PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF TAMILNADU & PUDUCHERY

(UNDER RULE NO: 16/17 of the INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – Shri Segar Sampathkumar

CASE OF Sri. G. Virabadran vs M/s. National Insurance Company Limited

COMPLAINT REF: NO: CHN-H-048-2122-0964

Award No: IO/CHN/A/HI/0010/2022-2023

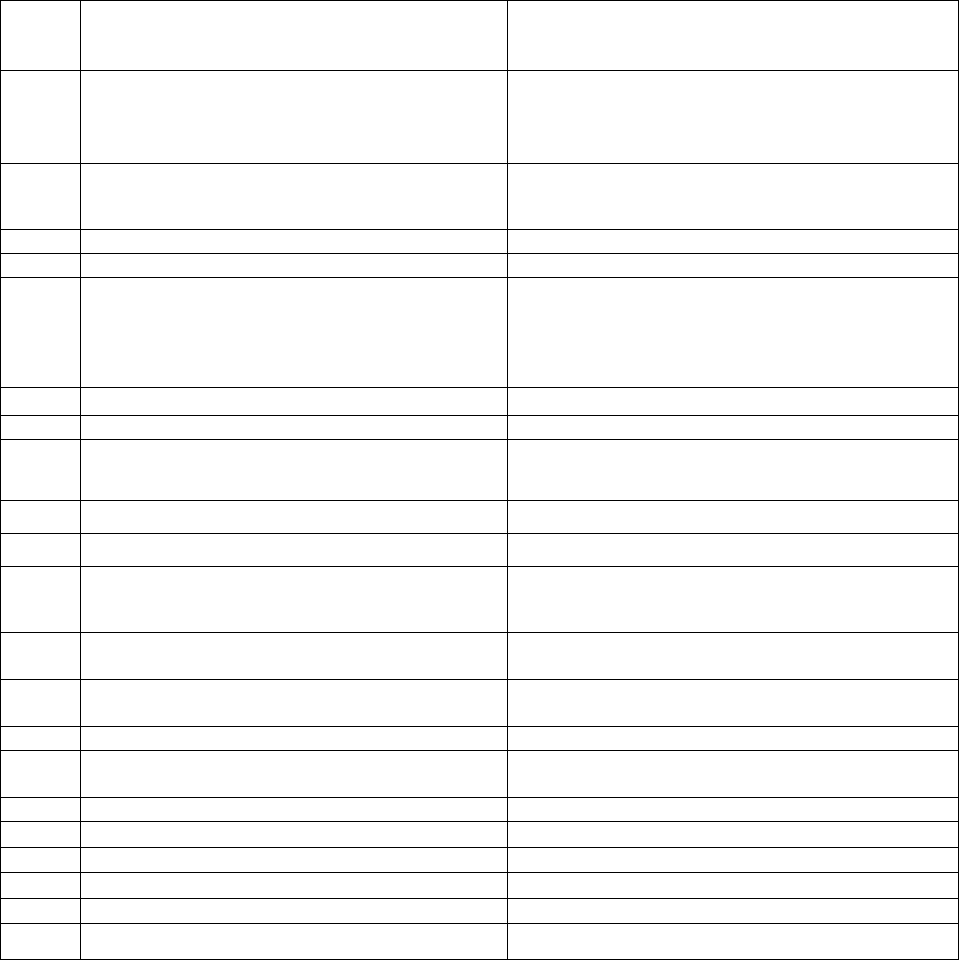

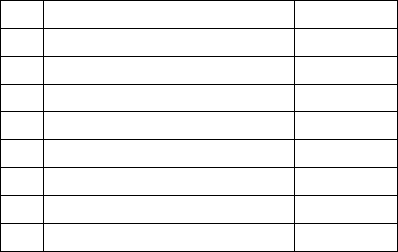

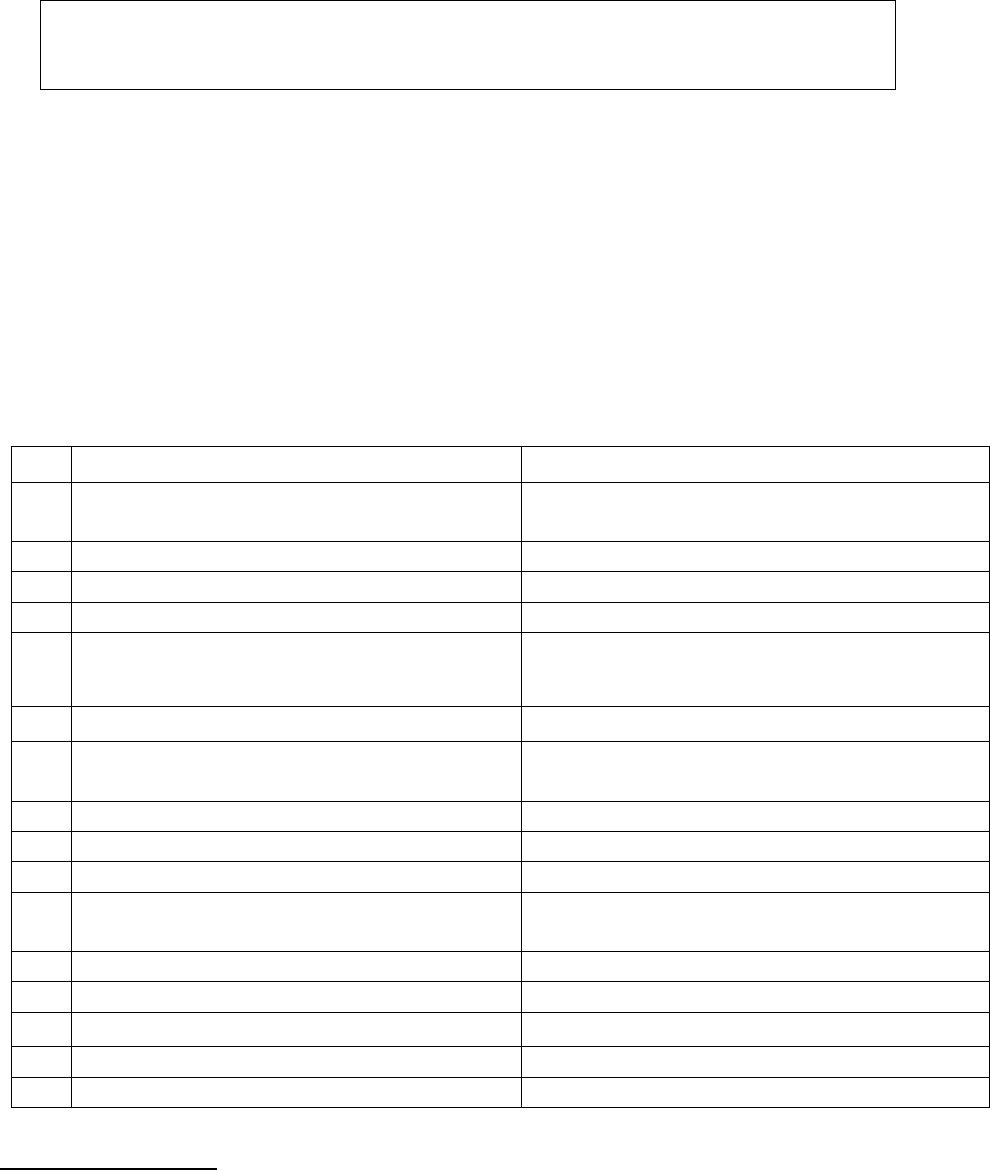

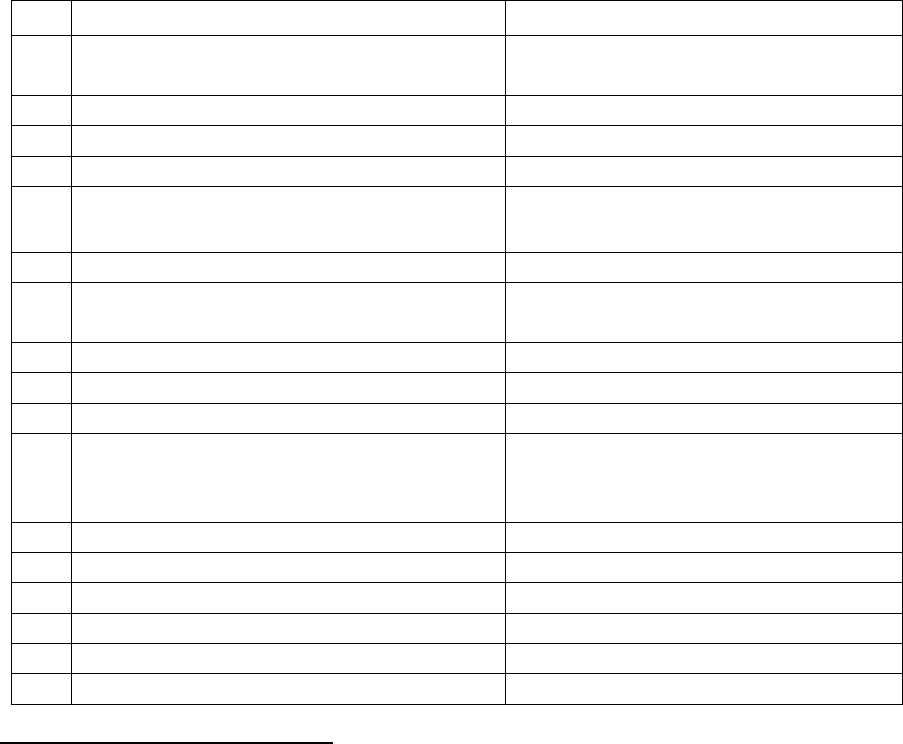

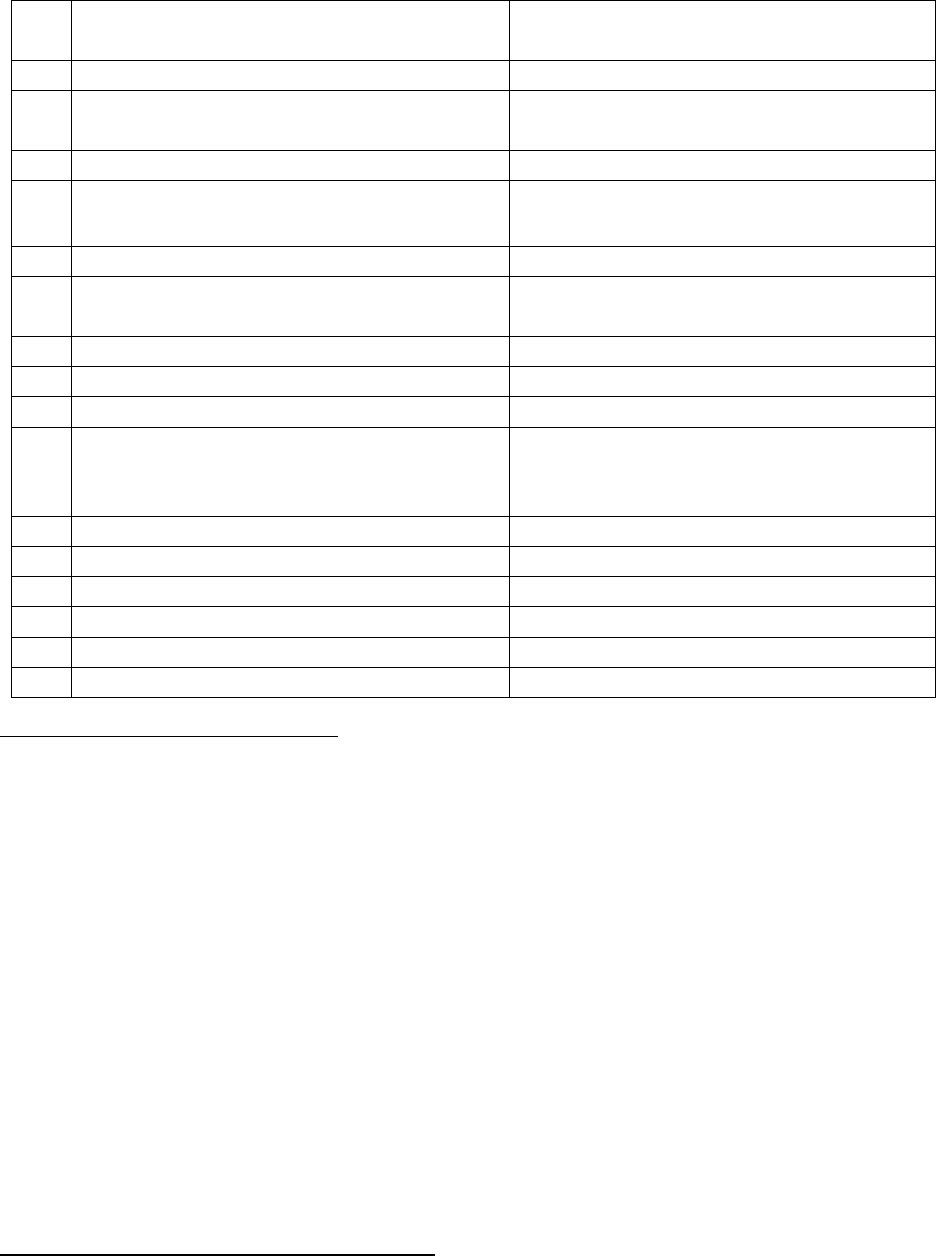

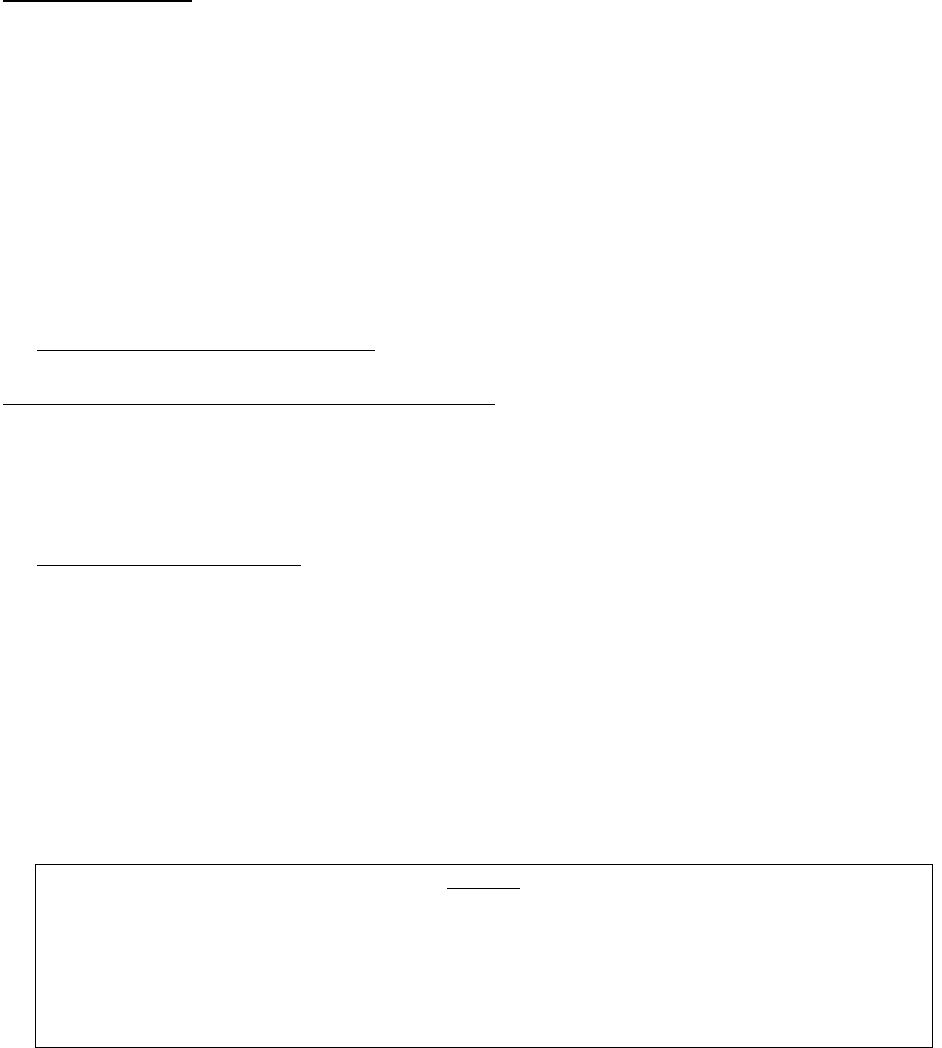

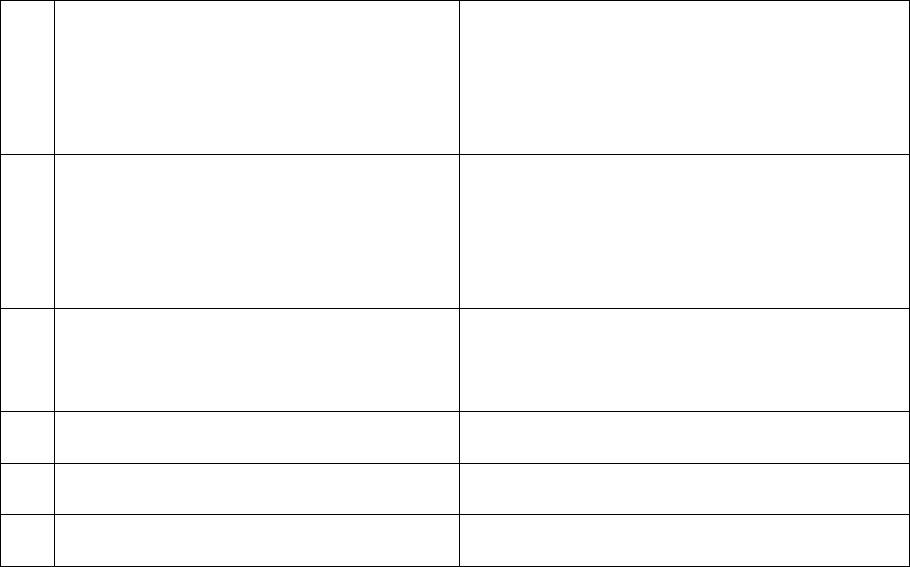

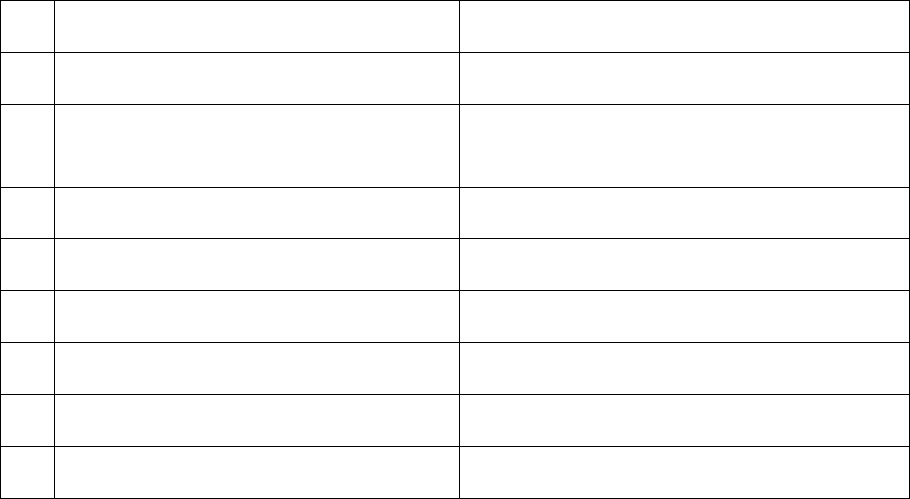

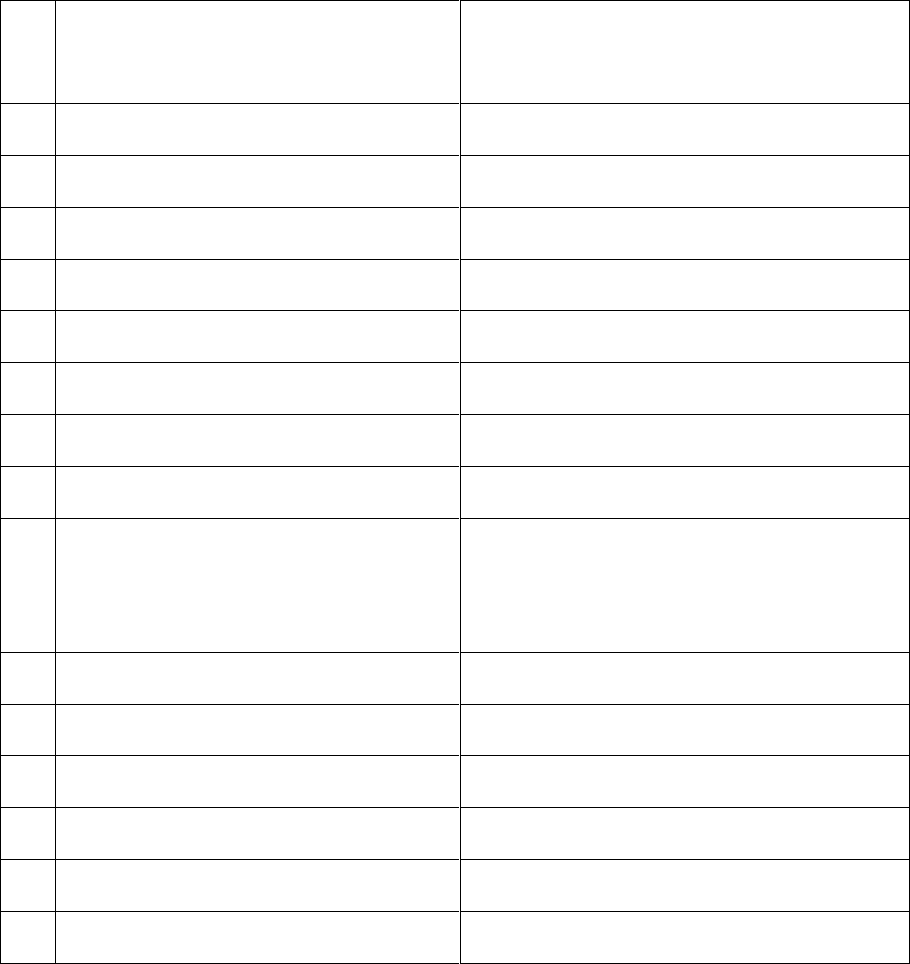

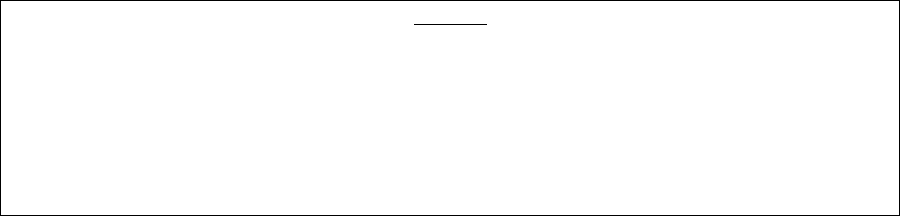

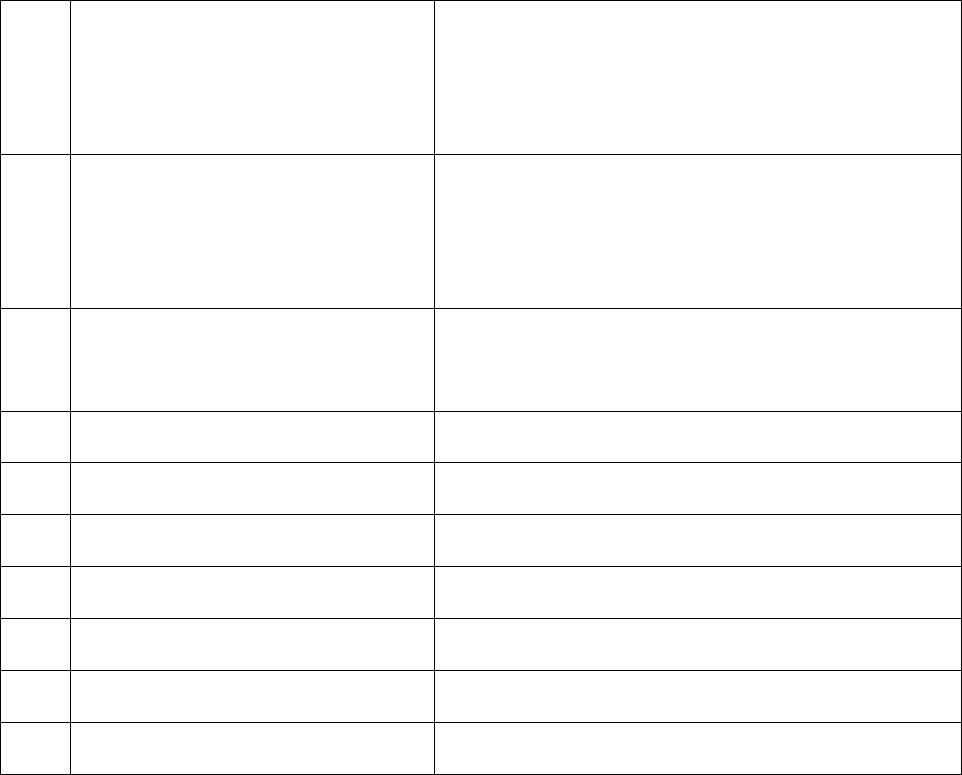

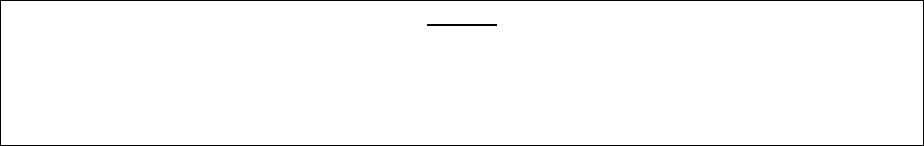

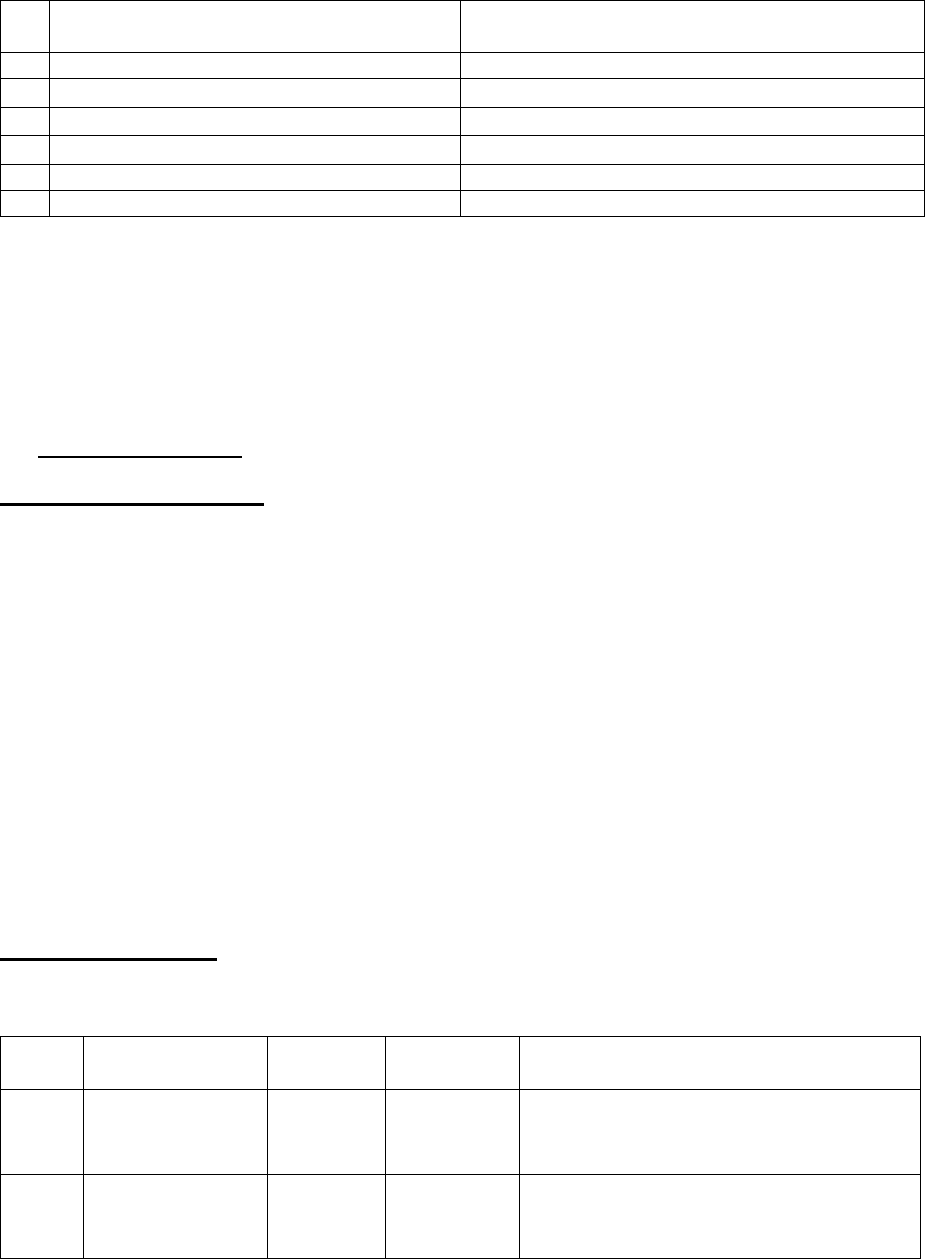

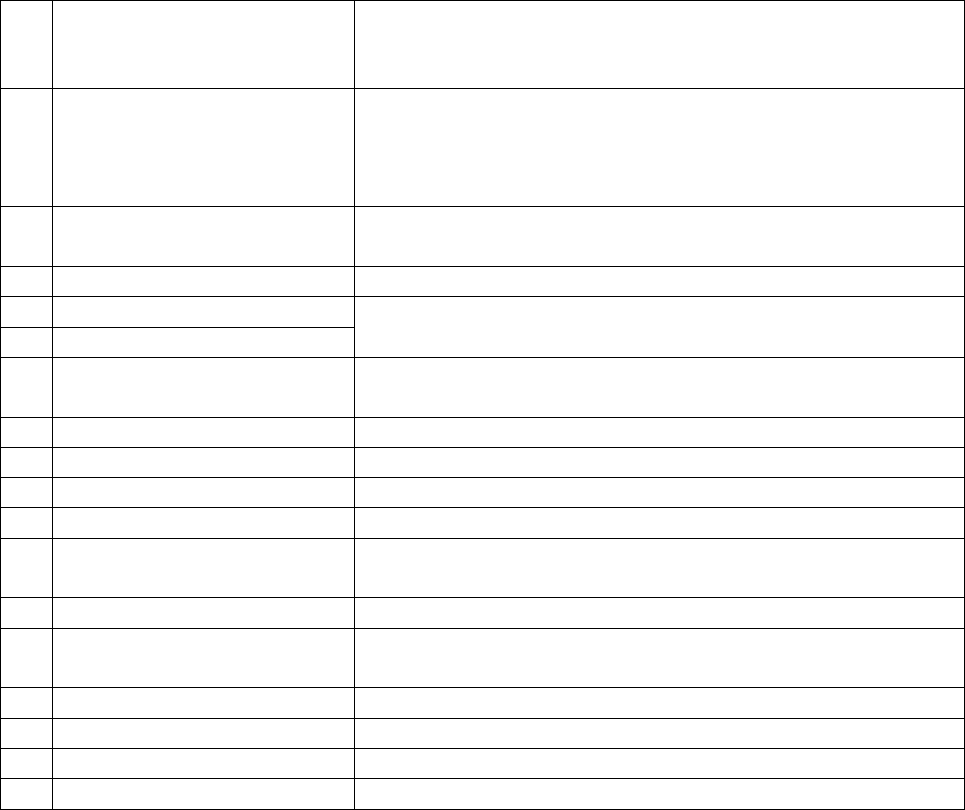

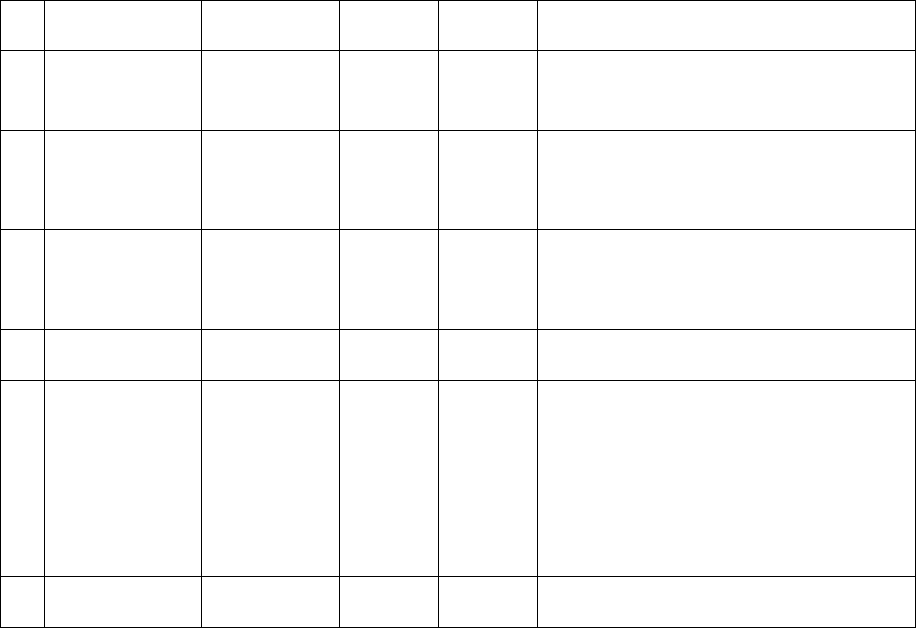

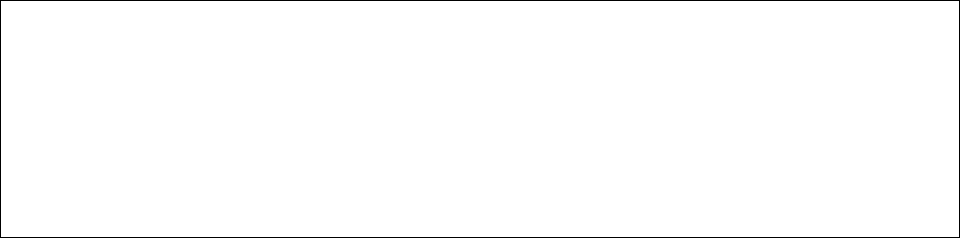

20. Brief Facts of the Case:

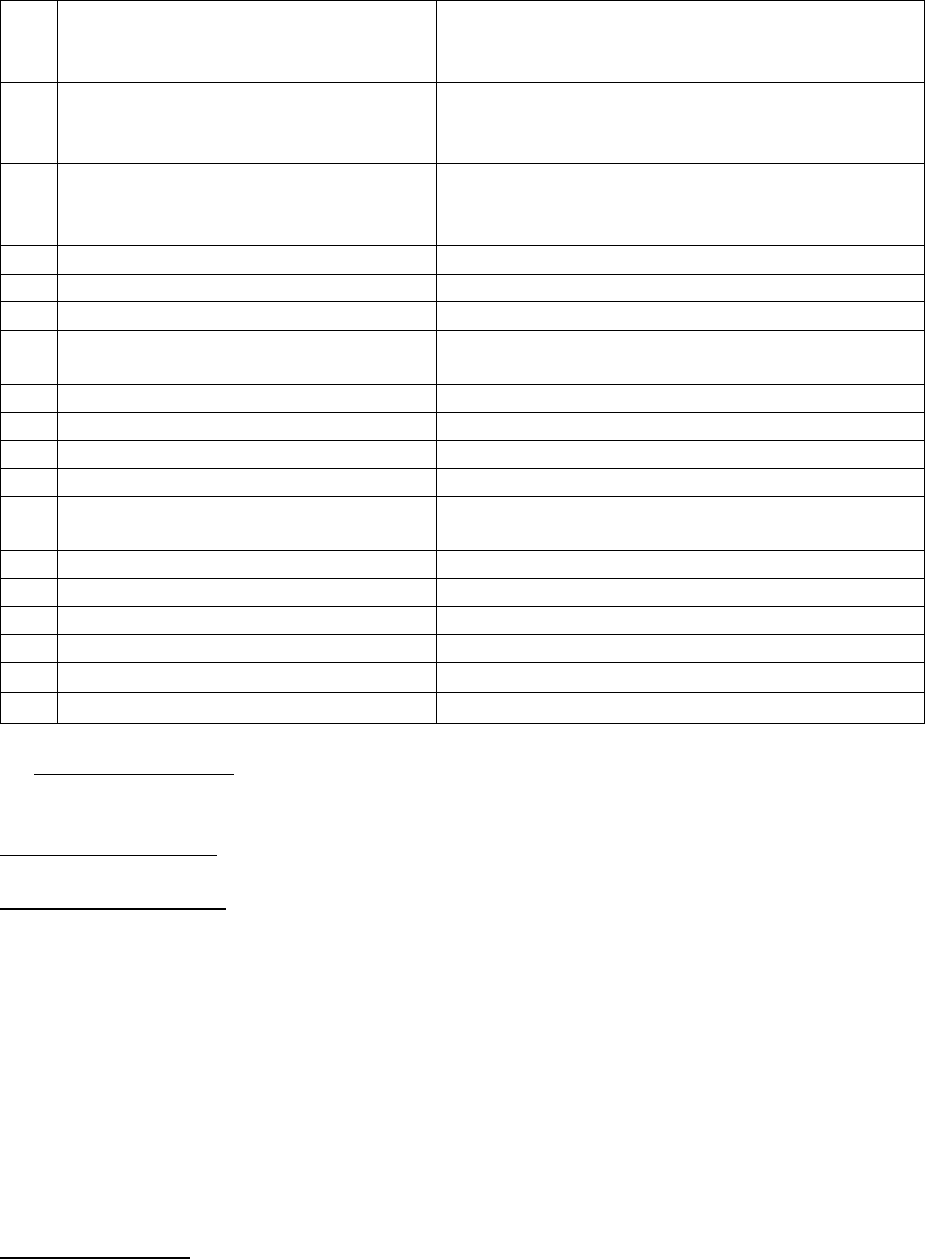

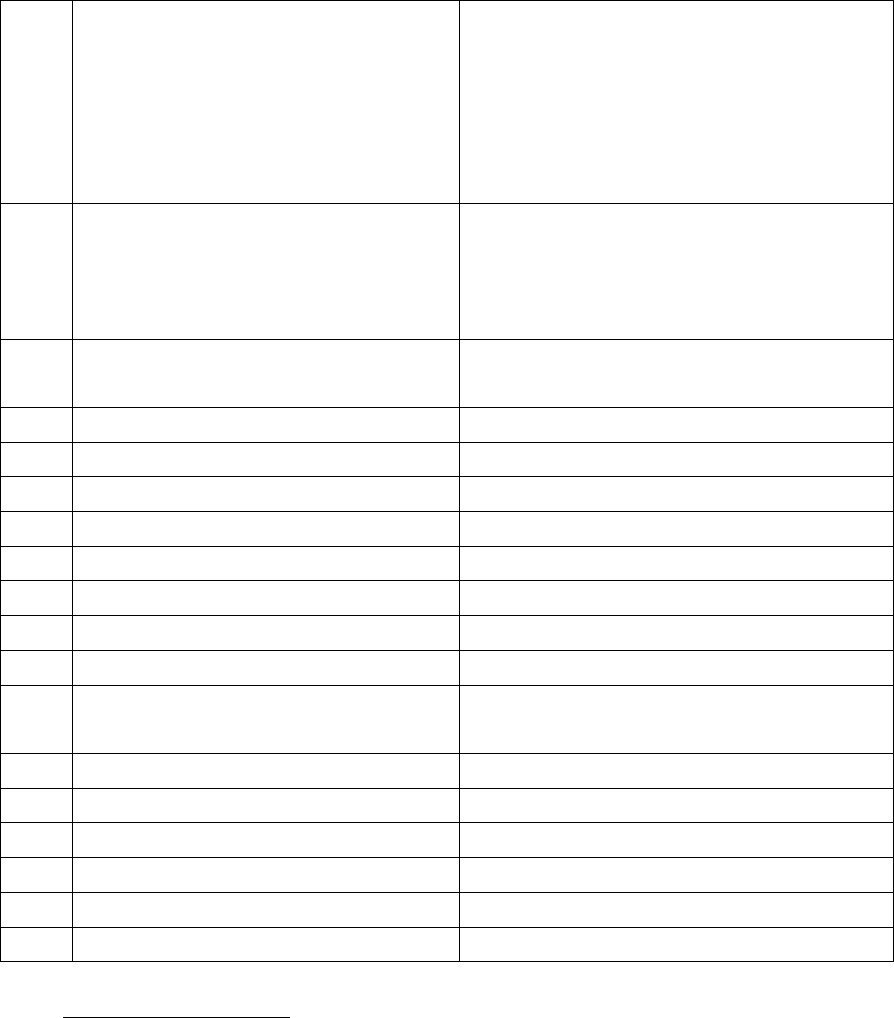

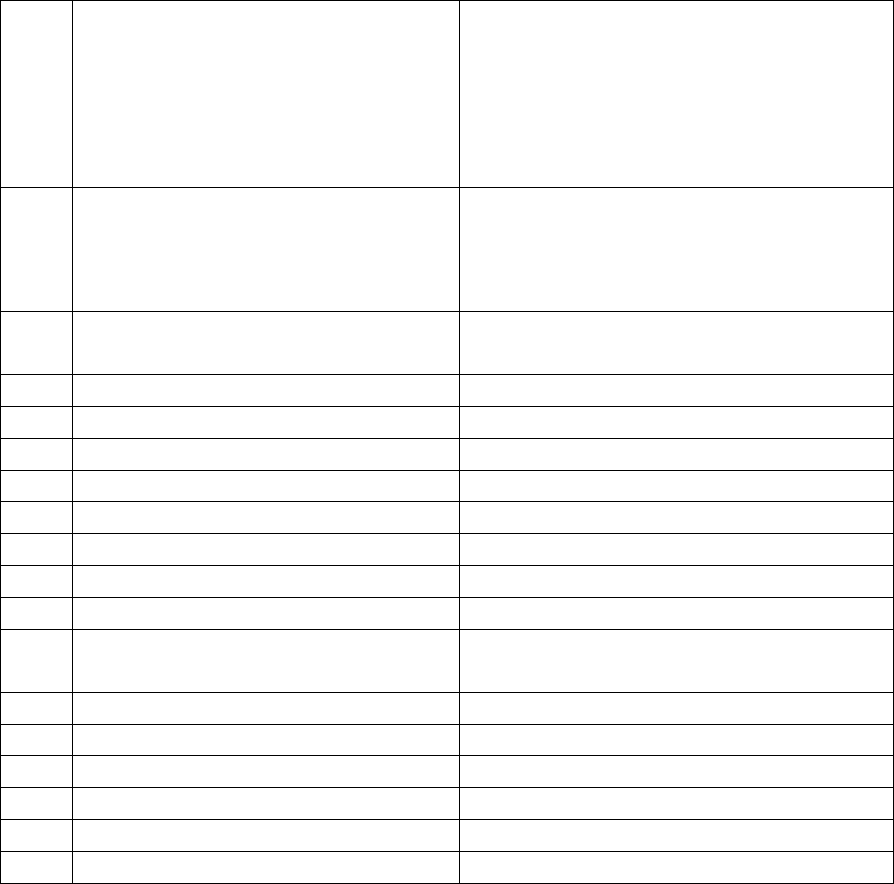

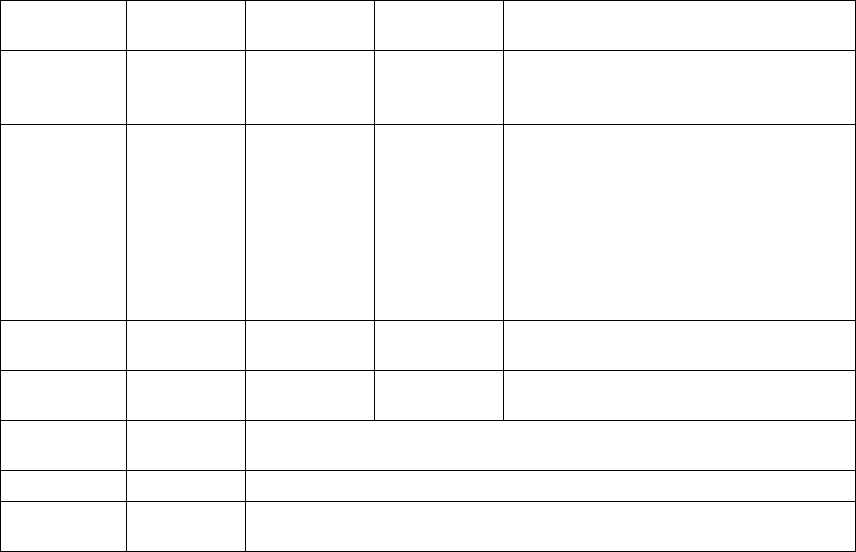

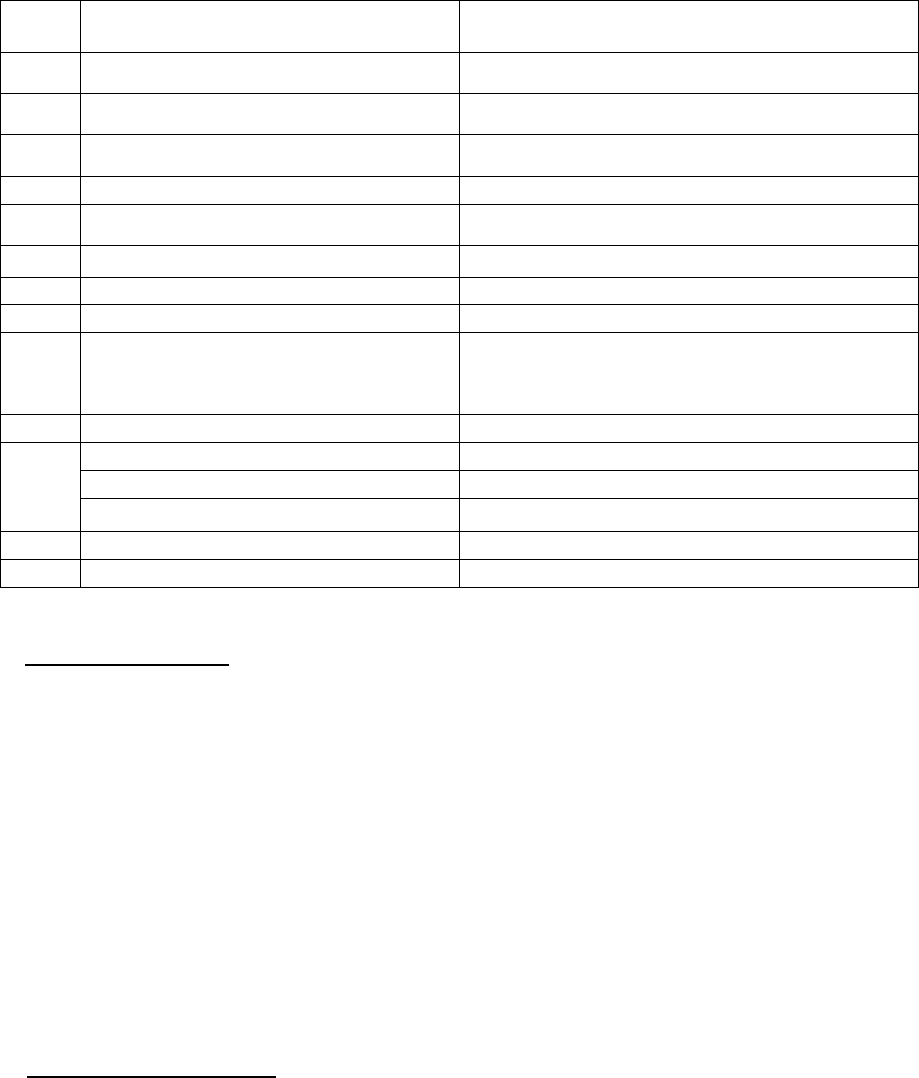

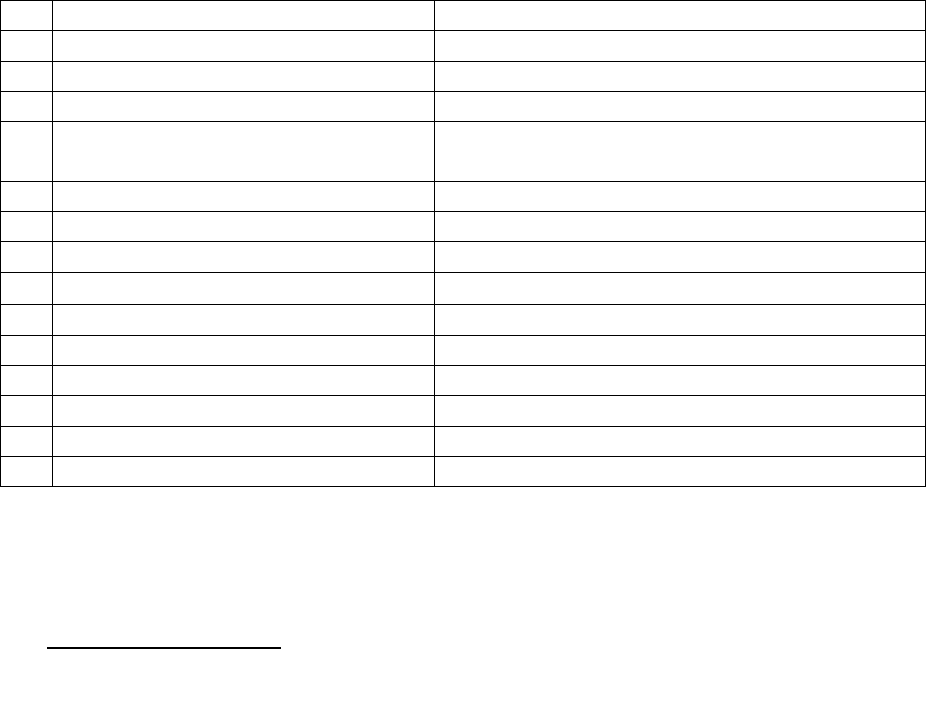

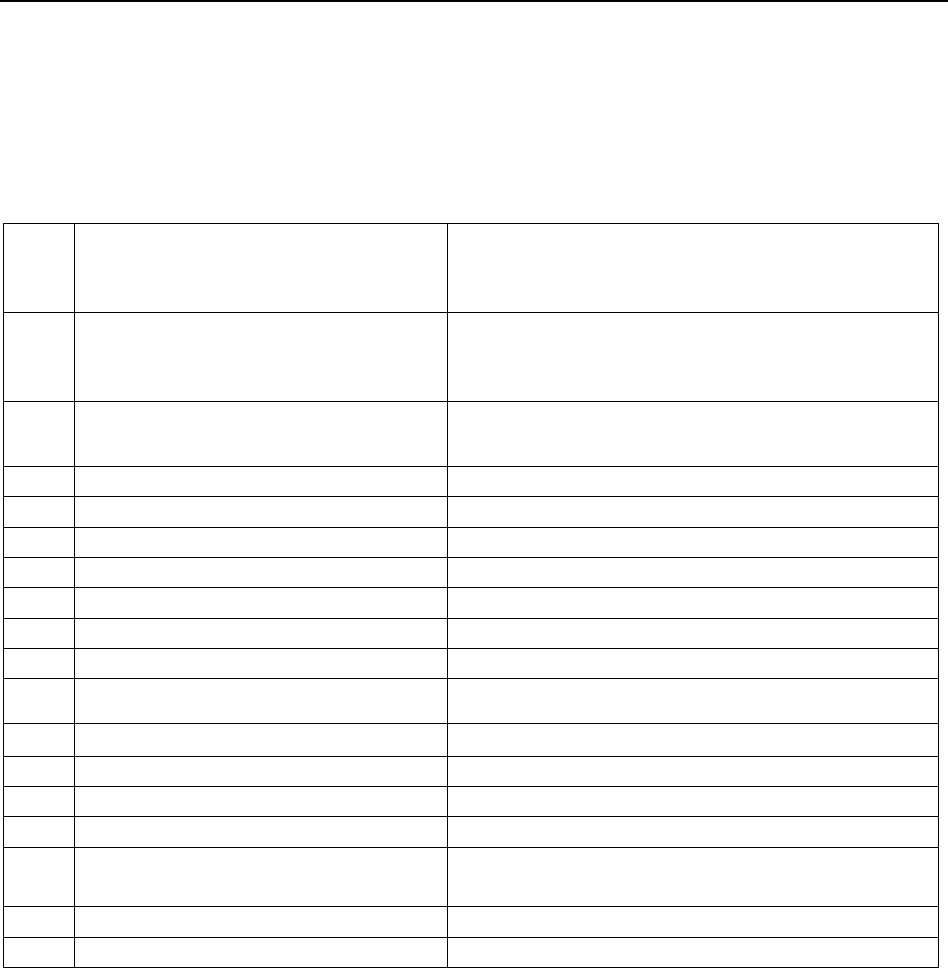

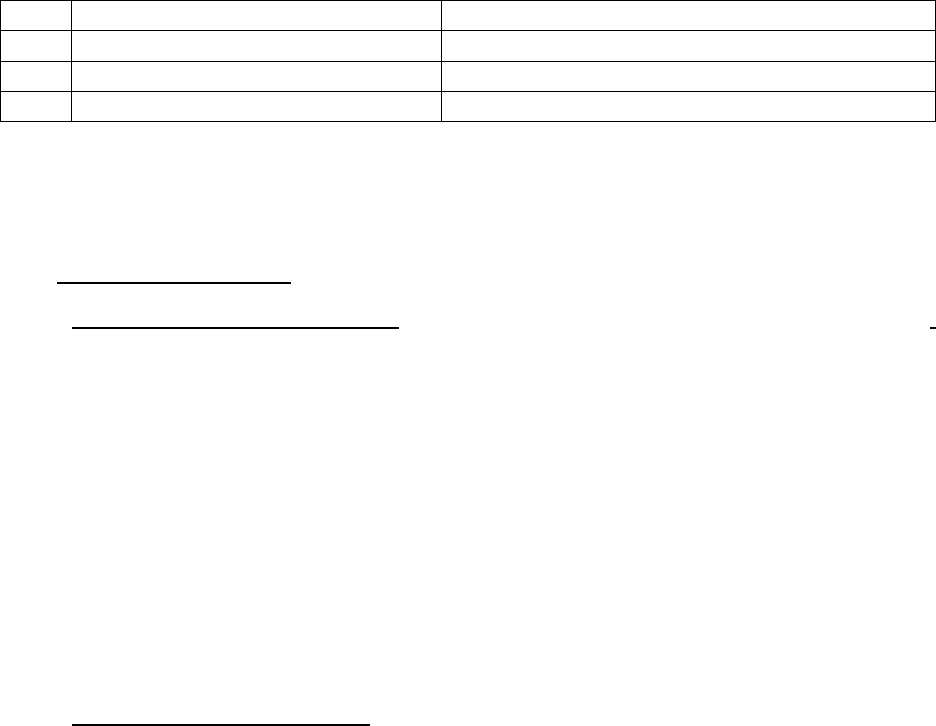

1.

Name & Address of the Complainant

MR. G. Virabadran

2/606, Nakeeran Street, Mogappair East,

Chennai 600 037

2.

Policy No.

Type of Policy

Duration of Policy/Policy Period

Floater Sum Insured (SI)

251100502010000403

Tailor made Group Mediclaim policy

01/11/2020 to 31/10/2021

3.

Name of the Insured &

Name of the Policyholder/Proposer

Mr. G. Virabadran

4.

Name of the Insurer

M/s. National Insurance Company Ltd

5.

Date of Short Settlement

July 2021

6.

Reason for Short Settlement

on various heads

7.

Date of receipt of the Complaint

15/12/2021

8.

Nature of Complaint

Short settlement

9.

Date of receipt of Consent (Annexure VI A)

06/01/2022

10.

Amount of Claim

Rs. 2,19,830/-

11.

Amount paid by Insurer, if any

Rs. 1,57,966/-

12.

Amount of Monetary Loss (as per Annexure

VI A)

Rs. 60,000/-

13.

Amount of Relief sought (as per Annexure VI

A)

Rs. 60,000/-

14.a.

Date of request for Self -Contained Note

(SCN)

23/12/2021

14.b.

Date of receipt of SCN

Received by mail on 08/04/2022

15.

Complaint registered under

Rule 13(1)(b) of the Insurance Ombudsman

Rules, 2017

16.

Date of Hearing/Place

VC HEARING ON 13/04/2022

17.

Representation at the Hearing

a) For the Complainant

Mr. G Virabadran

b) For the Insurer

Mr. Ranjan Bhatiya

18.

Complaint how disposed

By award

19.

Date of Award/Order

29/04/2022

Complainant Mr. G Virabadran is a member of Tailormade Group Mediclaim policy

issued by M/s. National Insurance Company Limited Covering Retirees of Bank of Baroda

vide policy bearing number 251100502010000403 for a period of one year effective from

01/11/2020 to 31/10/2021. Insured was admitted in Sai Speed Medical Center Pvt

Limited, Chennai on 22/04/2021 for the treatment of Covid 19 and discharged on

29/04/2021. Complainant submitted reimbursement claim for an amount of Rs. 2,19,830/-

for the expenses incurred for the treatment during the hospitalization. M/s. Medi Assist

TPA processed and approved the claim for an amount of Rs. 1,57,966/- and disallowed

Rs. 60,000/- under the head consultation / visit. Complainant not agreeing with the

settlement made by the Insurer approached the Forum seeking intervention for the

settlement of the balance claim amount.

21(a) Complainant’s submission:

Complainant Mr. G. Virabadran in his complaint stated that he was affected by Covid

19 in the month of April 2021 and was admitted in Sai Speed Medical Center on

22/04/2021 and discharged on 29/04/2021. Complainant further stated that he had

submitted reimbursement claim for an amount of Rs. 2,19,830/- and got settlement for

Rs. 1,57,966/- only. The processing TPA M/s. Medi Assist informed that Rs. 10,000/- per

day is the maximum allowed under the head consultation /visit, hence Rs. 60,000/- was

dis allowed. The settlement was not acceptable to the Complainant and mentioned that

