Paraguay ECT Final Report

i

Office of

Technical

Assistance:

Rwanda

Revenue

Program

Program Evaluation

Report

Final Submission

Aug 1, 2023

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

i

Table of Contents

I. EXECUTIVE SUMMARY .................................................................................................. 1

KEY FINDINGS AND CONCLUSIONS .............................................................................................. 1

KEY RECOMMENDATIONS ............................................................................................................ 3

II. EVALUATION OVERVIEW .......................................................................................... 5

PROGRAM DESCRIPTION .............................................................................................................. 5

EVALUATION PURPOSE ................................................................................................................ 6

EVALUATION QUESTIONS ............................................................................................................ 7

EVALUATION METHODOLOGY ..................................................................................................... 7

DATA COLLECTION ...................................................................................................................... 8

QUALITY ASSURANCE .................................................................................................................. 8

LIMITATIONS ................................................................................................................................ 9

III. FINDINGS AND CONCLUSIONS ................................................................................. 9

PROGRAM COMPONENT 1: KEY PERFORMANCE INDICATORS (KPIS) ......................................... 10

PROGRAM COMPONENT 2: COMPLIANCE IMPROVEMENT PLANNING .......................................... 13

PROGRAM COMPONENT 3: TAX DEBT COLLECTIONS ................................................................. 15

PROGRAM COMPONENT 4: SPECIALIZED SECTOR AUDIT............................................................ 22

PROGRAM COMPONENT 5: COMPUTER-ASSISTED AUDIT ........................................................... 25

PROGRAM COMPONENT 6: GENERAL AUDIT CAPACITY ............................................................. 28

PROGRAM COMPONENT 7: TAX DISPUTE RESOLUTION .............................................................. 32

PROGRAM COMPONENT 8: INTERNAL AUDIT ............................................................................. 36

PROGRAM COMPONENT 9: RISK MANAGEMENT (INFORMATION TECHNOLOGY RISK

MANAGEMENT) .......................................................................................................................... 39

EVALUATION QUESTION 3 ......................................................................................................... 44

IV. PROGRAM LEVEL RECOMMENDATIONS ........................................................... 44

PROGRAM DESIGN CONSIDERATIONS ......................................................................................... 44

STAFFING AND ONBOARDING CONSIDERATIONS ........................................................................ 46

V. ANNEXES ........................................................................................................................... 48

ANNEX A. LIST OF DOCUMENTS REVIEWED .............................................................................. 48

ANNEX B. KEY INFORMANTS INTERVIEWED .............................................................................. 49

ANNEX C. EVALUATION TEAM .................................................................................................. 50

ANNEX D. EVALUATION TEAM’S RESPONSE TO THE OTA REVENUE TEAM’S COMMENTS ......... 51

ANNEX E. OTA RESPONSE TO “OFFICE OF TECHNICAL ASSISTANCE: RWANDA REVENUE

PROGRAM EVALUATION REPORT” ............................................................................................. 52

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

ii

This report was prepared by Bixal

August 1, 2023

Bixal Solutions, Inc.

3050 Chain Bridge Road, Suite 305

Fairfax, VA 22030

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

iii

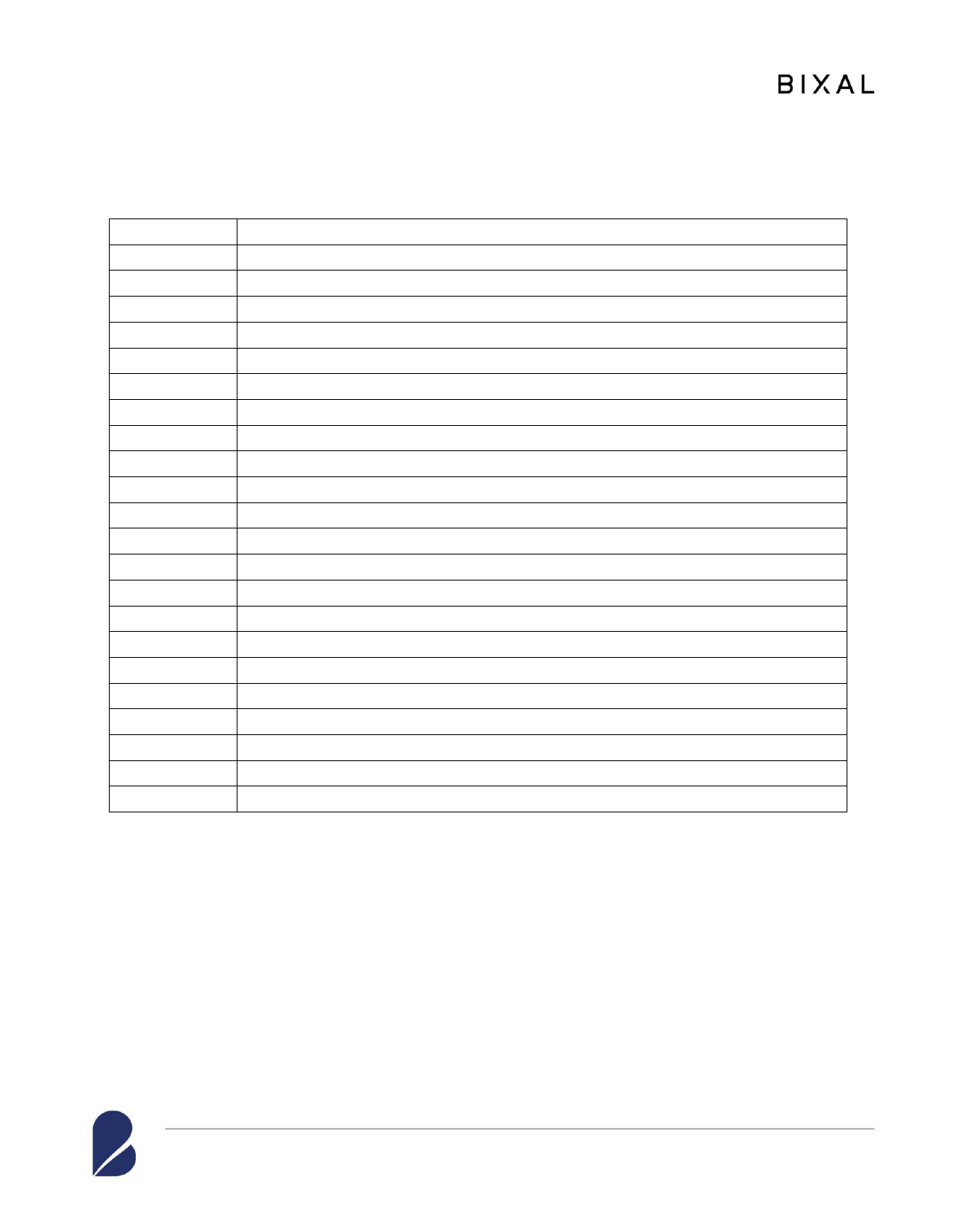

ACRONYMS & ABBREVIATIONS

CAA

Computer-Assisted Audit

CAS

Computer Audit Specialist

CIP

Compliance Improvement Plan

DTD

Domestic Tax Division

EO

Enforcement Officer

EQ

Evaluation Question

FATAA

Foreign Aid Transparency and Accountability Act

IA

Internal Audit

ICTD

International Center for Tax and Development

IRS

Internal Revenue Service

IT

Information Technology

KII

Key Informant Interview

KPI

Key Performance Indicator

Logframe

Logical Framework

M&E

Monitoring and Evaluation

MIS

Management Information System

OTA

Office of Technical Assistance

QRS

Quality Review Staff

RRA

Rwanda Revenue Authority

TA

Technical Assistance

TADAT

Tax Administration Diagnostic Tool

TIATA

Treasury International Affairs Technical Assistance

USAID

United States Agency for International Development

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

1

I. EXECUTIVE SUMMARY

From 2015–2020, the U.S. Treasury’s Office of Technical Assistance (OTA) engaged with the

Rwanda Revenue Authority (RRA) to increase domestic resource mobilization in support of

Rwanda’s economic and development priorities. OTA focused on building technical capacity in

nine program components: 1) key performance indicators (KPIs) and reports; 2) compliance

improvement planning; 3) debt collection; 4) specialized sector audit; 5) computer assisted audit;

6) general audit; 7) tax dispute resolution; 8) internal audit; and 9) risk management, including

information technology (IT) risk management. Over the course of the program, OTA provided

technical assistance by periodic deployment of short-term expert advisors who worked closely

with RRA counterparts.

In compliance with the Foreign Aid Transparency and Accountability Act (FATAA)

requirements, Bixal

1

conducted a third-party, summative, program evaluation of OTA’s Rwanda

Revenue Authority Program, under contract to OTA. The evaluation of the OTA/Rwanda

revenue sector program is meant to provide OTA with in-depth, third-party, retrospective

insights of its activities in Rwanda and lessons learned for future programming.

The qualitative evaluation methods included a desk review of key project documents and 22 key

informant interviews (KIIs) with the OTA advisors and RRA counterparts.

The evaluation focused on the following evaluation questions (EQs):

EQ 1. Which of the expected project outcomes were achieved?

EQ 2. Which of the achieved outcomes have been sustained up to the present?

EQ 3. OTA took a new approach to program design in Rwanda by involving

counterparts in the design and writing of key operational manuals. Did OTA’s new

approach contribute to the sustainability of the outcomes, and if so, how?

EQ 4. For any expected outcomes that were not achieved, which factors hindered

success?

Key Findings and Concl u sions

PROGRAM COMPONENT 1: SUPPORT FOR THE DEVELOPMENT OF KEY

PERFORMANCE INDICATORS (KPIs)

While RRA had already adopted some KPIs (related to audits) at program inception, OTA’s

assistance was limited to some training for audit and debt staff. Further development of the KPI

component was limited because RRA was planning to implement a new Management

1

www.bixal.com

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

2

Information System (MIS) system that will support expanded collection and reporting of KPI

data. The evaluation team found that data already collected by RRA were not currently utilized

to their full extent—data were used at the managerial level but not at a corporate or strategic

level.

PROGRAM COMPONENT 2: COMPLIANCE IMPROVEMENT PLANNING

(TAXPAYER)

OTA’s engagement with this component was limited because it was discovered that RRA

already had a compliance improvement plan (CIP) in place. However, OTA initiated an idea that

RRA commission a taxpayer behavior study, which was commissioned late in the program cycle

(2020). OTA assisted with updating the CIP as informed by the study findings.

PROGRAM COMPONENT 3: TAX DEBT COLLECTIONS (ARREARS)

OTA provided overall guidance on debt policies to be incorporated into RRA’s tax debt manual,

including extending the payment period for delinquent accounts. However, the evaluation team

concluded that OTA’s advice in this case may lead to increased delinquencies, as some taxpayers

may take advantage of the extended leniency and withhold tax payments. They also concluded

that OTA’s support did not help RRA address a growing issue with the lack of write-offs that

distorts RRA’s accounting. The RRA needed to revise its write-off approval processes before

they could apply OTA’s technical advice which led to delays. Finally, OTA introduced the use

of a timesheet to track “productive” time (engaged in cases) and “unproductive” time (meetings,

travel, etc.) of auditors. However, the timesheet was not well received and is only used to

measure auditors’ performance rather than improve the efficiency of RRA’s audit department.

PROGRAM COMPONENT 4: SPECIAL (BUSINESS) SECTOR AUDITS

OTA provided specialized training to a select group of RRA’s auditors on the construction sector

businesses. However, RRA deployed the trained auditors back to their previous general-sector

audit work and, as a result, the newly trained auditors lost the ability to apply and develop their

newly acquired skills to the construction sector.

PROGRAM COMPONENT 5: COMPUTER ASSISTED AUDITS

While providing some training to prepare key RRA staff for future adoption of computer-assisted

audit practices, OTA did not achieve most of its objectives for this component because RRA did

not have an MIS or software in place to support computer-assisted audits.

PROGRAM COMPONENT 6: GENERAL AUDIT CAPACITY

OTA’s key achievement under this component was supporting RRA to produce a high-quality,

detailed audit manual. This manual has been digitized by RRA and is frequently updated to

maintain its utility and relevance. Moreover, RRA has since initiated the development of other

procedures manuals without inputs from OTA. In addition, OTA introduced enhancements for

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

3

RRA’s quality review process for audits that remain updated and useful. However, the

evaluation team concluded that OTA’s recommended enhancements to the audit manual may

have been too detailed and included too many prescriptive procedures. While the inclusion of

detailed audit cases was intended to eliminate ambiguity across a wide range of audit cases,

OTA’s approach should have been to create high-level guides and build capacity of the auditors

on how to make decisions.

PROGRAM COMPONENT 7: TAX DISPUTE RESOLUTION

OTA helped draft new dispute resolution policies, advised on legal support for consistent, fair

and effective dispute processes, and provided training to enforcement staff on improved

procedures. However, despite these outputs, RRA’s dispute resolution process remains largely

the same because not all affected departments were consulted in this process. More importantly,

there was inadequate outreach and education to taxpayers to raise awareness of the changed

resolution process.

PROGRAM COMPONENT 8: INTERNAL AUDIT

OTA reviewed RRA’s internal audit procedures, recommended revisions including enhanced

reporting, and developed a process strategy for addressing RRA’s backlog in aged, unaddressed

past internal audit recommendations. However, OTA did not follow up with internal audit

training or support for related interdepartmental communication practices that would capitalize

on the assessment activities and support RRA to engage internal audit practices more fully.

PROGRAM COMPONENT 9: RISK MANAGEMENT (INFORMATION

TECHNOLOGY RISK MANAGEMENT)

OTA assessed RRA’s physical and IT risk environment, supported RRA in developing a risk

register used to identify and manage risks, and provided risk management training to appropriate

RRA staff on a regular basis. Follow-up activities included building security enhancements,

using staff key cards to control access to different building floor sections, and developing an IT

security plan for equipment, password, and network security practices. However, the evaluation

team found that security measures that protect taxpayer confidential records remains weak,

indicating that IT security remains at risk. Likewise, a comprehensive risk management plan for

taxpayer information and records that includes risk reduction and disaster recovery planning is

needed.

