INCOME TAX

INTRODUCTION

This simplied tax flyer on income tax was

prepared as a guide to newly registered taxpayers

and other existing taxpayers seeking to better

understanding their tax obligations and rights to

smoothen their business operations.

The information provided in this flyer is sourced

from the following tax laws:

Law Nº 027/2022 of 20/10/2022 establishing

taxes on income

Law nº 051/2023 of 05/09/2023 amending Law

nº 027/2022 of 20/10/2022 establishing taxes on

income

WHAT IS TAX ON INCOME?

Tax on income is a tax imposed on prots of an

individual or a company that set up a business or

other taxable activities.

TAX PERIOD

The income tax is calculated for the calendar year,

which starts on 1st January and ends on 31st

December unless otherwise provided by the law.

The personal income tax shall be levied on an

individual annual income

Each tax period, a resident taxpayer is liable to

personal income tax from all domestic and foreign

sources

DISTINCT TYPES OF INCOME TAX

1. PERSONAL INCOME TAXE (PIT):

1.1 PIT- Flat tax regime

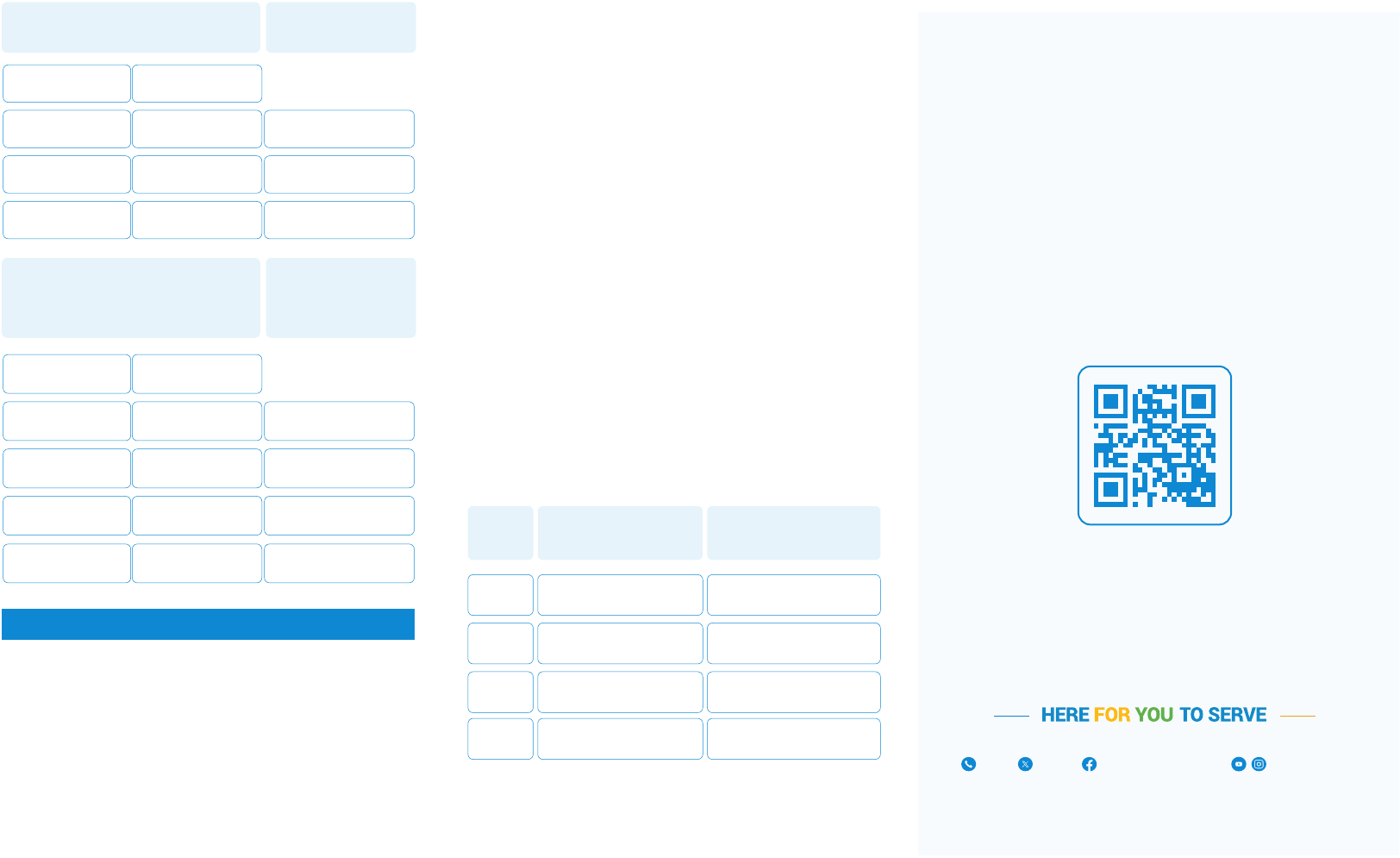

PIT REGIMES BASED ON ANNUAL TURNOVER

REALIZED

A lump sum tax rate of 3% is applied on a turnover

by business activities which realize a turnover

ranging between twelve million and one Rwandan

francs (FRW 12,000,001) and twenty million

Rwandan francs (FRW 20,000,000) per each tax

period. They can opt to carry out accounting

subject to authorization by the Tax Administration.

This decision is irrevocable for a period of three

(3) years starting from the date the taxpayer has

informed the Tax Administration.

Annual Turnover/

sales in (Frw)

Income tax quarterly

prepayment

Annual

Flat Tax

(Frw)

From 1-2,000,000

From 2,000,001-

4,000,000

From 4,000,001-

7,000,000

From 7,000,001-

10,000,000

From 10,000,001 -

12,000,000

No Tax

60,000

120,000

210,000

300,000

No tax

A quarterly

prepayment tax is is

calculated based on

the tax paid for the

previous annual tax

period divided by the

turnover of the same

tax period, times the

current quarterly

turnover

1.2 PIT - Lump sum tax regime

