A GUIDE FOR INSURANCE PROFESSIONALS

2

For Agent Use Only. Not for Distribution To the Public.

LONG TERM CARE

INSURANCE RIDER OVERVIEW

The Company and its representatives do not give tax or legal advice. For questions regarding tax implications, the policy owner must consult with his or her own tax advisor.

1

Named Eligibility Period in the state of New York

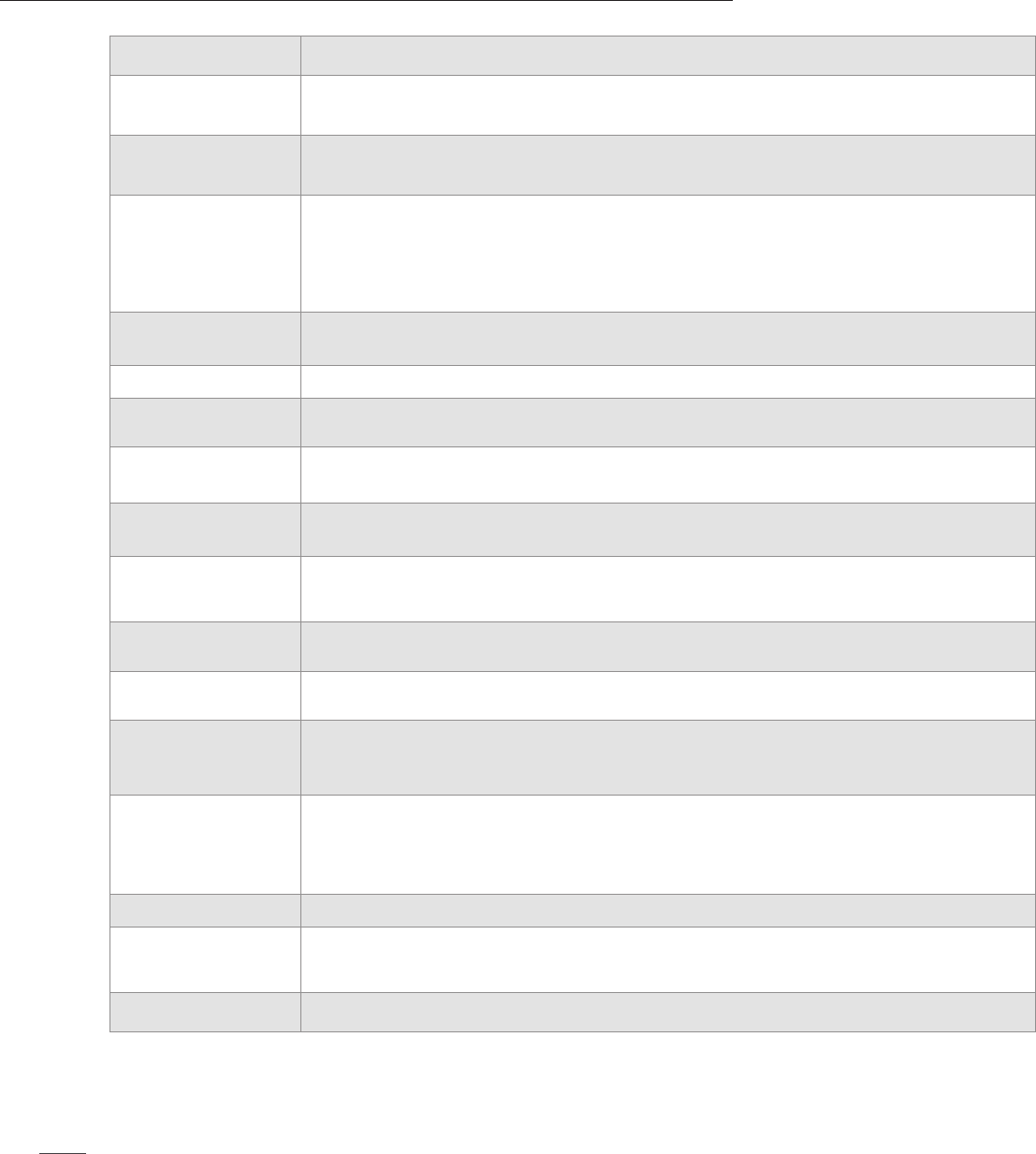

Issue Ages 18-75 years (age last birthday), subject to policy issue age maximums

Minimum LTC Rider

Specified Amount

$100,000 ($112,500 Vermont, $150,000 South Dakota)

Maximum LTC Rider

Specified Amount

For IUL09 the LTC Rider Specified Amount is $2,000,000

LTC Rider Risk Classes

Preferred (no Substandard)

Nontobacco (up to Table D)

Tobacco (up to Table D)

Note: LTC Rider is not available on life insurance base policies rated higher than Table D;

LTC Rider and base policy may have dierent risk classes and ratings.

Base Policy Death

Benefit Option Availability

Level, Increasing, or Graded. Increasing Option policies will be changed to Level upon exercise of the LTC Rider.

