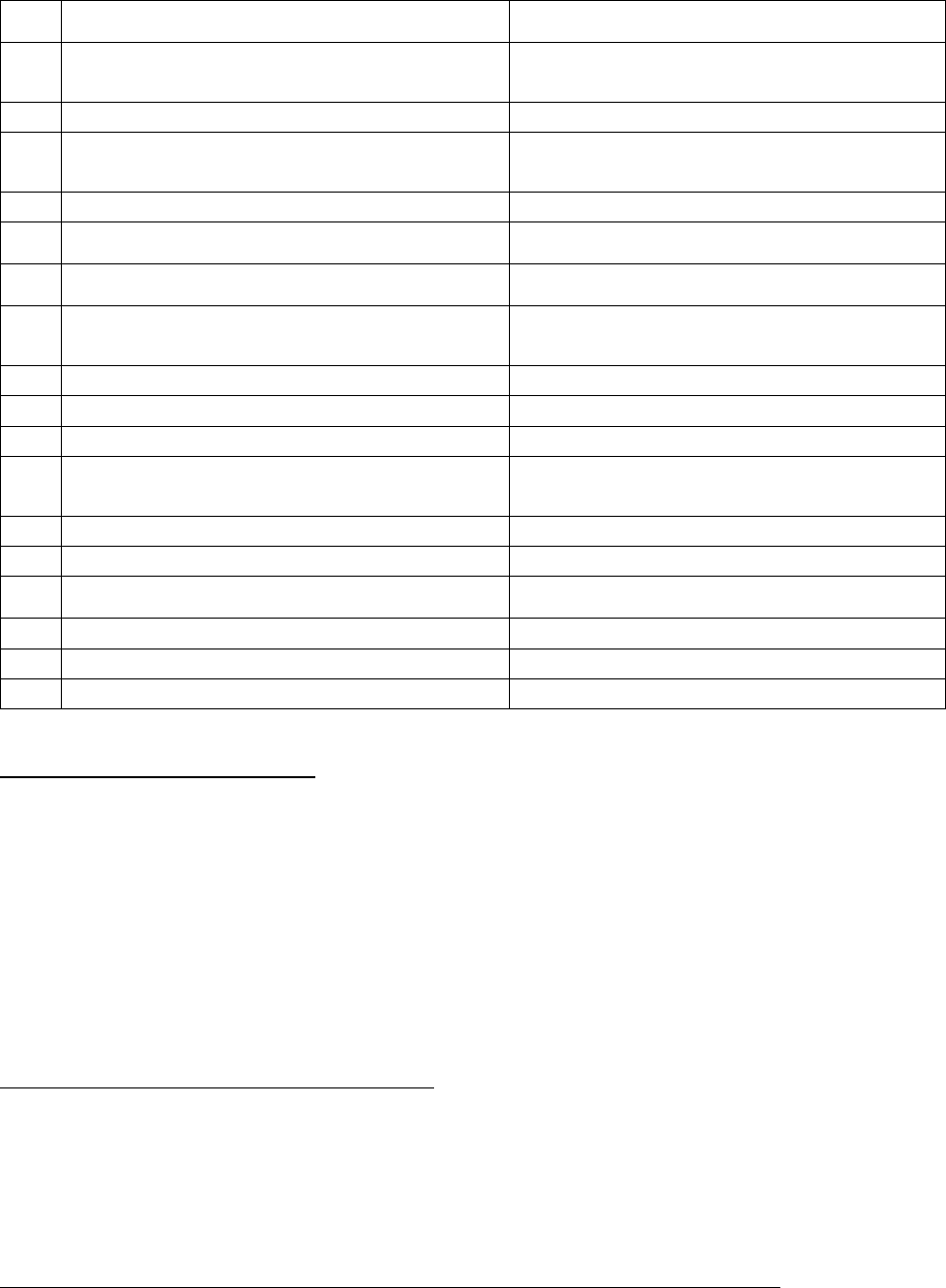

3.

Name of the insured

Name of the policy holder

Anil Kumar Bansal

Anil Kumar Bansal

4.

Name of the insurer

HDFC ERGO General Insurance Company Ltd.

5.

Date of repudiation

29.03.2020

6.

Reason for repudiation

Non-disclosure of pre-existing disease

7.

Date of receipt of the complaint

10.08.2021

8.

Nature of complaint

Rejection of claim; Cancellation of policy

9.

Amount of claim

Rs 92536/-

10.

Date of partial settlement

NA

11.

Amount of partial settlement

NA

12.

Amount of relief sought

Rs 92536/-

13.

Complaint registered under Rule No.

of the Insurance Ombudsman Rules,

2017

Rule 13(1) (b) – any partial or total repudiation of

claim by insurer.

14.

Date of hearing/place

27.09.2021, Delhi, Online, Via WebEx

15.

Representation at the hearing

For the Complainant

1. Shri Anil Kumar Bansal, the Complainant

2. Shri Ayushman Bansal, s/o the Complainant

For the insurer

Shri Manoj K Prajapati, Manager (Corporate Legal)

16.

Date of Award/Order

Award under Rule 17/ 27.09.2021

contention of suffering from OSA for previous 5 months only. They rejected the cashless claim on account

of Non-disclosure of material fact in the proposal form. They invoked Section 7 of the policy terms and

conditions and rejected his claim. Since the complainant did not adhere to the principle of utmost good

faith, the existing policy was cancelled too.

19. Reason for registration of Complaint: Rejection of claim.

20. The following documents were placed for perusal:

a) SCN, Insurance policy.

b) Proposal Form, Discharge summary, Doctor’s certificate.

c) Letter of GRO.

21. Result of hearing of the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

The Complainant states that the Insurers had defaulted in not auto-renewing his policy, as they had done

in the past. The Insurers state that they renew the policy only after getting consent of the policyholder,

for which they had issued the renewal notice on 14.8.2019. The Complainant denies having received the

renewal notice. It was, however, incumbent upon the Complainant to have got his policy renewed on

time and he cannot pass on this responsibility onto the Insurers.

The Complainant denies having submitted the proposal form for the fresh policy. However, on one hand

the Complainant is expecting auto renewal and on the other hand he is objecting to the issuance of policy,

for which he paid the premium. This makes his argument unreasonable.

The Insurers had noted from the documents received from the hospital for preauthorization that the

Complainant had a history of OSA for preceding 5 years. Subsequently, the Complainant secured an

undated certificate from the treating physician stating that the words ‘5 years’ should be read as ‘5

months’. Such casual approach on the hospital/physician makes the entire hospital records suspect.