Key Re co mmen datio ns

While OTA did make progress in achieving some outputs and outcomes at the component level,

the evaluation team found that the design and approach to implementation could be strengthened.

This section contains high-level recommendations that relate to Rwanda but may also be

applicable to OTA’s work more broadly.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

4

PROGRAM DESIGN CONSIDERATIONS

Theory of Change

A theory of change (or similar) should have been created at an early stage of the project. The

process to create the theory of change would have helped the participants to better identify the

development needs and to obtain a common understanding of a feasible way forward. The

process should have followed a common process, using standard formats and terminology.

Benchmarking at Program Inception

The theory of change could also serve as the basis for establishing a monitoring framework to

measure progress towards outputs and outcomes over the course of the project implementation.

Baselines and targets should be included to set expectations and to serve as a point of

comparison.

Systems Approach

The evaluation team recommends that OTA advisors take more time to understand the

counterpart’s organization, business processes, and priorities prior to developing a workplan.

This would ensure the organization is ready for the activity and is able to implement the changes

and sustain them after the OTA engagement. This system’s approach would also ensure OTA

advisors understand the interdependencies and can address barriers to specific changes.

STAFFING AND TRAINING CONSIDERATIONS

Selection of Advisors

Many OTA advisors were very senior but lacked practical day-to-day operations expertise to

translate recommendations to frontline workers to implement the reforms. OTA should consider

the composition of the teams of advisors to encompass a wider range of experiences and

backgrounds. While OTA engaged a local project coordinator to provide communications,

logistics, and administrative support for the program, the evaluation team recommends that OTA

also needs a higher-level technical role with specific country knowledge and capable of working

across multiple program component areas.

Orientation Package

The evaluation team also identified that an orientation package for the intermittent advisors is a

missing component of training. It should have included information from RRA staff on

organizational structure and identified issues, business processes, and information on Rwandan

cultural and their political and legislative process. Technical assistance would be more effective

if local cultures were understood.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

5

II. EVALUATION OVERVIEW

Pr og ram Des cripti on

Since 2015, the U.S. Department of the Treasury’s OTA has provided technical assistance in

public financial management to Rwanda using a resident-based project coordinator and

intermittent expert advisors who worked closely with counterparts in RRA. The goal of the

project has been to support RRA's efforts to increase domestic resource mobilization in support

of Rwanda's economic and development priorities by building its capacity in nine areas:

1. KPIs and reports.

2. Compliance improvement planning.

3. Debt collection.

4. Specialized sector audit.

5. Computer assisted audit.

6. General audit.

7. Tax dispute resolution.

8. Internal audit.

9. Risk management, including IT risk management.

At the time this project began, RRA was reasonably well developed, compared to its regional

counterparts, and had motivated, educated employees. Third-party Tax Administration

Diagnostic Tool (TADAT)

assessments were conducted in both 2015 and 2019.

2

These

assessments identified some deficiencies to be addressed by RRA. Some of the main issues

identified were:

• RRA’s strong performance of promoting voluntary compliance was outweighed by the

relatively weak execution of audits and debt management functions, resulting in a high

rate of tax payment arrears.

• RRA had an established risk management structure but lacked the depth needed for a

comprehensive compliance improvement strategy, and it faced challenges to identify and

mitigate corporate risks, especially those in the IT sector.

• The cumbersome dispute resolution process required high-level internal approvals of

relatively minor individual taxpayer objections, causing undue delays.

• Auditors did not have the specialized skills required to audit specialized sectors, such as

the construction industry, or engage in complex computer-assisted audits.

2

Internationally recognized tax administration assessments conducted by the TADAT organization.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

6

• Internal auditors were not trained to conduct high-quality audits, and there was no

overarching process to monitor departments’ responses to audit recommendations.

• RRA did not use KPIs to monitor organizational progress.

According to the OTA advisors, these assessments informed the annual work plans, which in

turn constituted the basis for the drafting of the statements of work that outlined the activities for

OTA advisors engaged with RRA. Advisors’ intermittent visits typically lasted two weeks. The

visits included following up on the advice given during an earlier visit, discussions with RRA

staff, new assessments of RRA capacities and operations, and the presentation of new or updated

advice to the senior management at RRA.

A Program Manager who also served as an advisor coordinated OTA’s activities and provided

technical oversight and produced monthly and annual reports.

At the close of the program, the OTA team provided RRA’s Commissioner General with future

recommendations. The recommendations focused on RRA’s Domestic Tax Division (DTD) in

the areas of quality assurance, human resources, administration, and training. The OTA team

also drafted a six-month action plan to implement the recommendations. The registers and the

action plan were included with the final Closing Memo to the Commissioner General.

Ev al uati on Purpose

OTA commissioned Bixal to carry out a summative program evaluation. The evaluation

activities took place during January–July 2023, with a field visit by the evaluation team to

Kigali, Rwanda, during the period of March 23–April 9, 2023.

This summative program evaluation was designed to serve two purposes. The first is for OTA to

comply with the Foreign Aid Transparency and Accountability Act (FATAA) of 2016.

3

The

second is to provide OTA with in-depth, third-party, retrospective insights of its project activities

in Rwanda. Some aspects of OTA’s experience in Rwanda may be extrapolated to other current

or future projects in Rwanda or other countries to inform adaptation, improve projects, discover

ways to reduce the time to achieve project outcomes, identify new ways to effect positive

change, and document project achievements and success.

3

Foreign Aid and Transparency and Accountability Act of 2016, Public Law 114-191

https://www.congress.gov/114/plaws/publ191/PLAW-114publ191.pdf

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

7

Ev al uati on Q uesti ons

Bixal’s evaluation team collaborated with OTA’s revenue and RRA teams to develop the

following evaluation questions (EQs). The EQs provided the foundation for the remaining

design elements of the evaluation, such as methodology and approaches to data collection and

analysis.

EQ 1. Which of the expected project outcomes were achieved?

EQ 2. Which of the achieved outcomes have been sustained up to the present?

EQ 3. OTA took a new approach to program design in Rwanda by involving

counterparts in the design and writing of key operational manuals. Did OTA’s

new approach contribute to the sustainability of the outcomes, and if so, how?

EQ 4. For any expected outcomes that were not achieved, which factors hindered

success?

The evaluation findings found in Section III are grouped by OTA’s nine program components,

each of which includes multiple objectives. For each program component objective, the report

addresses findings, conclusions, and recommendations for EQ 1, EQ 2, and EQ 4. Note that

EQ 3, a high-interest line of inquiry for OTA, is focused on assistance with developing

operational manuals and is broken out and discussed explicitly at the end of Section III. The

evaluation team determined that EQ 3 findings are integral to several program components, so

EQ 3 is largely addressed in context together with the other EQs.

Ev al uati on M et h odology

The evaluation methods included a desk review of nearly 350 project documents provided by

OTA, followed by individual interviews of OTA’s advisors, their counterparts, and other key

respondents. The overall evaluation design was developed using a theory-based approach with

OTA’s program logical framework (logframe) as a starting point, which divided the program into

nine project components. The evaluation team produced an evaluation framework (see Annex

A) that mapped specific areas of inquiry for each of the nine project components. The evaluation

team used this to develop detailed interview guides that were tailored for each KII. The KIIs

provided multiple perspectives and sources that support findings related to the EQs.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

8

Da ta Coll ecti on

OTA and RRA shared vital project documents with the evaluation team. Among these

documents were the terms of reference for the program, the program logframe, workplans, trip

reports, statements of work, monthly reports, project narratives, project performance reports, a

debt management manual, closing memo, the end of project review, and an evaluation

coversheet. Annex B contains a detailed list of the documents used by the evaluation team. The

team reviewed each document to provide context for the program, as well as to elicit findings to

add to the base of evidence.

The desk review was complimented by 22 KIIs, 18 with RRA officials and 4 with the OTA

advisors. Of the 22 interviews, 15 were conducted in person and seven were conducted using

virtual technology. A detailed list of key respondents is included in Annex C.

DATA ANALYSIS PROCESS

The evaluation team conducted qualitative analysis of KII data on an ongoing basis, concurrent

with interviews, to ensure quality in real time and to identify findings and trends in a timely

manner. Interview notes were completed by the team members and voice recordings were made

with the respondent’s consent. A selection of KIIs were also transcribed to cross-check and

validate for coding.

KII notes and transcriptions were coded and analyzed using ATLAS.ti, grouping similar data

under different categories and themes. Thus, the evaluation team could locate, retrieve, and

combine the textual data that corresponded to a category of interest. These data were further

triangulated and contextualized with the findings from the desk review.

When the data collection was nearly complete, the evaluation team members convened for a joint

analysis. The evaluation team discussed potential findings, conclusions, and trends. Insights and

ideas from this process were shared in a presentation of preliminary findings to OTA for vetting

and discussion before the final evaluation report was drafted.

Qualit y Assur a nce

The evaluation team followed standard quality assurance best practices that included the

following:

1. Notetakers uploaded their notes at the end of each day of data collection. Notes were

reviewed to ensure completeness and comprehension and to identify emerging themes.

2. The evaluation team met at the end of each day of data collection in Kigali. The team

discussed what they heard and observed to ensure consistency in collecting and reporting

data.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

9

3. The ATLAS.ti application enabled the team to check for accuracy and completeness of

qualitative data as they were entered and coded.

4. The joint analysis and presentation of preliminary findings provided further opportunity

to cross-check and validate data and findings.

The evaluation team took steps to ensure data security, including using secure communication

platforms, storage of information on secure and password-protected sites, and deletion of

recording and transcription files after the completion of the study.

Limita tion s

In general, the evaluation team faced very few limitations. Most KIIs could be carried out as

planned and sufficient documentation was provided for a comprehensive desk review. However,

a few circumstances limited the data collection and consequently the analysis:

• Lack of program framework, action plan, coherent documentation

• The Logframe was designed very late into the project and did not include sufficient

indicators that could help measure progress over the life of the project.

• For some respondents, it was difficult to remember, in detail, the activities that OTA had

carried out and to what activities OTA advisors had contributed.

• Some staff had left RRA and were not available for interviews.

• In most cases, KIIs with Rwandan counterparts were conducted offsite, outside their offices.

This was due to both the lack of quiet meeting spaces, a result of ongoing construction in

RRA facilities, and the counterparts’ frequently stating their preference for interview privacy

away from their colleagues. While this had some advantages for candid discussions with the

evaluation team, it also limited opportunities for direct observation of RRA’s workspace and

environment.

• The structure of the workplans changed from year to year and were not fully compatible with

the program logframe. This made longitudinal tracking of achievements difficult.

III. FINDINGS AND CONCLUSIONS

Section III presents each of the evaluation findings for OTA’s nine program components for the

RRA program. Section IV discusses additional conclusions and recommendations at a systems

level and considers OTA’s overall program.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

10

Pr og ram Compon e nt 1: Key Per fo rm a nce I ndicators (KPIs)

COMPONENT 1 OBJECTIVE

Component 1 focused on assisting RRA’s leadership in adopting and using KPIs to monitor

and manage organizational performance, set expectations, and allocate resources in key tax

administration functions, especially in audit and debt management. The planned project

activities included: 1) designing KPIs; 2) identifying data sources; 3) training staff on collecting

KPIs; and 4) training on how to analyze KPI data.

In assessing this objective, the evaluation team considered that KPIs need to be developed

carefully to align with activities, provide baselines and targets, identify data sources, collect data,

and, finally, analyze and communicate data to decision makers to contribute to the operation of

the program.

Table 1 summarizes the findings for Component 1, and a detailed discussion follows the

summary.