1.3 PIT Real regime

Annual Taxable Prot in

Rwandan francs (FRW) in 2023

Annual Taxable Prot in

Rwandan francs (FRW) in

2024 Going forward

Tax Rate

Tax Rate

0

0

1,200,0001

1,200,0001

2,400,001

720,0001

720,0001

From

From

720,000

720,000

More

2,400,000

More

1,200,000

1,200,000

To

To

0%

0%

30%

20%

20%

20%

10%

Taxable income is taxed following the real prot

realized according to the following tables:

2. CORPORATE INCOME TAX (CIT)

Corporate income tax is levied on business prots

received by taxpayers other than individuals

Taxable Business prot of companies is rounded

down to the nearest 1000 Rwandan Francs and

taxable at a rate of 28%.

For more information, please

contact us on Following address:

Call Center: 3004

E-mail:[email protected].rw

Website: www.rra.gov.rw

March 2024

@rrainfo Rwanda Revenue Authority Rwanda Revenue

3004

Tax declaration and tax payment:

However, a newly listed company on capital

market in Rwanda is taxed for a period of ve years

starting from the date of listing on the following

rates:

(a) 20% if that company sells at least 40% of its

shares to the public;

(b) 25% if that company sells at least 30% of its

shares to the public.

1. Annual tax declaration: Not later than 31st

March of the following tax period;

2. Quarterly prepayment: paid not later than 30th

June, 30th September, 31st December and

31st of March) of the year of taxable business

activities. This amount is reduced by the tax

withheld in that quarter, unless the taxable

income is not included in the total taxable

income.

Summarized table of income tax prepayments

(Corporate and individual business) is here below:

Tax period

Declaration and

Payment period

Quarter

January 1

st

to March

31

st

July 1

st

to September

30

th

April 1

st

to June 30

th

January1

st

to

December 31

st

1

3

2

Annual

April 1

st

to 30

th

June

October 1

st

to 31

st

December

July 1

st

to 30

th

September

January 1

st

to 31

st

March

of the following year

Note: The annual income tax is settled after

deducting the quarterly prepayments tax paid in

advance