Upon examination of the arguments and the evidence submitted by both the parties, it is concluded that

(a) the Complainant had failed to get his policy renewed on time, (b) the new policy was issued upon

receipt of fresh proposal form, and (c) the complainant had a history of OSA for preceding 5 years that he

did not disclose in the proposal form, which would justify the action of the Insurers in repudiation of the

claim and cancellation of the policy.

Pursuantly, the complaint shall deserve to be rejected.

Award

The complaint is rejected.

(Sudhir Krishna)

Insurance Ombudsman

September 27, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Mahavir Prasad Soni versus The United India Insurance Company Ltd.

Complaint Ref. No.: DEL-H-051-2122-0316

1.

Name & Address of the Complainant

Shri Mahavir Prasad Soni

101, Avlon Apartment, New Manglapuri, Delhi-110030

2.

Policy No.

Type of Policy

Policy term/policy period

5001002818P109894215

Group Health Insurance Policy

01.10.2018 to 30.09.2019

3.

Name of the insured

Name of the policy holder

Mahavir Prasad Soni

Indian Banks’ Association A/c Punjab National Bank

4.

Name of insurer

The United India Insurance Company Ltd.

5.

Date of repudiation

28.01.2020

6.

Reason for grievance

Rejection of Mediclaim

7.

Date of receipt of the complaint

26.07.2021

8.

Nature of complaint

Rejection of Mediclaim

9.

Amount of claim

Rs.7635/-

10.

Date of partial settlement

N.A

11.

Amount of partial settlement

N.A

12.

Amount of relief sought

Rs.7635/-

13.

Complaint registered under Rule No.

of the Insurance Ombudsman Rules

2017

Rule 13(1)(b)- Any Partial or total repudiation of claims

by an Insurer

14.

Date of hearing

07.09.2021

Place of hearing

Delhi, Online via Cisco WebEx & Telecall

15.

Representation at the hearing

For the Complainant

Shri Mahavir Prasad Soni, the Complainant

For the Insurer

Smt. Pamela Pinto, Deputy Manager (LCD), Mumbai

16.

Date of Award/Order

Recommendation under Rule 16, 06.09.2021

(i) Brief Facts of the Case:

Shri Mahavir Prasad Soni (hereinafter referred to as the Complainant) has filed this

complaint against the decision of The United India Insurance Company Ltd. (hereinafter

referred to as the Insurers) alleging wrong rejection of Mediclaim.

(ii) Cause of Complaint:

Complainant's Argument:

The Complainant has stated that thetotal bills for domiciliary mediclaim of his wife at AIIMS

were 15 and the claim amount was Rs.13614/-. He submitted all the bills to the Insurance

Company but his claim was repudiated on the ground of claim document deficiency.

Further he raised this issue with the Grievance Deptt. of the Insurance Company and

requested to settle the claim at least for Rs.7635/- for which original bills have been

received by the TPA but Insurance Company refused to settle the claim.

Case of Mahavir Prasad Soni versus The United India Insurance Company Ltd.

Complaint Ref. No.: DEL-H-051-2122-0316

b) Insurer's Argument:

The Insurance Company, vide Self Contained Note dated 13.08.2021, has stated that the

Complainant and his dependent members were covered under Group Mediclaim Policy issued

to Indian Banks Association – Punjab National Bank. After receiving the domiciliary claim of

23.08.2019 at AIIMS, the query for deficient documents were raised but there was no reply

from the Complainant even after sending stipulated query reminders to insured. Hence, claim

was repudiated as per Clause No.5.6 for claim document deficiency.

19. Reason for registration of Complaint: Rejection of Mediclaim.

a) The following documents were placed for perusal:

1. Copy of policy.

2. Copy of GRO Letter, query letter, reply of query, bills, claim form, rejection letters.

3. SCN of the Insurers along with enclosures.

b) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage the Insurers inform that they are agreeable to settle the claim for Rs. 7585. The

Complainant accepts this offer. Thus an agreement of conciliation could be arrived at between the

Complainant and the Insurers, which I consider as fair and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall settle the claim for Rs. 7585.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman

September 06, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Ashutosh Sinha versus Star Health and Allied Insurance Company Ltd.

Complaint Ref. No.: DEL-H-044-2122-0309

1.

Name & Address of the Complainant

Shri Ashutosh Sinha

J-1101, Pioneer Park, Sector 61,

Gurugram, Haryana-122005

2.

Policy No.

Type of Policy

Policy term/policy period

P/161219/01/2020/000059

Group Health Insurance Policy

08.09.2019 to 07.09.2020

3.

Name of the insured

Name of the policy holder

Sneha Sinha

Axtria India Private Limited

4.

Name of insurer

Star Health and Allied Insurance Company Ltd.

5.

Date of repudiation

17.12.2019

6.

Reason for grievance

Rejection of Mediclaim

7.

Date of receipt of the complaint

06.08.2021

8.

Nature of complaint

Rejection of Mediclaim

9.

Amount of claim

Rs.120000/- as per Form VI A

10.

Date of partial settlement

N.A

11.

Amount of partial settlement

N.A

12.

Amount of relief sought

Rs.120000/- as per Form VI A

13.

Complaint registered under Rule No. of

the Insurance Ombudsman Rules 2017

Rule 13(1)(b)- Any Partial or total repudiation of claims

by an Insurer

14.

Date of hearing

15.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx App

15.

Representation at the hearing

For the Complainant

Shri Ashutosh Sinha, the Complainant

For the Insurer

1. Dr. Madhukar Pandey, Chief Manager (Health Claims)

2. Shri Mantosh Kumar, Sr. Manager (Claims)

16.

Date of Award/Order

Recommendation under Rule 16/ 15.09.2021

17.Brief Facts of the Case: Shri Ashutosh Sinha (hereinafter referred to as the Complainant) has

filed this complaint against the decision of Star Health and Allied Insurance Company Ltd.

(hereinafter referred to as the Insurers) alleging wrong rejection of Mediclaim.

