RWANDA REVENUE AUTHORITY

COMPLIANCE IMPROVEMENT PLAN

2016 - 2017

June, 2016

2

Compliance Improvement Plan

www.rra.gov.rw

3004 @rrainfo

3

Compliance Improvement Plan

FOREWORD

Citizens of Rwanda,

We are proud to introduce the inaugural RRA Compliance Improvement Plan, a high-level

overview of our plans for the next nancial year to further improve compliance with tax

legislation.

We plan to do this by focusing particular attention on areas which our research and risk

analysis model and tools have shown pose a signicantly higher risk of non-compliance.

By focusing on these issues we believe we can make a signicant impact on increasing the

fairness of the tax system.

RRA is currently guided in its eorts by a Strategic Plan that covers the period of 2015 -

2018. That Plan also provides for our commitment to developing a separate Compliance

Strategy through which we can use our resources more eectively in ensuring voluntary

compliance of our population of taxpayers.

I would like to thank the IMF for their technical assistance in the development of this strategy,

particularly Mr. Joshua Aslertt, who provided assistance regarding developing a Compliance

Risk Analysis Model and Tool, based on the compliance strategy best principles published

by the OECD for use by both developing and modern tax administrations.

Our tax system is based on the principles of self-assessment and voluntary compliance.

Voluntary compliance relies on taxpayers’ honesty in determining their tax obligations and

accurate reporting.

We believe that if you are making your fair contribution and doing the right thing, you deserve

to know that everyone else is doing so too! As we make it easier for all taxpayers to meet

their obligations quickly, easily and cost-eciently, we must make equally sure that those

who don’t pay their fair share and don’t abide by the rules are brought into the fold.

We believe that the most eective way to gain and maintain voluntary compliance is through

building a relationship of mutual trust and respect between the tax administration and the

taxpayers of Rwanda. That is why our Strategy includes an emphasis on improving our

service delivery to the public so that we can meet your expectations and provide the service

you deserve.

I hope that you will join RRA in ensuring that our tax system works fairly and that everyone

pays their fair share. In this way, the Government of Rwanda can trust to have sucient

revenues to enabling it to meet citizens’ expectation in terms of public goods and services

supply, hence leading to self reliance.

Sincerely,

Richard TUSABE

Commissioner General

4

Compliance Improvement Plan

CONTENTS

FOREWORD

1. GENERAL INTRODUCTION

• 1.1 Introduction

• 1.2 Background

• 1.3 Compliance Model

2. OUR COMPLIANCE IMPROVEMENT PLAN

• 2.1 Methods used to determine non compliance

2.1.1 Detecting non Compliance using Macroeconomic Data

2.1.2 Risk Dierentiation Framework

2.1.3 Detecting non compliant business sectors

• 2.2 PRIORITY AREAS AT A GLANCE

2.2.1 Compliance Strategy: Construction

2.2.2 Compliance Strategy Action Plan: Construction

2.2.3 Compliance Strategy: Hotels

2.2.4 Compliance Strategy Action Plan: Hotels

2.2.5 Compliance Strategy: Large Taxpayers

2.2.6 Compliance Strategy Action Plan: LTO

2.2.7 Compliance Strategy: Medium Taxpayers

2.2.8 Compliance Strategy Action Plan: MEDIUM

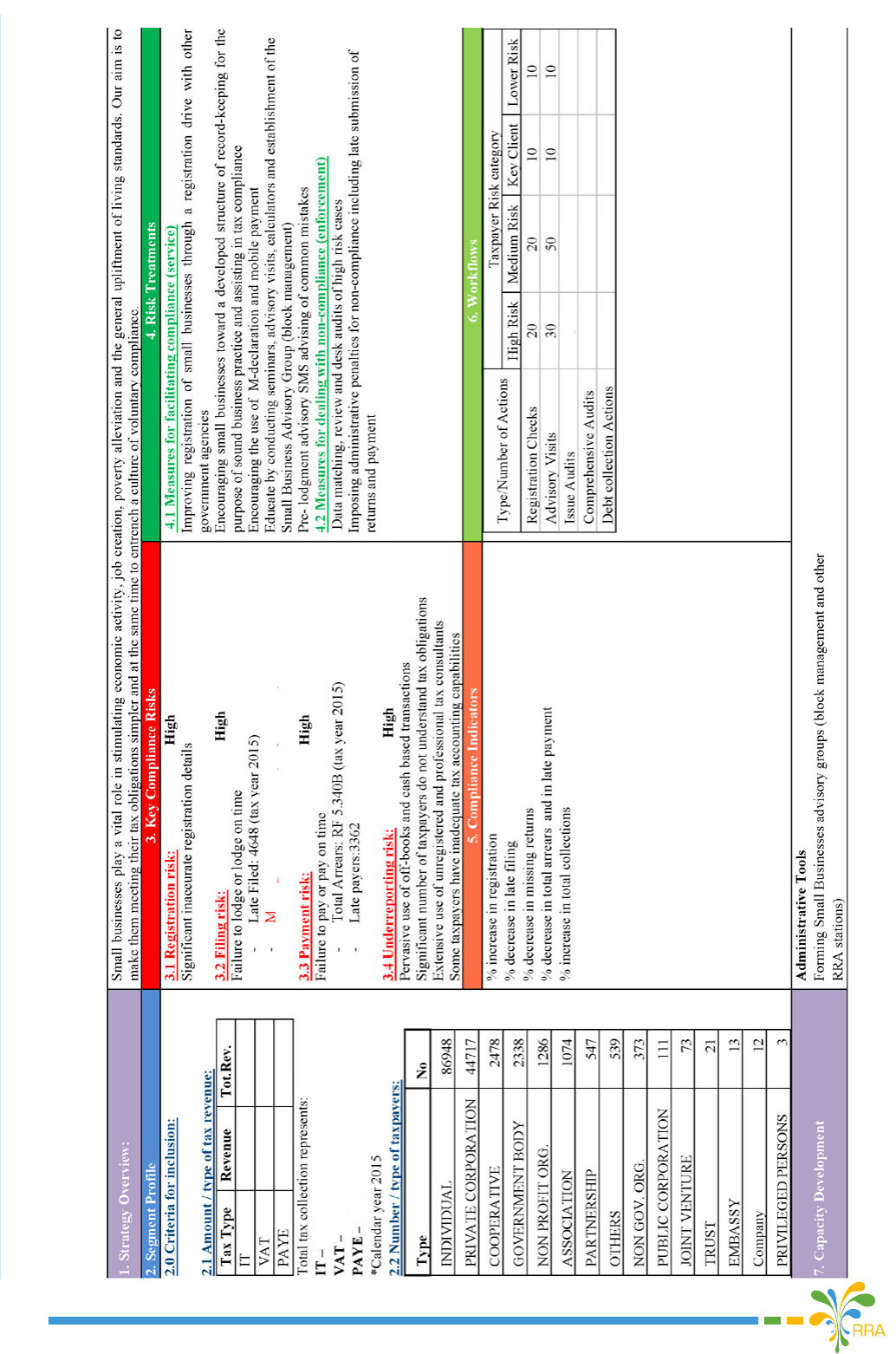

2.2.9 Compliance Strategy: Small Taxpayers

2.2.10 Compliance Strategy Action Plan: Small Taxpayers

3. MONITORING AND EVALUATION FRAMEWORK

4. CONCLUSION

LIST OF FIGURES

FIGURE 1 RRA RISK DIFFERENTIATION FRAMEWORK

FIGURE 2 COMPLIANCE MODEL

FIGURE 3 APPROACH TO DEVELOP COMPLIANCE IMPROVEMENT PLAN

FIGURE 4 REGRESSION ANALYSIS

FIGURE 5 LIST OF METRICS DEVELOPED

3

6

6

7

8

8

9

10

11

11

16

17

18

23

24

31

36

37

43

44

45

45

5

Compliance Improvement Plan

LIST OF ABBREVIATIONS

RRA: Rwanda Revenue Authority

TADAT: Tax Administration Diagnostic Assessment Tool

TA: Technical Assistance

RDF: Risk Dierentiation Framework

PSF: Private Sector Federation

IMF: International Monetary Fund

GDP: Gross Domestic Product

ISIC: International Standard Industrial Classication

ATAR: Association of Tax Advisors in Rwanda

ICPAR: Institute of Certied Public Accounts in Rwanda

TPS: Taxpayer Service

CRMMD: Corporate Risk Management and Modernization Department

CRMC: Corporate Risk Management Committee

DTD: Domestic Taxes Department

6

Compliance Improvement Plan

1. GENERAL INTRODUCTION

1.1 INTRODUCTION

The mission of Rwanda Revenue Authority (RRA) is to “Mobilize revenue for economic

development through ecient and equitable services that promote business growth.” RRA

is a quasi-autonomous body charged with the task of assessing, collecting, and accounting

for tax, customs and other specied revenues. This is achieved through enhancing taxpayer’s

compliance as per the RRA rst priority in the Strategic Plan for 2015/16-2017/2018.

Dierent studies categorize Taxpayer’s compliance in two perspective models (economic

Deterrence model and scal and social psychology model). Economic Deterrence model is

based on the concept that the risk of detection and punishment will improve compliance

behavior. Whereas scal and social psychology models inductively examine the attitudes

and beliefs of taxpayers in order to predict actual behavior.

The rationale for enhancing taxpayer’s compliance derives from the primary goal of the

RRA which is to collect taxes and duties payable in accordance with the law and do this

in such a manner that will sustain condence in the tax system and its administration. The

actions of taxpayers, whether due to ignorance, carelessness, recklessness or deliberate

evasion, as well as weaknesses in the tax administration mean that instances of failure to

comply with the law are inevitable. As such, RRA will endeavor to promote strategies and

structures that ensure non-compliance with the tax law is kept to a minimum level.

The overall objective of this compliance improvement plan is to facilitate the compliance

process by creating a compliance environment in which easy administrative procedures,

systematic guidance of the taxpayers and a variety of incentives will make the taxpayers

comply with their tax obligations to the highest extent possible.

During the period of this compliance improvement plan, RRA eorts will focus on the

expansion of the tax base and collection of the appropriate amount of tax from taxpayers.

This is going to be achieved through undertaking various initiatives targeting to inuencing

the current taxpayers’ compliance behavior and strong enforcement measures for intentional

non compliance attitude leading to reduction of the tax gap.

1.2. BACKGROUND

The TADAT assessment report of August 2015 identied unsystematic impact assessment

of compliance management interventions across the RRA. Some weak areas were pointed

out including but not limited to: registration, ling, payment and accuracy reporting and there

is a need for RRA to understand the causes of non-compliant behavior of taxpayer and take

adequate corrective measures. The International experience suggests that most types of

non compliance are best treated by: i) understanding underlying causes; ii) making groups

of taxpayers aware that their noncompliant behavior is known; iii) adopting a cooperative

approach to reconciling; and iv) demonstrating the seriousness of the administration

through small numbers of high-prole enforcement activities.

It is in this context that RRA with IMF TA had developed Compliance Risk Analysis Model

and Tool based on best practices from Australia Tax Oce. The adopted model will help the

tax administration to maintain a best and sustainable way of improving taxpayer’s attitude

and behavior towards fullling their obligations.