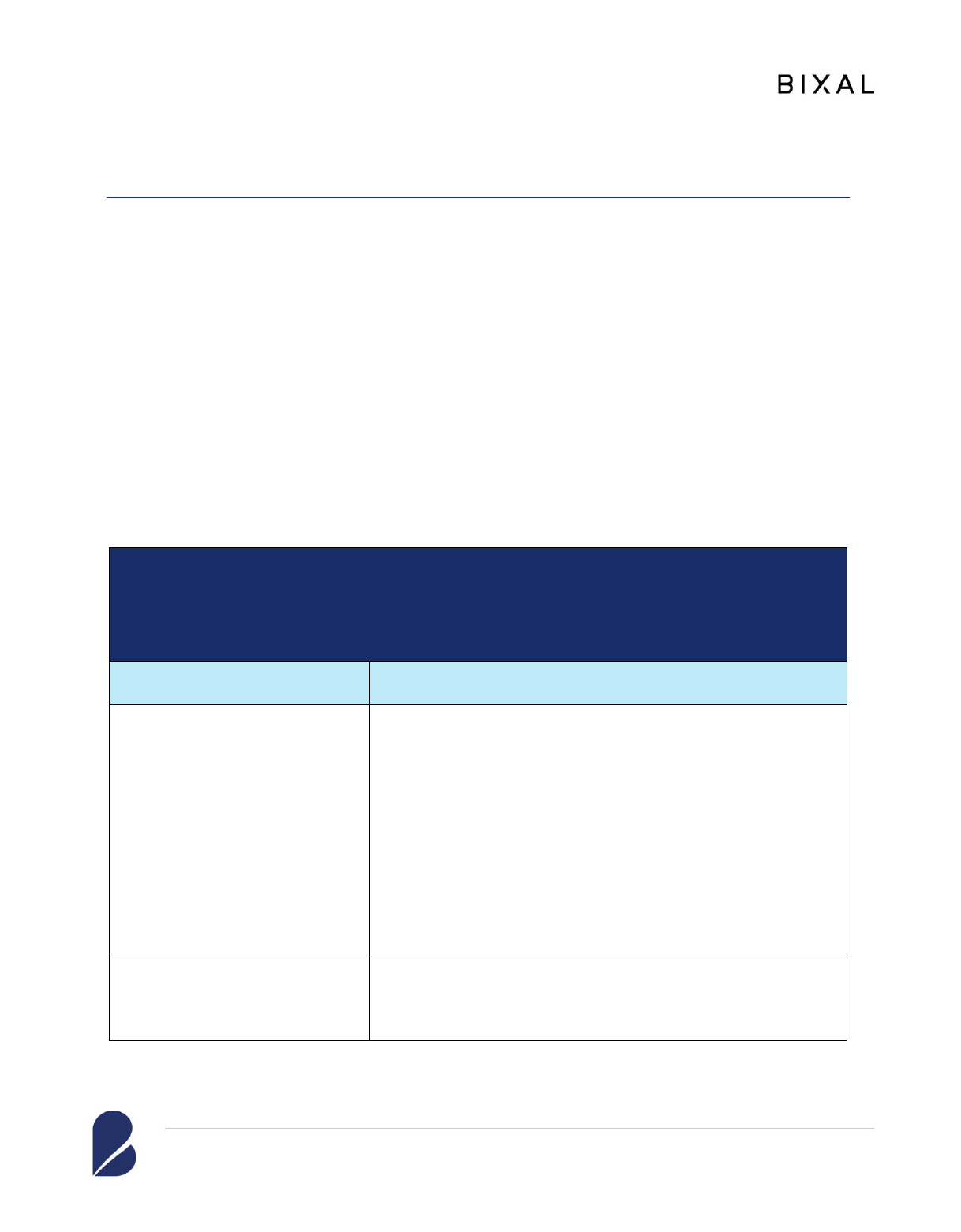

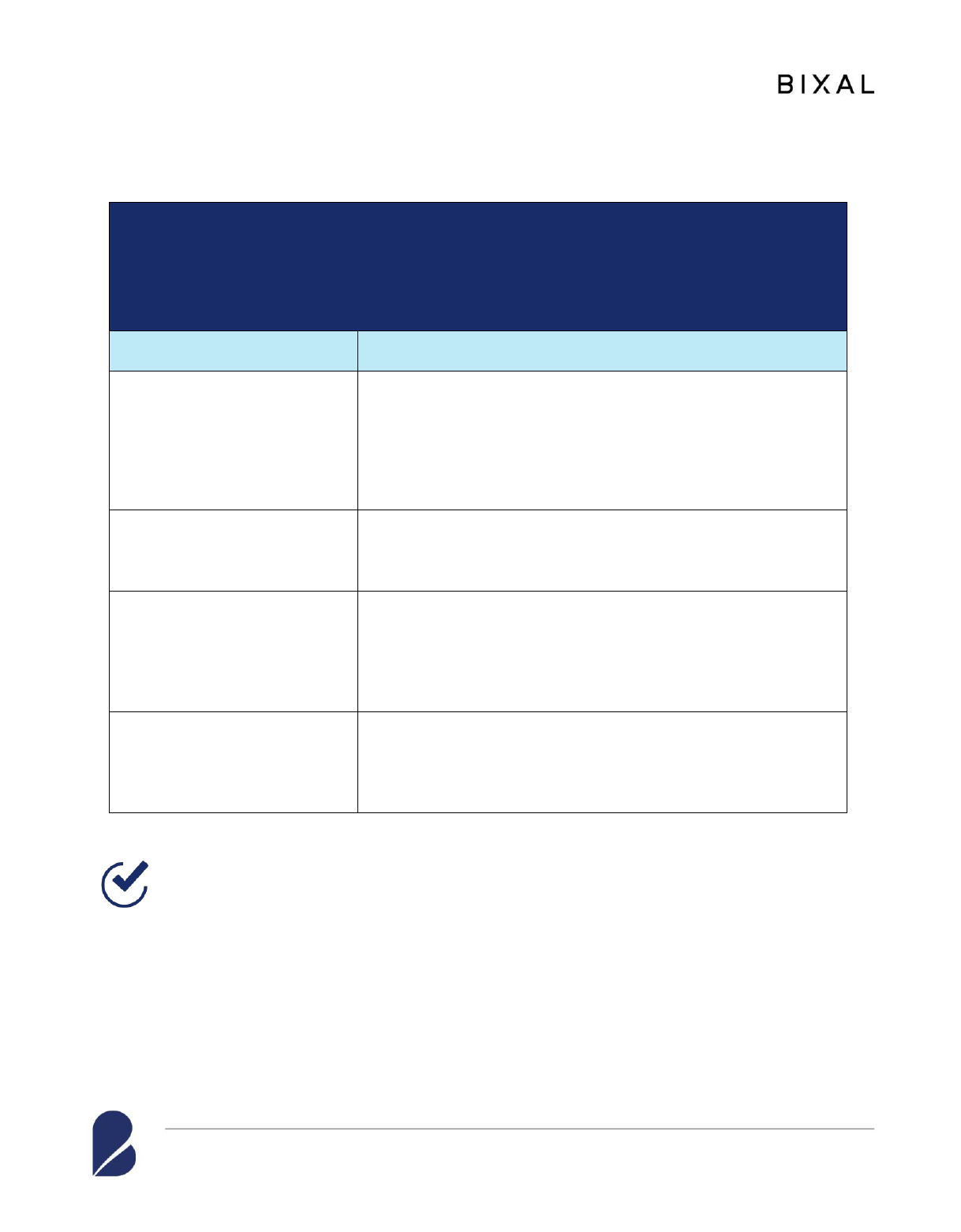

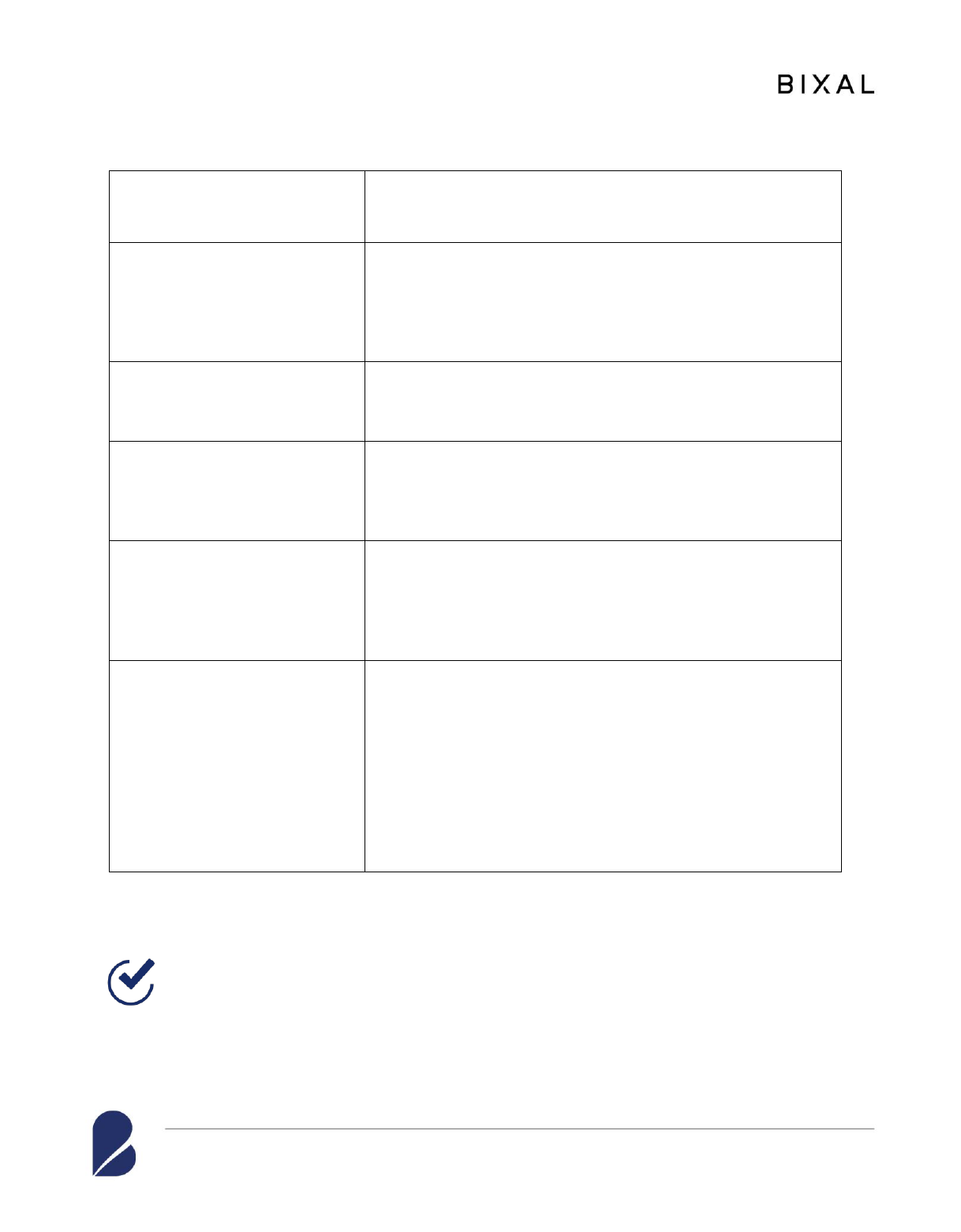

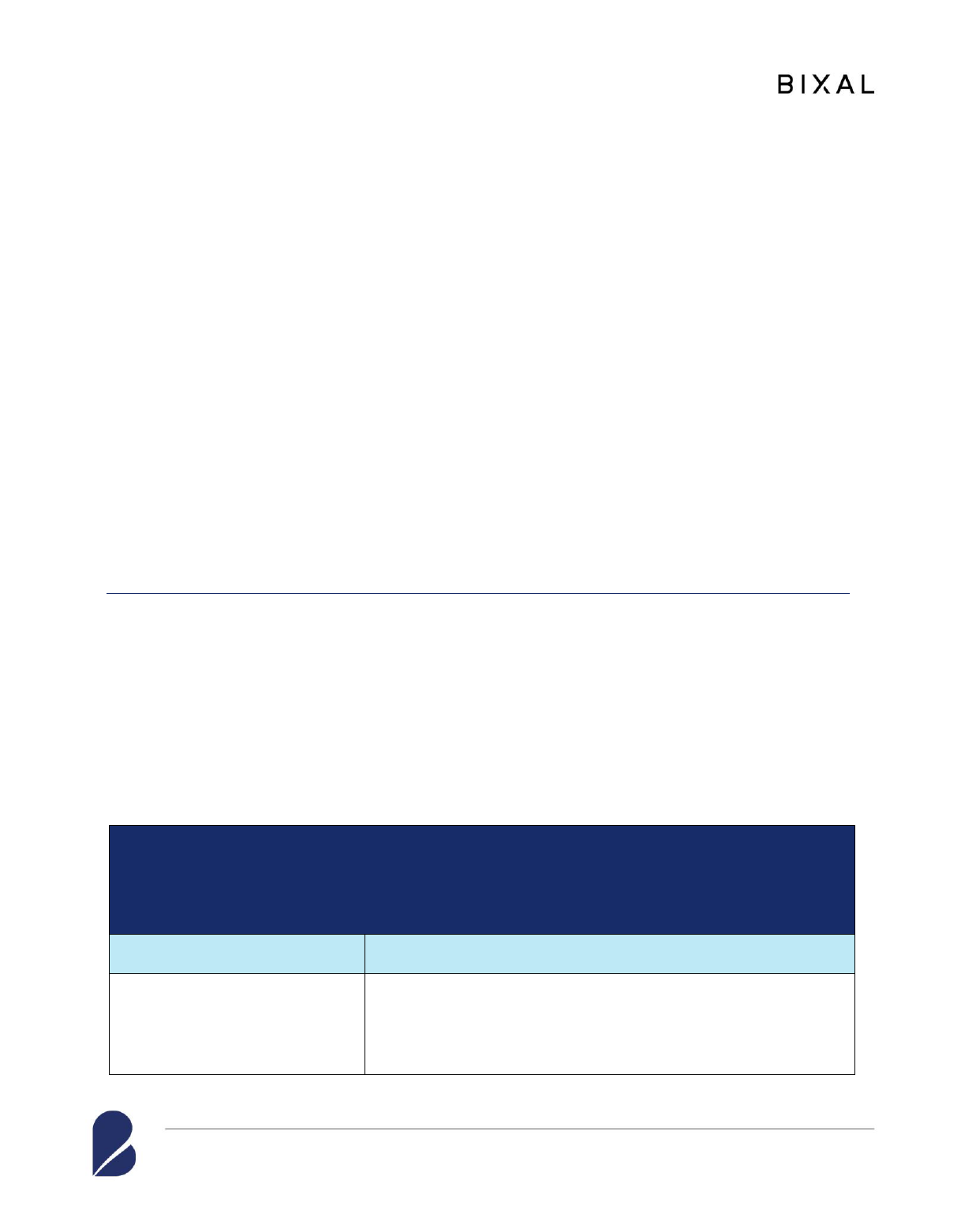

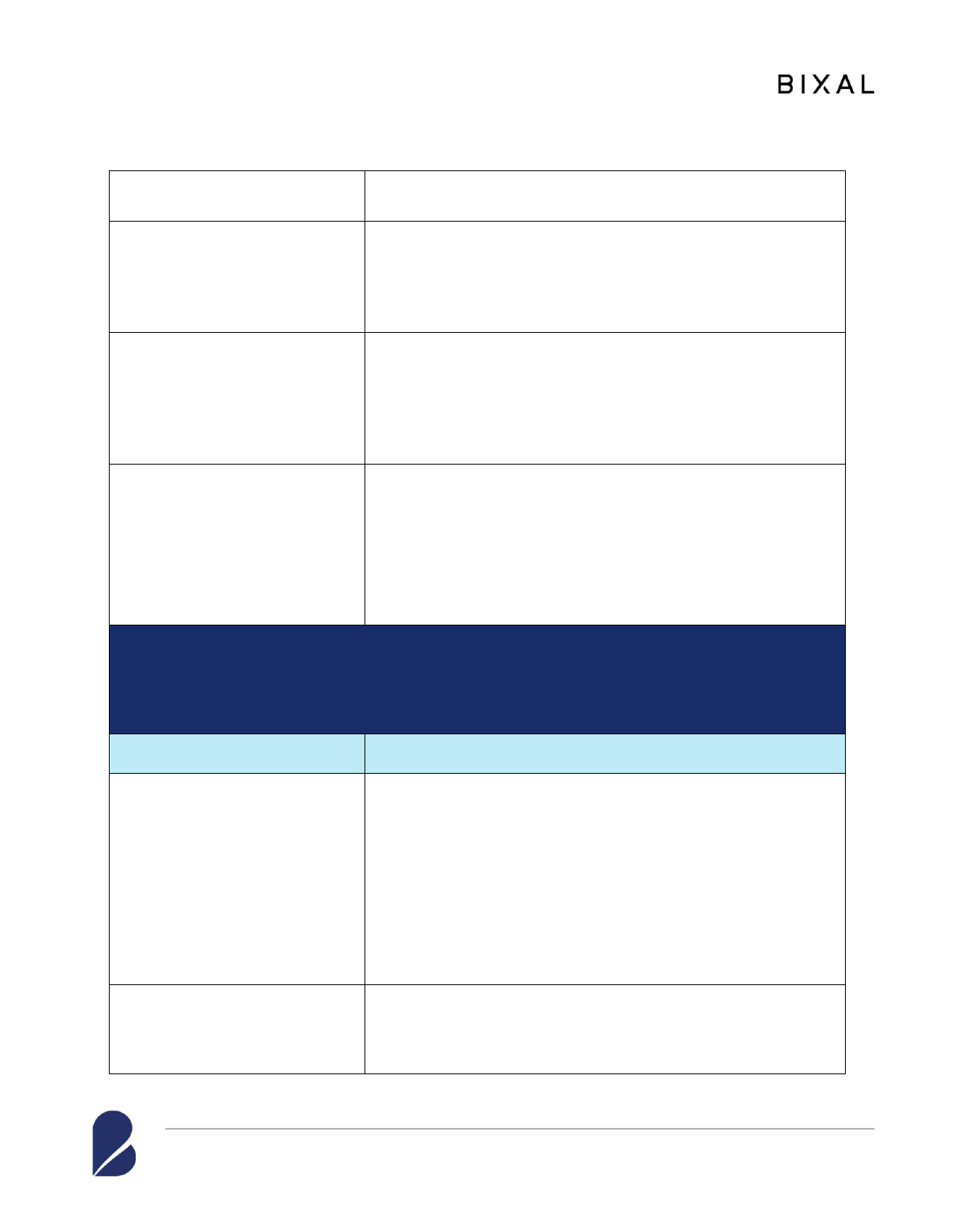

Table 1: Component 1 Outcomes—Activities and findings

Expected Outcome 1.1: RRA develops and regularly collects KPI data. RRA leadership uses

KPI data to measure the efficiency/effectiveness of core functions (i.e., audit and debt

collections), set expectations for organizational performance, and allocate resources in

accordance with organizational goals.

Activities

Findings

1.1.1: Assist RRA Planning and

Research Director to identify

and design RRA KPIs

• RRA was collecting some KPI data manually, mostly

focused on the number and types of audits.

• OTA assisted RRA to update and further develop an

existing KPI template.

• RRA updated KPI measures with OTA’s support.

• Counterparts reported satisfaction with OTA’s assistance

and that department managers did continue to use KPIs.

However, KPIs were not used at the corporate or

strategic level.

1.1.2: Identify data sources to

enhance KPIs

• OTA assisted RRA to identify relevant data; however,

they did not have the appropriate MIS in place to begin

collecting the information.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

11

1.1.3: Train specialized audit,

debt, and planning and research

staff to collect KPI data

• Some audit and debt staff were trained in the use of

KPIs, but this was on a limited scale.

• This activity was delayed because the MIS needed to be

developed prior to the training.

1.1.4: Train management to

analyze and use KPIs

• OTA was not able to train management staff on KPIs, as

the MIS system for collecting more strategic level KPIs

was not yet in place.

COMPONENT 1 FINDINGS

EQ 1: Which of the expected project outcomes were achieved?

Outcomes Status: Partially achieved

The outcomes for Component 1 were partially achieved. The evaluation team found that RRA

has developed KPIs and regularly collects KPI data at the managerial level. These data were

collected manually and tracked in an Excel document. The information collected was minimal

and, during the tenure of the OTA project, RRA leadership did not use KPI data to set

expectations for organizational performance or to allocate resources. KPI data continue to be

used only to perform basic revenue functions (e.g., measuring the efficiency and effectiveness of

the core functions of audit and debt collections) but do not inform higher-level decision-making.

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Monthly KPI reports

The evaluation team found, through counterpart interviews, that RRA continues to produce five

monthly KPI reports that were supported by OTA advisors, so this practice is sustained. This

information can inform day-to-day operations; however, without a broader organizational effort,

there continued to be missed opportunities.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: 1) No single, coordinated technical assistance action plan; 2)

Lack of organizational level MIS for KPI data collection and analysis

The evaluation team found significant differences regarding the formulation of the achieved

objectives as reported in the End of the Project Review Document compared to the objectives for

each program component in the project logframe document. This indicated that OTA did not