18.Cause of Complaint:

Complainant's Argument: His wife had a planned surgery for fibroid removal via uterine

artery/fibroid embolization (UAE/UEF) for which pre-authorization approval for Rs.30000/- was

given by the Insurance Company. On the date of the procedure 5

th

Nov’19, a representative

from Star Health visited hospital and inquired about the condition, procedure as well as for pre-

authorization approval. Next day, on 6

th

Nov. 2019, i.e. on the day of discharge, they waited for

10 hours for final cashless settlement but Insurance Company refused to settle the cashless

claim on the ground that Gynecologist opinion was not taken. He then filed reimbursement

claim but the same was not settled. He approached the Grievance Cell who also reiterated the

same reasons for rejection of his claim. He has now approached this forum for relief.

Case of Ashutosh Sinha versus Star Health and Allied Insurance Company Ltd.

Complaint Ref. o.: DEL-H-044-2122-0309

b) Insurer's Argument: The Insurance Company, vide Self Contained Note dated 24.08.2021, has

stated that the insured was admitted in Fortis Hospital from 05.11.2019 to 06.11.2019 and was

diagnosed with Diffuse Adenomyosis. Insured submitted a Pre authorization request for cashless

treatment on 02.11.2019 and the same was initially approved for a sum of Rs.30000/- and

subsequently the cashless approval was withdrawn because Gynecologist opinion was not

obtained for uterine fibroid embolization. The insured submitted the reimbursement claim for

medical expenses. From the Discharge Summary, it was observed that the insured patient was

admitted for Uterine Artery Embolization for Uterine Fibroids/Adenomyosis without prescription

or advice from a Gynecologist. Hence, the claim was repudiated as per Exclusion Clause no. 14 of

the policy. Exclusion Clause 14 states: “The Company shall not be liable to make any payment

under this policy in respect of any expenses what so ever incurred by the insured person in

connection with or in respect of Dietary supplements and substances that can be purchased

without prescription, including but not limited to Vitamins, minerals and organic substances

unless prescribed by a medical practitioner as part of hospitalization claim or day care

procedure”.

19. Reason for registration of Complaint: Rejection of Mediclaim as stated in para 18 (a) above.

c) The following documents were placed for perusal.

4. Copy of policy.

5. GRO letter, pre-authorization approval, pre-authorization withdrawal, discharge, query

letter, rejection letter.

6. SCN of the Insurer along with enclosures.

d) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offer to admit and settle the claim as per the policy terms and

conditions as a one-time exception. The Complainant accepts this offer. Thus an agreement of

conciliation could be arrived at between the Complainant and the Insurers, which I consider as

fair and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall admit and settle the claim as per

the policy terms and conditions as a one-time exception.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 15, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Vineet Kapoor versus The United India Insurance Company Ltd.

Complaint Ref. No.: DEL-H-051-2122-0360

1.

Name & Address of the Complainant

Shri Vineet Kapoor

Kedar Square, L-29/5, DLF Phase-2,

Gurugram, Haryana-122008

2.

Policy No.

Type of Policy

Policy term/policy period

2214002817P104805321

Tailor Made Group Health Policy

03.06.2017 to 02.06.2018

3.

Name of the insured

Name of the policy holder

Vineet Kapoor

M/s Welue Strategic Alliances Pvt. LTd

4.

Name of insurer

The United India Insurance Company Ltd.

5.

Date of repudiation

02.07.2021

6.

Reason for grievance

Inadequate settlement of Mediclaim

7.

Date of receipt of the complaint

30.08.2021

8.

Nature of complaint

Inadequate settlement of Mediclaim

9.

Amount of claim

Rs.5,30,000/-

10.

Date of partial settlement

N.A

11.

Amount of partial settlement

Rs.2,00,000/-

12.

Amount of relief sought

Rs.3,30,000/-

13.

Complaint registered under Rule No.

of the Insurance Ombudsman Rules

2017

Rule 13(1)(b)- Any partial or total repudiation of claims

by an Insurer

14.

Date of hearing

22.09.2021 & 29.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx App

15.

Representation at the hearing

For the Complainant

Shri Vineet Kapoor, the Complainant

For the Insurer

1. Shri Sanjeev Kumar, Deputy Manager, DO-14,

Gurgaon

2. Ms Rajni Ahuja, Dy. Manager, RO-2 Delhi

16.

Date of Award/Order

Award under Rule 17/ 30.09.2021

17.Brief Facts of the Case: Shri Vineet Kapoor (hereinafter referred to as the Complainant) has

filed this complaint against the decision of The United India Insurance Company Ltd. (hereinafter

referred to as the Insurers) alleging inadequate settlement of Mediclaim.

18.Cause of Complaint:

Complainant's Argument: The Complainant had taken the subject Group Mediclaim Tailor-

made Policy for Sum Insured of Rs.35 lakh for himself, spouse, parents and parents-in-law and

the policy cover the dental treatment without any limits and without any riders. His mother-in-

law was treated for dental treatment between 17.04.2017 to 21.08.2017 and paid Rs.5,30,000/-

in 9 parts during the treatment period, which involved full mouth rehabilitation workup through

multiple long restoration sessions. He filed the claim for Rs.5,30,000/- and Insurance Company

settled the claim for Rs.2,00,000/- with a large deduction of Rs.3,30,000/-. He approached the

Grievance Cell of the Insurance Company and the claim was still rejected under the reasonably

and customary clause.

Case of Vineet Kapoor versus The United India Insurance Company Ltd.

Complaint Ref. No.: DEL-H-051-2122-0360

b) Insurer's Argument: The Insurance Company, vide Self Contained Note dated 20.09.2021, has

stated that the Complainant was covered under Group Health Policy covering himself, spouse,

parents and Parent-in-laws. The Complainant lodged a claim for Rs.5,30,000/- on 30.11.2017 for

dental treatment of his Mother-in-law, Smt. Ashima Gupta. As the dental treatment was taken on

OPD basis, the claim was assessed and settled for Rs.2,00,000/- as per Policy Condition No.2.35-

Reasonable and Customary Charges. In order to verify the comparative charges with the prevailing

fees in the region, a local investigation was carried out. Accordingly , the claim was settled as per

policy condition 2.35 and informed to the Complainant.

19. Reason for registration of Complaint: Inadequate settlement of Mediclaim.

e) The following documents were placed for perusal.

7. Copy of policy.

8. Copy of GRO Letter, discharges summaries, bill, claim form, settlement letters.

9. SCN of the Insurers along with enclosures.

f) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

The claim relates to the treatment of Smt. Ashima Gupta, Mother-in-law of the Complainant for

the period from 17.04.2017 to 21.08.2017 in 9 sittings. Out of these, 4 were on 17.4.2017 (Rs.