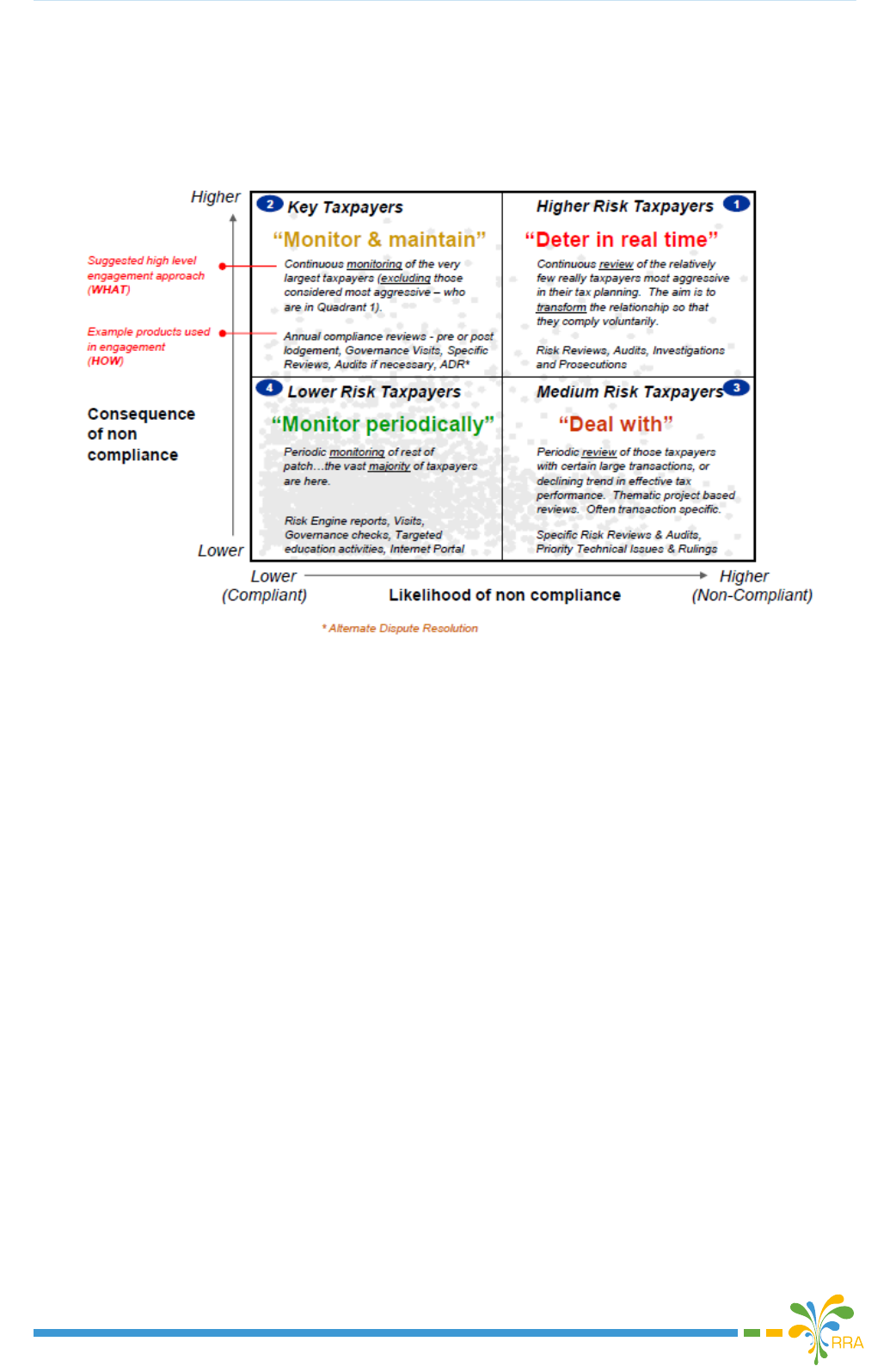

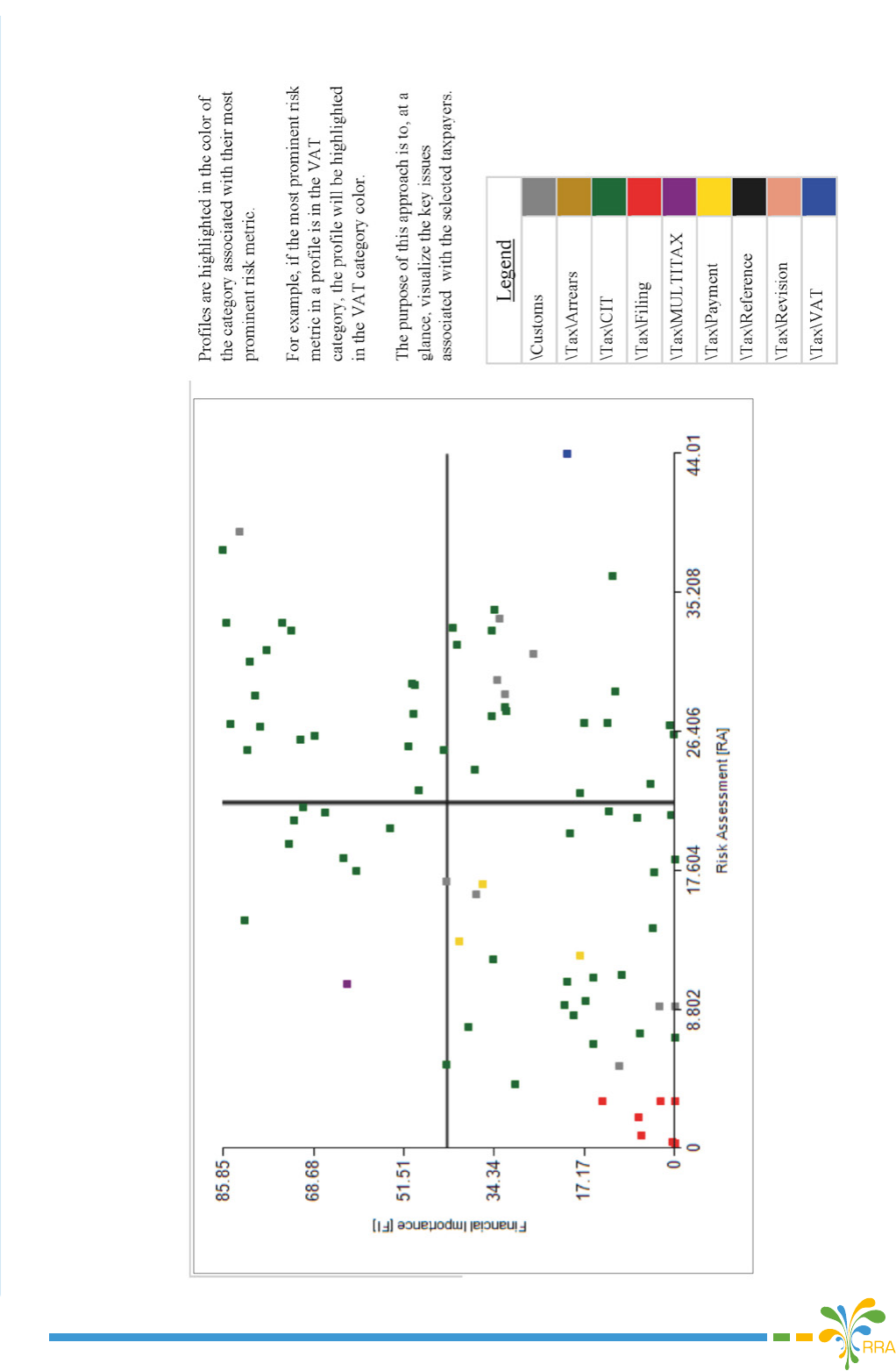

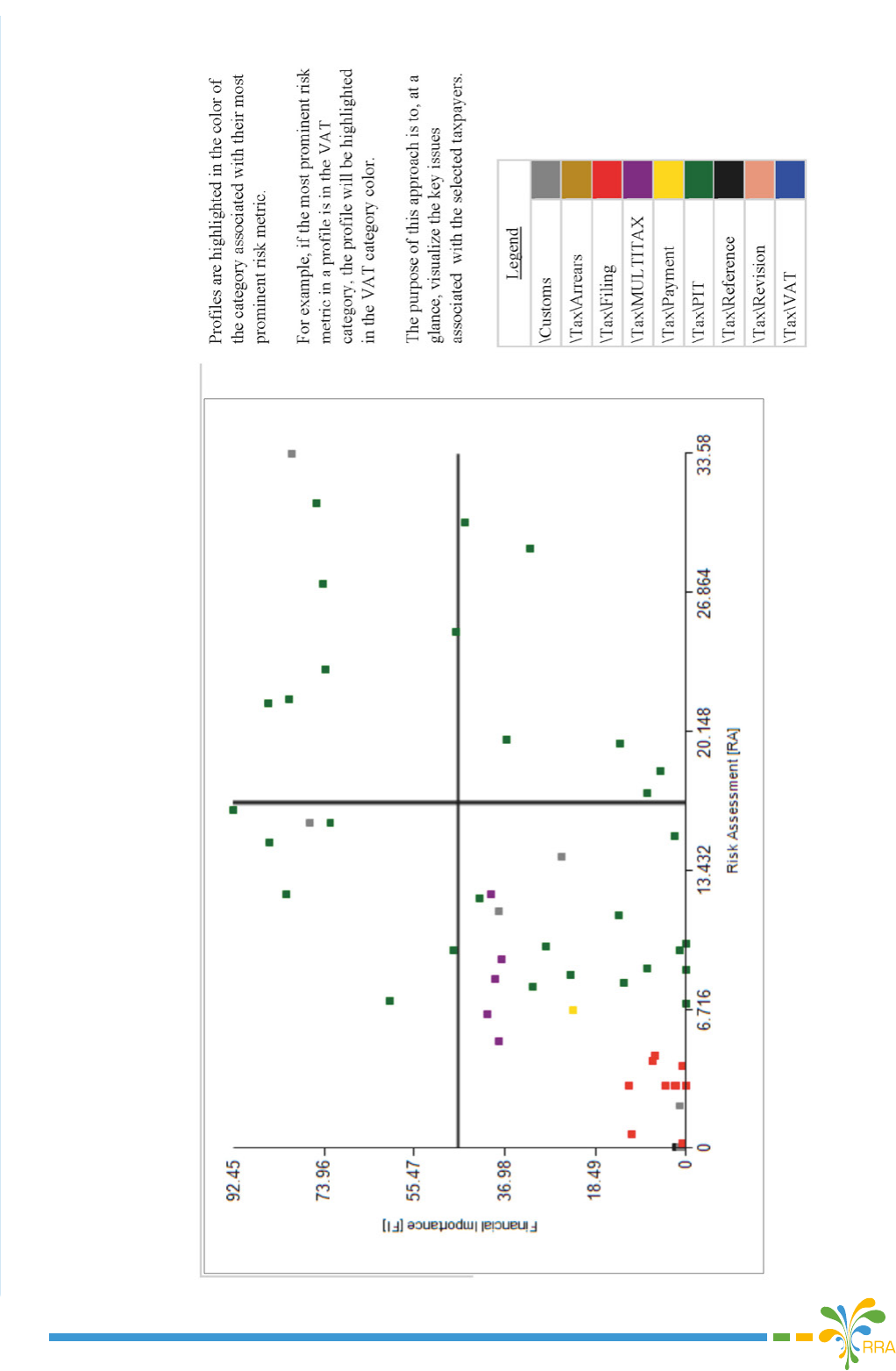

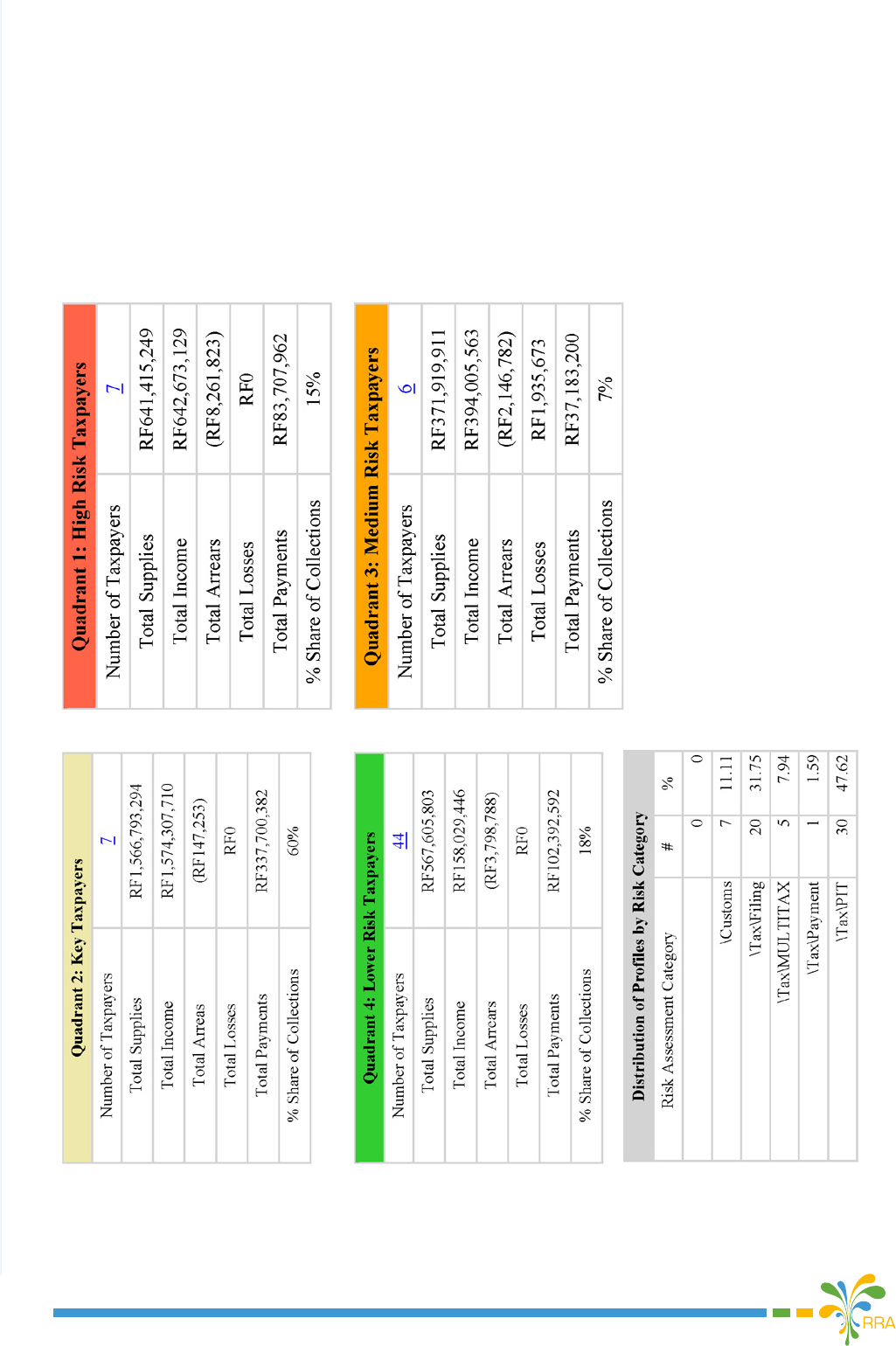

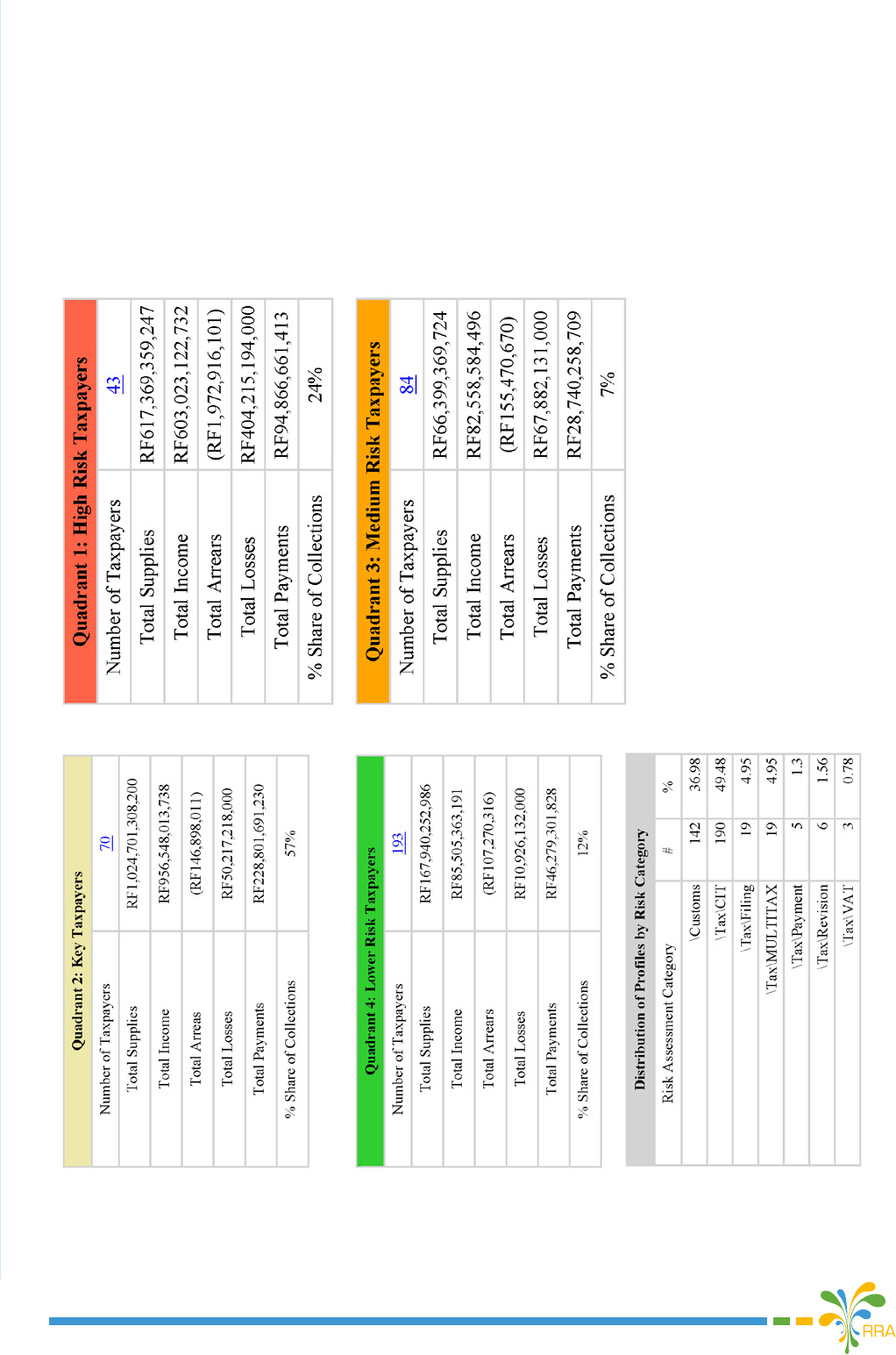

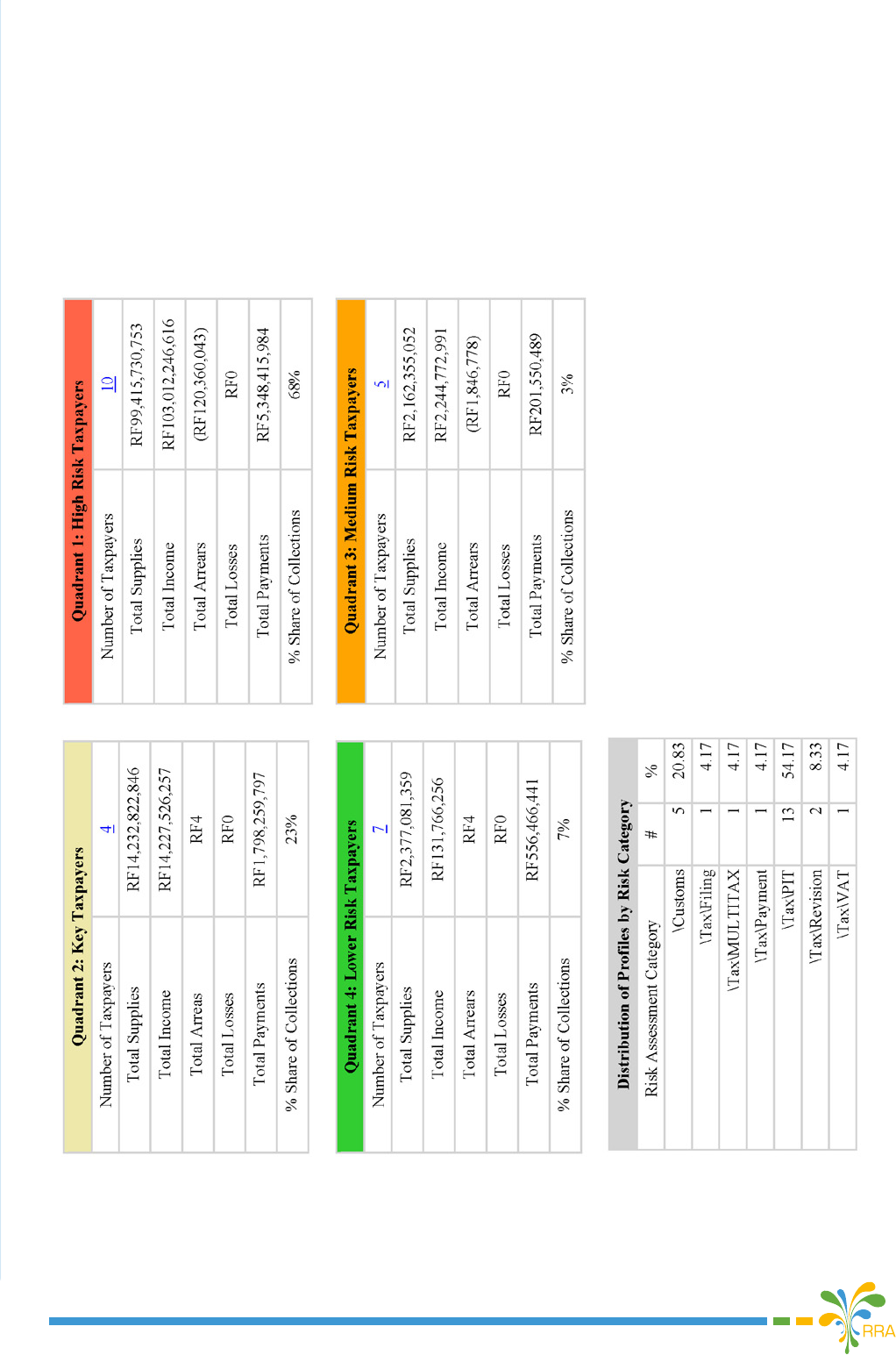

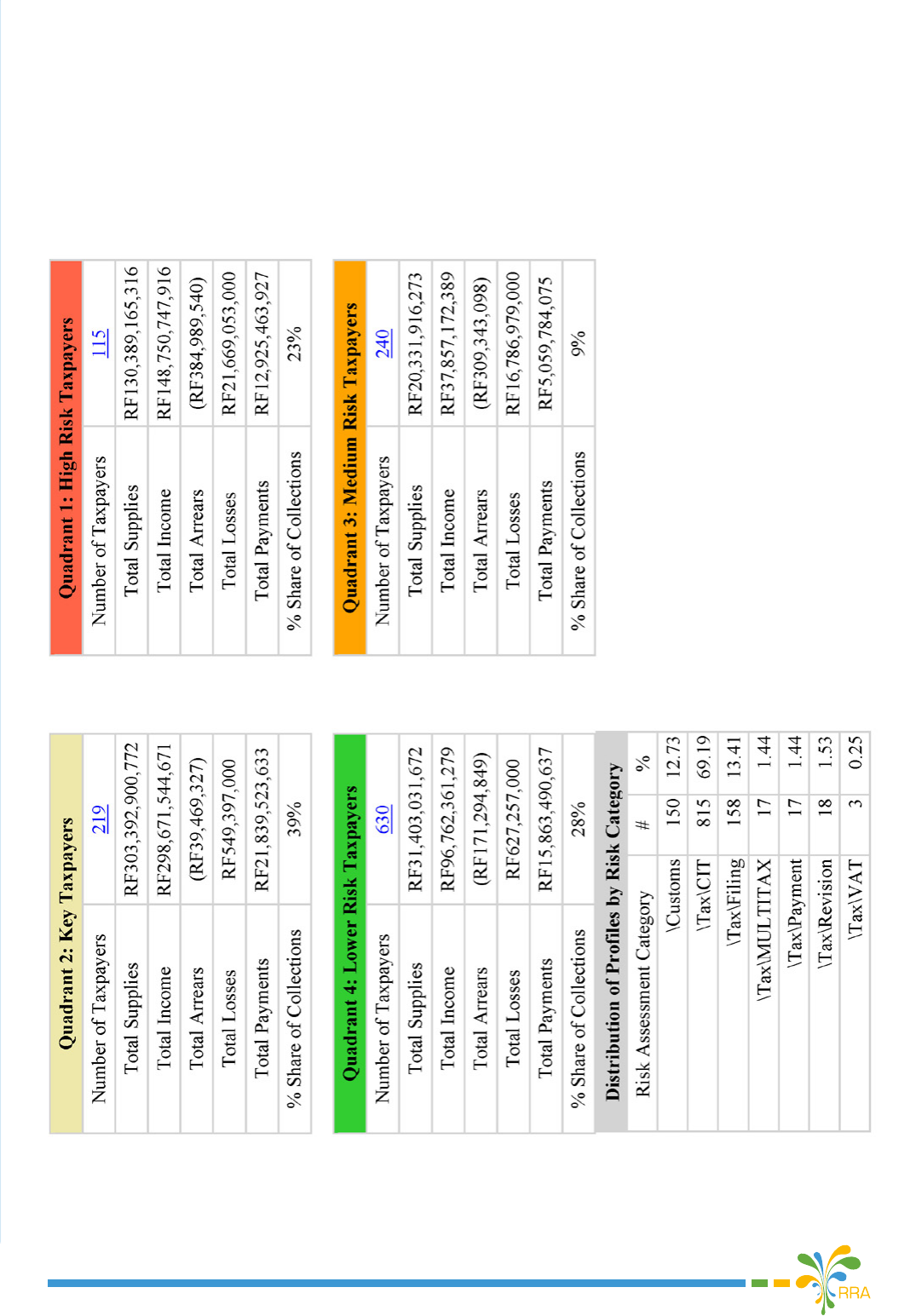

The adopted following Risk Dierentiation Framework (RDF) is made up of four dierent

quadrants (groups) that contain taxpayers with common behaviors as per risk perspective:

7

Compliance Improvement Plan

Quadrant 1: Higher Risk Taxpayers

Quadrant 2: Key Taxpayers

Quadrant 3: Medium Risk Taxpayers

Quadrant 4: Lower Risk Taxpayers

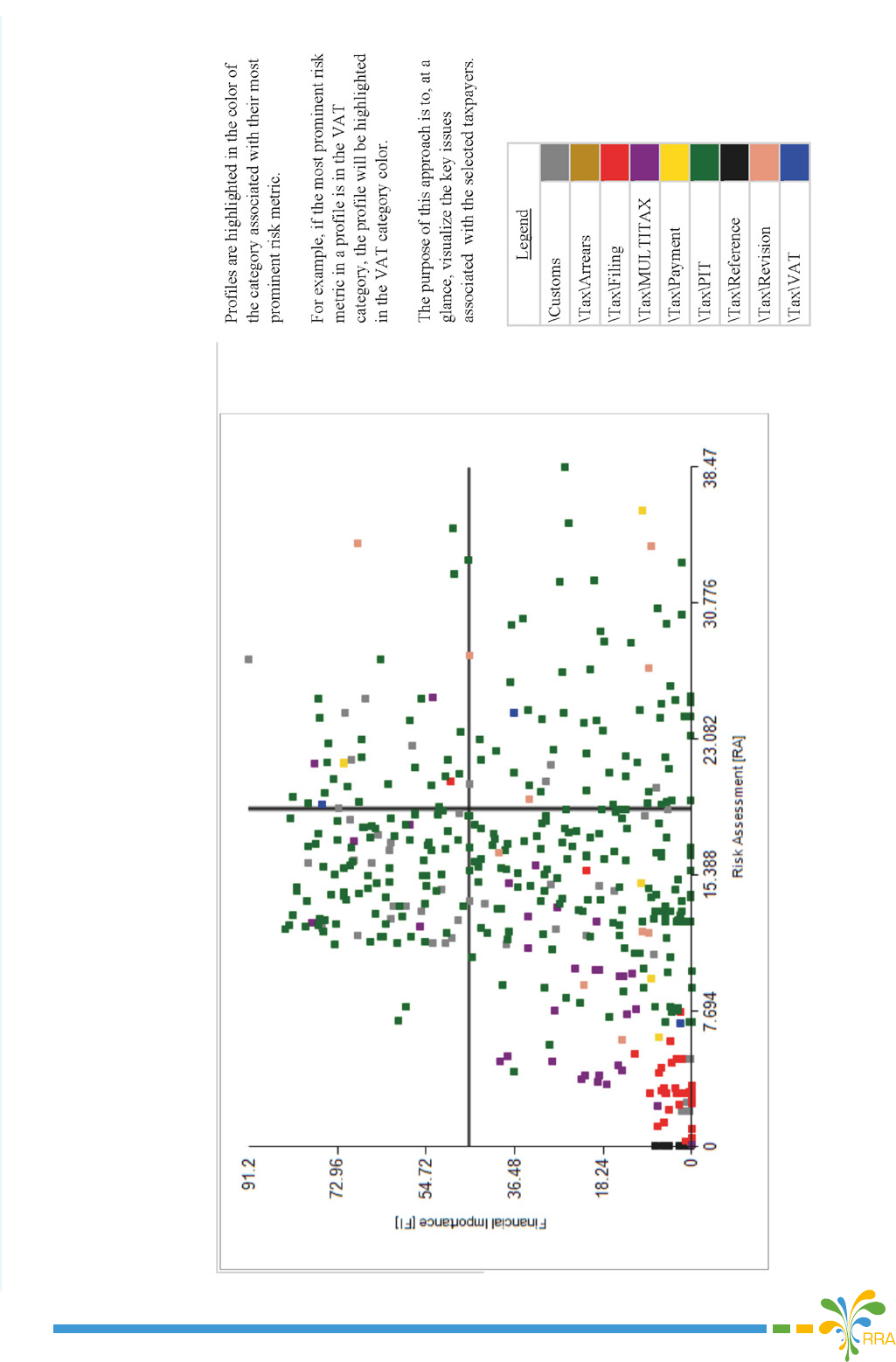

Figure 1 RRA Risk Dierentiation Framework

The above RDF is based on the premise that our risk management approach to tax

compliance should take account of our perception of both the:

i) estimated likelihood of you having a tax position that we disagree with, or you (through

error or omission) have misreported your tax obligations (as evidenced by your behavior,

approach to business activities, governance, and compliance with tax laws),

ii) Consequences of that potential non-compliance (nancial impact, relative inuence,

impact on community condence).

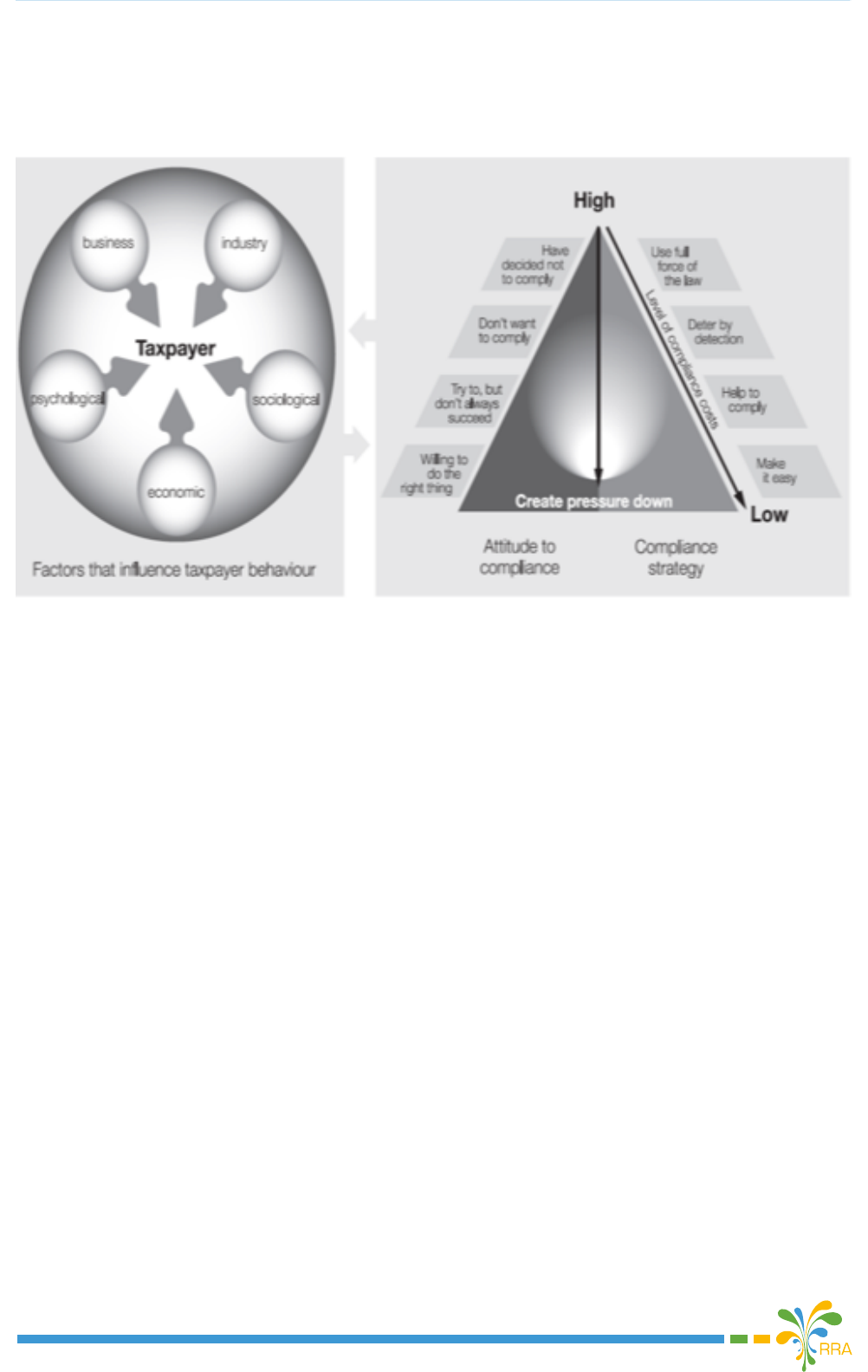

1.3. COMPLIANCE MODEL

The compliance model below provides a structured way to better understand what

motivates people to comply, or not comply, and it assists us to tailor our responses and

interventions so that we can inuence taxpayer behavior in a positive way. It recognizes

that taxpayers are not a homogenous group and their circumstances can change over time.

The left side of the model identies the wide variety of factors that can inuence the extent

to which a taxpayer chooses or is able to meet their obligations, including business,

industry, sociological, economic and psychological factors. This mix of environmental

factors is represented by the acronym BISEP: B = business prole, I = industry factors, S =

sociological factors, E = economic factors and P = psychological factors.

The right side of the model reects the dierent taxpayer attitudes to compliance, ranging

from ‘willing to do the right thing’ to ‘have decided not to comply’, and the corresponding

ATO RDF TreatmentStrategies

8

Compliance Improvement Plan

high level strategies that are most likely to eectively address those attitudes.

Figure 2 Compliance Model

The model advocates a deeper understanding of motivation, circumstances and

characteristics, so that assistance and enforcement actions can be tailored to promote

better compliance. The ultimate aim is to inuence as many taxpayers as possible to

move down the pyramid into the ‘willing to do the right thing’ zone. Analyzing compliance

behavior in this way assists us to address the actual causes of non-compliance rather than

the symptoms.

2. OUR COMPLIANCE IMPROVEMENT PLAN

2.1. METHODS USED TO DETERMINE NON COMPLIANCE

While the overall compliance climate is not good but showing improvement, we know

that we need to continuously focus our eorts on not just sustaining the levels of willing

compliance, but on creating a climate that is increasingly conducive to full compliance by

all taxpayers.

To do this we need to constantly monitor the compliance levels of taxpayers, traders

and other stakeholders in order to pin-point areas of high or low compliance and then to

understand the drivers of this good or bad behavior so that we can devise appropriate

strategies in line with our compliance approach to sustain or alter the behavior as required.

9

Compliance Improvement Plan

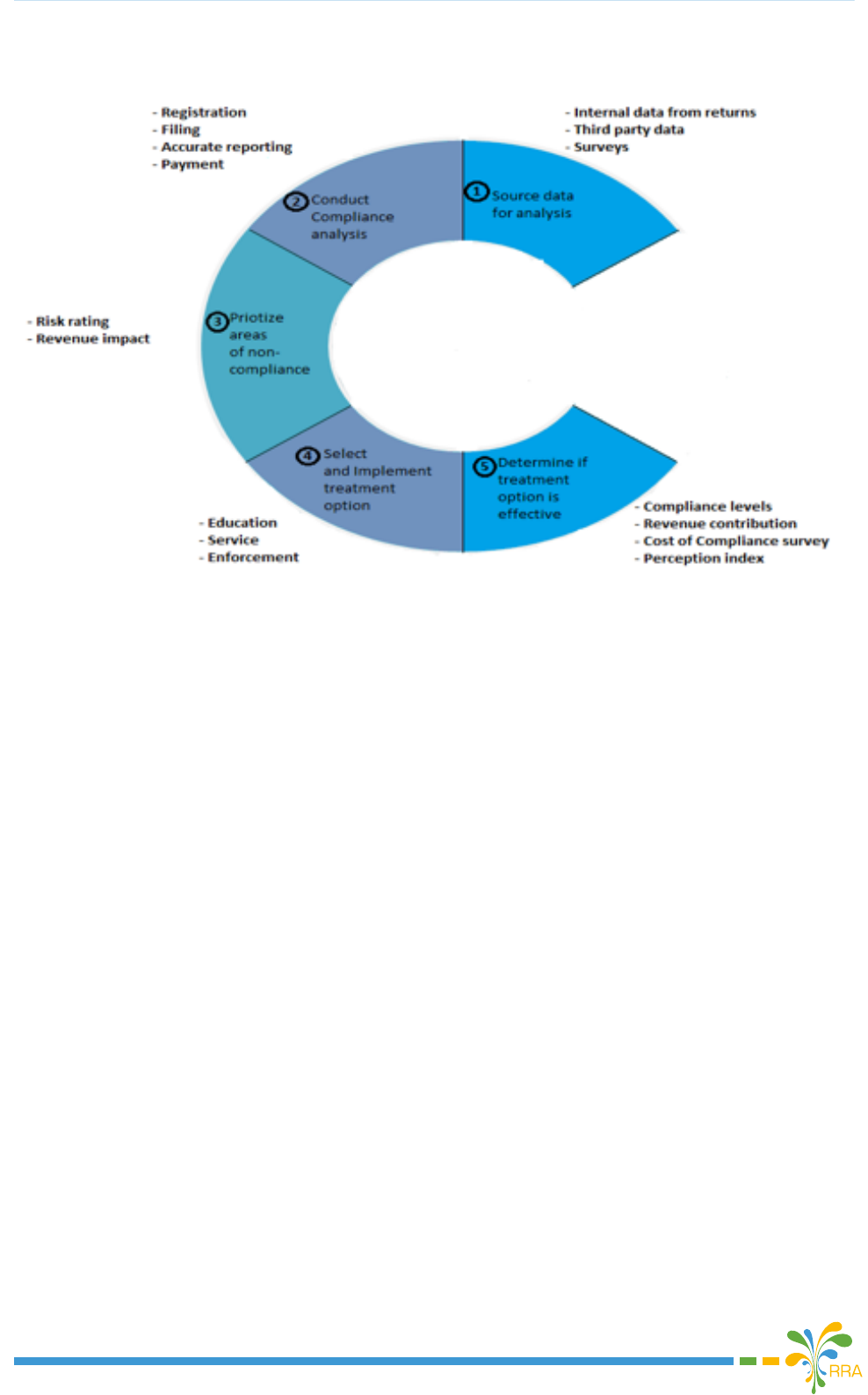

OUR APPROACH IN DEVELOPING THE COMPLIANCE STRATEGY

Figure 3 Approach to develop compliance improvement plan

How we select our priority areas:

To ensure our Compliance Improvement Plan is broad and inclusive, and that we explicitly

focus on changing the compliance landscape, we look beyond just basic above-the-line

risk assessments. This means that for each of our segments and sectors we consider:

The industry’s overall risk rating

The revenue risk posed by the industry

Specic lifecycle risks relating to registration, ling, accurate reporting and payment

Systemic legislation and policy gaps and risks

Which system optimization would have the biggest impact on compliance

Which education and empowerment initiatives would have the biggest impact on compliance

What leverage opportunities we have to maximize compliance

To select and prioritize areas for compliance improvement, we used the macroeconomic

approach to detect non compliance and RDF model methods on 2015 tax returns data to

classify taxpayers into dierent quadrants as described in previous pages.

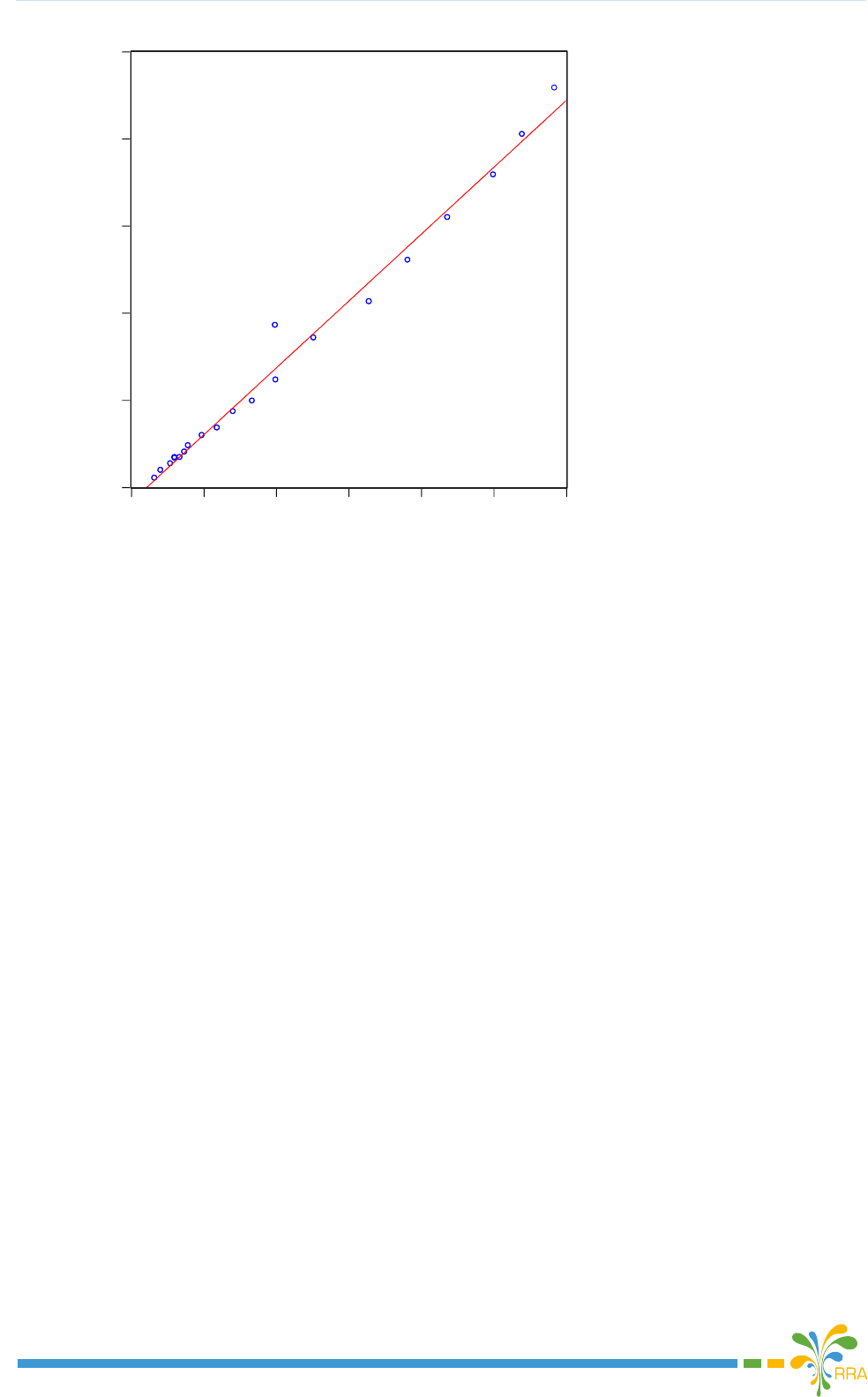

2.1.1 DETECTING NON COMPLIANCE USING MACROECONOMIC DATA

The objective of using macro economic data while analyzing the level of compliance is

mainly to determine the underreporting of income by economic sectors. To achieve this

objective, one has to use the basic econometric model establishing the relationship among

taxes and GDP (expressed in nominal values), the latter being taken as a proxy of the tax

base. The basic model is given by the following formula:

ln TRt = ln β0 + β1 ln GDPt + εt

10

Compliance Improvement Plan

0

200

400

600

800

1,000

0 1,000 2,000 3,000 4,000 5,000

6,000

GDPN

TRN

Where: TRt is aggregated Tax Revenues in time t

GDPt is Gross Domestic Product in time t

εt is the Error Term or stochastic term

ln is natural logarithm

Figure 4 Regression Analysis

Tax revenues being a stochastic variable, one may easily point out that for 2014 and 2015

tax periods, the authority has collected revenues above the average which signicantly

conrm the good performance compared to previous tax periods under consideration.