as per policy terms he is entitled to claim the full amount. Aggrieved on the deduction

amount Complainant approached the Forum seeking balance un settled claim amount.

21(b) Insurer’s submission:

As per SCN of RI Company which states that Insured Mr. Virabadran was admitted in

Sai Speed Medical Center on 22

nd

April 2021 and discharged on 29

th

April 2021 for the

treatment of Covid 19 and submitted reimbursement claim for Rs. 2,19,830/-. The claim

was settled for Rs. 1,57,966/- Company processed the claim as per GIC metro charges

accordingly deducted Rs. 61,864/- which is in order.

22) Reason for Registration of Complaint: - Rule 13(1)(b) of the Insurance

Ombudsman Rules, 2017, which deals with “any partial or total repudiation of claims by

the life insurer, General insurer or the health insurer in the regulations, framed under the

Insurance Regulatory and Development Authority of India Act, 1999”

23) Results of hearing of both the parties (Observations and Conclusion):

# The complaint was heard through Video Conference on 13/04/2022 with the consent

of both the parties. The complainant and the Insurer were present for the hearing.

# During the hearing Complainant stated that the deductions made by the Insurer is not

correct and as per terms and conditions of the policy he is entitled to get more.

# During the hearing Insurer reiterated that the claim was processed as per terms and

conditions of the policy. Insured was hospitalized for 8 days and as per the bills submitted

Rs. 17,500/- per day was charged by the hospital which consisting room rent Rs. 5,000/-

, Duty Medical Officer Rs. 4,000/-, Nursing charges Rs. 3,500/- consultant pulmonary

specialist Charges Rs.3,000/- Oxygen consumption charges Rs,2,500/-, safety and

hygiene charges Rs. 1,500/-laundry Rs. 1,000/- Oxygen consumption charges

Rs.2,500/-. Company has considered Rs. 10,000/- per day against Rs. 17,500/-

# After hearing both sides and also going through the documents placed the Forum is

of the opinion that the disallowance of Rs. 2,500/- per day billed by the hospital towards

the Oxygen charges is not correct and directs the Insurer to pay Rs. 2,500/- * 8 days =

Rs. 20,000/- along with the interest.

23) Documents placed before the Forum for perusal:

✓ Written Complaint to the Ombudsman dated 15/12/2021

✓ Complainant’s representation to the insurer b mail dated 29/07/2021

✓ Insurer’s response to the Complainant – no response

✓ Consent (Annexure VI A) submitted by the Complainant – 06/01/2022

✓ Policy copy, terms and conditions

✓ Self-Contained Note of Insurer dated – not submitted

✓ Discharge Summary of Speed Hospitals.

24) .

25. The attention of the Insurer is hereby invited to the following provisions of the

Insurance Ombudsman Rules, 2017:

a) According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the

insurer shall comply with the award within thirty days of the receipt of the

award and intimate compliance of the same to the Ombudsman

b) According to Rule 17(7) of the Insurance Ombudsman Rules, 2017, the

complainant shall be entitled to such interest at a rate per annum as specified

in the regulations, framed under the Insurance Regulatory and Development

Authority of India Act, 1999, from the date the claim ought to have been settled

under the regulations, till the date of payment of the amount awarded by the

Ombudsman.

c) According to Rule 17(8) of the Insurance Ombudsman Rules, 2017, the award

of Insurance Ombudsman shall be binding on the insurers.

Dated at Chennai on this 29

th

day of April 2022.

Sd/-

(Segar Sampathkumar)

INSURANCE OMBUDSMAN

FOR THE STATE OF TAMIL NADU AND PUDUCHERRY

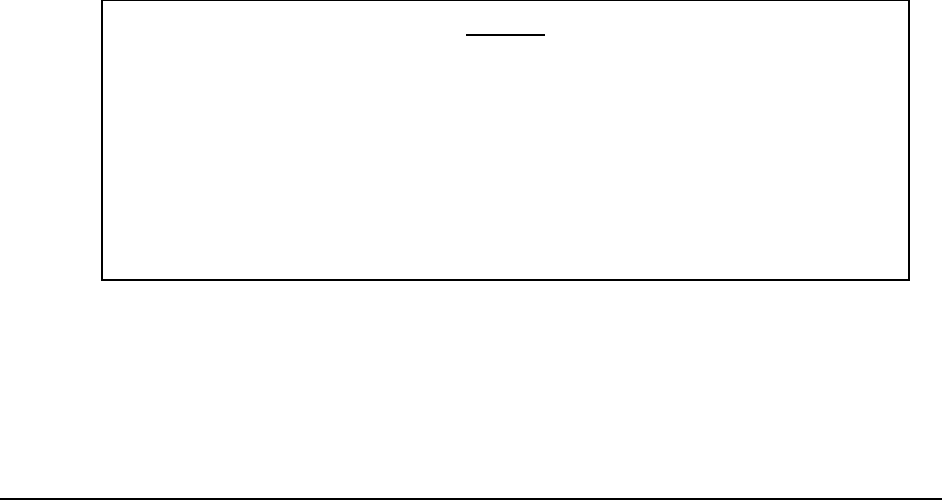

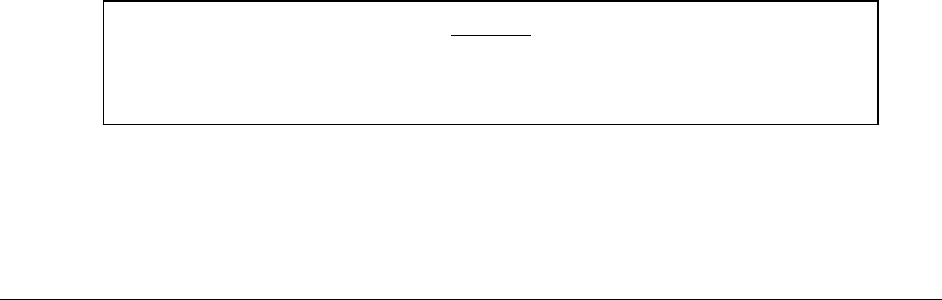

AWARD

Taking into account the facts & circumstances of the case and the submissions

made by both the parties during the course of hearing, the Forum hereby

directs the Insurer to pay Rs. 20,000/- in addition to the already settled amount

as per terms and conditions of the Policy along with interest at applicable rates

as provided under Rule 17(7) of the Insurance Ombudsman Rules, 2017.

Thus, the complaint is PARTLY ALLOWED.