10000), 22.04.2017 (Rs. 20000), 18.05.2017 (Rs. 1 lakh) and 29.05.2017 (70000), which were prior

to the commencement of the policy, i.e. 03.06.2017, and hence inadmissible for reimbursement

under the policy. The rest of the 5 sittings were during the policy period and the bills paid

amounted to Rs. 3.30 lakh. The Insurers have examined the rates for their Network Hospital (Aster

Hospital, Bengaluru), which is Rs. 97,500, which is lower than the amount of Rs. 2 lakh that they

had settled the claim for. The Insurers have argued that they have thus settled the claim under the

definition of ‘medical expenses’ and ‘reasonable and customary charges’ per clauses 2.22 and 2.35

of the Policy. However, while these clauses are generally applicable for claims under the policy,

this Tailor-made Policy has made specific provision of ‘OPD coverage without any limit’. Therefore,

the clam will have to be examined for the 5 sittings without any limit. The complaint deserves to

be allowed to this extent only.

Award

The complaint is allowed partially as stated above. Accordingly, the Insurers should settle the

claim for the five OPD sittings of the insured falling under the Policy period, without any monetary

limit, as per the terms and conditions of the Policy, after adjusting for the partial settlement

already made, within 30 days.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 30, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Rakesh Ranjan versus Star Health Insurance Company

Complaint Ref. No.: DEL-H-044-2122-0443

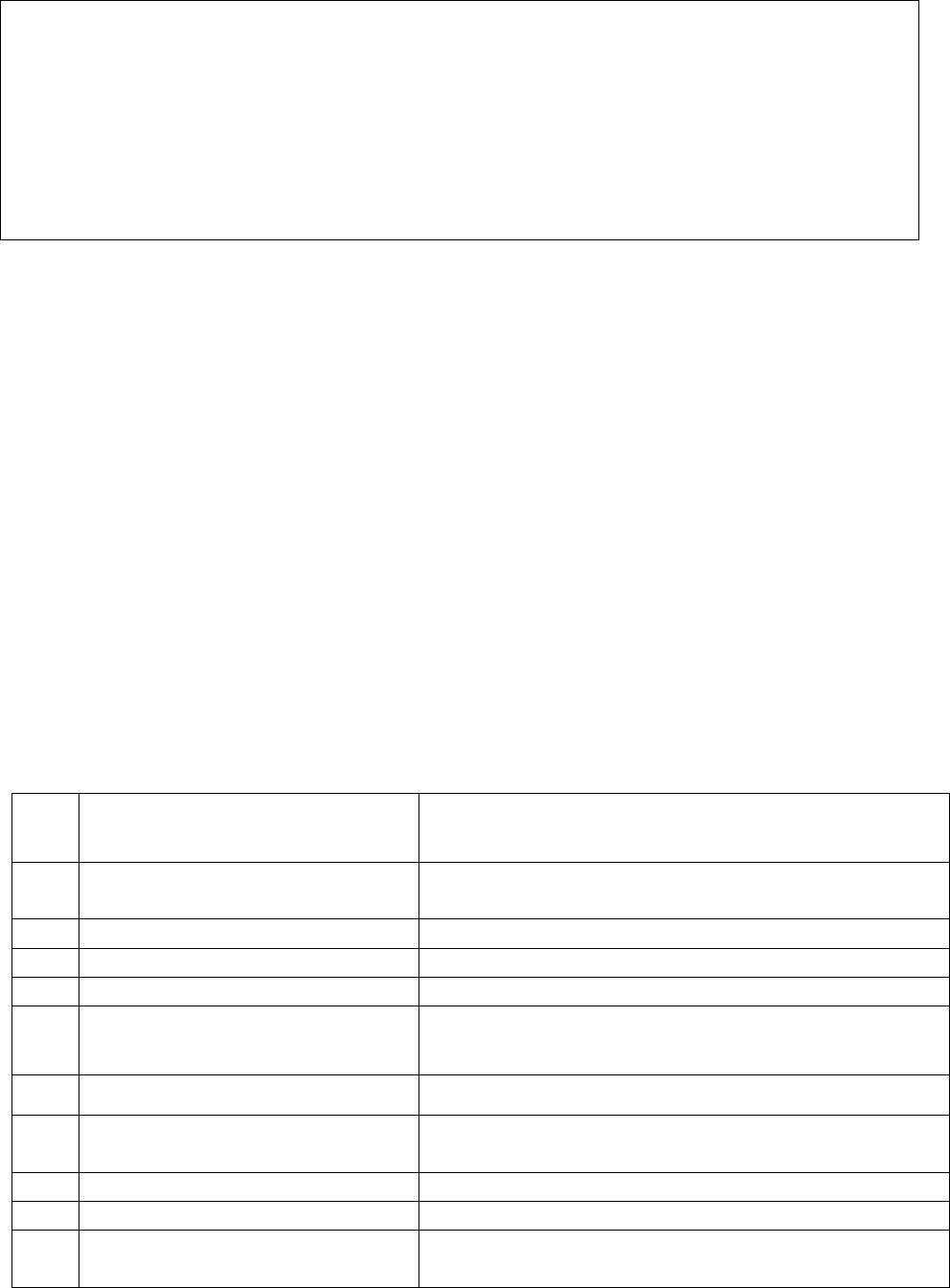

1.

Name & Address of the Complainant

Shri Rakesh Ranjan S/o Chandramani Singh,

At+ Post, Dariapur, P.S. Muffasil,

Distt. Munger, Pin-811201, Bihar

2.

Policy No.

Type of Policy

Policy term/policy period

P/161211/01/2020/005099

Group Health Insurance Policy

14.08.2019 to 13.08.2020

3.

Name of the insured

Name of the policy holder

Rakesh Ranjan

Somani Kanak Seedz Pvt. Ltd.

4.

Name of insurer

Star Health Insurance Company

5.

Date of repudiation

17.09.2020

6.

Reason for grievance

Repudiation of Mediclaim

7.

Date of receipt of the complaint

08.09.2021

8.

Nature of complaint

Repudiation of Mediclaim

9.

Amount of claim

Rs.1,75,000/-

10.

Date of partial settlement

N.A.

11.

Amount of partial settlement

N.A.

12.

Amount of relief sought

Rs.2,00,000/- as per Form VI

13.

Complaint registered under Rule No.

of the Insurance Ombudsman Rules

2017

Rule 13(1)(b)- Any Partial or total repudiation of claims

by an Insurer

14.