Base Policy 7702 Test Cash Value Accumulation Test (CVAT) or Guideline Premium Test (GPT) (May vary by product)

Benefit Eligibility Triggers

Inability to perform 2 out of 6 Activities of Daily Living (bathing, continence, dressing, eating, toileting,

transferring); or Severe Cognitive Impairment

Elimination Period

1

Insured has incurred expenses for Qualified LTC Services for 90 days and does not have to be continuous

90 days. (Needs to be satisfied only once)

Maximum Monthly Rider

Benefit

Lesser of: 2% of the LTC Specified Amount when LTC benefits begin; or the per diem amount allowed by HIPAA

times the number of days in the month.

Rider Availability

The LTC Rider will be available with the Base Insured Rider (max age is 60), Terminal Illness Rider, Critical

Illness Rider (Not available in the state of New York), Income Protection Option, and Overloan Protection Rider.

The Chronic Illness Rider is NOT available with the Long Term Care Rider.

Rider Charges

Until the policy anniversary at the insured’s age 121, Rider Charges will be calculated monthly and subtracted

from the Policy Value at the beginning of each policy month.

Waiver of LTC Rider

Charges

LTC Rider charges are waived while LTC Rider benefits are being paid. All other policy monthly deductions

continue.

Residual Death Benefit

(Provided by separate

endorsement)

A Residual Death Benefit may be payable if the insured dies while on claim or if the Rider Maximum Amount has

been paid. No Residual Death Benefit is payable if the insured has recovered and is not on claim.

Loans and Withdrawals

In all states except California, not allowed while on claim. Loans and withdrawals will reduce the death benefit

and LTC Rider benefit. For IUL09: Under the Terminal Illness Rider, the insured can qualify for benefits under

both riders, but the Terminal Illness will be paid first. Payment under Terminal Illness Accelerated Death Benefit

will reduce the policy and the LTC Rider Face Amount proportionately. Benefits for both riders will not be paid

simultaneously.

LTC Specified Amount Equals the base policy Face Amount. No other amount can be elected.

Increase in LTC Rider

Specified Amount

Increases aren’t allowed on the base policy or the LTC Rider while LTC Rider is on the policy. However, if the

owner changes the death benefit option which results in an increase in the Face Amount of the policy, the LTC

Rider Specified Amount will also increase such that it is equal to the base policy Face Amount.

Illustration Capabilities Hypothetical LTC claim scenarios available

3

For Agent Use Only. Not for Distribution To the Public.

PROTECTION THAT MAY

HELP FOR THE LONG HAUL

OPTIONAL LONG TERM CARE RIDER OFFERS ADDITIONAL PROTECTION IN AN

UNCERTAIN WORLD

The Long Term Care (LTC) Rider is designed to accelerate the death benefit of

the base policy to help policy owners oset expenses that arise in connection

with Qualified Long Term Care Services for the insured.

The LTC Rider Specified Amount is equal to 100% of the base policy Face Amount, so the full Face Amount of the

policy, less any outstanding loans, can be accelerated over the life of the LTC Rider.

There is a Rider charge taken as a Monthly Deduction from the Policy’s Value. The LTC Rider monthly deduction

rates will not be level in all policy years (in most states) but rather will vary by the insured’s attained age, gender,

risk class, and Face Amount band.

2

The LTC Rider is intended to be federally tax-qualified LTC insurance coverage under Sections 101(g) and 7702B of

the Internal Revenue Code (IRC) of 1986, as amended.

3

The LTC Rider provides insurance coverage for Qualified Long Term Care Services as described in Section 101(g)

and Section 7702B(c). As such, LTC Rider benefits may be income tax-free when received. Generally, accelerated

death benefit payments from a qualified LTC rider or contract are not included as income for tax purposes so long

as the payments made from all LTC contracts are not more than the greater of (a) the HIPAA per diem limits for

LTC benefits or (b) the actual expenses incurred for Qualified Long Term Care Services. Since the maximum income

tax-free LTC benefits for any insured are based on benefits paid from all sources, it is possible, of course, that any

benefit payment from the LTC Rider could be taxable if LTC benefit payments are received from other sources. Also,

the tax-free limit for any insured is first allocated to benefits paid to the insured, with any remaining nontaxable limit

then allowed to others who may receive benefits related to the insured. Clients should consult with and rely on a

tax advisor.

Benefits paid under the LTC Rider will reduce the life insurance policy’s death benefit and Cash Surrender Value.

Policy owners should consider whether their life insurance needs would still be met if LTC Rider benefits are paid

out in full. There is no guarantee that the LTC Rider will cover all of the costs associated with long term care that the

insured incurs during the period of coverage.

The Long Term Care Rider is not disability insurance and does not provide disability insurance.

AVAILABILITY

Only the primary insured on the policy is covered under the LTC Rider. If the policy owner and the insured are

dierent individuals, the policy owner is not covered. On certain policies, the Overloan Protection Rider (OPR) is

available in conjunction with the LTC Rider. However, the OPR cannot be exercised if the client is receiving LTC

benefits. The LTC Rider will be available with the Base Insured Rider (max age is 60), Terminal Illness Rider, Critical

Illness Rider, Income Protection Option, and Overloan Protection Rider. The Chronic Illness Rider is NOT available

with the Long Term Care Rider.