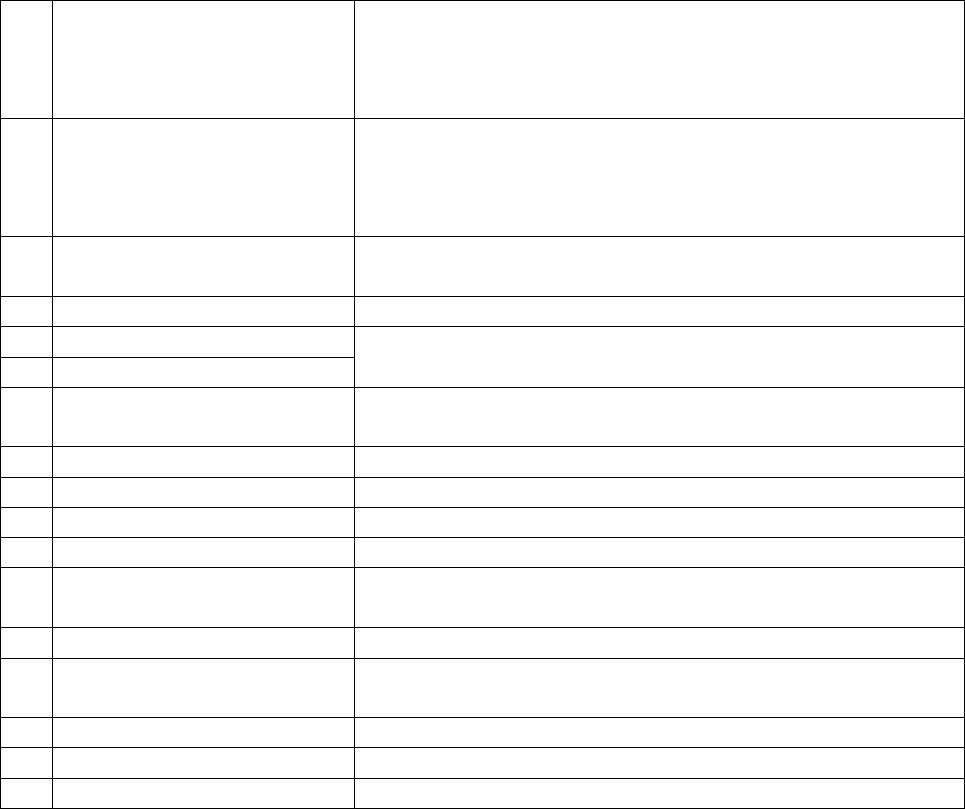

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF TAMIL NADU & PUDUCHERRY

(UNDER RULE NO: 16/17 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – Shri Segar Sampathkumar