follow a single, coordinated technical assistance action plan among the multiple advisors to

guide activities and track progress across the duration of the program.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

12

Additionally, the evaluation team learned from counterpart interviews that RRA lacked an MIS

with the functionality to collect and consolidate KPI data across the organization. Due to this,

OTA was unable to provide training to staff on how to produce usable analysis that leadership

could use to set expectations for organizational performance and allocate resources in accordance

with organizational goals.

COMPONENT 1 CONCLUSIONS

OTA provided relevant advice to RRA on Component 1, but RRA lacked relevant IT

infrastructure to execute fully.

The evaluation team found that RRA had been using some KPIs to track audits prior to OTA’s

assistance and RRA was interested in further developing additional indicators and using data to

inform management decisions. Unfortunately, RRA lacked an organization-wide MIS to collect

and process KPI data. OTA provided relevant advice and RRA retained one Oracle contractor to

make improvements to their MIS. Overall, this component is still in progress toward OTA’s

anticipated outcomes indicated in the program logframe. Training did not happen as planned as

the MIS was not yet in place.

COMPONENT 1 RECOMMENDATIONS

Continue improvements in reaching and sustaining outcomes by adopting a formal approach to

KPI technical assistance; forming a dedicated unit of technical experts focused on knowledge

management and implementation; collaborative use of a plan/tracker; clearly defining future

steps to achieving outcomes and measuring progress.

A formal approach by OTA to delivering technical assistance on the development and use of

KPIs could have produced more substantial and sustainable outcomes. For example, when RRA

requested support on KPIs, securing agreement on the use of KPIs from all management levels at

RRA would have achieved the expected outcome under Component 1.

The formation of a dedicated unit composed of technical experts to track, manage, and

implement OTA’s advice and continue implementing the new knowledge gained from OTA’s

support may have provided better and more sustained outcomes for RRA. RRA maintained their

own internal tracker, but we recommend using an agreed-upon action plan/tracker between

counterparts and OTA for any future programming.

Structuring the work plan, activities, outputs, and outcomes in a way that is clearly defined and

can be measured over time is key to making this sustainable. The new templates are a step in

this direction, but the need remains for further buy-in at the different levels of the organization,

training to operationalize, and a system to ensure accurate analysis and use.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

13

Pr og ram Compon e nt 2: Complia nce I mpro v eme nt Plan ni ng

COMPONENT 2 OBJECTIVE

OTA’s objective was to improve voluntary taxpayer compliance by identifying and

mitigating barriers. Project activities included assisting RRA to develop a comprehensive CIP

that addresses different steps of the process including taxpayer registration, tax filing, payment,

and mitigating accuracy in reporting/filing. OTA also advised RRA on how to identify and

mitigate revenue risks.

Table 2 summarizes the findings for Component 2, and a detailed discussion follows the

summary.