2

May vary by state

3

The Company and its agents and representatives do not give tax or legal advice. This material and the concepts presented here are for information purposes only and should

not be construed as tax or legal advice. Any tax and/or legal advice the client may require or rely on regarding this material should be based on their particular circumstances

and should be obtained from an independent professional advisor.

LONG TERM CARE RIDER OVERVIEW | TRANSAMERICA

4

For Agent Use Only. Not for Distribution To the Public.

UNDERWRITING

For detailed underwriting information, please download the Long Term Care Rider Underwriting Guide.

The LTC Rider will be fully underwritten for all issue ages and risk classes. Information regarding the insured’s health

status and underwriting risk class will be obtained from the base policy application, a supplemental application,

the Medical Information Bureau (MIB), a telephone interview, a prescription benefit manager report, a cognitive

screening test via telephone interview, and an onsite face-to-face assessment, as applicable, depending on the issue

age of the proposed insured.

Underwriting approval and rating classification of the LTC Rider is separate and distinct from approval and rating of

the base policy. All underwriting evidence that is required for the life insurance policy and the LTC Rider will need to

be received prior to underwriting making final determinations. The underwriting evidence received for both the base

policy and the Rider will be used in determining the risk classification for both the base policy and the LTC Rider.

UNDERWRITING RISK CLASSES FOR THE LTC RIDER ARE:

• Preferred (no Substandard)

• Nontobacco (up to Table D)

• Tobacco (up to Table D)

The base policy must be rated Table D or less in order to be eligible for the LTC Rider. A Non-Preferred class

LTC Rider may be rated Tables A – D and may have a dierent rating than the base policy. Initial underwriting

requirements for the LTC Rider are shown in the following chart:

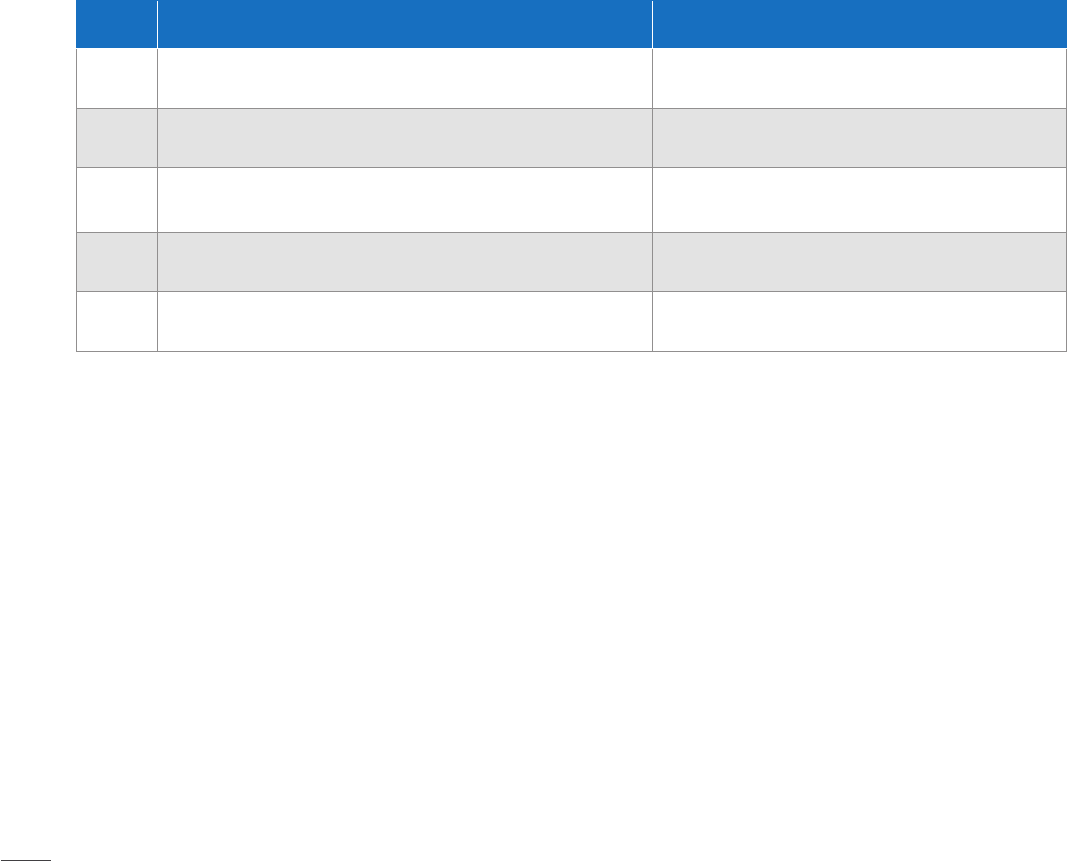

AGE INITIAL LTC U/W REQUIREMENTS AT UNDERWRITER’S DISCRETION

18–44 Medical Information Bureau (MIB), Prescription History (RX)