CASE OF Mr. S. Sankaranarayanan Vs HDFC ERGO Genl. Insurance Co. Limited

COMPLAINT REF: NO: CHN-H-018-2122-1065

Award No: IO/CHN/A/HI/0002/2022-2023

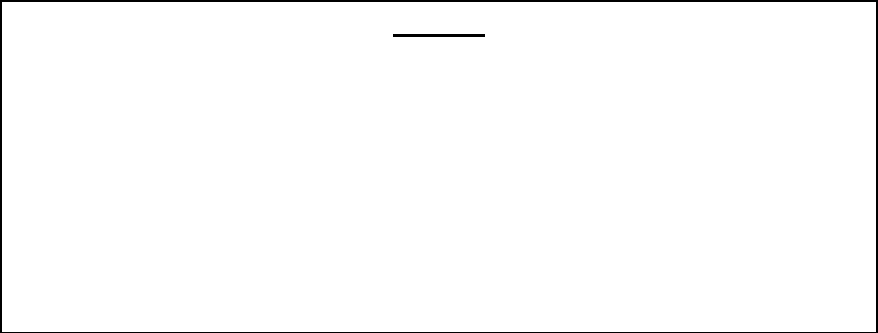

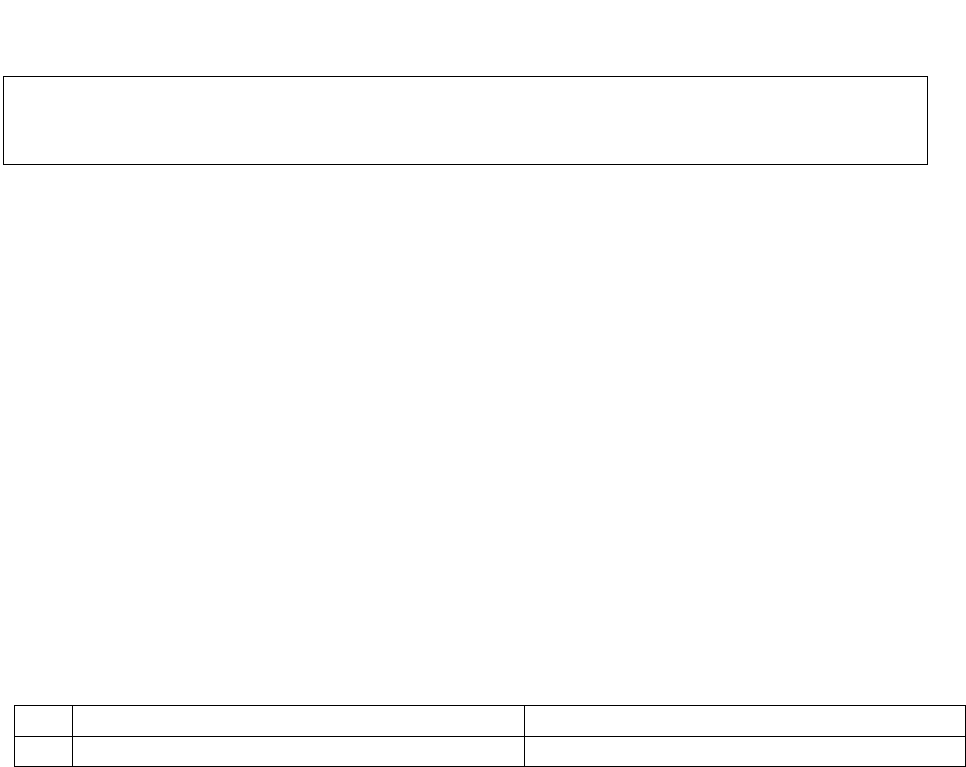

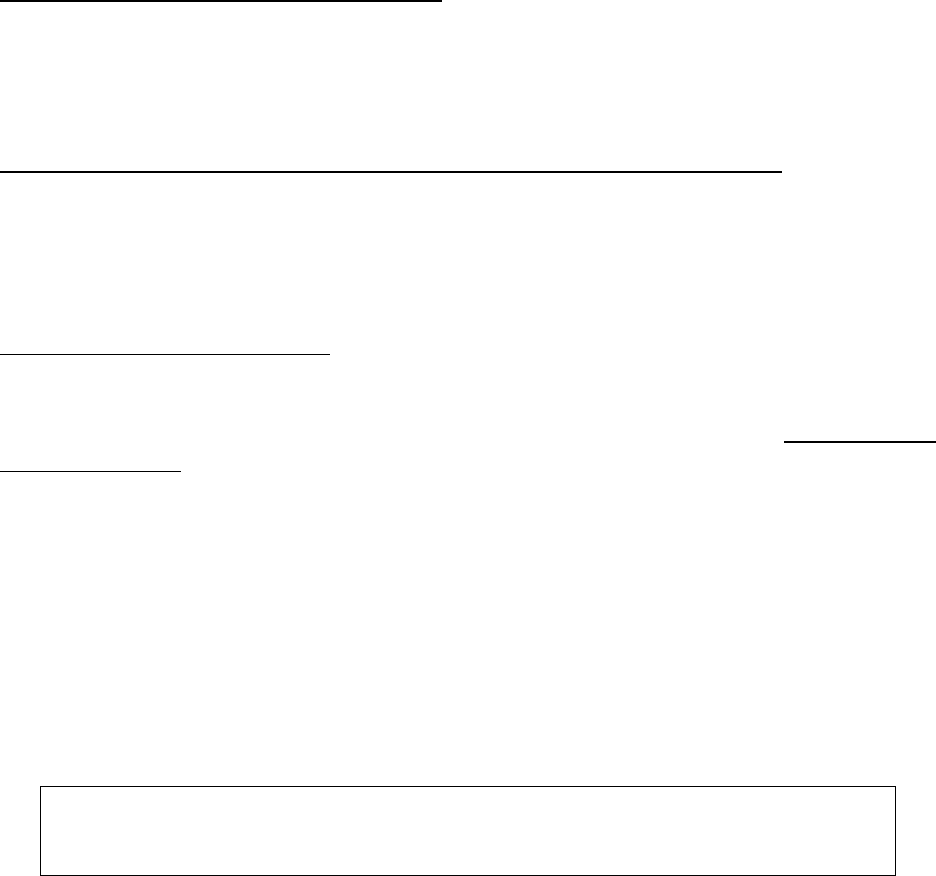

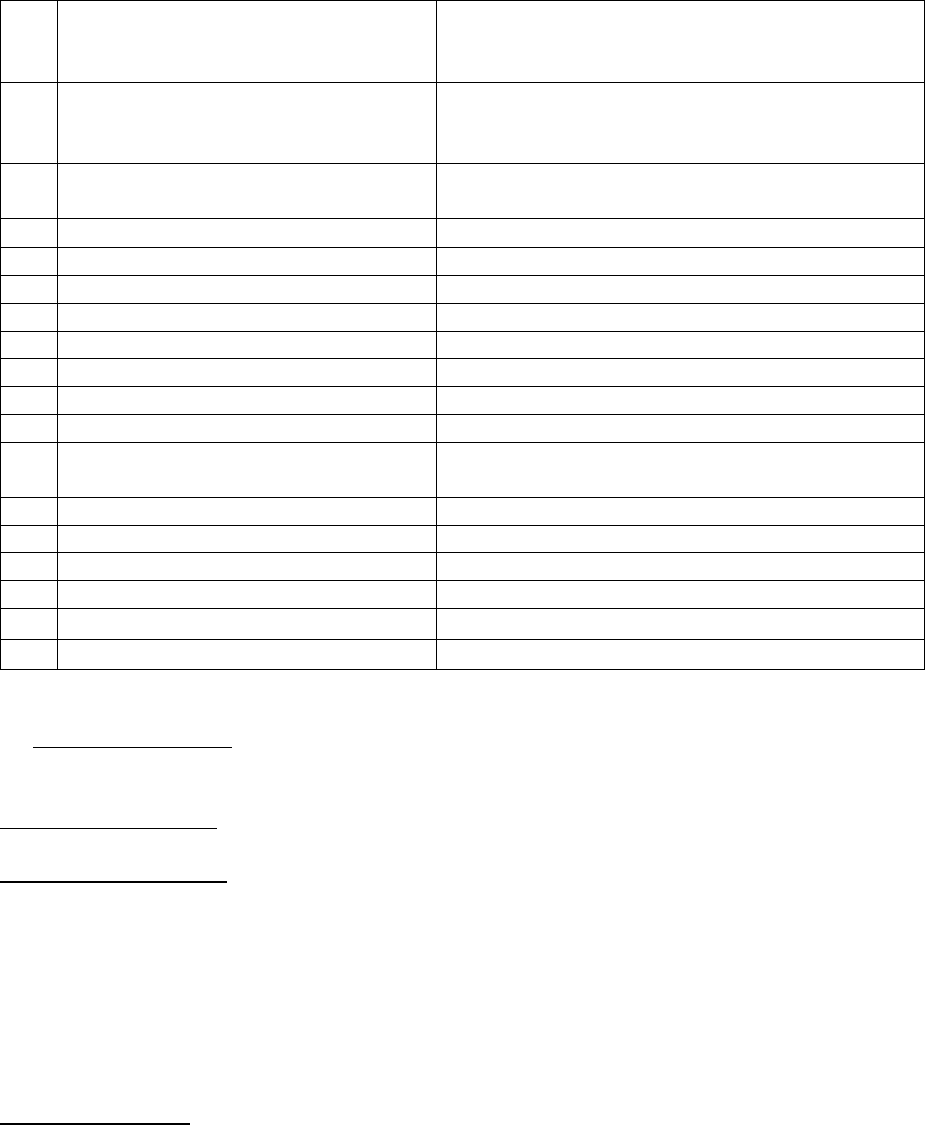

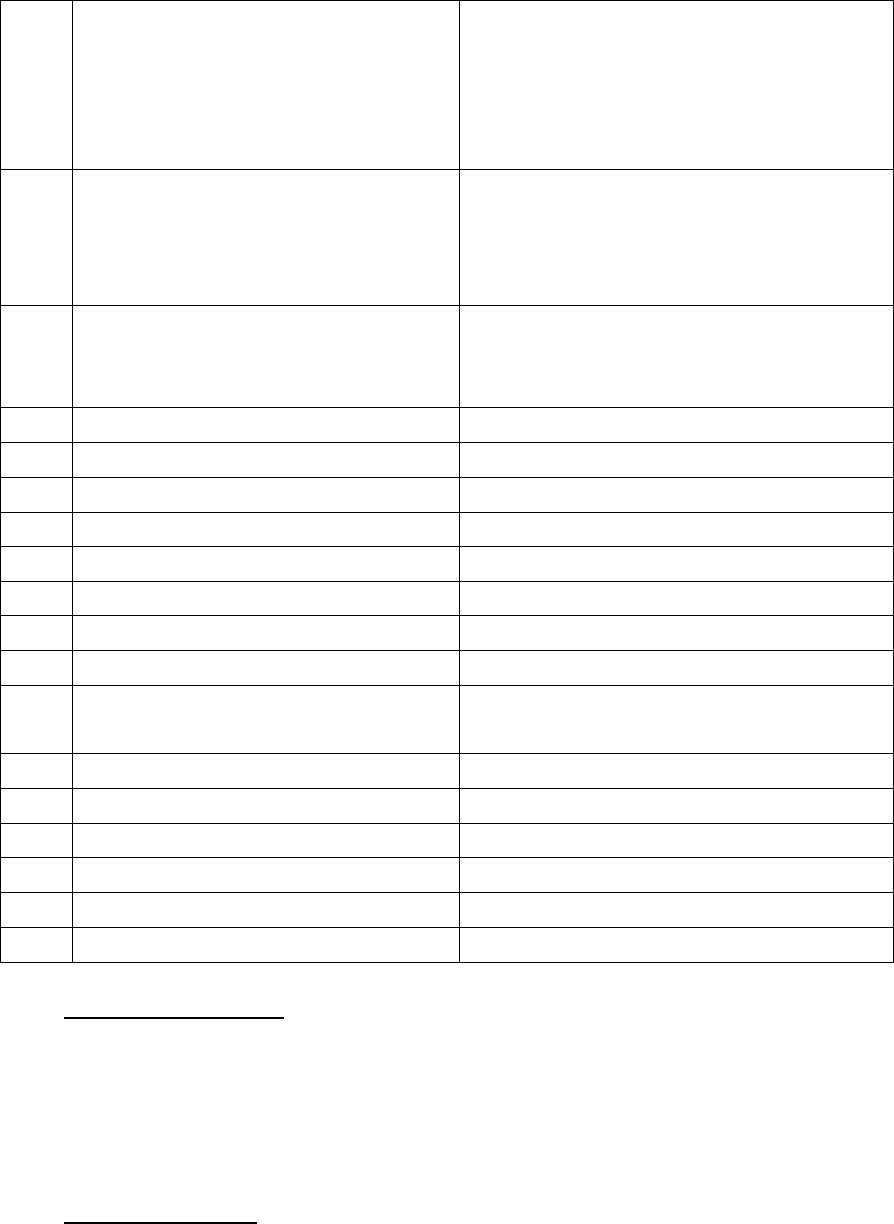

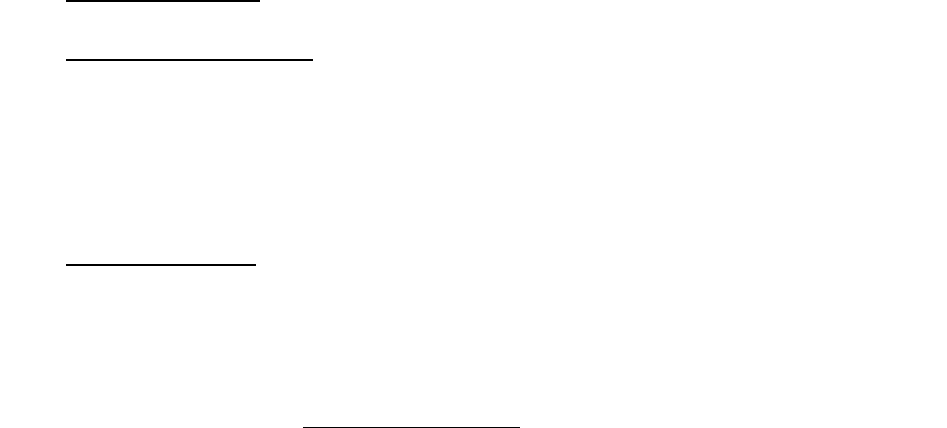

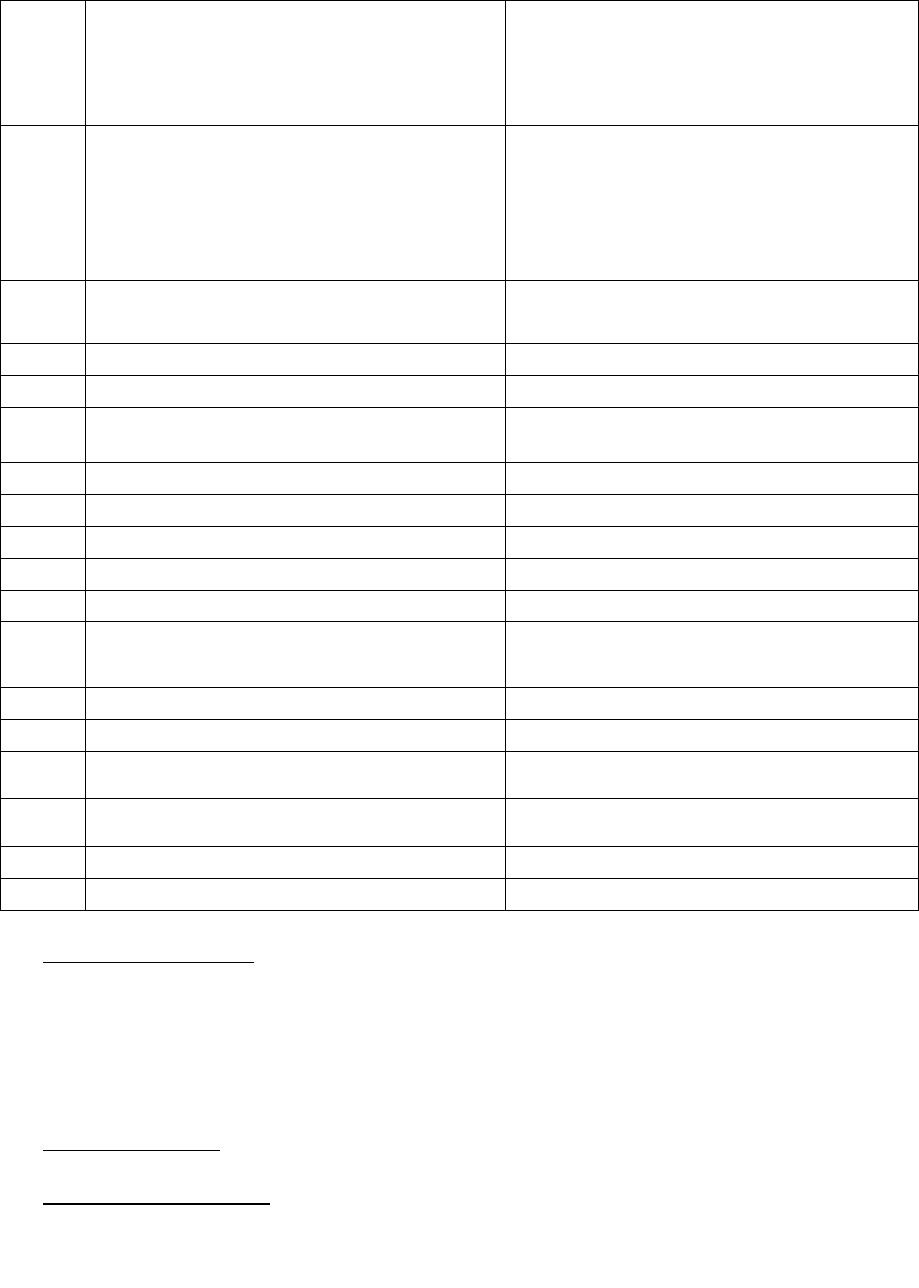

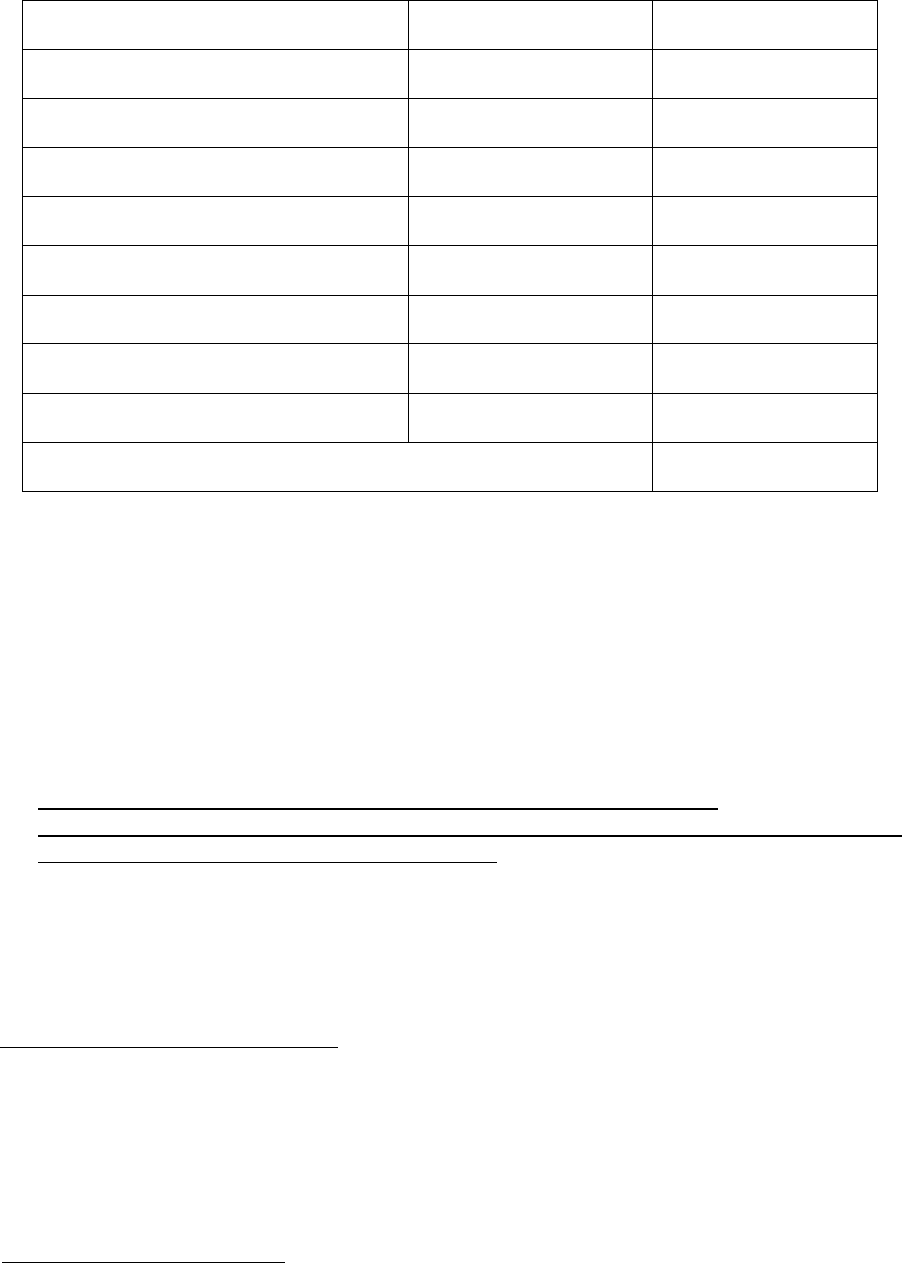

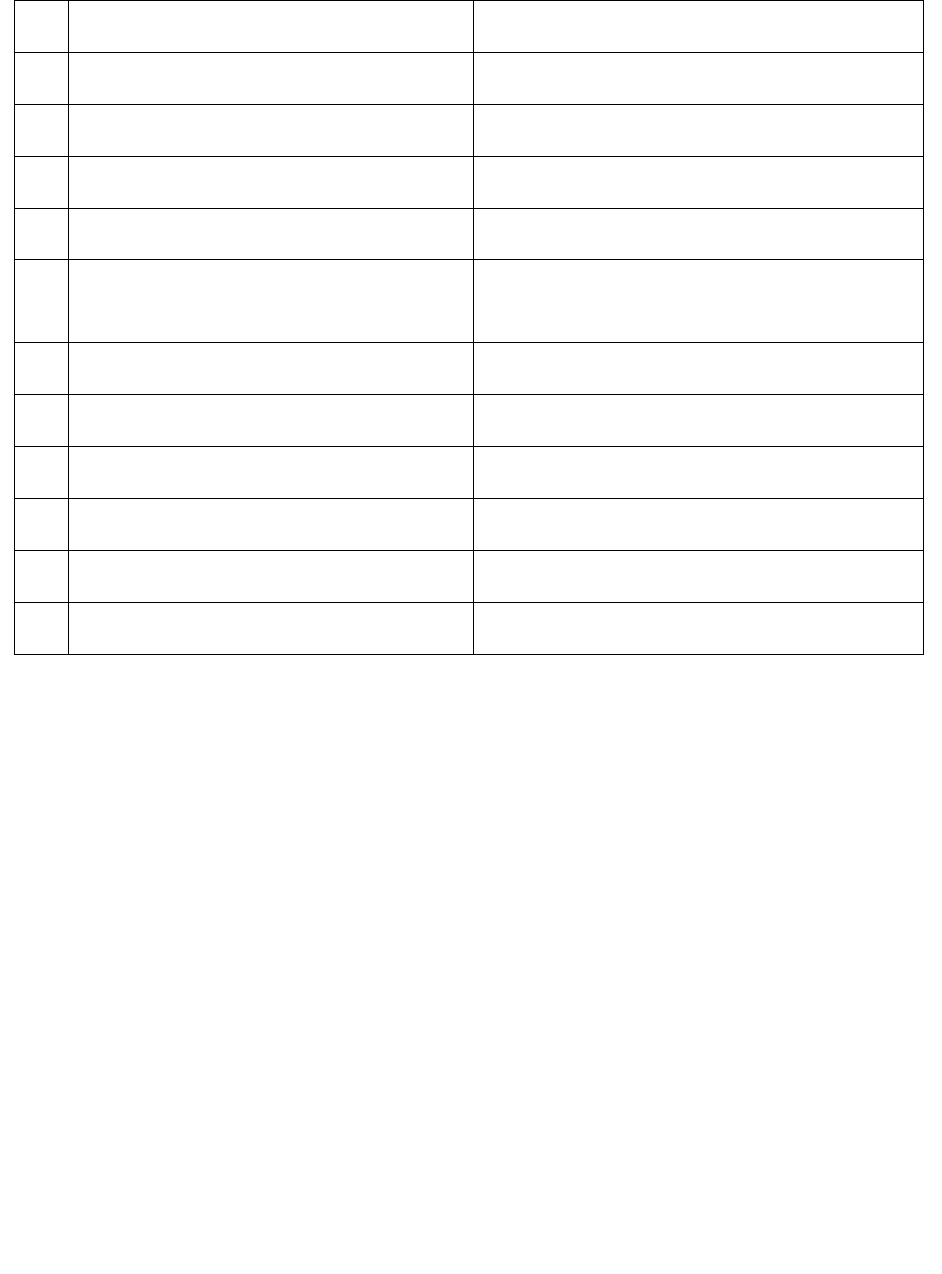

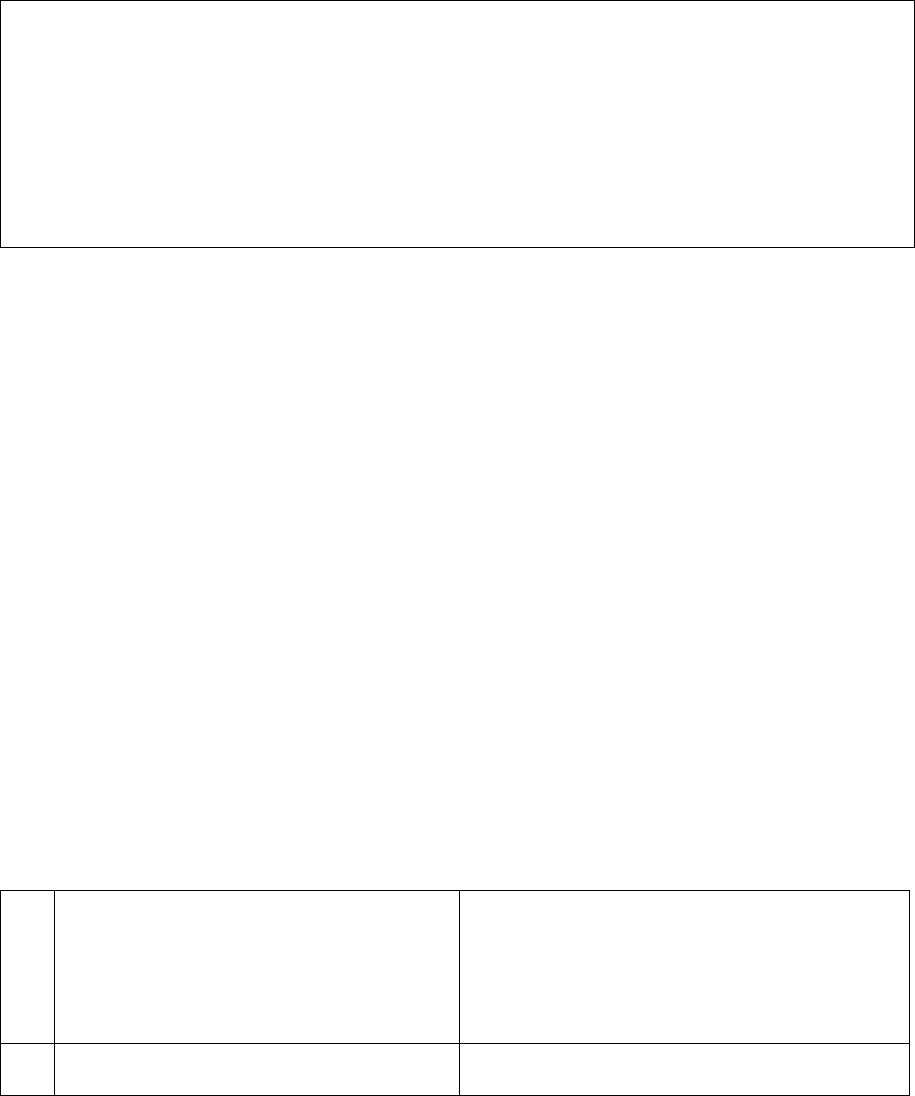

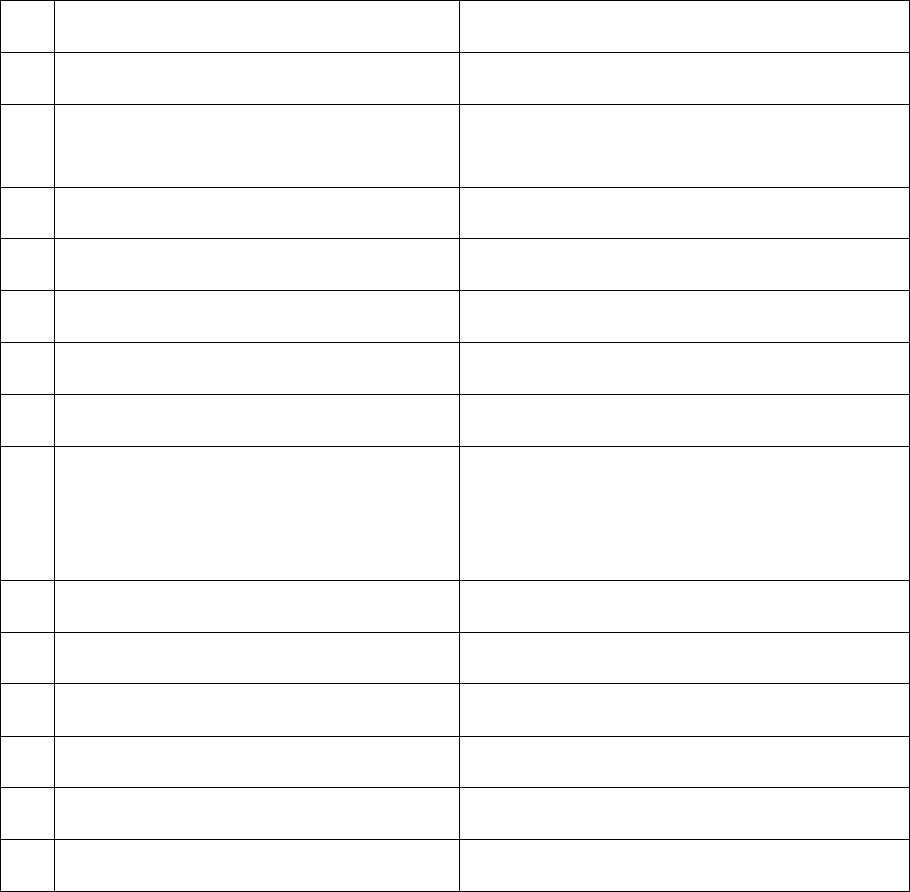

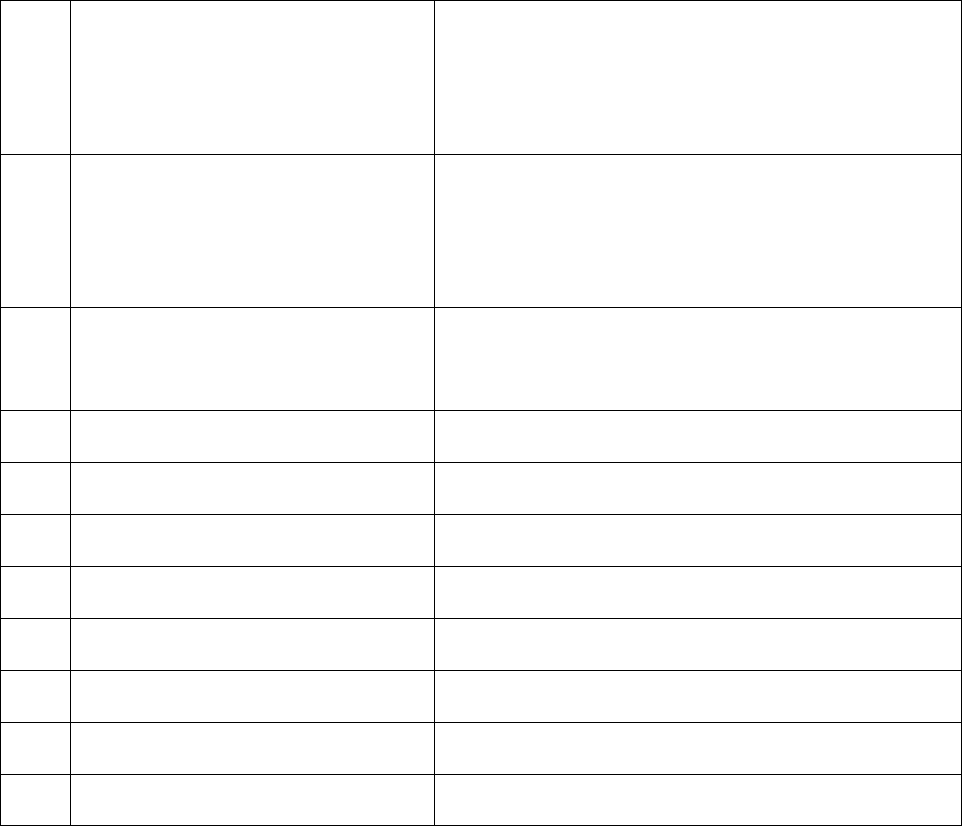

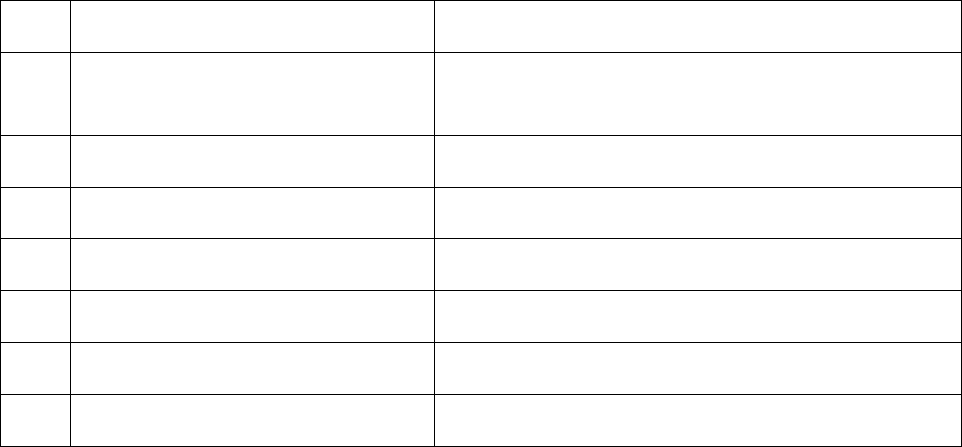

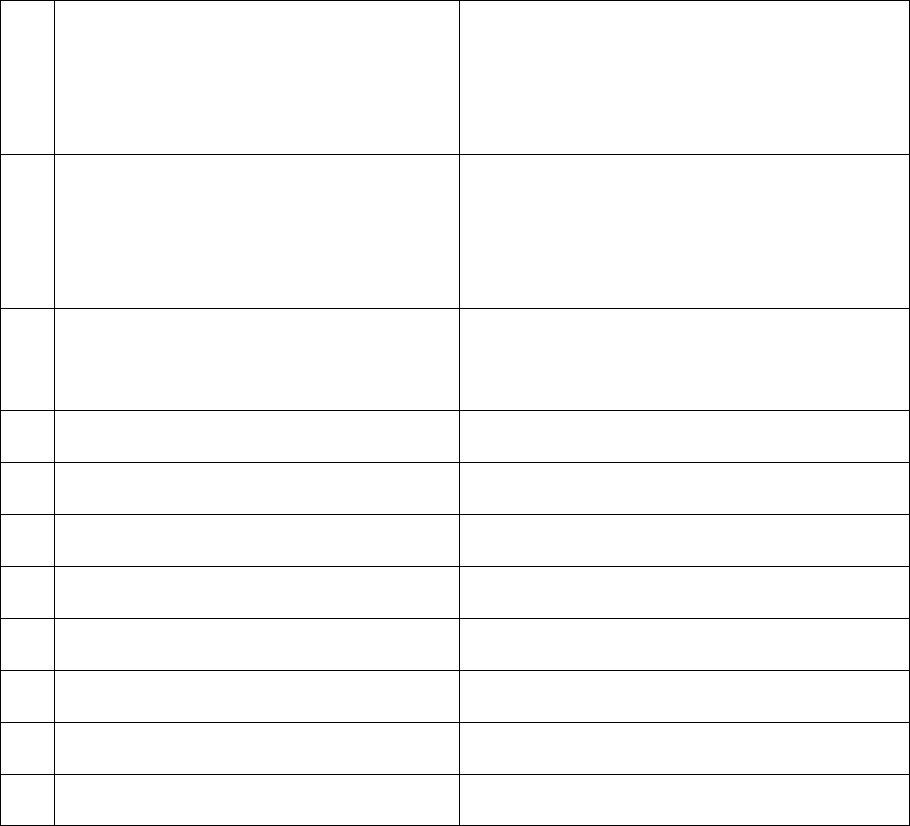

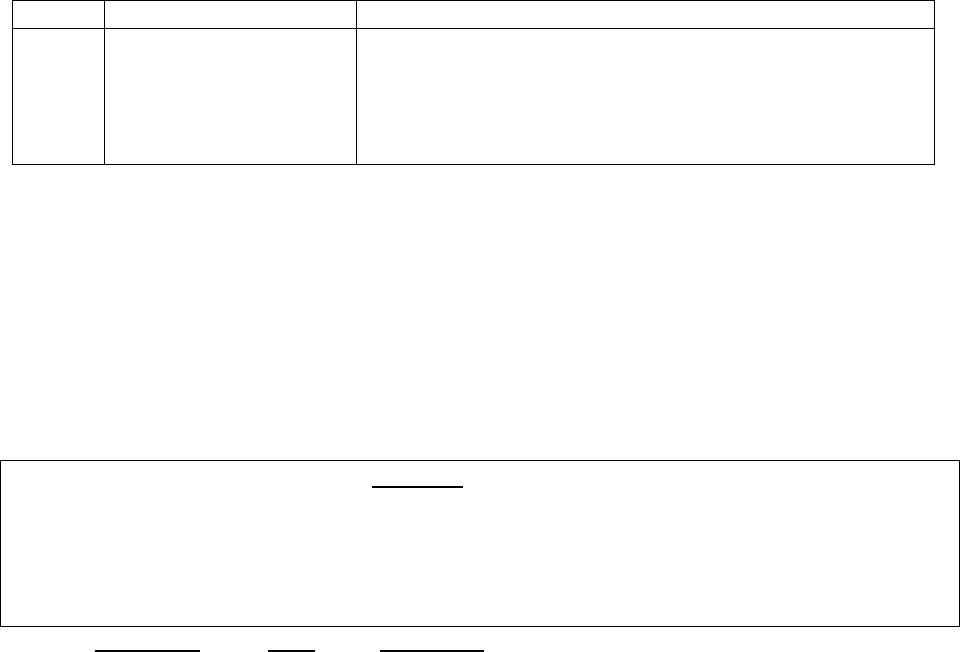

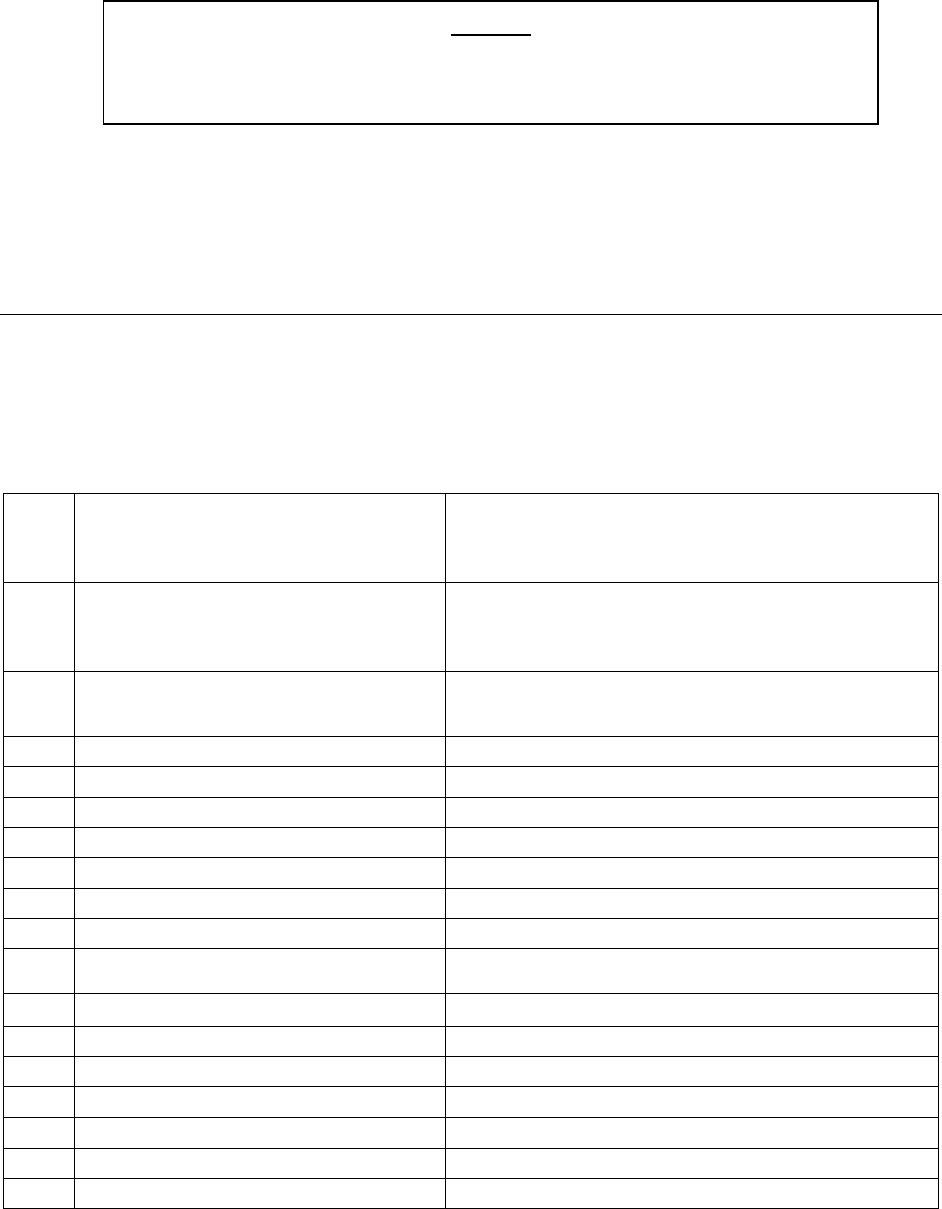

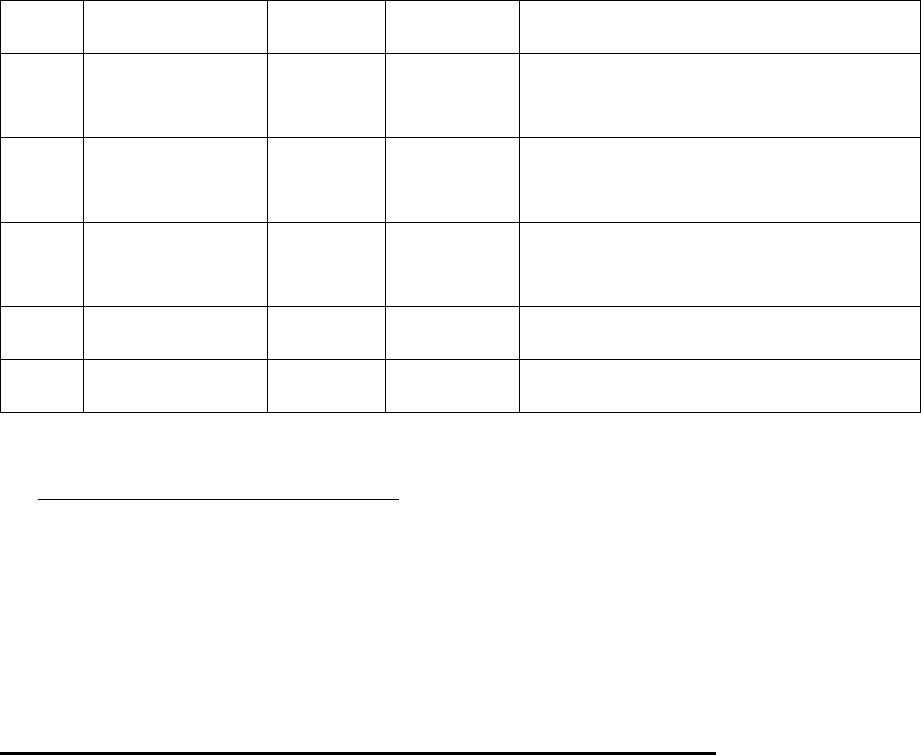

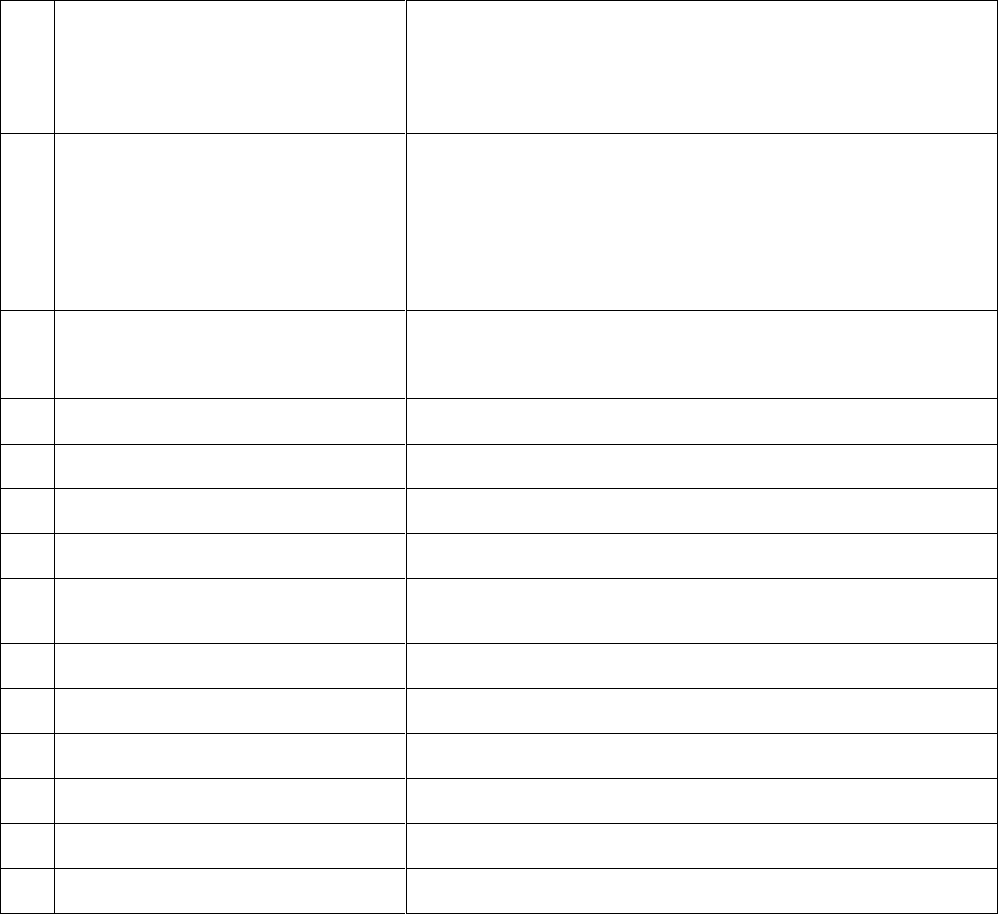

1.

Name & Address of the Complainant

Mr. S. Sankaranarayanan,

2/235-2, Poongavanam Street,

Gomathipuram, MADURAI - 625020

2.

Policy No.

Type of Policy

Duration of Policy/Policy Period

Sum Insured (SI)

2812203779411500001

Easy Health Group Insurance

31/07/2020 to 31/07/2021

Rs.5,00,000/-

3.

Name of the Insured

Name of the Policyholder/Proposer

Mr. Sankaranarayanan.S & Mrs.S. Saradha

Mr. Sankaranarayanan.S

4.

Name of the Insurer

HDFC Ergo General Insurance Co. Ltd.,

5.

Date of Repudiation / Short Settlement

Short settlement of claim – Diet Expenses &

Infection control charges

6.

Reason for repudiation/ Short settlement

Settled as per Terms and conditions of the Policy

7.

Date of receipt of the Complaint

23/11/2021

8.

Nature of Complaint

Short settlement of Covid Claim-Diet Expenses &

Infection control charges

9.

Date of receipt of Consent (Annexure VI

A)

7/4/2022

10.

Amount of Claim

₹ 450943/- (Mr. Sankaranarayana & Mrs. S.

Saradha)

11.

Amount paid by Insurer, if any

₹ 410466/-

12.

Amount of Monetary Loss (as per

Annexure VI A)

₹ 35000/- (Rs.17,500/- each)

(13.

Amount of Relief sought (as per Annexure

VI A)

₹ 35000/-

14. a.

Date of request for Self Contained Note

(SCN)

20/1/22

14. b.

Date of receipt of SCN

5/4/22

15.

Complaint registered under

Rule No. 13(1) b of the Insurance Ombudsman

Rules, 2017

16.

Date of Hearing/Place

By Video Conferencing (VC) on 12/4/22

17.

Representation at the hearing

a) For the Complainant

Mr. S. Sankaranarayanan

b) For the Insurer

Mr. Aneesh Bhaskaran/Mr. S. Desai

18.

Disposal of Complaint

By Award

19.

Date of Award/Order

13/4/2022

20. Brief Facts of the Case:

The complainant states that he and his wife were hospitalised for Covid 19 in April 2021.

He submitted the claims to the insurer and the insurer also settled partially without

considering the dietary expenses of Rs.10,500/- each and infection control charges of

Rs.7,000/- each totalling to Rs.35,000/- was not considered for settlement.

The insurer has replied that they relooked into the claims of the above claimant and both

are fall under non-payable items and thus not-admissible.

21 (a) Complainant’s Submission:

The complainant states that the insurer has not settled the Dietary expenses and infection

control charges of himself and his spouse who were hospitalised in April 21 which

amounts to Rs.35,000/-. Hence he approached the Forum for its intervention and advise

the insurer to settle this amount.

21 (b) Insurer’s Submission: The Insurer in their Self Contained Note has stated that

they have deducted the following heads only from their Claim.

a) MRD Charges (b) Dietary Charges (c) Infection Control Charges (d) Pharmacy Bills

(Bills not legible). In the instant case they relooked into the claim and found that the food

charges and Infection Control charges respectively fall under non-payable items and thus

not admissible.

2. Reason for Registration of Complaint:- Rule No.13(1) (b) of the Insurance

Ombudsman Rules, 2017, which reads as “Any partial or total repudiation of claims by

the Life Insurer, General Insurer or the Health Insurer”.

23. Documents placed before the Forum for perusal.

✓ Complaint letter dated 23/11/21 to the Insurance Ombudsman

✓ Consent (Annexure VI A) submitted by the Complainant dt.7/4/22

✓ Policy copy, terms and conditions

✓ Self Contained Note of the Insurer

24. Result of hearing with both parties (Observations & Conclusion)

➢ The Complainant and the insurer’s representative participated in the hearing and

consented for Video Conferencing.

➢ The Complainant has stated that he and his wife’s covid claim, the insurer has not

settled the dietary expenses of Rs.10,500/- each and Rs.7,000/- towards infection

control charges charged by the hospital amounting to Rs.35,000/- totally for both.

➢ The insurer has informed the Forum that they agree to settle the dietary expenses

incurred during hospitalisation of covid in respect of the complainant and his wife

for Rs.10,500/- each and Rs.7,000/- towards infection control charges does not fall

under their Policy condition.

➢ The Forum has appreciated the spontaneous act of the insurer and advised them

to settle the dietary expenses of both for Rs.10,500/- each and asked the

complainant to furnish necessary details to the insurer to make the payment.

AWARD

The insurer is directed to settle the diet expenses of Rs.10,500/- charged by the

hospital to the Complainant and his wife.

Thus the Complaint is Partly Allowed.

The attention of the Insurer is hereby invited to the following provisions of the Insurance

Ombudsman Rules, 2017:

a) According to Rule 17(6) of the Insurance Ombudsman Rules, 2017, the insurer

shall comply with the award within thirty days of the receipt of the award and

intimate compliance of the same to the Ombudsman.

b) According to Rule 17(7) of the Insurance Ombudsman Rules, 2017, the

complainant shall be entitled to such interest at a rate per annum as specified in

the regulations, framed under the Insurance Regulatory and Development Authority

of India Act, 1999, from the date the claim ought to have been settled under the

regulations, till the date of payment of the amount awarded by the Ombudsman. –

NOT APPLICABLE.

c) According to Rule 17(8) of the Insurance Ombudsman Rules, 2017, the award of

Insurance Ombudsman shall be binding on the insurers.

Dated at Chennai on this 13

th

day of April 2022.

Sd/-

(Segar Sampathkumar)

INSURANCE OMBUDSMAN

FOR THE STATE OF TAMIL NADU AND PUDUCHERRY

Proceedings of

THE INSURANCE OMBUDSMAN

KERALA, LAKSHADWEEP & MAHE

[Under Rule No.13 1(b) Read with Rule 14 of the Insurance Ombudsman Rules, 2017]

Present: Mr Girish Radhakrishnan

Insurance Ombudsman

Complaint No. KOC-H-048-2122-0797

Complainant : Mr. Babu P

Respondent Insurer : National Insurance Company Ltd.