Various empirical studies have shown that Rwanda has an elastic tax system, with an

overall elasticity estimated to 1.39% which implies that there is a way of increasing revenue

collections without necessarily introducing discretionary policy changes. The analysis

has also shown that except the import duty which the elasticity was estimated to 0.67%,

other tax heads were found elastic with elasticity estimated to 1.637%, 1.114%, 1.0147%

respectively for direct taxes, VAT and excise duty (BNR, Economic Review, Vol 8).

The detailed analysis of non compliance by tax head and by business sector will be more

useful after updating the tax registry as per ISIC requirement and most probably will be

included in the next compliance improvement plan.

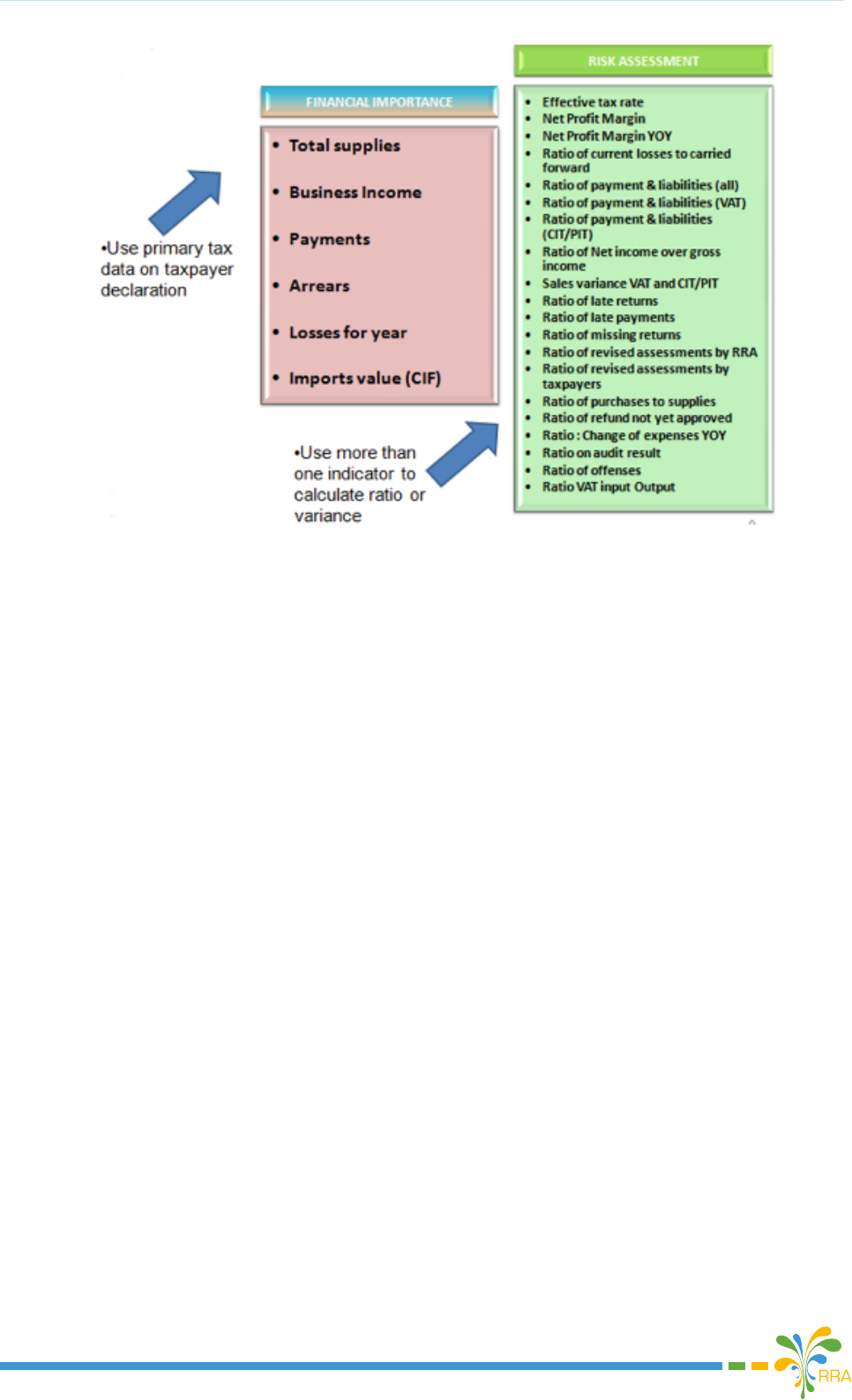

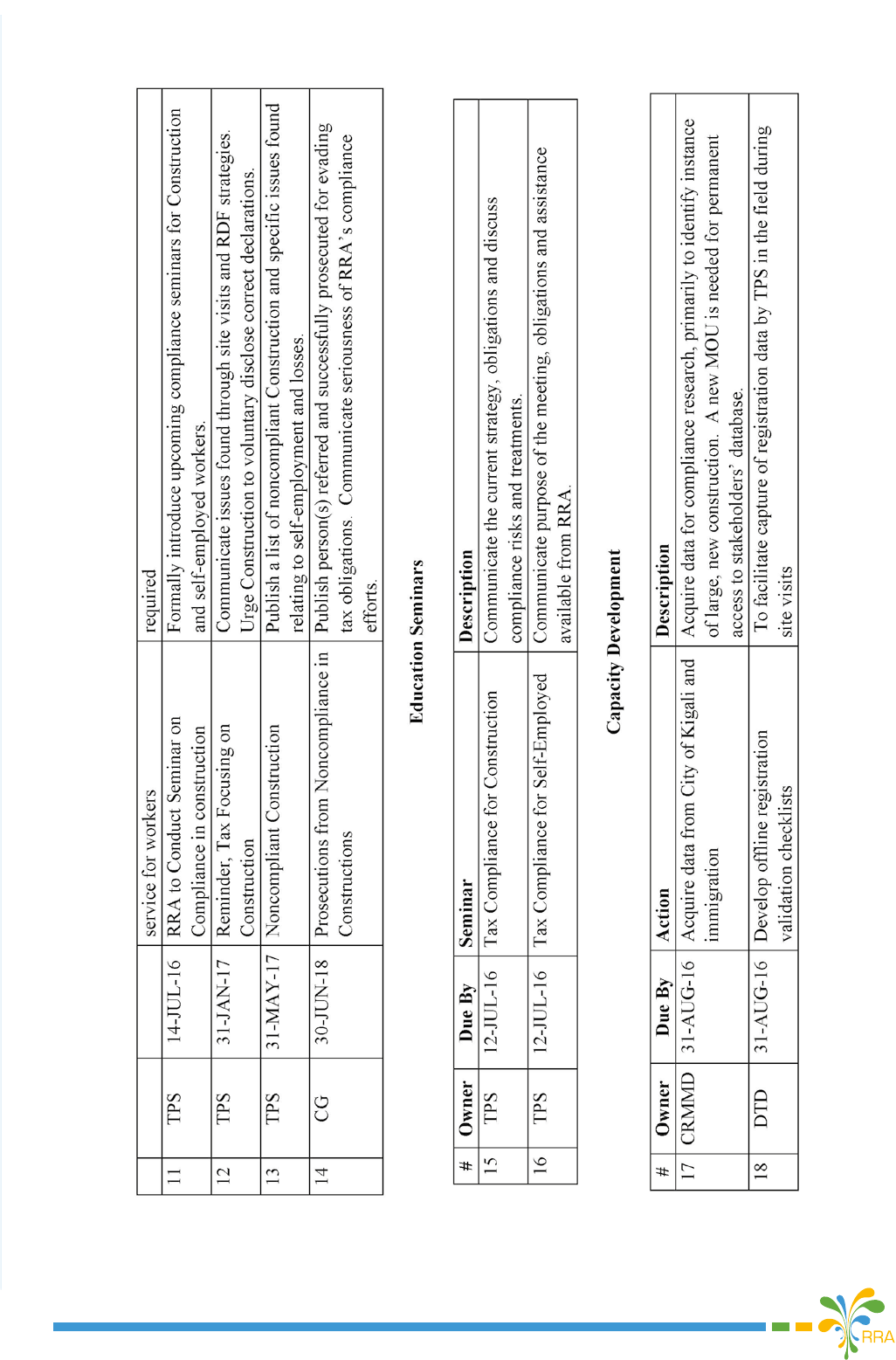

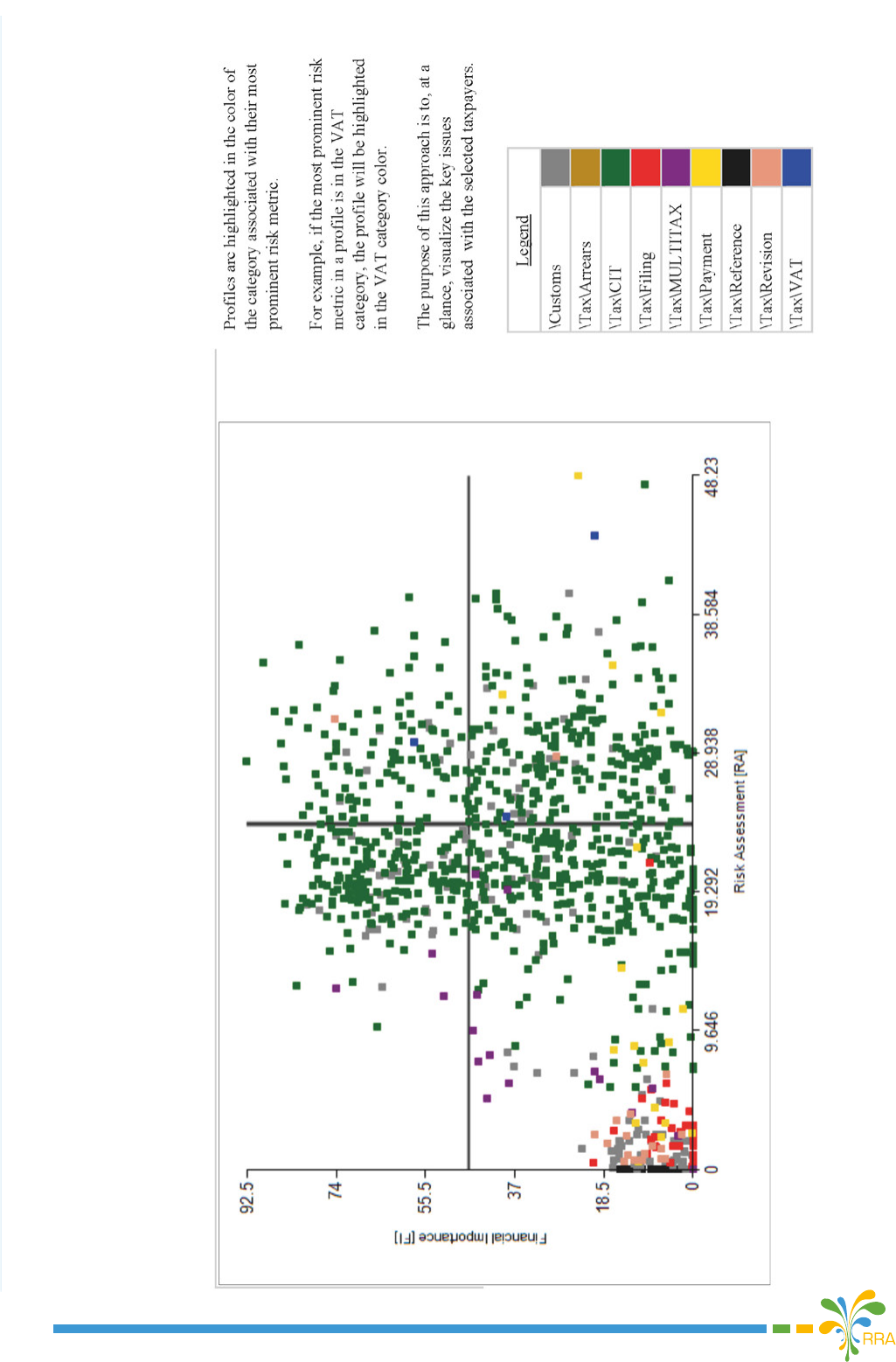

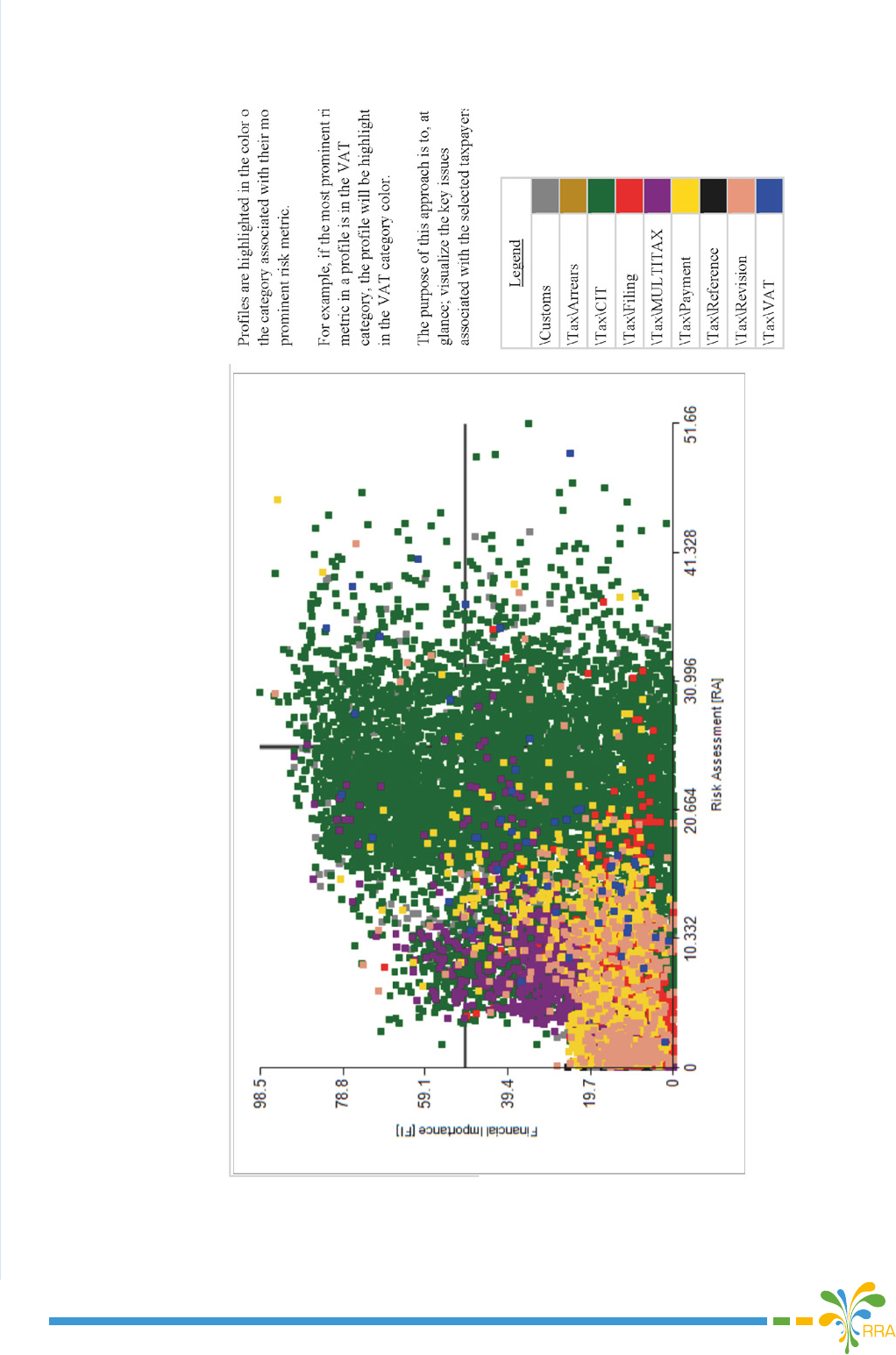

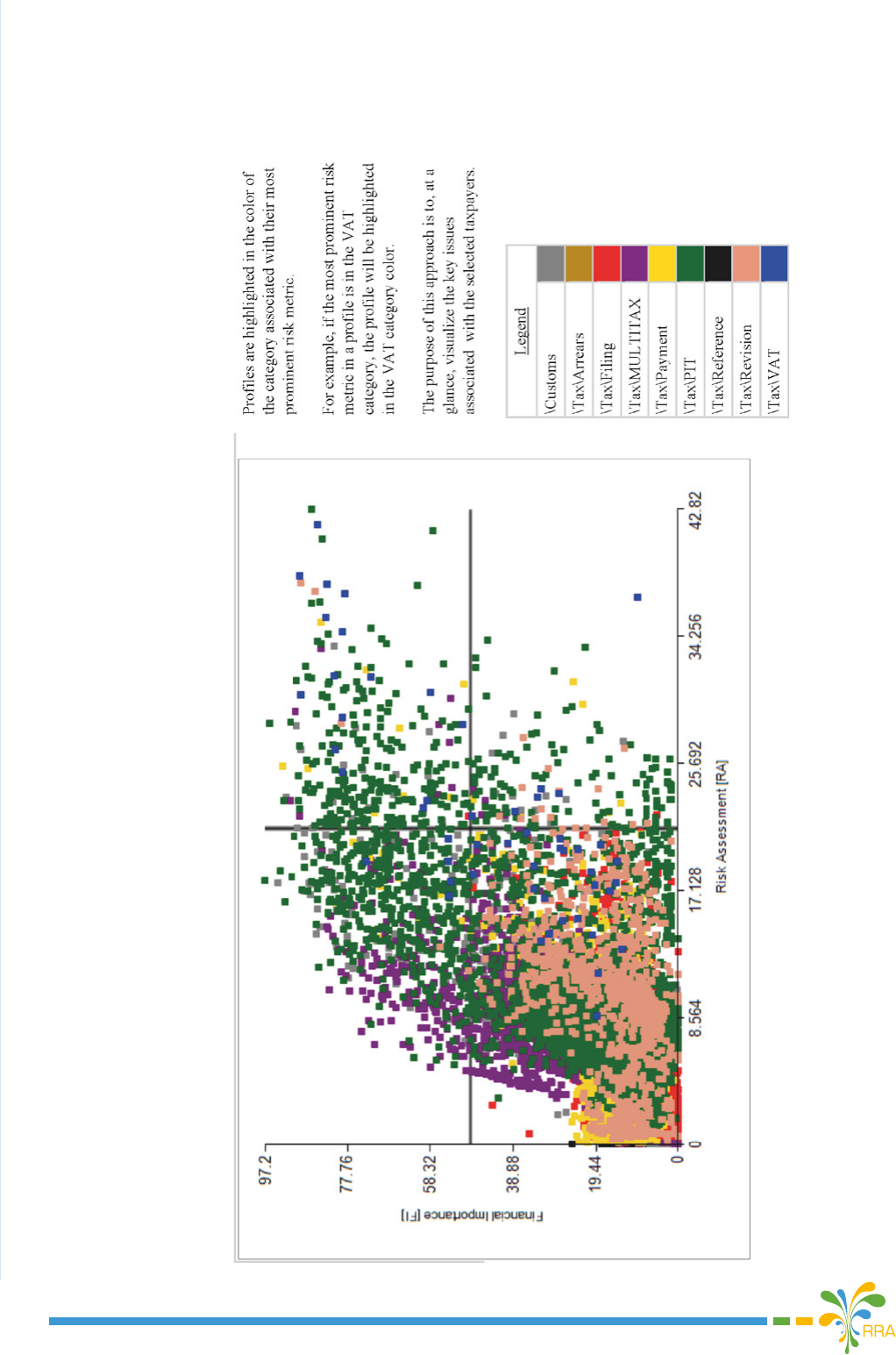

2.1.2. RISK DIFFERENTIATION FRAMEWORK

To be aware of its own causes of non-compliant behavior of taxpayers, the tax administration

needs to stimulate compliance and prevent non-compliance. In order to attain that objective,

RDF tool helps to frame taxpayers’ risk to revenue using dierent metrics to measure and

calculate data for proling purpose.