Medical Records “For Cause,” Face-to-Face Assessment

(F2F) “For Cause”, LTC Phone Interview (PIL)

45–59 Medical Information Bureau (MIB), Prescription History (RX)

Medical Records “For Cause,” Face-to-Face Assessment

(F2F) “For Cause,” LTC Phone Interview (PIL)

60–65

Medical Information Bureau (MIB), LTC Phone Interview with

Cognitive Screen (PIC), Prescription History (RX)

Medical Records “For Cause,” Face-to-Face

Assessment (F2F) “For Cause”

66–69

Medical Information Bureau (MIB), Medical Records, LTC Phone

Interview with Cognitive Screen (PIC), Prescription History (RX)

Face–to-Face Assessment (F2F) “For Cause”

70–75

Face-to-Face Assessment (F2F), Medical Information Bureau (MIB),

Medical Records, Prescription History (RX)

Not Applicable

BENEFIT ELIGIBILITY

To be initially eligible for benefits, the following must be satisfied:

• The insured must be certified as a Chronically Ill Individual

• A Plan of Care prescribed and approved by a Licensed Healthcare Practitioner must be provided

• Proof of Loss documentation must be provided to us each month showing expenses incurred for Qualified LTC

Services in accordance with the Plan of Care

• The 90-day Elimination Period must be satisfied

• Qualified Long Term Care Services must begin while the Rider is in force

• All LTC expenses must be incurred for Qualified LTC Services rendered or goods provided while the Rider is in force

• All care and services must be in accordance with accepted medical and nursing standards of practice and be

consistent with the insured's current Plan of Care

• If required, an assessment of the insured’s functional and cognitive abilities will be completed at our expense. If an

assessment is performed and the Licensed Healthcare Practitioner cannot certify that the individual is Chronically

Ill and is expected to remain so for a period of at least 90 days, then the claim will not be approved.

5

For Agent Use Only. Not for Distribution To the Public.

CHRONICALLY ILL

Chronically Ill Individual means an individual who has been certified by a Licensed Healthcare

Practitioner as:

1. Being unable to perform, without substantial assistance from another individual, at

least two out of the six Activities of Daily Living (ADL) — bathing, continence, dressing,

eating, toileting, transferring — for an expected period of at least 90 days due to a loss of

functional capacity

2. Requiring substantial supervision to protect the insured from threats to health and safety

due to Severe Cognitive Impairment

ELIMINATION PERIOD

4

This Rider has an Elimination Period of 90 days. This means that we will not pay benefits under

this Rider for any period before the insured has incurred expenses on each of 90 separate days

during which this Rider is in eect for Qualified Long Term Care Services that would otherwise

be covered under this Rider. These days of care or services need not be continuous. Proof of

Loss must be provided in order to satisfy the Elimination Period.

The 90-day Elimination Period needs to be satisfied only once for the Rider.

5

During the

Elimination Period, the insured must satisfy the requirements for qualification and incur expenses

for receipt of covered long term care services. We will require a certification by a Licensed

Healthcare Practitioner that the insured was a Chronically Ill Individual during the Elimination

Period. It must include documentation that during the Elimination Period, the insured received

Qualified Long Term Care Services for which the insured incurred a charge.

The actual dollar amount of expenses incurred and paid is not material in determining whether

an Elimination Period has been satisfied. Qualifying long term care expenses must be incurred

and paid. Evidence of those expenses must be provided to Transamerica to support satisfaction

for each day in the Elimination Period.

PROOF OF LOSS

Proof of Loss documentation must be provided to Transamerica each month showing expenses

incurred for Qualified Long Term Care Services, in accordance with the Plan of Care. The

documentation must be provided within 90 days after the end of the Elimination Period, and

within 90 days after the end of each month and for each month for which benefits may be paid.

The policy owner must either provide us with this information or authorize its release to us.

PLAN OF CARE

We must receive a written assessment of the insured’s physical and cognitive abilities by a

Licensed Healthcare Practitioner based on a face-to-face evaluation of the insured. All care and

services must be consistent with the assessment done to develop the Plan of Care and be in

accordance with generally accepted standards of care for a Chronically Ill Individual.

WHAT IS NOT COVERED?

Qualified Long Term Care Services do not include care, confinement, or services:

• Resulting from alcoholism or drug addiction

6

• Resulting from attempted suicide or intentionally self-inflicted injury

• Resulting from participation in a felony, riot, or insurrection

• For which no charge is normally made in the absence of insurance

• For informal care outside of the 50 U.S. states and the District of Columbia

• Not included in the insured’s plan of care

4

Named eligibility period in the state of New York

5

In New York, the 90-day Eligibility Period must be satisfied within a period of 180 consecutive days. Any LTC Rider benefits payable will be

payable retroactively as of the first day of the Eligibility Period.

6

May vary by jurisdiction. Please refer to the LTC Rider for details.