Date of hearing

29.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx

15.

Representation at the hearing

For the Complainant

Shri Rakesh Ranjan, the Complainant

For the Insurer

1. Dr. Madhukar Pandey, Chief Manager (Health

Claims)

2. Shri Matosh Kumar, Senior Manager (Claims)

16.

Date of Award/Order

Recommendation under Rule 16/ 29.09.2021

17.Brief Facts of the Case: Shri Rakesh Ranjan (hereinafter, ‘the Complainant’) has filed this

complaint against the decision of The Star Health Insurance Company (hereinafter, ‘the Insurers’)

alleging wrong repudiation of Mediclaim.

18.Cause of Complaint:

i. Complainant's Argument: The Complainant had stated that his newborn baby son had some

breathing complication after birth and was hospitalized in Silliguri Neotia Getwell Health Care

,West Bengal from 20.02.2020 to 29.02.2020. As the hospital was expensive, after getting LAMA

discharge, they continued the treatment in Bachha Hospital, Katihar from 01.03.2020 to

11.03.2020. They had informed the insurance company for baby addition and submitted

reimbursement claims but insurance company had not settled the claim as new baby was not

covered from day one and baby treatment is not covered under their policy. He represented to

Insurance company on 09.08.2020 but they have not settled the claims.

Case of Rakesh Ranjan versus Star Health Insurance Company

Complaint Ref. No.: DEL-H-044-2122-0443

ii. Insurer's Argument: The Insurance Company, vide Self Contained Note dated 16.09.2021 has

stated that Complainant was a member covered under Group Medical Health Insurance Policy.

The insured raised two reimbursement claims in respect of Baby of Mrs. Roji Kumari, wife of

insured , in 2

nd

year of Mediclaim policy, one for Rs.1,40,341/- towards hospitalization expenses

at Neotia Getwell Healthcare Centre, Siliguri, West Bengal for the period 20.02.2020 to

29.02.2020 and 2

nd

claim for Rs.35,011/- towards medical expenses incurred in Bachcha

Hospital, Katihar for the period 01.03.2020 to 11.03.2020. As per discharge summary, the new

born baby was diagnosed with Sepsis with Neonatal Jaundice and was kept in observation and

was given vaccination and screening test, which was not covered, as per terms and conditions

of the policy. Moreover, the baby is not endorsed in policy as member covered. Hence they had

repudiated the claims as per Exclusion No.5 of the policy and special condition regarding

midterm inclusion of any employees and dependents.

19. Reason for registration of Complaint: Repudiation of Mediclaim.

20. The following documents were placed for perusal:

10. Copy of policy.

11. Copy of GRO Letter, discharge summary, bills

12. SCN of the Insurer along with enclosures.

21.Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offers to review and settle the claim as per the terms & conditions of

policy in respect of the hospitalisation of the baby in Neotia Getwell Healthcare Centre, Siliguri

and Bachcha Hospital, Katihar, subject to submission of the Bills of tests done and medicine

bills. The Complainant accepts this offer. Thus an agreement of conciliation could be arrived at

between the Complainant and the Insurers, which I consider as fair and reasonable for both the

parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall review and settle the claim as per

the terms & conditions of policy in respect of the hospitalisation of the baby in Neotia Getwell

Healthcare Centre, Siliguri and Bachcha Hospital, Katihar, subject to submission of the Bills as

mentioned above.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 29, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Ranjana Sinha versus The United India Insurance Company Ltd.

Complaint Ref. No.: DEL-H-051-2122-0442

1.

Name & Address of the Complainant

Smt. Ranjana Sinha, H.No. 283, 2

nd

Floor, Hauz Rani,

Malviya Nagar, New Delhi-110017

2.

Policy No.

Type of Policy

Policy term/policy period

5001002819P112786266

Group Health Insurance Policy

01.11.2019 to 31.10.2020

3.

Name of the insured

Name of the policy holder

Hari Prakash Sinha (Husband)

Indian Bank Association A/c Allahabad Bank

4.

Name of insurer

The United India Insurance Company Ltd.

5.

Date of repudiation

N.A.

6.

Reason for grievance

Inadequate settlement of Mediclaim

7.

Date of receipt of the complaint

10.09.2021

8.

Nature of complaint

Inadequate settlement of Mediclaim

9.

Amount of claim

Rs.5,09,493/-

10.

Date of partial settlement

30.12.2020 & 15.02.2021

11.

Amount of partial settlement

Rs.1,72,205/-

12.

Amount of relief sought

Rs.3,50,000/- as per Form VI

13.

Complaint registered under Rule No. of

the Insurance Ombudsman Rules 2017

Rule 13(1)(b)- Any Partial or total repudiation of

claims by an Insurer

14.

Date of hearing

29.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx

15.

Representation at the hearing

For the Complainant

1. Smt. Ranjana Sinha, the Complainant

2. Ms Neha Sinha, D/o the Complainant

For the Insurer

Smt. Pamela Pinto, Dy. Manager (LC&B), Mumbai

16.

Date of Award/Order

Recommendation under Rule 16/ 29.09.2021

17.Brief Facts of the Case: Smt. Ranjana Sinha (hereinafter, ‘the Complainant’) has filed this

complaint against the decision of The United India Insurance Company Ltd. (hereinafter, ‘the

Insurers’) alleging inadequate settlement of Mediclaim.

18.Cause of Complaint:

iii. Complainant's Argument: Her husband, Dr. Hari Prakaksh Sinha was admitted to

Pushpanjali Hospital, Agra on 21.07.2020 and was transferred to Nayati Hospital (Covid

hospital) after being diagnosed of corona positive on 26.07.2020, where he expired on

06.08.2021. She submitted the claim for reimbursement for Rs.5,81,713/- but insurance

company had credited Rs.33,947/- on 30.12.2020 and Rs.1,38,258/- on 15.02.2021 after

several reminders without any details of deduction. Insurance Company had again credited

Rs.8,150/- on 02.07.2021 without any intimation or details. She approached the insurance

company but her balance claim was not settled.

iv. Insurer's Argument: The Insurance Company, vide revised Self Contained Note dated

27.09.2021 has stated that they had received two reimbursement claims towards

hospitalization expenses in respect of the insured Dr. Hari Prakash Sinha for Rs. 72,278/-

incurred at Pushpanjali Hospital and Rs. 5,09,493/- at Nayati Health Care, Agra. Out of

the claimed amount, Rs. 33,947/-were settled under Base Policy (Sum Insured

Exhausted) and Rs. 1,38,258/- under Top Up policy totaling to Rs. 1,72,205/-. Out of

Balance claim of Rs. 4,09,566/-, Rs. 3,37,289/- deducted as per G.I. Council Rates and Rs.