The metrics listed below have been used for tax compliance.

11

Compliance Improvement Plan

Figure 5 List of metrics developed

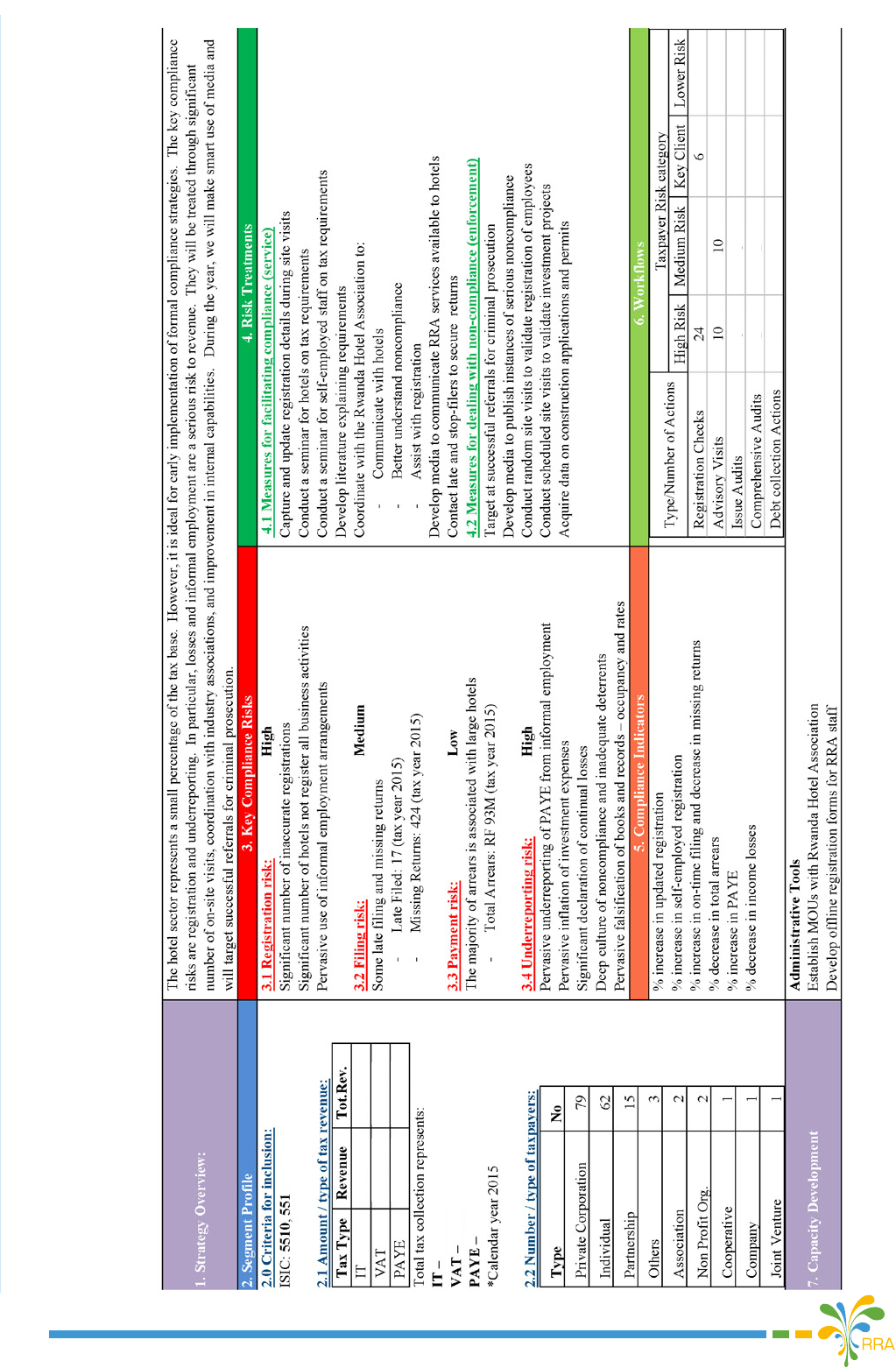

2.1.3. DETECTING NON COMPLIANT BUSINESS SECTORS

Apart from addressing the non compliance behavior of a specic group of taxpayers (large,

medium and small), we are targeting the two business sectors that we are found highly non

compliant namely construction and hotel sectors.

The recent study on business protability analysis where two metrics (Gross prot margin,

Pre-tax prot margin) were used and seven business sectors including transportation,

general commerce, hardware, construction, hotel, banking and insurance were covered,

ndings revealed that banking was the most protable industry with an average pre-tax

prot margin of 11.87% followed by hardware, general commerce and insurance industries

with an average pre-tax prot margin of 3.26%, 0.8% and 0.48% respectively.

The three last industries in protability were construction, transportation and hotels with an

average pre-tax prot margin of -2.9%, -8.4% and -14.4% respectively.

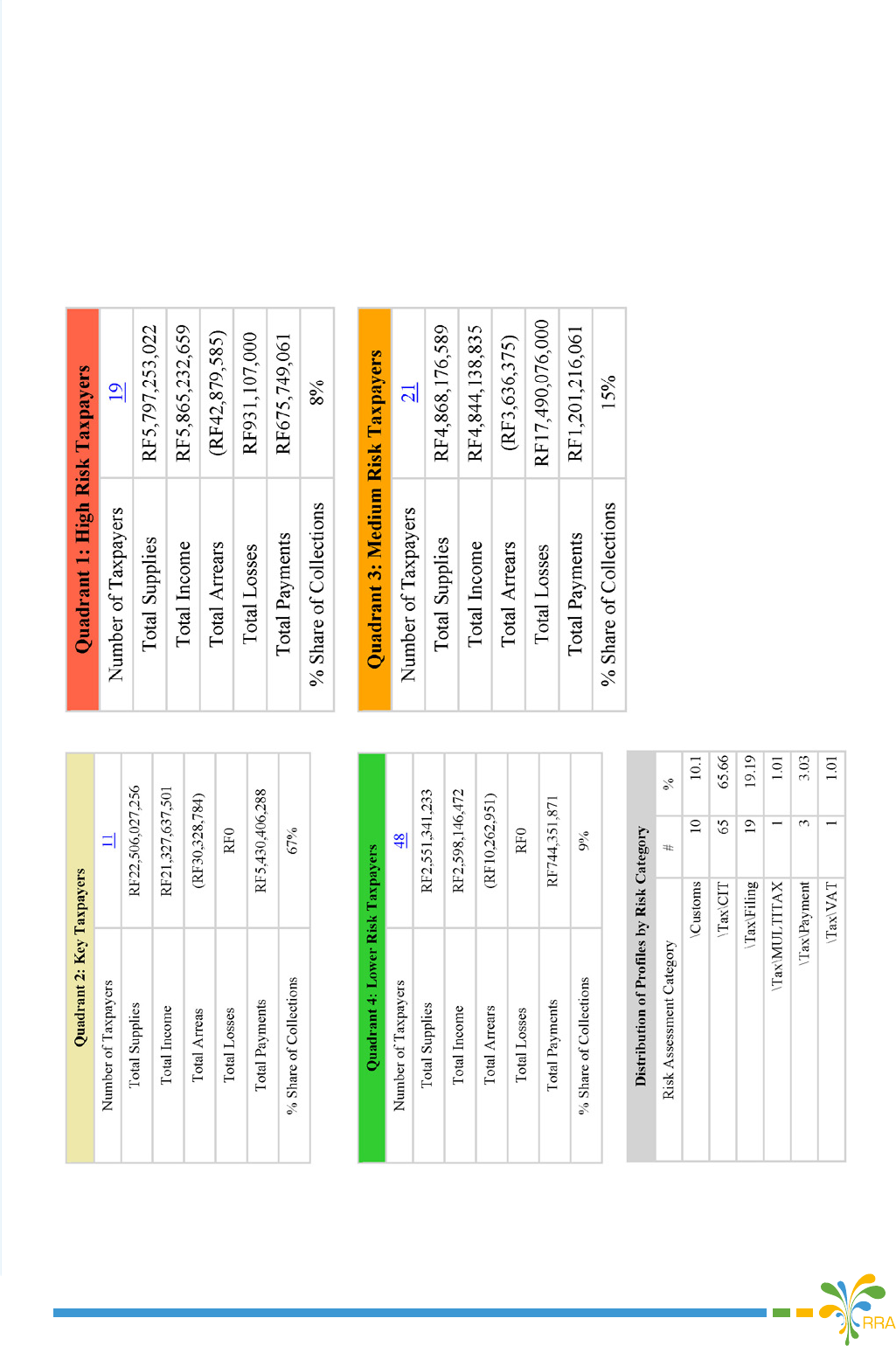

Based on the above ndings, RDF tool was used to extract data on the Hotel and Construction

sectors in order to analyze, prole and classify taxpayers into dierent dierentiation

quadrants as per their compliance levels.

2.2 PRIORITY AREAS AT A GLANCE

Using the approaches and methods discussed above, over the next nancial year we will

specically focus on two following sectors across Large, Medium and Small taxpayers:

1. Construction sector

2. Hotel Sector

Broadly we will also focus on the remaining sectors in the three mentioned segments.

Therefore, we have developed Compliance Strategies for target sectors: Construction and

Hotel, Large, Medium and Small Taxpayers as groups

.