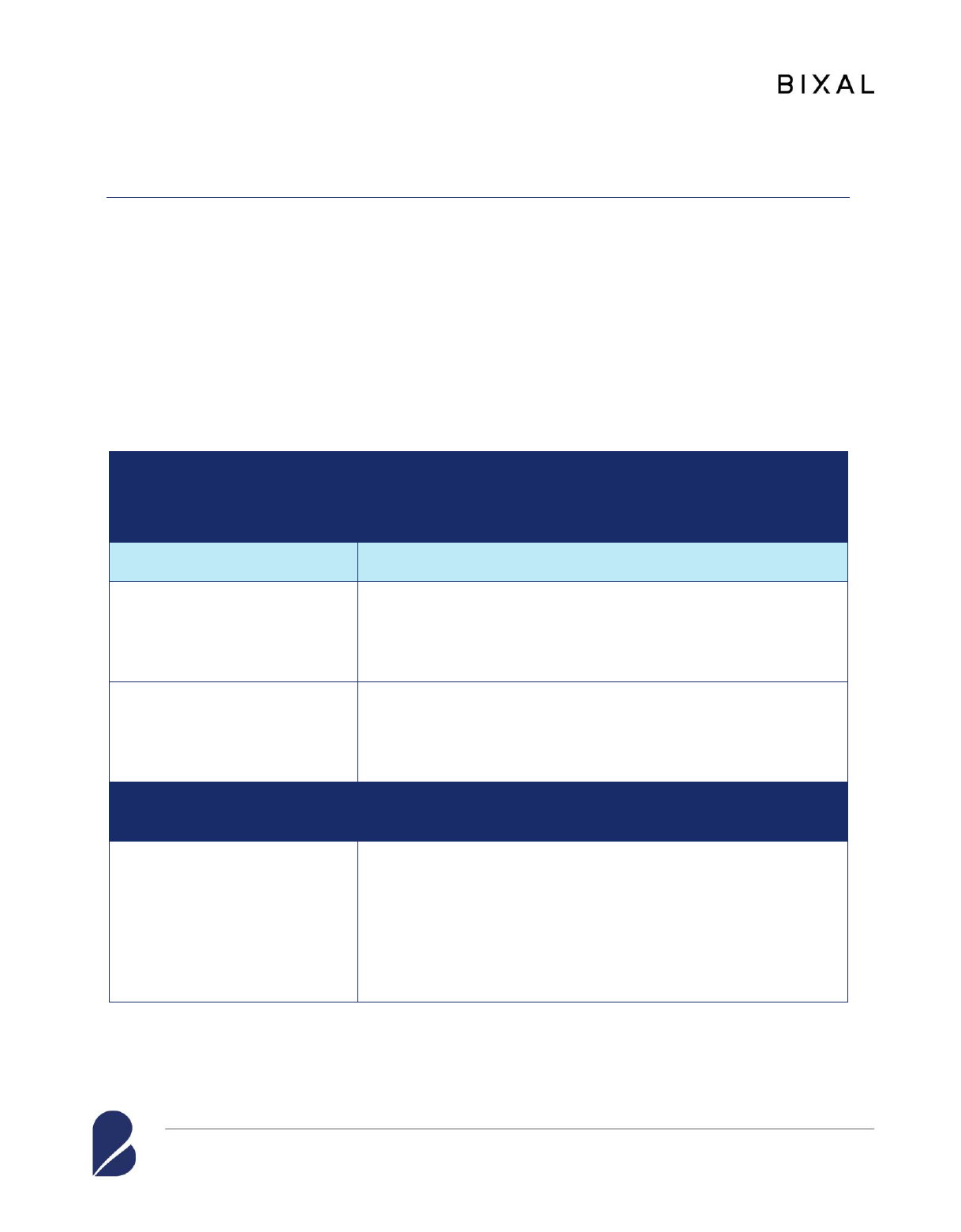

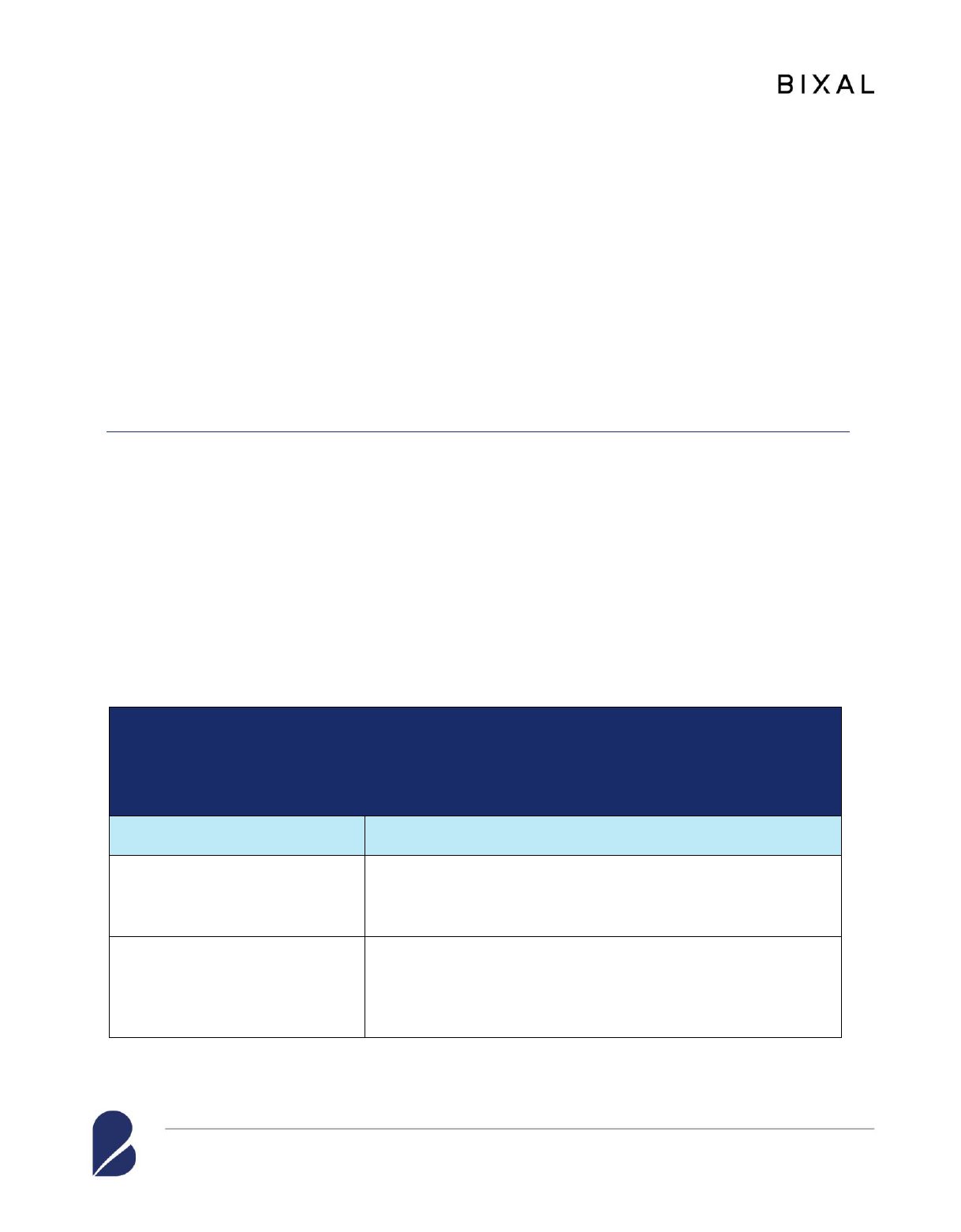

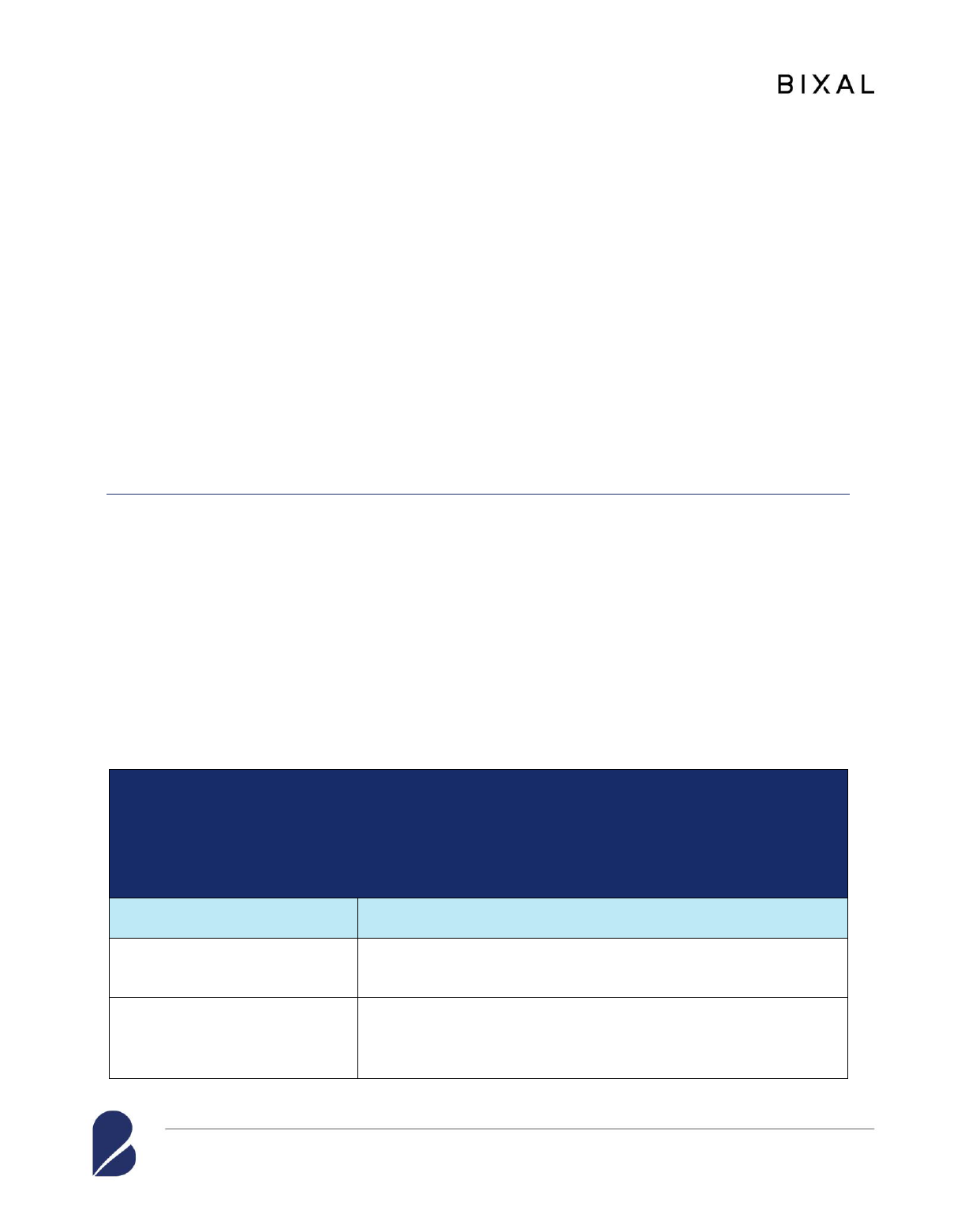

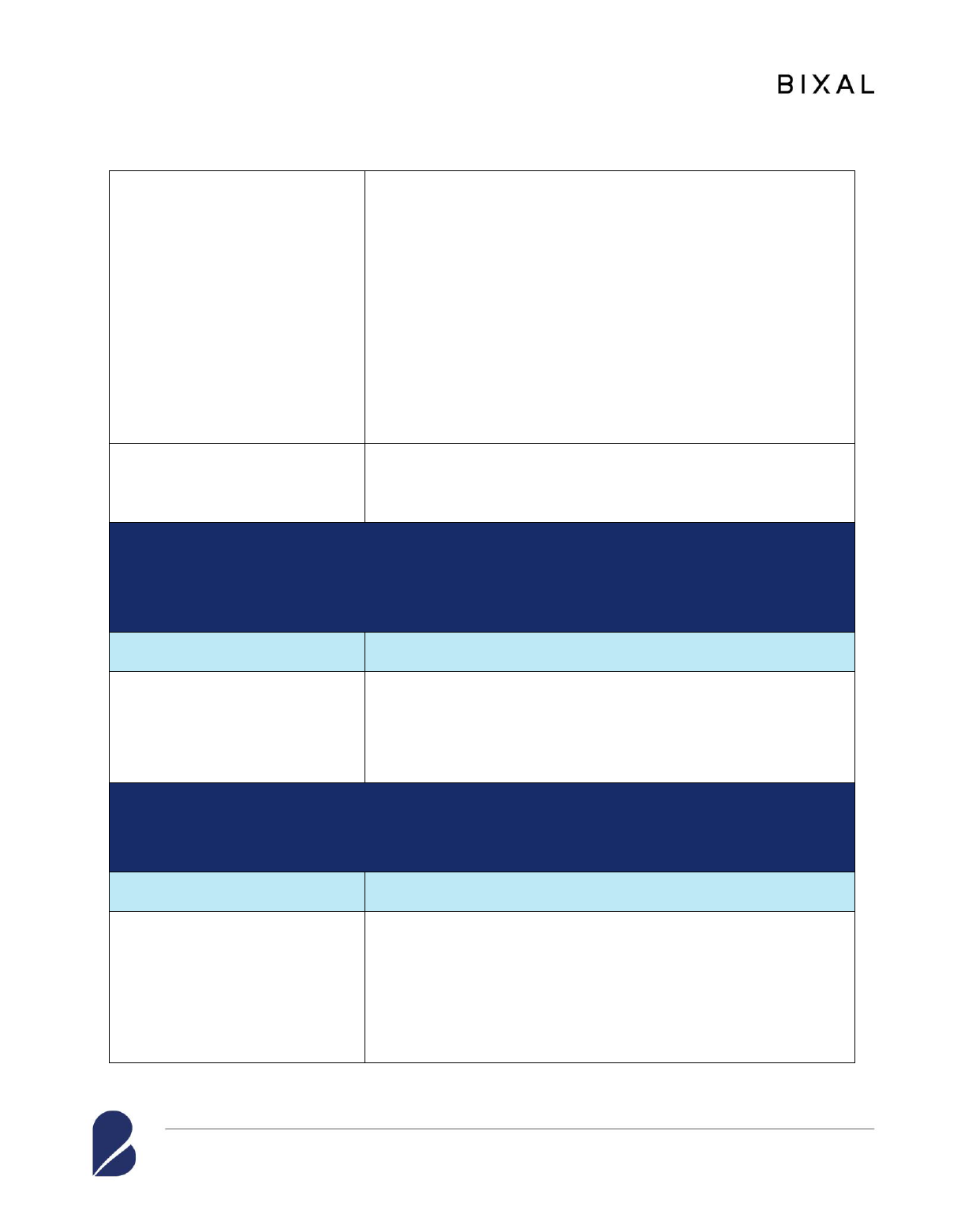

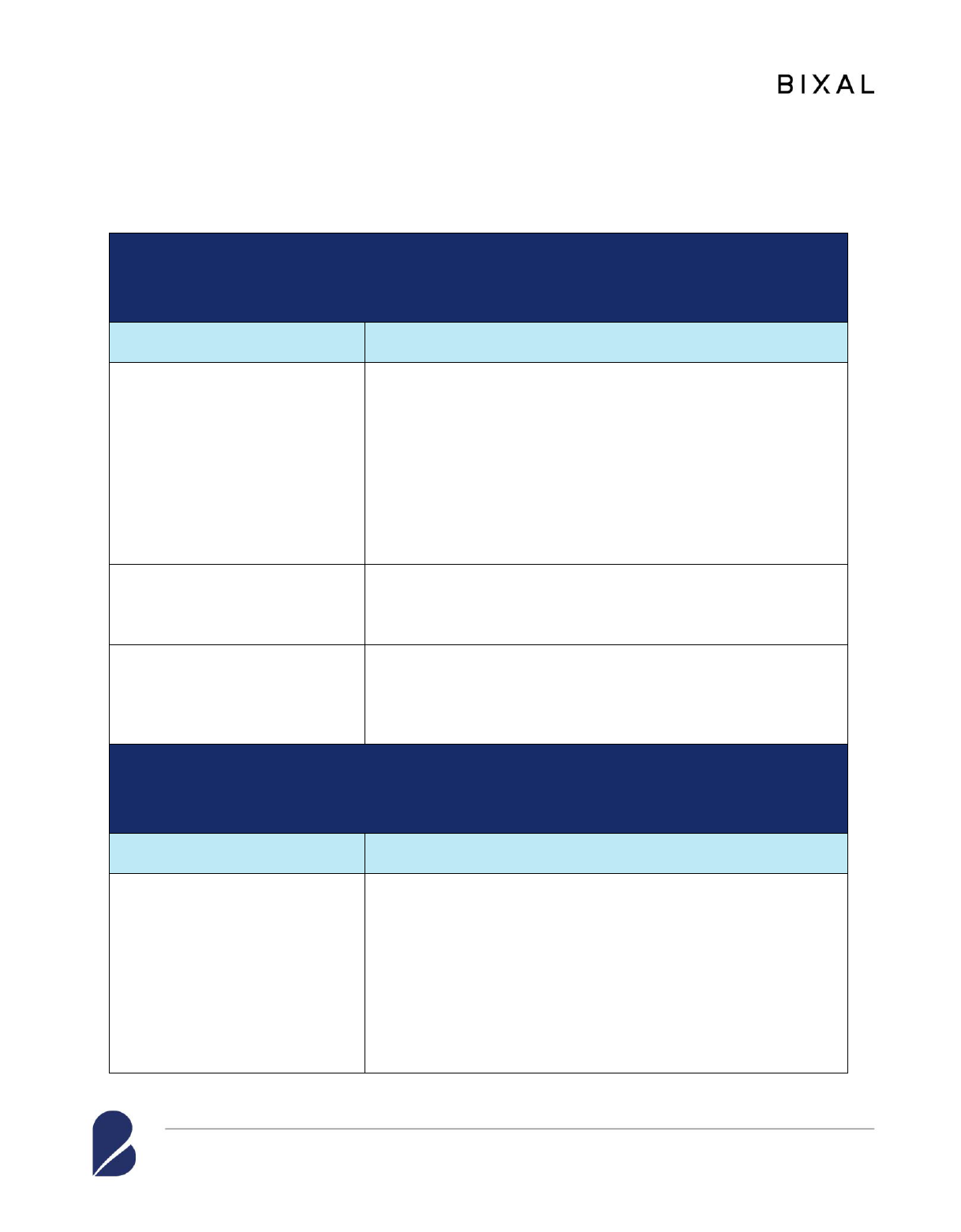

Table 2: Component 1 Outcomes—Activities and findings

Expected Outcome 2.1: RRA to research taxpayer behaviors and attitudes to understand barriers to

voluntary compliance in the areas of registration, filing, and payment. RRA adopts and implements a

CIP to increase taxpayer registration and mitigate filing and payment accuracy risks.

Activities

Findings

2.1.1: Develop compliance

research plan

• OTA suggested RRA conduct a study to research taxpayer

behaviors. RRA conducted the study with help from the

International Center for Tax and Development (ICTD) in 2020.

OTA did not contribute directly to the research.

2.1.2: Develop a CIP

• RRA already had a well-developed CIP. OTA contributed to

the plan by recommending the audit teams be better focused

and trained before attempting to work in the field, but this

activity was limited in scope.

Expected Outcome 2.2: RRA identifies areas that need additional focus on an ongoing basis and

dedicates resources to mitigation activities.

2.2.1: Assist RRA to develop

ongoing monitoring

methodology

• Since the CIP was not operationalized until after the ICTD

study, OTA was not able to complete this activity. The

evaluation team found that identification and mitigation of

compliance risks through the CIP was not being monitored.

OTA provided guidance for developing risk reports. However,

senior management had not used the risk reports to inform their

annual workplans or measure performance against the plan.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

14

COMPONENT 2 FINDINGS

EQ 1: Which of the expected project outcomes were achieved?

Outcome Status: Partially achieved

Overall, OTA’s expected outcomes under this component were partially achieved. At the

suggestion of OTA, RRA engaged ICTD in 2020 to conduct research on taxpayer behaviors and

attitudes—to better understand barriers to voluntary compliance in the areas of registration,

filing, and payment. Since this study was not conducted until near the end of OTA’s program in

2020, there was not enough time within OTA’s program cycle to incorporate the findings.