72,278/- not paid through oversight. They had further stated that they had paid Rs.

14350/- per day towards treatment cost in Nayati Health Care, which is as per

Reasonable & Customary Clause of the policy. Hence the claim was settled as per GI

Council Rates and Policy Terms & Conditions.

19. Reason for registration of Complaint: Inadequate settlement of Mediclaim

20. The following documents were placed for perusal:

13. Copy of policy.

14. Copy of GRO Letter, discharge summary, bills

15. SCN of the Insurer along with enclosures.

g) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offers to review and settle the claim as per the Policy terms &

conditions up to the SI under the Top-up Policy and also to pay interest in terms of the

provisions of the IRDAI (Protection of the Policyholders’ Interest) Regulations 2017. The

Complainant accepts this offer. Thus an agreement of conciliation could be arrived at

between the Complainant and the Insurers, which I consider as fair and reasonable for

both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall review and settle the claim as per the

Policy terms & conditions up to the SI under the Top-up Policy and also to pay interest in terms of

the provisions of the IRDAI (PPHI) Regulations 2017.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 29, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Manish Sharma versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0359

1.

Name & Address of the Complainant

Shri Manish Sharma

2264/172, Ganesh Pura, Tri Nagar,

New Delhi-110035

2.

Policy No.

Type of Policy

Policy term/policy period

360305501910005905

Parivar Mediclaim Policy

05.03.2020 to 04.03.2021

3.

Name of the insured

Name of the policy holder

Manish Sharma

Manish Sharma

4.

Name of insurer

The National Insurance Company Ltd.

5.

Date of repudiation

27.01.2021

6.

Reason for grievance

Rejection of Mediclaim

7.

Date of receipt of the complaint

09.08.2021

8.

Nature of complaint

Rejection of Mediclaim

9.

Amount of claim

Rs.54095/- as per Form VIA

10.

Date of partial settlement

N.A

11.

Amount of partial settlement

N.A

12.

Amount of relief sought

Rs.54095/- as per Form VIA

13.

Complaint registered under Rule No. of

the Insurance Ombudsman Rules 2017

Rule 13(1)(b)- Any Partial or total repudiation of

claims by an Insurer

14.

Date of hearing

22.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx

15.

Representation at the hearing

For the Complainant

Shri Manish Sharma, the Complainant

For the Insurer

Shri Govind Lal, Admin. Officer, DA Br., Punjabi Bagh

16.

Date of Award/Order

Award under Rule 17/ 22.09.2021

17.Brief Facts of the Case: Shri Manish Sharma (hereinafter referred to as the complainant) has filed

the complaint against the decision of The National Insurance Company Ltd. (hereinafter referred to

as the Insurers or the Respondent Insurance Company) alleging wrong rejection of Mediclaim.

18.Cause of Complaint:

v. Complainant's Argument: The Complainant had stated the he made two claims for Injection

Rituximab for Rs.54095/-. Further he stated that he was patient of Acquired homophiles.

Doctor prescribed him for Injection Rituximab in Govt. Hospital AIIMS and that was not

immunotherapy. Insurance Company rejected his claim by giving irrelevant reasons

whereas his claim was genuine. He approached the Grievance Cell of the Insurance

Company but his claim was not settled.

Case of Manish Sharma versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0359

vi. Insurer's Argument: The Insurance Company, vide Self Contained Note dated 15.09.2021,

has stated that on scrutiny of the documents, it was observed that the patient availed

treatment in AIIMS Hospital with the diagnosis of ‘Acquired Hemophilia (FVIII INH) &

underwent “Rituximab Therapy”. The Complainant has lodged 2 claims for treatment of

Acquired Hemophilia & underwent Rituximab Therapy on 17.03.2020 & 01.04.2020 on

Short admission basis in AIIMS, New Delhi. The hospitalization was solely for

Immunotherapy, which on a standalone basis does not require hospitalization and was

not listed in the day care procedure annexed at appendix 1 of the policy. Hence the

claim was repudiated as per Policy Clause No. 3.11 and list of Day Care Procedure

Appendix 1.

19. Reason for registration of Complaint: Rejection of Mediclaim as stated in para 18 (a)

above.

h) The following documents were placed for perusal.

16. Copy of policy.

17. Copy of GRO Letter, discharge summary, bills, rejection letters.

18. SCN of the Insurer along with enclosures.

i) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

I have examined the arguments and the evidence submitted by both the parties. The Complainant

had lodged two claims for treatment of Acquired Hemophilia and underwent Rituximab Therapy

on 17.03.2020 & 01.04.2020 on Short-admission basis in AIIMS, Delhi. The Insurers had

determined that the hospitalization was solely for immunotherapy, which on a standalone basis

does not require hospitalization and was not listed in the admissible day care procedures listed in

Appendix 1 of the policy. There was error on the part of the Insurers in arriving at this

determination. Hence the claims were rightly repudiated as per Policy Clause No. 3.11 read with

the list of admissible Day Care Procedures vide Appendix 1. Pursuantly, the complaint shall

deserve to be rejected.

Award

The complaint is rejected.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 22, 2021