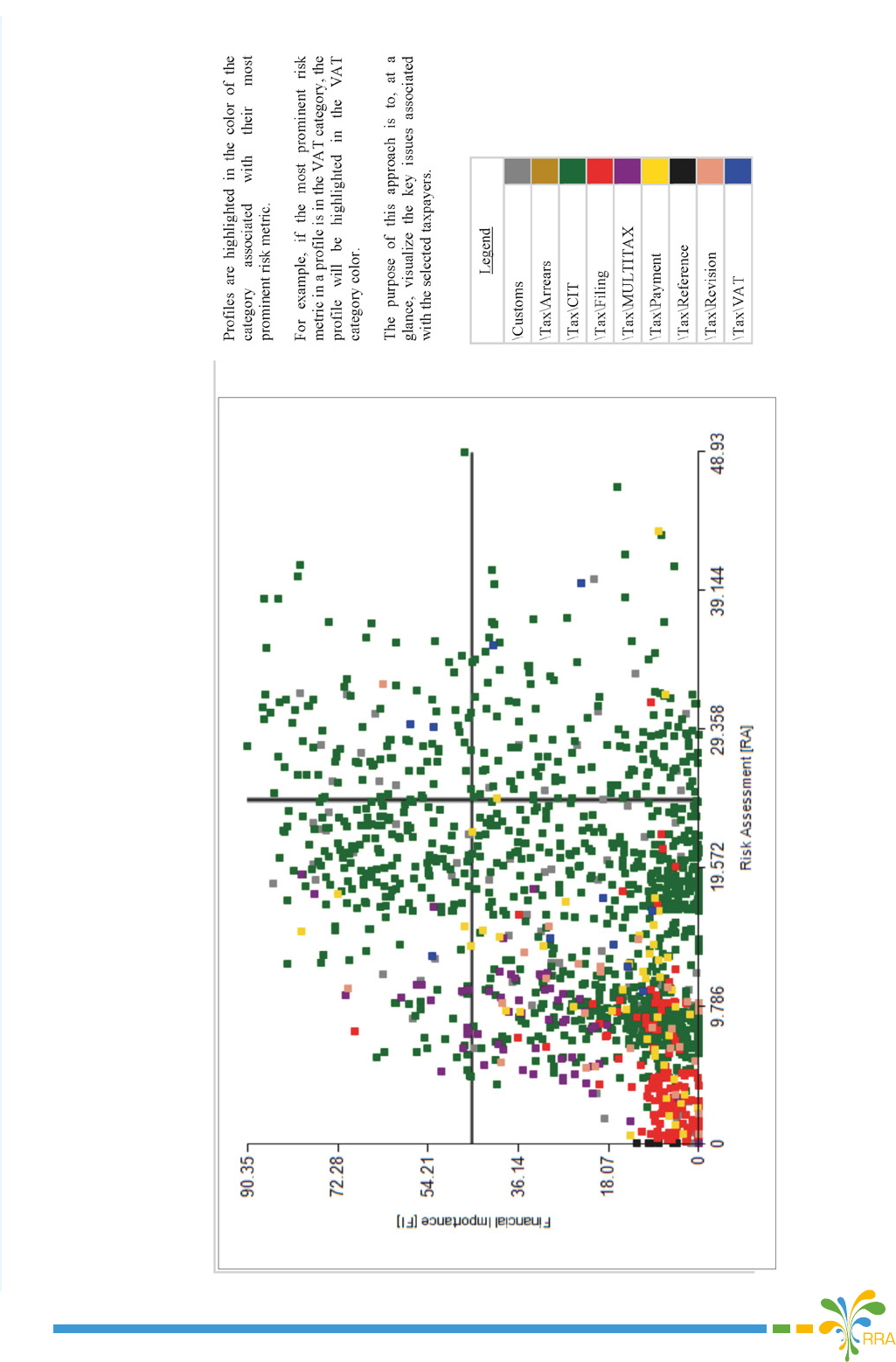

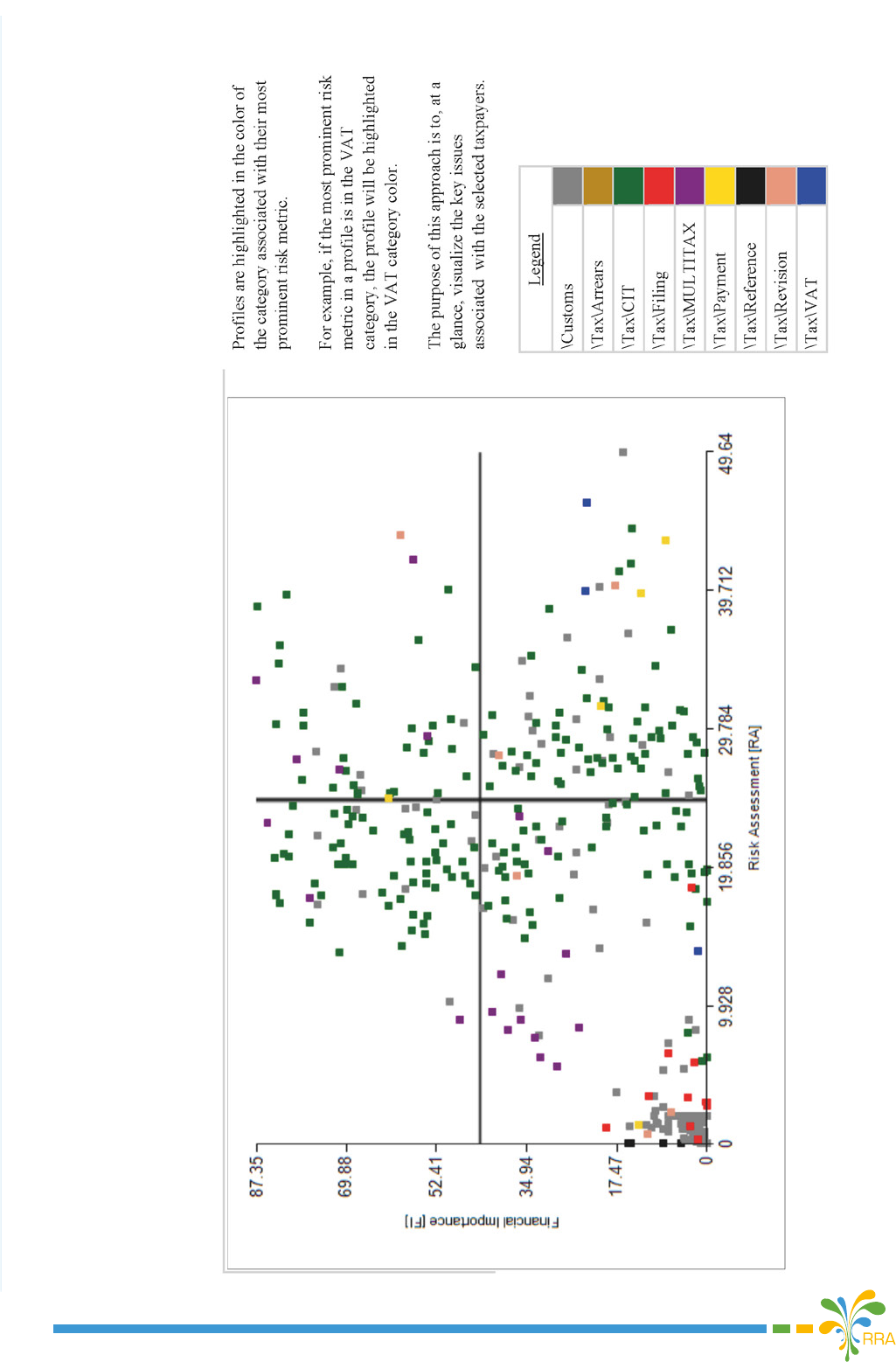

RDF Results for Construction

Risk Proles: Enterprises (Sector, Point-Score Base

Compliance Improvement Plan

12

Compliance Improvement Plan

13

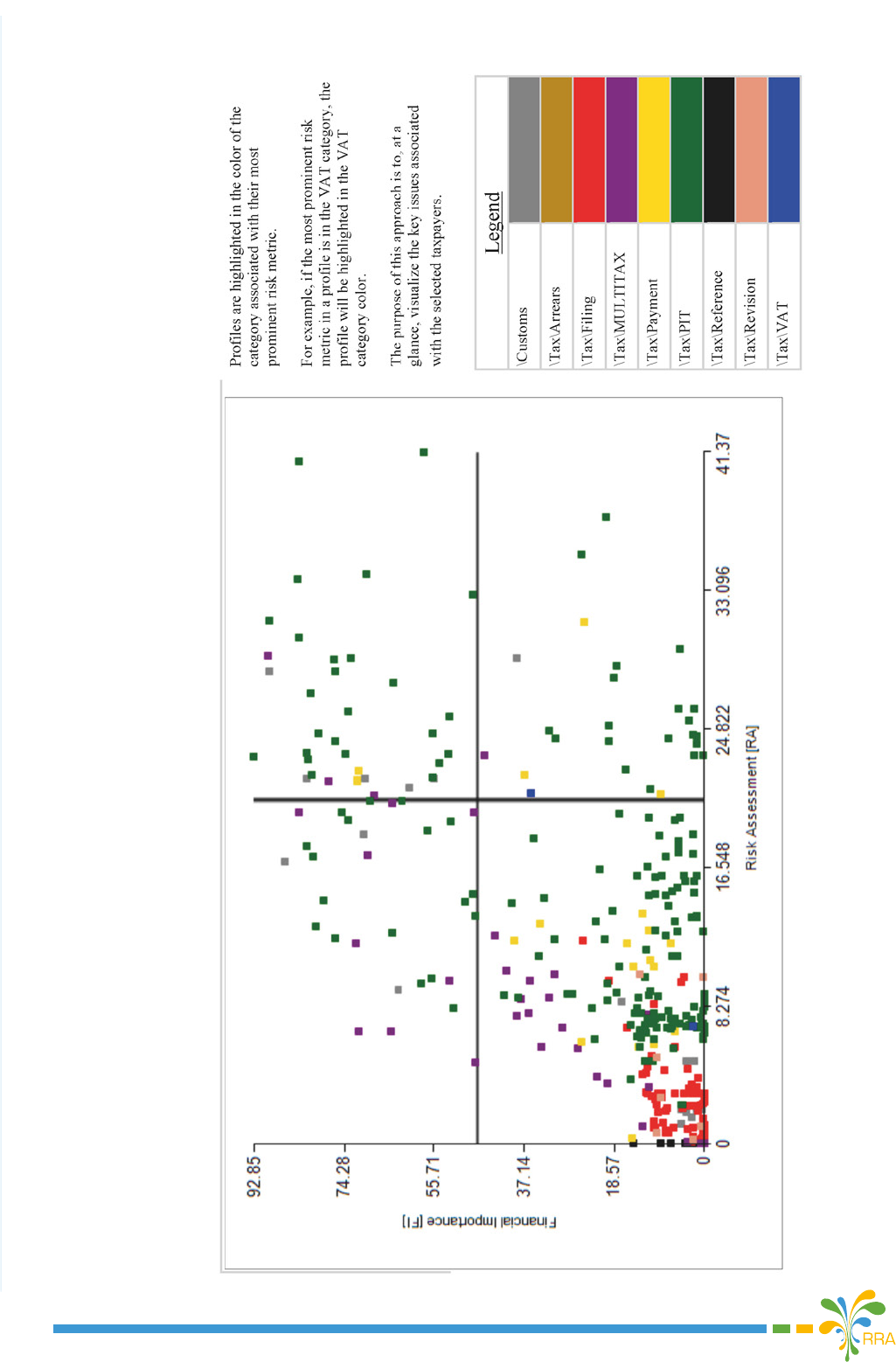

RDF Results for Construction

Risk Proles: Individuals (Sector, Point-Score Basis)

Compliance Improvement Plan

14

Compliance Improvement Plan

15

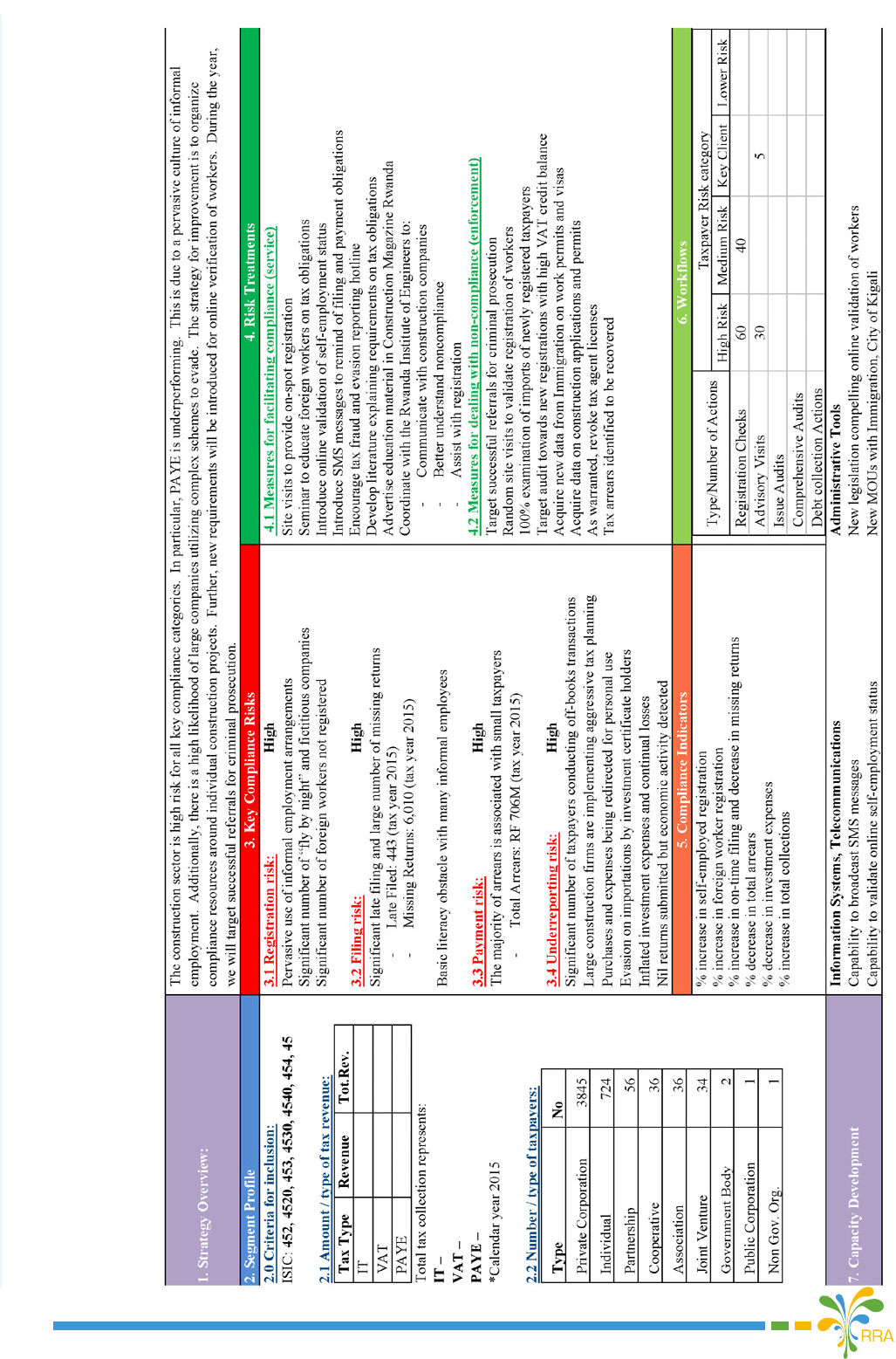

2.2.1. Compliance Strategy: Construction

Compliance Improvement Plan

16

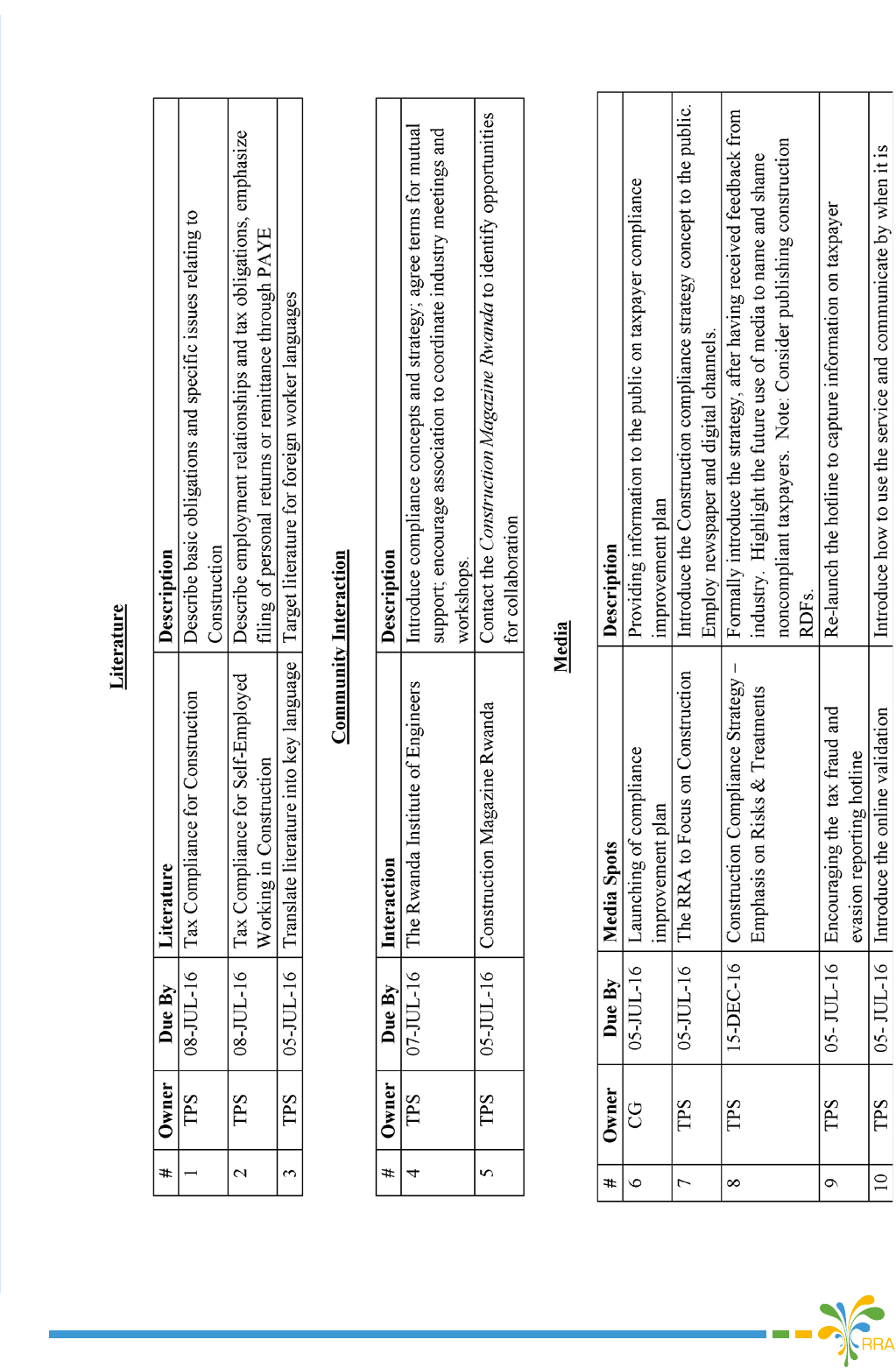

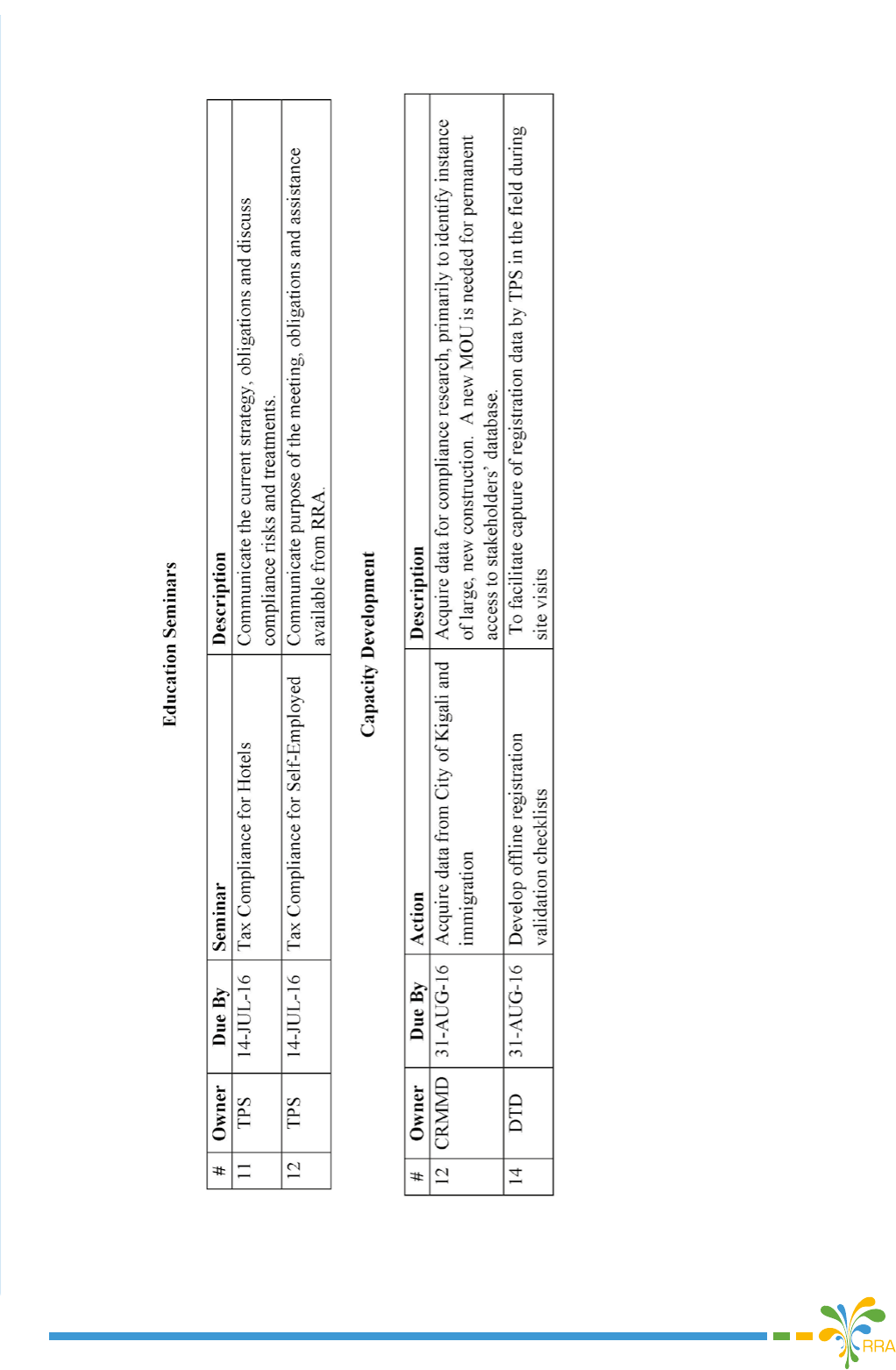

2.2.2. Compliance Strategy Action Plan: Construction

Compliance Improvement Plan

17

2.2.2. Compliance Strategy Action Plan: Construction [Continued]

Compliance Improvement Plan

18

RDF Results for Hotels

Risk Proles: Enterprises (Sector, Point-Score Basis)

Compliance Improvement Plan

19

Compliance Improvement Plan

20

RDF Results for Hotels

Risk Proles: Individuals (Sector, Point-Score Basis)

Compliance Improvement Plan

21

Compliance Improvement Plan

22

2.2.3. Compliance Strategy: Hotels

Compliance Improvement Plan

23

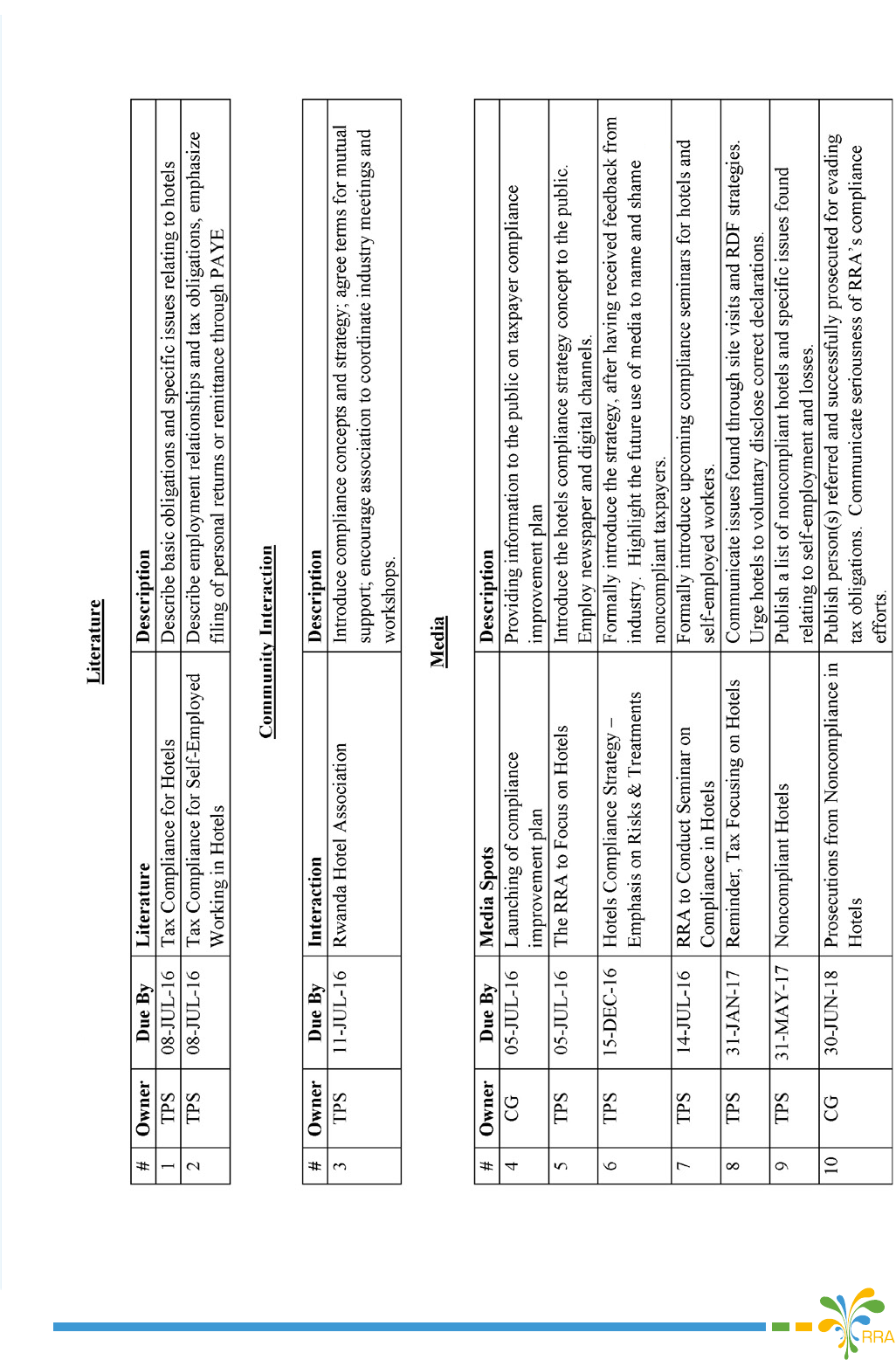

2.2.4. Compliance Strategy Action Plan: Hotels

Compliance Improvement Plan

Note: Consider publishing hotel RDFs.