However, the evaluation team learned from counterpart interviews that RRA recently used the

findings from the ICTD study to update and implement a revised CIP to increase taxpayer

registration and mitigate filing and payment accuracy risks. OTA helped identify some areas

that needed additional focus and, in a final memorandum, recommended that RRA dedicate

additional resources to the mitigation of the risks that arise from taxpayer noncompliance.

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Improved voluntary taxpayer compliance

Counterparts reported to the evaluation team that voluntary taxpayer compliance has improved,

although RRA is not measuring taxpayer compliance against an established baseline, and

quantitative data as evidence for improved compliance was not available.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Sequencing and timing

OTA’s contributions were limited due to the sequencing and timing of events. RRA needed data

to design effective activities. While RRA acted on that recommendation, research was not

available until after the OTA program cycle.

COMPONENT 2 CONCLUSIONS

Resource allocation decisions need to factor in country context and best practices for optimal

allocation (e.g., number of auditors per case)

OTA’s contributions to this Component 2 were minimal as RRA already had a CIP and a process

to update and revise it in place. Nonetheless, OTA suggested conducting a study researching

taxpayers’ behaviors that could inform and improve compliance behaviors. Since this study was

only conducted in 2020, OTA’s engagement was over prior to the findings being available.

For better resource allocation, OTA recommended a reduced number of auditors assigned to each

case (lowered from a team of two auditors per case to only one auditor per case). The

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

15

recommendation was adopted by RRA without the necessary investigation. In our view, RRA’s

practice of assigning two auditors per case was providing a safeguard against corruption and

malpractice that often arises when there is only one auditor for a case. Corruption mitigation

plays a significant role in the allocation of resources to the revenue authorities in most

developing economies and OTA might have discussed with RRA to investigate the logic behind

the choice of two auditors per case. We iterate this gap under program-level recommendations,

which highlights the need for OTA to better align expertise and advice with the best practices

suitable to the country context and consider the reasons that lead RRA to making some of these

operational decisions.

COMPONENT 2 RECOMMENDATION

For increased efficiency, stage efforts to complete joint planning, target and goal setting, and

monitoring framework prior to start of project activity

Prior to initiating development work of this type, joint planning should be completed before the

engagement—this should include a desk review and interviews. This planning process would

help identify data gaps and the need for further research, which could be done prior to the start of

the OTA engagement. This would save valuable time and increase efficiency of the OTA

advisors.

In addition, in line with the first component, establishing a baseline and setting up targets and

milestones to achieve those targets would help quantify gains due to OTA’s technical assistance

efforts.

Pr og ram Compon e nt 3: Tax De bt Co llecti ons

COMPONENT 3 OBJECTIVE

OTA’s objective for this project component was to guide the development of standardized

procedures for increasing RRA collection of established tax debts. The planned project

activities included revising tax debt policies and procedures, developing a case selection process,

updating the procedural manual, training employees in the use of the manual, designing

management information reports, training staff to analyze management information reports,

designing timesheets, and training management in the analysis of timesheet data. Due to the

relatively large scope of OTA’s activities under this component, the findings are categorized into

three outcome areas under Component 3.

COMPONENT 3; OUTCOME 3.1 FINDINGS

Table 3 summarizes the findings for Component 3; Outcome 3.1 and a detailed discussion

follows the summary.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

16

Table 3: Component 3; Outcome 3.1—Activities and findings

Expected Outcome: 3.1

RRA adopts and implements revised tax debt policies, procedures, and manual to select cases with

a higher likelihood of collectability, resulting in increased revenues from collections.

Activities

Findings

3.1.1: Assist RRA in

revising tax debt policies

and procedures, including

write-offs of uncollectible

accounts, installment

agreements, improving

data on tax arrears.

• OTA provided overall support on debt policies, including

revising the tax debt manual and guiding RRA to put in place

standard operating procedures.

• Of note, under advisement by OTA, RRA extended the

maximum possible repayment period for tax debtors from 12

months to 36 months.

• Support for the write-off of uncollectible debts did not

materialize and support for improving data on tax arrears was

minimal.

3.1.2: Assist RRA to

develop a tax debt case

selection process

• OTA supported RRA to revise or streamline procedures for case

selection and case management; this led to a higher likelihood of

debt collectability.

• OTA recommended a matching program that would offset debts

against government contract payments, but it was not

implemented because the e-Tax case management system was

not sophisticated enough to accept the changes. This suggestion

was recently submitted to the Ministry of Finance and is

awaiting approval.

3.1.3: Draft updates to the

Debt Management

Procedures Manual

• OTA’s most significant contribution was the support provided by

advisors to develop and update the debt management manual.

• RRA continues to have out-of-date debt write-off procedures in

its policies. The process is cumbersome and involves approvals

from the top level of government.

3.1.4: Conduct training for

debt management

employees in use of the

revised manual

• OTA provided brief training to the enforcement officers and

managers in the use of the revised debt manual.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

17

EQ 1: Which of the expected project outcomes were achieved?

Outcome 3.1 Status: Partially achieved

Outcome 3.1 was partially achieved. OTA assisted RRA in streamlining the audit and

debt management processes for increased efficiency. One of the major achievements under this

activity was the reduced level of involvement by the senior management in audit cases and their

approvals. This delegation and streamlining of functions resulted in reduced interactions

between managers and taxpayers in the audit and debt departments, which led to more efficient

processes.

OTA developed a memo with recommendations for the RRA legal department to consider

increasing the use of legal actions to recover money from the largest debtors. This includes

garnishment actions, seizure and sale of assets, and other significant enforcement measures that

better utilize already available tools. OTA recommended improvements to tax arrears

management data as well to inform RRA’s process.

EQ 2: Which of the achieved outcomes have been sustained up to present?

Outcomes Sustained: Streamlining of the audit and debt management process and use

of updated collections manual

RRA has maintained changes to the audit and debt process that made it more efficient. RRA

does not have benchmark data prior to the changes, which will make it difficult to quantify the

specific resulting impacts on revenue. The Rwandan Parliament amended the law to lower the

penalty and interest rates on arrears to encourage delinquent taxpayer compliance. This action

will ensure application; however, it still needs to be incorporated into policy at RRA.

Based on feedback from interviews, the collections manual is being used by RRA staff in its

updated form.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Approval delays and OTA’s broad scope

Some of the changes that OTA recommended are not yet enacted due to high-level decision-

making. For example, the e-Tax case management system changes have been submitted to the

Ministry of Finance but are still awaiting approval. Additionally, some tasks did not get OTA’s

focus given the amount of work in this area. These have been addressed in the final

Memorandum of Recommendations to Commissioner General of RRA for further follow up.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

18

OUTCOME 3: COMPONENT 3.1 CONCLUSIONS

Component 3.1: The support of OTA was well received and many of the recommended changes

have already been adopted or are underway. Additional recommendations for future work are

included in the OTA Memorandum of Recommendations to the Commissioner General. Several

areas for improvement were identified, including 1) delinquent tax payment deadlines, 2)

collections officer capacity building, 3) joint development of a comprehensive collections

approach, 4) ending automatic assessment of non-filers, and 5) guidance for best practices in

arrears balance management.

Overall, OTA’s support was well received in this area and RRA adopted many of the

recommended changes or is in the process of doing so. Due to the large number of issues to be

addressed, OTA recommends continued work, which is detailed in the Recommendations Memo.

Despite OTA’s advice to RRA, the evaluation team concludes that extending delinquent payment

periods is not considered best practice. OTA’s recommendation has been adopted, but the

evaluation team concluded that OTA may have misunderstood the root causes of taxpayers’

delinquencies. An efficient collections operation requires several enforcement stages because

delinquent accounts become less likely to collect over time. OTA recommended policy changes

that assumed delinquent taxpayers needed more time to pay; however, the evaluation team

concludes that extensions of delinquent payments to 36 months contributed to noncompliance.

Arrears become increasingly more difficult to collect as they aged, eventually becoming

uncollectable. Devoting efforts to educate taxpayers and enforce timely payment of tax

obligations in a consistent way is widely considered best practice.

The evaluation team also concludes that OTA’s support to develop RRA’s collection manual is

only part of a capacity building strategy that, to be fully effective, should have included

specialized training in improved investigative techniques that enable collections officers to work

through the best strategies and solutions for the many variations in circumstances and challenges

they encounter. RRA’s manual should describe how the business process works in any given

sector, describe the necessary documentation, and provide guidance for where to look for assets

and income. Rather than simply following prescribed solutions to anticipated situations, the

manual should enable critical thinking for auditors based on principles and critical questions for

each situation. The evaluation concludes, based on multiple counterpart interviews, that RRA’s

officers face limitations to investigate taxpayer's arrears properly, particularly where

circumstances vary beyond the limited cases found in the manual.

OTA also advised RRA to prioritize collections of easy case collections. However, the

evaluation team concludes that, based on evidence from counterparts, this resulted in more

complex cases to be almost entirely neglected, resulting in an increase in aged arrears. Instead of

selecting easy cases, OTA needed to work with RRA to develop a more comprehensive

collections approach that included enforcement interventions at each stage of the collections

process that would provide sequential enforcement and increased consequences as cases age.

Every case should see the same initial level of effort applied as the case moves up the

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

19

enforcement ladder. The easy resolution cases will be finalized early and the more complex will

continue up the ladder. OTA’s advice to focus on the easiest cases effectively allows

enforcement staff to pick the cases on which they wish to work, reducing incentives for resolving

all but the least revenue-recovering, more consequential, cases and generally erode a culture of

taxpayer compliance.

The evaluation team also concludes that OTA should have advised against RRA’s policy of

unrestrained, automatic assessments for non-filers. Automatic assessments should stop after one

or two late payments to confirm that the taxpayer’s business is active, as counterparts reported

many temporary and short-lived businesses remain on RRA’s registry, contributing to higher

arrears rates.

Finally, the evaluation team concludes that OTA should have provided guidance regarding

policies for write-offs or the setting aside of uncollectible debts that reflect best practices. Write-

offs provide a critical step in collections cycle, without which total arrears balances grow without

the appropriate enforcement action being taken and distort the Government of Rwanda’s revenue

accounting. OTA did not appear to assist RRA with arrears balance management best practices

through generally accepted, standard write-off policies.

COMPONENT 3: OUTCOME 3.1 RECOMMENDATIONS

OTA needs to use a more systematic approach to planning engagements.

It is critical that OTA advisors are current on country context and best practices in the field of tax

administration. It is an evolving field; as such, it is critical that OTA advisors recommend

changes that advance RRA’s practices. The conclusions section outlines a number of examples

where OTA guidance may not have been as efficient or effective due to a lack of understanding

of RRA’s larger business process and context. See Section IV for further information.

COMPONENT 3; OUTCOME 3.2

Table 4 summarizes the findings for Component 3.2, and a detailed discussion follows the

summary.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

20

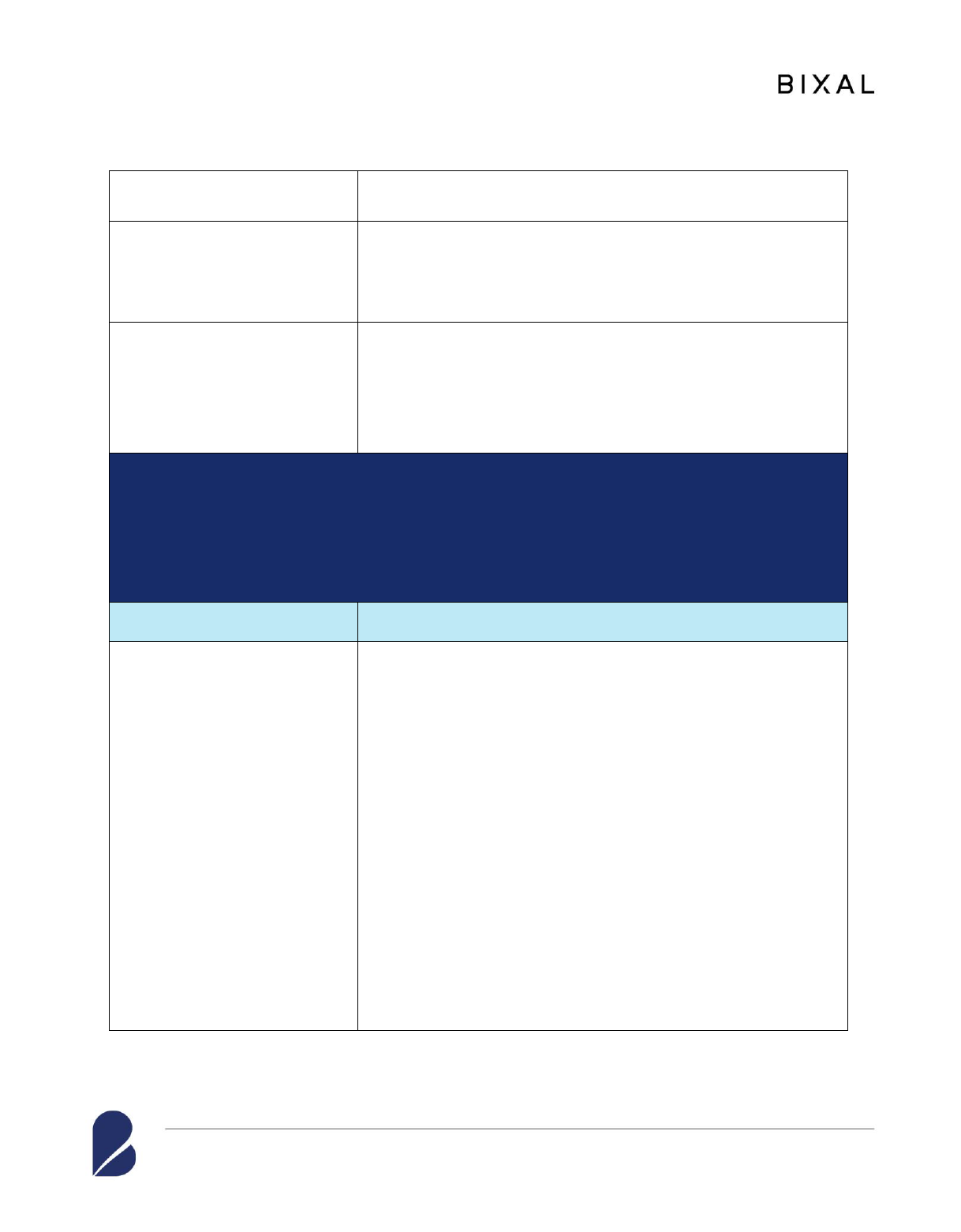

Table 4: Component 3 Outcome 3.2—Activities and findings

Expected Outcome: 3.2

RRA adopts and implements management information reporting and debt management reporting to

track and analyze trends in arrears over time. RRA management adjusts policies/procedures as needed

to facilitate debt collection.