AWARD

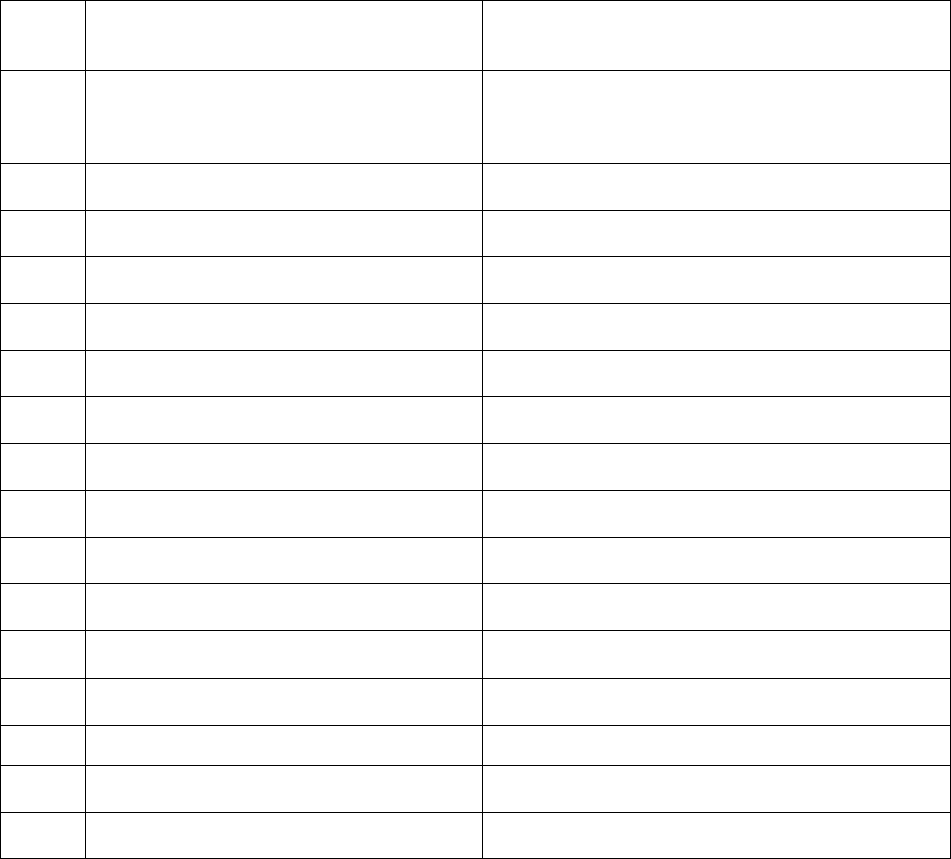

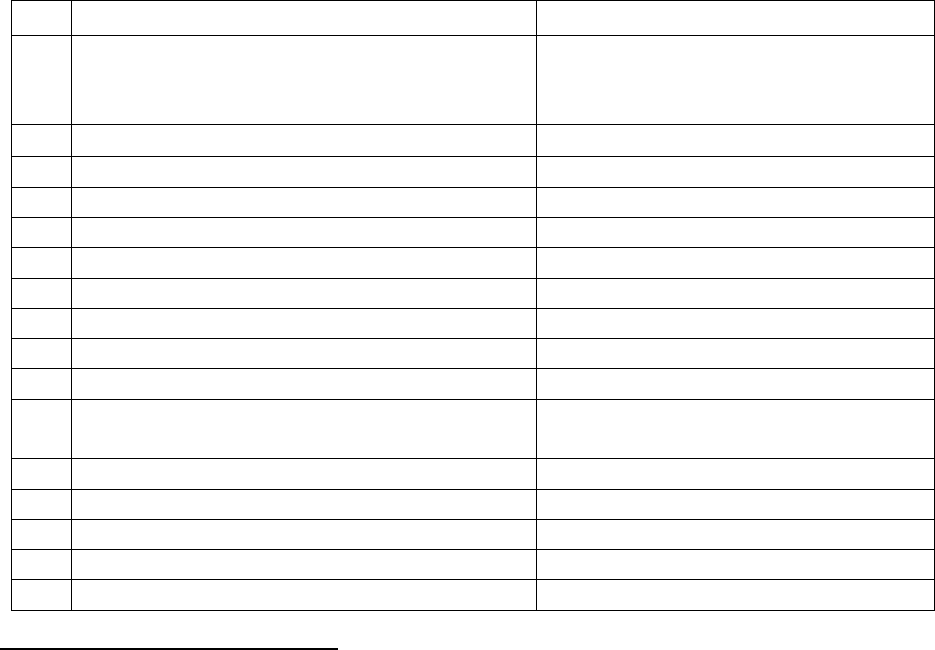

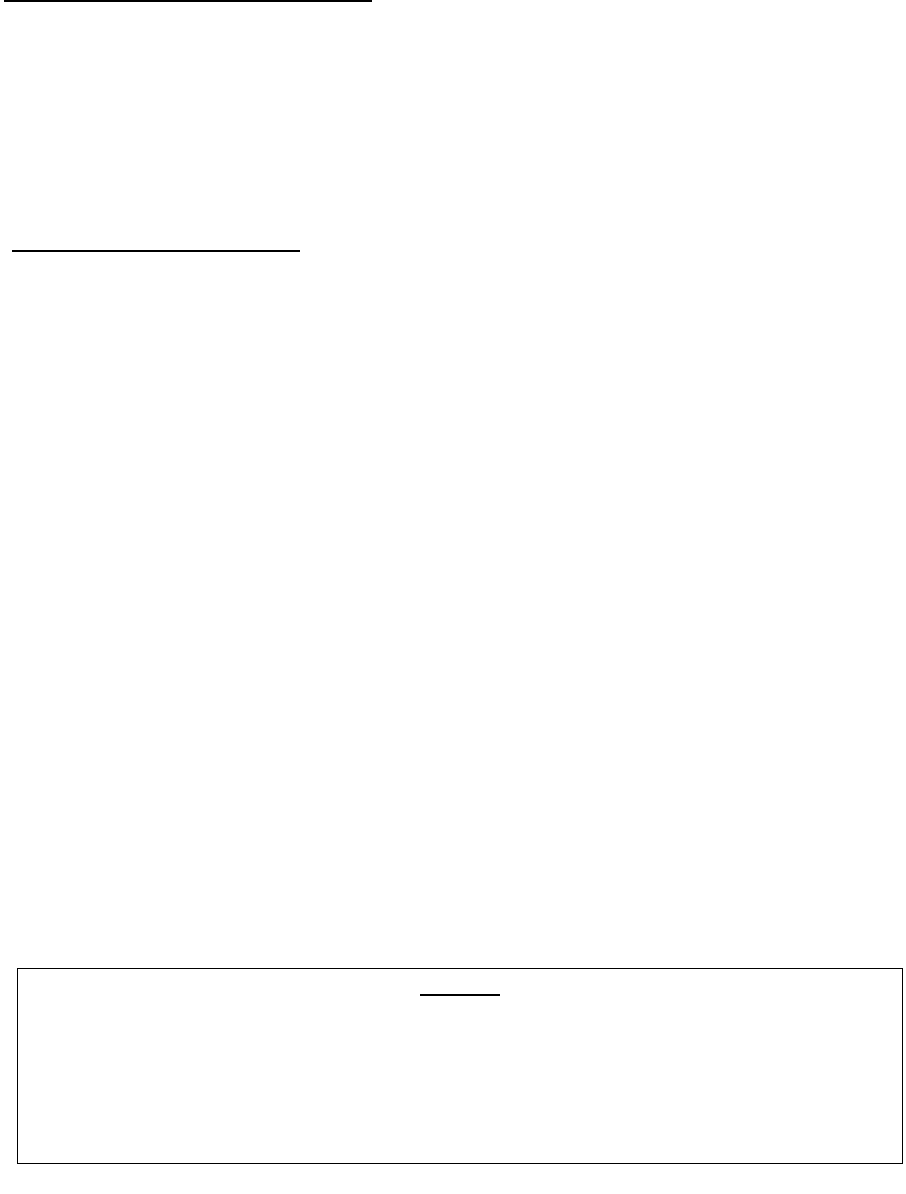

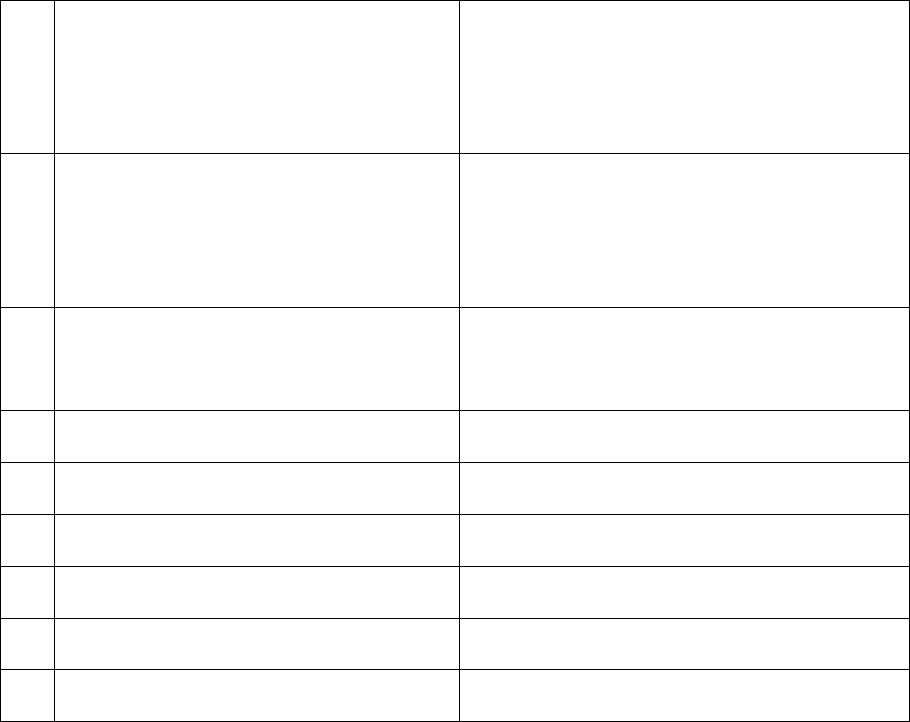

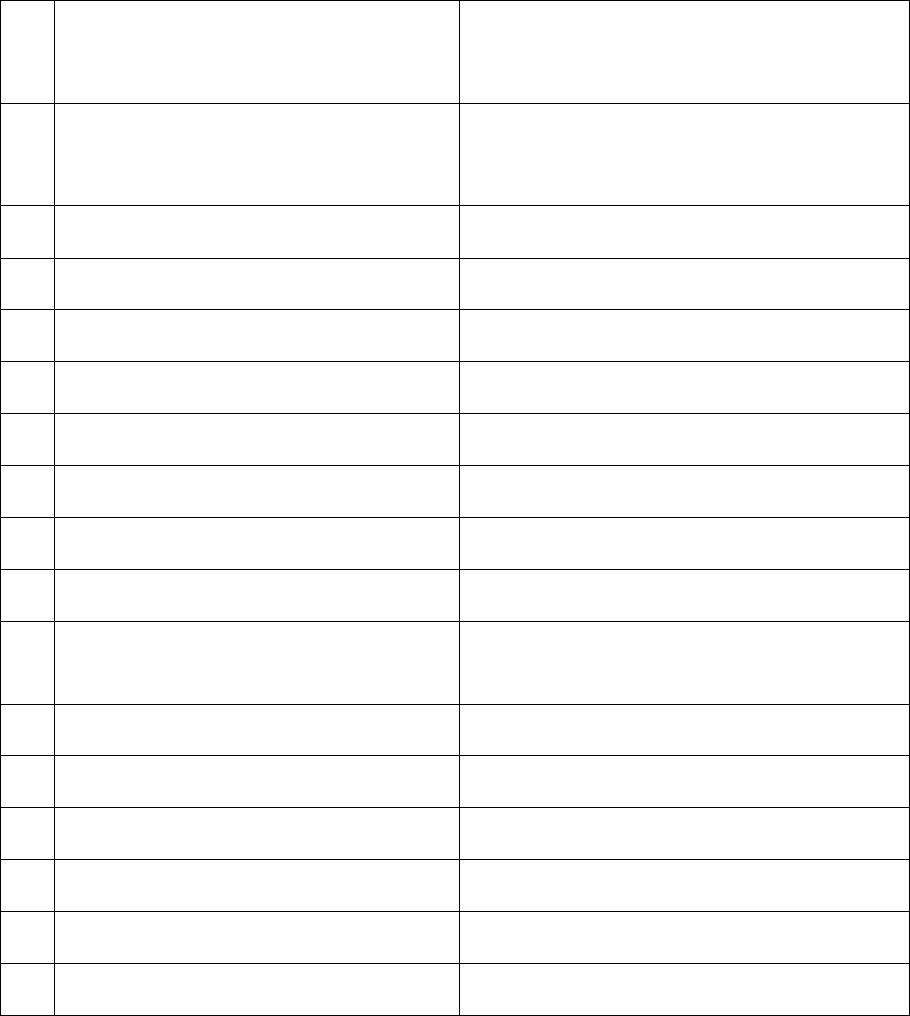

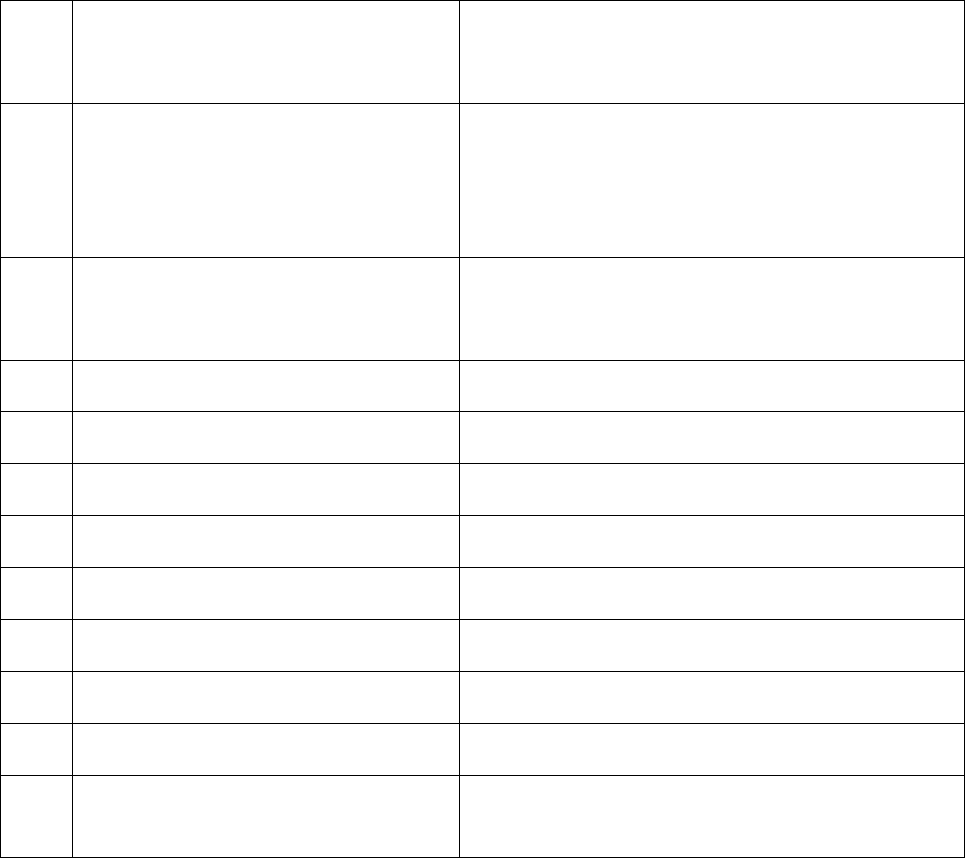

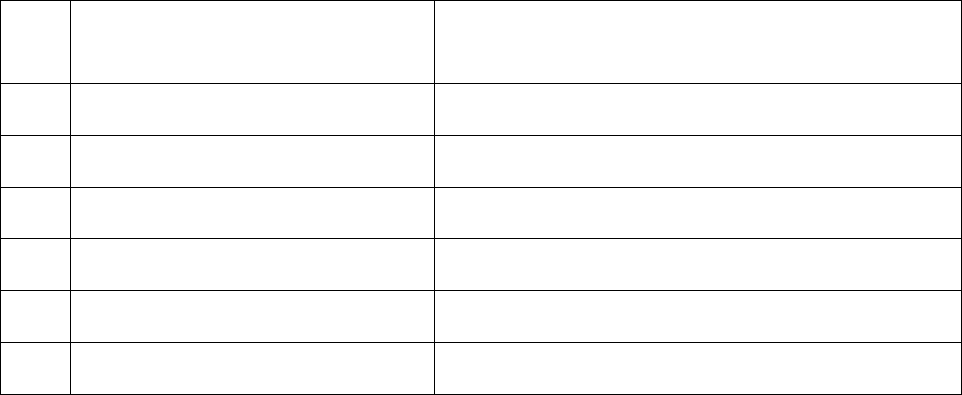

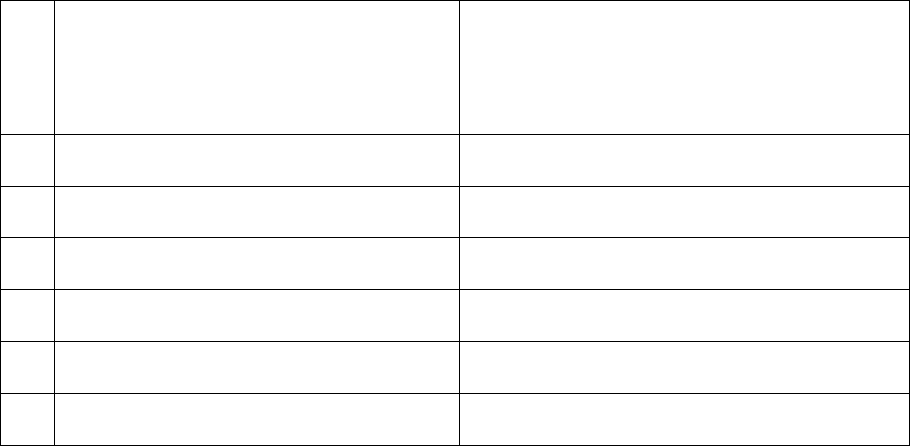

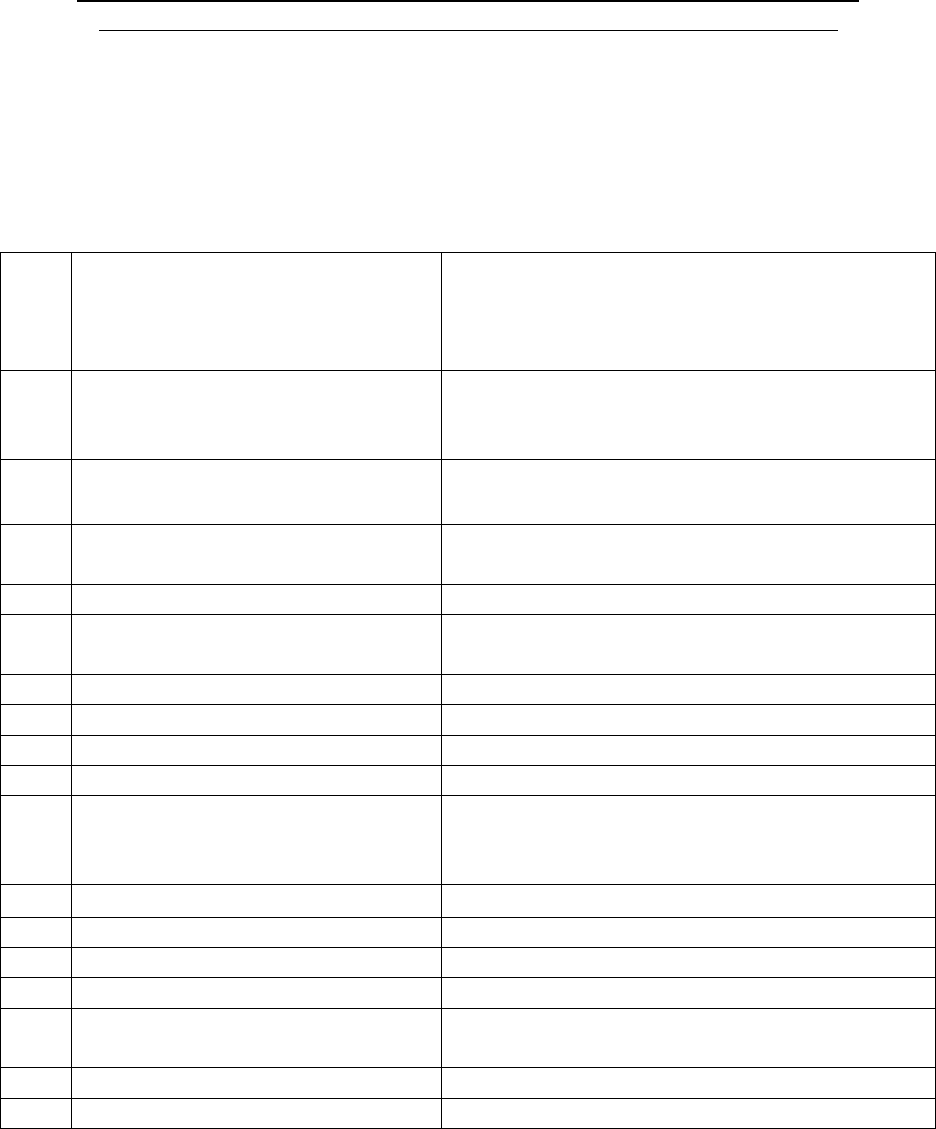

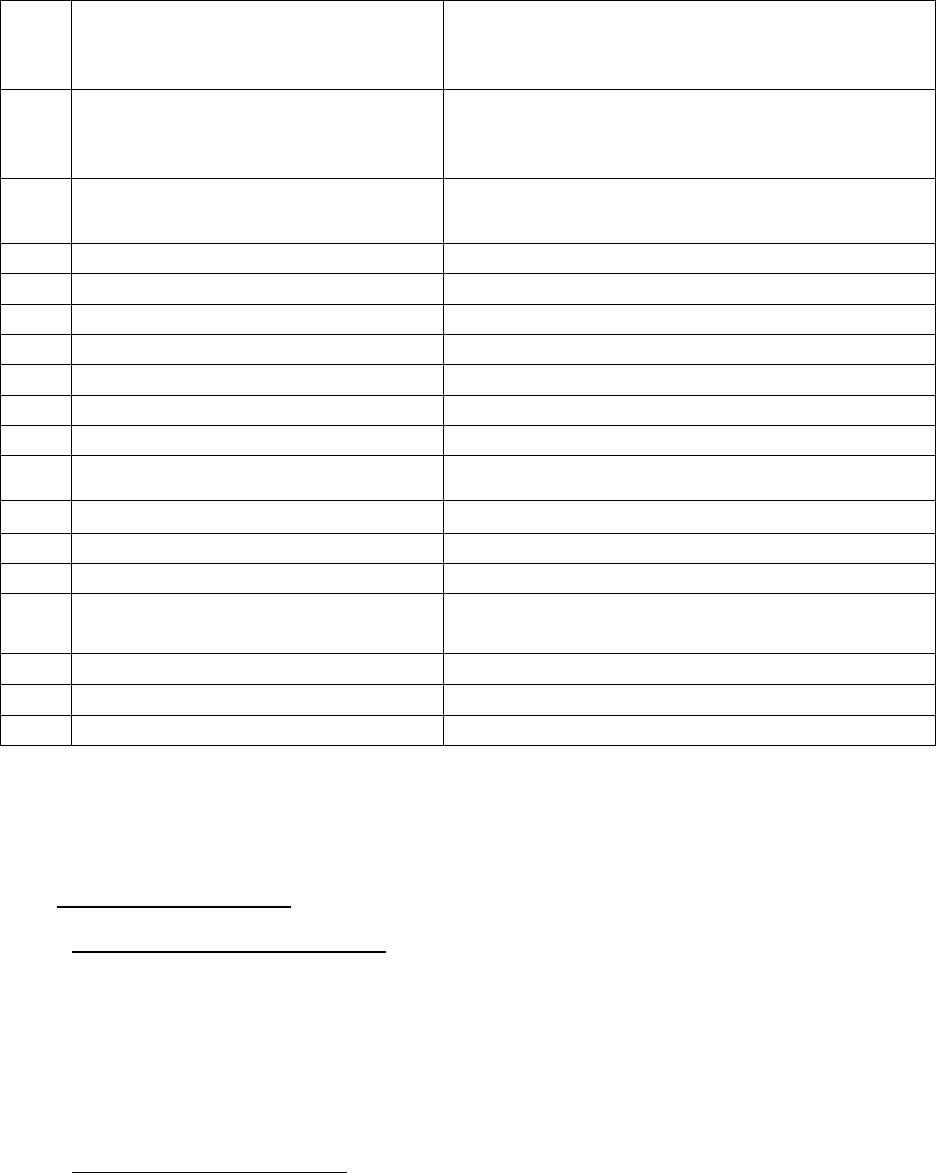

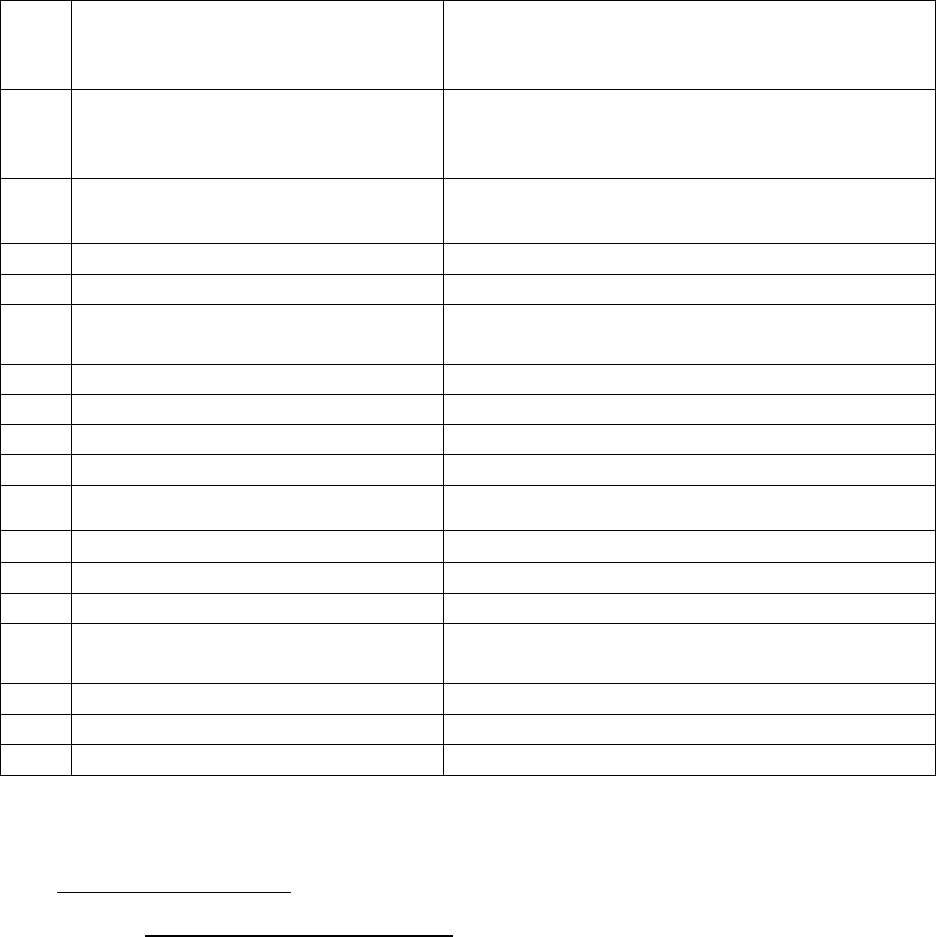

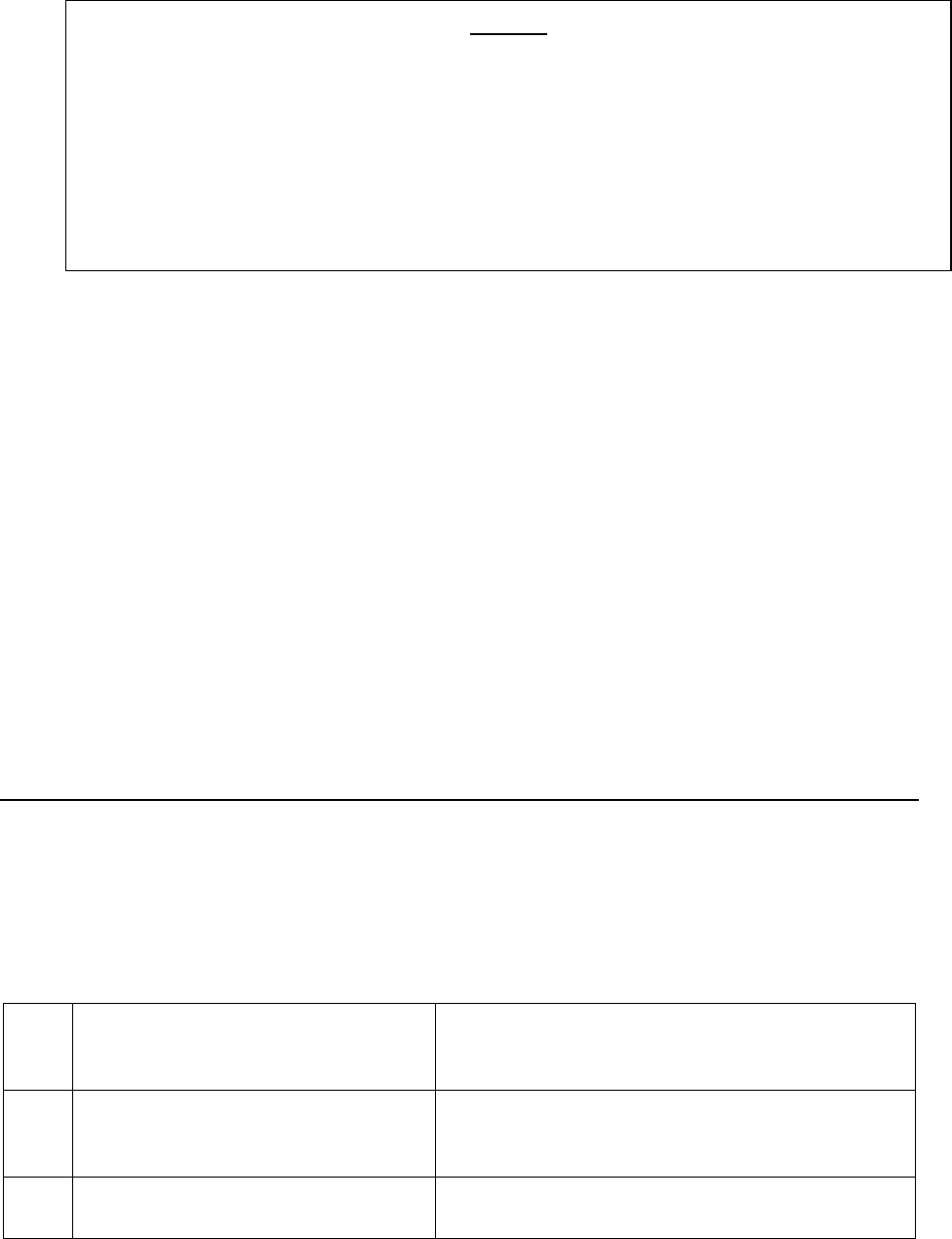

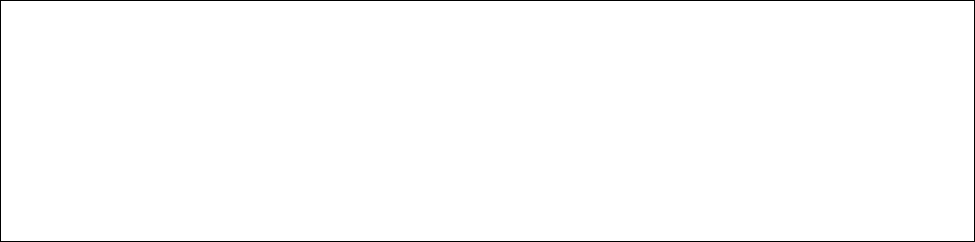

1.

Address of the Complainant

:

Alakapuri,Pudukudi Road,Manjeri (PO),

Malappuram Dist; 676121KERALA

2.

Policy Number

:

251100502010000359

3.

Name of the Insured

:

Mr. Babu p

4.

Type of Policy

:

HEALTH

5.

Date of receipt of Complaint

:

09.09.2021

6.

Nature of complaint

:

Rejection of claim

7.

Date of Hearing

:

16/03/2022

8.

Present at the Hearing for Complainant

:

Mr. Babu P

9.

Present at the Hearing for the Insurer

:

Mr. Atul Malhotra

Award No. IO/KOC/A/HI/0001/2022-23

This is a complaint filed under Rule 13(1)b read with Rule 14 of the Insurance Ombudsman Rules,

2017. The complaint alleges rejection of a claim under a Health Insurance policy issued by the

Respondent Insurer (RI). The Complainant, Mr. Babu P is the policyholder.

1. Complainants’ Averments

The averments, contentions and submissions in the complaint are summarized as follows:

(1) The complaint is related to rejection of reimbursement of treatment expenses of the

Complainanat’s wife who is a cancer patient underwent medical treatment with Regional

Cancer Centre(RCC) Trivandrum, a Government Organisation.

(2) The claim submitted is in connection with the medical expenses incurred for

Immunotherapy – Monoclonal Antibody given as injection to his wife Smt.K Shyamala

who is a cancer patient.

(3) She is suffering from right breast cancer for the last 2 years. RCC prescribed a treatment

cycle consisting of Chemotherapy, Surgery, Radiation and 17 immunisation course of a

combination of Transtusumab and Pertusumab injections at an interval of 21 days.

Chemotherapy was completed on 01/04/2020. Surgery was conducted on 19/05/2020

with removal of right breast.

(4) He is a retiree of The Federal Bank Ltd with employee No.2582 and holding the Group

Mediclaim Health Insurance policy under which the medical treatment expenses incurred

for his wife is reimbursable.

(5) The medical expenses claim amount Is INR 1,24,494/- incurred between 30/11/2020 to

25/02/2021.

(6) They were submitting bills at regular intervals to their previous Insurer United India

Insurance through their TPA, which were reimbursed in due course.

(7) Then the Insurance Company was changed w.e.f 01/11/2020 to National Insurance

Company. Hence they have submitted the bills after the above cut-off date to the TPA of

National Insurance for reimbursement of the medical expenses incurred.

(8) The RI rejected their claim under clause number 2.19 of the policy by informing that the

day care treatment expenses are not covered.

(9) The treatment was a series consisting of Chemotherapy, Surgery, Radiation and

immunotherapy of Monoclonal Antibody injection with Modern Treatment

method/Advanced Technology. The entire course of treatment was prescribed by RCC,

the leading organization for cancer treatment and it is a Government organization.

2. Respondent Insurer’s Contentions

The Respondent Insurer entered appearance and filed a Self Contained Note (SCN). The

averments, contentions and submissions in the SCN are summarized as under:-

(1) The Respondent Insurer had received the reimbursement request of Rs.1,24,494/- from

the above patient towards expenses incurred for administration of Monoclonal antibody

on standalone basis and accordingly the claim was reported vide CCN HH172126981.

(2) On reviewing the claim documents, they found that the treatment documents submitted

by the insured shows that the patient was admitted for Monoclonal antibody of

standalone basis, which found not covered under the scope of IBA policy. This procedure

does not require hospitalization and usually done in OPD. Hence the claim is not

admissible as per policy terms and hence recommended for repudiation under the Clause

2.19 of IBA GMC policy.

(3) The procedures undergone by the insured does not require hospitalization and usually

done in OPD. So the claim is not admissible as per policy terms & conditions and hence

denied under Clause 2.19 of IBA GMC policy.

3. I heard the Complainant and the Respondent Insurer at a Hearing on 16/03/2022

The Complainant reiterated that his wife is a cancer patient, undergone treatment at RCC,

Trivandrum, a Government organization. He is a retired bank employee of Federal Bank Ltd.

He and his wife are insured under the Group Mediclaim – Tailormade policy issued by the RI

for Federal Bank retirees. The claim submitted for the medical expenses incurred for

immunotherapy – Monoclonal Antibody given as injection to his wife, comes to Rs.1,24,494/-

was rejected by the RI. The reason for rejection as stated by the RI is “the procedure does

not require hospitalization and usually done in OPD; hence the claim is rejected under the

Clause No.2.19 of IBA GMT policy.”

His wife’s illness being Breast Cancer comes under Critical Medical Care hospitalization and

related medical treatment undertaken as advised by Regional Cancer Centre. The

reimbursement claims submitted during the previous policy period in connection with the

treatment of Cancer consisting of Chemotherapy, Surgery, Radiation and immunization

courses submitted to the previous Insurers United India Insurance Company at regular

intervals were reimbursed in due course. He has faced this difficulty only with the present

RI.

The Respondent Insurer stated that the procedure done is administration of Monoclonal

antibody on standalone basis, which does not require hospitalization and usually done in

OPD. Hence the claim is non-admissible as per terms and conditions of the IBA GMC policy.

So the claim recommended for repudiation under the Clause 2.19 which reads as:-

2.19 HOSPITALISATION

Means admission in a Hospital/Nursing Home for a minimum period of 24 in-

patient care consecutive ‘in-patient care’ hours except for the specified day

care procedure/treatments, were such admission could be for a period of less

than 24 consecutive hours. For the list of these specified day care

procedures/treatments, please see 3.3.

Note: Procedures/treatments usually done in outpatient department are not

payable under the policy even if admitted/converted as an in-patient in the

hospital for more than 24 hours.

The list of procedures allowable is expressly mentioned in the list. Immunotherapy is not

mentioned in the day care procedures list, although Chemotherapy is included in the list.

4. Having heard both the sides and having perused all the documents submitted in detail, I find

as under:-

(1) The Complainant insured submitted that his wife (the insured person here) is a Cancer

patient and she underwent chemotherapy and surgery as per the doctor’s advice. Her

illness being Breast Cancer comes under Critical Medical Care Hospitalisation and related

medical treatment undertaken as advised by Regional Cancer Centre. The RCC, I may

mention here, is one of the most renowned cancer treatment centres in the country.

(2) A total claim amount of Rs.1,24,494/- incurred by the Complainant from 30/11/2020 to

25/02/2021 for injections given at the RCC to his wife, have been repudiated by the RI

and this is the basis of the dispute herein.

(3) For fighting this insured person’s cancer, the Regional Cancer Centre had evidently

prescribed a treatment cycle consisting of Chemotherapy followed by Surgery, Radiation

and then concluding with a 17-set immunization course of a combination of two drugs,

namely Transtusumab and Pertusumab injections at an interval of 21 days.

Chemotherapy was completed on 01/04/2020, Surgery was conducted on 19/05/2020

with removal of right breast. She was discharged on 20/05/2020. After healing wound 8

Radiations were given from 29/06/2020 to 17/07/2020. Pertusumab injections continued

and the treatment was ended on 24/02/2021.

(4) In support of his contention of the particular expense falling within the ambit of

theinsurance cover, the Complainant points out that the similar medical expenses bills

upto 31/10/2020 (the previous policy end date) were submitted to the previous Insurers

M/s United India Insurance, and were being reimbursed without any objection. The

Complainant would also cite that under Clause number 6.15 IRDA Regulations of the IBA

GMT policy which reads as :-

This policy is subject to Provisions of Insurance Act, 1938, IRDAI (health

insurance) Regulations 2016 and IRDA (protection of policyholder’s interest)

Regulations 2017 as amended from time to time.

(5) In defence, the RI submits that the process involved in this insured person’s case is not

hospitalization as per Clause 2.19 read with Clause 3.3 of the policy for criteria

“hospitalization”. Further they would have it that the procedure is not one that is listed

as allowed Day-Care procedures covered under the policy but is merely something that

could be done in OPD and hence outside the scope of the coverage.

(6) In assessing whether the particular procedure claim for by the Complainant would fall

within the policy coverage, I am guided principally by two factors:

(a)

Firstly, the policy itself indicates that coverage for this procedure claimed for, does

exist in it – as I shall explain below:

(i)

I note that Clauses 3.5 and 3.8 of the policy lay down criteria for “Pre-existing

Diseases/Ailments” and “Advanced Medical Treatment” respectively without any

ambiguity. Pre-existing Diseases/Ailments – Pre-existing diseases are covered

under this insurance scheme from day one. Advanced Medical Treatment – New

advanced medical procedures approved by the appropriate authority eg.Laser

surgery, stem cell therapy for treatment of a disease is payable on

hospitalization/day care surgery. Pertuzumab (Perjeta

®

) and trastuzumab are

known to be specifically only used to treat breast cancers that have too much of

a protein (receptor) called HER2 on the surface of their cells. This is called HER2-

positive breast cancer. It is therefore to be considered essential, approved and

bonafide treatment designed as part of the management of the insured person’s

ailment as I have explained in (3) above.

(ii)

As regards whether this is a mere process of giving an injection to the patient and

can be done in OPD as the RI would have it, I find from easily available literature

that the administration of these strong medicines into the body (and that too of

an otherwise ill person) has a risk of triggering cardiac problems and is hence

given only under specific supervision of her treating doctor who monitors her for

a certain period even after the administration of the drugs.

(iii)

I must therefore conclude that there is ample ground to conclude that the drug

therapy described here as monoclonal antibody administration is a continuing

part of the treatment process for the insurped person’s ailment and must

therefore be part of the policy coverage that includes new advanced medical

procedures as shown above.

(b)

Secondly, the IRDAI itself has mandated inclusion of such a process in their Circular

IRDA/HLT/REG/CIR/177/09/2019 dated 27/09/2019. I draw attention of the RI to

Chapter V of the Circular which reads as under:

1. To ensure that the policyholders are not denied availability of

health insurance coverage to Modern Treatment Methods

Insurers shall ensure that the following treatment procedures shall

not be excluded in the health insurance policy contracts. These

Procedures shall be covered (whichever medically indicated) either

as in-patient or as part of domiciliary hospitalization or as day care

treatment in a hospital.

A. Uterine Artery Embolisation and HIFU

B. Balloon Sinuplasty

C. Deep Brain stimulation

D. Oral chemotherapy

E. Immunotherapy – Monoclonal Antibody to be given as

injection

F. Intra vitreal injections

I believe nothing further needs to be said about the Regulatory mandate on this

subject.

(7) Considering all facts and circumstances of the case, I am of the opinion that the insurance

policy issued by the RI does respond positively to the Complainant’s claim under

discussion here. As to the quantum of claim, I do not find any part of the claimed amount

of Rs. 1,24,494 to be superfluous or indicating deduction or adjustment. I consider on

balance, that the decision to reject the claim was taken by the RI in bonafide manner and

intent and no ususual latches are found in their claim processing, in consideration of

which I do not think allowing of any interest or other compensation is indicated. Found

accordingly.

5. Award

In the result, I hereby order as under:

The Respondent Insurer shall reopen their file on the Complainant’s claim discussed herein

allow the amount of Rs. 1,24,494.00 as a valid claim under the insurance policy no.

251100502010000359 and pay the said amount to the Complainant. No interest or cost.

As prescribed in Rule 17(6) of Insurance Ombudsman Rules, 2017, the Insurer shall comply

with the award within 30 days of receipt of the award and intimate compliance of the same

to the Ombudsman.

Dated this the 11

th

day of April 2022

Sd/-

Girish Radhakrishnan

INSURANCE OMBUDSMAN

Proceedings of

THE INSURANCE OMBUDSMAN

KERALA, LAKSHADWEEP & MAHE

[Under Rule No.13 1(b) Read with Rule 14 of the Insurance Ombudsman Rules, 2017]

Present: Mr Girish Radhakrishnan

Insurance Ombudsman

Complaint No. KOC-H-050-2122-0833

Complainant : Mr. Lijoy T Varghese

Respondent Insurer : The Oriental Insurance Company Ltd.

AWARD

1.

Address of the Complainant

:

Thazhathumuriyil House, SNRA 39 Marana

Road, North P.O. Thripunithura 682036

2.

Policy Number

:

124500/48/2021/7909

3.

Name of the Insured

:

Mr. Lijoy T Varghese

4.

Type of Policy

:

HEALTH

5.

Date of receipt of Complaint

:

29.10.2021

6.

Nature of complaint

:

Rejection of Health Insurance claim

7.

Date of Hearing

:

25.03.2022

8.

Present at the Hearing for Complainant

:

Mr. Lijoy T Varghese

9.

Present at the Hearing for the Insurer

:

Mr.Saurab

Award No. IO/KOC/A/HI/0003/2022-23

This is a complaint filed under Rule 13 (1)b read with Rule 14 of the Insurance Ombudsman Rules,

2017. The complaint is regarding alleged rejection of a claim under a Health Insurance policy

issued by the Respondent Insurer (RI). The Complainant, Mr. Lijoy T Varghese is the policyholder.

1. Complainant’s Averments

The averments, contentions and submissions in the complaint are summarized as follows:

(1) A claim was registered by the complainant during the last week of January 2021.

(2) The TPA Medi Assist was asking for the indoor case sheets from the Hospital. The hospital

provided a letter asking an authorized person to visit and check the indoor case sheets as

their policy doesn`t allow to hand over the indoor papers out side. The TPA did not visit

the hospital for checking the indoor case sheets.

(3) The complainant submitted all medical records with the TPA. His claim was rejected

stating that `no active line of treatment given for hospitalization and the treatment can

be done on OPD basis`.

2. Respondent Insurer’s Averments

The RI entered appearance and filed a Self Contained Note (SCN). The averments, contentions

and submissions in the SCN are summarized as follows:

(1) The Complainant was covered under a GMC (Axis Bank Ltd.) policy

no.124500/48/2021/7909, for the period 1.10.20 to 30.9.2021, for a SI of Rs.4lacs.

(2) Smt. Saritha Krishna Menon (spouse of the Complainant) was admitted in Lakshmi

Ayurvedic Hospital, Ernakulam, on 6.1.2021, with diagnosis Adhosakthi Shool with

complaints of pain in both lower limbs and headache and was discharged on 20.1.2021,

The Insured claimed Rs.35,413/-.

(3) During hospitalization, the patient was treated with ayuevedic procedures – patrapottala

swedam, kadikizhi, shirodhara and internal medicine. Hospitalisation is not justified for

the above procedures as the same can be done on OPD basis.

(4) The claim was denied as per clauses- i).4.22– Any stay in the hospital for any domestic

reason or where no active regular treatment is given by the specialist. ii).2.3-

Hospitalisation period.

3. I heard the Complainant and the Respondent Insurer at a Hearing on 25.03.2022.

The Complainant stated that he insurance claim for the Ayurveda treatment taken by the

Complainant`s spouse was rejected stating that the treatment which she had taken viz.

patrapottala swedam, kadikizhi, shirodhara and internal medicines could have been taken on

OPD basis and thus hospitalistion was not justified. She was admitted in the Lakshmi

Ayurvedic Hospital, with complaints of pain in both lower limbs and headache; the quantum

of settlement sought is Rs.35,413/-. The insurance company’s TPA also delayed the matter

unduly by first saying that they would visit the hospital and verify the records, but did not do

so even after the Complainant produced a letter from the hospital containing their consent.

Then the Complainant himself submitted all the required papers to get a decision and that

decision was a negative one.

The Respondent Insurer stated that the patient underwent treatment under ayurvedic

procedures like patrapottala swedam, kadikizhi, shirodhara and internal medicines, which

their TPA advised them, did not require Hospitalisation since the same can be done on OPD

basis. The claim was denied as per clauses - i).4.22– Any stay in the hospital for any domestic

reason or where no active regular treatment is given by the specialist. ii).2.3- Hospitalisation

period.

4. Having heard both the sides and having perused all the documents submitted in detail, I find

as under:-

(1) The Complainant had a valid policy as on date of the event giving rise to the claim

occurred. He preferred a claim for a set of ayurvedic procedures done on his wife which

has been rejected by the RI and the same forms the basis of this dispute. The RI would

have it that the Ayurvedic procedures the Complainant was subjected to could well have

been done on OPD basis and did not need any hospitalization and they have invoked

Clause (i) 4 22 and (ii) 2. 3 of the policy to justify their decision.

(2) The insured patient, according to the hospital discharge papers, was presented to the

hospital with pain on both lower limbs and headache. This was diagnosed at the hospital

as Adhosakthi Soola (pain on both lower limbs) and she was hospitalised from 06.1.2021

to 20.1.2021 and she underwent the following treatments : patra potala swedam,

kadikizhi, and shirodhara and was given other internal medicines. That the insured

person was treated for a specific diagnosed medical condition/ailment and not for a

general convalescence/rejuvenation process is borne out from the record and is a fact

uncontested by the RI.

(3) Publicly available and accessible literature tell us that patra potala swedam is known in

Malayalam as elakkizhi and kadikkizhi is known in Sanskrit as pinda swedam and both

these involve a long and elaborate process of applying appropriate heated poultices to

the body kept in different poses. Shirodhara is a process of slow dripping of heated

medicinal oils on the forehead and scalp of a prone patient. Each of these processes takes

at least an hour and must be done for the number of days as decided by the doctor but

in any case for a minimum of 7 days for it to have any efficacy at all. These are invariably

accompanied by strictly prescribed diet based on the particular ailment and condition of

the patient and may often involve other requirements like avoiding exertions, avoiding

day-time naps etc.

(4) While in theory, these treatments may be administered without an IP admission, hospitals

ask patients to go through the treatment as inpatients for proper supervision by doctor

and staff. Also, and equally importantly, it behoves a reasonable person to consider the

sheer impracticality and the humanly impossible task of maintaining an OP visit schedule

(from both patient and hospital sides) for a period of 14 continuous days and that too

involving particular specifications about diet, rest, sleep etc. simply to avoid

inconveniencing the insurer by way of a claim. I have therefore no hesitation in noting

here that the RI (via their TPA) have taken a stand that can only be characterized as hyper-

technical to the exclusion of any semblance of reasonableness.

(5) It therefore follows that the decision of the RI to treat the Ayurvedic procedures

undergone by the Complainant’s spouse as ineligible under the policy coverage on

grounds of these purportedly being OP procedures not requiring IP admission in the

hospital is deeply flawed and untenable. The policy must respond positively to the

Complainant’s claim. Found accordingly.

5. Award

In the result, I hereby order as under:

The Respondent Insurer shall reopen the Complainant’s claim file and pay him the admissible

claim amount as per the policy terms, conditions and limits/caps specified. No interest or cost.

As prescribed in Rule 17(6) of Insurance Ombudsman Rules, 2017, the Insurer shall comply with

the award within 30 days of receipt of the award and intimate compliance of the same to the

Ombudsman.