24

2.2.4. Compliance Strategy Action Plan: Hotels [Continued]

Compliance Improvement Plan

25

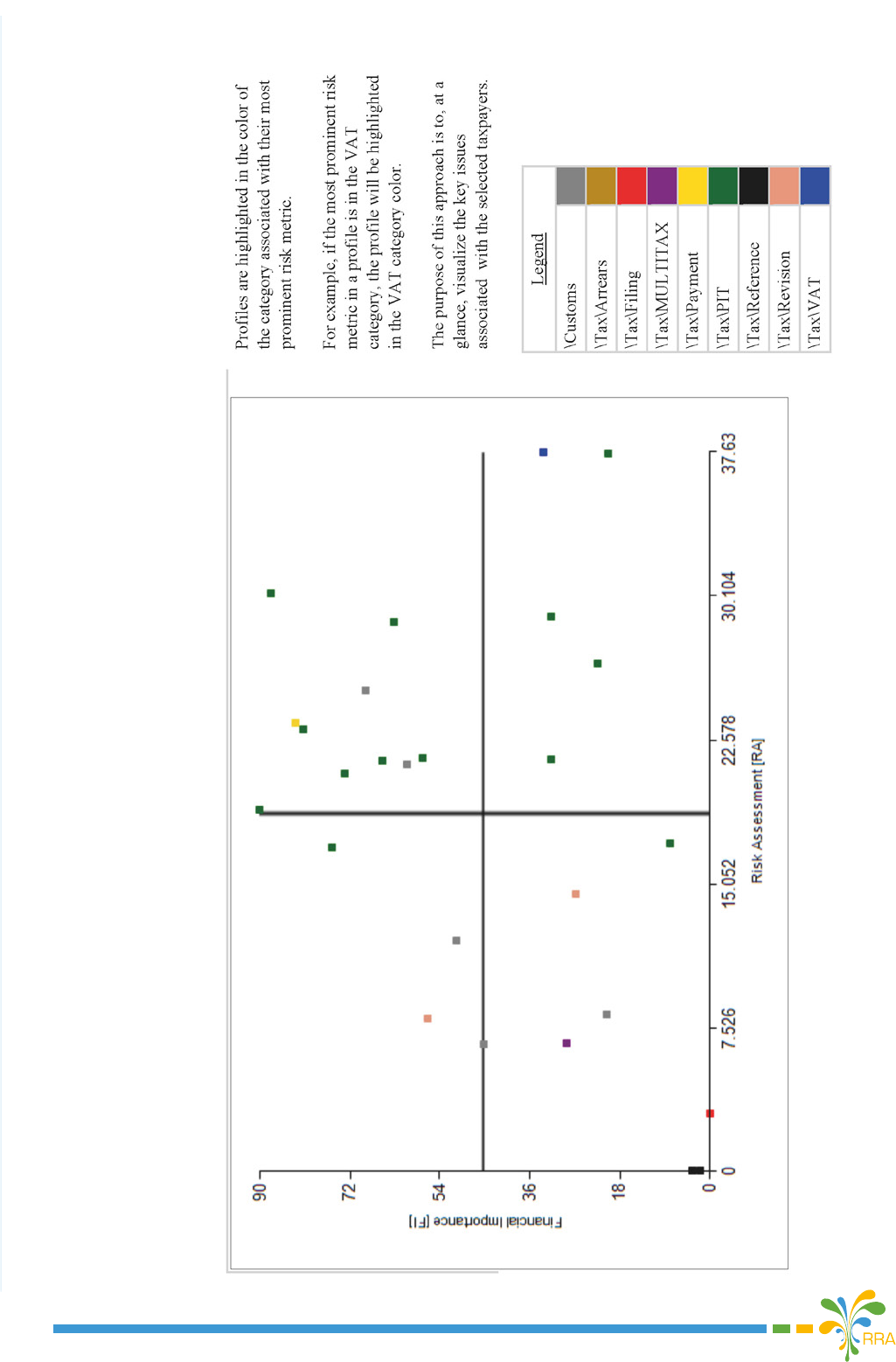

RDF Results for Large Taxpayers

Risk Proles: Enterprises (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

26

Compliance Improvement Plan

27

RDF Results for Large Taxpayers

Risk Proles: Individuals (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

28

Compliance Improvement Plan

29

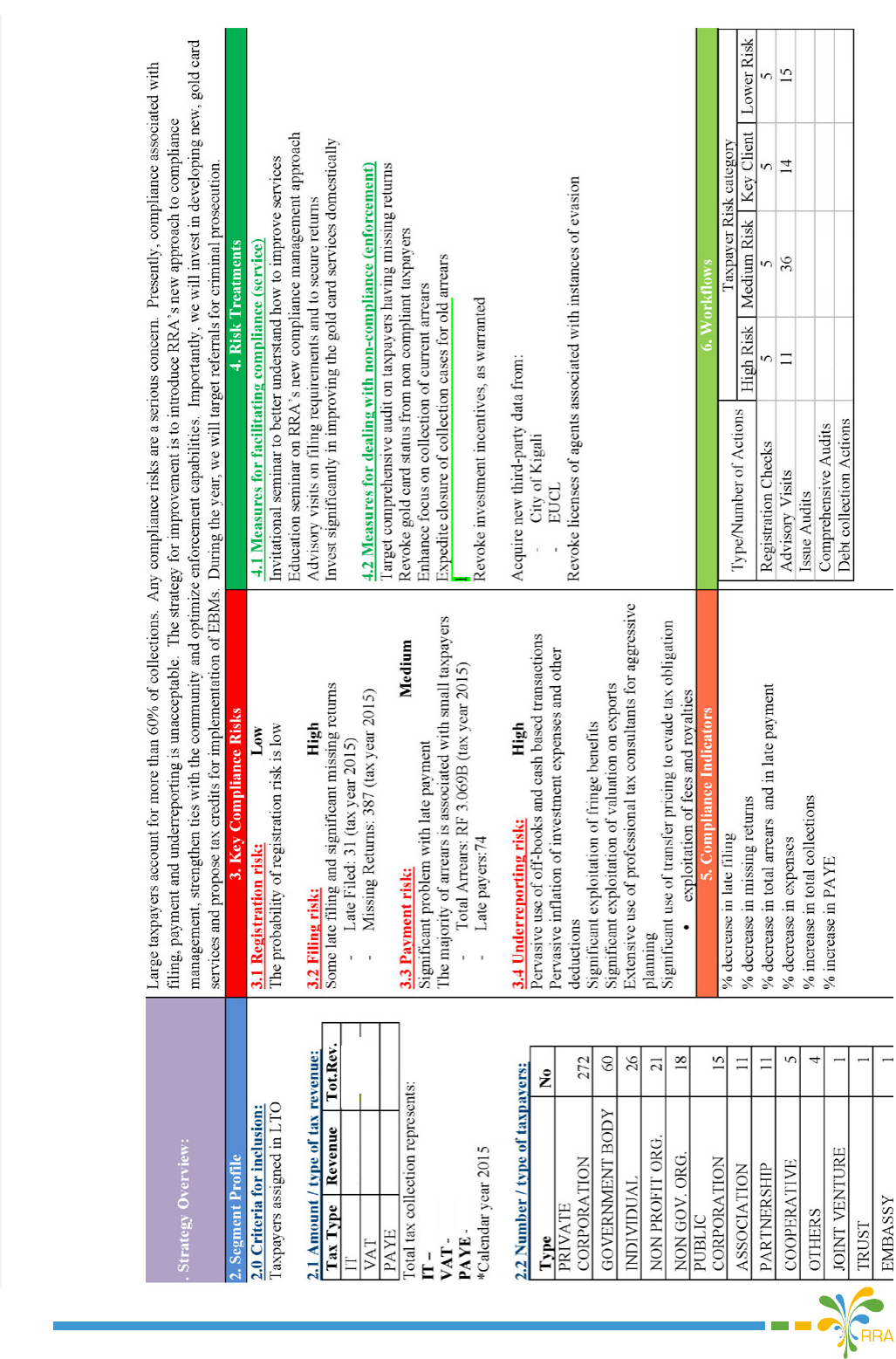

2.2.5. Compliance Strategy: Large Taxpayers

Compliance Improvement Plan

54.9B

Focus issue audits on investments and loses

30

2.2.6. Compliance Strategy Action Plan: LTO

Compliance Improvement Plan

31

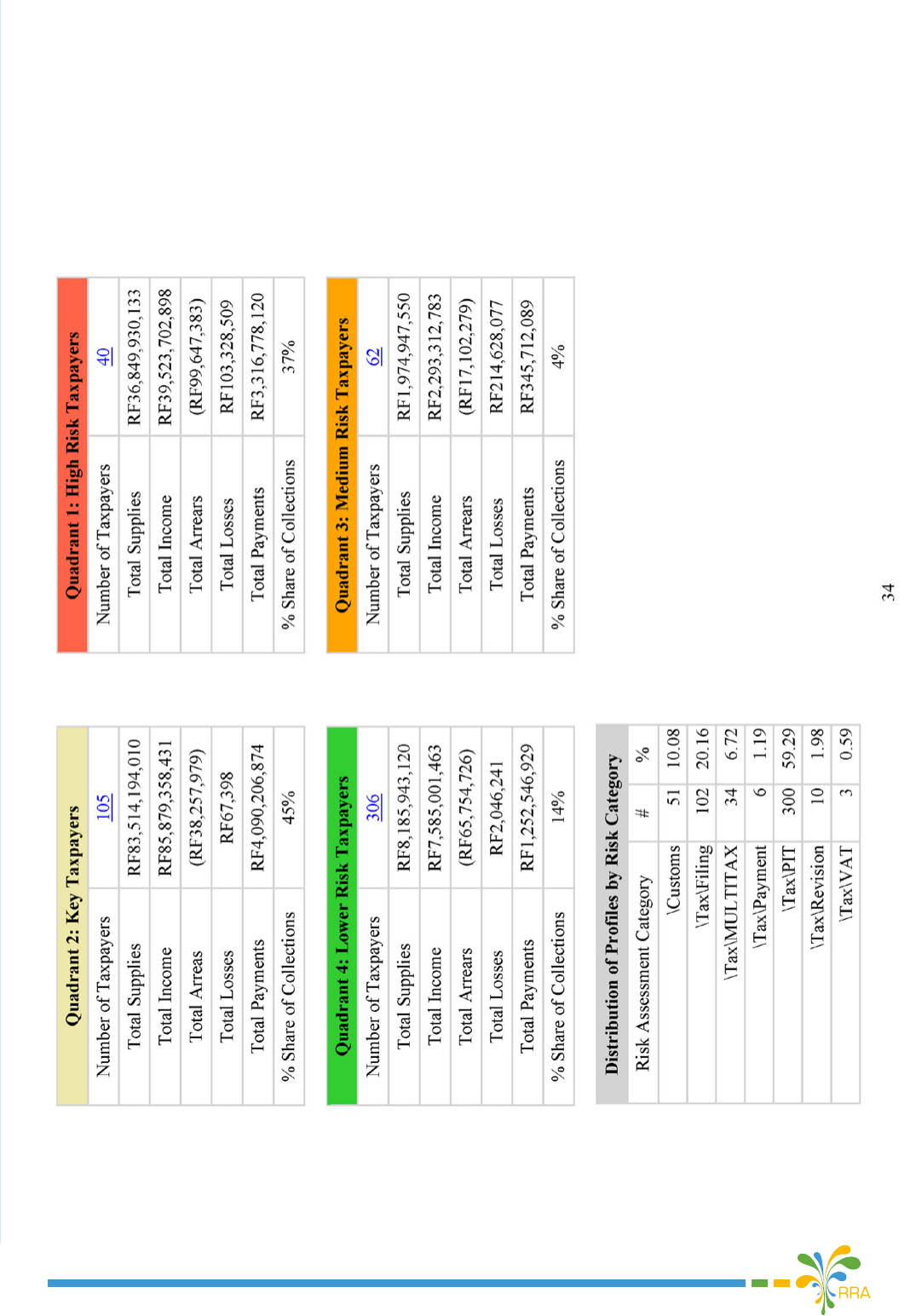

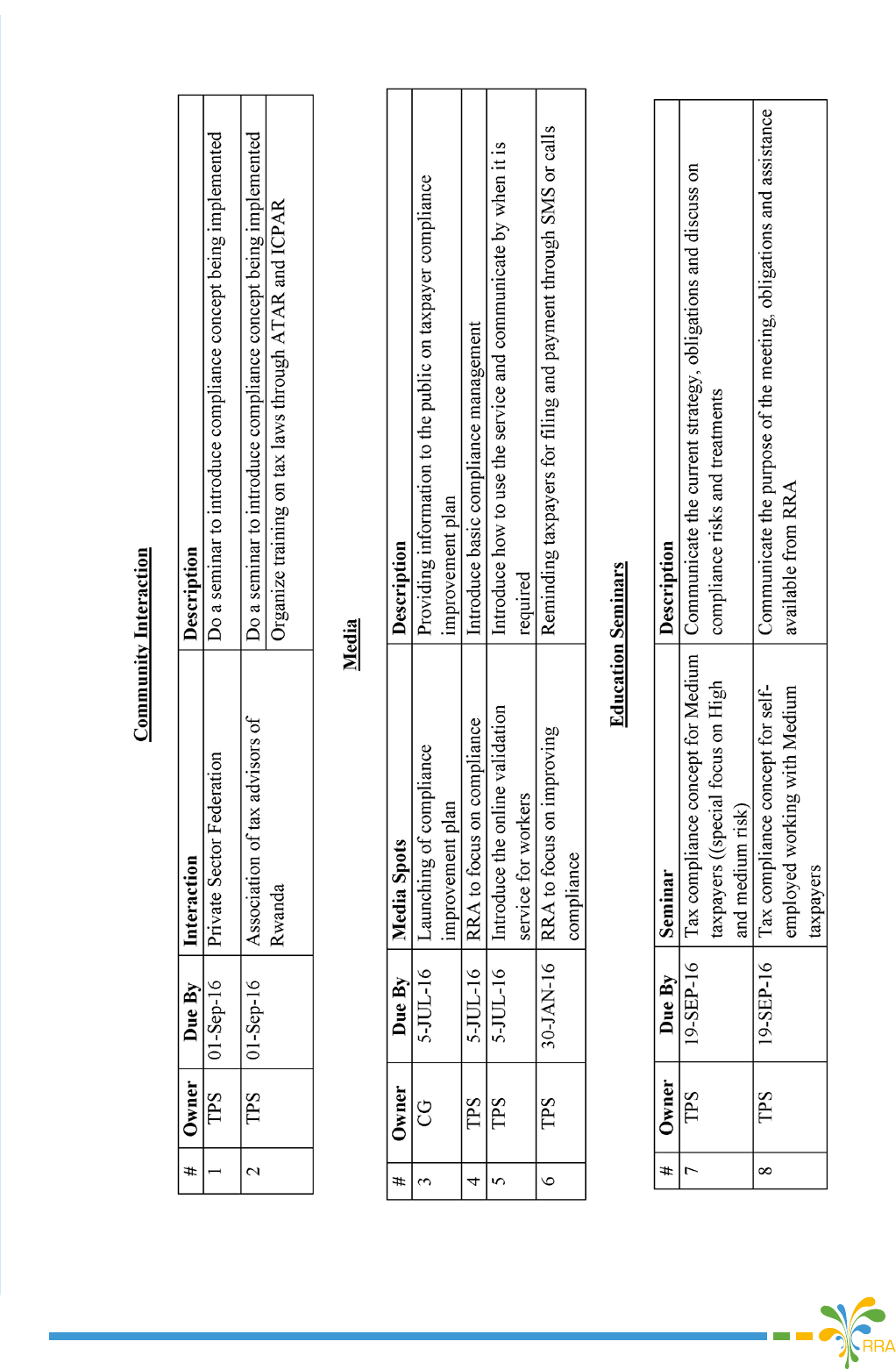

RDF Results for Medium Taxpayers

Risk Proles: Enterprises (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

32

Compliance Improvement Plan

33

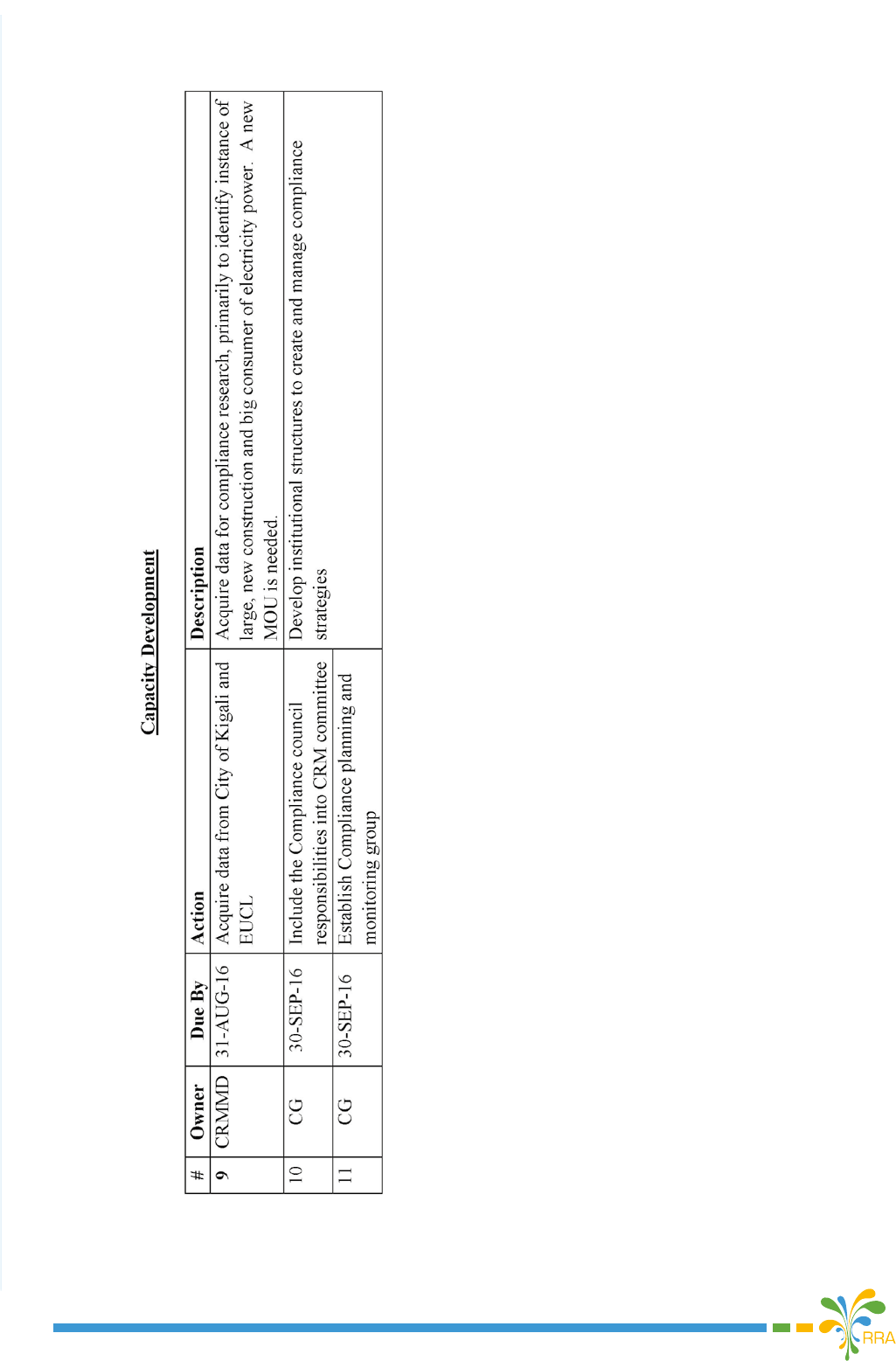

RDF Results for Medium Taxpayers

Risk Proles: Individuals (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

34

Compliance Improvement Plan

35

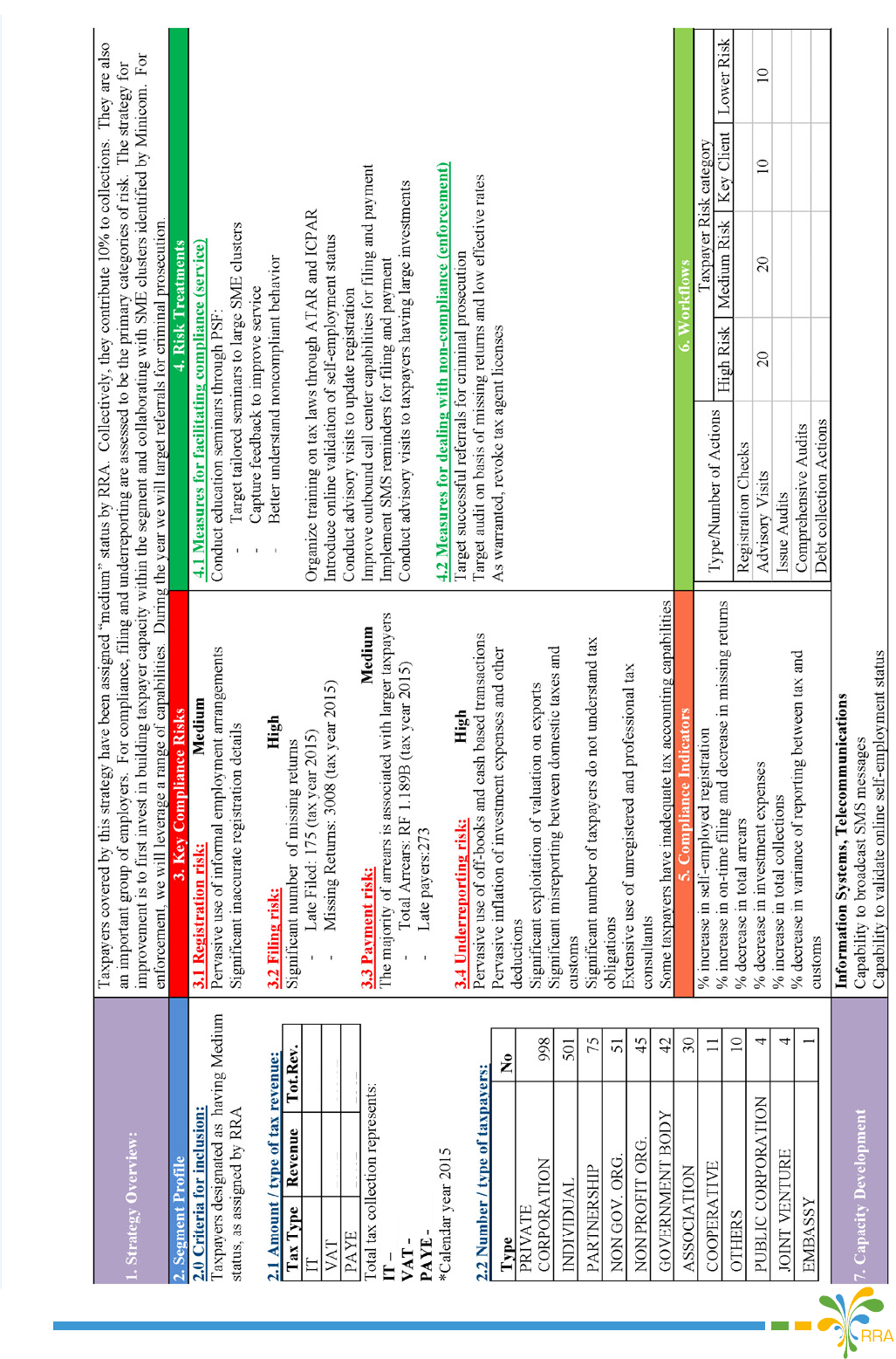

2.2.7. Compliance Strategy: Medium Taxpayers

Compliance Improvement Plan

36

2.2.8. Compliance Strategy Action Plan: MEDIUM

Compliance Improvement Plan

37

2.2.8. Compliance Strategy Action Plan: MEDIUM [Continued]

Compliance Improvement Plan

38

RDF Results for Small Taxpayers

Risk Proles: Enterprises (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

39

Compliance Improvement Plan

40

RDF Results for Small Taxpayers

Risk Proles: Individuals (Cross-Sector, Point-Score Basis)

Compliance Improvement Plan

41

Compliance Improvement Plan

42

2.2.9. Compliance Strategy: Small Taxpayers

Compliance Improvement Plan

Missing Returns: 136459 (tax year 2015)

43

44

Compliance Improvement Plan

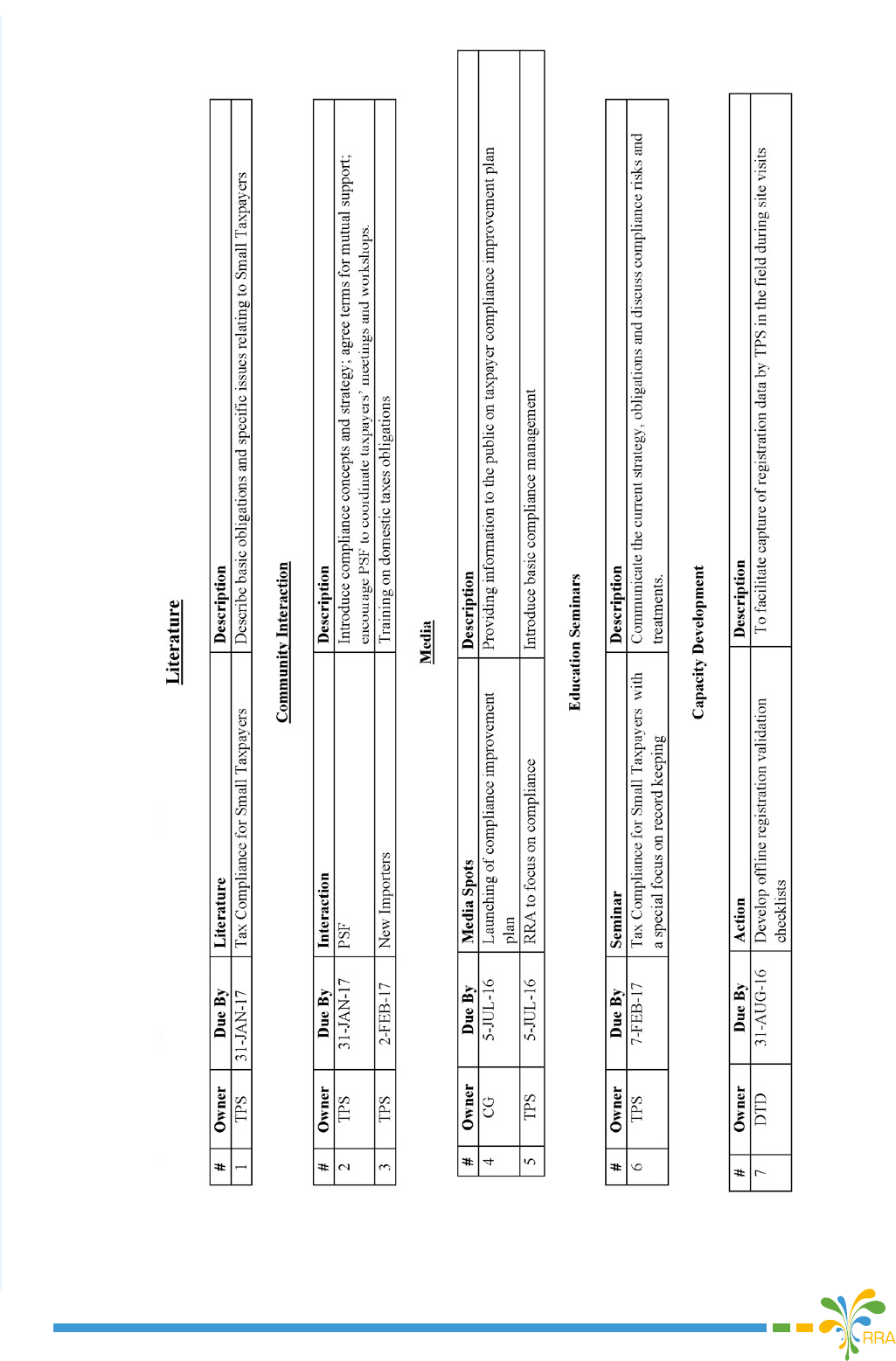

2.2.10. Compliance Strategy Action Plan: Small Taxpayers

45

Compliance Improvement Plan

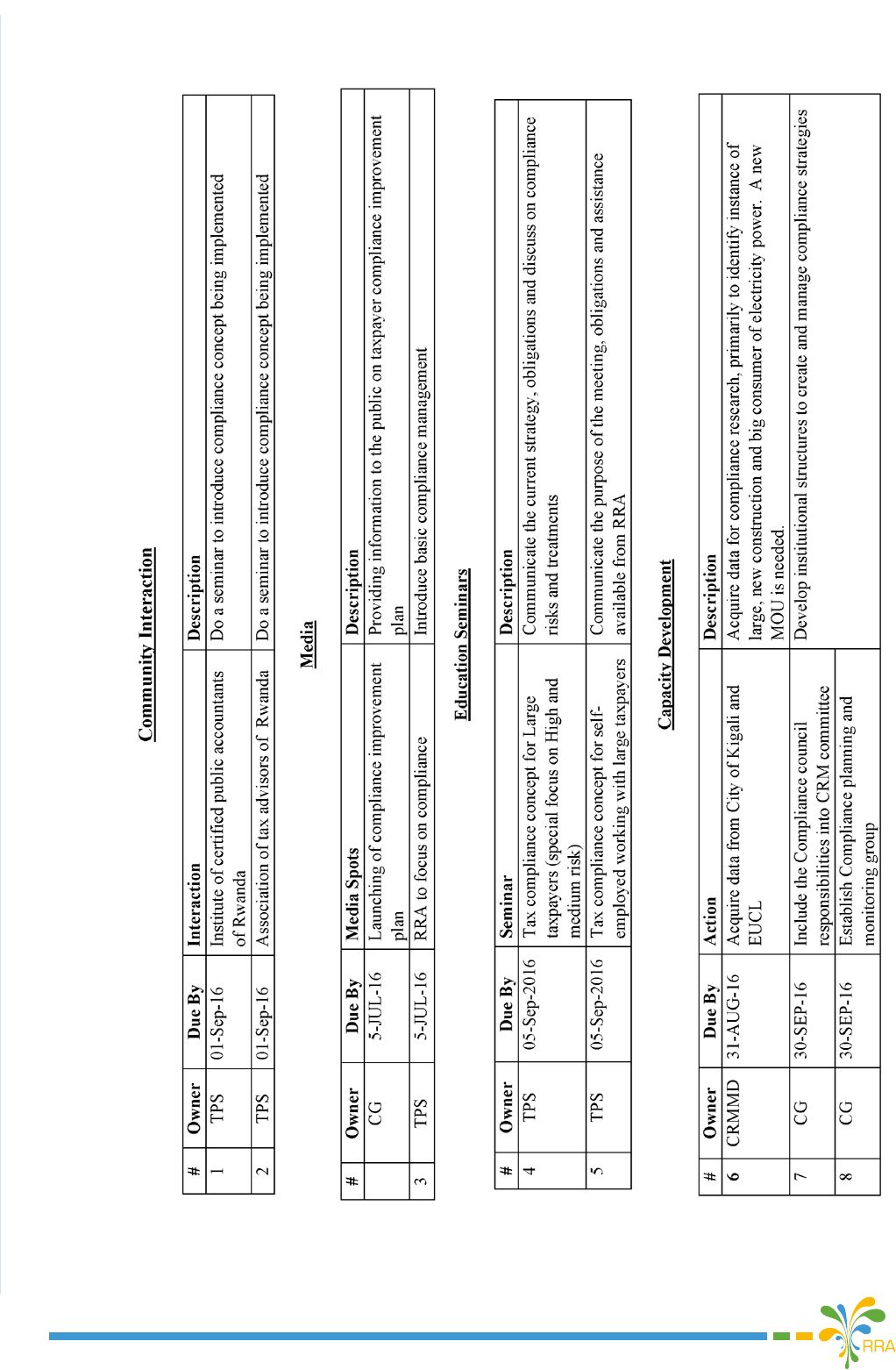

3. MONITORING AND EVALUATION FRAMEWORK

CRMM Department will be conducting a review on the implementation of each activity assigned to the

concerned Department and a report will be submitted to the Commissioner General on a quarterly basis.

The monitoring of performance will be evaluated based on various compliance indicators as described in the

compliance strategy.

4. CONCLUSION

The RRA operates in a complex environment characterized by rapid change. Ensuring compliance, voluntary

or otherwise, in this environment is an ongoing challenge requiring communication, quality services, and

credible enforcement strategies. For the RRA to be successful it must not only continue but also enhance