5

BENEFITS ON ELIGIBILITY | TRANSAMERICA

6

For Agent Use Only. Not for Distribution To the Public.

QUALIFIED LONG TERM CARE SERVICES DO NOT INCLUDE CARE, CONFINEMENT, OR SERVICES:

• Provided in a government facility (unless otherwise required by law) or under any governmental programs

(except Medicaid or Medi-Cal)

• Paid or payable under Medicare

7

or under any state or federal workers compensation, employer’s liability or

occupational disease law, or any motor vehicle no-fault law; unless the costs incurred and paid exceed the

amount covered by one of these entities, policies, or programs

RIDER BENEFITS

MONTHLY BENEFITS

Any benefits payable under the LTC Rider will be paid monthly in the amount the policy owner chooses, subject to

the minimum of $500 (in most states) and the maximum. The maximum monthly benefit for any calendar month

will be equal to the lesser of “a” or “b” where:

• Is 2% of the LTC Rider Specified Amount at commencement of benefits

• And is the monthly amount allowed by HIPAA, which is the per diem amount times the number of days in the

calendar month

Choosing an amount less than the Maximum Monthly LTC Rider Benefit could extend the period during which

benefits may be payable.

Once selected, the benefit amount will remain in eect for the remainder of the current calendar year. It may

be changed for subsequent calendar years by providing written notice 30 days before the beginning of the next

calendar year.

LTC RIDER SPECIFIED AMOUNT

The LTC Rider Specified Amount will be equal to 100% of the base policy Face Amount.

• Minimum LTC Rider

Specified Amount: $100,000

($112,500 in Vermont and $150,000 in South Dakota)

• Maximum LTC Rider

Specified Amount at issue: $2,000,000

8

7

This includes any amount that would be covered under Medicare, except that they are subject to a Medicare deductible or co-insurance of some kind. This does not apply when

expenses are reimbursable under Medicare solely as a secondary payer.

8

For states that have not yet approved IUL09, the maximum specified amount remains at $1,000,000.

7

For Agent Use Only. Not for Distribution To the Public.

LTC RIDER SPECIFIED AMOUNT CHANGES

Reductions in the LTC Rider Specified Amount are not allowed independent of reductions in the policy Face Amount.

While this Rider is in force, increases in the base policy’s Face Amount are not allowed. Transactions that increase

or reduce the Face Amount of the policy, such as a death benefit option change, will also result in a dollar-for-dollar

change in the Long Term Care Rider Specified Amount. At the commencement of LTC Rider benefits, we will change

the policy death benefit option to Level, if it is not already.

RIDER BENEFIT PERIOD

Monthly Rider benefit payments begin after the end of the Elimination Period and after the claim for Rider benefits

has been approved by us.

Once Rider benefit payments begin, they will continue to be paid each calendar month so long as:

1. The insured remains Chronically Ill and incurs expenses for Qualifying Long Term Care Services

2. The LTC Rider Maximum Amount has not been fully paid out

3. The policy owner does not request termination of the claim or the Rider

4. All care and services are consistent with the insured’s current Plan of Care, and required Plan of Care, and Proof

of Loss documentation is provided

LAPSE PROTECTION

While LTC Rider benefits are being paid, the policy will not lapse due to the policy’s Cash Surrender Value not being

sucient to pay the Monthly Deduction or any applicable Index Account Monthly Charge.

INTERNATIONAL COVERAGE BENEFIT

Under the International Coverage Benefit, benefits are payable if the Insured has incurred expenses for International

Long Term Care Facility confinement outside the 50 United States and the District of Columbia, or Canada.

All of the terms of the Policy and the Long Term Care Rider attached to the policy apply to this benefit except as

specifically stated in this provision.

The International Coverage Benefit will pay benefits in lieu of all other benefits under this rider. Monthly charges

for this rider will not be waived while the insured is receiving the International Coverage Benefit. In addition to a

claim form and Proof of Loss, proof acceptable to us that the insured is receiving care outside of the 50 United

States and the District of Columbia, or Canada must be provided. We may require updates to this proof no more

frequently than every 30 days. All documentation must be provided to Transamerica in English. The translation of

any documents must be done by a professional translation service, at the insured’s own expense. A copy of any

untranslated documentation must be provided as well.

Receiving benefits outside the United States may subject to taxation in the United States, in the insured’s country

of residence or both. Benefits may be subject to tax withholding. We may require additional information from the

insured at the time of claim to determine our withholding and reporting obligations. As with any tax matter, the

policyowner should consult a tax advisor to evaluate any tax impact.

The International Coverage Benefit is available with the Long Term Care Rider (LTCR03) on Transamerica Financial

Foundation IUL (IUL09) policies. This benefit is not available in all states.

INTERNATIONAL LONG TERM CARE FACILITY

An International Long Term Care Facility is a health care facility that is located outside the 50 United States and the

District of Columbia, or Canada and is licensed, certified, or registered by the appropriate authority in the country in

which it is located to provide inpatient care for persons who are in need of assistance with Activities of Daily Living or

are Severely Cognitively Impaired. The facility must charge a fee for the inpatient care at the time the care is provided.