Dated this the 11th day of April 2022

Sd/-

Girish Radhakrishnan

INSURANCE OMBUDSMAN

Proceedings of

THE INSURANCE OMBUDSMAN

KERALA, LAKSHADWEEP & MAHE

[Under Rule No.13 1(b) Read with Rule 14 of the Insurance Ombudsman Rules, 2017]

Present: Mr Girish Radhakrishnan

Insurance Ombudsman

Complaint No. KOC-H-005-2122-0866

Complainant : Mr. P A Abraham

Respondent Insurer : Bajaj Allianz General Insurance Co. Ltd.,

AWARD

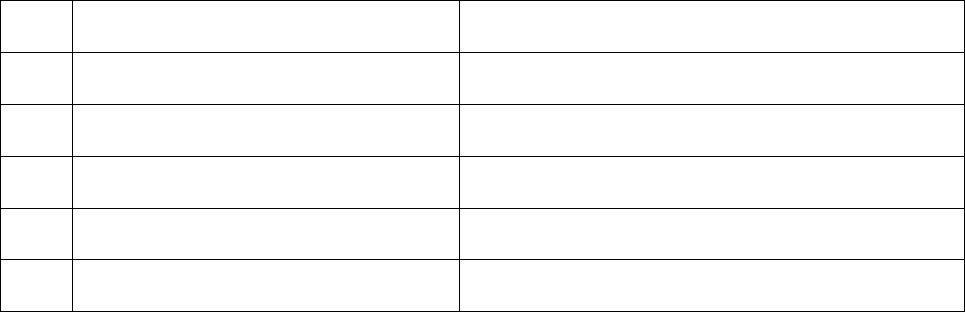

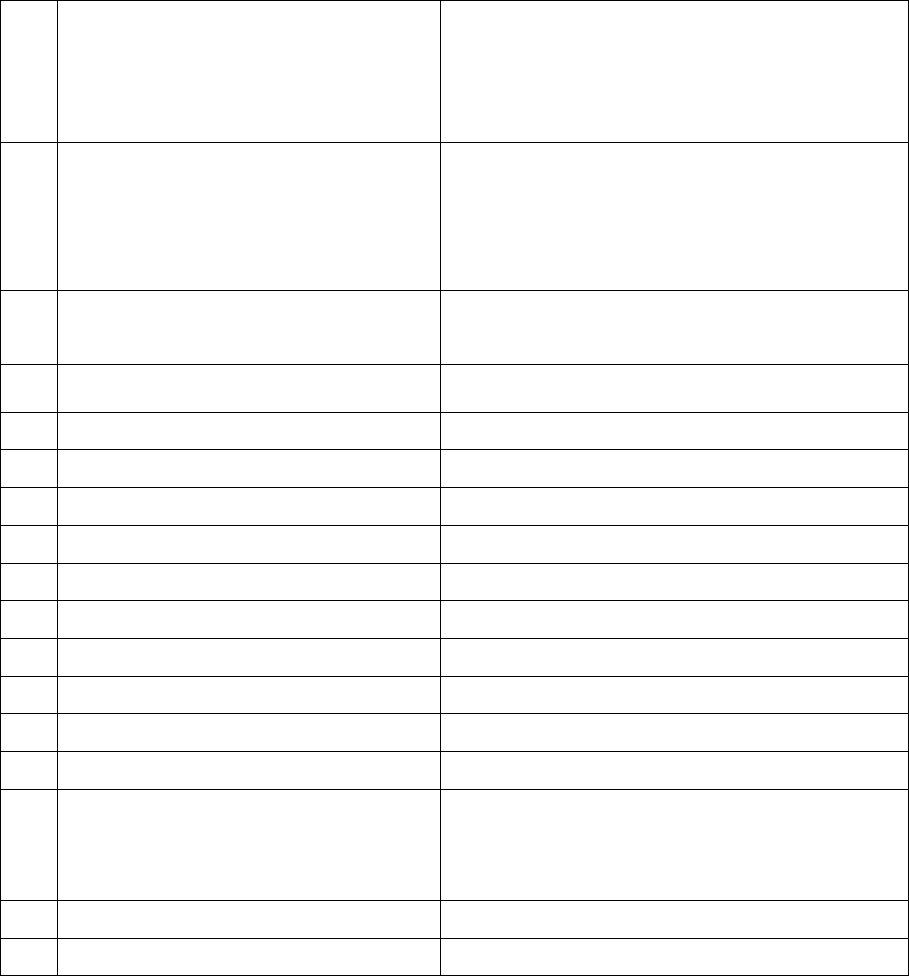

1.

Address of the Complainant

:

8E Infra Hillock-3 Parijatham Road

Kalamassery Kochi 682033

2.

Policy Number

:

OG 21 1602 6021 00000575

3.

Name of the Insured

:

Mr. P A Abraham

4.

Type of Policy

:

HEALTH

5.

Date of receipt of Complaint

:

08.11.2021

6.

Nature of complaint

:

Rejection of claim

7.

Date of Hearing

:

18.03.2022

8.

Present at the Hearing for Complainant

:

Mr. P A Abraham

9.

Present at the Hearing for the Insurer

:

Ms. Reshma

Award No. IO/KOC/A/HI/0005/2022-23

This is a complaint filed under Rule 13 (1)b read with Rule 14 of the Insurance Ombudsman Rules,

2017. The complaint is regarding alleged rejection of a claim under a Health Insurance policy

issued by the Respondent Insurer. The Complainant, Mr. P A Abraham is the policyholder.

1. Complainant’s Averments

The averments, contentions and submissions in the complaint are summarized as follows:

(1) Complainant’s wife’s claim for Rs.2,97,563/- for an emergency procedure of implanting

pacemaker was totally rejected on technical grounds. Theirs was a 10 years’ continuous

Group policy , first three years for Sum Insured of Rs. 3 lakhs and next seven years for

Sum Insured of Rs.5 lakhs , with United India Insurance, till it was ported to this Insurer

on 25th January, 2021 due to their original Syndicate Bank getting merged with Canara

Bank.

(2) The new bank processed their portal request and passed it to the new Insurer, who took

15 days to enquire and process and issue ported policy starting on 25/1/2021 by

mentioning United India old policy no. and with remark of portability provisions and

acceptance.

(3) His wife used to consult and undergone tests in nearby MAJ Hospital but due to

emergency, she was admitted in Lisie Hospital due to low heartbeat and exhaustion, on

28/6/2021. A pacemaker was implanted and she was discharged on 1/7/2021.

(4) The Insurer interpreted the medical condition narrated by the patient at the time of

admission which was noted in the Discharge summary, that she had 4 months medication

in about May 2018 for HTN and Dyslipidemia and had 22 years old condition of Rheumatic

fever and so, were existing while porting the policy with them on 25/1/2021.

(5) However, she was not having any medical condition or medication in Jan, 2021 or prior to

implantation of pacemaker and the Doctor’s Certificate states that there is no relation

with her short term BP or Cholesterol.

(6) Contention of the insurer, of a non-existing medical condition at the time of porting under

Portability Clause of IRDA, is not understandable. The Complainant’s several mails were

not responded to. He requests the Ombudsman to negotiate and give him justice and get

him the claim and continue the policy, as they are Senior Citizens and cannot get new

Mediclaim Insurance although paying premium for 10 continuous years, for the sake of

benefit in retired life.

2. Respondent Insurer’s Averments

The Respondent Insurer (RI) entered appearance and filed a Self Contained Note (SCN). The

averments, contentions and submissions in the SCN are summarized as follows:

(1) The Respondent Insurer entered appearance and filed a Self Contained Note (SCN). The

averments and submissions in the SCN are summarized as under:-

(2) The Policy number: OG-21-1602-6021-00000575 Group Mediclaim Insurance - Canara Bank

(Previously Syndicate Bank) for the period of 25-JAN-2021 To 24-JAN-2022 in favour of

the petitioner was issued under certain terms, conditions and limitation thereof.

(3) There is no deficiency of service or unfair trade practice on the part of the RI. Hence the

Complaint is liable to be dismissed at the outset for want of cause of action.

(4) Policy is a contract and both the parties are under obligation to obey/fulfill all the terms

and conditions of the same in the strict sense of the words written therein. As the terms

and conditions of the Policy are sacrosanct, the claim arrived is also processed within the

precincts of the Policy only. 5. The policy issued to the complainant is a Group Mediclaim

policy. The Insured was holding Group Health Mediclaim Insurance Scheme: Syndicate

Bank with United India Insurance Co. Ltd. After the Syndicate Bank was taken over by

Canara Bank during bank merger as per RBI guidelines, Canara Bank had tied up with RI

and hence the continuity of their existing policy was ported with this Respondent by

signing a new proposal form and portability form. RI has issued Policy covering 25-JAN-

2021 To 24-JAN-2022 - Plan Chosen: Group Mediclaim Insurance - Canara Bank

(Previously Syndicate Bank)with special continuity conditions –“ It is hereby agreed and

understood that the Mediclaim Insurance policy is issued with Portability Benefit from

Mediclaim policy of United India Insurance Co. Ltd. and Continuity is extended from 20-

01-2014. The Continuity for 7 years is extended on Sum Insured of Rs. 5 lakhs for P A

ABRAHAM, the Continuity for 7 years is extended on Sum Insured of Rs. 5 lakhs for Rachel

Abraham. All other terms, conditions, coverage and exclusions of the policy remain

unaltered, all waiting Periods apply afresh on Enhanced Sum Insured. Any disease/ injury

contracted during breakin period will not be payable.”

(5) As per proposal form and portability form the complainant/insured have not declared any

of the ailments with regards to Hypertension, Dyslipidemia and Rheumatic fever. Medical

Certificate from Lisie Hospital mentions that Mrs. Rachel Abraham has medical history of

Hypertension for past 10 years and was on medication Amlorpes 5 mg and Roseday 5mg.

The same certificate also mentions that Mrs. Rachel Abraham had Rheumatic fever at the

age of 40 years and took penicillin prophylaxis for 5 years. It is humbly brought to the

notice of this Hon’ble Forum that Amlopres 5 mg medicine is used to treat high blood

pressure/Hypertension and to prevent heart attack and strokes. Tab Roseday 5 mg

medicine is used to lower cholesterol and reduce the risk of heart disease. It is used in the

treatment of high blood cholesterol. Cholesterol is a fatty substance that builds up in

blood vessel and causes narrowing, which may lead to a heart attack or stroke. This

medicine blocks the production of unhealthy fats in the body and prevents the risk of

heart problems and stroke. These medicines are being consumed by Mrs. Rachel Abraham

over the past 10 years which shows that she was having a very high risk of heart related

problems. But yet these facts were not disclosed to this Respondent in the Proposal Form.

Hence it was very much important for this Respondent to have known about the pre-

existing ailments of Mrs. Rachel Abraham at the time of accepting her proposal for

insurance by this Respondent.

(6) Discharge Summary from Lissie Hospital also shows that Mrs. Rachel Abraham was

diagnosed with Dyslipidaemia, which is a medical condition involving abnormally elevated

cholesterol or fats in the blood. It increases the chance of clogged arteries and heart

attacks or other circulatory disorders. This medical condition was also not informed to

this Respondent at the time of availing the policy. The Discharge Summary from Lissie

Hospital mentions that Mrs. Rachel Abraham had risk factors – Systematic Hypertension

and Dyslipidemia. This Respondent was not informed of these preexisting conditions as

well.

(7) Medical document from Lissie Hospital mentions that Mrs. Rachel Abraham had Rheumatic

fever at the age of 40 years and took penicillin prophylaxis for 5 years. Rheumatic fever

causes swelling and muscle damage to the heart. This is an infection which causes heart

valve leaflets to stick together, which narrows the valve opening thus damaging the heart

valve and chronic heart failure. Penicillin is administered for curing this infection. From

the said medical document it is seen that Mrs. Rachel Abraham took penicillin prophylaxis

for 5 years. These are medical conditions which must have been intimated to this

Respondent at the time of availing the policy as they form material facts for this

Respondent.

(8) The above stated medical history of Mrs. Rachel Abraham was very much relevant and

material for the RI for accepting the policy. The claim in respect of which the complaint is

filed before this Hon’ble Forum pertains to expenses incurred in Implant of Pacemaker

due to heart failure. The Discharge Summary shows that there is complete heart block.

Hence there was non-disclosure of material facts at the time of availing the policy.

Insurance is a matter of solicitation. Hence the complainant ought to have disclosed all

pre-existing medical conditions to RI at the time of insurance. The Respondent Insurer

was denied an opportunity to decide the correct terms and conditions or to decide

whether to accept the proposal of the complainant.

(9) Point No. 23 in the Proposal form bears the question whether the persons to be insured

suffer from or is investigated with heart disorder or circulatory system , chest pain, high

blood pressure, diabetics, hepatitis etc. As the above mentioned medical conditions have

been existing since 10 years and since medicines such as Amlopres 5 mg and Roseday 5

mg were being taken by Mrs. Rachel Abraham, these facts must have been mentioned in

answer to the question in point 23 and informed to this Respondent. Instead, the

complainant has stated in answer to point 23 that there is “no” such issues. Hence there

is clear non-disclosure of material facts.

(10) Point No. 24 in the Proposal form bears the question whether the persons to be insured

has any health complaint, taking treatment or medication. The fact that Mrs. Rachel

Abraham had Rheumatic fever and had taken penicillin for 5 years must have been

disclosed at this point. The fact of hypertension and Dyslipidaemia must also have been

disclosed. Instead, the complainant mentioned “not applicable” which amounts to non-

disclosure of material facts.

(11) Point No 25 in the Proposal Form bears the question if any of your immediate family

members have Diabetes, Hypertension etc. To this the complainant has answered that his

brother has diabetics. However, the complainant intentionally remained silent about the

medical condition of his own wife Mrs. Rachel Abraham. This is not bonafide act on the

part of the complainant and was only intended to deceive the Respondents and to avail

health policy by concealing essential facts.

(12 The complainant has also signed a “Declaration” in the proposal Form stating that the

facts disclosed in the proposal form are true and that it shall form the basis of the policy.

When material facts are not disclosed in the proposal form, the policy issued by this

Respondent becomes null and void. The Preamble to the Policy Terms and Conditions

reads as “Our agreement to insure You is based on Your Proposal to Us, which is the basis

of this agreement, and Your payment of the premium. …” Hence when the proposal made

to us is silent on material particulars essential to accepting the proposal, there is no

consensus and there is no contract of insurance. Thus the insurance agreement becomes

void. Clause no 16 under Part B of the policy terms and conditions mentions that the

Policy shall be void and all premiums paid hereon shall be forfeited to the Company, in

the event of misrepresentation, mis-description or non-disclosure of any material fact.

(13) The RI submits that they are not liable to pay any claim arising out of pre-existing illness

as per the policy terms and conditions. Clause C1 of the policy terms and conditions

stipulates: What we will not pay (Exclusions) under this policy? We shall not be liable to

make any payment for any claim directly or indirectly caused by, based on, arising out of

or attributable to any of the following: Benefits will not be available for Any Pre-existing

condition, ailment or injury, until 36 months of continuous coverage have elapsed, after

the date of inception of the first Mediclaim Insurance Policy, provided the pre-existing

disease / ailment / injury is disclosed on the proposal form. The above exclusion 1 shall

cease to apply if You have maintained a Mediclaim Insurance Policy with Us for a

continuous period of a full 36 months without break from the date of Your first Mediclaim

Insurance Policy. In case of enhancement of Sum Insured, this exclusion shall apply afresh

only to the extent of the amount by which the limit of indemnity has been increased (i.e.

enhanced Sum Insured) and if the policy is a renewal of Mediclaim Insurance Policy. The

Complainant was obliged to fill the Proposal Form correctly as per the regulation of IRDAI.

As per Schedule-I relating to Portability of Health Insurance Policies offered by General

Insurers and Health Insurers specified in the IRDAI (Health Insurance) Regulations, 2016,

in every portability case, every insurer is mandated to furnish to an applicant the

Portability Form together with a proposal form., and the policyholder is required to fill

the portability form along with proposal form and submit the same to the insurer. So even

if it is a portability case, it is necessary to disclose any existing ailment in order to give

opportunity to the new insurer to determine the policy terms and conditions w.r.t to that

particular customer because insurance is a matter of solicitation. It was following this

regulation of the IRDAI, this Respondent had sought the complainant to fill the Proposal

Form.

(14) RI had issued the policy believing that the complainant had given true disclosure of the

material facts affecting the contract of insurance. Insurance is a matter of solicitation and

since no existing illness was disclosed RI had issued this policy. If the pre-existing ailments

were disclosed to RI as per the principle of Utmost good faith before portability RI would

not have ported the policy with us or would have ported with certain conditions. Hence

RI repudiated the claim. Continuity benefit is given to only those disease/ailments

diagnosed subsequent to the inception of the policy. In such cases where the insured is

diagnosed of a completely new disease, the waiting period is bypassed. But in this case,

Mrs. Rachel Abraham was having Hypertension for past 10 years and was under

medication for same over these years. She was also having Dyslipidemia and had suffered

from Rheumatic fever for which she was taking Penicillin. All these are ailments seriously

affecting the heart functioning. The present claim is for the expenses incurred in

implanting pacemaker. This procedure had to be done as there was complete heart block

for Mrs. Rachel Abraham. So, the ailment/hospitalization for which the claims were made

is not one diagnosed subsequent to policy inception. It was due to pre-existing health

condition not disclosed in Proposal Form. Hence continuity benefit will not apply to this

claim as the claim has arisen of the non-disclosed condition which was existing prior to

the inception of policy with this Respondent.

(15) Thus, under these facts and circumstances, RI says and submits that the claim under the

policy was rightly denied as per terms and condition of the policy and as per guidelines of

IRDAI and all the contents of complaint are denied by this respondent.

(16) A contract of insurance is one of utmost good faith. A proposer who seeks to obtain a

policy is duty bound to disclose all material facts bearing upon the issue as to whether the

insurer would consider it appropriate to assume the risk which is proposed. It is with this

principle that the proposal form requires specific disclosure of pre-existing ailments so as

to enable the insurer to arrive at a considered decision based on the actuarial risk. The

Hon’ble Supreme Court of India in Reliance Life Insurance Co Ltd & Anr v. Rekhaben

Nareshbhai Rathod Civil Appeal No. 4261/2019 has held that the contention that the

signature of the insured was taken without explaining the details of the terms and

conditions cannot be accepted. The Court relied on the decision of the Division Bench of

the Mysore High Court in V K Srinivasa Setty v. Messers Premier Life and General

Insurance Co Ltd wherein it was held that a person who affixes his signature to a proposal

which contains a statement which is not true, cannot ordinarily escape from the

consequence arising therefrom. This respondent is not guilty of any deficiency in service

as alleged in the complaint.

(17) Therefore, it is humbly prayed that this Hon’ble Ombudsman may be pleased to accept

this self-contained notes and to dismiss the complaint with the cost to RI.

3. I heard the Complainant and the Respondent Insurer at a Hearing on 18.03.2022.

The Complainant stated that pacemaker was implanted for his wife at a cost of Rs.2,97,563/-

but his claim was rejected stating non-disclosure of pre-existing diseases. The policy was a

ported one and his wife had no ailment at the time of porting. The insurer cancelled the policy

without any rule to do so. He requested Ombudsman to get the policy revived and also the

opportunity to get his policy renewed without any gap and at the same premium, without any

increase.

The Respondent Insurer stated that they rejected the claim since it was in its first year of

insurance with RI and it was a case of non-disclosure. However, they have now decided to

revoke the non-disclosure since the Complainant had been insuring for Sum Insured of Rs. 5

lakhs for 7 continuous years before porting. They also agreed to reinstate the policy but at

premium applicable as per underwriting guidelines.

4. Having heard both the sides and having perused all the documents submitted in detail, I find

as under:-

(1) RI has offered to reinstate the policy at the applicable premium based on their

underwriting guidelines and also settle the claim for Rs.2,83,195 out of total claim for

Rs.2,97,563, making deductions of Rs. 14,368 for certain items.

(2) However, in the light of IRDAI Master Circular on Health Insurance dated 22nd July 2020,

in which, inter alia, several heads of expenses commonly disallowed by Insurers have

been identified and Insurers have been asked to consider these when computing claim

amounts, I find that several items that have been deducted/disallowed by the RI need to

be reviewed and allowed. The following are the heads of expenses that have been

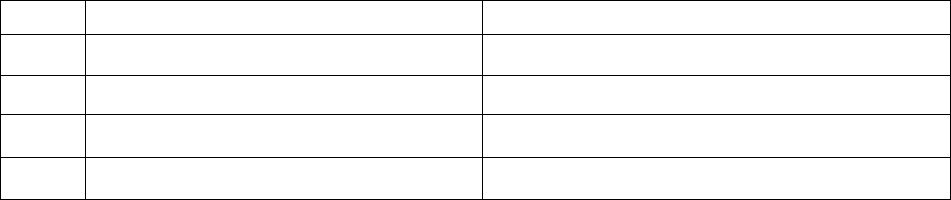

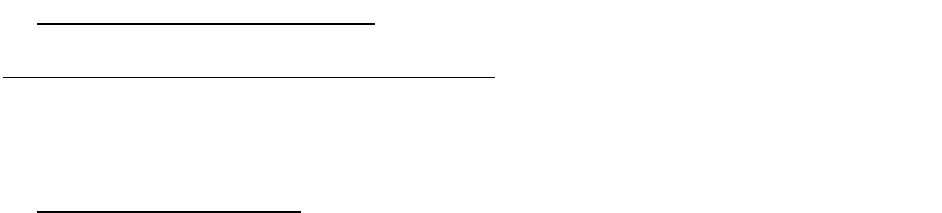

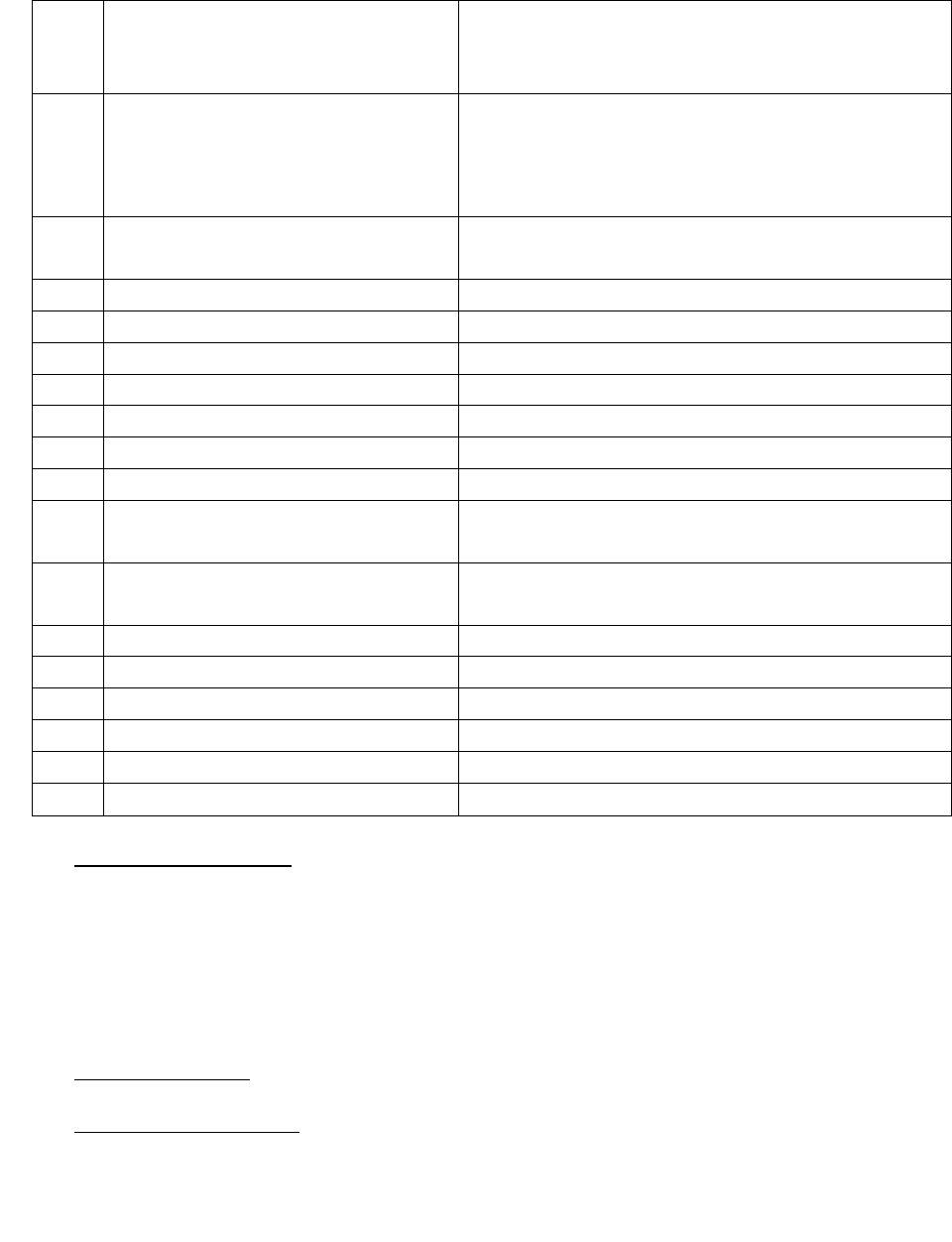

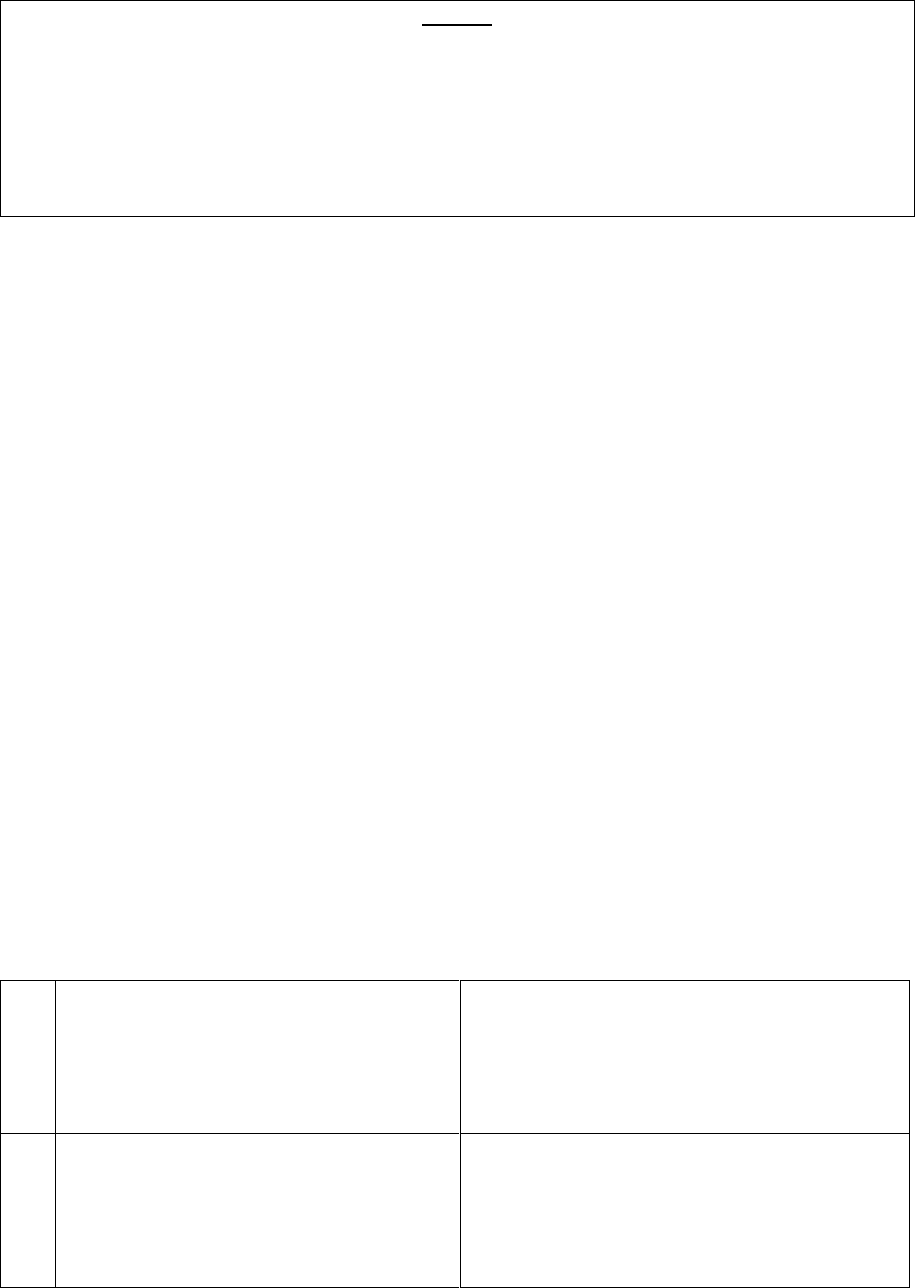

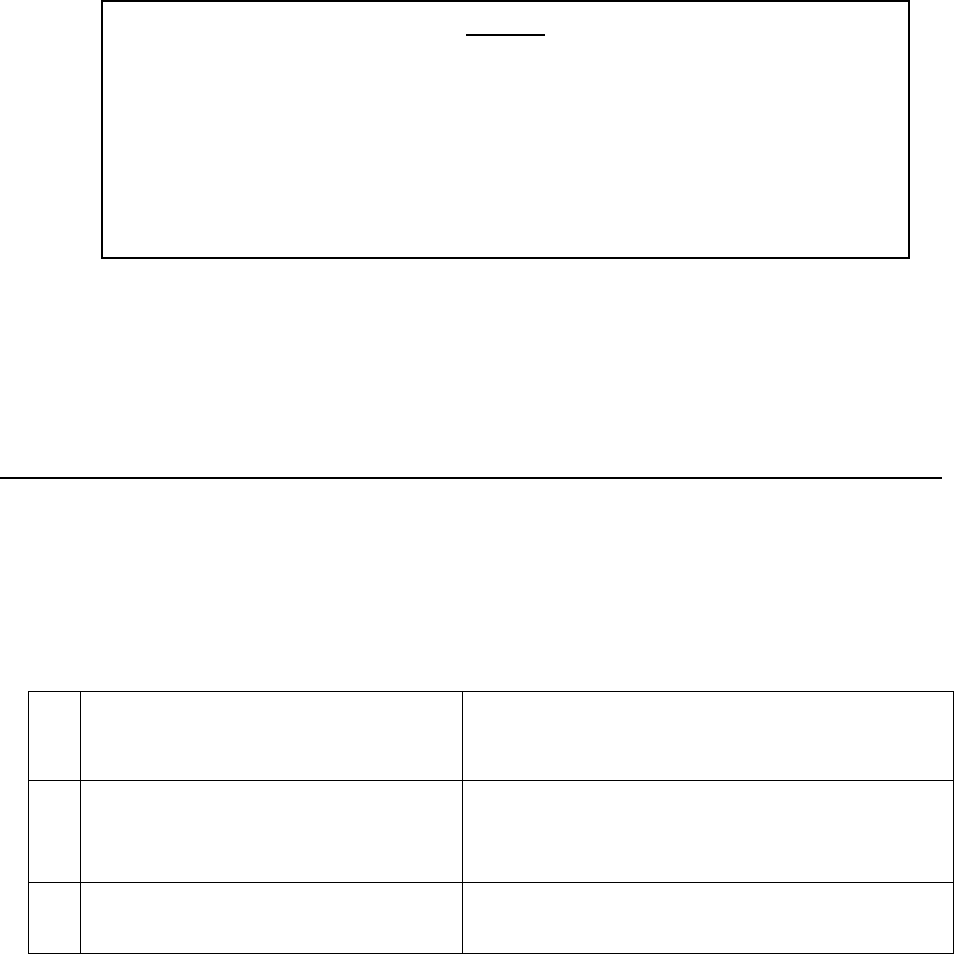

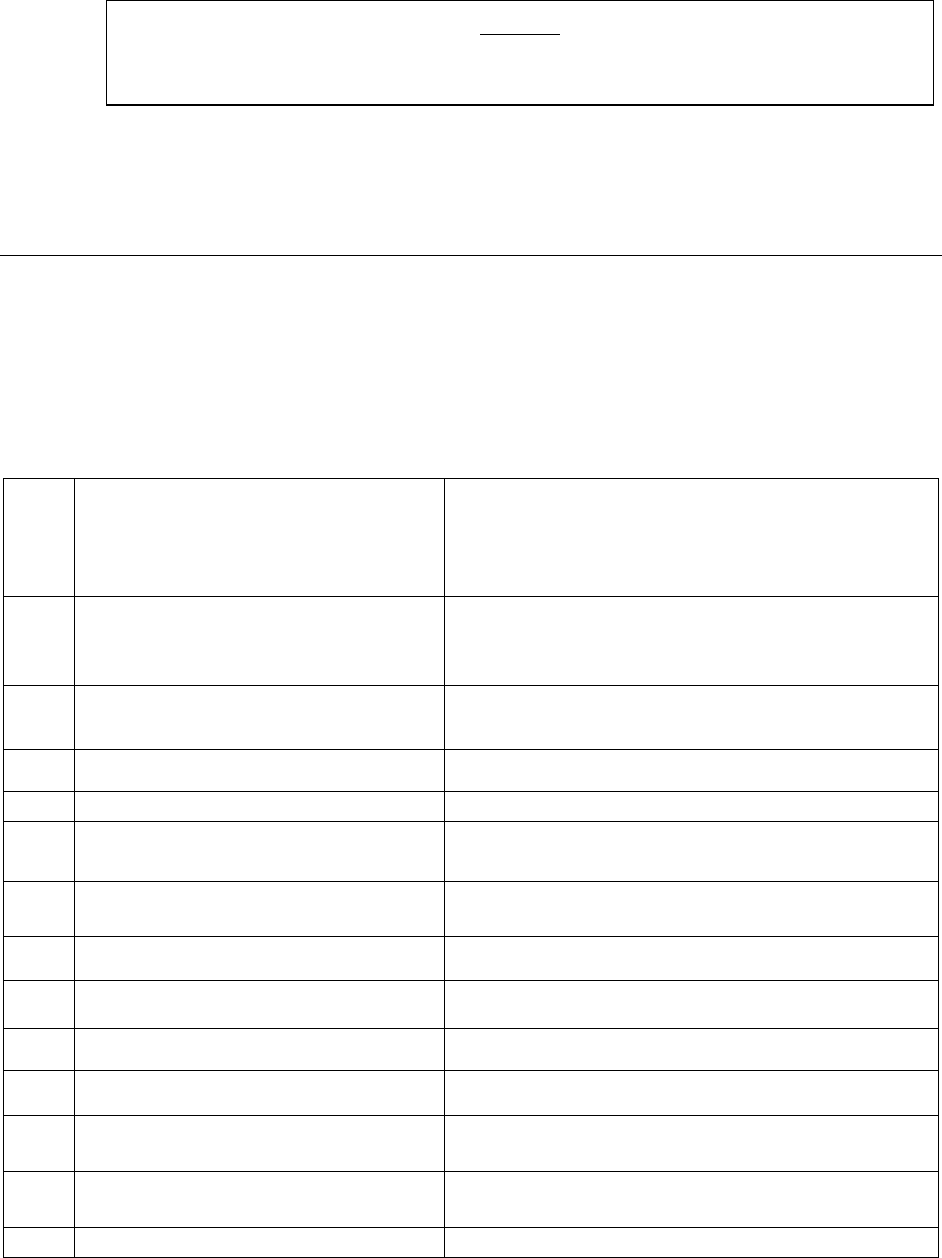

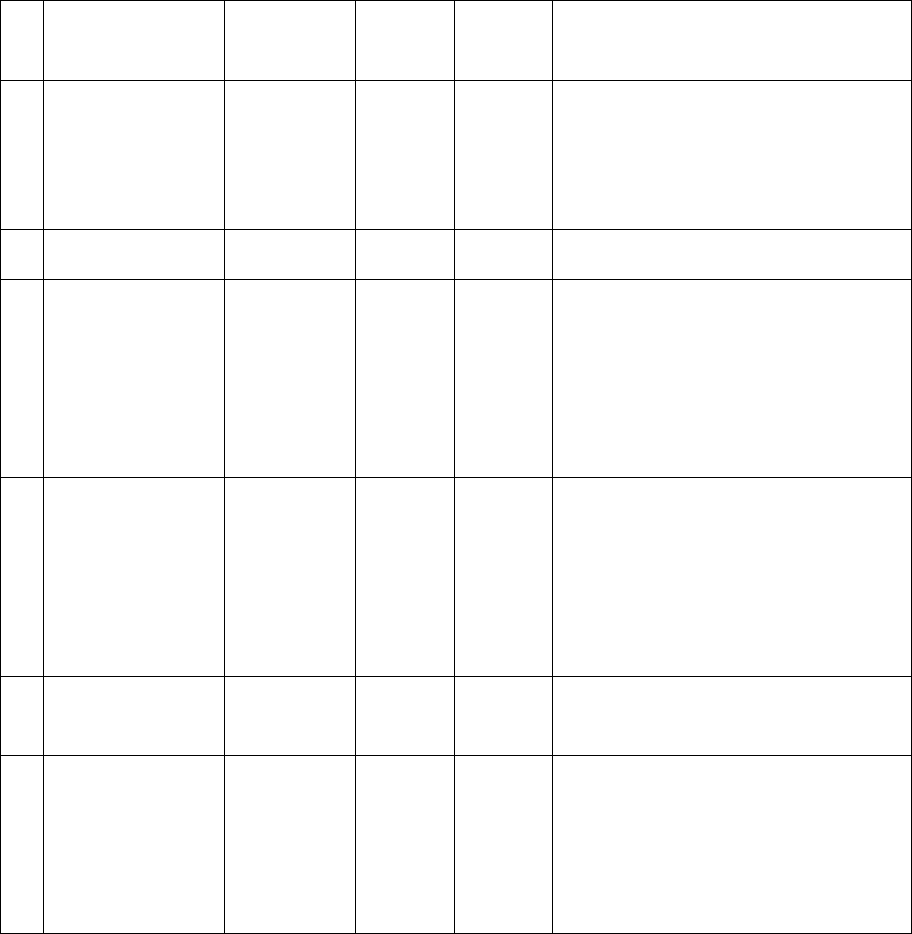

wrongly deducted and need to be allowed:

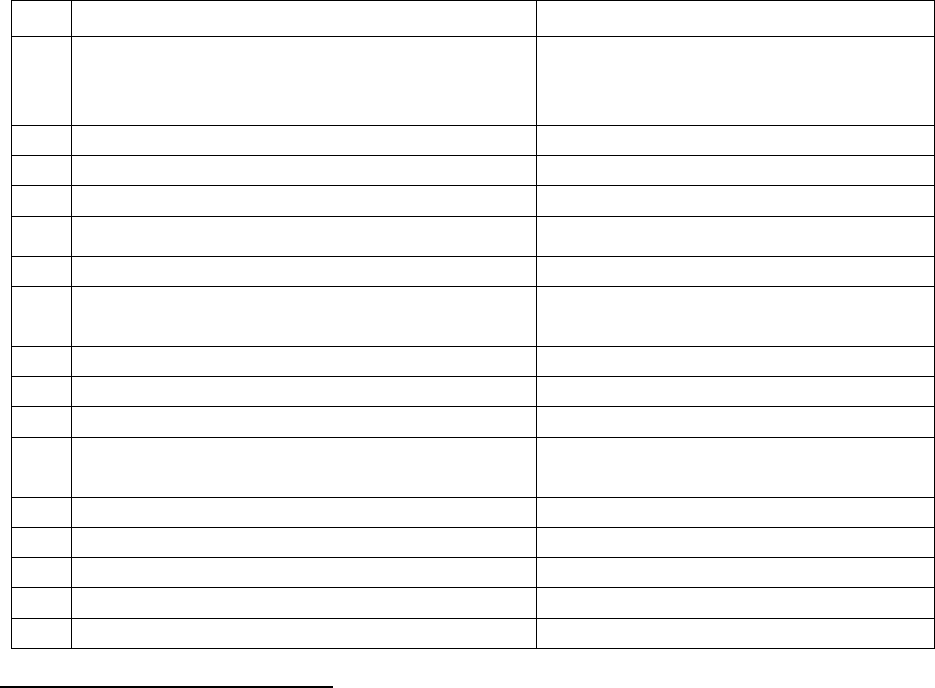

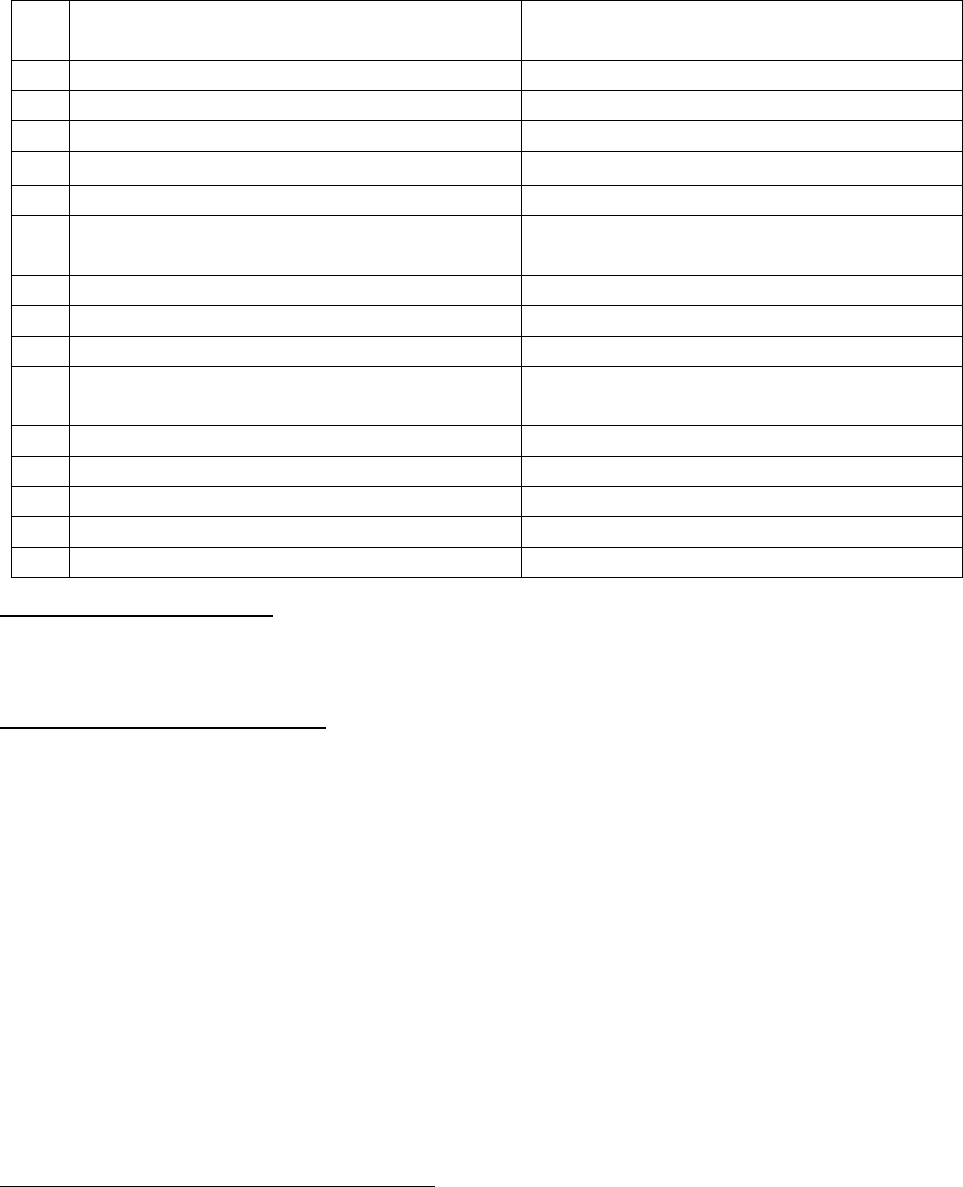

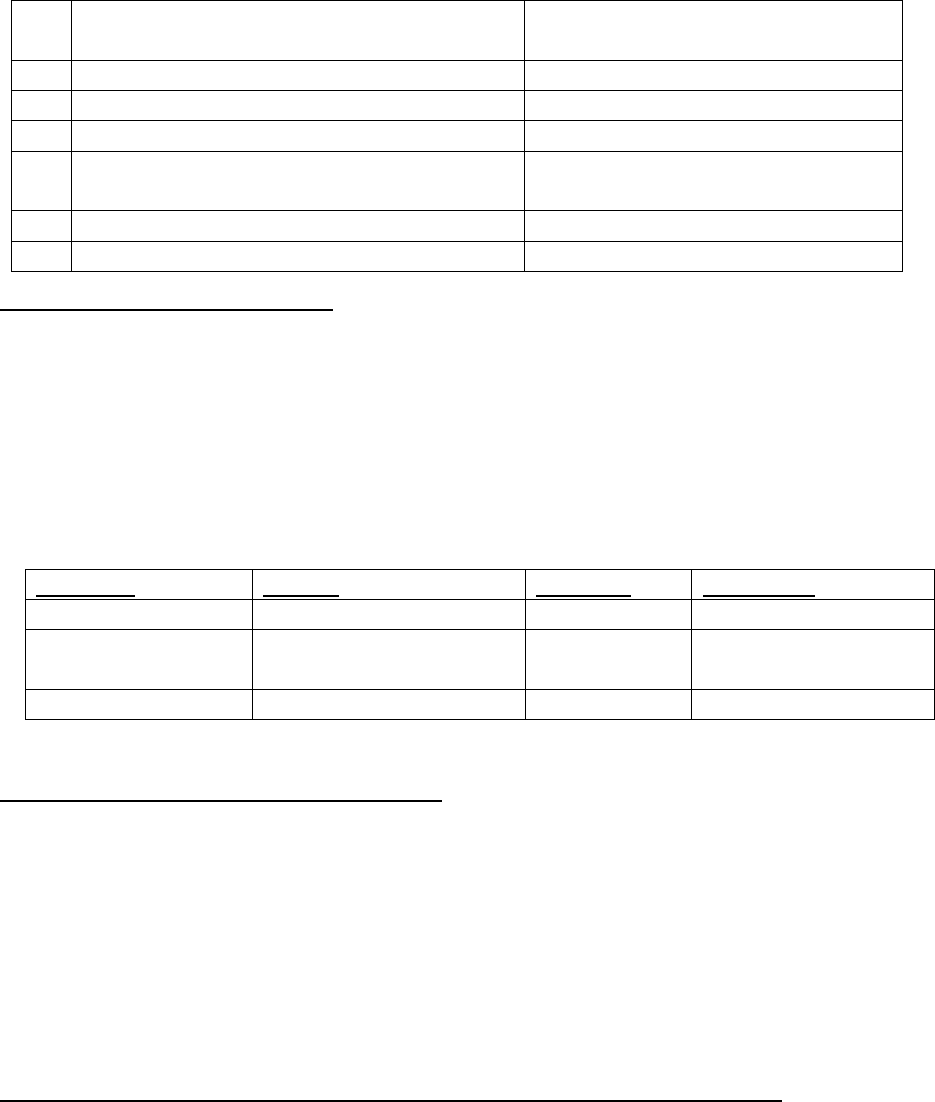

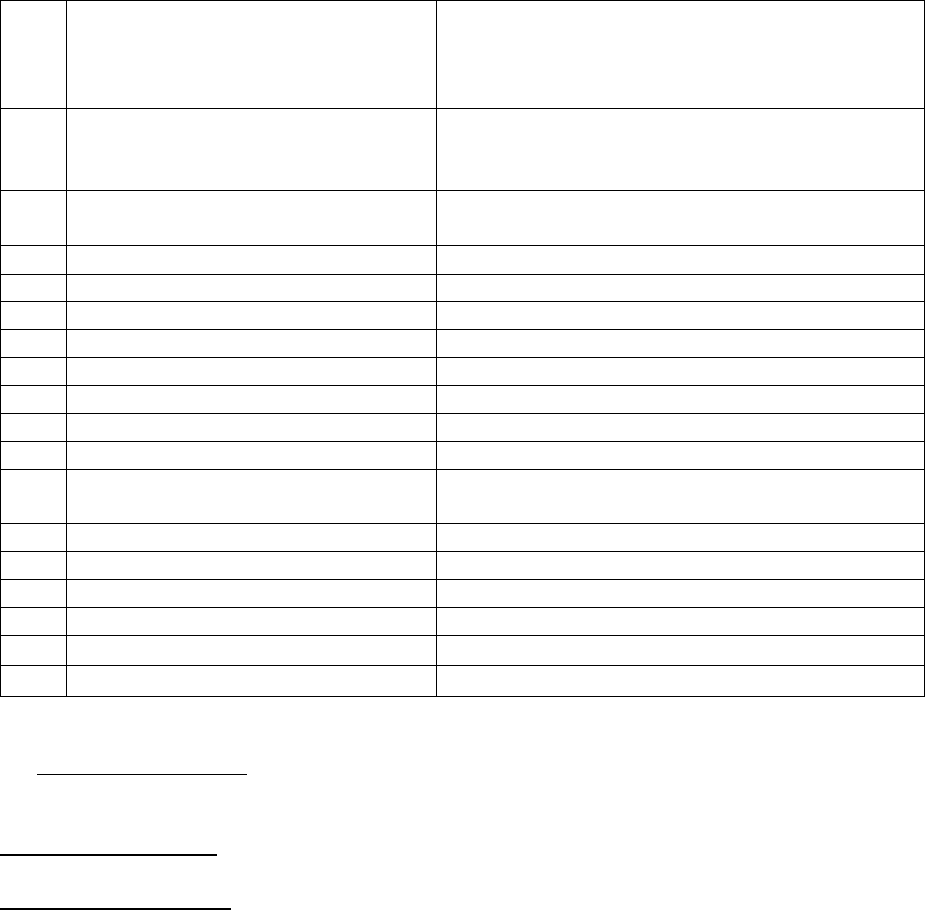

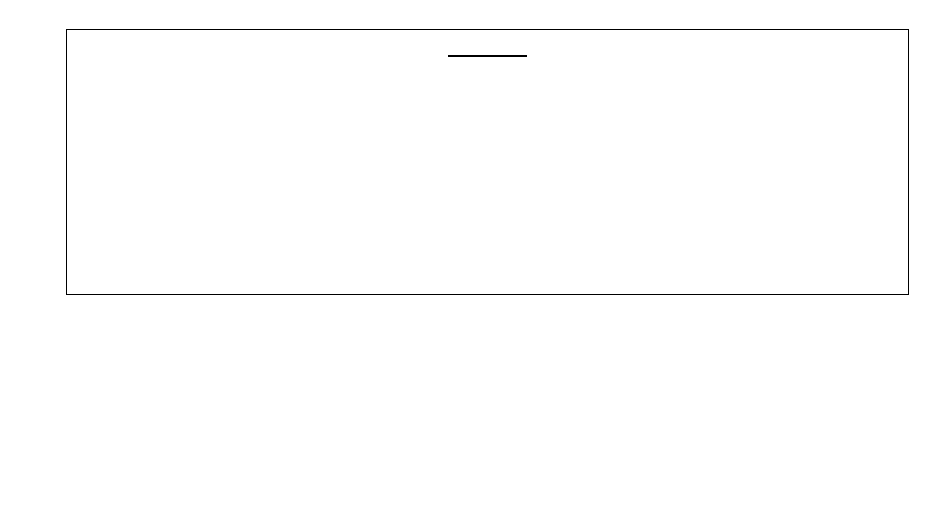

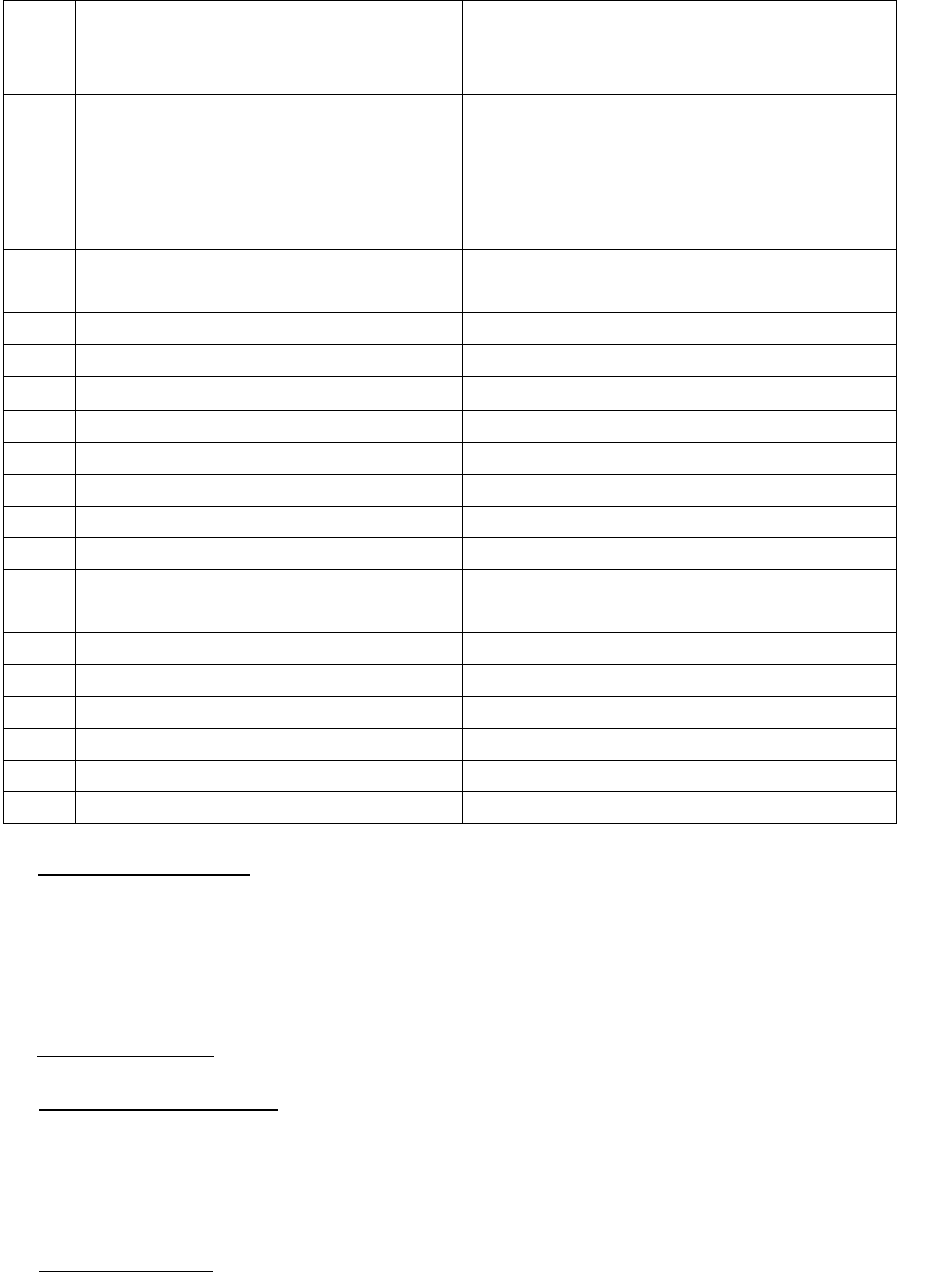

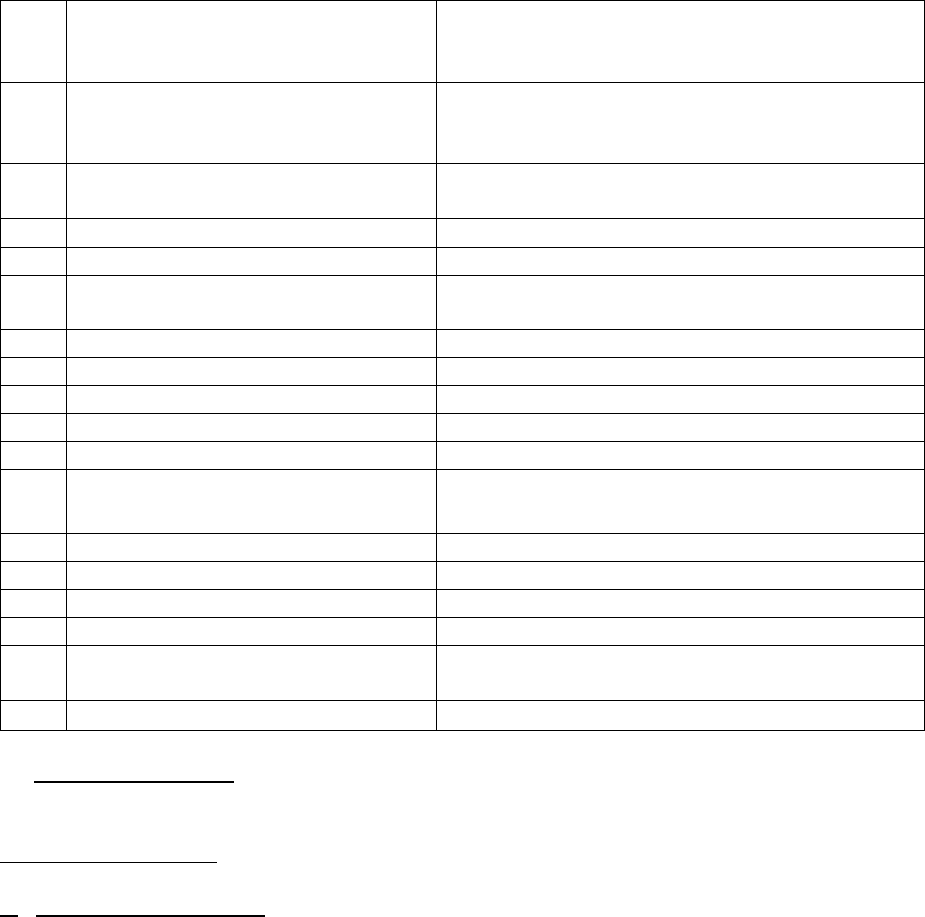

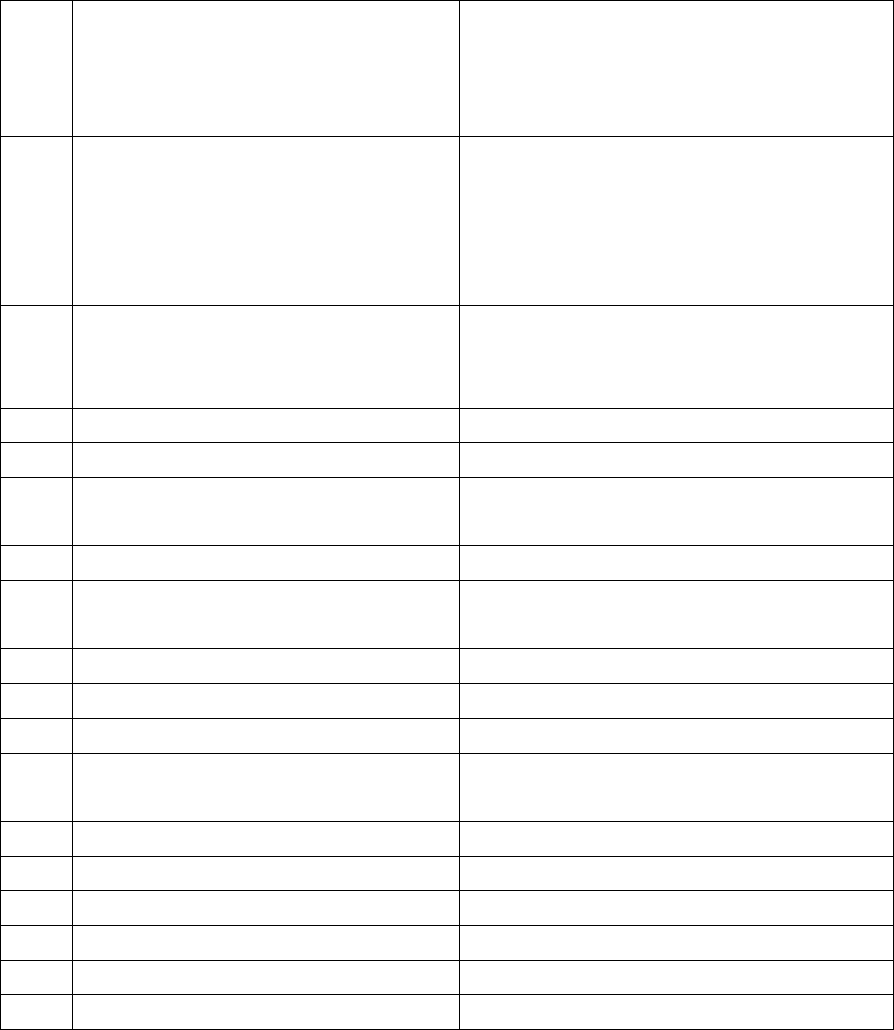

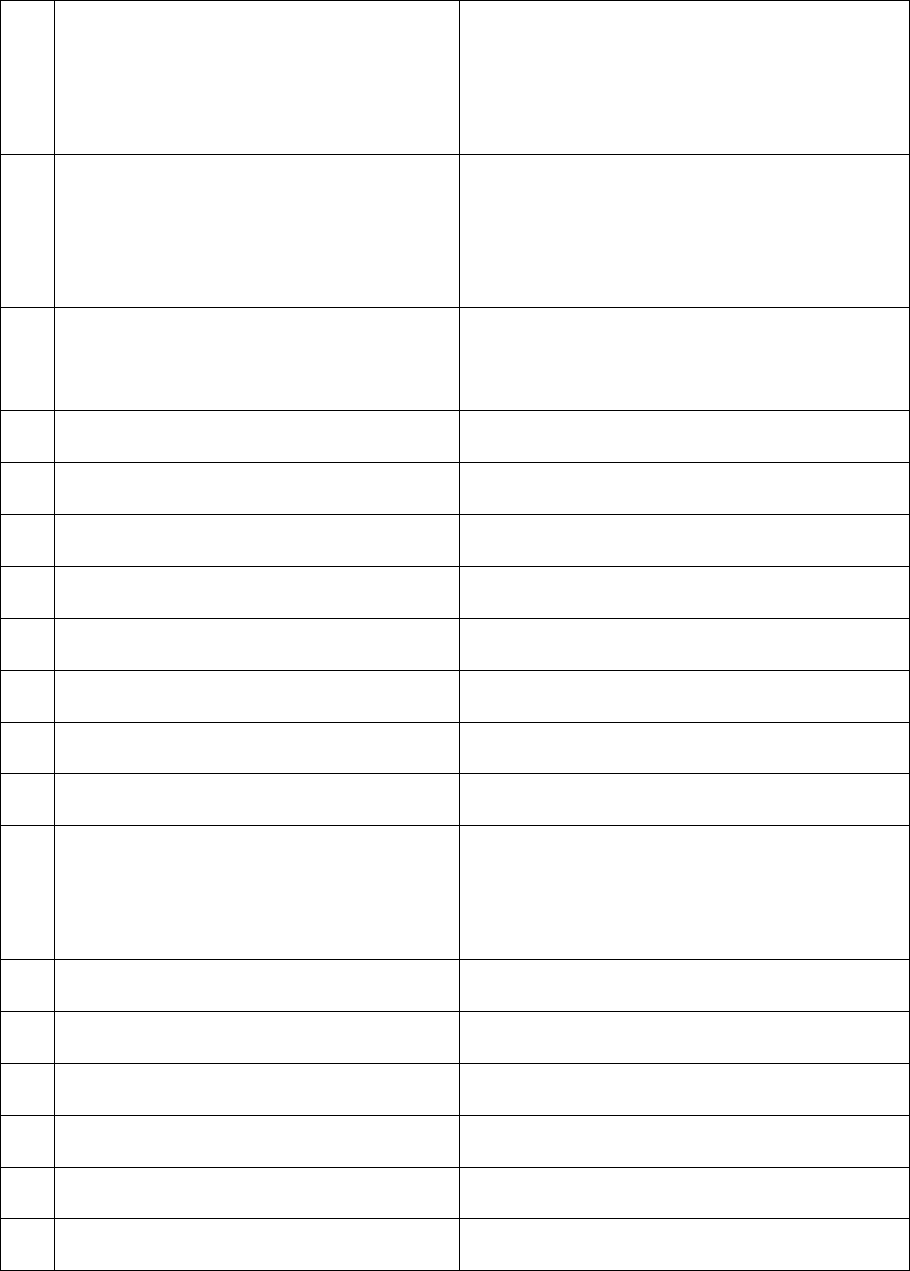

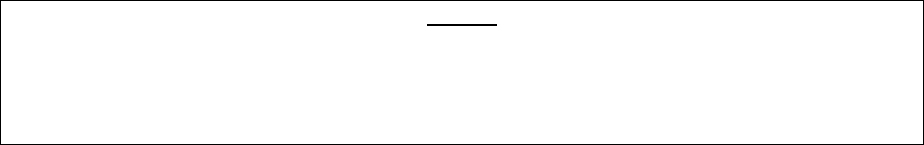

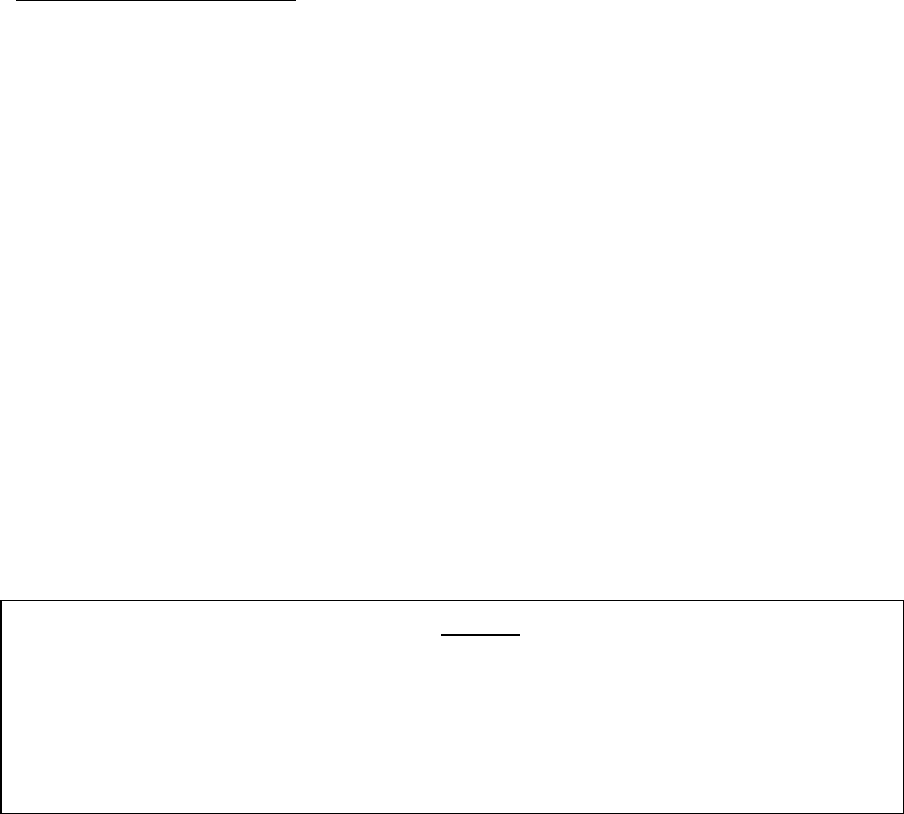

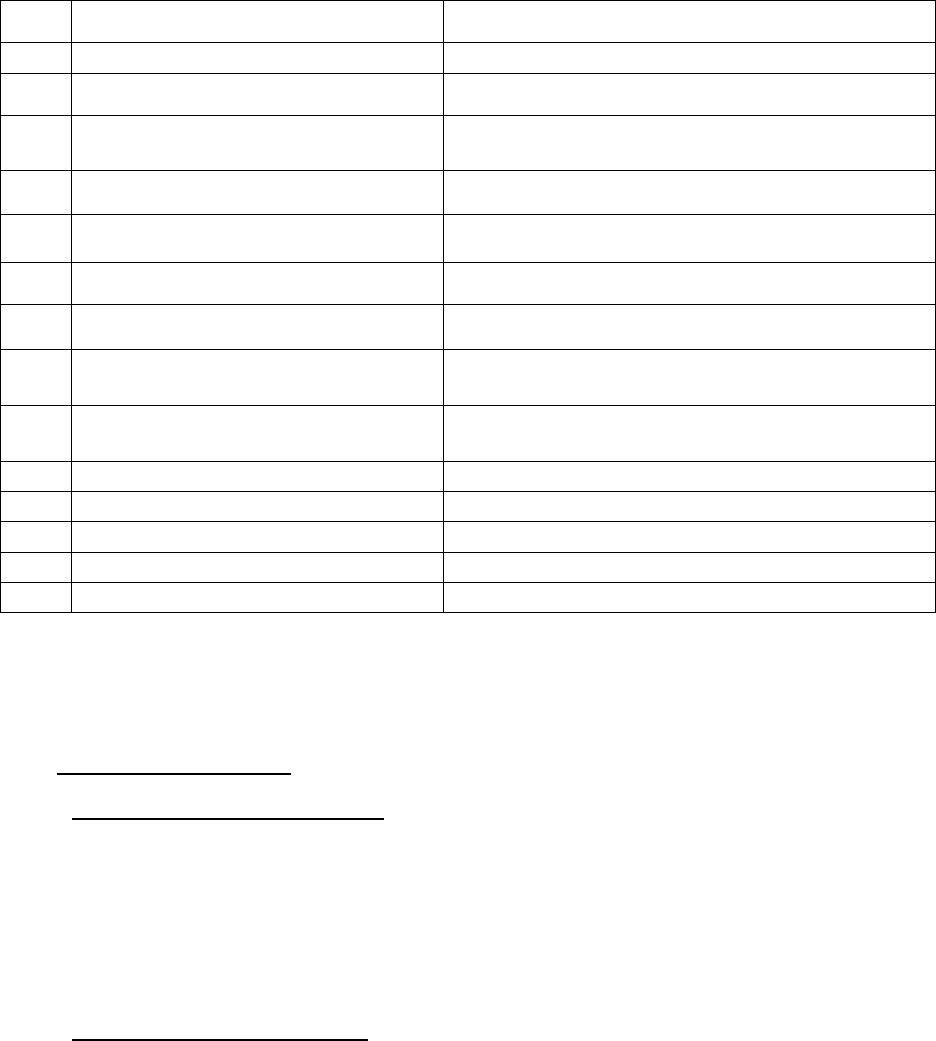

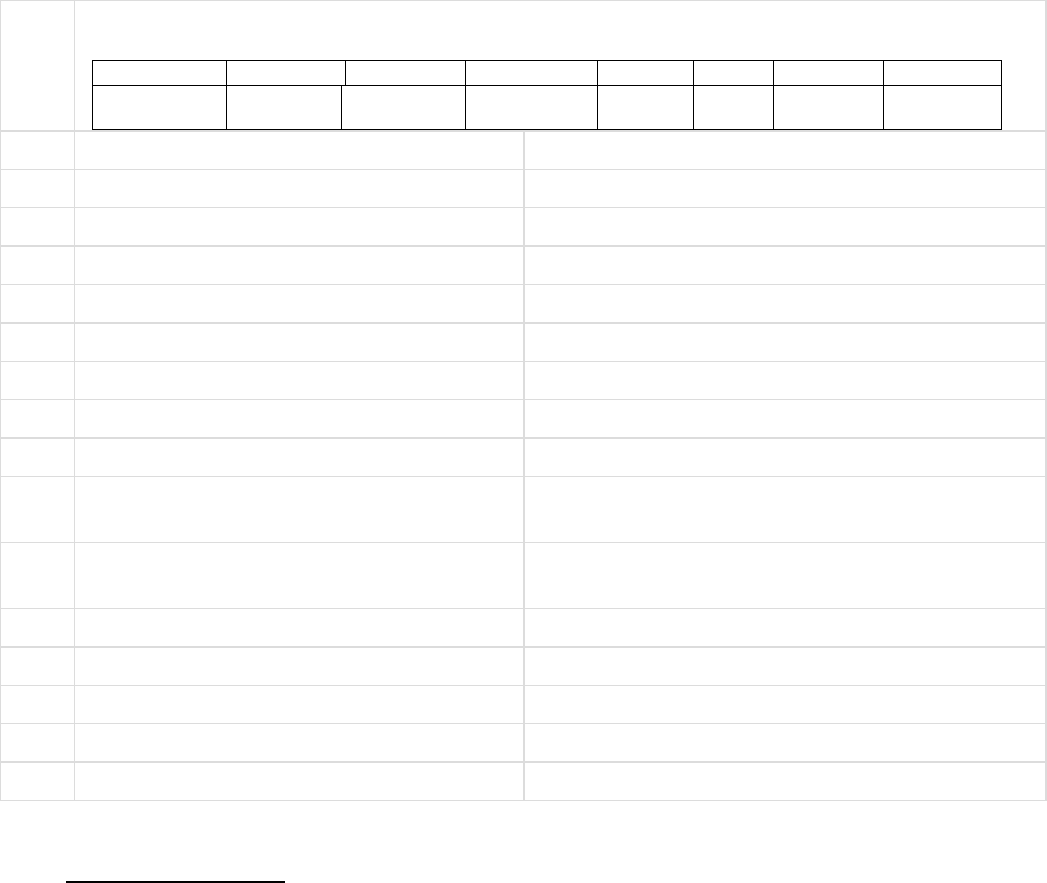

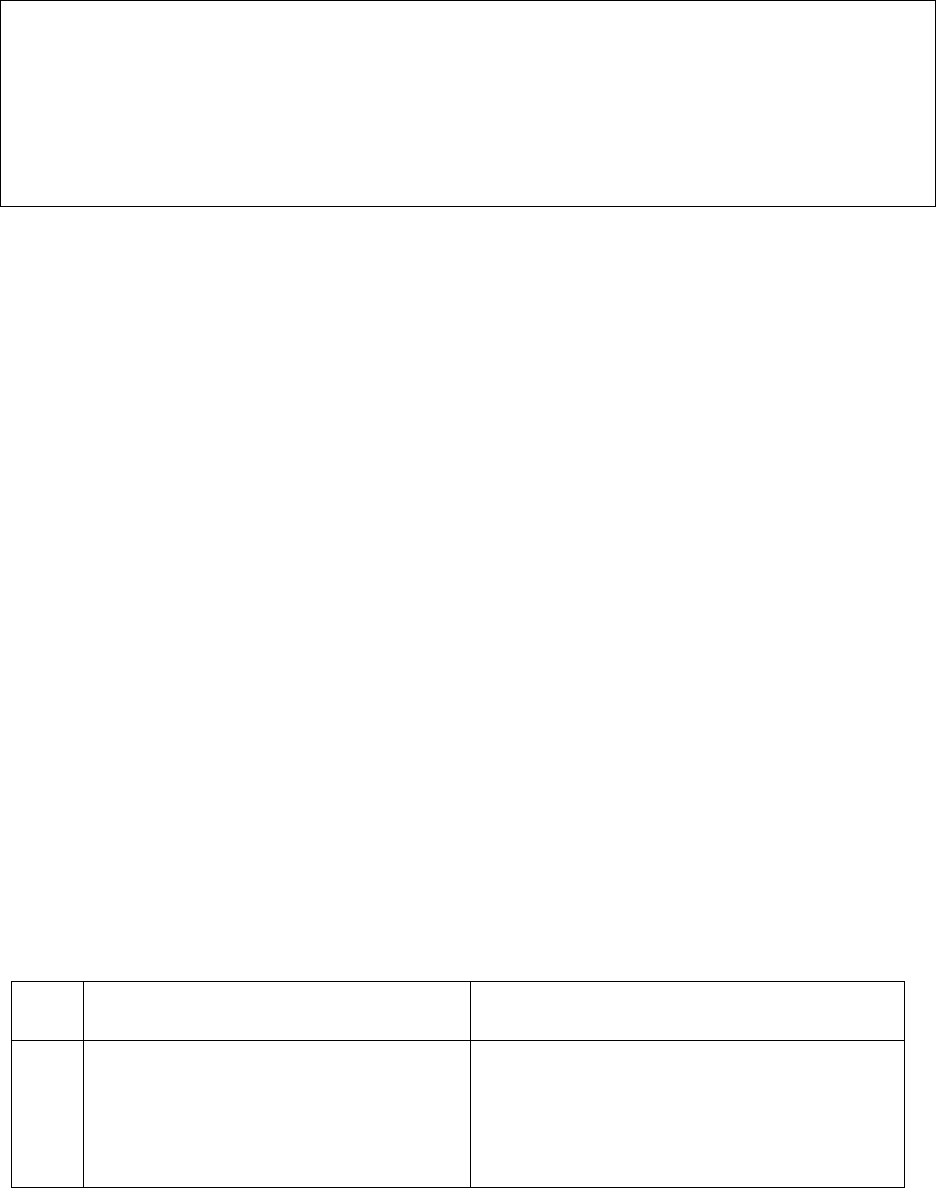

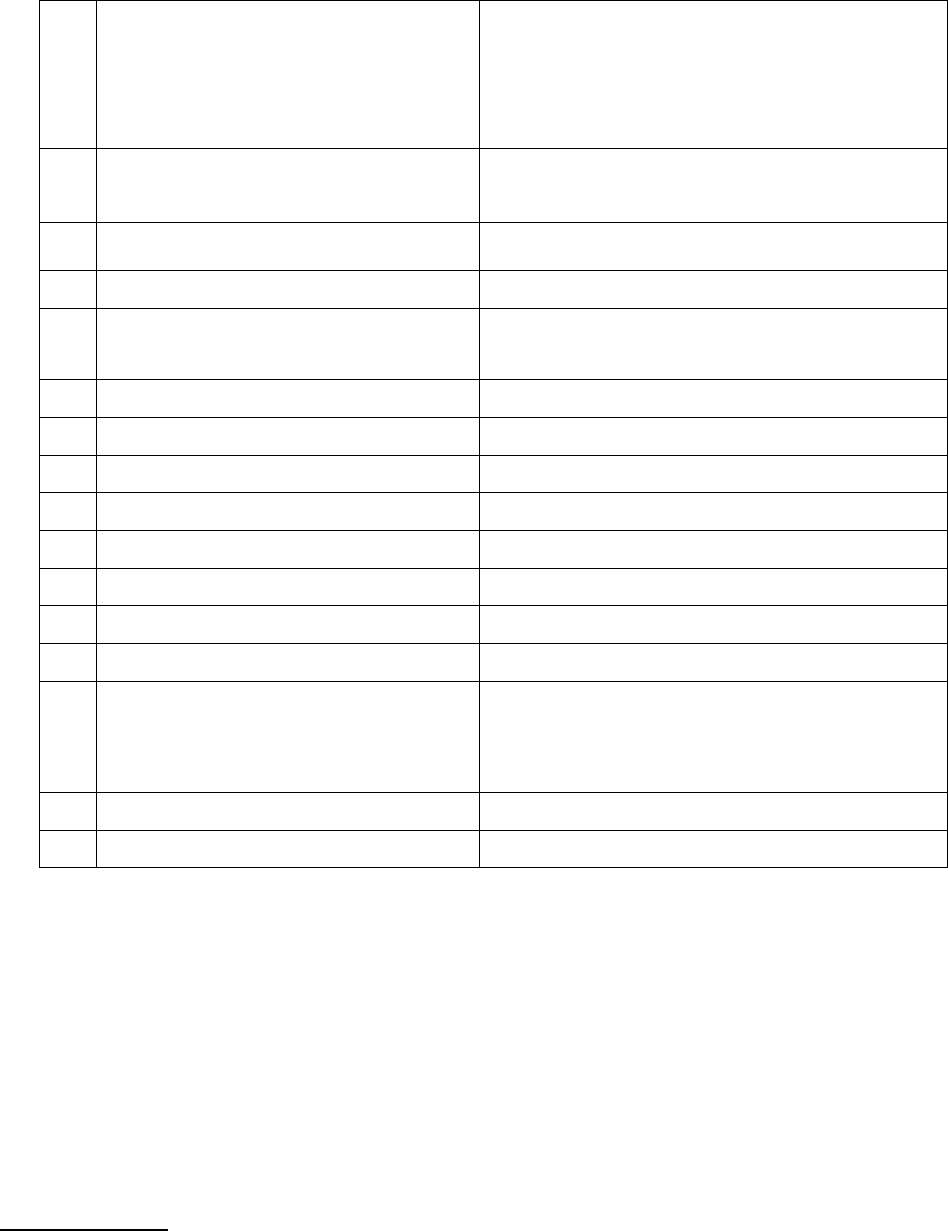

Head of Expense

Amt(Rs)

1

Monitoring

940

2

Admission

260

3

Clinical Support

75

4

Gauze

70

5

Sheet

84

6

Alcohol Swab

4

7

Mask

72

8

I D Tag

28

9

Spirit

44

10

Gown

578

11

BMW

100

12

Hand rub

140

13

Tissue Paper

60

14

Preparation

225

15

Dressing

330

16

Cotton Bandage

30

17

Betadine

84

18

Pulse Oximeter charges

360

19

PPE Kit

1,750

20

Blade

404

21

Scrub Solution

161

22

Cotton

15

23

Apron

233

24

Surgiraze

28

25

Energy, Water

900

6975

Hence the correct claim amount due to the Complainant works out to Rs.2,90,170. Found

accordingly.

5. Award

In the result, I hereby order as under

The Respondent Insurer is directed to pay to the Complainant, an amount of Rs.2,90,170.00

in full and final settlement of his claim under policy number OG-21-1602-6021-00000575. No

interest or cost.

The Respondent Insurer is also directed to reinstate the cancelled policy of the Complainant

with the same coverages and limits and other continuity benefits, charging the appropriate

premium as per their underwriting guidelines so as to ensure that the Complainant and his

spouse continue to have unbroken insurance coverage.

As prescribed in Rule 17(6) of Insurance Ombudsman Rules, 2017, the Insurer shall comply

with the award within 30 days of receipt of the award and intimate compliance of the same

to the Ombudsman.

Dated this the 11

th

day of April, 2022.

Sd/-

Girish Radhakrishnan

INSURANCE OMBUDSMAN

Proceedings of

THE INSURANCE OMBUDSMAN

KERALA, LAKSHADWEEP & MAHE

[Under Rule No.13 1(b) Read with Rule 14 of the Insurance Ombudsman Rules, 2017]

Present: Mr Girish Radhakrishnan

Insurance Ombudsman

Complaint No. KOC-H-055-2122-0901

Complainant : Mr. Sreekumaran Nair

Respondent Insurer : Aditya Birla Health Insurance Company Limited

AWARD

1.

Address of the Complainant

:

Sreeji Bhavan Kuttara Mulliliavinmoodu

Aruvikkara 695564

2.

Policy Number

:

GHI-HB-21-2015172-V2

3.

Name of the Insured

:

Mr. Sreekumaran Nair

4.

Type of Policy

:

HEALTH

5.

Date of receipt of Complaint

:

18.11.2021

6.

Nature of complaint

:

Rejection of claim (Covid)

7.

Date of Hearing

:

18.03.2022

8.

Present at the Hearing for Complainant

:

Mr. Sreejith S S (son)

9.

Present at the Hearing for the Insurer

:

Dr. Pranita Godbole

Award No. IO/KOC/A/HI/0013/2022-23

This is a complaint filed under Rule 13 (1)b read with Rule 14 of the Insurance Ombudsman Rules,

2017. The complaint is regarding an alleged rejection of a claim under a Health Insurance policy

issued by the Respondent Insurer (RI). The Complainant, Mr. Sreekumaran Nair is the

policyholder.

1. Complainant’s Averments

The averments, contentions and submissions in the complaint are summarized as follows:

(1) Complainant’s previous Insurer Bajaj Allianz ported his health insurance to Aditya Birla.

Bajaj Finance had informed him that he would have the same insurance cover upon

porting, according to which he is entitled to have cover for Pulmonary Embolism and deep

Vein Thrombosis.

(2) On 21/10/2021, his wife was diagnosed with Covid 19 Pneumonia and was admitted in

SUT Hospital and discharged on 30/10/2021. He incurred Rs.96,141/- His claim was

however denied, on 12/11/2021, due to his non-disclosure of his wife’s Deep Vein

Thrombosis for which she has been under treatment since 2019.

(3) On 12/11/2021, Bajaj Finance enquired about his wife’s medical history. He informed

them that she was diagnosed with Deep Vein Thrombosis in 2019 and that Bajaj Allianz

had settled claim on May 30

th

, 2019.

(4) Since both Bajaj Finance and Bajaj Allianz were aware of his wife’s condition, and they had

informed him that Aditya Birla would be notified, it is sad that they denied the claim for

Covid 19. He requests the ombudsman to help him with his grievance.

2. Respondent Insurer’s Averments

The RI entered appearance and filed a Self Contained Note (SCN). The averments, contentions

and submissions in the SCN are summarized as follows:

(1) Mr. Sreekumaran Nair referred herein as the Proposer approached RI for a policy via Bajaj

Finance Limited under the group policy no. GHI-TB-OL-21-IN5944144 for a Health

Insurance Cover under RI’s “Group Activ Health Policy”.

(2) RI has issued a welcome letter and certificate of insurance dated 15.11.2021 for the period

covering 15.11.2021 till 14.11.2022. The Policy was issued covering the Insured’s Mr.

Sreekumaran Nair and Mrs. Shobhana Kumari.

(3) The proposer Mr. Sreekumaran Nair has filed for cashless request of Rs. 75,000/- vide Pre-

authorization form for the treatment of Insured Shobhana Kumari. The insured was

hospitalized on 21.10.2021 with an expected hospitalization for 7 days at SUT Hospital,

Pattom. The patient was admitted with provisional diagnosis of COVID Infection Cat B – D

Dimers High.

(4) The case was investigated during the cashless process, and it came to notice from the

Cashless form duly filled and submitted by the Claimant that the Insured has a history of

Pulmonary Embolism with Deep Vein Thrombosis (DVT) in the year 2019 which has not

been disclosed while taking the insurance policy. It is important to note that the history

Pulmonary Embolism is an important fact which is relevant for underwriting of the risk as

it may affect the decision of the underwriter based on the underwriting principles and

claimant has precluded RI from adjudicating the proposal in a fair manner by failing to

disclose the same in the proposal form submitted for availing the policy. Further, RI would

also like to apprise the forum that the patients with Pulmonary Embolism tend to report

shortness of breath or impairment or difficulty in functioning of the lungs even after the

treatment of the same.

Pulmonary embolism is a blockage in one of the pulmonary arteries in lungs. In most cases,

pulmonary embolism is caused by blood clots that travel to the lungs from deep veins in

the legs or, rarely, from veins in other parts of the body (deep vein thrombosis)

(5) Thus, the claim was declined stating the reason “On scrutiny of the documents it is

observed that patient is suffering from Pulmonary Embolism with Deep Vein Thrombosis

since 2019 which was not disclosed at the time of inception of the Policy. Hence, this claim

stands denied for Non- disclosure of material facts and hence, we are unable to approve

the claim. ”

(6) The claim is declined in accordance with the terms and conditions of the policy. The clause

reads as under:

Disclosure of Information Norm: means the Policy shall be void and all

premium paid hereon shall be forfeited to the Company, in the event of

fraud, misrepresentation, mis-description or non- disclosure of any material

fact.

(7) Without prejudice to the submissions as made in supra para it is submitted that the

Complainant never filled a reimbursement claim and has directly approached

Ombudsman Forum. Thus, it is important to note that RI has discharged their duty strictly

in accordance with the IRDAI guidelines and hence cannot be compelled to pay something

which is inadmissible.

(8) Insurance policy is given on utmost good faith. Decline of claim is based on the product

structure and the guiding claims and medical principles.

(9) In the view of the above, RI requests the Hon’ble Ombudsman to kindly dismiss the

complaint.

3. I heard the Complainant and the Respondent Insurer at a Hearing on 18.03.2022.

The Complainant’s son reiterated the statements in the written complaint and further stated

that his mother was hospitalized for Covid pneumonia but the claim was denied stating non-

disclosure of Pulmonary Embolism. The policy was ported from Bajaj Allianz with whom the

insurance cover was from 2018 to 2020. During this period a hospitalization claim of his

mother for Pulmonary embolism was paid by Bajaj Allianz. Bajaj Finance had ported the policy

to Aditya Birla Health Insurance Co. Ltd.

The Respondent Insurer stated that the Complainant had sought Cashless facility for

hospitalization of his wife and the same was denied due to Non-disclosure of her pre- existing

disease of pulmonary embolism, at the time of porting the policy. There was no information

received regarding pre-existing disease, from previous insurer during porting.

4. At the Hearing, the RI was asked to submit to this office, a copy of the full wording of the

policy and audio file/transcript of telecall with Complainant, proposal form and policy porting

form to enable a clearer understanding of the matter. The RI reverted on 6

th

April 2022

informing the office of their readiness to settle the claim per terms and conditions of the

policy.

While this is a welcome development, RI’s attention is also drawn to the requirements of the

IRDAI Master Circular on Health Insurance Ref: IRDAI/HLT/REG/CIR/193/07/2020 dated 22

July 2020 including specifically, Lists II, III and IV under its Annxure I.

5. Award

In the result, this Award is passed, directing the Respondent Insurer to process the

Complainant’s claim as per terms and conditions of the policy in question and keeping in mind