its partnerships with business in order to encourage cooperative compliance and professional organizations,

identify, analyze and address areas of noncompliance as well as remain innovative in transforming our core

business in a manner that keeps pace with changes in technology, business and management practices, and

the expectations of Rwandans.

APPENDIX

The degree to which the tax administration mitigate assessed risks to the tax system through a compliance

improvement plan.

TADAT requirements for a good Compliance

Improvement Plan

At what extent RRA Compliance Improvement

Plan respond to TADAT requirements

Does the tax administration have a compliance

improvement plan to mitigate identied risk to the

tax system?

A compliance improvement plan has been designed

for the period 2016-2017.

If so, does the compliance improvement plan include

planned mitigation actions in respect of

• All core taxes

• The key taxpayer segments

• Risk associated with the four main compliance

obligations of taxpayers (registration, ling,

payment and accurate reporting in declarations)?

• All risks assessed as ‘High’?

The current compliance improvement plan takes into

account:

• PAYE, VAT, Corporate and Personal Income

taxes

• Hotels and Constructions Sectors are highlighted

as High Risks in dierent segments Large,

Medium and Small in the area of Registration,

Filing, Accurate reporting and Payment

• Areas identied as high risks are taken into

consideration on the Compliance Improvement

Plan with dened risk strategies for mitigation.

Does the compliance improvement plan also cover

less serious risks where ongoing monitoring, rather

than active intervention, is appropriate to ensure

that any further erosion of compliance is quickly

identied?

Registration checks, advisory visits are included

in the compliance improvement plan as actions

to be taken to continuously monitor and maintain

taxpayer’s behavior and attitude for less serious

risks areas.

Does the compliance improvement plan cover multi-

ple years or a single year only?

The current compliance improvement plan covers

one year (2016-2017)

To what extent was the compliance improvement

plan for the most recent completed scal year

actually implemented?

The evaluation of the implementation of 2015/2016

Compliance Improvement Plan will be done during

the 1st Quarter of 2016/2017

46

Compliance Improvement Plan

47

Compliance Improvement Plan

TAXES FOR GROWTH AND

DEVELOPMENT

RWANDA REVENUE AUTHORITY

Kimihurura, Avenue du Lac Muhazi, Kigali

P.O.Box 3987 Kigali, Rwanda

www.rra.gov.rw

3004

@rrainfo

www.rra.gov.rw

3004 @rrainfo