An International Long Term Care Facility must:

1. provide personal care by on-site sta. It must also provide three meals a day, including special diets;

2. have procedures in place establishing appropriate protocol for medication management and the handling and

administration of drugs and biologicals;

RIDER BENEFITS | TRANSAMERICA

8

For Agent Use Only. Not for Distribution To the Public.

3. provide an emergency call system and on-site facility sta able to respond to and meet both scheduled and

unpredictable needs of residents on a 24-hour-a-day basis. The sta’s duties must include supervision of safety,

security and awareness of the whereabouts of the residents at all times; and

4. have a medical doctor or medical nurse on site or on contract to provide nursing services specified in case of an

emergency. A medical doctor must be licensed and legally authorized to practice medicine in the jurisdiction in

which the services of a doctor are provided. A medical nurse must be (1) the functional equivalent of a Nurse (as

defined in this rider) for the jurisdiction in which the nursing services are provided; and (2) be licensed or registered

and legally authorized to provide skilled nursing services in the jurisdiction in which nursing services are provided.

Regardless of name, any properly licensed, certified, or registered facility providing the services set forth above

will qualify as an International Long Term Care Facility. This includes, for example: nursing homes; skilled nursing

facilities; nursing care facilities; assisted living facilities; adult foster care facilities; congregate care facilities; basic

care facilities; residential care facilities; family and group assisted living facilities; boarding care homes; domiciliary

care homes; personal care homes; and hospice care facilities.

In those countries where there is no facility that is licensed, certified or registered to provide inpatient care for

persons who are in need of assistance with Activities of Daily Living or are Severely Cognitively Impaired, a

facility must meet all of the requirements in items # 1-4 listed above. In addition, it must meet all of the following

requirements in order to qualify as a Long Term Care Facility:

1. provides the following information in writing to each resident:

a. a tenant services contract or agreement in place for each resident; and

b. admission and transfer/discharge requirements;

2. provides a minimum of 10 beds; and

3. has sta on site 24-hours-a-day to provide personal care.

An International Long Term Care Facility does not mean a facility or part of a facility that is operated mainly for

the treatment and care of: mental, nervous, psychotic or psychoneurotic deficiencies or disorders; tuberculosis;

alcoholism, substance abuse, or drug addiction; or rehabilitation or occupational therapy. An International Long

Term Care Facility is not a rehabilitation hospital/facility.

An International Long Term Care Facility does not include a hospital, except for a separate and distinct wing or

section of a hospital, if such wing or section, including the Insured’s assigned bed, is appropriately licensed, certified,

or registered to provide the level of care defined above. Also, an International Long Term Care Facility does not

include: an independent living apartment or unit; hotel; motel; retirement home; or any dwelling similar to these.

LTC RIDER CHARGES

The monthly Rider charge will be determined by multiplying the base Policy’s Net Amount at Risk (NAR) by the

LTC Rider charge (per $1,000 of base Policy NAR). The LTC Rider charge is taken until the policy anniversary at the

insured’s age 121. The LTC Rider monthly deduction rates will vary by the insured’s issue age, duration, gender, risk

class, and Face Amount band.

WAIVER OF LTC RIDER CHARGES

Rider charges will be waived while Rider benefits are being paid. When

the insured is no longer on benefit, Rider charges will be assessed beginning with the first monthly date following

the cessation of Rider benefits. When the sum of LTC Rider benefits paid out equals the LTC Rider Specified Amount

or the LTC Rider Maximum Amount, we will no longer assess any LTC Rider Monthly Deductions under the policy.

ADDITIONAL INFORMATION

DEATH BENEFIT

The total amount of LTC Rider benefits paid reduces the death benefit payable on the death of the insured. If

the insured dies while receiving benefits under the LTC Rider, or the insured dies after we have paid the Rider

Maximum Amount, the Residual Death Benefit will be available if it is higher than the policy’s death benefit (less any

outstanding loans), reduced by the total amount of the LTC Rider benefits paid.

9

For Agent Use Only. Not for Distribution To the Public.

9

Permanent life insurance policies are required to keep a certain margin between the Policy Value and the death benefit in order to qualify as life

insurance for federal income tax purposes. To maintain this margin, the death benefit may be increased relative to the Policy Value, causing the

policy to be what is referred to as “in corridor.” Although the policy’s death benefit may exceed the Face Amount of the policy when the policy is

in corridor, the LTC Rider Specified Amount does not increase since it is based on the policy’s Face Amount and not on the death benefit (when

that latter amount differs from the Face Amount).

Although the policy’s death benefit may exceed the Face Amount of the policy when the

policy is in corridor

9

, the LTC Rider Specified Amount does not increase since it is based on

the policy’s Face Amount and not on the death benefit (when that latter amount diers from

the Face Amount).