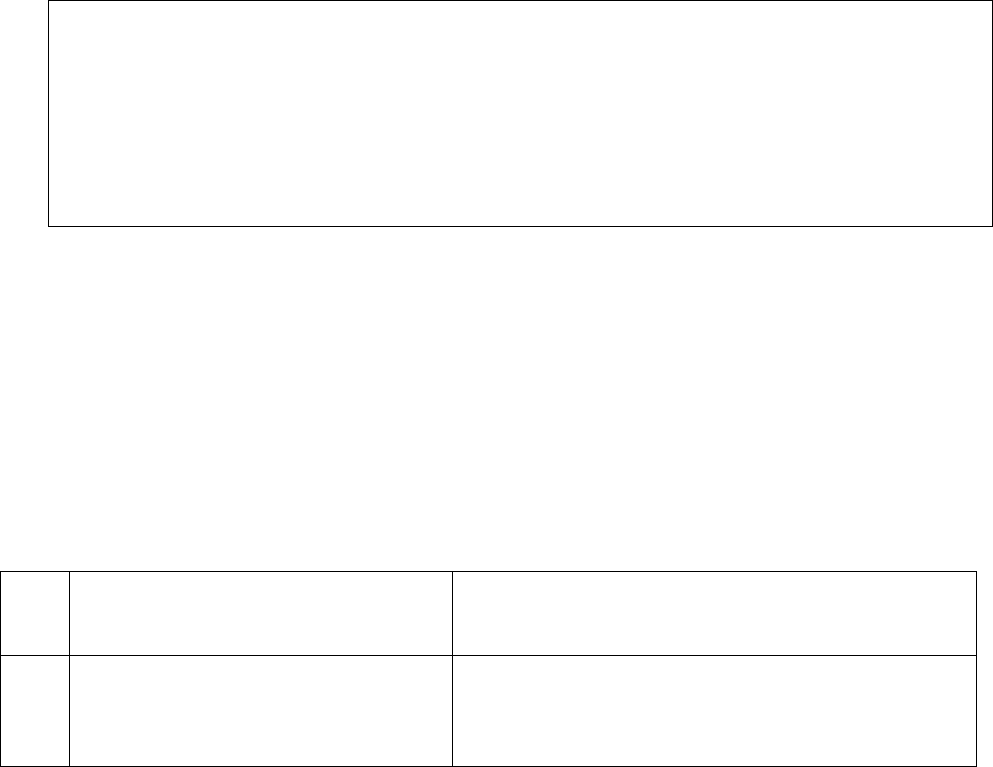

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Sandeep Saxena versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0421

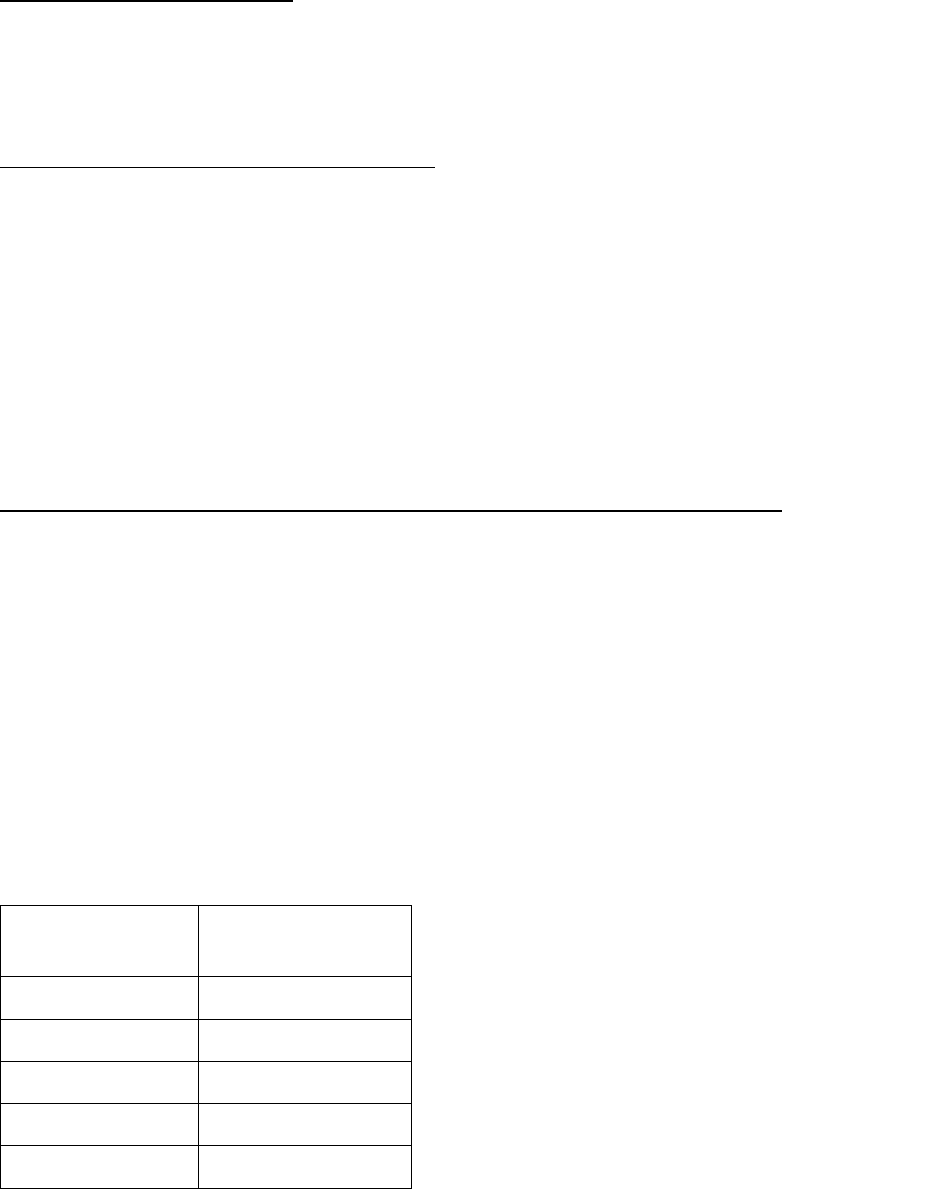

1.

Name & Address of the Complainant

Shri Sandeep Saxena

151, Vigyapan Lok Apartments, Mayur Vihar Extension

Phase-1, Delhi-110091

2.

Policy No.

360801502010004633

National Parivar Mediclaim

16.11.2020 to 15.11.2021

Type of Policy

Policy term/policy period

3.

Name of the insured

Name of the policy holder

Namita Kapoor Saxena

Sandeep Saxena

4.

Name of insurer

The National Insurance Company Ltd.

5.

Date of repudiation

N.A.

6.

Reason for grievance

Inadequate settlement of Mediclaim

7.

Date of receipt of the complaint

03.09.2021

8.

Nature of complaint

Inadequate settlement of Mediclaim

9.

Amount of claim

Rs.1,12,857

10.

Date of partial settlement

16.06.2021

11.

Amount of partial settlement

Rs.70,634

12.

Amount of relief sought

Rs.42,223

13.

Complaint registered under Rule No. of

the Insurance Ombudsman Rules 2017

Rule 13(1)(b)- Any Partial or total repudiation of claims

by an Insurer

14.

Date of hearing

22.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx App

15.