Activities

Findings

3.2.2: Assist RRA in

designing management

information reports

• RRA had some management information in place, produced

manually in Excel spreadsheets. OTA supported the revision and

improvement of these reports. For example, OTA assisted with

refinement of the Top 25 arrears case reports and the debt

management report.

• RRA revised, adopted, and implemented some of the tax debt

policies suggested by OTA. However, RRA was primarily focused

on tax debt processes and procedures. Industry sector notes

(construction sector only) were produced to increase efficiency

when working with this key sector.

• RRA was already tracking one KPI for the aging of debts when the

OTA program started.

3.2.2: Train an RRA analyst

to conduct trend analyses

and develop monthly debt

management analytical

reports for management

• Training was completed for a number of staff, but few managers

were included in the sessions. Most trainings were single sessions,

not components of a systematic training approach.

• Training materials were developed by OTA but were not

complemented by use of a train-the-trainer model.

EQ 1: Which of the expected project outcomes were achieved?

Outcomes Status: Partially achieved

The outcomes under outcome 3.2 were partially achieved. Full achievement of Component 3.2

would have included training managers and building in a more systematic implementation, such

as a train-the-trainer model, to ensure training would continue to be replicated.

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Report revision and construction sector industry notes

The evaluation team has found that OTA’s assistance with the revision of the Top 25 reports has

been carried forward and continues to be used. Respondents noted that construction industry

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

21

sector notes have been continued but they have not been developed for the other sectors, such as

telecoms, banking, etc.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Time restraints prevented training

RRA was not trained to analyze data because of time restraints at the end of the project.

COMPONENT 3; OUTCOME 3.3 FINDINGS

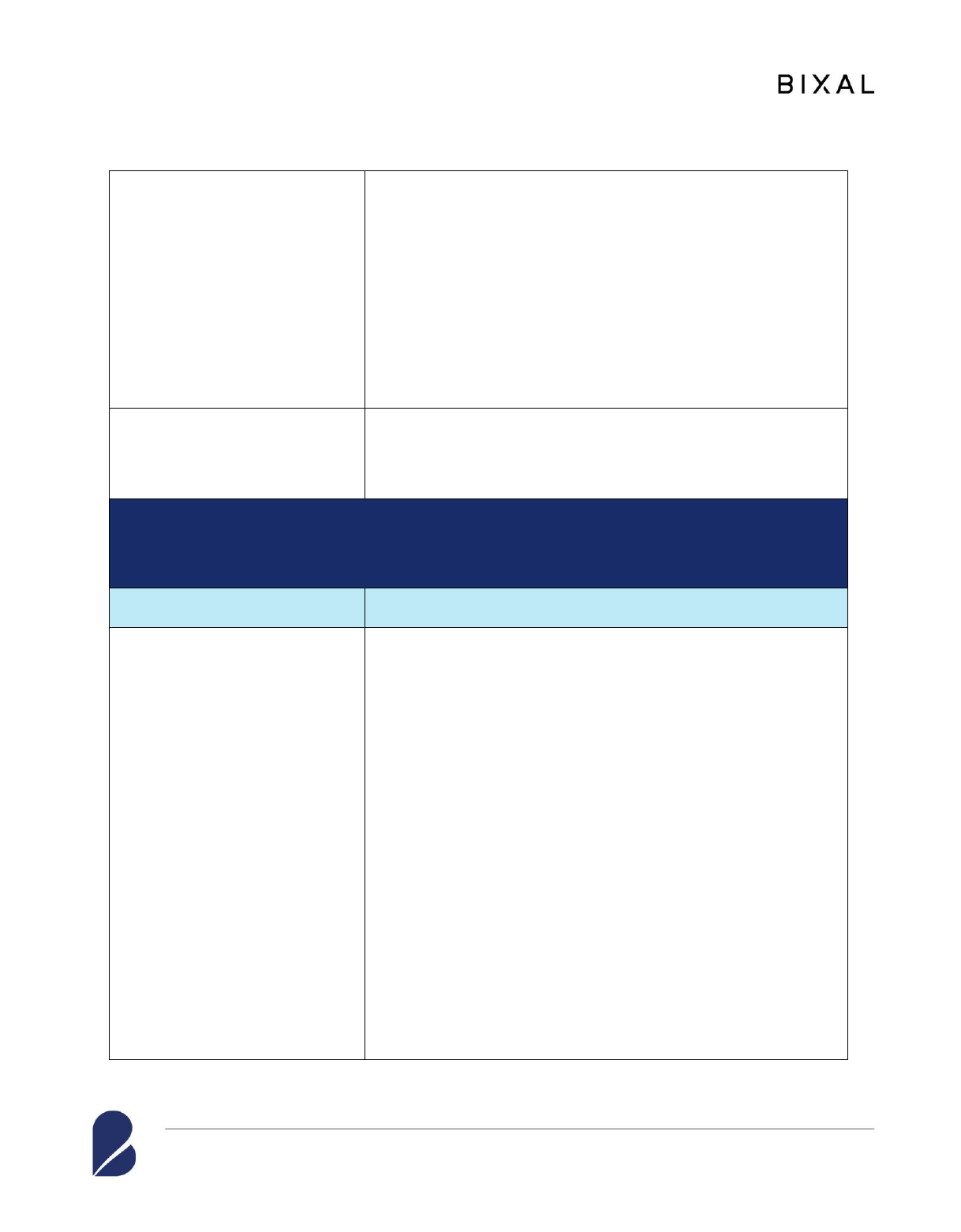

Table 5 summarizes the findings for Component 3.3, and a detailed discussion follows the

summary.

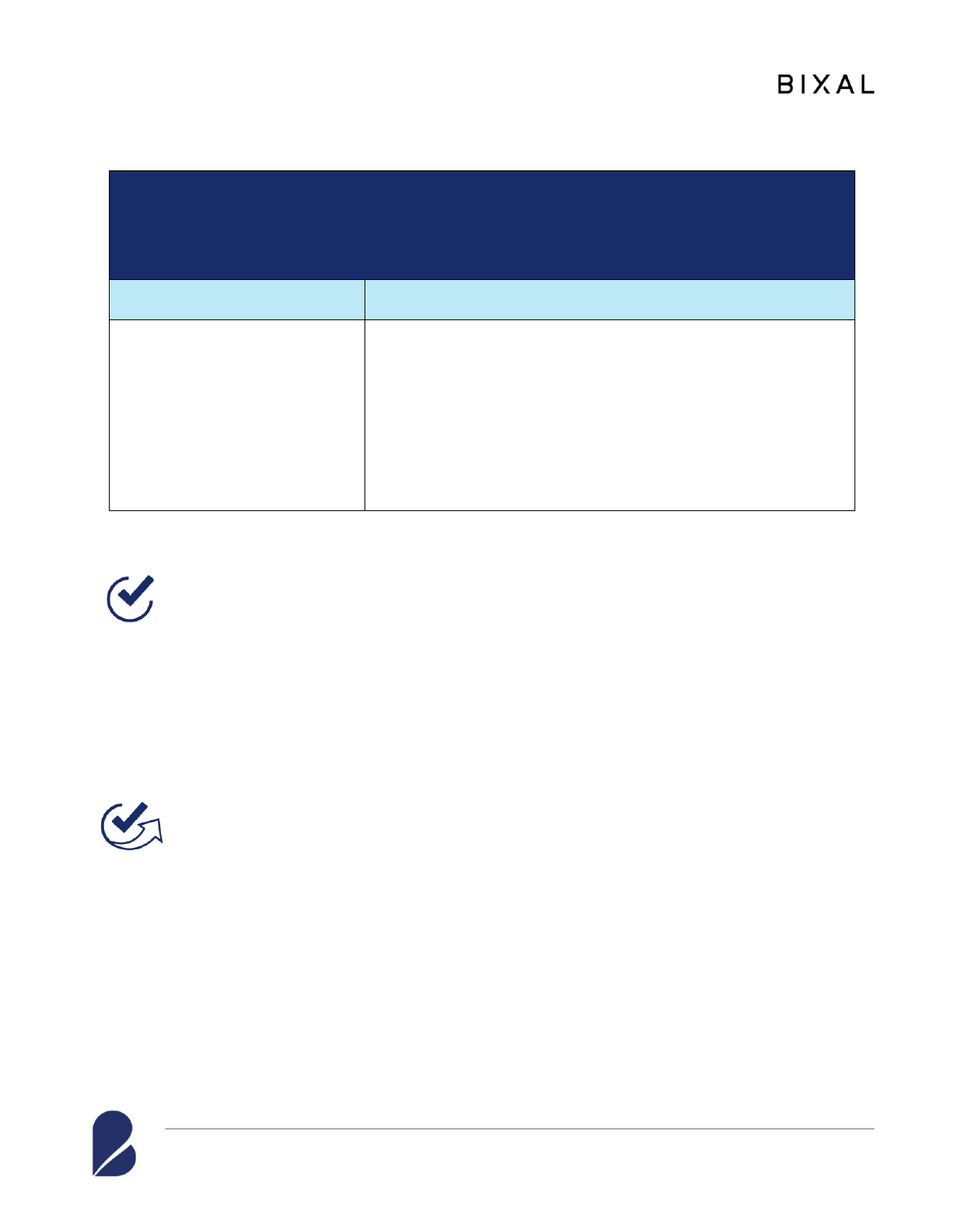

Table 5: Component 3; Outcome 3.1—Activities and findings

Expected Outcome 3.3

RRA analyzes data from timesheets to understand trends in productivity and assign cases to match

enforcement officer skills with caseloads.

Activities

Findings

3.3.1: Assist RRA in designing

timesheets for enforcement

officers (EOs)

• OTA supported the adoption and implementation of timesheets

for debt management as requested by RRA leadership.

However, OTA did not socialize this change or do any change

management, which led to poor adoption by staff.

3.3.2: Train Debt Management

managers and EOs on timesheets

• Training for RRA to analyze and use data from timesheets for

management decisions did not happen due to time constraints.

EQ 1: Which of the expected project outcomes were achieved?

Outcomes Status: Partially achieved

Outcome 3.3 was partially achieved. OTA introduced the concept of timesheets and the

importance of tracking staff time for accountability and task management. RRA put timesheet

protocols in place and is using them to monitor individual auditors’ performance.

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Timesheet protocols and practices

RRA has maintained the timesheet protocols and practices, but adaptation continues to be limited

in scope and not systematic across the organization.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

22

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Incomplete timesheet use

Timesheets are not used by all staff or fully completed; therefore, RRA is not able to use and

analyze timesheet data to understand trends in productivity across the organization. Ideally, this

information would be used to identify efficiencies and inform resource allocation, but data are

not sufficient for this level of analysis.

COMPONENT 3; OUTCOME 3.3 CONCLUSIONS

Timesheet use is not consistent across RRA and may not fully meet operational needs.

Timesheets were introduced by OTA, but never fully operationalized. While the use of

timesheets is a best practice, OTA advisors should begin the process by understanding RRA’s

operational process and ensuring the timesheets met their business needs. This would have made

the tool more useful and alleviated some of the resistance by staff to using the timesheet.

COMPONENT 3; OUTCOME 3.3 RECOMMENDATIONS

Train OTA advisors in change management principles and employ this approach when

introducing and operationalizing new tools or processes, such as timesheets.

OTA advisors should be trained in change management principles in the future to ensure they are

taking a more holistic approach when introducing new tools or processes. Any organizational-

level change should use a change management approach to ensure the new process meets the

needs of the organization and to gain buy-in by staff and managers. All levels of staff should

also be consulted to ensure the practice is applied and used throughout the organization.

Pr og ram Compon e nt 4: Sp eci alized S ect or Aud it

COMPONENT 4 OBJECTIVE

The objective of this component was to strengthen RRA’s capacity to audit construction

sector businesses and improve taxpayer compliance. The project components focused on

strengthening RRA’s ability to understand the sector’s business environment and regulations,

building them into their own audit policy and procedures. The expected outcome was to increase

the number of cases to be upheld in appeals as the result of RRA auditors using a completed and

more accurate audit manual.

COMPONENT 4 FINDINGS

Table 6 summarizes the findings for Component 4, and a detailed discussion follows the

summary.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

23

Table 6: Component 4—Activities and findings

Expected Outcome 4.1

RRA adopts and implements a construction sector section of the audit manual that complies with the

sector’s policies, procedures, laws, and regulations. RRA staff use audit manuals to conduct audits that

are complete and accurate, which are more likely to be upheld when appealed, leading over time to

increased voluntary tax compliance.

Activities

Findings

4.1.1: Assist auditors in

reviewing the laws and

regulations pertaining to the

construction sector and propose

revisions to the sector audit

policies and procedures

• OTA supported auditors to review the laws and regulations

pertaining to the construction sector and develop sector-specific

notes.

4.1.2: Assist in drafting a new

construction sector section of the

audit manual

• OTA helped adopt and implement a construction sector section

of the audit manual that complies with the policies, procedures,

laws, and regulations specific to the sector.

4.1.3: Train designated managers

and staff in the use of the

construction sector manual

• OTA provided some training materials and trained designated

managers and staff in the use of the construction sector section

of the audit manual. However, trained staff were moved to do

general audits right after receiving construction sector

training.