RESIDUAL DEATH BENEFIT

The Residual Death Benefit is equal to the lesser of:

1. 10% of the lowest Face Amount of the base policy from inception, less any outstanding

policy loans

2. $10,000

No Residual Death Benefit is payable if the insured has recovered and is not on claim.

EFFECT OF REACHING THE RIDER MAXIMUM AMOUNT

After the Rider Maximum Amount has been paid:

• We will not charge any further monthly charges for this Rider

• Interest will continue to be credited to the Policy Value if it is not less than zero

• Any negative Policy Value will be reset to zero

• Policy owner must pay interest on any policy loans as it becomes due or the policy may

terminate

POLICY VALUE

Since payment of monthly Rider benefits is an acceleration of the base policy’s death benefit,

the sum of the LTC Rider benefit payments is a lien on the death benefit and the Cash

Surrender Value. However, there is no eect on the Policy Value. While Rider benefits are

being paid, even though Rider charges are waived, all other policy Monthly Deductions and

Index Account Monthly Charges (if applicable) continue to be assessed even if the Policy

Value becomes negative.

CASH SURRENDER VALUE

The Cash Surrender Value is reduced by the total amount of LTC Rider benefits paid. Further,

the amount available for any future policy loans or withdrawals will be limited to the excess of

the Surrender Value over the sum of Rider benefits paid.

LOANS AND WITHDRAWALS

Loans and withdrawals will not be permitted while LTC Rider benefits are being paid.

POLICY LOANS

If there are any outstanding policy loans at the time Rider benefits are being paid, and

loan interest due is not paid, the outstanding loan will capitalize until the amount of any

outstanding loan plus the LTC Rider benefits paid equals the LTC Rider Specified Amount (i.e.,

the Rider Maximum Amount is reached).

BASE POLICY FACE AMOUNT

Transactions that reduce the Face Amount of the policy will result in a dollar-for-dollar

reduction in the LTC Rider Specified Amount. When monthly LTC Rider benefits begin, the

policy Face Amount is not reduced dollar-for-dollar each month by the amount of the LTC

Rider benefits paid.

9

LTC RIDER CHARGES & ADDITIONAL INFORMATION | TRANSAMERICA

10

For Agent Use Only. Not for Distribution To the Public.

FREE-LOOK PERIOD AND DELIVERY RECEIPT

The LTC Rider has a 30-day free-look period which begins on the date the policy is received by the owner. We will

require a delivery receipt upon delivery of a policy. If the Rider is not taken but the policy is accepted, the policy will

need to be reissued with revised policy data pages and without the LTC Rider.

REINSTATEMENTS

If the policy lapses and is reinstated, the LTC Rider may be reinstated with evidence of insurability specific to the LTC

coverage. At time of reinstatement, the supplemental application will need to be submitted. The “reinstatement” box

in the supplemental application will need to be checked.

However, if the Rider lapses while the insured is Chronically Ill but not yet receiving LTC benefits, we will reinstate

the Rider along with the policy, subject to all the conditions for reinstatement described in the policy and any

endorsements to the policy, except that evidence of insurability will not be required if:

• We receive a written request for reinstatement within 180 days after the date of lapse

• We receive a Licensed Healthcare Practitioner’s written certification that the insured was diagnosed, using

generally accepted medical diagnostic methods and tests, as being a Chronically Ill Individual at the time the Rider

lapsed

• We receive all unpaid, overdue rider charges for this Rider. If the policy and LTC Rider are being reinstated under

this provision, the supplemental application will not need to be submitted. Any claim incurred during the 180-day

period will be considered for benefits subject to all other Rider provisions.

LTC REPLACEMENT

If a life insurance policy that includes a Long Term Care Rider is being replaced by another life insurance policy that

includes the LTC Rider, then both life insurance as well as long term care replacement requirements must be satisfied.

TAX CONSIDERATIONS

The LTC Rider is intended to provide federally tax-qualified long term care insurance coverage under Section 101(g)

and Section 7702B(b):

11

For Agent Use Only. Not for Distribution To the Public.

• LTC benefits are intended to be excludable from Federal Gross Income, with the exception for certain business-

related policies described in Section 101(g)(5)

• Even if the policy is a Modified Endowment Contract (MEC), the intent is for the LTC benefit to continue to be

excludable from income taxes, subject to the exceptions in Section 101(g)(5)

POINT OF SOLICITATION REQUIREMENTS

Because sales of the LTC Rider are governed by Long Term Care Regulations, the following requirements are necessary

for solicitation in addition to those required for the base policy:

• Outline of Coverage

• Notice of Availability of Senior Insurance Counseling Program

• Medicare Supplement Buyers Guide

• HIPAA Notice of Health Information Privacy Practices

Note: Some states require additional materials at time of solicitation.

ILLUSTRATING THE LTC RIDER BENEFIT

The illustration software allows for a hypothetical LTC benefit scenario to be illustrated when the HIPAA per diem estimated

growth rate and the insured’s age, at which, to begin receiving LTC monthly benefits are specified. The Hypothetical Long

Term Care Benefit Scenario will appear in a supplemental illustration. The Quick View page will reflect the annualized cost

of the LTC Rider. When the LTC Rider is selected, the base policy illustration will display the initial underwriting requirements

for the LTC Rider alongside the underwriting requirements. An Outline of Coverage will also be generated with the illustration

output. The Outline of Coverage is a required document that must be presented to the applicant at the time of solicitation.