IRDAI Master Circular on Health Insurance dated 22 July 2020 and pay him the due claim

amount thereof. No interest or cost.

As prescribed in Rule 17(6) of Insurance Ombudsman Rules, 2017, the Insurer shall comply

with the award within 30 days of receipt of the award and intimate compliance of the same

to the Ombudsman.

Dated this the 11

th

day of April, 2022.

Sd/-

Girish Radhakrishnan

INSURANCE OMBUDSMAN

Proceedings of

THE INSURANCE OMBUDSMAN

KERALA, LAKSHADWEEP & MAHE

[Under Rule No.13 1(b) Read with Rule 14 of the Insurance Ombudsman Rules, 2017]

Present: Mr Girish Radhakrishnan

Insurance Ombudsman

Complaint No. KOC-H-035-2122-0850

Complainant : Ms. Jaya Chacko Cheriyan

Respondent Insurer : Reliance General Insurance Company Ltd.

AWARD

1.

Address of the Complainant

:

T C 19/940 Pearl Gardens Thamalam

Poojappura 695012

2.

Policy Number

:

220392128451000043

3.

Name of the Insured

:

Ms. Jaya Chacko Cheriyan

4.

Type of Policy

:

HEALTH

5.

Date of receipt of complaint

:

02.11.2021

6.

Nature of complaint

:

Rejection of Claim

7.

Date of Hearing

:

24/03/2022

8.

Present at the Hearing for the Complainant

:

Ms. Jaya Chacko Cheriyan

9.

Present at the Hearing for the Insurer

:

Mr. Sujith Krishna,

Dr.Santhosh Kumar

Award No. IO/KOC/A/HI/0016/2022-23

This is a complaint filed under Rule 13 (1)b read with Rule 14 of the Insurance Ombudsman Rules,

2017. The complaint alleges rejection of a claim under a Health Insurance policy issued by the

Respondent Insurer (RI). The Complainant, Ms. Jaya Chacko Cheriyan is the policyholder.

1. Complainants’ Averments

The averments, contentions and submissions in the complaint are summarized as follows:

(1) The Complainant, one of the Directors of Saj Flight Services (P) Ltd is having current

account with Bank of India, Palayam Branch, Trivandrum.

(2) BOI offers to all its customers, insurance coverage under BOI Swasthya Bima Scheme from

2017 onwards. The Complainant and her family were covered under the scheme till date.

(3) On 3rd April 2019, the insurance coverage for BOI customers was taken over by the

Respondent Insurer, Reliance General Insurance Company (RI).

(4) The RI has issued the health insurance policy for the year 2021-22. Till date the she have

not availed any claim from the RI.

(5) During September 2021, the doctor advised her to conduct Cataract operation for her

right eye and she was admitted in Chaithanya Eye Hospital & Research Institute,

Trivandrum.

(6) The operation was planned to conduct on 5th October 2021, so the insurance help desk

of the hospital submitted cashless claim form on 1st of October 2021.

(7) Without any investigation, the RI rejected her claim stating that “As per received claim

documents, patient had past history of DM since 18 years and has undergone Angioplasty

3 years back and the same was not disclosed in the proposal form during the inception of

policy with Reliance General Insurance (RI) dated 11/04/2019, hence the claim is

repudiated under Clause 6.1-Disclosure of information norm.”

2. Respondent Insurer’s Contentions

The RI entered appearance and filed a Self Contained Note (SCN). The averments, contentions

and submissions in the SCN are summarized as under:-

(1) The Complainant Insured applied and purchased RGI-BOI Swasthya Product Insurance

Policy after understanding the policy features, benefits, terms and conditions and

exclusions.

(2) RI have informed the Complainant regarding the necessary documents required for

processing the claim and have requested for the Discharge Summary, Final Bills, all

breakups and paid receipts, cancelled cheque/pass book copy of insured and copy of PAN

Card etc.

(3) RI contacted the Complainant on multiple occasions, for which the Complainant was

hesitant to provide the necessary documents. The RI had requested over phone as well

as through mail for the necessary documents for processing the claim on multiple

occasions but the same has not been submitted even now by the Complainant.

(4) RI is still willing to settle the claim of the Complainant herein as per the terms and

conditions mentioned in the policy by paying the admissible amount. But the same is not

possible to be processed without the required documents.

(5) The Hon’ble forum may graciously direct the Complainant to submit the necessary

documents and accept the admissible amount and to settle the matter amicably in the

interest of justice.

3. I heard the Complainant and the Respondent Insurer at a Hearing on 24/03/2022

The Complainant reiterated her statements in the written complaint and further stated that

she intimated the claim to the RI for pre-authorisation prior to the scheduled date of surgery

(05/10/2021), since for Cataract surgery, pre-authorisation is mandatory as per policy terms.

Continuity benefits allowed in the policy schedule as stated in the policy which reads:

Continuity benefits allowed as per the duration of policy one is holding in earlier/existing

scheme operated by Bank of India and on renewal wishes to renew the policy with us, then

he/she shall be given the benefit of continuity on the expiring policy’s Sum Insured. Hence the

denial of claim by the RI is against the policy conditions. Their allegation about the non-

disclosure of the disease history of the insured is also false as this is a continuity policy.

The Respondent Insurer reiterated their contentions in the SCN and expressed their will to

settle the claim of the Complainant as per the terms and conditions mentioned in the policy

by paying the admissible amount. They asked to produce the necessary documents required

for processing the claim and have requested the submission of the Discharge Summary, Final

Bills, all breakups and paid receipts, cancelled cheque/pass book copy of insured and copy of

PAN Card etc. for an early settlement.

4. Having heard both the sides and having perused all the documents submitted in detail, I find

as under:-

(1) The Complainant and spouse were covered under BOI Swasthya Bima scheme from 2007

onwards. The insurance coverage for BOI Swasthya Bima scheme was taken over by the

RI, Reliance General Insurance Company with continuity benefits.

(2) The date of enrollment to the scheme is clearly mentioned in the policy schedule is 14,

Mar 2014. Continuity benefits allowed in the policy schedule as stated in the policy.

Hence the waiting period for specified diseases and pre-existing illnesses has no relevance

in the scope of the policy issued by the RI.

(3) RI is on record as having expressed their readiness to settle the subject claim of the

Complainant as per the terms and conditions mentioned in the policy by paying the

admissible amount for which they have been requesting the Complainant repeatedly to

submit the relevant documents, viz; Discharge Summary, Final Bills, all breakups and paid

receipts, cancelled cheque/pass book copy of insured and copy of PAN Card etc. for an

early settlement.

(4) I am unable to comprehend why the Complainant is not willing or able to supply the

required documentation to enable settlement of her claim. I find no ground to order any

specific relief except to direct her to provide the required documents to RI who in turn

must process her claim with all due dispatch.

5. Award

In the result, this Award is passed, directing the Complainant to submit the required

documentation to the Respondent Insurer and directing the latter to process the

Complainant’s claim with all due dispatch and pay her the correct and reasonable claim

amount as per terms, conditions, exceptions and limits (caps) specified in the policy.

As prescribed in Rule 17(6) of Insurance Ombudsman Rules, 2017, the Insurer shall comply

with the award within 30 days of receipt of the award and intimate compliance of the same

to the Ombudsman.

Dated this the 13

th

day of April 2022

Sd/-

Girish Radhakrishnan

INSURANCE OMBUDSMAN

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, PUNE

(STATE OF MAHARASHTRA EXCEPT MUMBAI METRO)

UNDER SECTION 16/17 OF THE INSURANCE OMBUDSMAN RULES-2017

OMBUDSMAN– VINAY SAH

CASE OF MR. DATTATRAY S BHOSALE V/S CHOLAMANDALAM MS GEN INS CO LTD

COMPLAINT NO: PUN-H-012-2021-0653

Award No IO/PUN/A/HI/ /2022-23

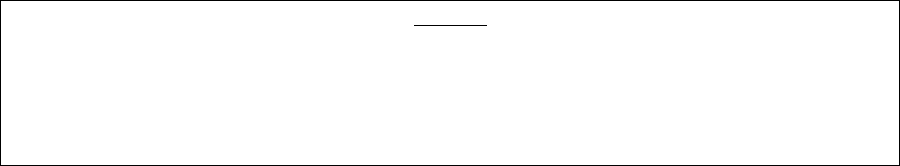

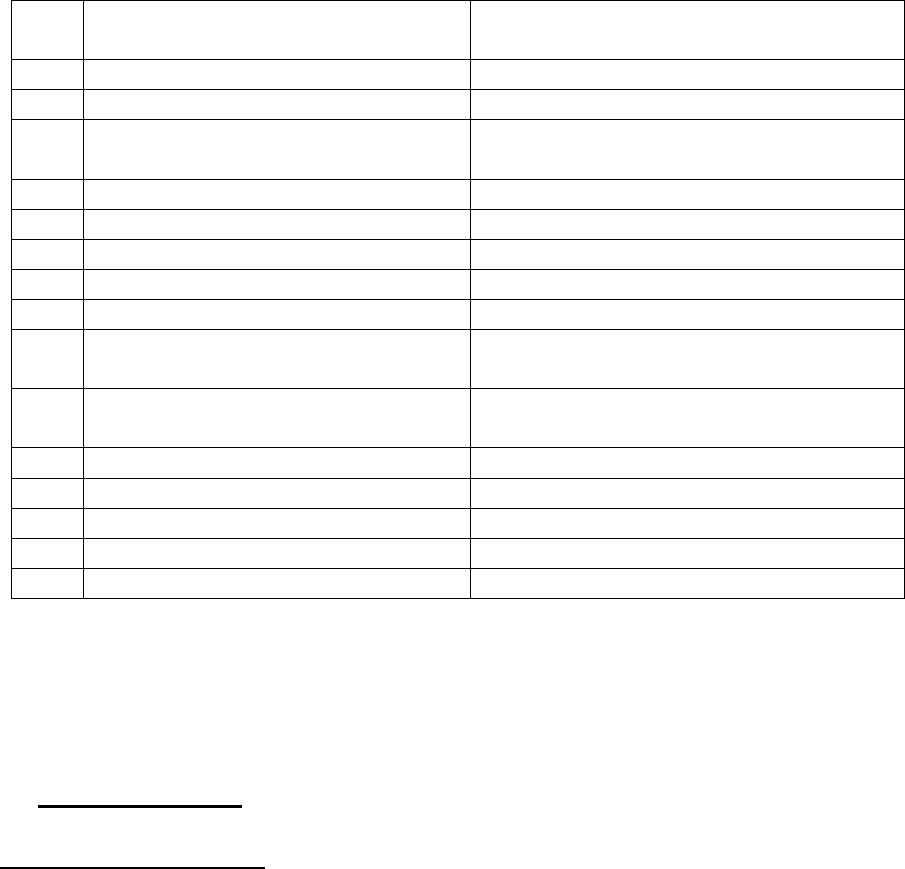

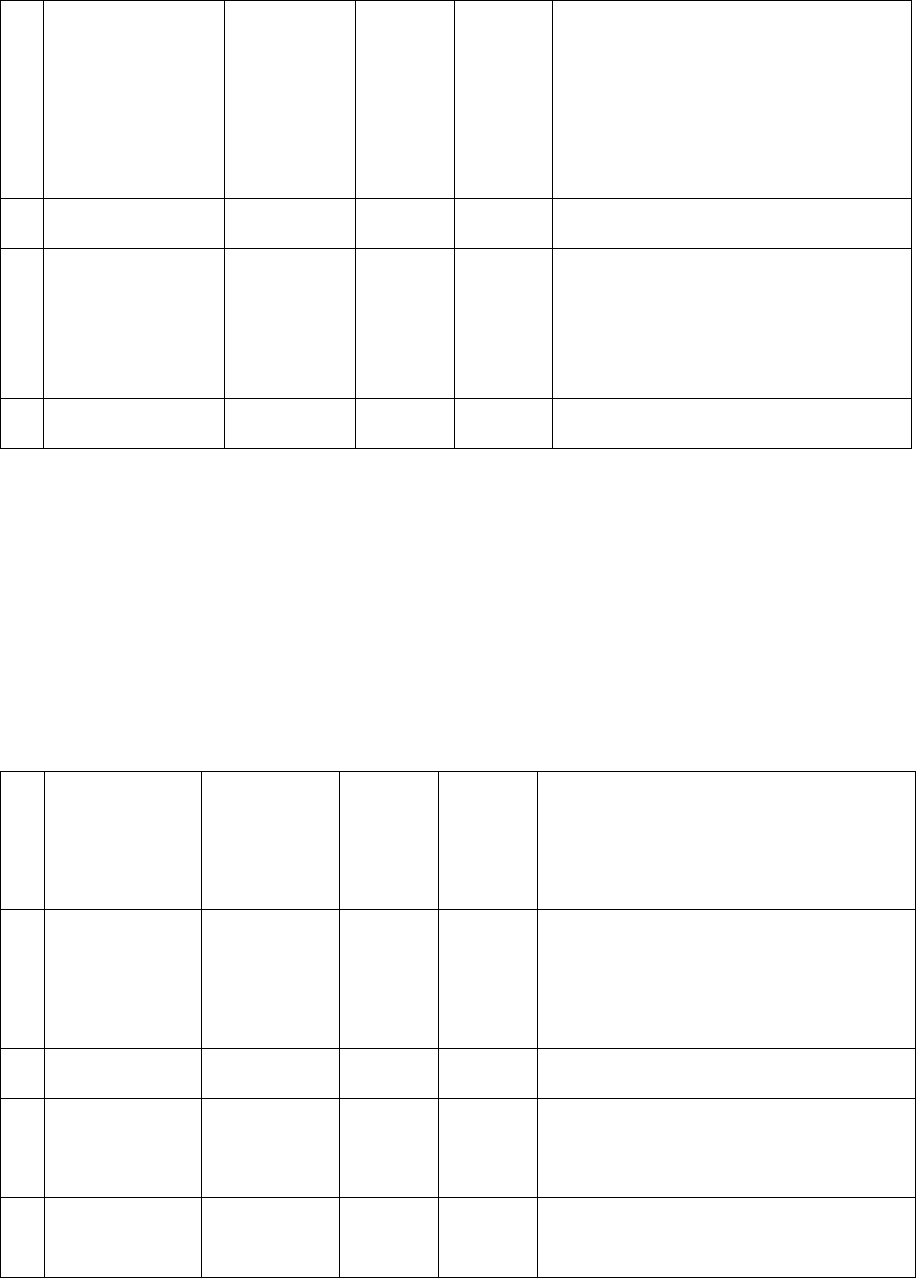

1.

Name & Address of the Complainant:

Mr. Dattatray S Bhosale ,Pune

2.

Policy No:

Type of Policy:

28XXXX00/00

Group Health Insurance

(Family Floater)

3.

Policy period:

21.07.2020 to 20.07.2021

4.

Sum Insured

500000

5.

Date of inception of first policy:

6.

Name & Age of the Insured and Policyholder:

Mr.Dattatray Bhsoale, 35 yrs

7.

Name of the Insurer:

Cholamandalam MS Gen Ins Co Ltd

8.

Reason for repudiation/Partial Settlement:

Hospitalization period does not

warrant inpatient admission

9.

Date of receipt of the Complaint:

15.02.2021

10.

Nature of complaint:

Full settlement of claim amount

11.

Amount of Claim:

Rs.60,822 /-

12.

Insurance Ombudsman Rule (IOR)2017 under

which the Complaint was registered:

Rule 13 1 (b)

13.

Date of hearing/Place:

On line hearing on 25.03.2022

14.

Representation at the hearing

c) For the Complainant:

Himself

d) For the insurer:

Mangesh Inamdar, Dr. Minal Vinoth

15.

Complaint how disposed:

Dismissed

Contentions of the Complainant:-

• The complainant had taken Group health insurance (Family floater) with Respondent

Insurer The Cholamandalam MS Gen Ins. Co Ltd for self for SA 5 lakh. He lodged claim of

self-hospitalization in Siddhivinayak Criticare Hospital from 02.09.2020 to 08.09.2020 for

Bilateral Pneumonia with mild ARDS with covid negative. The total expenditure on