Representation at the hearing

For the Complainant

Shri Sandeep Saxena, the Complainant

For the Insurer

Shri Puneet Bhatia, Divisional Manager, DO-34

16.

Date of Award/Order

Recommendation under Rule 16/ 22.09.2021

17.Brief Facts of the Case:

Shri Sandeep Saxena (hereinafter, ‘the Complainant’) has filed this complaint against the

decision of The National Insurance Company Ltd. (hereinafter ‘the Insurers’) alleging

inadequate settlement of Mediclaim.

18.Cause of Complaint:

vii. Complainant's Argument: The Complainant had stated that his wife Smt. Namita Kapoor

was admitted in Bansal Hospital from 01.05.2021 to 03.05.2021 for the treatment of

COVID-19 Pneumonia. He applied for the reimbursement of claim for Rs.1,12,857/- but

Insurance Company reimbursed only Rs.70,634/-with a deduction of Rs.42,223/- citing

Government guidelines. He approached the Grievance Cell of the Insurance Company but

his balance claim was not settled.

Case of Sandeep Saxena versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0421

viii. Insurer's Argument: The Insurance Company, vide Self Contained Note has stated that the

patient Smt. Namita was admitted in Bansal Hospital, Delhi on 01.05.2021 with complaints

of Generalised weakness, shortness of breath, Ghabrahat, Dry cough, low grade fever, dry

mouth, and was diagnosed with Covid-19 pneumonia. She was discharged on 03.05.2021,

after hospitalization for 2 days. The reimbursement claim was approved and paid for

Rs.70,634/- on 21.06.2021 as per circular dated 20.06.2020 issued by the Govt. of National

Capital Territory of Delhi. A sum of Rs.42,223/- was deducted towards non-payable items

and deduction details were informed to the Complainant. Hence, claim was paid as per

Policy clause 6.42 of Reasonable and Customary charges, circular of Govt. of National

Capital Territory of Delhi and Table of Benefits limit for ambulance charges.

(iii) Reason for registration of Complaint: Inadequate settlement of Mediclaim.

j) The following documents were placed for perusal:

19. Copy of policy.

20. Copy of GRO Letter, Discharge summary, hospital bills, claim form, settlement details.

21. SCN of the Insurer along with enclosures.

k) Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offer to make payment for Pharmacy charges (Rs. 11163), Lab Tests

charges (Rs. 19316), and Physiotherapy charges (Rs. 1491), totaling to Rs. 31970, in full and final

settlement of the balance claim. The Complainant accepts this offer. Thus an agreement of

conciliation could be arrived at between the Complainant and the Insurers, which I consider as fair

and reasonable for both the parties.

Award

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, the Insurers shall make a payment of Rs. 31,970, as

noted above, to the Complainant in full and final settlement of the balance claim.

Parties should implement this agreement within 30 days.

(Sudhir Krishna)

Insurance Ombudsman, Delhi

September 22, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Seema Gupta versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0357

1.

Name & Address of the Complainant

Smt. Seema Gupta

G-23/278, Sector-7, Rohini, Delhi-110085

2.

Policy No.

Type of Policy

Policy term/policy period

360400502010000170

Parivar Mediclaim

15.04.2020 to 14.04.2021

3.

Name of the insured

Name of the policy holder

Seema Gupta

Seema Gupta

4.

Name of insurer

The National Insurance Company Ltd.

5.

Date of inadequate settlement

09.03.2021

6.

Reason for grievance

Inadequate settlement of Mediclaim

7.

Date of receipt of the complaint

16.08.2021

8.

Nature of complaint

Inadequate settlement of Mediclaim

9.

Amount of claim

Rs.78831/-

10.

Date of partial settlement

-----

11.

Amount of partial settlement

Rs.65165/-

12.

Amount of relief sought

Rs.13666/-

13.

Complaint registered under Rule No. of

the Insurance Ombudsman Rules 2017

Rule 13(1)(b)- Any Partial or total repudiation of

claims by an Insurer

14.

Date of hearing

22.09.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx

App

15.

Representation at the hearing

For the Complainant

1. Smt. Seema Gupta, the Complainant

2. Shri Arjun Gupta, s/o the Complainant

For the Insurer

Shri Puneet Kanoria, Sr. Divl Manager DO-9, Rohini

16.

Date of Award/Order

Recommendation under Rule 16/ 22.09.2021

17.Brief Facts of the Case:

Smt. Seema Gupta (hereinafter referred to as the complainant) has filed the complaint

against the decision of The National Insurance Company Ltd. (hereinafter referred to as the

Insurers) alleging inadequate settlement of Mediclaim.

18.Cause of Complaint:

ix. Complainant's Argument: The Complainant was admitted at Shree Aggarsain International

Hospital from 26.02.2021 to 06.03.2021. Hospital bill was for Rs.78831/- but Insurance

Company settled the bill for Rs. 65165/-. She paid a sum of Rs.13666/- to the hospital.

After discharge she requested the Insurance Company for balance claim but they did not

pay the balance claim. She approached the Grievance Cell of the Company but there was

no relief.

Case of Seema Gupta versus The National Insurance Company Ltd.

Complaint Ref. No.: DEL-H-048-2122-0357

x. Insurer's Argument: The Complainant was admitted in Shree Aggarsain International

Hospital from 26.02.2021 to 06.03.2021 with complaints of Type 2 Diabetes Mellitus with

Acute meningitis. The claim was settled and a sum of Rs.13666/- was deducted for non-

medical items. The Insurance Company has carefully reviewed all the documents on

record and observed that a further payment of Rs.8536/- can be made as per policy terms

and conditions. Further the Insurance Company gave the detail of balance payment of

Rs.5130/- (PPE Kit, examination gloves, dietician, admission charges, medical evaluation

etc.) which were not payable under the policy.

19. Reason for registration of Complaint: Inadequate settlement of Mediclaim.

20.The following documents were placed for perusal.

22. Copy of policy.

23. Copy of GRO Letter, discharge summary, bills, deductions mail.

24. SCN of the Insurer along with enclosures.

21.Result of hearing with the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

At this stage, the Insurers offer (a) to pay an additional amount of Rs. 8536 as stated in Para 18b

above and another sum of Rs. 2000 towards the PPE Kit and (b) to write to the Hospital with copy to

the Complainant to explain to the Complainant the reasons for collection of the remaining amount

of Rs. 3130 and if there are no justification, refund the same to the Complainant. The Complainant