The LTC Rider option appears on the Policy Riders section. On this screen the notice reminds the user that the producer must

be appropriately licensed to sell LTC insurance. The default risk class for the LTC Rider will be the risk class most similar to the

base policy risk class. An LTC Rider risk class dierent from the default risk class may be selected by the user.

To illustrate the Hypothetical Long Term Care Benefit Scenario, the user can indicate:

• The HIPAA Per Diem Growth Rate field allows the user to specify an inflation rate that would aect the

HIPAA per diem amount

• The Projected LTC Benefit Starting Age field allows the user to specify the age at which LTC benefit may

be received

Loans, withdrawals, and policy changes are not illustratable on the Supplemental LTC illustration for durations

beginning after the Projected LTC Benefit Starting Age.

PROTECTION AGAINST UNINTENTIONAL LAPSE – THIRD-PARTY DESIGNATION & GRACE PERIOD

The LTC Rider cannot lapse or terminate unless a notice of termination for nonpayment of premium has been provided

to the policy owner and any third-party designee at least 30 days before the eective date of the lapse or termination.

The notice will not be provided until a period of 30 days after a premium is due and unpaid.

Before the policy is delivered, the policy owner must be given the opportunity to designate, in writing, at least one

other person who may receive a notice of termination for nonpayment of premium and a policy lapse notice. The third

party’s full name and address must be provided. If the owner chooses to not have a third party designated, it must be

specified in writing. A section for the designation election will be included on the Application Supplement Part 1 for

the LTC Rider.

The Grace Period for this rider is 65 days. If any amount due is not paid within 30 days from the date that it was due,

we will send a notice to the policy owner, the insured and the person or persons designated by the policy owner to

receive such notice at the addresses provided to us. A notice will be given by first-class United States mail, postage

prepaid. An additional 35 days will be provided to pay the amounts due after we have mailed the notice. During the

Grace Period this rider will stay in eect. The person or persons named are not responsible for paying the premium.

The policy owner may change the person or persons named at any time while this rider is in eect. Please note that

the new address must be provided if any of the addresses change. Information regarding any changes should be sent

in writing to our Administrative Oce at 4333 Edgewood Rd. NE, Cedar Rapids, IA 52499. We will provide a reminder

of the right to change the person or persons named at least every two years.

LTC RIDER CHARGES & ADDITIONAL INFORMATION | TRANSAMERICA

Named Comprehensive Long Term Care Insurance Rider (LTC Rider) in California, the Long Term Care Rider is an optional rider available on the Transamerica Financial

Foundation IUL policy.

The LTC Rider and the base policies are issued by the following companies: Transamerica Premier Life Insurance Company, Cedar Rapids, IA, Transamerica Life Insurance

Company, Cedar Rapids, IA, or Transamerica Financial Life Insurance Company, Harrison, NY.

LTC Rider Form #s LTCR03, ICC12 LTCR03, LTCR03 CA, and LTCR03 NY

Policy Form #s ICC16 IUL09, IUL09, and IUL09 NY

Rider forms and numbers may vary, and may not be available in all jurisdictions.

TFLIC Financial Foundation IUL is issued by Transamerica Financial Life Insurance Company, Harrison, NY. Transamerica Financial Foundation IUL is issued by Transamerica

Premier Life Insurance Company, Cedar Rapids, IA, or Transamerica Life Insurance Company, Cedar Rapids, IA. Transamerica Financial Life Insurance Company is authorized to

conduct business in New York. Transamerica Premier Life and Transamerica Life Insurance Company are authorized to conduct business in all other states.

This Rider should not be the sole basis to purchase any life insurance policy. This brochure is not intended to be a full description of the Long Term Care Rider.

Rider availability, provisions, and benefits may vary by state. Please see the Rider for complete details regarding exclusions and limitations.

Rider benefits may be income tax-free when received. Since the maximum income tax-free LTC Rider benefits are based on benefits paid from all sources, benefit payments from

the Rider could be taxable if LTC Rider benefit payments are received from other sources.

This Rider accelerates the death benefit of the underlying life insurance policy, for Qualified Long Term Care Services, and is not a health insurance policy providing

long term care insurance subject to the minimum requirements of New York law, does not qualify for the New York State Long Term Care Partnership program, and

is not a Medicare supplement policy. Receipt of accelerated benefits may affect eligibility for public assistance programs.

The Company and its agents and representatives do not give tax or legal advice. This material and the concepts presented here are for informational purposes

only and should not be construed as tax or legal advice. Any tax and/or legal advice the client may require or rely on regarding this material should be based on the

client’s particular circumstances from an independent professional advisor.

For Agent Use Only. Not for Distribution To the Public.

127017R4 12/21

Begin your journey today.

Visit: transamerica.com