4.1.4: Mentor RRA auditors and

management on conducting

construction sector audits

• OTA provided on-the-job training and provided some live-case

reviews (one case was examined); however, OTA fell short on

securing commitment from RRA management to keep the

trained auditors in the same section.

EQ 1: Which of the expected project outcomes were achieved?

Outcomes Status: Achieved

OTA provided comprehensive support for all aspects of the component including devising and

updating the special sector audit manual, sector notes, and providing experiential training using a

live case. In general, the evaluation team found that the support provided in drafting the sector

notes was very useful and appreciated by the auditors at RRA.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

24

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Use of construction sector audit notes and updated manual

section

RRA still uses and regularly updates the sector notes and revised construction sector audit

manual.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Transfer of trained sector auditors to nonspecialized audits

After OTA provided the construction sector audit training, RRA management transferred the

trained auditors back to general, nonspecialized audit work. As a result, according to several

counterparts, OTA’s training has not been used.

COMPONENT 4 CONCLUSIONS

The range of construction sector audit support and advice of OTA was well received, gains were

made in all aspects of construction sector audits. Efforts are needed to keep auditors with

specialized training assigned to work in their new area of specialization.

This is one of the components where OTA provided comprehensive advice and their support

covered all aspects of the construction sector audit activity ranging from devising and updating

the special sector audit manual, sector notes, demonstration through a live case, and training.

OTA’s support on this component remained available consistently through the program. The

counterparts were very pleased with the model of support provided by OTA. However, the

auditors trained in construction were pulled away for work in other sectors immediately after

they completed their construction sector training. Here, OTA could have used the leverage and

sought assurance from the senior management that the trained auditors will be allowed to

practice their newly acquired skills.

COMPONENT 4 RECOMMENDATIONS

For future programs, direct and frequent meetings of OTA advisors and audit (technical)

managers, along with the user of a wider range of cases to demonstrate techniques during

training, can improve direct knowledge transfer. Securing an RRA leadership commitment to

retain auditors in the department of their (sector) training will also help sustain knowledge

transfer and future training.

OTA advisors worked only on one live case during the training on the construction sector. It

would have been more useful if OTA had demonstrated audit techniques by using a variety of

cases during the training to give a wider perspective. Feedback from respondents was that the

OTA advisors should meet directly and more frequently with the audit (technical) managers

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

25

instead of the senior managers. This would provide for more direct knowledge and skills transfer

to audit managers that are more involved in the day-to-day operations.

RRA would have seen greater benefits from OTA efforts if there was a commitment on their part

to train and deploy special sector auditors in a more efficient manner. RRA has a culture of

shifting employee resources at will and this practice could have been addressed in the areas

where OTA provided assistance, such as the construction sector audits. This could have been

done by securing an agreement from RRA leadership to keep the auditors in the same department

for which they received training until they cement their expertise and then train more auditors for

more sustainable outcomes.

Pr og ram Compon e nt 5: Computer -Assis te d Au dit

COMPONENT 5 OBJECTIVE

The objective of this component was to enhance the capacity of RRA auditors to conduct

complex audits and streamline the audit process in high-risk compliance sectors, such as

telecommunications and banking, using a Computer-Assisted Audit (CAA) program.

Component activities focused on training Computer Audit Specialists (CAS), educating

taxpayers on the relevant filing requirements that enable RRA to use computer-based audits, and

teaching auditors how to use audit data.

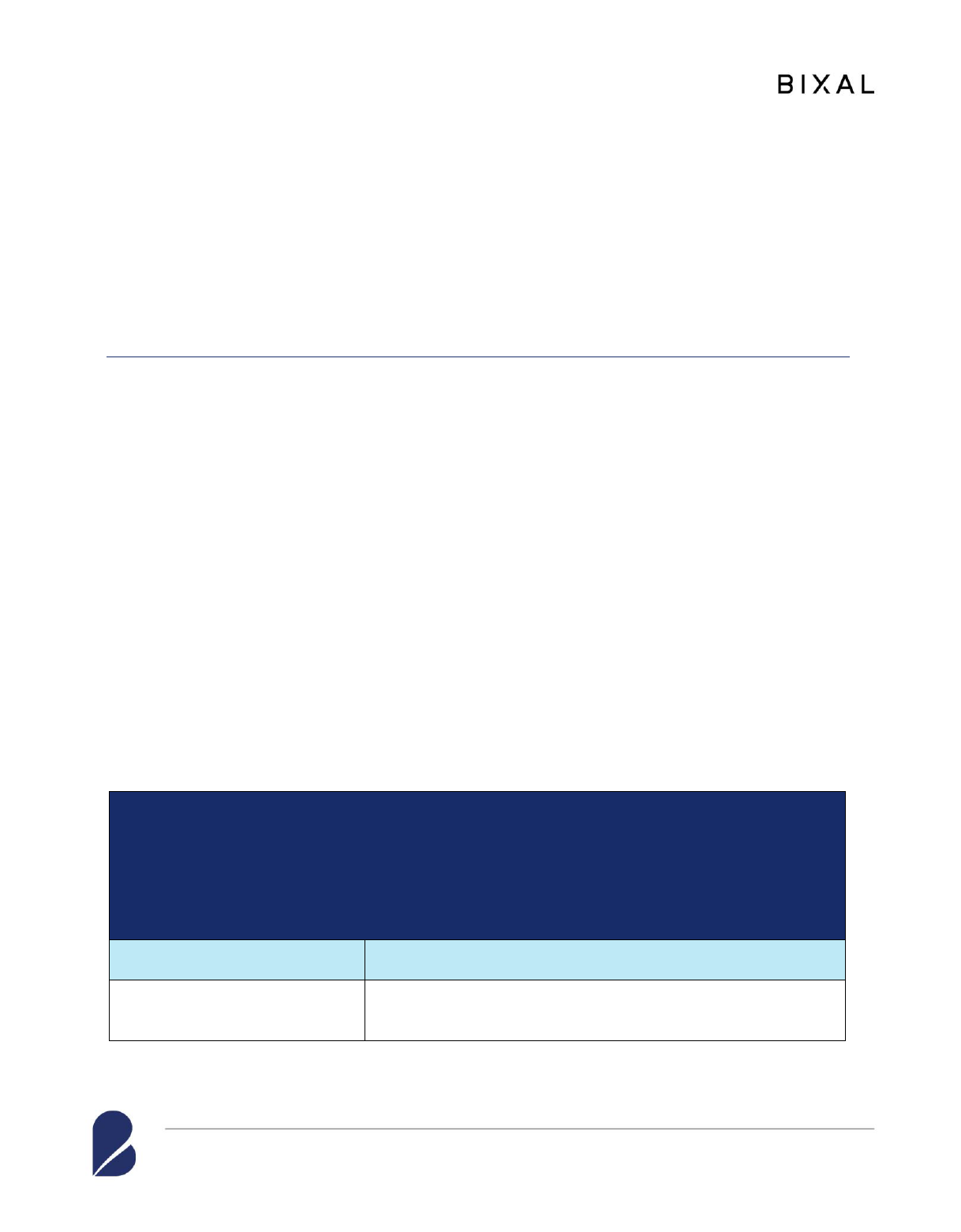

Table 7 summarizes the findings for Component 5, and a detailed discussion follows the

summary.

Table 7: Component 5—Activities and findings

Expected Outcome 5.1

RRA operationalizes and appropriately staffs a CAA Manager and a CAS. RRA adopts and

implements the CAA audit manual to analyze large datasets of taxpayer substantiation and efficiently

and effectively identify issues and adjust or verify tax returns.

Activities

Findings

5.1.1: Advise RRA management

on recruiting and staffing CAA

and CAA manager

• OTA suggested the idea of CAA and advised RRA

management on recruiting, staffing, and software needs

necessary for CAA management.

5.1.2: Train CAS auditors on data

management, analysis,

presentation skills, and other

fundamental CAA skills

• OTA developed some training materials for CAA and trained

three auditors. However, the team of three auditors who

received the training are no longer on staff. RRA is currently

training new CASs.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

26

• Due to fast staff turnover, RRA wanted OTA to train all

auditors on CAA; however, OTA did not have the resources

to do so.

5.1.3: Identify sources for online

and classroom training in

advanced Excel and IDEA Data

Analysis Software for the CAS

auditors

• The evaluation team did not find evidence, such as training

materials or sources for online or classroom training, for this

activity.

5.1.4: Assist RRA in developing a

new CAA section of the audit

manual

• OTA assisted in adopting and implementing the CAA manual

to analyze large datasets of taxpayer substantiation.

5.1.5: Train CAA manager in

CAS group management

responsibilities and how to

conduct CAA case reviews

• OTA did not provide any training to the CAA manager in

CAS group management.

5.1.6: Assist the CAA manager in

reviewing the development of the

CAS auditors and, as needed,

provide on-the-job training for

CAA

• This output was only partially achieved as CAA had not

actually started during OTA’s program. RRA is currently

preparing their officers so they can launch a formal CAA

program.

5.2.1: Assist RRA in developing

guidance to taxpayers on

maintenance of electronic records

for use in taxpayer audit

• RRA has not yet issued any guidance or materials to

taxpayers to educate them on how to maintain electronic

records for use in CAAs.

• Furthermore, OTA suggested revising the tax law and

procedures (the legislation was passed just a few weeks prior

to the evaluation team’s visit). The new law requires

taxpayers to file returns in an approved format, which enables

RRA to use the information and data from the return for CAA

purposes.

COMPONENT 5 FINDINGS

EQ 1: Which of the expected project outcomes were achieved?

Outcomes Status: Partially achieved

The expected outcomes for Component 5 were only partially achieved. OTA was able to

introduce CAA as a concept and begin initial steps of implementation, including the training of

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

27

staff. However, CAA is a complicated and resource-heavy endeavor. Full implementation will

take time and both human and financial resources beyond the scope of the current OTA project.

EQ 2: Which of the achieved outcomes have been sustained up to the present?

Outcomes Sustained: Not achieved, prerequisite infrastructure needed

This component cannot be considered achieved or sustainable because of prerequisites

that must be in place for operationalizing CAA—including software that can process CAA data

and expertise to use the CAA tool. In addition, regulations that allow RRA to perform CAAs

were only recently passed in 2023 after the program ended. The passage of the regulations

demonstrates buy-in by the Government of Rwanda to this process. RRA expects to conduct

further training to implement CAA now that a legal framework is in place.

EQ 4: For any expected outcomes that were not achieved, which factors hindered

success?

Hindering Factors: Prerequisite infrastructure needed

As mentioned above, RRA does not yet have the relevant infrastructure to support the

outcomes—the software and systems and the expertise to carry out such audits. The needed

legislative changes were enacted after the program ended. While OTA successfully introduced

CAA, systematic barriers prevented undertaking or achieving most of the workplan activities.

COMPONENT 5 CONCLUSIONS

Technical advice on CAA was provided by OTA before RRA had the established infrastructure

necessary to fully adopt and operationalize a CAA system. Further technical assistance on

establishing CAA, from taxpayer education to computing infrastructure, will be needed.

CAA is generally a very useful concept. This concept was recognized by the OTA team when

they recommended setting up a dedicated CAA team in RRA. However, the evaluation team

concludes that RRA had neither the capacity nor the systems in place to utilize technical advice

on CAAs. OTA provided technical advice that would have been useful (and needed) only after

RRA had established infrastructure to fully adopt a CAA system.

There will be continued work by RRA to implement the CAA that may require ongoing technical

assistance. This initiative requires a significant investment in taxpayer education for this type of

program to be successful. Implementation of a CAA program also requires software that

communicates with other RRA systems to be able to interpret information provided by taxpayers.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

28

COMPONENT 5 RECOMMENDATIONS

A whole-package approach to CAA in Rwanda, which includes sequential planning and is

informed by a thorough understanding of the local context, is key to effectively introducing and

operationalizing CAA.

CAA needs to be seen as an all-encompassing program from RRA and needs to be planned

accordingly. The recommendations made by OTA should therefore have included the whole-

package approach with an outline and sequencing of the necessary steps to be taken.

Due to high staff attrition, RRA wanted OTA to train all auditors for CAA. However, OTA did

not agree to the proposal and provided CAA training only to a couple staff members who have

since left RRA. This component highlights another aspect where close attention to the local

context rather than prescribing/following standard practice would be beneficial.

Pr og ram Compon e nt 6: General Audit Capacit y

COMPONENT 6 OBJECTIVE

The objective of this component was to strengthen RRA’s audit quality by establishing

Quality Review Staff (QRS), documenting procedures and standards for audit quality, and

developing a staffing plan and organizational structure to assure and expand adherence to

standardized good audit practices. Better quality audits were anticipated to result in accurate

assessments, allowing for better targeted collections and reducing the burden on the tax authority

in resolving disputes via the formal dispute resolution process.

Table 8 summarizes the findings for Component 6, and a detailed discussion follows the

summary.

Table 8: Component 6—Activities and findings

Expected Outcome 6.1

RRA establishes a QRS team with qualified employees, selected in accordance with stipulated position

descriptions and selection criteria. QRS personnel understand and execute their duties using defined

roles and responsibilities. RRA establishes a QRS team that operates a fully developed QRS that

improves audit case quality and reduces taxpayer appeals.

Activities

Findings

6.1.1A: Assess baseline audit

quality

• The evaluations assessed that this activity had not happened.

6.1.1B: Review current audit

organizational structure and

• OTA supported the establishment of a QRS team with qualified

employees, selected in accordance with stipulated position

descriptions and selection criteria.

Office of Treasury Assistance: Rwanda Revenue Authority Program Evaluation Draft Final Report

29

recommend establishment of a

QRS team

6.1.2: Assist RRA in creating

position descriptions and

selection criteria for QRS

auditors

• OTA helped QRS personnel understand and execute their duties

using defined roles and responsibilities and set up a fully

developed QRS that improves audit case quality and reduces

taxpayer appeals.

6.1.3: Assist RRA in developing

plans and procedures for quality

control in the audit process

• OTA supported the development of a quality review plan, a set

of procedures and audit techniques for audit quality control.